Key Takeaways

- Structural shifts toward shared mobility and alternative transport modes threaten traffic volumes and revenue sustainability from toll operations.

- Increased regulatory uncertainty, geographic concentration, and rising competition in smart mobility platforms pose significant risks to long-term earnings growth.

- Robust economic tailwinds, expanding mobility trends, and diversified ancillary revenue streams position Salik for sustained earnings growth, operational efficiency, and strong financial resilience.

Catalysts

About Salik Company P.J.S.C- Designs, constructs, operates, and maintains the toll gates in Dubai.

- A shift toward electric, autonomous, and shared vehicles poses a significant risk to Salik's long-term growth, as evolving mobility patterns could sharply reduce individual car ownership and daily commuter dependence on toll roads, leading to sustained declines in traffic volumes and core revenue streams over the coming years.

- Expanding public transportation usage and increased investment in alternative infrastructure, such as metros and cycling initiatives, threaten road traffic volumes through toll gates; initial data following dynamic pricing already shows a 9 percent decline in traffic and a 4 percent increase in public transportation ridership, suggesting incremental revenue from toll usage could be at risk of stagnating or reversing, undermining future top-line growth.

- High dependence on the Dubai road network leaves Salik vulnerable to geographic concentration risk and susceptible to shifts in government policy; any future regulatory interventions, such as rate caps or mandated toll fee reductions, could directly compress net profit margins and limit the company's ability to achieve sustained earnings growth.

- Regulatory mechanisms governing toll pricing are transitioning from inflation-linked fixed tariffs toward more complex blended-rate models that remain subject to ongoing governmental negotiation; lingering uncertainty could impact the predictability of revenue and complicate long-term financial forecasting and cash flow planning.

- Rising competitive pressure from technology-enabled smart mobility platforms-including ride-hailing, micro-mobility solutions, and potential new entrants in integrated mobility-may erode Salik's market share and reduce transaction volumes, affecting both current ancillary revenues and longer-term earnings from prospective growth platforms.

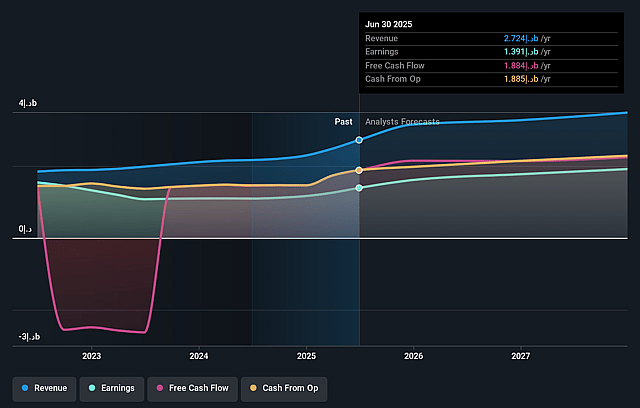

Salik Company P.J.S.C Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Salik Company P.J.S.C compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Salik Company P.J.S.C's revenue will grow by 8.2% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 51.0% today to 56.3% in 3 years time.

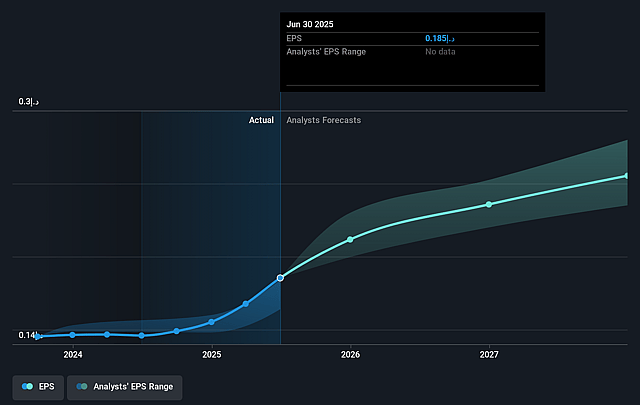

- The bearish analysts expect earnings to reach AED 1.9 billion (and earnings per share of AED 0.26) by about September 2028, up from AED 1.4 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 34.3x on those 2028 earnings, up from 33.9x today. This future PE is greater than the current PE for the AE Infrastructure industry at 24.4x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 20.3%, as per the Simply Wall St company report.

Salik Company P.J.S.C Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Dubai's ongoing strong economic growth, robust inbound tourism, and high population growth rates are supporting a rapid increase in vehicle registrations and active Salik accounts, which in turn are likely to drive higher toll usage and consequently boost Salik's revenues and overall earnings.

- The successful rollout of variable pricing and new toll gates is already resulting in a significant increase in chargeable trips and revenues, underscoring Salik's ability to capitalize on secular mobility trends, thereby supporting net profit growth and expanding margins.

- Salik's aggressive expansion into ancillary revenue streams-such as digital parking payments, data monetization, and insurance partnerships-with quantifiable guidance for sharp growth (up to AED 150 million in parking and AED 60 million in data monetization by 2030), provides meaningful opportunities to diversify revenue streams and support long-term earnings growth.

- The company's asset-light business model, high EBITDA margin above 69 percent, and strong free cash flow generation (over AED 626 million in Q1 with an 83 percent margin) position Salik for continued high operating efficiencies, supporting both net margins and long-term financial resilience.

- Securing investment-grade credit ratings from Moody's and Fitch, combined with a net debt-to-EBITDA ratio significantly below covenants, reflects Salik's strong balance sheet and financial discipline, enhancing the company's capacity to invest in future growth while safeguarding profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Salik Company P.J.S.C is AED5.1, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Salik Company P.J.S.C's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of AED7.7, and the most bearish reporting a price target of just AED5.1.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be AED3.5 billion, earnings will come to AED1.9 billion, and it would be trading on a PE ratio of 34.3x, assuming you use a discount rate of 20.3%.

- Given the current share price of AED6.29, the bearish analyst price target of AED5.1 is 23.3% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.