Key Takeaways

- Monopolistic market position and digital solution integration fuel recurring revenue growth and high margins, boosted by Dubai's rapid urbanization and smart city initiatives.

- Rapid scaling of ancillary services and strategic partnerships could drive group margins and revenues well above consensus as adoption accelerates beyond core toll operations.

- Salik faces structural risks due to technological disruption, sustainability policies, geographic concentration, and overdependence on toll revenues amid evolving mobility trends.

Catalysts

About Salik Company P.J.S.C- Designs, constructs, operates, and maintains the toll gates in Dubai.

- While analyst consensus sees the new toll gates and variable pricing model driving steady growth, early data and management commentary suggest the true upside is substantially higher, with chargeable trips up 35 percent year-on-year and the potential for revenue to consistently exceed guidance as commuter behavior adapts, setting the stage for significant topline outperformance.

- Analysts broadly agree that ancillary revenue streams like parking and insurance are a medium-term growth pillar, but based on the rapid uptake, partnerships extending beyond Dubai, and robust projections for parking and data monetization (expected to quadruple by 2030), the contribution to group revenue and net margins could materially outstrip consensus expectations as these initiatives gain scale.

- Salik's exclusivity as Dubai's sole toll operator, combined with the city's explosive population growth and urbanization, gives it a monopolistic advantage in capturing an expanding pool of vehicle registrations and trips; this entrenched position is likely to enable persistent high net margins and recurring revenue growth, far into the future.

- The rollout of advanced digital payment and mobility solutions, such as seamless fuel and parking payments, positions Salik at the core of Dubai's smart city and integrated transportation agenda, creating long-term incremental high-margin revenue streams as technology adoption accelerates across the region.

- With accelerating government investment in infrastructure, increasing adoption of electric and autonomous vehicles expected to boost traffic on tolled roads, and a scalable, asset-light business model, Salik is primed for operating leverage that could unlock further margin expansion and compound earnings growth at a pace the market significantly underappreciates.

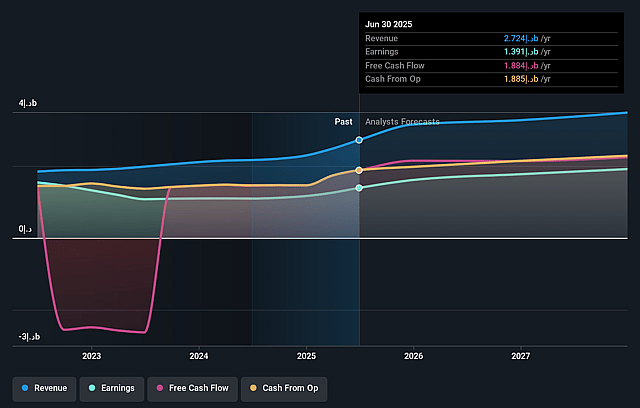

Salik Company P.J.S.C Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Salik Company P.J.S.C compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Salik Company P.J.S.C's revenue will grow by 12.4% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 51.0% today to 57.2% in 3 years time.

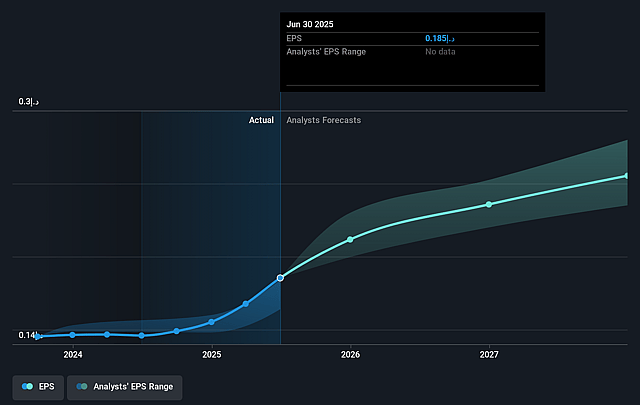

- The bullish analysts expect earnings to reach AED 2.2 billion (and earnings per share of AED 0.3) by about September 2028, up from AED 1.4 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 45.4x on those 2028 earnings, up from 33.9x today. This future PE is greater than the current PE for the AE Infrastructure industry at 24.4x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 20.3%, as per the Simply Wall St company report.

Salik Company P.J.S.C Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Salik's over-reliance on physical toll collection in Dubai exposes the company to secular risks from rising adoption of electric and autonomous vehicles, as these trends may reduce private vehicle dependence and long-term toll road traffic volumes, resulting in weaker revenue growth.

- The increasing public focus on sustainability and environmental concerns, combined with government efforts to promote mass transit and discourage car usage, could lead to policy changes or regulatory measures that cap or reduce toll rates, directly constraining Salik's future revenue and margin expansion.

- The company's core business is highly concentrated geographically within Dubai, making revenues and net earnings susceptible to regional economic cycles, adverse changes in urban planning, or decisions by the RTA that may deprioritize toll expansion.

- While ancillary revenue streams like parking and data monetization are growing, they are projected to remain a small fraction of overall revenue compared to the toll business, leaving Salik vulnerable to stagnating or declining toll volumes and increasing pressure on future earnings.

- Emerging technologies such as shared, autonomous, or alternative transit modes could decrease road usage over the long-term, weakening the traditional pay-per-use tolling model and posing structural threats to both Salik's revenues and net profit margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Salik Company P.J.S.C is AED7.7, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Salik Company P.J.S.C's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of AED7.7, and the most bearish reporting a price target of just AED5.1.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be AED3.9 billion, earnings will come to AED2.2 billion, and it would be trading on a PE ratio of 45.4x, assuming you use a discount rate of 20.3%.

- Given the current share price of AED6.29, the bullish analyst price target of AED7.7 is 18.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.