Narratives are currently in beta

Key Takeaways

- Strategic expansion and diversification initiatives, like the Mubadala JV, are poised to boost recurring income and long-term earnings growth.

- International market expansions, including Egypt and London, are supporting revenue increases as these markets stabilize and mature.

- Capital commitments, tax changes, economic instability, and reliance on expatriate buyers pose financial risks to growth, earnings, and revenue predictability.

Catalysts

About Aldar Properties PJSC- Engages in the real estate development, investment, construction, leasing, management, sale, and related services in the United Arab Emirates.

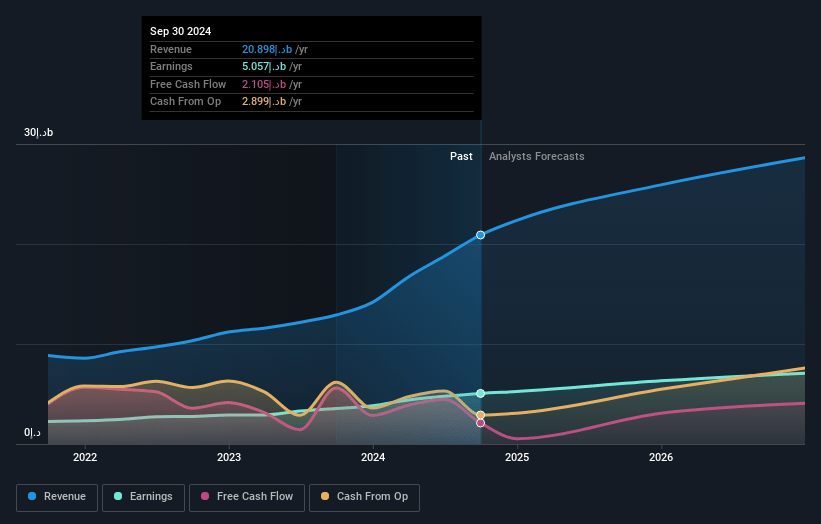

- Aldar's development backlog stands at over AED 48 billion, providing strong revenue visibility over the next 2 to 3 years, likely leading to significant future revenue growth.

- Strategic expansion and diversification in Aldar Investment, including partnerships like the joint venture with Mubadala, has the potential to significantly increase recurring income streams, benefiting long-term earnings.

- The D-Hold strategy to develop prime assets for retention is expected to enhance the company's asset base and boost net margins through long-term capital appreciation and increased revenue from owned assets.

- Significant international sales driven by strategic overseas market expansions, such as SODIC's growth in Egypt and London Square's acquisitions, support a revenue increase as these markets mature and stabilize.

- Planned extensive CapEx in luxury hospitality and integration of luxury retail, paired with anticipated strategic synergies from ventures like the Mubadala JV, is expected to enhance overall profitability and elevate net margins through increased operational efficiencies and capital utilization.

Aldar Properties PJSC Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Aldar Properties PJSC's revenue will grow by 9.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 24.2% today to 26.0% in 3 years time.

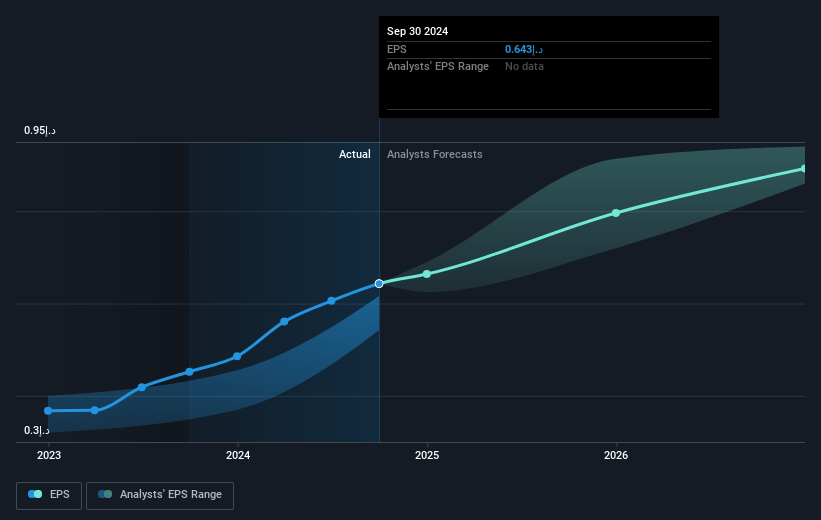

- Analysts expect earnings to reach AED 7.1 billion (and earnings per share of AED 0.9) by about January 2028, up from AED 5.1 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.7x on those 2028 earnings, up from 11.9x today. This future PE is lower than the current PE for the AE Real Estate industry at 27.4x.

- Analysts expect the number of shares outstanding to grow by 0.11% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 20.59%, as per the Simply Wall St company report.

Aldar Properties PJSC Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Capital expenditure commitments exceeding AED 20 billion in the coming years could lead to financial strain or risk of insufficient returns if projects do not yield expected income, potentially impacting cash flow and earnings.

- The introduction of corporate income tax, along with potential changes to tax policies, could increase the effective tax rate, reducing net margins and overall profitability.

- Economic downturns or geopolitical instability in key markets like Egypt (SODIC) and London (London Square) could derail growth plans, affect revenue realization from international sales, and impact earnings predictability.

- Heavy reliance on overseas and expatriate buyers (76% of UAE sales) exposes Aldar to risks of changing immigration policies or economic conditions in source markets, potentially affecting revenue from development sales.

- A focus on deleveraging to maintain a conservative leverage profile might limit available resources for opportunistic investments or rapid scalability, potentially impacting the ability to generate higher returns or sustain growth in earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of AED 8.06 for Aldar Properties PJSC based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of AED 8.6, and the most bearish reporting a price target of just AED 6.8.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be AED 27.3 billion, earnings will come to AED 7.1 billion, and it would be trading on a PE ratio of 15.7x, assuming you use a discount rate of 20.6%.

- Given the current share price of AED 7.68, the analyst's price target of AED 8.06 is 4.7% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives