Last Update07 Aug 25Fair value Increased 5.91%

Despite a slight downward revision in revenue growth forecasts, the consensus analyst price target for Dubai Islamic Bank P.J.S.C was marginally increased from AED8.90 to AED8.99.

What's in the News

- Dubai Islamic Bank participated as a Joint Lead Manager and Joint Bookrunner in a proposed USD-denominated perpetual non-call 6-year Additional Tier 1 Sukuk offering, subject to market conditions.

- Board meeting held to discuss regular business matters not impacting the share price.

Valuation Changes

Summary of Valuation Changes for Dubai Islamic Bank P.J.S.C

- The Consensus Analyst Price Target remained effectively unchanged, moving only marginally from AED8.90 to AED8.99.

- The Consensus Revenue Growth forecasts for Dubai Islamic Bank P.J.S.C has fallen slightly from 5.0% per annum to 4.8% per annum.

- The Future P/E for Dubai Islamic Bank P.J.S.C remained effectively unchanged, moving only marginally from 14.33x to 14.19x.

Key Takeaways

- Reliance on exceptional market conditions and non-recurring gains may not sustain future profitability or growth as economic momentum slows and risk factors increase.

- Rising expenses, greater competition, and credit risk in new segments could constrain margin recovery, operational efficiency, and earnings stability over the longer term.

- Strong asset quality, digital transformation, and focus on sustainable finance position the bank for stable earnings, cost efficiency, and diversified long-term growth.

Catalysts

About Dubai Islamic Bank P.J.S.C- Engages in the corporate, retail, and investment banking activities in the United Arab Emirates and internationally.

- Current market optimism may be overestimating the sustainability of rapid loan and balance sheet growth, which has been exceptionally strong due to near-term UAE/GCC economic momentum and non-oil sector expansion; this pace may not be repeatable as the population and credit demand normalize, impacting future asset and revenue growth rates.

- The bank's robust current profitability and low cost of risk are being significantly boosted by unusually high recoveries and legacy real estate gains amid buoyant market conditions-factors that management acknowledges are not consistent or easily modeled, which could lead to lower earnings in periods where these non-recurring inflows fade.

- Investors may be too positive about margin recovery, as the bank's guidance for net interest margin relies on anticipated rate cuts and liability repricing; if global interest rates remain higher-for-longer or deposit competition intensifies, funding costs may stay elevated, compressing net margins and profit growth.

- The stock could be priced as if DIB will capitalize fully on the wave of digital banking and sustainable finance trends, yet expense growth and ongoing tech investments are rising, and there is mounting competition both from incumbent banks and non-traditional fintechs, creating potential headwinds for operational efficiency and fee income.

- DIB's recent asset quality improvements and capital strength may be extrapolated too optimistically; as sector diversification continues and credit is increasingly extended to new growth segments (e.g., aviation, utilities, SMEs), longer-term credit risk and provisioning needs could rise if macro conditions deteriorate, putting pressure on future returns and earnings stability.

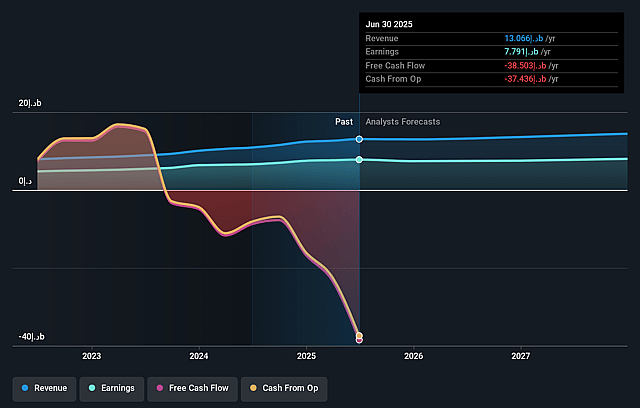

Dubai Islamic Bank P.J.S.C Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Dubai Islamic Bank P.J.S.C's revenue will grow by 4.9% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 59.6% today to 52.4% in 3 years time.

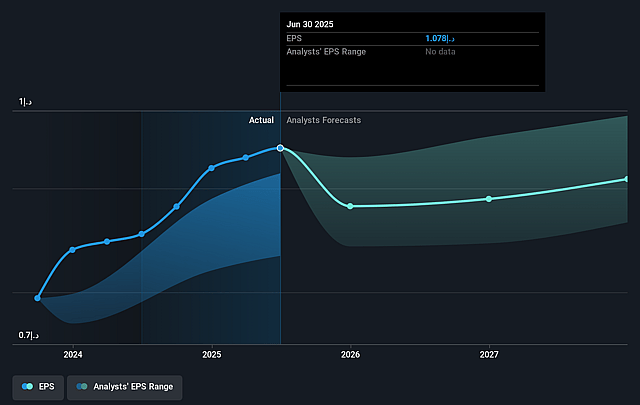

- Analysts expect earnings to reach AED 7.9 billion (and earnings per share of AED 1.0) by about August 2028, up from AED 7.8 billion today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as AED8.9 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.0x on those 2028 earnings, up from 9.1x today. This future PE is greater than the current PE for the AE Banks industry at 9.6x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 20.28%, as per the Simply Wall St company report.

Dubai Islamic Bank P.J.S.C Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Continued robust economic growth in the UAE and GCC, driven by diversification away from oil, population growth, and expanding tourism and real estate sectors, is likely to support sustained credit demand and revenue expansion for DIB over the long term.

- DIB's improved asset quality, with nonperforming financing ratio at the lowest level in a decade and strengthened coverage ratios, reduces credit risk exposure and enhances earnings stability through lower impairment charges.

- Aggressive growth in both consumer and corporate banking portfolios, combined with record-level underwriting and growing customer deposit base, suggests the franchise is successfully attracting new business, which can support core revenue and balance sheet growth.

- DIB's investments in digital transformation and rising digital channel adoption are helping the bank operate at a low cost-to-income ratio (28.4%), driving operational efficiency and supporting net margins even as expenses rise due to technology upgrades.

- The bank's proactive participation in sustainable finance and the issuance of sustainability-linked financial products position DIB to capture new growth opportunities in ESG-aligned sectors, attracting capital and customers and potentially boosting fee and commission income over time.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of AED9.427 for Dubai Islamic Bank P.J.S.C based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of AED10.9, and the most bearish reporting a price target of just AED7.3.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be AED15.1 billion, earnings will come to AED7.9 billion, and it would be trading on a PE ratio of 15.0x, assuming you use a discount rate of 20.3%.

- Given the current share price of AED9.8, the analyst price target of AED9.43 is 4.0% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.