What Happened in the Market This Week?

Market Insight for 18th April - 22nd April

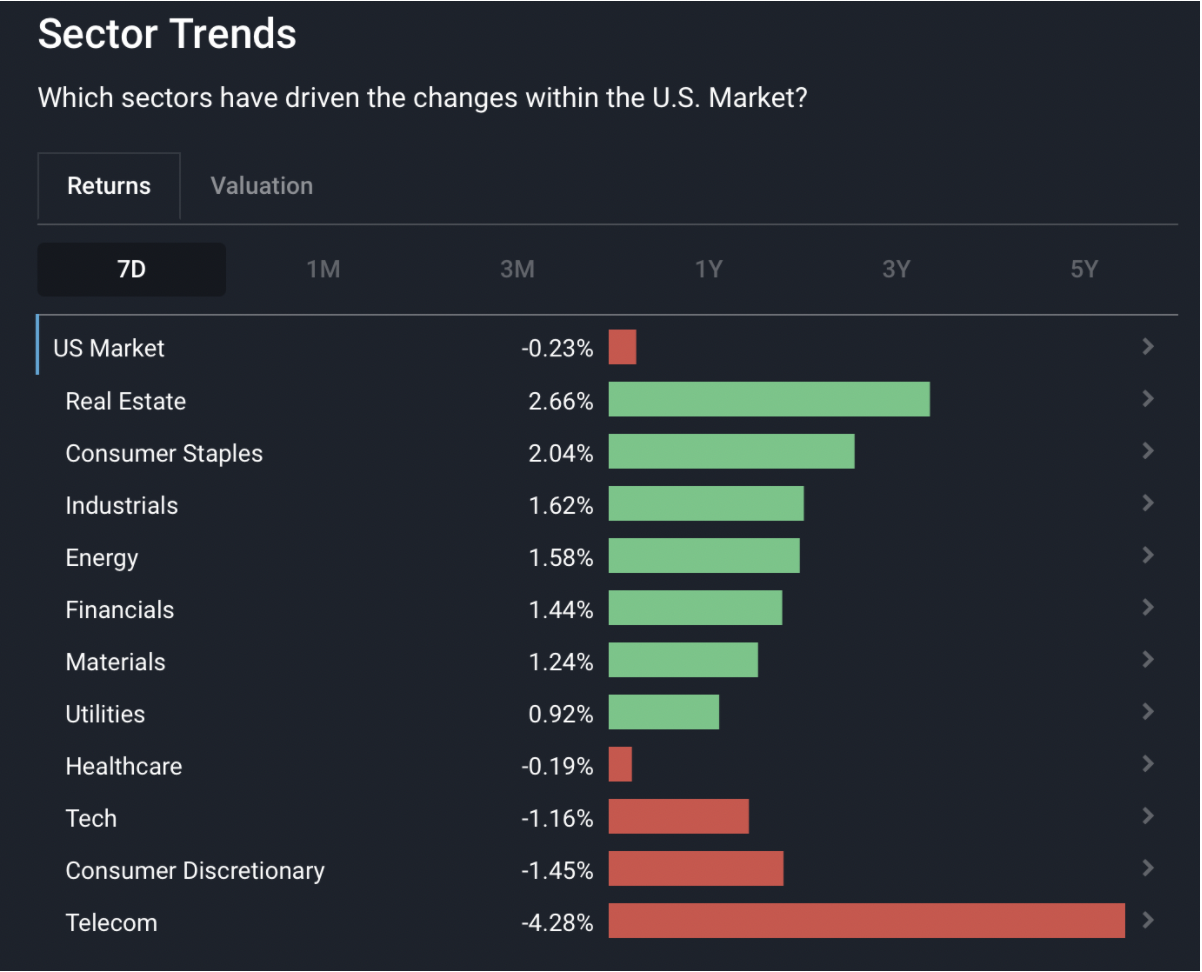

While the majority of the U.S. market has been trading sideways for most of the week, some notable names experienced significant share price declines. Investors are still trying to estimate the effects of inflation as uncertainty increases across the board, and some companies' latest earnings reports are disappointing investors.

In the past week, we’ve seen these key developments:

- Netflix’s (NASDAQ:NFLX) shift in paradigm craters the stock

- The risk of geopolitical changes is starting to affect the insurance business

- Germany’s Producer Price Index (PPI) is reaching record levels

US Sectors 7D performance - April 21st, 2022

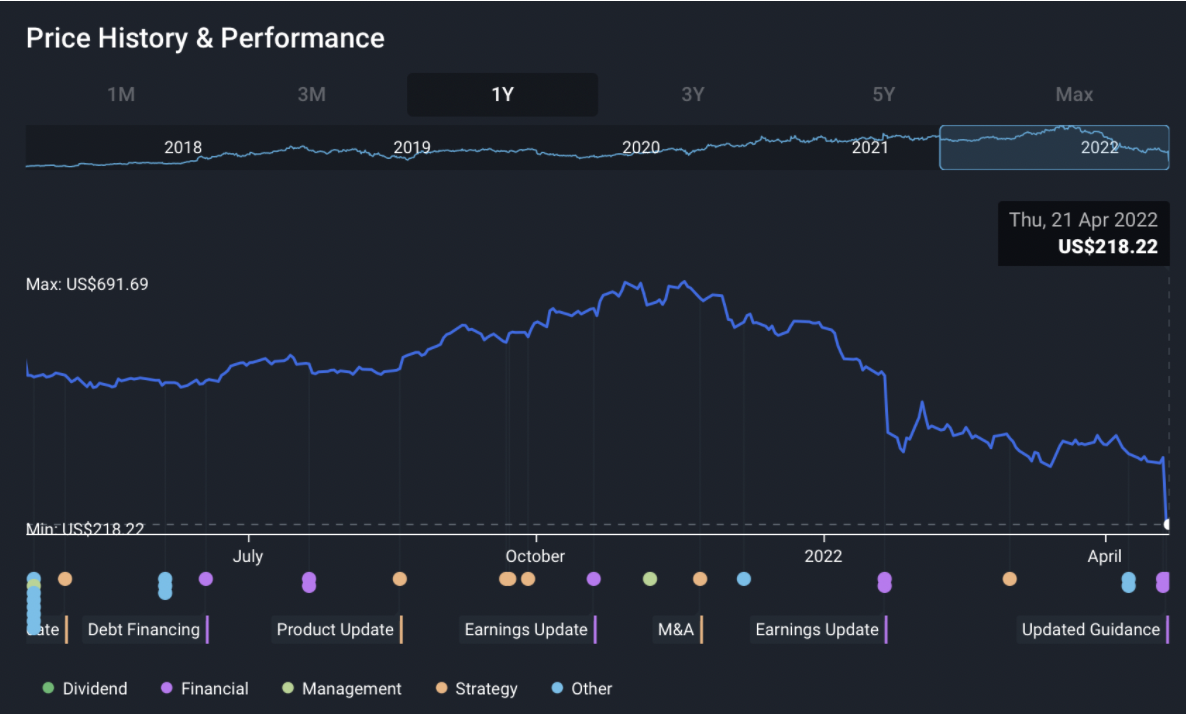

Netflix falls short of guidance and investor expectations

High-growth companies regularly possess high valuations since investors have correspondingly high expectations of the company's future prospects. When these expectations aren’t met, those same stocks can experience painful declines as investors re-evaluate the company’s future prospects with lower expectations.

Evaluating a company’s future prospects and discounting it to the present is not a straightforward process. It relies on making assumptions about both external and internal factors and the potential of future cash flows.

Unfortunately, if one of these assumptions proves wrong, the outcome can be disastrous, as seen from two Netflix drops after their earnings release.

Following Netflix’s approximately 30% drop in stock price last January after a subpar number of new subscribers, the stock dropped even more this week - falling an additional 35%. The stock is now at a 4-year low after closing at $218.22 The company initially provided estimates of 2.5 million new subscribers for this latest quarter, but instead it lost 200,000. Even with a loss of 700,000 Russian accounts, it was well under the guidance. For Q3, the company flipped to a guided 2 million loss.

With a subscriber base of over 220 million, the company has announced that it will now focus on creating new ways of monetization. After years of a simple subscription-based business model, management is now looking for a solution to solve rampant account sharing, where they estimate that up to 100 million households use accounts they do not pay for.

The first measure the company announced is introducing a new and cheaper subscription tier, compensating for the revenue difference through advertising. While possible, this will not be a straightforward process, as it will likely involve negotiating partnerships with advertisers.

Furthermore, the new subscription tier will generally target the market segment with the lowest purchasing power — thus potentially making it the least valuable to advertisers.

The Insight: High growth can’t last forever, and growth inevitably moderates. Netflix's first decline in users in over 10 years might signal that the company is reaching mass adoption. It is also no secret that rising inflation has put pressure on consumers in the last months. As the prices of food and other Consumer Staples go up, households might look to trim their expenses, and subscription entertainment is likely high on that list.

Thus, we’d keep an eye on the competitors’ earnings for further cues.

- The Walt Disney Company (NYSE:DIS): May 11, 2022

- Warner Bros. Discovery (NASDAQ:WBD): April 26, 2022

- Amazon.com (NASDAQ:AMZN): April 28, 2022

Insurance Businesses are Scrambling to Adjust to Geopolitical Risks

Insurance businesses have been around for a very long time. Their business model is simple – calculating a reasonable premium that will achieve a cash-flow surplus after all the claims are paid, and investing the collected premium to generate returns.

Thus, it is not surprising to see this business model be one of the favorites of successful institutional investors like Warren Buffett.

Insurers are often large businesses with risk exposures to multiple geographies and industries around the world. So, any unusual events, like financial downturns, natural disasters or geopolitical conflicts, can cause a domino effect through this network.

While the effects of war are a standard exclusion in insurance policies, economic sanctions pose a new challenge. Not only will they cause a drop in the business, they might trigger loss claims and require the implementation of new rules to keep up with the rising geopolitical risks. So far, it seems the most significant impact will be felt in aviation and space, maritime and trade credit.

As per London’s International Underwriting Association, just the velocity of changes is enough to raise caution amongst insurers. The rapidly changing environment forces insurers to conduct robust due diligence for every transaction, and potentially raise premiums to account for the additional risk they’re taking on. Even without the increased risks, this translates into a higher cost of doing business in the form of higher insurance costs for consumers and businesses.

The Insight: Rising insurance costs could constrict global trade further. We've already seen the effects of war in Ukraine on food and fuel costs. Now, we're feeling the aftershocks of that impact, as global insurance losses could be anywhere between US$16b-$35b, with reinsurers expected to assume 50% of those claims.

While reinsurers should have a sufficient buffer zone to cover those losses, we should always think about their adjustments going forward. The cost of doing business for emerging markets will unquestionably go up, and a ripple effect will be a more cautious investment approach. This, in turn, could lower the output of these markets, which often offer competitive prices through a low cost of labor than more developed nations.

The US Insurance Industry has performed well over the last 12 months, gaining 15.6% as at 22nd April.

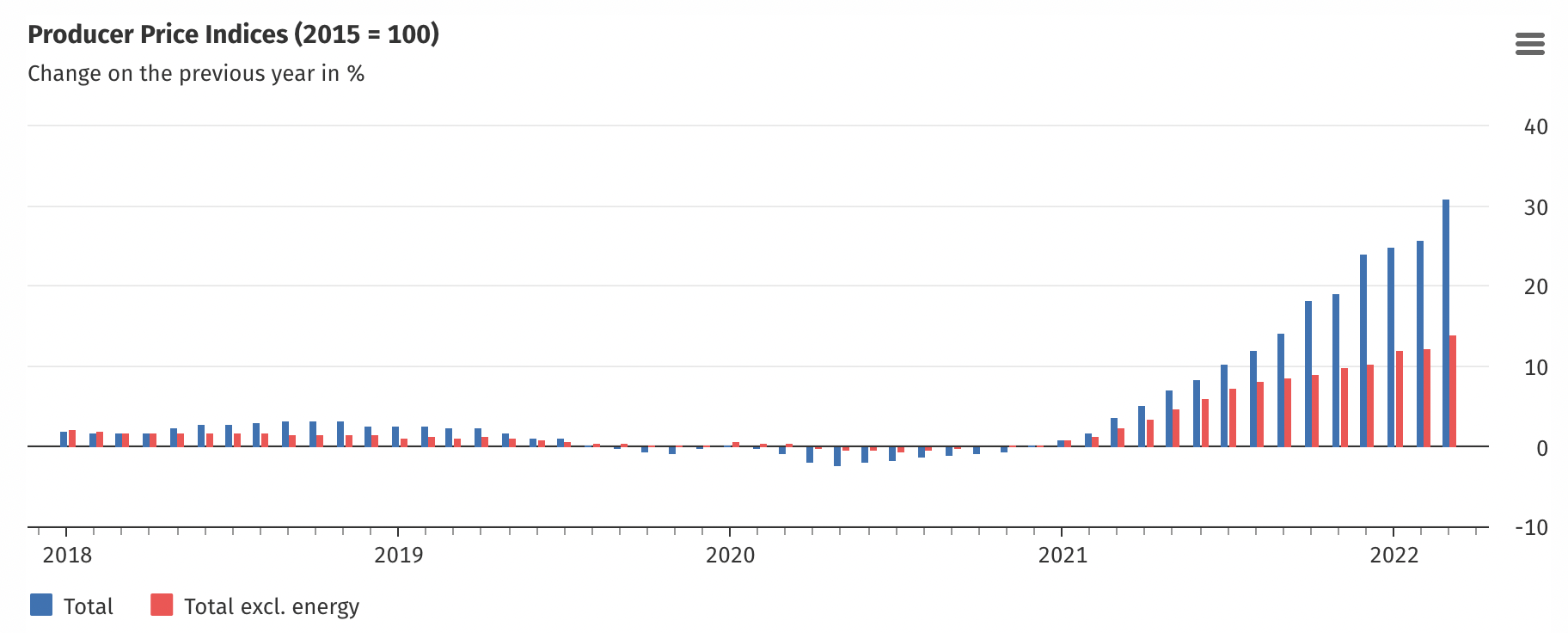

Leading Indicator - German Producer Inflation (PPI)

European markets are seeing some distress signals, as the German PPI (Producer Price Index) marked an annual increase of 30.8%. The PPI is a measure of the average change over time in the selling prices received by domestic producers. This volatile jump in prices can ripple across markets as retailers and services adjust for price increases from manufacturers. Ultimately, consumers will be absorbing most of this shock as they see their savings decline and their spending habits change due to higher prices.

The inflation this year seems to be driven mainly by energy price increases as supply in Europe has constrained because of the sanctions/war/invasion in Ukraine. Energy prices in March are up 83.8% year over year.

The Insight: German producer inflation signals that inflation may still be accelerating in some regions like Europe. There are many types of inflation (such as cost-push or demand pull), and its effects on stocks vary depending on the type of business its referring to. However, unpredictable inflation rates can be more dangerous than predictable inflation, as businesses will find it hard to adjust on short notice.

Looking Ahead

The French presidential elections took place this past Sunday where the incumbent, Mr. Macron won a second term as French president. European markets are expected to welcome the news given the more predictable nature of a re-elected official compared to a change in party that would likely introduce different policies.

U.S. Durable Goods Orders for March will be released on Tuesday. This indicator shows how much companies are ordering up-front for their businesses, which can be used as a gauge to the level of economic activity. The change in orders is expected to drop by 2.1%, which indicates a possible slowdown in future earnings.

Earnings season is currently underway, and is a great time for investors to re-evaluate some of their holdings. Price swings tend to be more volatile during this period as analysts are making new predictions and adjusting existing ones based on new information. Given the current market and the rising cost of doing business resulting from interest rates and inflation, the market seems to be preferring more cautious investments and avoiding high growth names.

For next week’s earnings release, the most watched companies are:

- Microsoft (NASDAQ:MSFT)

- Alphabet (NASDAQ:GOOGL)

- General Electric (NYSE:GE)

- Coca Cola (NYSE:KO)

- Meta (NASDAQ:FB)

- PayPal (NASDAQ:PYPL)

- Amazon (NASDAQ:AMZN)

- Apple (NASDAQ:AAPL)

- Caterpillar (NYSE:CAT)

- Exxon (NYSE:XOM)

- Chevron (NYSE:CVX)

- Honeywell (NASDAQ:HON)

A clear picture of the fundamentals in a portfolio will always help investors make better decisions. Investors can review their dashboard to stay up to date on their stocks, or use our markets page to see how the market and industries are reacting to the latest developments.

Until next week,

Invest Well

Simply Wall St

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.