Quote of the Day: “Try everything. Do everything. Nuclear. Biomass. Coal. Solar. You name it. I support them all." - T. Boone Pickens

When we checked in on commodity markets in November there was a lot of red on the YTD returns table.

Since then, the gold price has hit a new record and crude is back above $80. Most of the other commodity prices are also higher , while the likes of natural gas, iron ore, lithium, wheat, and corn are lower.

Do higher prices mean demand is outpacing supply, or is the market anticipating supply disruption due to the wars in Europe and the Middle East?

This week, we are checking in on energy and other commodity markets again to see how the outlook has changed.

🎧 Would you prefer to listen to these insights? You can find the audio version on our Spotify, Apple podcasts or Youtube !

What Happened In Markets This Week?

Here’s a quick summary of what’s been going on:

- 🇩🇪 Germany is looking to strengthen ties with ASEAN nations to reduce dependence on China ( Bloomberg )

- Our take : German Chancellor Olaf Scholz is holding meetings with leaders from Thailand, Malaysia and the Philippines to strengthen trade relationships. This is further evidence of the shifting trade alliances forming around the globe and will provide unique opportunities for companies that can put themselves in the ‘right place at the right time' (as we discussed last week).

- 🏢 Amazon acquires a nuclear-powered data center ( FT )

- Our take: Amazon’s AWS acquired the data center from Talen Energy, which built it next to a nuclear power station. This can probably be regarded as a sign of confidence for the cloud and AI industries - but it also points to a looming crisis that could unfold. If AI really takes off, consumers are going to find themselves competing with big tech for energy.

- ✈️ Airbus widens lead vs Boeing for 2024 deliveries ( CNBC )

- Our take: Boeing has been in the news for all the wrong reasons lately. It also delivered fewer new aircraft than Airbus in January and February. This isn’t as bad as it seems, as Boeing has also received more new orders than Airbus (15 vs 2 in February). Seems like airlines haven't given up on the aircraft maker just yet, but the list of reasons to is growing.

And some of the key economic data released recently:

-

🇬🇧 The UK’s unemployment rose from 3.8% to 3.9% in line with consensus estimates.

- Wage growth also slowed more than expected and vacancies fell by 43,000 as the economic slowdown continued to take a toll on the labor market.

-

🇬🇧 UK GDP increased slightly in January despite the cooling labor market.

- The economy expanded by 0.2% after contracting by 0.1% in December.

-

🇺🇸 US consumer prices rose 0.4% in February and 3.2% year-on-year.

- The annual increase was slightly higher than economists expected and reflected an ongoing battle bringing inflation down to 2%.

⚡🛢️ Energy and Commodities: Slowing Demand Growth vs Supply Risks

Commodity markets have more or less normalized after the turmoil created during and after the pandemic. But the near term outlook seems to be even more uncertain than ever.

The energy, metals and agricultural markets are all facing surprisingly similar dynamics:

- Firstly, output has been higher than expected,

- Secondly, demand growth has slowed as global growth slows, and

- Lastly, the geopolitical risks we mentioned last week pose risks to supply.

Of course, some factors are unique to each market. So let’s get into them now.

🛢️Oil And Gas Supply Could Be Tighter in the Medium Term

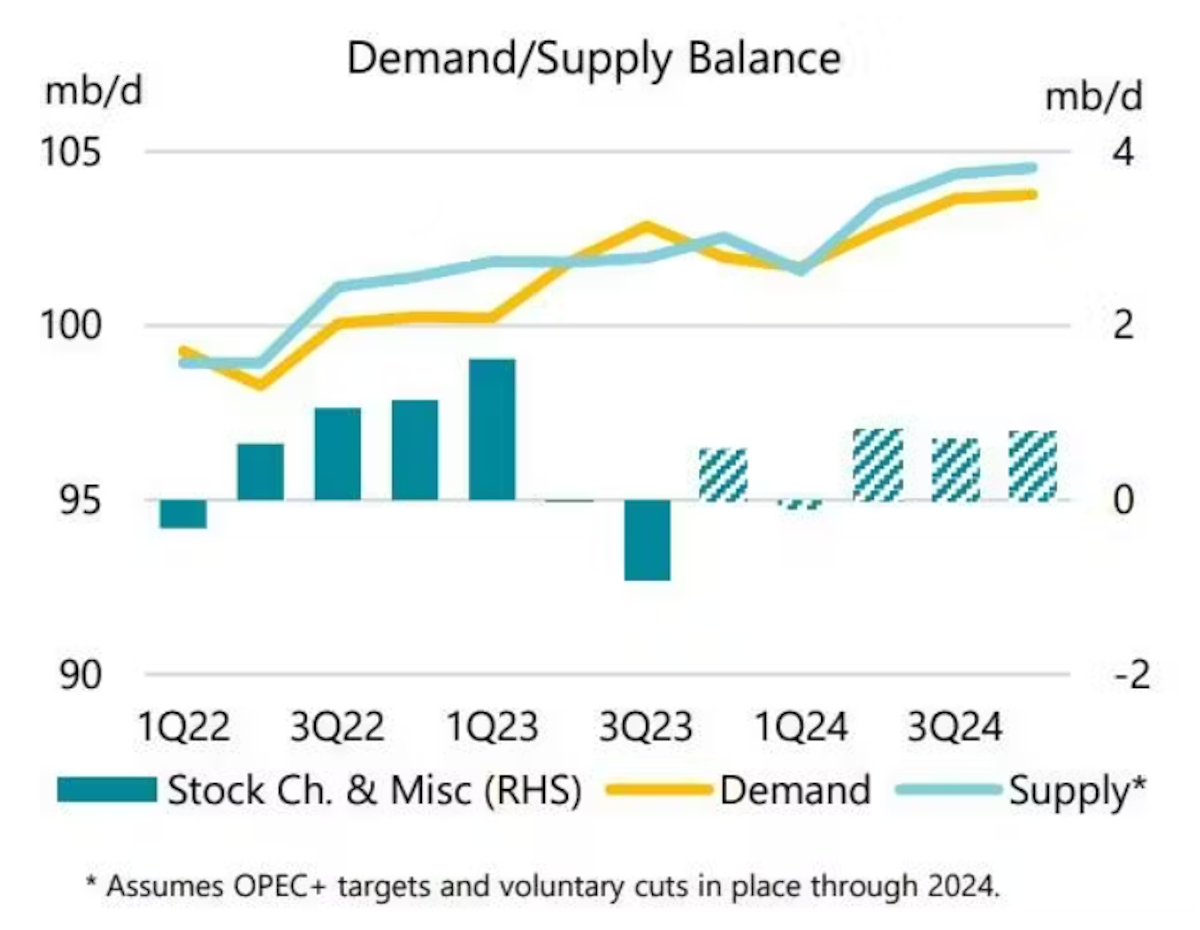

While OPEC+ members have been cutting oil production, non-OPEC producers have actually increased production.

✨ Most notably, US production reached a record high of 12.9 million barrels per day. The International Energy Agency now believes there will be a surplus between supply and demand for the remainder of the year.

This is likely to keep a lid on oil prices unless supply is affected by the conflict in the Middle East and the Red Sea.

✨ Looking further into the future, supply could be tighter. The industry is consolidating, and the large producers are focussing on efficiency and profitability.

Three major acquisitions have been announced in the last few months, with ExxonMobil buying Pioneer Natural Resources , Chevron acquiring Hess , and Diamondback Energy buying Endeavor Energy Partners.

In the past, oil majors prioritized growth, but as the world transitions to cleaner energy, they are shifting their focus to high-margin assets. This means they will be in a better position if demand growth slows due to more renewable energy supply - but it also means the market could be a lot tighter going forward.

This focus on margins rather than size is one of the primary catalysts for this investment narrative for Exxon.

Natural gas prices are still depressed after the boom and bust of 2022. Winter in the Northern Hemisphere has been relatively mild, industrial demand in Europe has fallen, and storage is still higher than average.

✨ However, these lower natural gas prices are already having an impact on supply. Chesapeake Energy is cutting output by 30%, and other producers are likely to follow if prices don’t rebound.

In addition, an existing gas transit deal between Russia and Ukraine expires at the end of 2024, and Ukraine has indicated that they don’t intend to extend it. So heading into 2025 supply could be a lot tighter, breathing life back into the price.

🪙 Precious Metals Have Been Outperformers

There are a couple of tailwinds driving demand for gold, including central bank buying, anticipation of lower rates and a weakening dollar, and rising geopolitical risks. All of these tailwinds should remain in place unless interest rates remain higher than expected.

At least some of the buying has been via leveraged instruments, so there is a "carry cost" and those positions could be closed out if rates don’t fall as expected.

The iron ore price has been affected by China’s slowdown, as well as the manufacturing slowdown in Europe. Production at all the large producers fell in 2023 which has partially offset the slowdown in demand. The success of China’s stimulus measures is going to be key for this metal going forward.

Analysts are more optimistic about copper due to its diverse markets, its numerous applications, and a potential shortage in supply.

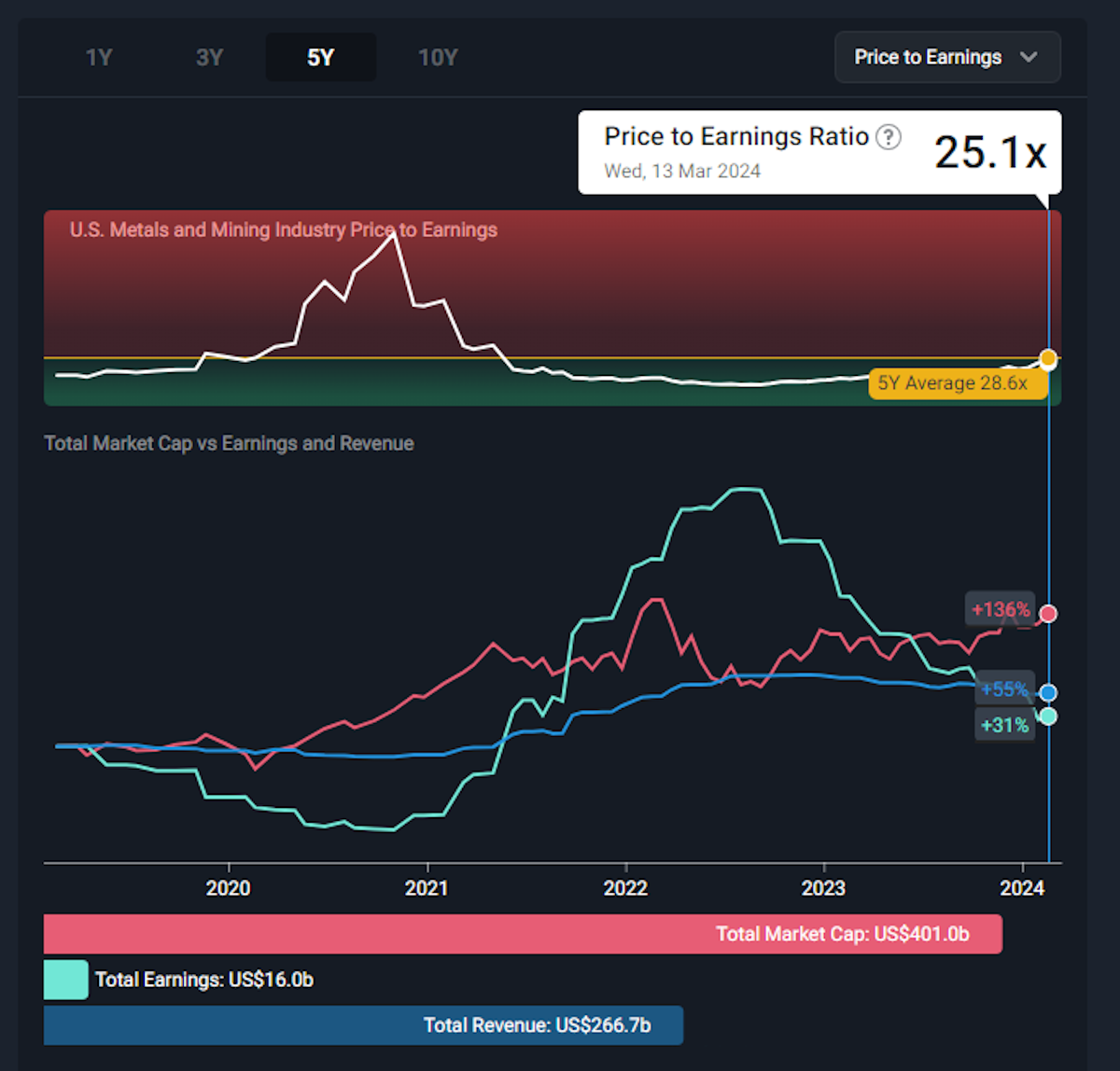

The chart below reflects performance and valuations for the US metals and mining industry. The P/E multiple is still below its 5-year average, though that number may be a little misleading due to the abnormally high peak in 2020. More importantly, the P/E ratio is rising, which suggests optimism is rising.

The outlook for metals used for batteries, namely lithium, cobalt, and nickel is more subdued.

Production has increased in the last few years, while demand growth has stalled. This will probably remain the case until EV production increases again - or we see more adoption of battery storage elsewhere.

Feel free to check out this narrative on Tesla that explores the possibilities of growth within their Energy Storage segment .

🧑🌾 Agricultural Commodities Are a Mixed Bag

After global food shortages in 2022, agricultural production increased and there have been bumper wheat and corn harvests around the world. China recently cancelled a series of wheat import orders from the US and Europe due to plentiful supply at lower prices and closer to home.

Crops grown closer to the equator, including rice, cocoa, sugar and coffee have suffered from more severe weather, and so prices are still high. The likes of cocoa is up 186% over the past year. So don’t be surprised if your hot chocolates get a whole lot more expensive!

According to Trading Economics, concerns persisted over shrinking West African cocoa supplies. Traders said that top exporter Ivory Coast and No.2 producer Ghana are in the midst of their worst harvest in years, with Ivorian arrivals estimated to be down more than 28% on last season.

Additionally, analysts pointed out that for other agricultural commodities, the risks are still to the upside (higher prices still) due to the El Nino weather event which is now in its second year, and the risks to global shipping routes.

💡 The Insight: Commodity Supply And Demand Vary Far Less Than Prices Suggest

Commodity prices are known for extreme volatility. But these price changes actually result from very small imbalances in supply and demand.

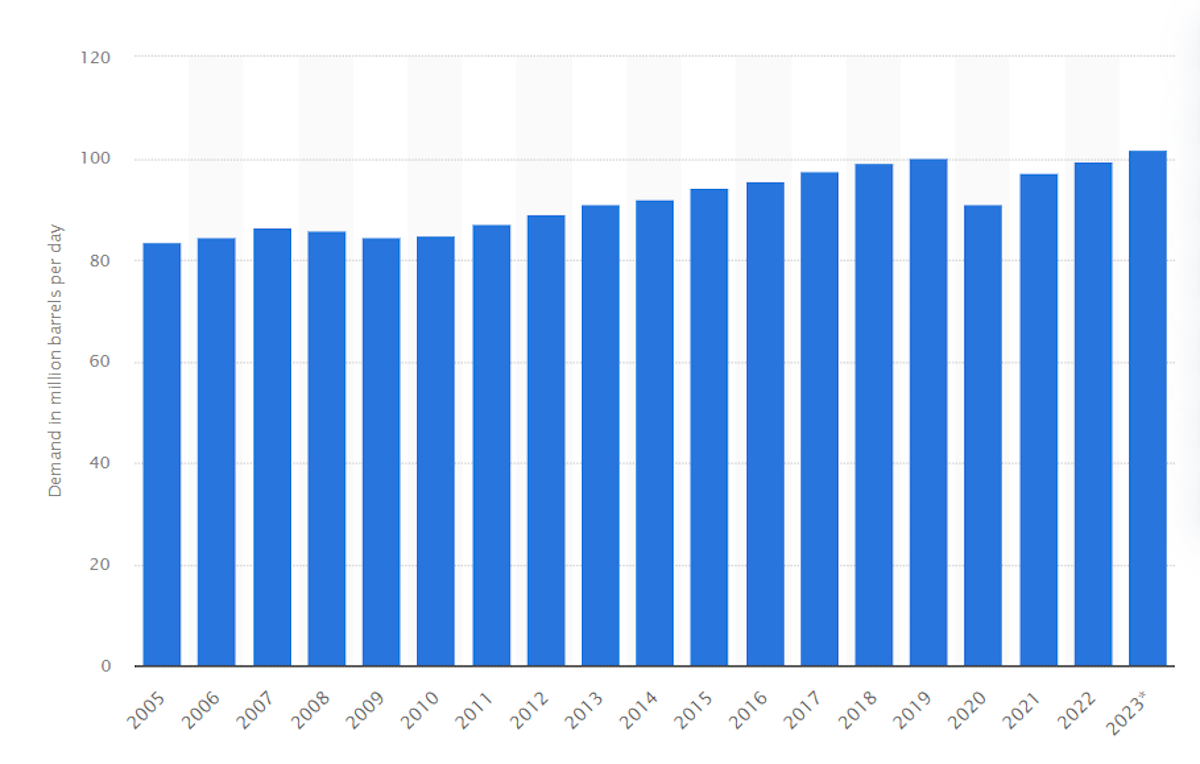

Consumption of commodities actually varies very little, and generally increases almost every year. Common sense dictates that growing populations and growing industry require more raw input materials like commodities to support growth.

The chart below reflects global crude oil consumption from 2005 to 2023. The COVID pandemic in 2020, which was about as unusual as it gets, resulted in demand falling by 9% and then jumping 6% the following year. The rest of the time, demand increased by close to 1% most years.

Most commodities follow a similar pattern, with consumption increasing gradually each year. When prices fall, investment in new production falls - but demand continues to rise. This sets up the inevitable rebound in prices when demand outstrips supply.

At some point, the world will eventually reach ‘peak oil’ as demand transitions to clean energy - which makes things a little different. Oil demand could stay flat for years before declining. But investment in new capacity is likely to lag, which means the oil price could rise even as demand falls.

In terms of how to find opportunities, you can use our updated Screener tool to filter for any market, industry or metrics you’re looking for. For example, in the energy sector, here’s a screener of US-listed Oil and Gas Stocks with a Good ROE. That took less than a minute to create, and you can play around with the rest of the settings if you want to find stocks that meet YOUR criteria.

✨ The beauty is, that once you’ve saved a screener’s settings, you’ll then be notified via email of any new companies that meet that criteria!

So if you’re interested in a bunch of thematics, you can create a few different screeners to discover stocks by casting a net in those fishing spots that you like and then waiting patiently.

Key Events During The Next Week

It’s Fed Funds week, and at least three other central banks are also setting rates - though no changes are expected:

Monday

- 🇨🇳 China’s latest retail sales number is expected to fall to 6% from 7.4%. The country’s unemployment rate is anticipated to remain unchanged at 5.1%.

Tuesday

-

🇯🇵 The Bank of Japan is expected to keep the official rate unchanged at -0.1%.

-

🇦🇺 Australia’s interest rate decision is also due, with consensus for the rate to remain unchanged at 4.35%.

-

🇺🇸 US Housing Starts will be released with consensus estimates at 1.43 million, up from 1.33 million. Building permits are expected to be slightly lower at 1.48 million.

-

🇨🇦 Canada’s Inflation rate is expected to be 2.7%, down from 2.9%.

Wednesday

- 🇺🇸 The US FOMC are meeting to decide on the Fed Funds rate. Futures markets are implying a 99% probability that the target range will stay at 5.25 to 5.5%.

Thursday

- 🇯🇵 Japan’s balance of trade is due, and the deficit is anticipated to fall to ¥950 billion from ¥1.78 billion.

- 🇬🇧The Bank of England is also expected to keep the UK’s benchmark rate at 5.25%.

Friday

- 🇯🇵 Japan's Inflation rate will be published, Economists are expecting it to rise from 2.2% to 2.9%.

The last of the US large caps are still due to report as earnings season winds down:

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.