What Happened in the Market This Week?

Market Insight for 22nd April - 29th April

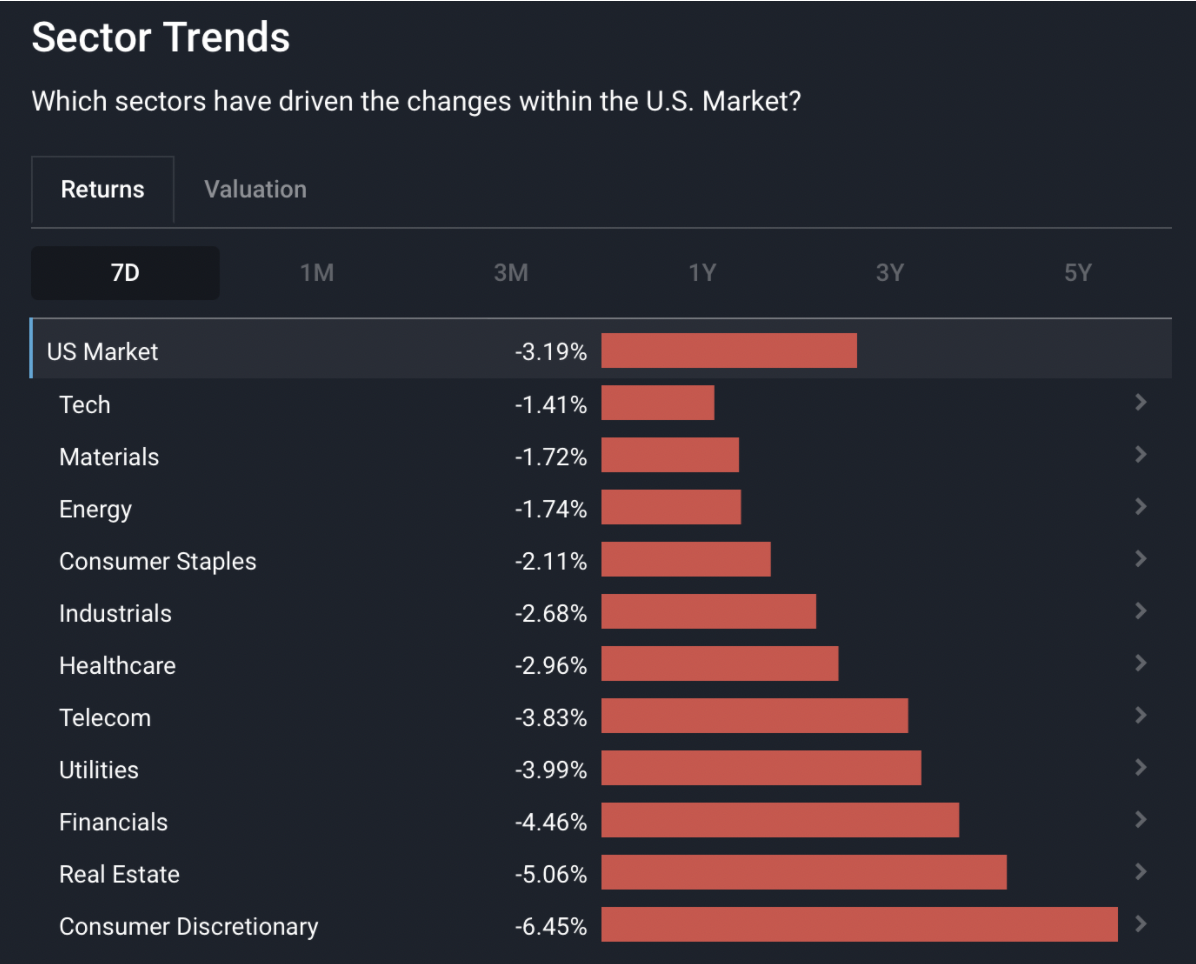

US stocks fell 3.19% last week after several notable companies delivered either disappointing results or lowered their guidance for the second quarter. Leading the downside was the consumer discretionary sector which was dragged down by its largest two components, Amazon (NASDAQ: AMZN) and Tesla (NASDAQ:TSLA). The S&P 500 index is now 14% below its highs, while the Nasdaq is down 23% and technically in a bear market.

Key developments during the last week included:

- First quarter results from US ‘Big Tech’ companies

- China announced a $2.3 trillion infrastructure investment plan

- US Goods Trade Deficit reached a record high, while first quarter GDP contracted

US Sectors 7D performance - May 1st, 2022

Big Tech First Quarter Results

The largest tech companies in the US, namely, Apple (NASDAQ: AAPL), Microsoft (NASDAQ:MSFT), Alphabet (NASDAQ: GOOG), Meta Platforms (NASDAQ: FB), and Amazon (NASDAQ: AMZN) all reported their first quarter financial results last week. These results often reflect the themes affecting the entire technology sector, and set the tone for the rest of earnings season.

Some of the themes that emerged last week included:

- Cloud computing growth remains robust relative to other segments.

- Ad revenue was under pressure at Meta, Alphabet and Amazon. Companies are struggling to beat the high bar set over the last two years, while consumers are now spending less time at home and online. It has also emerged that social media platforms are experiencing increased competition from TikTok.

- Inflation and supply chain constraints are affecting most companies, and are expected to continue until later in the year. Guidance ranged from cautious to weak for the coming quarters, mostly as a result of these issues.

Investment cycles

Another theme that last week’s results highlighted was the importance of investment cycles to investors. The big tech companies typically reinvest a large portion of their cash flows into new products and services to continue growing their earnings. This investment tends to occur in cycles which impacts profitability and share prices. When investment is ramped up profitability typically falls, but those investments can pay off later.

Apple, Amazon and Meta are all at different stages in their investment cycle, and this has been reflected in their financial performance and share prices:

- Apple is now beginning to reap the benefits of the investments it has made in its services businesses over the last few years, contributing to relative outperformance for the share price.

- Amazon has invested heavily in its fulfilment centers over the last few years which has impacted cash flows. This has contributed to the share price underperforming the market over the last 18 months. This investment cycle is now coming to an end as Amazon now has excess capacity.

- Meta is embarking on an extensive investment program to build Reality Labs, which is one of the factors weighing on the share price.

The Insight: Companies need to invest large amounts of capital to continue to grow and compound their earnings. For long term investors this is a good thing, and you should probably be more concerned if they aren’t investing for growth. In the short term, these investments can affect profitability and weigh on the share price — but this can also provide an opportunity to invest at an attractive price.

China’s $2.3 Trillion Infrastructure Investment Plan

On Tuesday China’s President Xi Jinping said all-out efforts must be made to spur infrastructure spending. He made the comments at a Central Committee for Financial and Economic Affairs meeting, although the plan was originally announced earlier in the month.

China is using infrastructure spending to stimulate economic growth which is under pressure due to Covid-related lockdowns and a slump in the property market. It is hoped that this spending will help the country achieve its goal of 5.5% GDP growth this year.

Local governments have been given targets totalling $2.3 trillion to invest in industrial park infrastructures, transportation facilities, and low cost housing, and these will be financed by special bonds. President Xi’s remarks helped China’s and Hong Kong’s stock markets outperform global markets last week.

Commodity prices and the shares of commodity-producing companies are closely tied to infrastructure spending in China. In the late 1990s and early 2000s, China’s massive investments in infrastructure led to a boom in commodity prices and the share prices of commodity producers as China quickly became the world’s largest consumer of iron ore, copper and coal.

In the 10 years to June 2008, the CRB commodity index rose 350%. After 2008, the index gave up most of those gains as China’s imports stabilized and supply outstripped demand. During the last two years however, the index has risen once again due to supply chain challenges and inflationary pressure.

The Insight: The CRB commodity index has rallied more than 150% since early 2020 due to supply chain constraints, but is still well below its 2008 highs. Increased demand from China (and other countries using infrastructure spending to stimulate their economies), could result in further upside for commodity prices — and profits for commodity producers. In addition, commodity prices tend to rise during inflationary periods.

As always, there are some caveats to consider. If, or when, supply chain issues are resolved, there may be less pressure on the prices of some commodities, and the prospect of a global recession could also dampen demand in the medium term. Commodity prices are volatile even at the best of times, and these factors suggest that even if prices do continue to rise, volatility should still be expected.

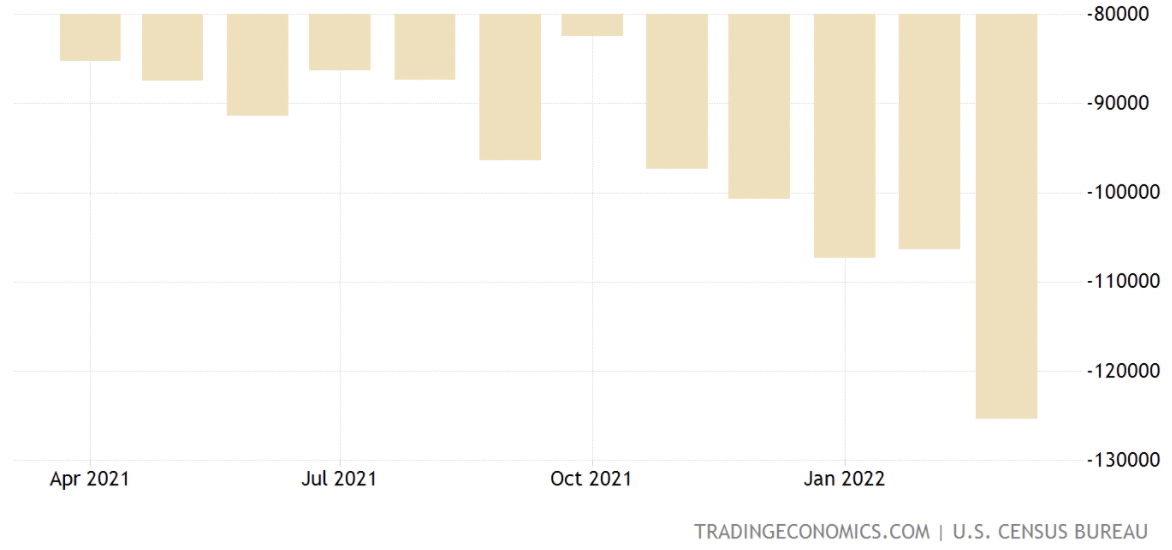

The US Goods Trade Deficit Reached a Record High, While First Quarter GDP Contracted

Two economic data releases last week caught analysts by surprise. Firstly, the US goods trade deficit rose 18% in March to reach a record high of $125.3 billion. And secondly, first quarter GDP unexpectedly fell by 1.4%.

A trade deficit occurs when a country’s imports are higher than its exports, and generally implies negative economic implications for the importing country.

These numbers may appear alarming, but were actually both skewed by the supply chain issues that have affected the global economy over the last two years. Contributing to the trade deficit was the fact that a backlog of goods were unloaded from cargo ships that had been waiting to enter US ports.

Nevertheless the trade deficit does reflect the fact that US demand for imports has rebounded faster than the rest of the world, and that the US is still very dependent on the rest of the world for manufacturing.

The GDP (gross domestic product) data also implies that the US economy shrank during the first quarter, which means that economic activity slowed in this period. For economists, a recession occurs when an economy contracts for two consecutive quarters, so GDP contraction in one quarter is a significant event.

However, investors should keep in mind that domestic consumer and business spending were actually higher during the quarter. The overall GDP number was only negative because inventories fell and the trade deficit rose - both of which were affected by supply chain issues.

The Insight: Economic data is often skewed by technical factors and the timing of certain events. With this in mind, last week’s data might not be as concerning as the headline numbers suggest, since US consumer demand is still strong. However, it is a little concerning to see that global demand for goods is trailing demand from the US.

Looking Ahead

On Wednesday the US Federal Reserve will set the federal funds rate, which affects the rates at which consumers and businesses borrow money. A 0.5% rate hike is widely expected, but the Fed’s Chair Jerome Powell may also provide some insights on future rate hikes and expectations for inflation.

If his comments allude to more “quantitative tightening” measures than what investors already expect to occur (hikes and balance sheet reduction), markets may decline as a result. Alternatively, if his tone sounds less aggressive than expected, markets may rally.

Either way, we should not base our investment decisions on the short term movements from comments by the Federal Reserve. Instead we should focus on identifying and buying high quality businesses below their intrinsic value.

Notable companies reporting quarterly results include:

- AMD (NASDAQ:AMD)

- Shopify (NYSE:SHOP)

- Airbnb (NASDAQ:ABNB)

- Pfizer (NYSE:PFE)

- BP (NYSE:BP)

- Starbucks (NASDAQ:SBUX)

- Cloudflare (NASDAQ:NET)

Until next week,

Invest Well

Simply Wall St

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.