"Compound interest is the eighth wonder of the world. He who understands it, earns it… he who doesn't… pays it.” - Albert Einstein

Since earnings season is upon us, we have decided to take a look at three topics related to company reports: earnings quality, share buybacks and margins.

🎧 Would you prefer to listen to these insights? You can find the audio version on our Spotify or Apple podcasts !

Earnings Quality Is Important In This Current Economic Landscape

The quality of a company’s earnings is a key consideration when assessing its merits as an investment. So what do we actually mean when we say earnings quality? While there isn’t a specific definition, the term refers to how reliable, predictable and sustainable a company's profits are.

Reliability implies that earnings in a given year are a true reflection of the ongoing profitability of a business. This means the following need to taken into account:

- Non-recurring items

- One-time financial transactions that can impact reported earnings, but since they are not expected to recur, they don’t reflect the company’s ongoing earning capacity.

- Changes in the value of investments that are marked to market

- Changes in market prices can lead to unrealized gains or losses for investments held by the company, impacting reported earnings without reflecting the company’s actual operational performance.

- Amortization and Depreciation

- Depreciation and amortization are accounting practices that impact reported earnings by spreading the cost of long-term assets over their useful lives, but do not affect cash flows, thus not reflecting true operational profitability.

- Changes in accounting periods and policies

- Changes in accounting periods or policies may misrepresent underlying business performance if not adjusted for. For example, changing from a first-in-first-out to last-in-first-out accounting policy will impact earnings on paper.

A good starting point to identify these items is by comparing operating income, net income and cash flow. If there’s a big difference, try to work out what caused it, and whether those differences are likely to continue or change in the future.

The predictability and sustainability of earnings requires a more qualitative analysis. Some of the factor to consider include:

- Business strategy and restructuring

- Restructuring costs may depress earnings temporarily, but could lead to a revision of business strategy leading to improved efficiency and more sustainable earnings in the future.

- Industry maturity

- Companies in mature industries may exhibit stable but possibly lower earnings growth compared to those in emerging industries.

- Company growth stage

- Established companies may have less volatile and more sustainable earnings, while growth-stage companies may have experienced higher earnings growth at the cost of predictability.

- Management and culture

- Effective management and a strong organizational culture can contribute to earnings sustainability by promoting consistent decision-making.

- Competitive advantages

- Sustainable competitive advantages such as strong brand, cost advantages, or unique technology, can lead to more predictable and sustainable earnings by shielding the company from competition.

- Unusual or one off events

- Unusual or one-off events can create volatility in earnings, making them less predictable. Identifying and adjusting for these events can provide a clearer picture of a company's underlying earnings performance.

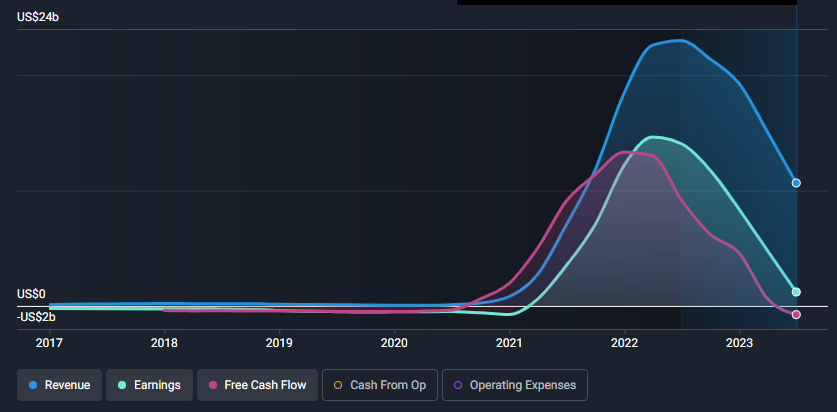

The pandemic was a good example of an unusual event which provided an unsustainable windfall to some companies. Here’s how Moderna’s revenue, earnings and cash flow have looked since 2017:

Moderna’s numbers may be perfectly reliable from an accounting point of view, but when you consider the bigger picture, the trends seen in the financials were unlikely to be sustainable. For an even more dramatic example have a look at the same chart for Zoom Video .

Earnings Quality Is As Important As Growth Trends

In the current environment, earnings quality is more important than ever. Prior to 2022, when rates were close to zero, all that seemed to matter was growth. During that period extrapolating growth trends tended to work - or at least be more achievable - and companies could easily ‘buy’ growth with cheap money. Did you want to give an extra kick to your earnings? Just acquire another company using debt!

Now that rates have increased dramatically (or have normalized, depending on who you ask), investors need to be more selective. If a company has high quality earnings it’s more likely that it will be able to keep producing those earnings for the next 5, 10 or 20 years. That will increase the likelihood of earning a decent return.

Building A Narrative

Determining the qualitative factors that drive growth is at the core of developing an investment narrative or thesis.

An investment narrative is a set of catalysts that you believe have a high probability of occurring in the future , along with an explanation of how they will ultimately affect the value of the business.

The catalysts for your narrative will be the most important factors (typically 4 to 8 or so) that you think will have a meaningful impact on the value of the business in the future. They can include:

- Industry and market trends

- Competitive landscape

- Product pipeline

- Business strategy

- Potential restructuring or acquisitions

- Share buybacks

- Anything else that can ‘move the needle’

Once you’ve identified your key catalysts, you can build a list of assumptions which quantify exactly how you believe the catalysts will impact revenue growth and profit margins over the next five to ten years .

You can then work out the price you would be prepared to pay to earn a return that justifies the risk. No matter how compelling a narrative is, you can only earn a return if you pay the right price.

By putting the time into developing a narrative like this, you will:

- Have a high degree of conviction in your ‘buy price’.

- As Warren Buffett will tell you, the key to investing is not only finding great companies, but finding great companies at fair prices.

- Know the risks to the narrative and what you need to see to know your thesis is on track.

- Companies don’t operate in isolation. A business’ long-term outcomes are also at the whim of the broader economic landscape and the companies it competes against. Any changes here could be a risk to your narrative playing out so they’re important to know.

- Own a piece of analysis that you can revise as new information becomes available.

- Investors that have created a narrative on a given stock will have a much greater understanding of how new announcements impact the overall business. Your narrative can be a living entity that changes to incorporate new information and keeps your concept of fair value up to date.

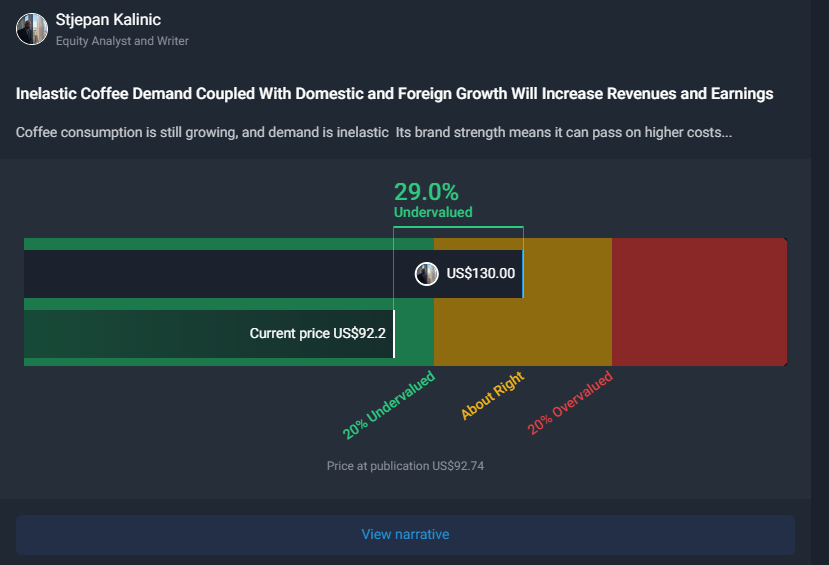

This narrative for Starbucks is a good example of a complete investment thesis including catalysts, assumptions, valuation and risks:

If you love this narrative and are interested in reading some more, be sure to check out the company reports for Intel, Apple, Amazon, Adobe, Netflix and Disney!

The Pros And Cons Of Share Buybacks

Share buybacks have become an important driver of earnings growth over the last decade and are closely watched during earnings season.

Repurchasing shares is just one way a company can return excess cash to shareholders, and often makes sense. Some the advantages of buybacks include:

- Increase the share of ownership of each shareholder . If a company with 100 outstanding shares repurchases 10 shares, the remaining 90 shares will each represent 1.1% of ownership.

- Increase earnings per share . When net income is divided by a smaller number of shares, the EPS increases.

- Buybacks can return cash to shareholders when the company doesn’t have a compelling way to invest it.

- Share buybacks are more flexible than regular dividends . However special dividends can also be used to make ad hoc payments to shareholders.

- Buybacks can be used to offset the dilution of stock-based compensation - but see the caveat below.

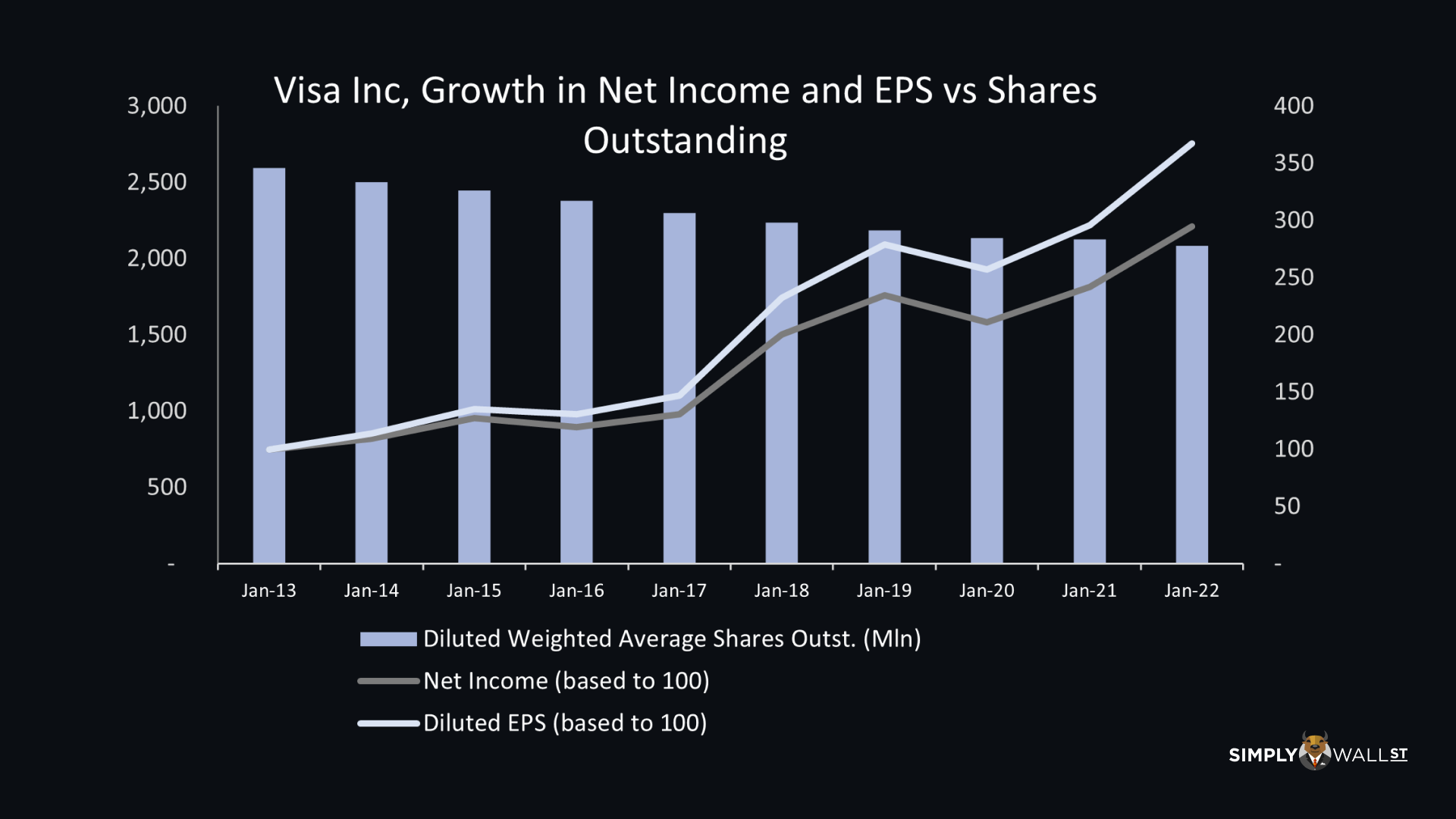

Buybacks can have a significant effect on EPS. Over the last 10 years Visa bought back 18% of outstanding shares. The result was that while net income increased by 218%, EPS increased 289%.

There are also times when buybacks are not a good idea:

- Buying back shares instead of paying down debt can have long-term consequences for shareholders.

- Buying shares when they are overvalued . Like any other investment, this can eventually lead to losses.

- Buying shares to support the share price . This excess cash would be better spent on operational improvements rather than supporting the share price.

- Company management are sometimes incentivized to repurchase shares to reach certain benchmarks that determine their own compensation . This can occur when the price is too high or paying off debt would make more sense.

It usually takes just a bit of common sense to tell when a buyback plan doesn’t make sense.

Buybacks Vs Stock-Based Compensation

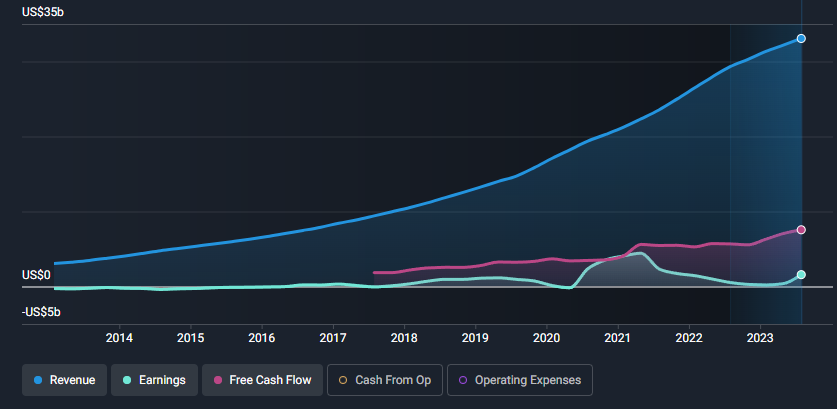

Last year Salesforce initiated its first share repurchase program. This was a relief to investors after years of dilution. It also makes sense at first glance as Salesforce has reached a point where free cash flows are steady and approaching $7.5 billion.

But this buyback program appears to merely offset the dilution caused by the company's massive stock-based compensation (SBC) payments. Reminder : SBC is a non-cash expense which explains most of the difference between free cash flow and GAAP earnings . Non-Gaap earnings leave the SBC out, which means it should follow free cash flow more closely.

Salesforce’s stock-based compensation for the 12 months to July was $7.8 billion . In addition the company has spent billions buying shares to reduce the dilution. In many ways all this does is turn a non-cash expense into a cash expense. Ultimately whether shareholders benefit will depend on what happens to the share price.

Margins: Temporary Or Sustainable?

Roughly half the companies in the S&P 500 index have reported third quarter results.

One of the interesting stats is the beat rate for EPS and revenue. The number of companies beating estimates is comfortably above average (~80%), while the number beating revenue estimates is well below average (~60%).

This implies that profit margins have also been better than expected. So far the net profit margin has been about 12% ( as per FactSet ), which is better than the 11.6% expected and roughly equal to the third quarter last year. This quarter is also shaping up to be the fourth consecutive quarter with higher margins, after a streak of seven consecutive quarters with shrinking margins.

💡The Insight: Cost Cutting And Inflation Lead To Higher Margins`

Over the last 18 months inflation and cost cutting have had a significant impact on margins:

- Inflation initially squeezed margins as costs rose quickly. However, since then companies with pricing power have managed to raise prices - and in some cases faster than inflation. With inflation now slowing, some companies are now reporting wider margins as higher prices kick in. This is a good indication of how much control a company has over costs, and whether they have pricing power

- Most industries have cut costs in anticipation of a tougher economy - and this has resulted in higher margins. Meta for example has more than doubled its net income margin from 14.5% to 33.92% in four quarters.

The question to consider now is whether recent changes to margins are likely to stay the same, reverse, or continue to improve. In many cases the earnings trend will only continue if revenue growth accelerates.

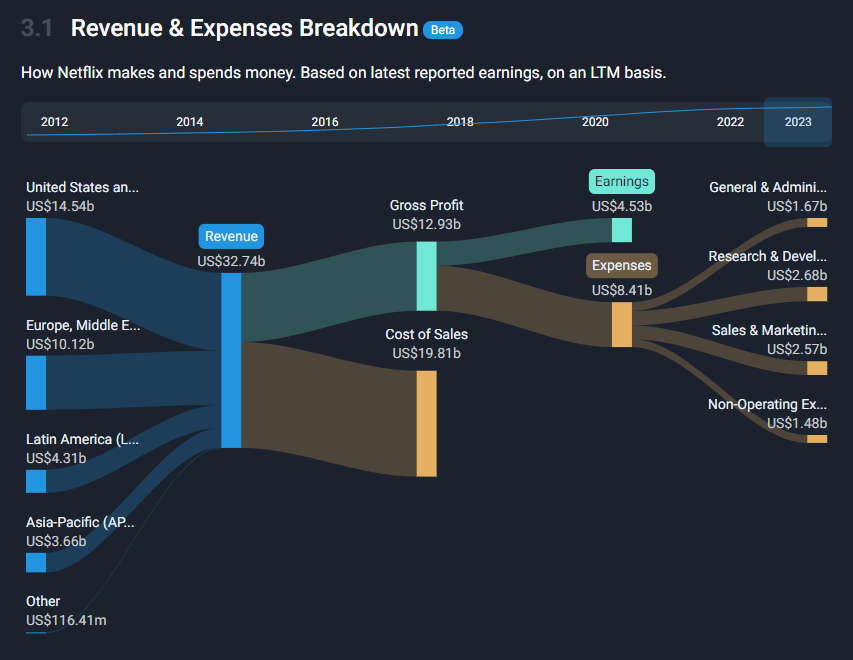

If you want to quickly see how margins are trending, head to the ‘Past Performance’ section of a company report and look at the Sankey chart which illustrates the revenue and expenses breakdown (Netflix example below). If you hover over the Gross Profit and Earnings you’ll see the relative percentages. You can go back over the last few years to see how those margins are trending.

What Else Is Happening?

First a recap of the key data releases we mentioned last week…

- 🇺🇸 The US Fed kept the benchmark funds rate at 5.25 to 5.5% as expected . Jerome Powell said the committee will now see how the data evolves over the next month . Powell summed up the Fed’s position by saying "We're not confident that we haven't, we're not confident that we have, reached that sufficiently restrictive plateau.”

- 🇺🇸 US employment pointed to a labor market that is holding steady. Job openings were little changed according to the Job Openings and Labor Turnover Survey . The ADP job report revealed that US companies added 113,000 jobs in September. This was higher than the prior month but lower than consensus estimates.

- 🇩🇪 Germany's GDP data showed the economy continuing to contract, but at a slower rate than expected . Germany’s inflation data pointed to lower than expected price increases.

- 🇨🇳 China’s PMI data was slightly softer than expected . This suggests that consumers are still propping up the economy, while manufacturing is taking longer to recover.

- 🇯🇵Japan’s BOJ kept rates steady at -0.1% for short term rates . However the bank is beginning to relax its yield curve control and redefined the 1% level as a ' reference level’ rather than a hard cap.

And then, one news item that we thought was worth noting…

- 🔋 Panasonic Holdings recently said it would cut battery production by 60% due to lower demand from its key client Tesla .

- Tesla’s sales have slowed despite price cuts, and Panasonic's decision suggests the slowdown could last a few quarters or even longer. Softening demand is affecting the entire EV value chain, from lithium producers to automakers.

- This should eventually provide an opportunity for investors, but it’s probably worth looking for evidence of a turnaround before jumping in.

- If you’re wanting to know more about what this could mean for Tesla, check out this investment narrative for Tesla .

Key Events During The Next Week

It’s a lighter week on the economic data front after last week's deluge of data.

On Tuesday China’s trade data is due and Australia's central bank announces its interest rate decision.

And then on Friday UK manufacturing and GDP data will be published.

Also on Friday, the US University of Michigan Consumer Sentiment Survey will be released.

Earnings season continues with the following prominent companies reporting:

- NXP Semiconductors

- Vertex Pharmaceuticals

- Uber

- Datadog

- Rivian

- Occidental Petroleum

- Roblox

- Walt Disney

- Affirm

- Plug Power

- Unity

- Trade Desk

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.