The Key Investment Themes of 2024

Reviewed by Bailey Pemberton, Michael Paige

We hope you’ve all had a great end to 2023!

It was a year that kept all investors on their toes, but given the S&P 500 finished the year up 24%, it seems that there were opportunities in the market if you knew what to look for.

But now it’s time to shift our focus to 2024!

What's in store for us? Well, we’ve taken a look at some of the 2024 Outlooks published by 10 major asset managers and sell-side research teams.

We’ve summarised some of the recurring themes and dived a little deeper into the individual insights that you ought to know.

🎧 Would you prefer to listen to these insights? You can find the audio version on our Spotify or Apple podcasts !

What Happened in Markets this Week?

Here’s a quick summary of what’s been going on:

- 🏛️ US national debt has reached a record $34 trillion ( AP )

- Our Take: While the trajectory is no doubt unsustainable, it’s anyone’s guess as to when this turns into a more dire situation.

- 🚗 Tesla falls behind China’s BYD in Q4 EV sales ( WSJ )

- Our Take: BYD is growing well, but faces a lot of potential geopolitical headwinds from European and USA regulators (investigations and tariffs respectively) which could slow down growth prospects.

- 🚢 Maersk stops Red Sea shipping until further notice after attacks ( CNBC )

- Our Take: If more attacks on container ships occur in this region, it could potentially wreak havoc on global supply chains and the economy as ships are either forced to take different routes or incur higher insurance fees, both of which could increase end costs.

- 🥊 Disney wins activists' backing in boardroom fight with Peltz ( Reuters )

- Our Take: With a bit more certainty around who’s going to be sitting on the board (pending the AGM vote), Disney investors will hopefully now be able to watch the company continue to implement its current turnaround plans and CEO succession, rather than watch continued fighting and stalemates in the boardroom.

🔄 The Recurring Themes of 2024 Outlooks

We’ll start by listing some of the themes and insights that came up in many of these reports:

🪶 The Soft Landing Has Been Priced In

There is general agreement that the market believes that central banks, and the US Fed in particular, have managed to engineer a soft landing.

While recessions aren’t out of the question, investors no longer expect the more bearish scenarios.

✨ If a soft landing is in fact ‘ in the price ’ of most assets, then a soft landing scenario is likely to result in modest returns from today’s prices.

🌎 Geopolitical Risks Will Play A Larger Role In 2024

Most strategists believe it's likely that geopolitical factors will play a bigger-than-usual role in 2024.

The major geo-political issues to consider include the wars in Ukraine and Israel/Palestine, China-US relations, China/Taiwan hostility, and rhetoric leading up to the US elections.

✨ The implication is that portfolios need to be balanced to mitigate risk from any one geopolitical risk.

💰 Consumers Have Depleted Their Savings

Another topic that came up often was the fact that company performance in 2023 was closely tied to consumer spending. In most economies, consumers are not over-extended but they have depleted their savings and are becoming more indebted.

✨ Those companies reliant on strong consumer discretionary spending may find 2024 tough if consumers remain under pressure with less disposable income.

⚖️ Some Markets And Sectors Will Be Heavily Favoured

The sectors and markets that strategists were most optimistic about included high-quality tech (particularly AI), Japan, India, Mexico , and US healthcare.

✨ If views are already widely optimistic on these areas, be prudent about what price you pay, because optimistic forecasts may already be “priced in” in these sectors and countries.

🔀 The Divergent Themes

There were two topics where opinions differed widely:

🎈 Inflation And Interest Rates

Research teams have widely divergent views on whether inflation might rebound and how quickly interest rates will fall (if at all) - or whether they might go even higher.

Time will tell, but as always, it’s probably best to avoid going all in on a specific outcome where you’re wiped out if the opposite occurs, and instead position yourself where you benefit from either outcome.

✨ Think in probabilities and weigh your positions accordingly. Have cash available to take advantage of opportunities from volatility, and exposure to the upside if conditions continue improving.

🌏 Emerging markets

There are also differing opinions on whether emerging markets are set to outperform.

On the one hand, EM valuations are lower than developed markets, on the other, they have historically been tied to China’s economy.

We pointed out recently that that relationship may be breaking down , but it's still a factor. The opportunities within those markets could be the companies that benefit from local consumption.

Specific Insights From Each Report

These are some specific insights from each company that we thought stood out as interesting or useful.

As you’d expect, there is some contradiction, but that’s what you get with many market participants with different thoughts on the future.

That’s actually great though, because it helps us think in probabilities rather than absolutes.

JP Morgan Asset Management: Expect the Unexpected

JP Morgan AM’s annual outlook is titled The Last Leg on the Long Road to Normal .

The outlook hopes for a boring year for the US economy, though growth is expected to slow compared to 2023. For other economies, the asset manager believes consumer spending will be key.

✨ While their outlook is cautiously optimistic, the report pointed out that there are several risks and unknowns. They therefore suggest a well-diversified portfolio that can benefit from a range of outcomes.

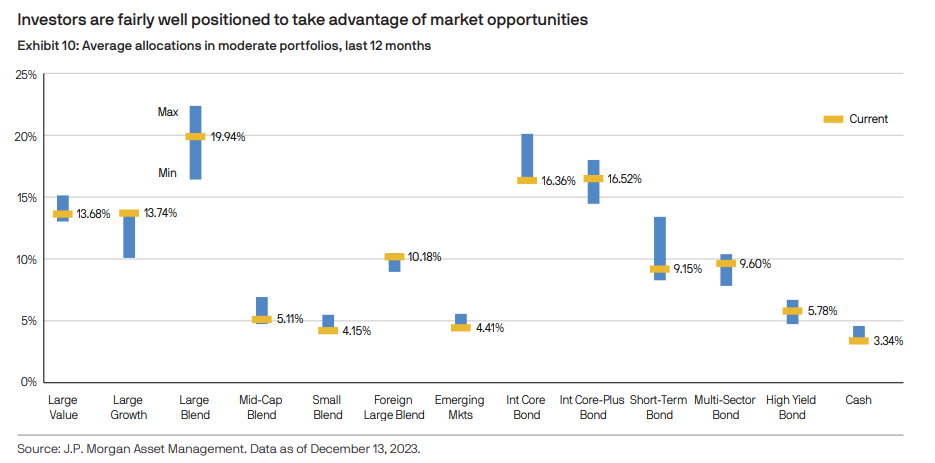

The following chart shows that US investors are underweight mid and small cap stocks, as well as emerging market stocks.

This implies that these stocks would outperform if their business performance is good enough to attract new investor's attention.

To make sure your portfolio's exposure and weightings align with where you have conviction, you can use our Portfolio tool to review your diversification by stock, industry and geographic region.

Russell Investments: REITs Are More Interest-rate Sensitive And Could Benefit From Lower Yields In The Year Ahead

Russell Investments pointed out that REITs (real estate investment trusts) are attractively valued. They are also very sensitive to interest rates and typically benefit from lower yields.

The global property market has had a rough time lately, and sentiment remains negative. However, the performance of REITs is often more closely tied to interest rates than activity or prices in the property market.

If rates fall faster than expected, REITs are likely to perform well - but if the higher-for-longer narrative plays out, the sector could disappoint.

Russell also favors the ‘quality factor’ ( as do we ) - and this applies to REITs as much as it does to other types of shares. Some real estate stocks and funds need very low rates to generate a positive return, while others are more resilient to rates remaining higher.

✨ The fact that the entire sector tends to react to rate expectations (and current expectations are that rates are going lower), you might be able to invest in high-quality REITs or exit the low-quality ones.

Russell Investments outlook also includes some good regional snapshots, including thoughts on Canada , Australia and New Zealand .

Julius Bär: High Rates Are Not Sustainable

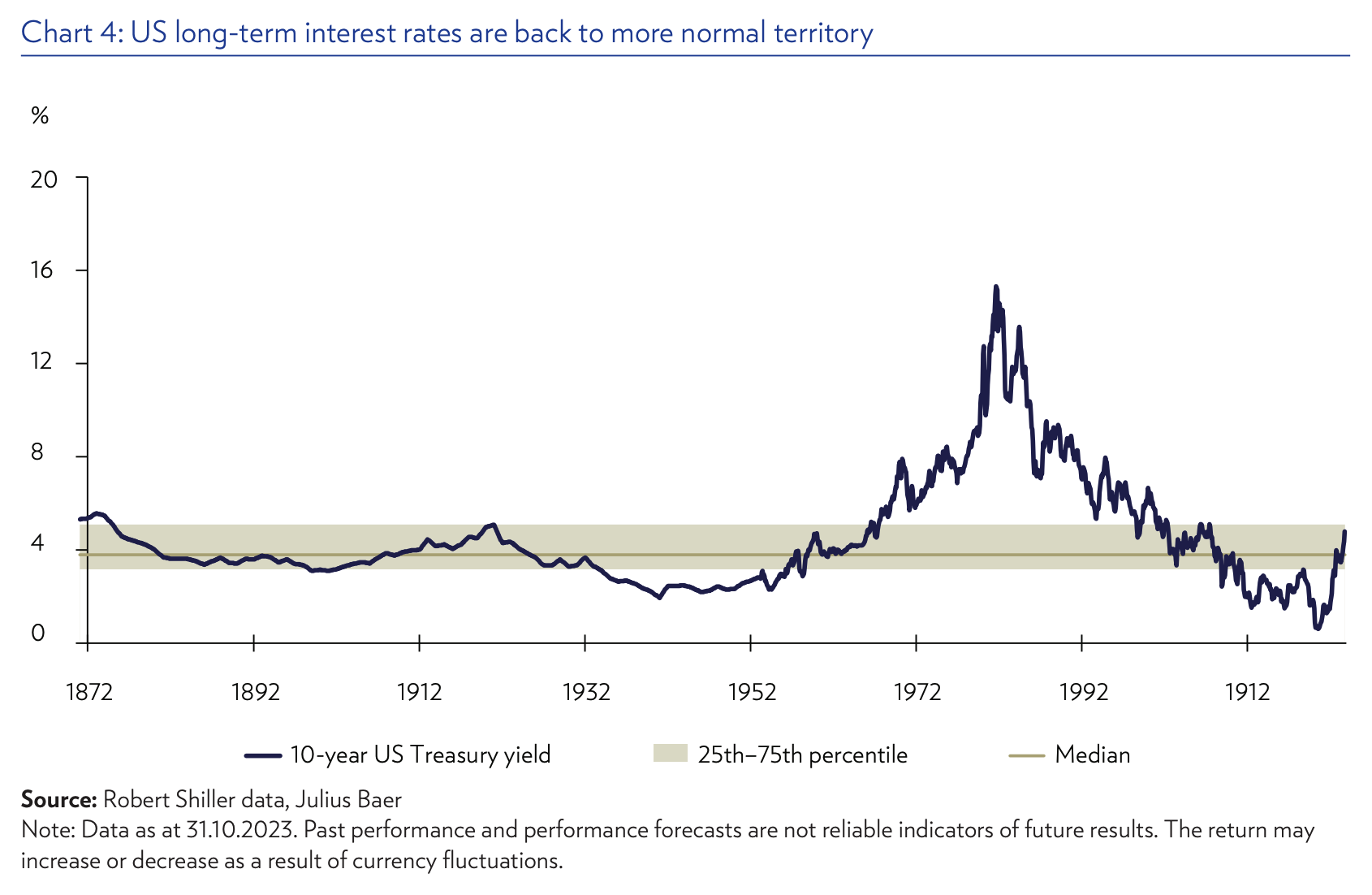

Swiss wealth manager Julius Bär pointed out that higher interest rates may not be sustainable .

Their reasoning is that with the massive amount of global financial assets and debt, the global economy wouldn’t be able to tolerate rates rising further or even remaining at current levels.

This ‘financialization’ of the global economy means the real economy is more sensitive to financial markets, which in turn are sensitive to rates. They also pointed out that central banks have new tools to deal with systemic risk, like the banking crisis of March 2023.

Policymakers may also tolerate inflation closer to 3% rather than the previous target of 2%, which would help them monetize government debt.

✨ So, while it’s unlikely that rates will return to zero, if Julius Bär is correct, we may see them back in the 2 to 3.5% range sooner rather than later.

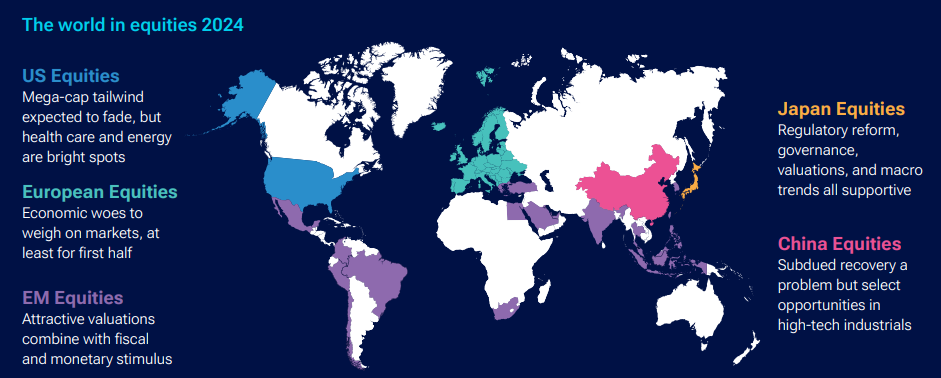

T.RowePrice: Equity Investors Will Need To Cast Wider Nets In 2024

T.RowePrice believes that global equity markets face challenges that could result in volatility.

They also believe investors will need to look to a broader range of sectors, industries and regions. They believe the leadership of big tech might fade and the “ opportunity set may broaden ”, i.e. market returns may come from more than just The Magnificent 7 .

✨ T.Rowe suggests opportunities may be found in the US healthcare and energy sectors, emerging markets, Japan and certain Chinese ‘high-tech industrials”.

T.RowePrice’s Outlook for Global Equities - Image Credit: T.RowePrice

You can use our Screener tool to filter by market, industry and stock fundamentals, and find opportunities that suit your criteria, then save that screener to be notified of any new companies that tick the boxes you’re looking for!

Blackrock: The Emerging Climate Resilience Theme

Blackrock’s outlook covers several themes including disruptive forces, macros risks and the fragmentation of the global economy. The report is relatively short and worth reading.

An interesting theme highlighted is climate resilience , which refers to the ability of economies and sectors to withstand and recover from climate-related crises. This is closely related to the energy transition, but possibly overlooked or underappreciated.

Blackrock recently published a 7-page report covering this emerging theme and the potential opportunities in the “ Climate Resilience ” trend are:

- Prepare: Assess and quantify the risks

- Prepare: Manage risks

- Repair: Built environment

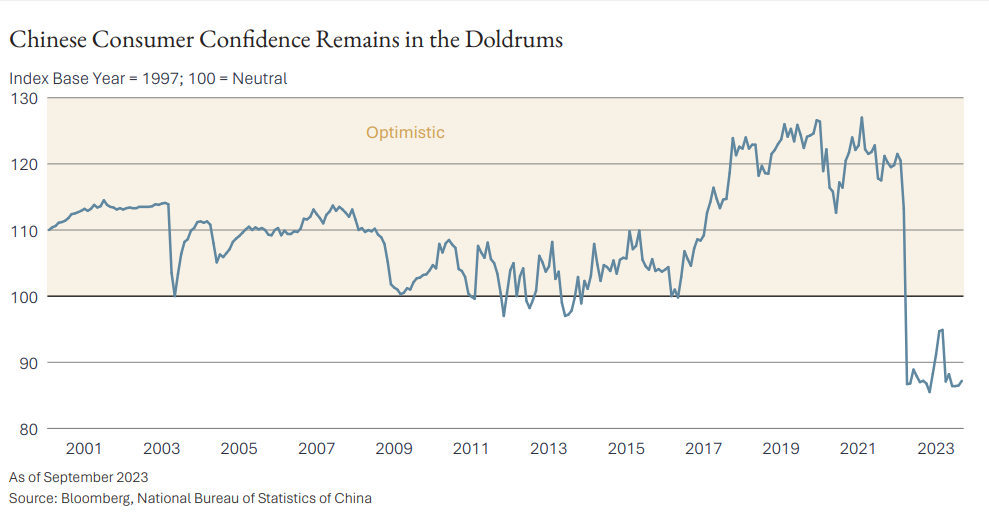

Lazard: Sentiment Around China May Be Too Negative

Lazard’s outlook acknowledges that China faces challenges, but believes sentiment may be too negative. They point out that China’s government has initiated numerous stimulus measures and the property sector appears to be stabilizing. Consumer confidence is at an all-time low, but there is some evidence that it may be bottoming.

Lazard also pointed out that China has become a crucial part of the supply chain for the global renewable energy industry, particularly wind and solar.

In addition, China is now the largest net exporter of EVs. The industries connected to this sector should benefit from these tailwinds regardless of the rest of the economy.

Besides China, this outlook also covers the Eurozone, Japan and geopolitical issues in some detail.

Morgan Stanley: India Is Better Positioned Than China

Morgan Stanley has been amongst the most bearish and remains cautious heading into 2024 .

They suggest that fixed income now “offers better risk/reward trade-offs than other asset classes”.

In particular, MS believes China’s challenges will continue to be a headwind for its own economy, as well as emerging markets and commodities.

The exceptions are India and Mexico , which other research teams have also highlighted.

✨ Morgan Stanley believes that India’s nominal GDP growth will support earnings growth, and Mexico will benefit as the US brings manufacturing closer to home.

Merrill: The US Resiliency Premium

Merrill’s annual capital market outlook included some interesting points about the US equity market and economy compared to the rest of the world.

The US stock market has outperformed most since 2009, and did so once again in 2023. The US economy is also one of very few that has matched or beaten growth forecasts over the last 5 years, despite the impact of a pandemic and decade’s high inflation.

This performance reflects the resilience of the US economy and corporate environment.

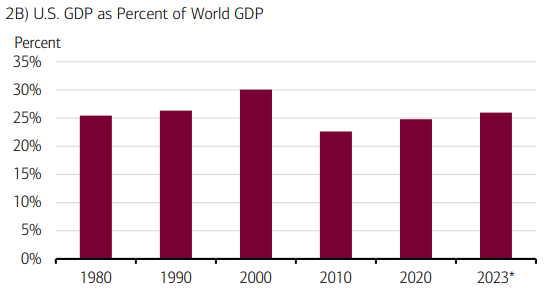

While pundits continually predict its imminent decline, the US share of the global economy has remained stable over the last four decades, despite the growth of economies like China.

US Share of Global GDP - Image Credit: Merrill

As Merrill put it: “no country in the world is as dynamic, resilient, productive, diversified and

wealthy as the U.S.”

✨ Their point is that US equities probably deserve a substantial premium. So, while other markets may offer better relative value, we shouldn’t expect the gap to close entirely.

JP Morgan: We May Need Market Volatility Before We See Substantial Rate Cuts

Like most research teams, JP Morgan Research suggests the recession risk is ‘modest’ but that economic growth and earnings growth will weigh on returns.

JP Morgan believes inflation will remain stubborn and rates will stay higher for longer.

The report also suggests that policymakers might need to see market volatility before they make substantial rate cuts. The last few decades have shown us that central banks are very quick to cut rates and provide liquidity when there is a crisis. But, without some sort of crisis, they may err on the side of keeping rates at elevated levels.

✨ JP Morgan also believes US stocks will continue to trade at a premium due to stronger cash flows and large tech weightings in the index.

They suggest that emerging market stocks could improve later in 2024 as global investors are underweight in their exposure to emerging markets which are trading on lower valuations.

Goldman Sachs: Possibility Of A “Fed Put”

The outlook from Goldman Sachs included a few observations worth noting:

The first ties in with JP Morgan’s view on rate cuts. They suggest that if volatility picks up, the Fed will cut rates quickly. This is known as the Fed Put, and implies that downside is limited as central bank action will support the market. It’s worked in the past, but that doesn’t mean it will always work.

Goldman also believes that a “ higher for longer” rates scenario would hurt some countries and sectors more than others. We have already pointed out that heavily indebted companies will struggle to refinance if rates remain at current levels. This could also impact consumer-facing companies if their customers have to deal with mounting debt.

✨ Finally, Goldman Sachs pointed out that one positive result of the “post-COVID policy excesses” is that markets are normalizing and positive yields are now available from fixed-income assets.

This means investors are no longer being forced into risky assets, and diversified portfolios of different asset classes (bonds, stocks, cash, etc) make sense again.

💡 The Insight: Be Ready To Take Advantage Of Any Volatility

Research teams are on the whole cautiously optimistic, but believe returns are likely to be more modest than 2023 with pockets of outperformance.

They also point out that volatility could come from several quarters, including geo-political factors and changing expectations for interest rates and corporate profits.

For long-term investors, volatility is a good thing. The market is prone to knee-jerk reactions that affect entire sectors. This creates opportunities for us when high-quality stocks get sold along with everything else.

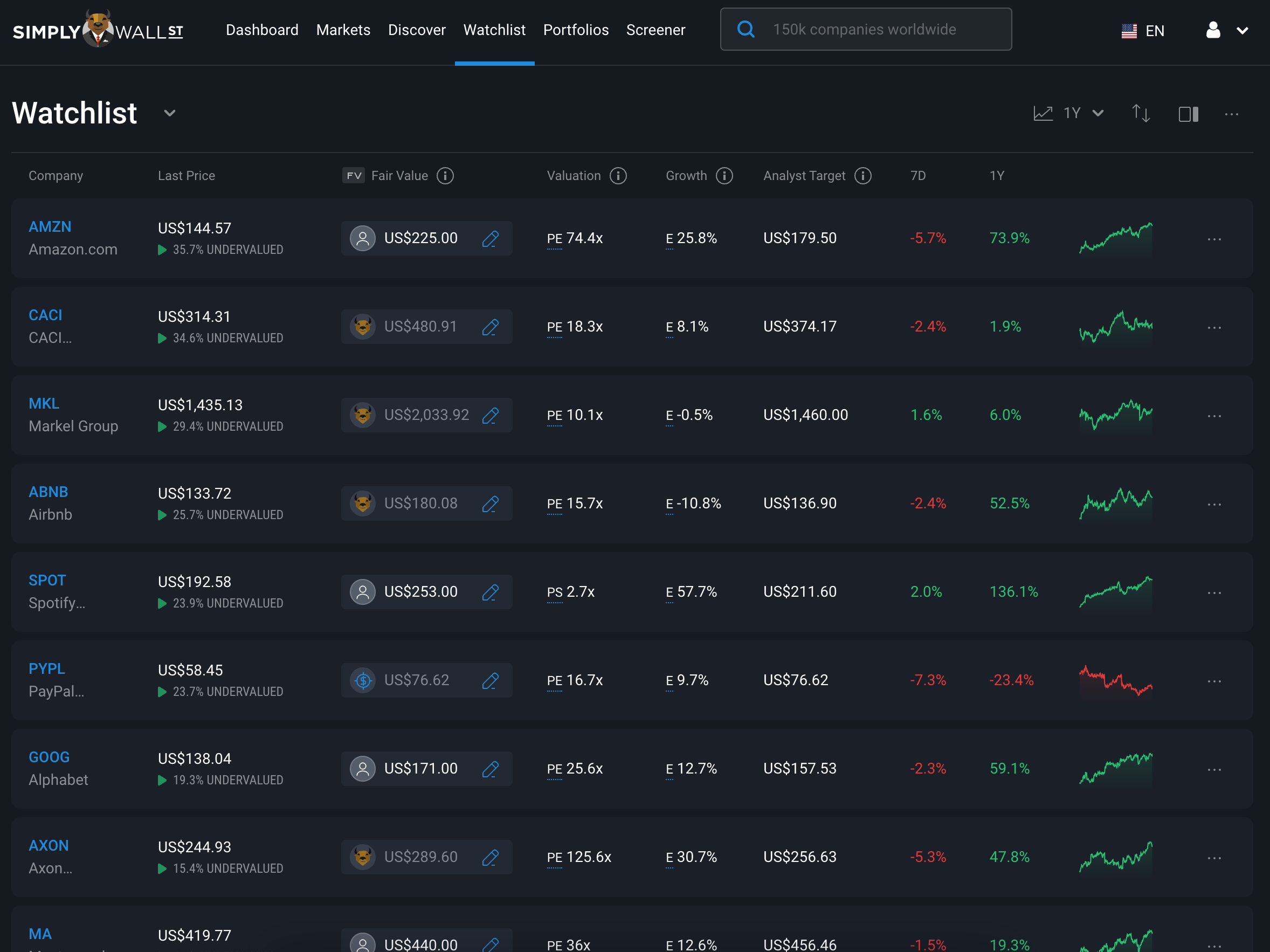

2024 could be a great year to buy shares in companies with solid long-term fundamentals at attractive prices. The best way to prepare for these opportunities is to make sure your watchlist is up-to-date with the stocks you would like to own, and the price you would like to own them at.

Key Events During The Next Week

In the second week of the new year we’ve got a bunch of data coming out, with a few countries reporting their Balance of Trade for November. Germany kicks it off on Monday, followed by Canada on Tuesday, Australia on Thursday and China capping it off on Saturday.

US inflation data will be published on Thursday for December, and China will follow suit on Friday, reporting their YoY inflation data.

On Friday, the UK is set to report their monthly GDP figures, ahead of Germany’s announcement of their Full Year GDP Growth stats on the following Monday.

As for company earnings, major banks are taking centre stage, and here are a few key earnings releases to look out for over the next week:

- Taiwan Semiconductor Manufacturing Company

- Infosys

- JP Morgan Chase

- UnitedHealth

- Bank of America

- Wells Fargo

- BlackRock

- Citigroup

- Bank of NY Mellon

- Delta Air Lines

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.