What Happened in the Market Last Week?

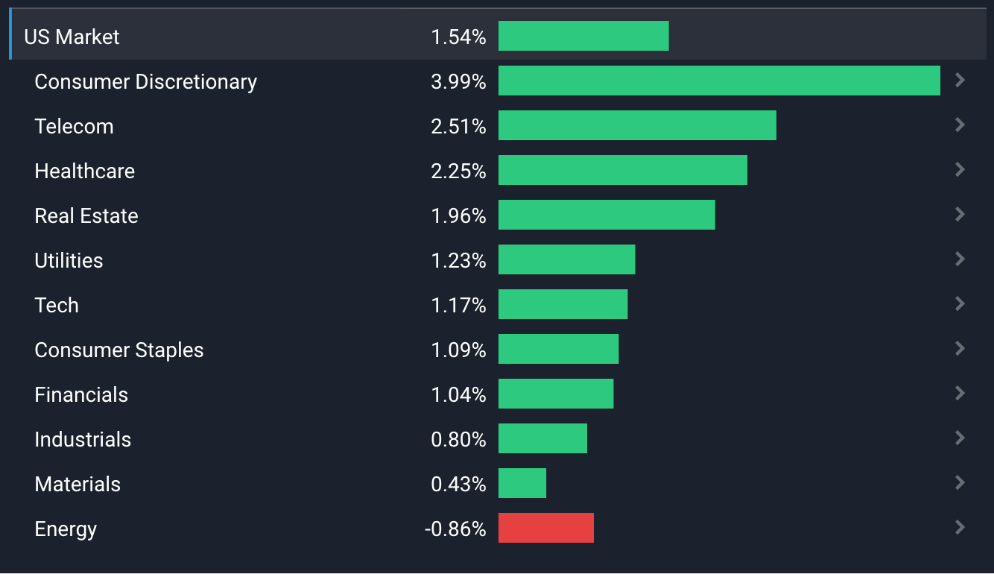

While concerns about protests in China weighed on markets earlier in the week, things turned around after Fed Chair Jerome Powell suggested rate hikes may slow as soon as December.

His comments prompted a rally in growth stocks with the US Consumer Discretionary , US Telecom and US Healthcare sectors benefiting most. Most sectors rose, but the cyclical sectors (US Energy, US Industrials and US Financials) lagged somewhat.

Early indications are that consumer still went on shopping sprees last week, since Black Friday and Cyber Monday sales hit record levels. However they didn’t quite outpace inflation - so in real terms they were less impressive.

Some of the developments we have been watching over the last week include:

- IMF projections suggest weak or no growth in 2023 for most major economies, then gradual recovery in 2024.

- Investors wonder if a jolly ol’ Santa Claus rally is coming, but data suggests investors may have already anticipated it.

- Another crypto platform, BlockFi, filed for bankruptcy protection, as contagion from the FTX collapse spreads.

The Latest on Global Economic Growth Forecasts

Economic growth forecasts around the world have been falling all year. So where do things stand now? Below we have the IMF’s GDP growth forecasts for some of the world’s major markets. These projections are from October.

In most cases, growth this year has remained quite strong and retained some momentum from the economic recovery in 2021. Some economists expected quite a few countries to slip into a recession by the end of the year which may not be the case - though some countries have yet to publish third quarter GDP numbers.

According to the IMF’s projections:

- The real softening will occur next year, and particularly in North America, Europe and Australia.

- In Asia, growth is projected to slow only slightly.

- After that a gradual recovery is expected in 2024.

Now let’s have a look at how those forecasts have changed since the IMF’s previous forecasts in October 2021 and April 2022. We have included the change in the P/E ratio for each country’s stocks market over the last year to see how the changing outlook has affected equity valuations.

Didn’t read all those numbers? No worries, here’s the key takeaways:

-

Forecasts for the US, Germany and China have been cut the most.

-

Meanwhile Brazil and other commodity producing economies are seen to be benefiting from higher commodity prices.

-

It seems that the US, UK, and Germany are expected to lead the world into a recession, with the rest of the world being less affected.

-

Overall these forecasts suggest growth will soften, but not necessarily that there will be recessions in every country.

Remember, these forecasts are for the full year, and individual quarters can be very different.

Additionally, there are however far more pessimistic forecasts around. It also seems that the ‘low point’ is being pushed further out from 2022 to 2023.

💡 The Insight: Forecasts don’t spell “Doom” for equity markets

There are two things to keep in mind.

-

Firstly, forecasts are worth keeping an eye on, but not worth placing too much emphasis on. Macroeconomic forecasts are often wrong or behind the curve. As it stands there’s a lot of uncertainty about inflation and energy prices, which makes forecasting more difficult than ever.

-

Secondly, the economy is not the stock market. If you look at the changes in GDP forecast and the changes in the P/E ratio of each stock market above, there is actually not much correlation.

What this means for investors

Ideally if you are a long term investor you should be looking five to ten years out and not worrying too much about economic forecasts for the next 12 months. Having said that, we are clearly in a period of heightened uncertainty which means there’s potential for volatility and further downside in the medium term.

You can reduce volatility by holding more cash (which pays slightly higher interest rates now) or less volatile stocks i.e companies with lower valuations and higher margins.

It may also be worth diversifying into companies with exposure to some of the countries that are less exposed to the US and Europe - two countries that stand out in the table above are India and Korea.

And, as we mentioned previously, the fundamentals for commodity and energy producers are improving. Nothing in the market is certain, but diversification usually helps reduce portfolio volatility.

Will we have a Santa Claus Rally?

Is it the most wonderful time of the year? (Cue Andy Williams singing)

Well, if you like your festivities, yes. If you believe in the Santa Claus (rally), then yes as well. It’s the time of year when investors start anticipating a ‘Santa Claus’ or year end rally.

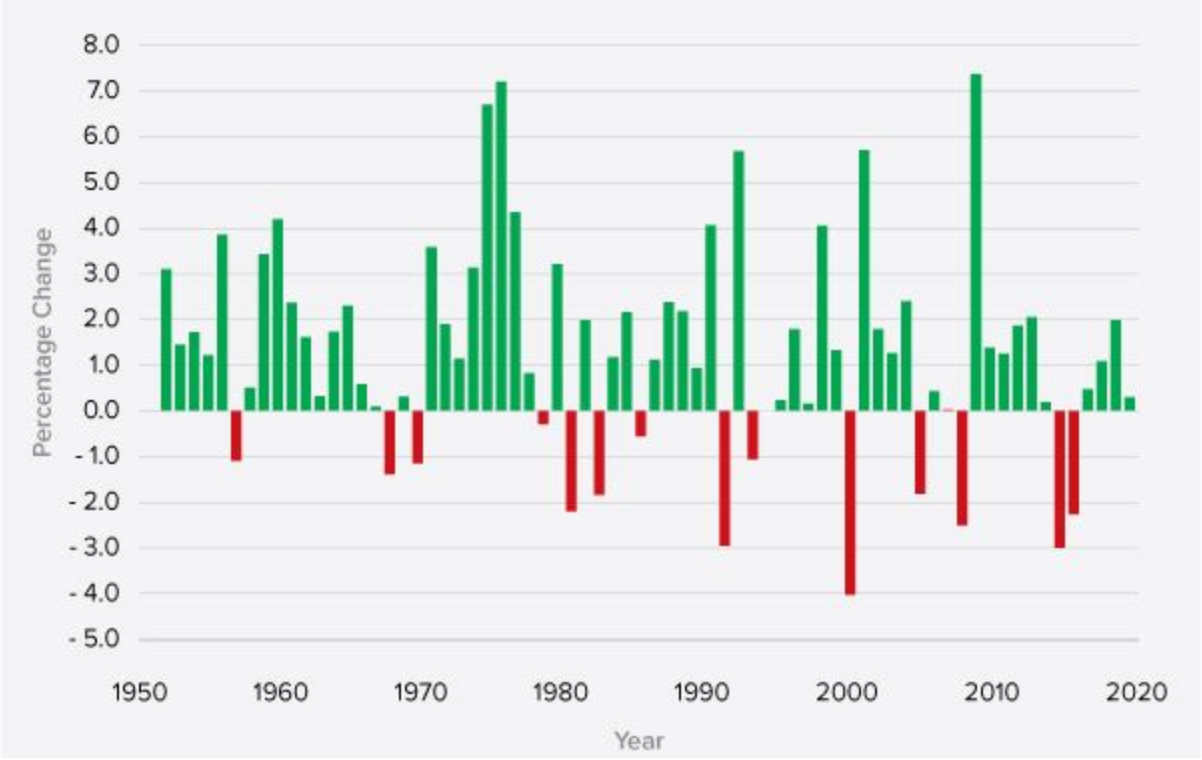

This rally often occurs between 25th December and 2nd January. The following chart from SmartAsset reflects the returns between these dates from 1950 to 2020. Interestingly, some of the biggest rallies occurred during bear markets.

What causes the Santa Claus Rally?

There are actually several possible reasons for this phenomenon, with the following being commonly cited:

- Pension fund managers may expect increased inflows in January as a result of year end bonuses. Fund managers don’t want to be underinvested with their current portfolios, so they make sure they are fully invested by the end of the year.

- Retail sales typically increase over the holiday season, and companies often spend unallocated budgets at the end of the year, which can lead to better than expected fourth quarter earnings.

- Investors are often more optimistic about the future during the holiday period. Maybe it’s the eggnog talking, but who knows.

💡 The Insight: Holidays rallies shouldn’t distract long term investors

Interestingly, the average gain during the year end rally has declined over time. It seems that as investors have become aware of the phenomenon they have anticipated it earlier each year.

This chart below (from Stockanalysis.com) of average monthly return for the S&P 500 index between 1980 and 2018 shows that December and January are usually positive months, but November has produced even better returns.

What this means for investors

The market does often rally into the new year, but the average returns are actually quite low when the occasional down year is taken into account. For long term investors, this is more of a distraction than anything - far bigger gains are earned by holding stocks for multiple years. If anything, a rally can be used as an opportunity to sell stocks you don’t want to hold.

Another Crypto Domino Falls - BlockFi Bankruptcy

Last week BlockFi became the latest cryptocurrency platform to file for bankruptcy. The list of crypto projects that have collapsed this year is growing. They include the FTX exchange, the Three Arrow Capital hedge fund, the Luna token, crypto lender Celsius and potentially the Genesis trading platform.

These collapses have mostly resulted from overleverage while using questionable tokens as collateral. In many cases straight up fraud and misrepresentation plays a role too. When a group of entities use their own tokens as collateral and then invest in and lend to one another, the term ‘house of cards ’ comes to mind.

💡 The Insight: The tide has gone out, and we can see who’s been swimming naked.

Over leveraged entities that blow up, Ponzi schemes, and scams have accompanied every stage of the evolution of financial markets. They usually occur in new markets, and during bubbles because that’s where the money is flowing and the supervision is light.

It’s only when the bubble bursts, and contagion spreads, that it becomes obvious how unsustainable or leveraged some businesses were. That’s when you discover which companies have been “swimming naked”.

What this means for investors

Regulations exist for a reason. Without some form of supervision there will always be enterprises that test the limits and get into trouble - with or without fraud. On the surface, the overleveraged businesses often seem to be doing better than anyone else.

This was the case at FTX where Sam Bankman-Fried was hailed as the next Warren Buffett... Though that claim in August 2022 was based purely off the fact that he was being “greedy while others were fearful” by investing in BlockFi and Voyager who were “troubled”… Both companies have now filed for bankruptcy, and with hindsight, he certainly isn’t the next Warren Buffett.

Without oversight it's difficult to know what is and isn’t real. If you do invest in an unregulated market, only invest what you can afford to lose.

Key Events Next Week

This week Australia’s latest interest rate decision will be announced on Tuesday and the country’s third quarter GDP numbers will be published on Wednesday. Expectations are for another 0.25% rise to 3.10%.

Canada’s latest interest rate will be announced on Wednesday.

In the US, trade data is due on Tuesday, jobless claims on Thursday and on Friday the PPI data will be released.

We are down to the last few companies reporting this earnings season. Some of the more popular companies due to report this week are:

- Autozone (NYSE:AZO)

- MongoDB (Nasdaq:MDB)

- C3.ai (NYSE:AI)

- Broadcom (Nasdaq:AVGO)

- Costco (Nasdaq:COST)

- Docusign (Nasdaq:DOCU)

- Li (Nasdaq:LI)

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. Any comments below from SWS employees are their opinions only, should not be taken as financial advice and may not represent the views of Simply Wall St. Unless otherwise advised, SWS employees providing commentary do not own a position in any company mentioned in the article or in their comments.We provide analysis based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.