What Happened in the Market Last Week?

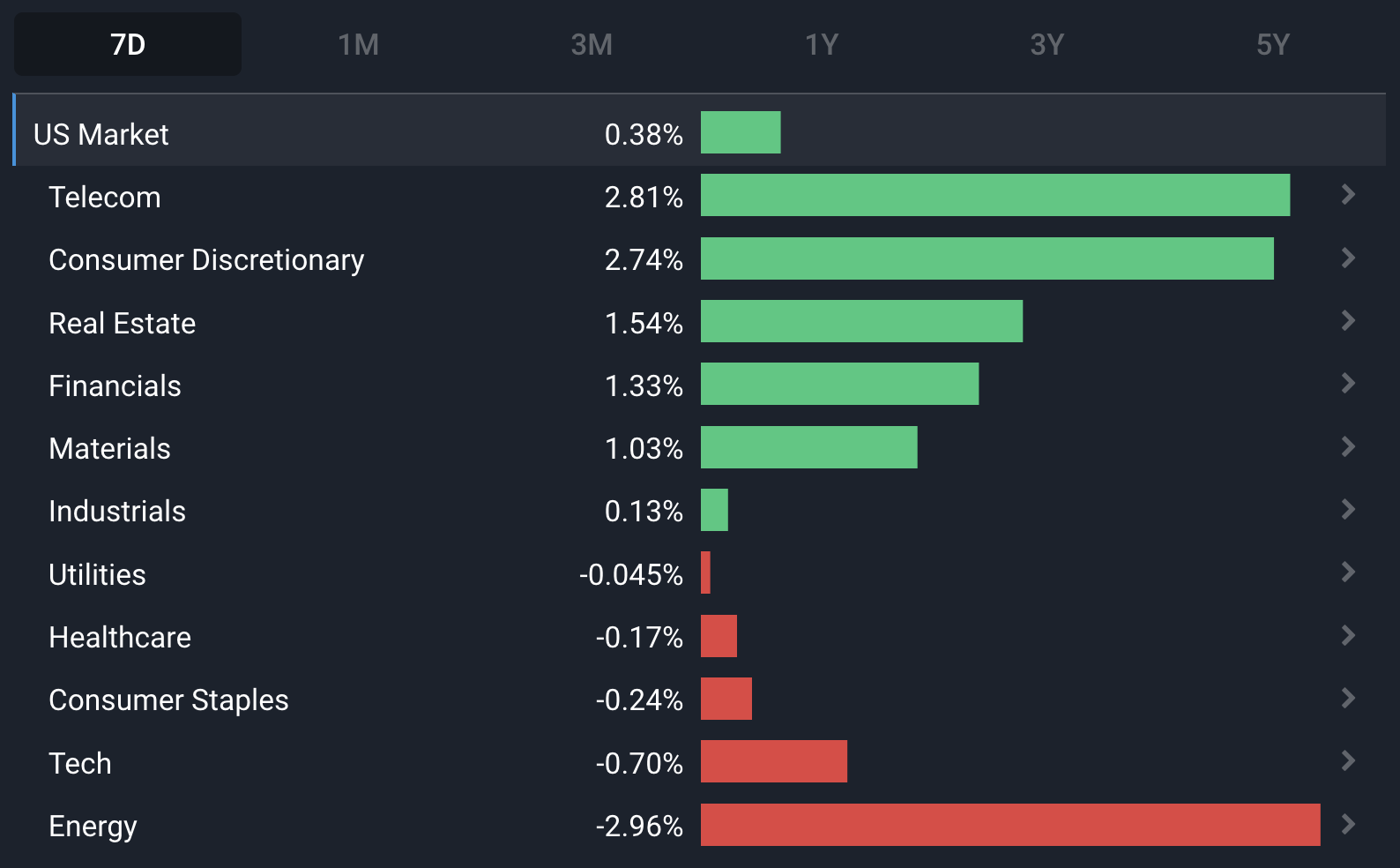

Equity markets hit the ground running in 2023, with the US Telecom , US Consumer Discretionary and US Real Estate sectors leading the way in the first week of the year. Interest rate sensitive stocks were performing particularly well, while energy stocks struggled as warmer than expected weather in Europe caused oil and natural gas prices to fall.

2023: A look towards the future

We capped off 2022 with a summary of the year that was . There was no shortage of excitement (if you wish to call it that) in the market last year with climbing interest rates, inflation and energy prices setting the tone for a tumultuous time for equity markets.

As we kick off the year, we turn to some of the big names in global finance to provide their own context and anticipations for the year ahead.

Goldman Sachs: This Cycle Is Different

The key points in the Goldman Sachs 2023 Outlook :

-

Global growth slowed in 2022 as the curtailing of the reopening boost, monetary tightening, the Russia-Ukraine war and China’s COVID restrictions made themselves apparent. Global growth is expected to be 1.8% in 2023, as US resilience contrasts with a European recession .

-

The US should avoid a recession as core personal consumption expenditure (PCE) inflation is expected to slow from 5% now to 3% in late 2023, with only a 0.5% change to the unemployment rate. To tame real income growth, the Fed could hike another 125 basis to a peak of 5-5.25% with no rate cuts expected this year.

-

Inflation is expected to fall, despite a minimal change in employment levels as this inflation cycle differs from previous high-inflation periods.

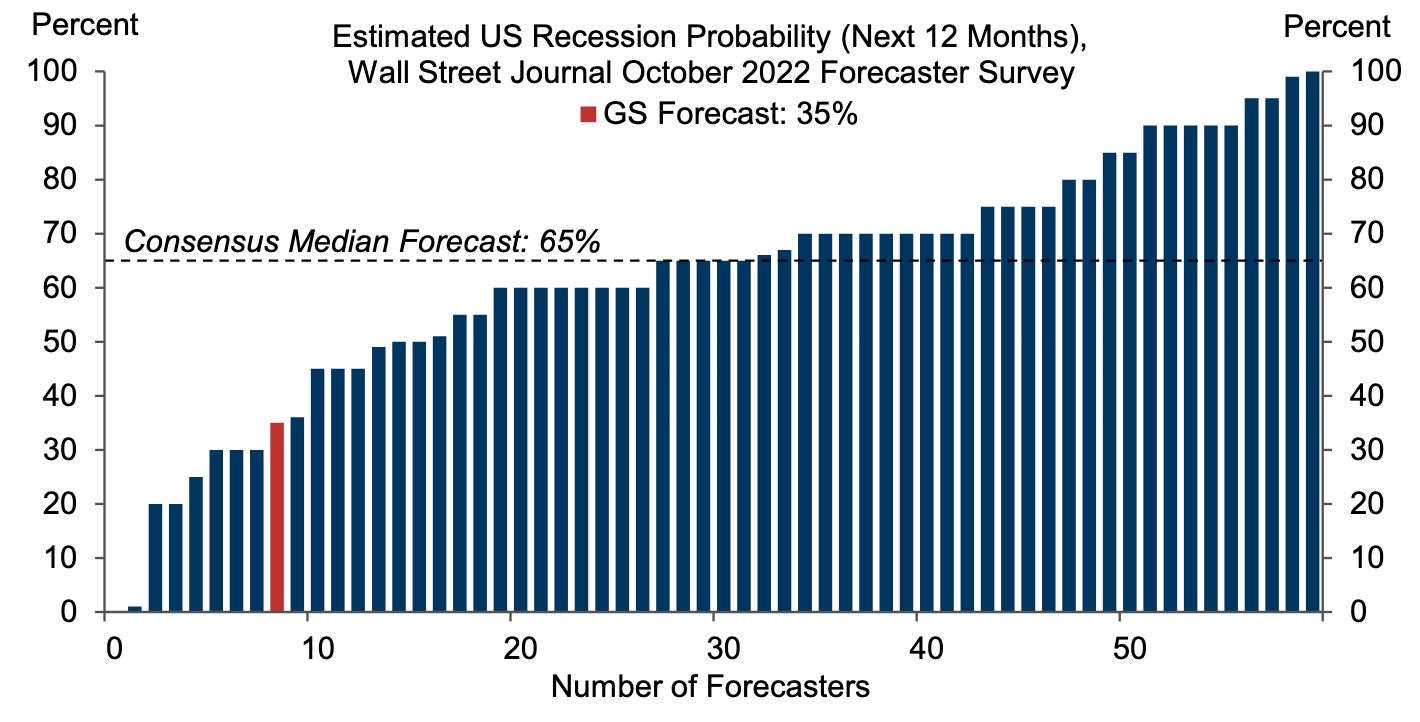

The word ‘recession’ has been thrown around a lot lately and for good reason. With economic growth quashed, the signals appear to indicate that many economies are heading towards a recession if they aren’t already there.

Goldman Sachs’ outlook for 2023 affirm their position that the US is likely to avoid a recession despite a diminishing reopening boost, declining real disposable income (a result of high inflation), and aggressive monetary tightening working to stifle growth.

The basis of their position comes from a few key factors they’ve identified.

- Firstly, that real disposable income has rebounded in the tail end of 2022 from the lows of the first half of 2022 where the initial rate increases were a sudden shock to household budgets.

- Secondly, they posit that this inflationary cycle differs from previous high-inflation cycles wherein the hot labour market manifested itself in an unprecedented amount of job openings rather than excessive employment.

They argue that employment levels post-pandemic rose to pre-pandemic levels but did not exceed it and now that things are cooling-off on the job market, employment levels are set to normalise and openings are set to fall to levels that would slow wage growth enough to be compatible with inflation targets.

JP Morgan: A bad year for the economy, a better year for markets

The key points in the JP Morgan 2023 Outlook :

-

Despite remaining above central bank targets, inflation should start to moderate

-

JP Morgan’s core scenario sees developed economies falling into a mild recession in 2023 .

-

Bonds have priced-in the ensuing macroeconomic troubles and are looking increasingly more attractive. The stock market sell-off has left some stocks with strong earnings potential trading at very low valuations .

-

If inflation begins to tame itself in 2023, central banks will stop raising rates, and recessions, where they occur, will likely be modest. JP Morgan has identified possible signs that inflationary pressures are moderating and will continue to do so throughout 2023.

JP Morgan has assumed a slightly more pessimistic position than Goldman Sachs, anticipating that more developed countries will slip into a recession, however their commentary echoes their belief in this recession being somewhat subdued.

When it comes to inflation, JP Morgan’s stance appears to be less clear cut. They put forward the belief that inflation should start to moderate itself on the balance of slowing economic growth, China reopening, relieving supply chain pressures and labour markets weakening but also provide a cautionary tale that if wage pressures don’t ease, things could get quite ugly.

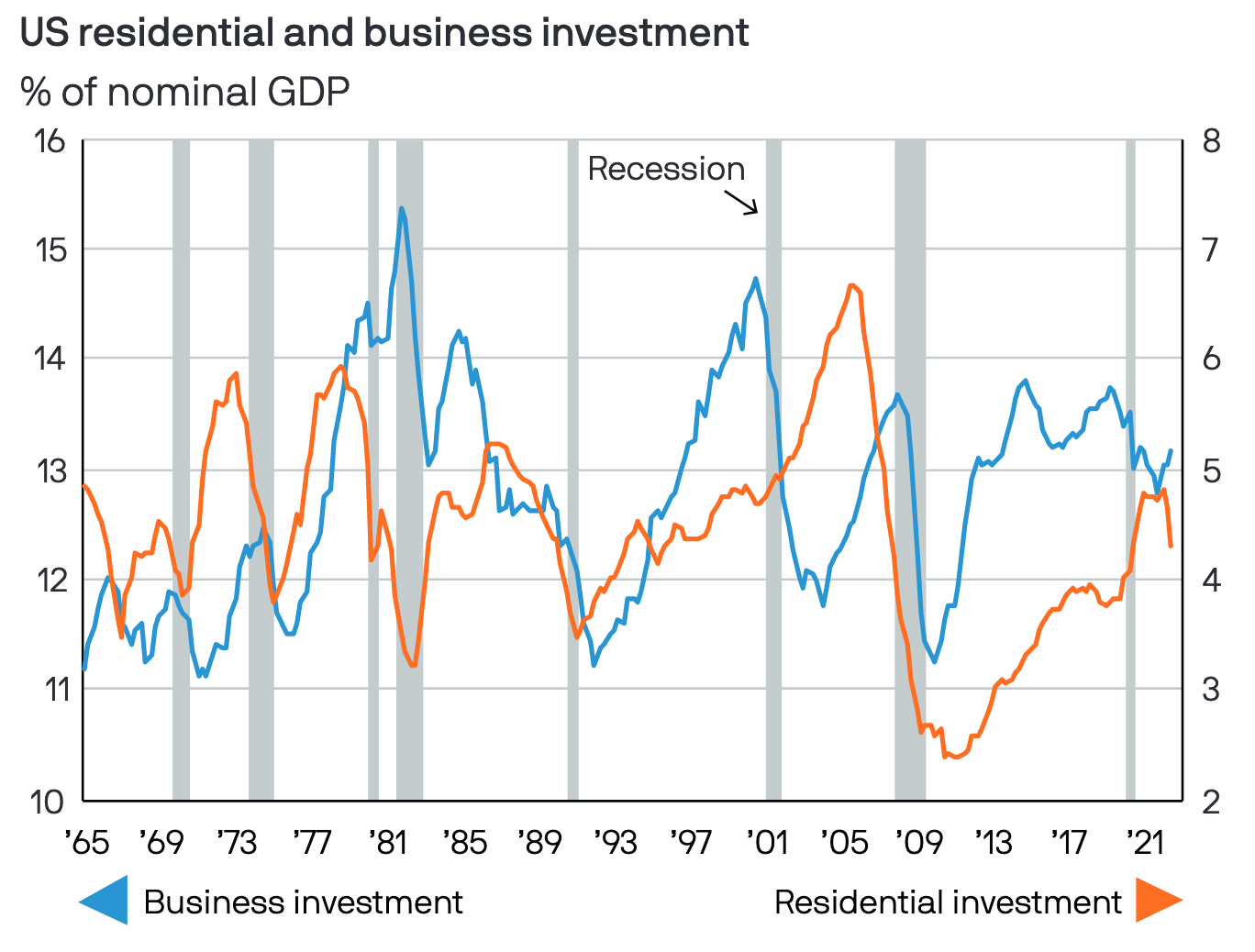

The outlook anticipates a modest recession on account of lower levels of investment in business and housing compared to prior recessions. Previous recessions have been fuelled by over-enthusiasm caused by excessive bank lending. However in the years since the GFC, the global banks come into this slowdown comparatively well capitalised and in a position where they can absorb losses without a credit crunch.

Turning to the equity market. The risk vs reward is in a more favourable position compared to 2022 given that the market should’ve priced in the worst case scenarios at this point. So while a bottom may still be yet to come, JP Morgan is of the opinion that we aren’t too far from it.

Morgan Stanley: A resilient economy without a looming collapse

The key points in the Morgan Stanley 2023 Outlook :

-

The first quarter of 2023 has the ingredients to build on strengths of the fourth quarter of 2022 but an inverted yield curve hints at a potential economic slowdown at some point in the year ahead.

-

The consensus view is that early in 2023, earnings will collapse , bringing the stock market down with them. But sectoral leadership from the financials, industrials and materials sectors suggest otherwise .

-

The economy is proving too resilient, causing the “looming collapse” in earnings to remain elusive for yet another quarter. Earnings are expected to drip down slowly, frustrating market bears. With continuing improvements on the inflation front mixed in, you have the ingredients for a strong first quarter.

Morgan Stanley’s Head of Applied Equity Advisers, Andrew Slimmon, asserts that consensus for the early stages of 2023 will be underpinned by an earnings collapse. As the impacts of rising costs, rising interest rates, supply chain disruptions and a diminished household disposable income wash through the quarterly earnings reports, the market is expected to drop accordingly.

However, as a counterpoint to the consensus, Slimmon turns to leaders in the financials, industrials and materials sectors to suggest otherwise. These sectors have outperformed during the months of October and November. He suggests that if an early 2023 collapse was imminent, then these economically cyclical sectors would not be outperforming the rest of the market.

Turning to yield curves, Slimmon acknowledges that an inversion is an important thing to note but that it typically isn’t a good indicator of when an economic slowdown will occur, rather, it more accurately suggests that one will occur at some point in the future. Could this slowdown occur in the latter half of the year after a strong start to 2023? Morgan Stanley seems to think so, although they acknowledge that this goes against the general consensus.

According to Morgan Stanley, there appears to be an opportunity for investors who have an eye on emerging markets. Emerging markets (EM) have better growth, lower inflation, and less sovereign and private debt, yet EM equities and currencies trade at what Morgan Stanley are calling “crisis-level valuations”. If emerging markets are an opportunity you’re interested in, then check out Simply Wall St’s top Latin American and African stocks.

Credit Suisse: A fundamental Reset

The key points in the Credit Suisse 2023 Outlook :

-

The UK and the Eurozone are expected to have slipped into a recession , while China will be in the midst of a “growth” recession (read - less growth). These economies should see the worst by mid-2023 and begin a slow recovery provided that the US escapes a recession. Tightening monetary conditions will keep economic growth low throughout 2023.

-

Inflation is expected to decline in 2023, but will remain above central bank targets.

-

2023 will be a ‘tale of two halves’ as interest rate rises remain a concern for the first half of 2023, the stock market performance should be quite restrained and sectors with stable earnings and low debts should fare better . Once central banks shift from increasing rates, growth stocks should receive a kick in the second half of the year .

-

Fears of a global recession will keep the USD strong in the early stages of 2023 . Once monetary policy becomes less aggressive and foreign growth risk subsides, the USD will naturally fall back and stabilise.

Credit Suisse’s outlook echoes the same comments as the others. The Eurozone and UK will likely slip into a moderate recession while the US should manage to escape.

Inflation is in and around its peak at the present and so the remainder of 2023 is expected to finally decline throughout the year. Although Credit Suisse expects inflation to decline, they’re still assuming that it remains above inflation targets and won’t decline enough to warrant any interest rate cuts for the foreseeable future.

Interestingly, Credit Suisse has asserted that the changing geopolitical landscape is presenting a unique situation for us to tackle. The West, East and the South have become quite polarised in terms of monetary policy and political views.

Strained geopolitical relationships and the COVID-19 pandemic have fundamentally altered global trade flows and has shifted the focus for international trade from trying to secure pricing dominance, to now ensuring supply chain resilience and geopolitical relationships are maintained.

💡 The Insight: Investors are not fortune tellers

It’s easy for retail investors - particularly beginner investors - to get carried away in the expectations of analysts and fund managers from reputable financial institutions. They hear talks of doom or market booms and attach themselves to the idea. But investors should remind themselves to take a step back and remember that no one is infallible when it comes to the market.

There are always unexpected twists and turns in the world. No matter a person's expertise, experience or talent, there’ll be some things that impact equity markets that cannot be forecast.

For example in late 2011, CBS News had a look into the accuracy of the predictions made by market strategists. The consensus was that the S&P 500 index would rise by an estimated 9.4%, with the most pessimistic of these strategists predicting a rise of only 5%. On the 28th of December 2011, with only three trading days left in the year, the S&P 500 was only up 0.6% for the year. It’s safe to say that their crystal balls weren’t in working order that year.

What this means for investors

The age-old saying of “do your own research” rings true, partially. Investors should take note of what financial powerhouses are saying, but they shouldn’t take it as gospel. If the consensus of the institutions is quite bullish but you personally have your doubts about where the market is headed, you shouldn’t disregard your own beliefs if they’re well founded.

Always invest to your own risk tolerance. Not just in terms of asset allocation, but also in terms of your perceived macroeconomic risk.

The things that have the potential to impact your investments most throughout 2023 may not be known to these large financial institutions yet and so to follow their words blindly could be hazardous.

In times of uncertainty investing in quality companies or investing in accordance to a theme that resonates with the economic landscape are quite effective approaches. If you’re interested in reading up on some investment theses for difficult macroeconomic periods, then be sure to check out Simply Wall St’s list of best stocks for rising interest rates or recessions .

What's in store for 2023?

It seems to be a common theme among these outlooks for 2023 that the US will manage to slip through 2023 without having to deal with a recession.

However, as JP Morgan pointed out, moderate recessions can actually be beneficial in periods of high inflation. The economic slowdown that defines a recession is quite effective in curtailing the runaway prices that crank up inflation.

Keeping on the topic of inflation, another common theme amongst these predictions is that inflation has already peaked and will continue to moderate itself into 2023 as China opens up and the flow on effects of rising interest rates begin to manifest.

The probability of this happening will seemingly ride on how well China can navigate the current COVID outbreak.

Commentary remains consistent that in times of rising interest rates, high quality companies with solid earnings and consistent dividends will tend to fare better. Growth stocks that have a sensitivity to interest rate adjustments will continue to struggle until inflation is under wraps and central banks hold steady on rate rises.

If this happens in accordance with the general consensus from the above institutions, then growth stocks could have their time in the sun during the later half of the year.

Key Events for the Week

The new year is kicking off into gear already with the year-on-year and month-on-month inflation figures to December 2022 scheduled to be released on January 12, 2023.

Initial jobless claims and continued jobless claims data is also set for release next week; important data for those interested in the effects of employment rates on inflation.

The next week will be a busy one with many companies beginning to post their Q4 2022 earnings. A few big players are stepping up to the plate, particularly those in the financials sector:

- UnitedHealth Inc. (NYSE:UNH)

- JP Morgan Chase & Co. (NYSE:JPM)

- Bank of America Corp. (NYSE:BAC)

- Citigroup Inc. (NYSE:C)

- Delta Air Lines Inc. (NYSE:DAL)

- BlackRock Inc. (NYSE:BLK)

- Wells Fargo & Co. (NYSE:WFG)

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Bailey and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Bailey Pemberton

Bailey is an Equity Analyst at Simply Wall St with 4 years of experience as an Associate Adviser at Baywealth Financial Group, where he helped with client portfolio management, investment strategy and research. He completed a Bachelor of Commerce majoring in Finance from the University of Western Australia. As an equity analyst, Bailey provides the team with valuable insights, helping guide the creation of article content and new features like Narratives.