“Time in the market beats timing the market.” — Ken Fisher

While investors are trying to decide whether the rest of the market is going to catch up with big tech or vice versa, we are having a look at the big themes from earnings season. Expectations were very low at the beginning of the second quarter, so lets see how it turned out.

Q1 2023: Better Than Feared And Holding Steady

All but two of the S&P 500’s constituent companies have now reported results for the first quarter. Quarterly results were mixed in absolute terms, but generally a lot better than expected.

According to I/B/E/S data from Refinitiv , 76% of companies beat earnings estimates, compared to the long term average of 66%.

Earnings were down between 0.1% and 2% (depending on the averaging method) from the first quarter last year. Either way it's well above the >6% decline analysts expected at the beginning of earnings season.

Revenues rose 3.6% from a year ago, compared to forecasts of 1.6%. So better than expected profits were due to both sales and margins being better than forecasts.

The Takeaway

Corporate profits are still under pressure, but analysts overreacted during the previous quarter when they slashed their forecasts. This may have been the result of companies trying to manage expectations with lower guidance, and analysts then trying to get ahead of the curve with even lower estimates. In their defense, the outlook isn’t clear at all.

Sector Performances Varied Widely

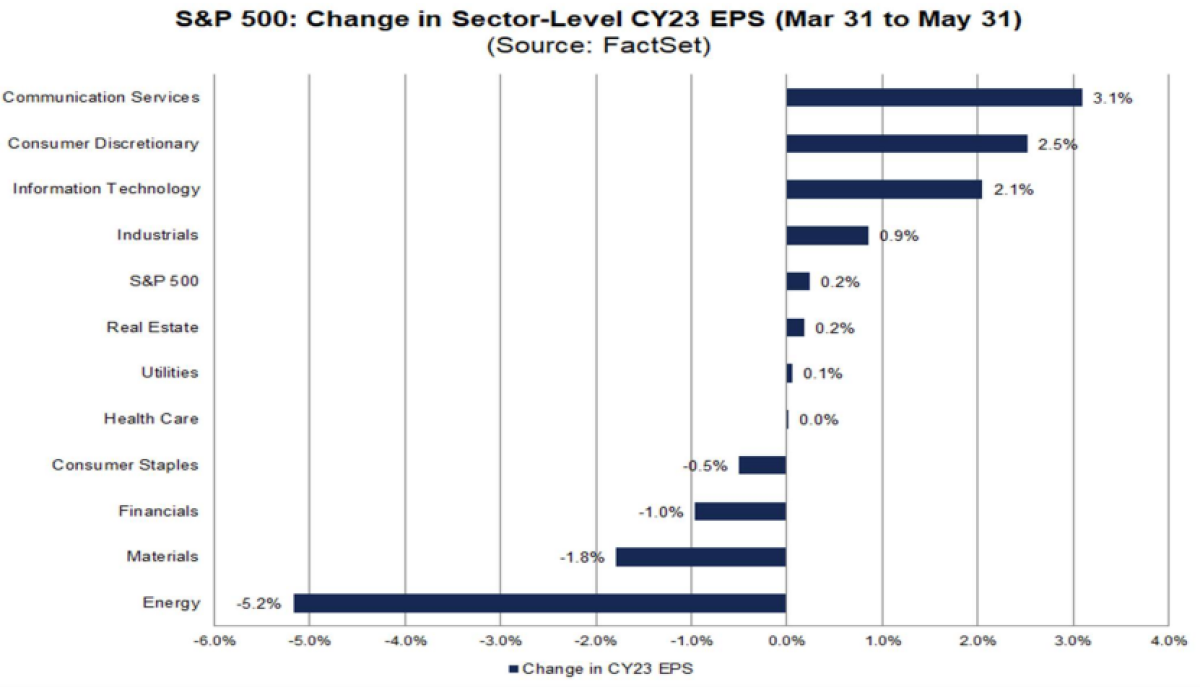

Earnings growth was just about flat for the overall market, but sector level performance varied widely. The top three sectors were:

- Consumer Discretionary (EPS up 56% YoY), with notable performance from hospitality and broad line retail (mainly Amazon ).

- Industrials (EPS up 27%) with Machinery , Trade Distributors , and Aerospace & Defense all showing strong growth.

- Energy (EPS up 20%) managing to hold onto margins despite a 5% decline in revenue.

And the three sectors with biggest year on year earnings declines:

- Materials (EPS down 22.2%) saw falling sales and margins as commodity prices fell.

- Utilities (EPS down 21.8%) struggled to maintain the high base set during the first quarter last year.

- Healthcare (EPS down 14.8%) is also struggling after the profit growth during and after the pandemic.

The changes to EPS growth estimates for the full year were largely in line with results above, as well as the number of earnings beats in each sector. Investors have actually done quite a good job anticipating these changes.

Global Earnings Were Better Than Expected

Around the world company profits were also better than anticipated. In Europe, banks proved to be resilient despite the collapse of Credit Suisse and the spillover from the US banking crisis. Profit margins have also held up better in Europe than almost anywhere else.

Japan has also been notable with strong earnings and guidance from automakers , and steel and shipping companies, at least partly due to the reopening of China's economy. The Nikkei 225 index is now at a three decade high.

Below are some of the earnings growth forecasts for the MSCI country indexes, ranked by forecasts for the full year 2024. You can see the full table on Ed Yardeni’s website which is a treasure trove of corporate and economic data.

First the top 5 countries….

The likes of South Korea are suffering from a decline in global demand, notably in exports, and lower demand from China, but they are expected to see earnings growth recover significantly in 2024 as these areas potentially rebound. Additionally, private consumption and investment in the region are expected to follow a similar trajectory of a decline in the short term, but recovery in 2024, according to the OECD.

So Korea’s rosy forecasts aren’t quite telling us they have a competitive advantage to the rest of the world’s economies and rather that their semiconductor exports are finally returning to normality after several years of supply-driven pressures.

Next, the 5 countries with the lowest estimates, (from highest to lowest)….

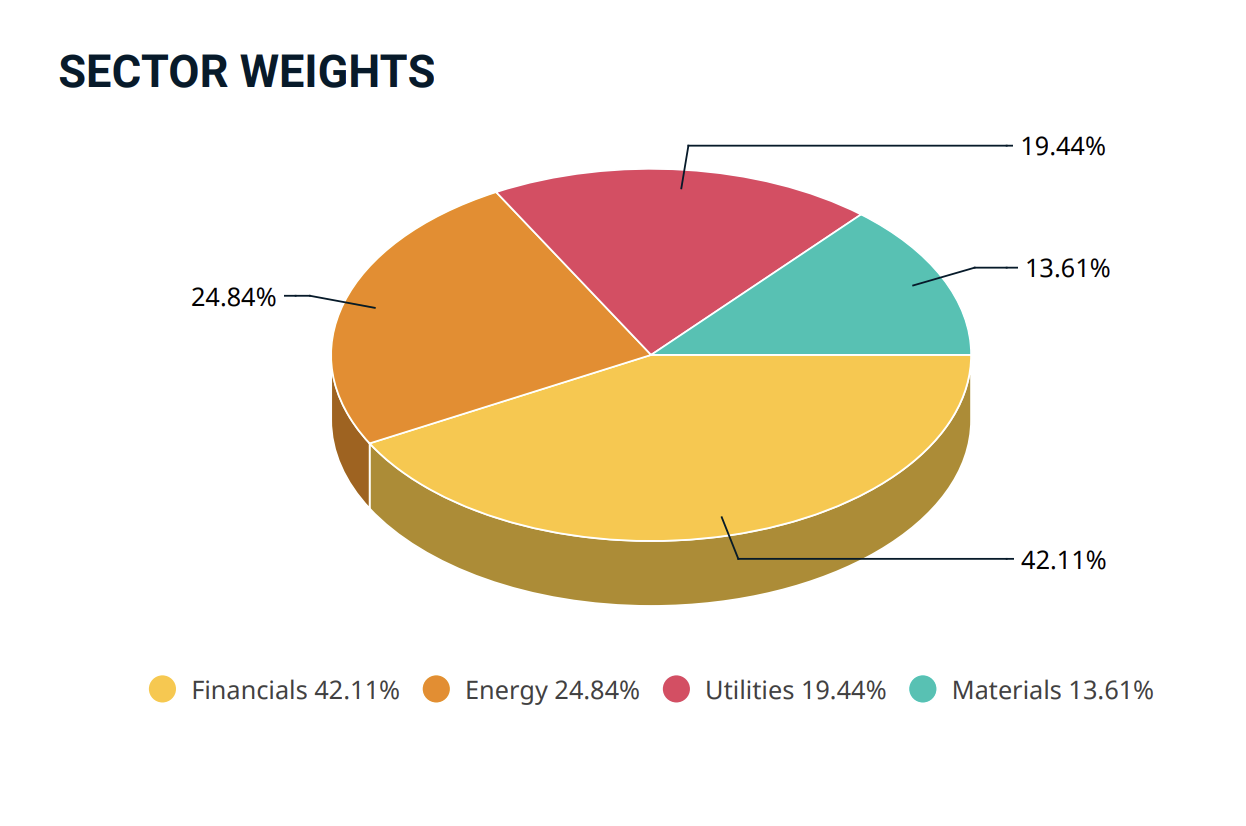

As for Austria being at the bottom of the list for 2024 earnings growth, its market has a heavy weighting towards financials, energy and utilities, which makes sense as to why they did so well in 2022, but aren’t expected to do too well in terms of profit growth over the next 18 months.

And the other key countries and regions…

💡 The Insight: The Outperformers Of 2022 May Become The Underperformers Of 2024

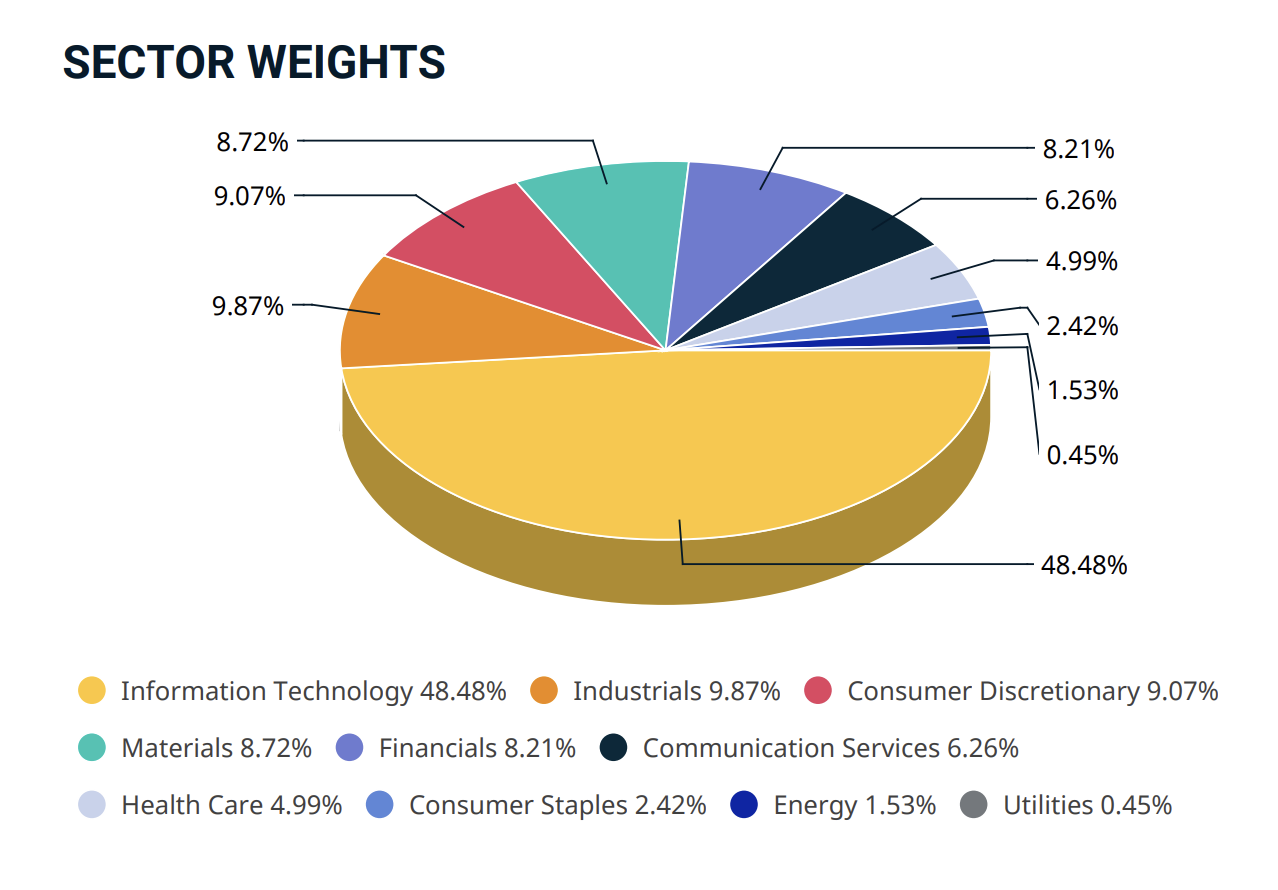

It seems that the economies that are forecast to undergo the strongest growth in earnings are ones that suffered more noticeably in 2022 and throughout 2023. These are generally emerging markets characterized by high levels of exports. Tech seems to be the theme for 2024, as the countries slated to perform better generally revolve their markets around the manufacturing of computer chips and hardware, or in the case of the US economy, computer software.

On the other hand, the economies that fared better throughout the last few years are expected to hit a bit of a rut in 2024. When you take a look at the dominant sectors within these economies, a common pattern begins to form. Heavy weightings in energy, financials and utilities hurt 2024 earnings growth forecasts quite significantly.

These are likely to change, but it's good to know what the expectations are for the next 18 months.

Where To Now?

Analysts typically overestimate earnings at the top of a cycle and then underestimate at the bottom. It’s possible that that’s what’s happened here, but it could also be a case of company’s ‘over managing’ expectations. Most strategists expect a gradual improvement from here with earnings in the US ending the year up 1.2%, while Morgan Stanley still expect a much bigger earnings recession later this year with earnings ending 16% lower.

Two other takeaways that emerged this earnings season were the fact that corporate balance sheets are strong and consumers are still in a fairly good position.

Consumers could be the key for the rest of the year (for earnings growth and a possible recession).If consumers stop spending, its hard to see how earnings recover.

What Else Is Happening?

First a recap of the key data releases we mentioned last week…

- 🇩🇪 Germany's exports rose more than expected in May resulting in an €18.4 bln trade surplus, compared to the €15.4 bln expected.

- 🇨🇳 China’s trade surplus for May fell to a 12-month low of $65 bln from $90 bln due to an unexpected 7.5% drop in exports. This is the latest data that suggests China’s recovery is losing steam quickly.

- 🇨🇦 Canada’s trade balance for April was C$1.94 bln compared to the C$0.9 bln economists expected. The increase was driven by better than expected exports of gold, oil and vehicles.

- 🇺🇸 United States' trade deficit widened to $74.5 bln, the biggest one month increase in almost eight years after energy exports declined while imports surged. The higher imports suggests the economy may be stronger than the recent GDP number suggested.

- 🇦🇺 Australia’s central bank unexpectedly raised the interest rate by 0.25% to 4.1%. The bank said that inflation was still too high and warned that “further tightening of monetary policy could be needed to ensure inflation returns to the target range in a reasonable timeframe”.

And then, a few news items that we thought were worth noting…

-

🛢Saudi Arabia will be making voluntary cuts to its oil production from July, reducing daily output by 10%. The remaining OPEC+ members will be sticking to the production levels agreed in April. Despite those cuts, oil has been trading well below the price prior to the agreement.

- The knee jerk reaction was a 4% spike in the oil price, but that quickly retraced.

- There are actually a few things weighing on the oil price. A potential recession would lead to lower demand, China’s recovery is slowing, inventories are rising, and US production is rising . Until that changes OPEC+ may have to accept the current price.

-

🥽 Apple’s much anticipated VR headset the Apple Vision Pro will be available early next year. The headset gives consumers yet another way to interact with Apple’s growing list of services.

- At $3,500, the company would have to sell over 100,000 of these to bring in 1% of current revenue, so it’s not going to move the needle for a while.

- At this stage the target market is probably developers who Apple hopes will create games and apps that make it appealing to everyone else.

- It’s hard to estimate the size of the AR/VR or metaverse opportunity right now - but if or when it takes off Apple will be in prime position.

-

📱 Amazon.com reportedly wants to start offering its Prime members low cost, or free, mobile phone service. It is afterall called the ‘everything store’.

- The company and some mobile operators have already denied the report - but Amazon is probably in a position to make it happen with all its buying power. The problem would be that Amazon wouldn’t have complete control over the service it offers customers, and the company prides itself on service.

- Amazon is clearly looking for a new growth engine as AWS begins to ‘mature’, but it remains to be seen if a phone plan is that growth engine

Key Events During The Next Week

It’s a big week for data with US CPI on Tuesday, and PPI and the Fed’s rate decision on Wednesday. The FOMC is expected to keep the federal funds rate at 5.25% which will be the first pause since rates began early last year. The fed fund futures are pricing in a 33% chance of a 0.25% hike.

In the UK, the unemployment rate will be published on Tuesday and GDP on Wednesday.

The ECB is also meeting, with its rate decision due on Thursday: a 0.25% hike to 3.5% is anticipated. Euro area inflation data is being published on Friday.

Bringing earnings season to a close (apart from quite a few OTC stocks) are just the following bigger companies reporting this week:

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.