"An investment in knowledge pays the best interest." — Benjamin Franklin

Equity markets are still at the upper end of the recent range despite concerns about the debt ceiling, growth and inflation. Investors seem to be sitting on the sidelines until the debt ceiling issue is resolved.

.png)

This week we are looking at the decade long trend that is the clean energy transition and more specifically, how investors can ride that wave like they’re surfing at a wave power generator .

JP Morgan Asset and Wealth Management recently published a paper, Growing Pains: The Renewable Transition in Adolescence . It’s 50 pages and incredibly detailed, but worth a read if you really want to get into the nitty gritty of what’s involved in decarbonizing the world’s energy supply. But if you don’t have the time, don’t worry, here are a few of the key takeaways:

A Complex Balancing Act

The world is now rapidly committing to decarbonizing the energy supply. Despite this commitment, and the urgency, it will probably take the next 20 to 30 years. This is actually good news for investors. It means there is lots of time to learn, research, find opportunities and then let the earnings compound.

The Two Transitions Toward Cleaner Energy

There are two processes required to decarbonize the world’s energy systems.

- Firstly, generating more power from renewable resources like solar and wind rather than oil and gas - (the Supply - where we get energy from).

- The second is the electrification of demand - (the Demand - what we need energy for)

Electric vehicles are a great example for this second point. Instead of burning fossil fuel in the vehicle, an electric motor uses energy stored in a battery, but generated elsewhere. Some of that energy may currently come from coal or natural gas, but in time it can all come from solar and wind.

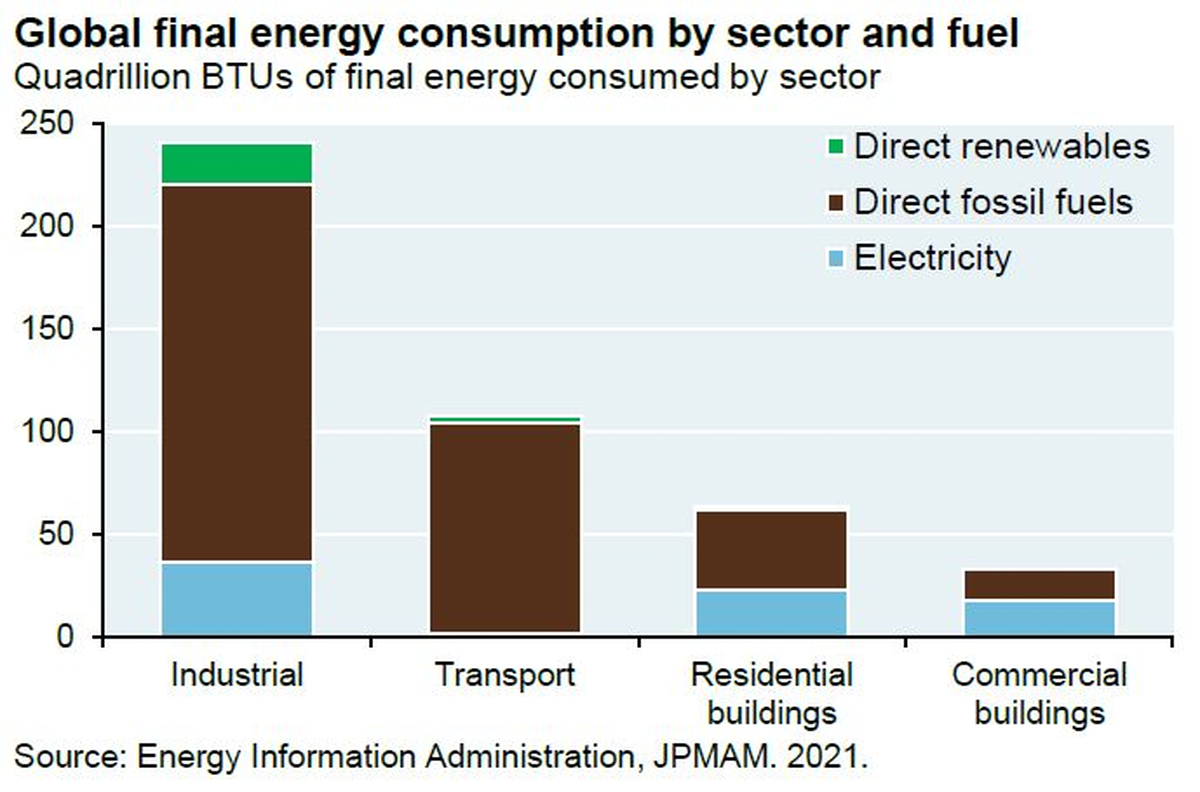

Transport is just one of the sectors that needs to be electrified. The chart below shows how energy is consumed in the US and China. The brown portions (ie. most of it) are the parts of the economy that use energy by burning fossil fuels directly. To decarbonize energy consumption, all of that needs to be electrified, or the fuels need to be replaced with cleaner synthetic fuels.

The Overlooked But Essential Industries

Solar, wind, EVs, and battery technologies have become the public face of the transition to renewable power. But there are other technologies and services that are just as vital to electrifying consumption.

Electrical infrastructure and the systems that manage heat and cooling are also essential to this transition.

Electricity infrastructure companies: As more energy consumption is electrified more parts of the economy need to be connected to the grid. At the same time more power generation will need to be connected to a grid that can transmit and distribute electricity efficiently. One estimate sees power transmission in the US needing to increase at 5.7% annually, compared to 1.5% over the past 40 years.

These are just some of the companies that provide services and technology used to build electrical infrastructure:

- Quanta Services

- Itron

- NV5 Global

- ABB (Switzerland)

- Eaton

Heating, ventilation, and air conditioning (HVAC): Traditional methods of heating and cooling buildings have been incredibly inefficient. Legacy systems are now being replaced by more efficient solutions and heat pumps. Last year the number of heat pumps sold in Europe increased 37% . In many cases legislation and tax credits are being introduced to encourage this.

Some of the companies that manufacture and sell HVAC systems include:

- Watsco

- AAON

- Tecogen

- Systemair (Sweden)

- Johnson Controls (Ireland)

- Zehnder (Switzerland)

- Daikin Industries (Japan)

Some Solar Stocks Burning Cash Like They’re On The Sun

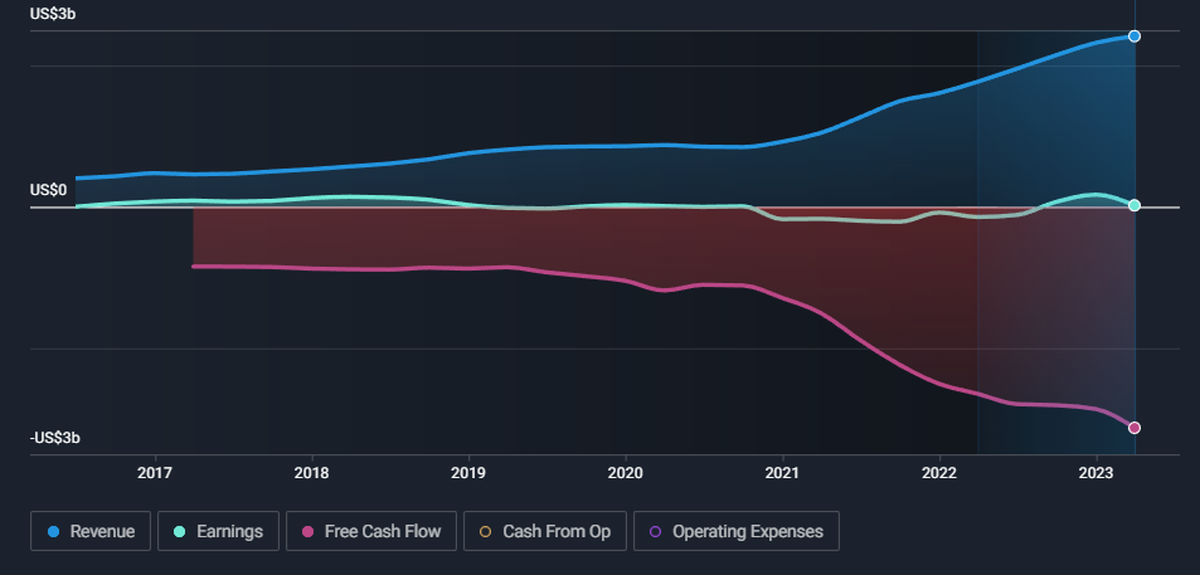

The solar energy sector performed relatively well in 2022, partly as a result of residential tax credits introduced in the US and other countries. But some of those companies, in particular companies like SunPower and Enphase Energy that supply the residential market are now dealing with the reality of higher interest rates and inflation. Higher rates increase financing costs for customers while inflation means higher costs for the companies.

Solar Isn’t Like Software

The solar industry is growing rapidly and there are strong tailwinds behind it. But it's not the same as other growth industries like software. It’s generally capital intensive and there can be long lead times between sales being made and cash beginning to flow.

If you are investing in solar companies, it's essential that you understand:

- How they generate cash flow (What are their main revenues streams?)

- How well capitalized they are (Are they self-sufficient or burning cash?)

- How much debt they have (Are they using a lot of leverage?).

Some companies can quickly run out of cash if they grow too quickly and don’t have the capital to fund that growth. Now that credit is tighter, financing is even harder.

This is what Sun Run's revenue, earnings and cash flow for the last six years looks like. It’s an extreme example, but it shows how growing revenue can translate into deteriorating cash flow.

Here are few other factors to consider when assessing solar companies:

- The business model: There are a few different types of companies in the industry. Equipment manufacturers , companies that do residential installations and utility type companies have very different business models each with their own strengths and weaknesses.

- Customer base: The residential market is probably more profitable at times, but also more cyclical than the large scale utilities market. First Solar as an example, supplies panels to large scale projects which are more stable.

- Competitive advantage: The price of solar panels has fallen dramatically, and there’s a danger that manufacturers without unique IP could end up with very little margin.

Our Solar Energy Stocks Collection includes a few of the leading companies in the industry.

Oil and Gas Will Be Around For A While

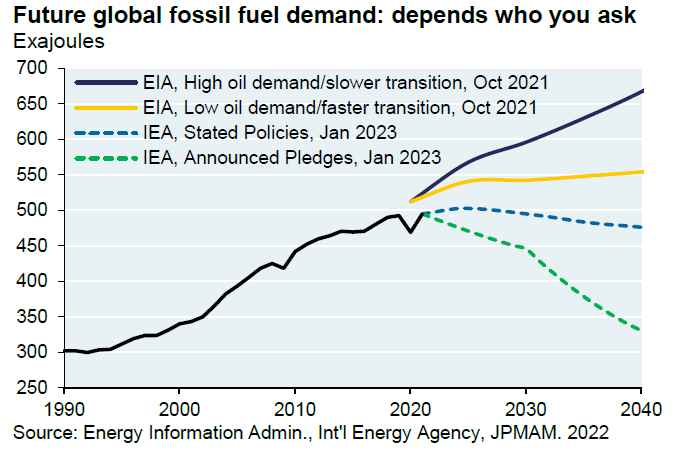

While the goal may be to move away from fossil fuels, they are likely to remain part of the mix for a long time. Energy analysts have a very wide range of demand forecasts - the four diverging forecasts below are from just two bodies.

A peak in oil and gas prices could also come some time after a peak in demand. As the incentive to invest in O&G declines so too does supply - so lack of investment can easily lead to higher prices.

The Current Opportunity

Now that the oil price is 40% below last year’s high, oil stocks are trading on much lower valuations. There’s also a lot of speculation about where the oil price is headed - especially after OPEC+ recently announced cuts to production .

While that will affect stock prices in the short term, what matters for long term investors is:

- The average oil price over a longer period of time,

- The producer’s cost of production, and

- How much oil they sell.

Forecasting oil prices is difficult and few get it right - but the following chart provides some context. This is the price of West Texas crude (black), and the 10, 20 and 30 year averages (red, green and blue respectively).

Going back 30 years we can see that the oil price has been below the 10 and 20 average for several extended periods - but only dipped below the 30 year average for relatively brief periods. The longer average is a far more reliable benchmark for the lower end of the range.

Why does this matter? Long term investors need to make sure there’s a margin of safety between a producer’s cost of production and the likely oil price over time.

For producers to deliver sustainable returns they need to be profitable on average over time, but they need to be solvent all the time. If their cost of production is high, they need a strong enough balance sheet to cover them during the lean years.

These are some of the other things to check when analyzing oil or gas companies:

- Annual production vs reserves: How many years will current reserves last?

- Capital Expenditures (Capex) : Is the company reinvesting to ensure continued production?

- Diversification: Geographical diversification reduces the impact of supply chain bottlenecks. Producers with upstream, midstream and downstream operations are also less affected by the oil price as downstream activities benefit from volume more than price.

What Else is Happening?

First a recap of the key data releases we mentioned last week…

- 🇺🇸 US Retail sales rose less than expected in April . A substantial improvement was expected after March’s negative print (-0.7%), but the increase of 0.4% fell short. Nevertheless, the positive number suggests consumers are still spending.

- 🇬🇧 UK unemployment rose slightly (3.8% to 3.9%) - While the unemployment rate was higher than expected, the number of people employed also rose more than expected.

- 🇨🇦 Canada’s inflation rate rose unexpectedly, from 4.3% to 4.4%. This was the first increase in CPI in 10 months and raised fears that the central banks may have to resume rate hikes.

And then, a few news items that we thought were worth noting…

- 🤖 Google (aka Alphabet ) went on the offensive in the AI war by releasing a new improved version of its chatbot, Bard. The new version comes with a host of new features, with more to come soon .

- Google must be making this move reluctantly - it’s got to be taking traffic away from its search engine which is monetized. The better Bard becomes, the less reason there is to use Google Search.

- It will be interesting to see how both Google and Microsoft manage to monetize these chatbots.

- 📺 Disney’s Q2 results reflected lower subscriber numbers in several markets. But, by far the biggest loss was a 4.6 million drop in subscribers to it Disney+ Hotstar service in India . The reason was that Disney lost the contract to broadcast the IPL cricket tournament in India.

- The IPL contract went to Viacom18 with a bid of $3 billion for 5 years. They will need a lot of subscribers to justify that expense, and those subscribers could cancel their subscription at the end of each season.

- This is exactly why Netflix has avoided sports. Last year CEO Ted Sarandos said “We’re not anti-sports, we’re just pro-profit” when asked why the company avoided sports.

- 🛠 Home Depot missed revenue forecasts for the first quarter and lowered its guidance for the remainder of the year. The company previously expected full year revenue to be similar to 2022, but now sees a 2 to 5% decline, with EPS likely to fall 7 to 13%.

- Some analysts see this as a more certain sign of a coming recession. That may be, but Home Depot has had a pretty good run since the pandemic, with sales up 41% in three years. That has set a high base for future comparisons, and probably pulled a lot of sales forward too.

Key Events During the Next Week

In the UK inflation data is due on Wednesday and retail sales data on Friday.

In the US, the minutes from the last FOMC meeting will be published on Wednesday and the Core PCE price index, along with personal income and spending data is due on Friday.

Earnings season continues with more of the discount retailers and the first of the cloud software companies reporting:

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.