"The most contrarian thing of all is not to oppose the crowd but to think for yourself." — Peter Thiel

We’re six weeks into our Big Trends series and this time, we’re looking into the huge world of automation !

From water wheels used in the 1st century BC to self-driving cars and robots, we’ve seen an exponential increase in automation potential and use cases, many of which may have seemed impossible until only recently.

In this week’s piece, we’re going to cover some of the latest automation innovations across different industries, the benefits of automation to business and consumers, and how we as investors can get exposure to this trend!

So let’s dive in!

🎧 Would you prefer to listen to these insights? Checkout the audio recording on Spotify and Apple Podcasts !

Automation: Doing more, with less.

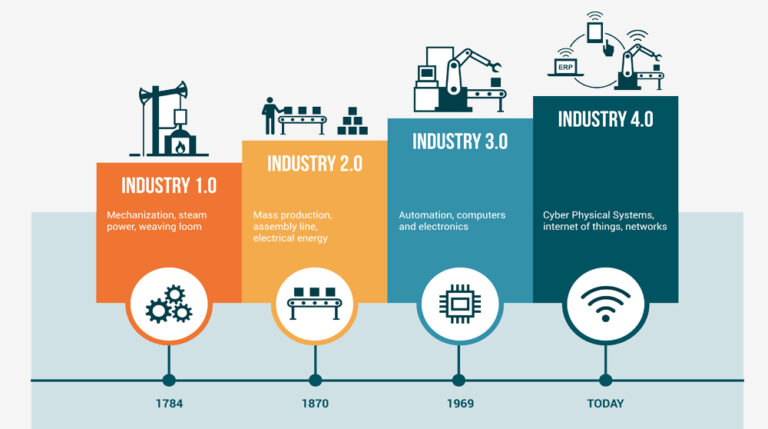

We’ve had multiple industrial revolutions over the last 250 years (jury’s out on whether it’s been 3, 4 or 5 revolutions), and the length of each seems to be getting shorter as technology advances at a rapid pace.

Past Industrial Revolutions - Siemens

And what’s been the backbone of all of them? Increasing levels of automation.

Automation is a crucial part in human evolution that has increased our productivity, created jobs (while displacing others), and moved our species forward at an exponential pace.

To cover some of the biggest areas of automation and opportunities this week, we’re going to look into:

- Autonomous vehicles, and

- Robotics

Both of these areas have received huge amounts of research and development dollars over the last decade, and the advancements in these spaces will continue to benefit businesses, end consumers, and ultimately, shareholders.

Autonomous Vehicles

Self-driving cars and drones were once a figment of science fiction, but now, they’re fast becoming a widely spread reality.

As the technology continues to improve, and manufacturers streamline production and enhance the safety of these vehicles, we’re well on our way to seeing a huge impact on transportation, ride-hailing, and logistics around the world.

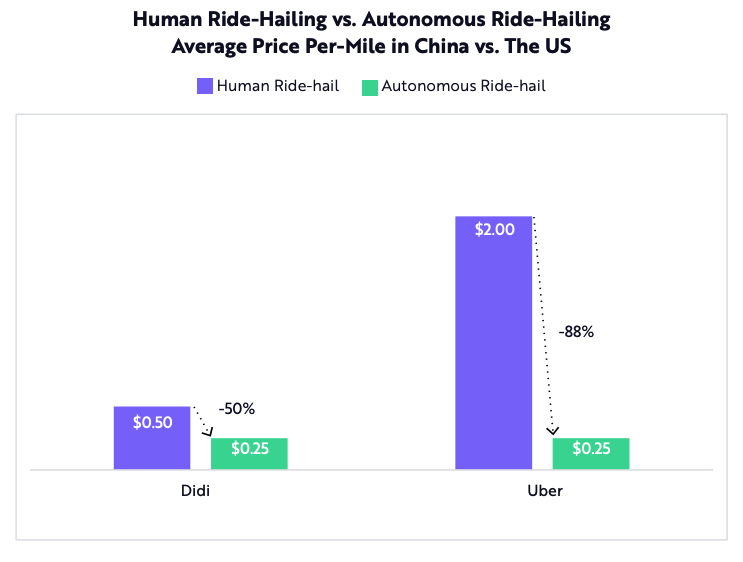

Ark Invest estimates that “the cost per mile of delivery from a human driver is about $1.60 per mile, but the cost with an autonomous delivery robot, could be as low as $0.06 per mile.” And believes the cost per mile of ride-hailing in the US could drop from $2 per mile to $0.25.

Human vs Autonomous Ride-hailing cost per mile - Ark Invest

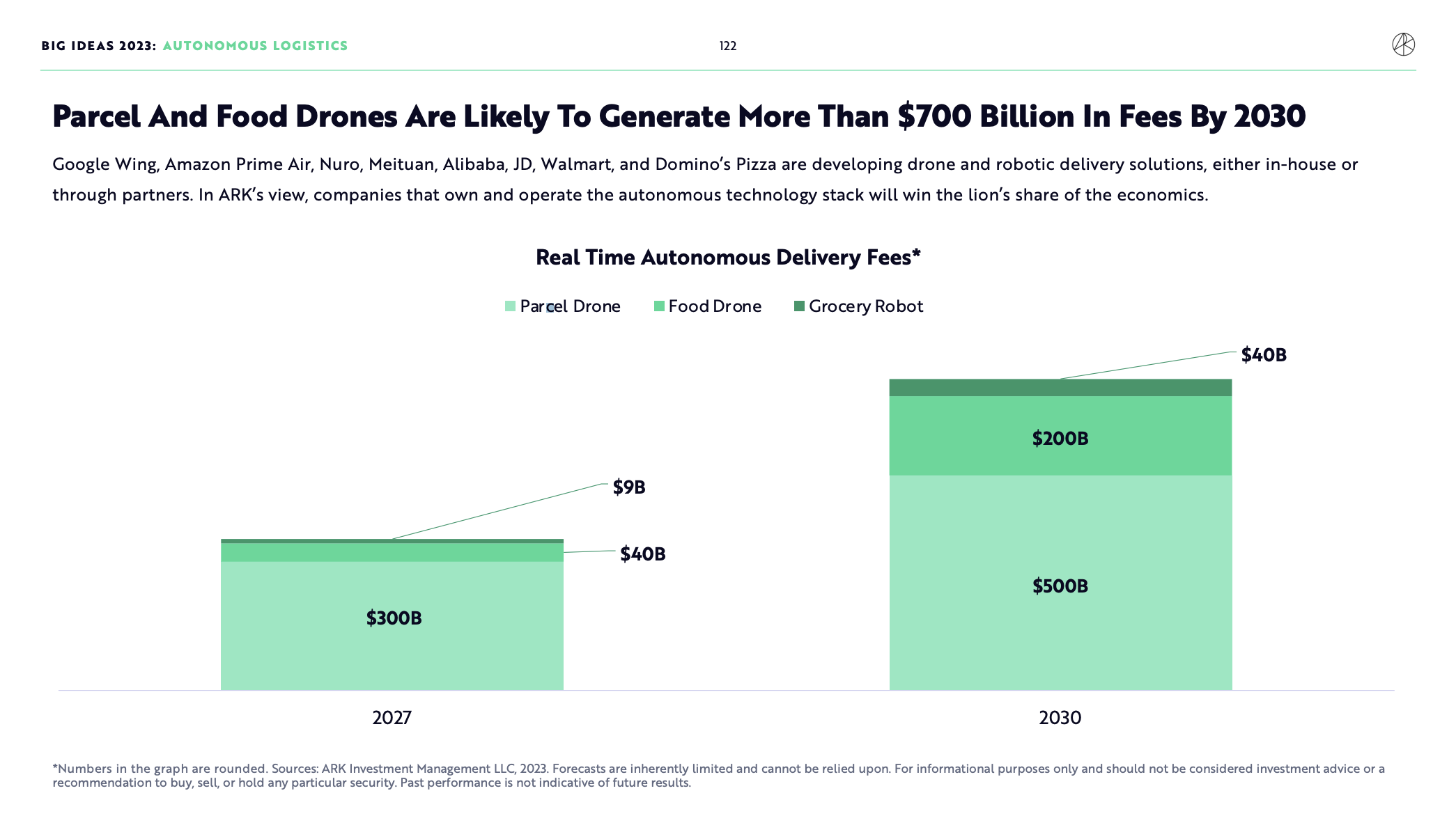

Whether it be autonomous drones delivering pizzas or packages , autonomous trucks delivering cargo or autonomous cars used for ride hailing , we’re already starting to see these technologies out there in the wild, and increases in adoption.

In 2017, Ark Invest wrote a piece entitled “Mobility-as-a-Service: Why self-driving cars could change everything” . While some of its time predictions did not eventuate exactly as forecasted, it is still an interesting read into insights of what could still occur as this technology gains momentum going forward.

Some of the potential impacts it listed include:

- Lower auto sales: as ridesharing becomes much cheaper from autonomous vehicles, and owning a car becomes less appealing.

- Lower car insurance premiums: since the technology will eventually be better than human drivers who are susceptible to distraction or poor choices.

- Consolidation in the auto industry: As market leaders gain traction and economies of scale while those who haven’t innovated well will fall behind and, or get acquired.

- The Mobility-As-A-Service Industry will grow: as non-car owners will make the most of the cheaper autonomous taxi services for transportation, and some owners rent out their cars while not in use.

- Delivery costs will drastically reduce for goods, improving margins for companies utilizing autonomous vehicles in their delivery fleets.

As mentioned, w hile the estimated time frames of adoption or market size may slightly differ from what ends up happening in reality, it’s hard to deny that these trends are occurring.

We’re seeing so many companies already use the technology, and while the benefits may not be flowing through the bottom line just yet, we’re still in the early days of adoption.

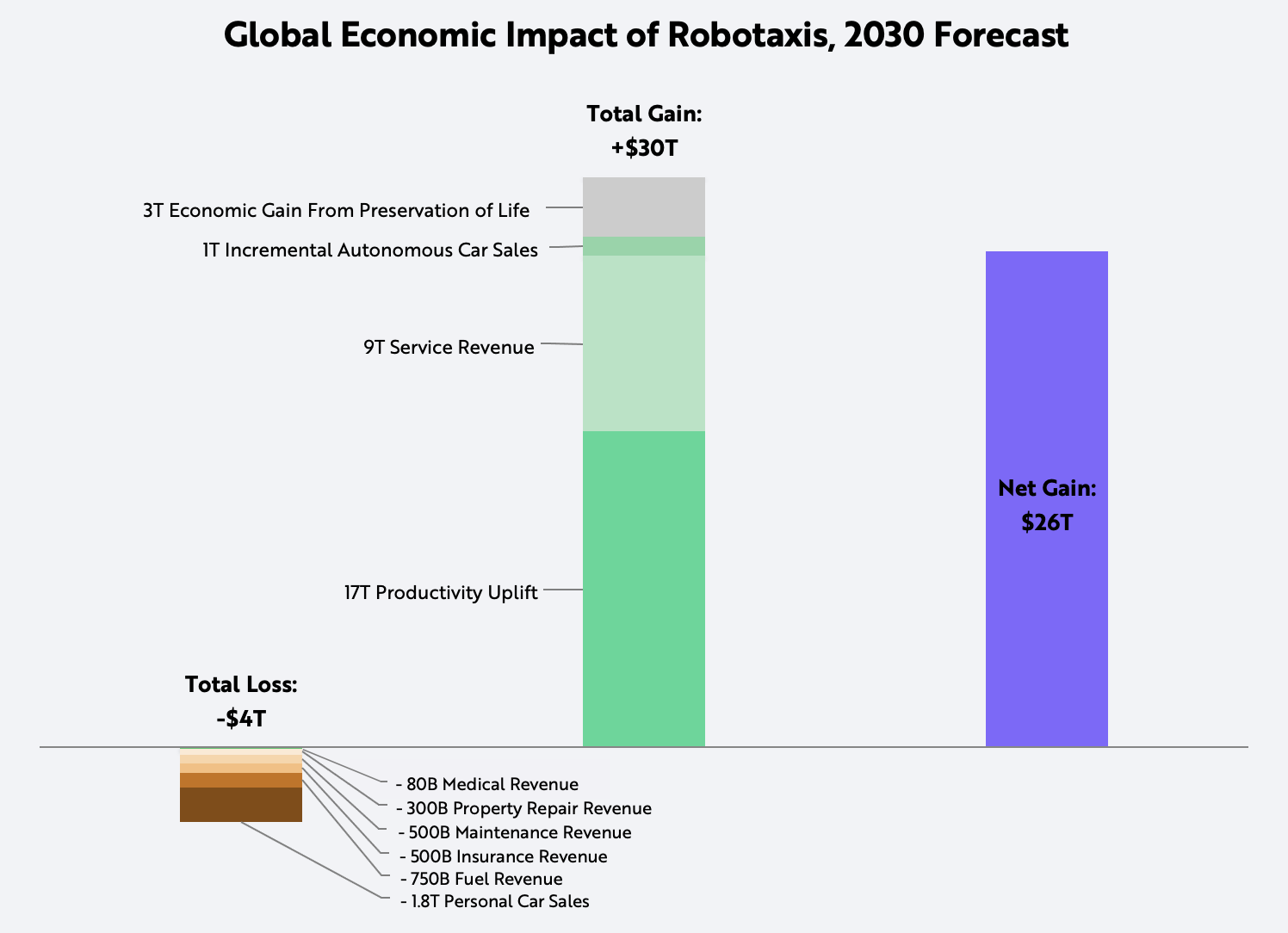

To reference Ark Invest again, since they cover the space so much, they have made a claim where they think autonomous taxis could have the biggest impact on GDP of any innovation in history .

This estimate stems from gains in productivity, services revenue, autonomous car sales, and preservation of life, and the reductions come from lower car sales, medical bills, insurance fees, repairs, fuel and maintenance.

Autonomous taxis forecasted impact on GDP - Ark Invest

Robotics - Man’s Best Mechanical Friend

As for the field of robotics, automation is fuelling unprecedented advancements across multiple industries.

The International Federation of Robots (IFR) released an interesting report in February this year, outlining the 5 trends in Robotics for 2023 which it expects will drive increased adoption among users from small enterprises all the way to global OEMs.

It claims the increasing affordability, capabilities and usability of robots, combined with shrinking workforces are going to bring in a new wave of productivity gains, with profound implications for labor markets, business’ economics and end consumers.

Robots are economical, time-savers, scalable, easily programmable, and the most underappreciated benefit of them all, is that they create new jobs.

Gavin Mee, Managing Director of Northern Europe at UiPath said : “ Robots will take on many lower-skilled tasks that involve data entry, rules-based processes, and monotonous tasks. But new positions requiring higher skills will more than fill the gap .”

According to Universal Robots , all of the following are required for robots to function: “ programming, engineering, end-effector design, operators, data analysts, manufacturing of robots, and systems integration.”

Another reason for the advancement of robotics simply comes from necessity.

Many industries like the ones we’ll cover below, are struggling to find workers, so robots and automation are being integrated into their businesses, not only from the goal of efficiency, but simply the goal of surviving.

Here’s a few incredible examples of robotics being used in different industries.

Agriculture - Robots Helping Farmers

Here’s one fascinating example in agriculture. A company called Carbon Robotics has developed a robot called “ Laserweeder ” to assist farmers in the grueling task of, you guessed it, killing weeds. It’s been covered in the news recently too.

In Carbon Robotics’ own words “Laserweeding is precision weed control for commercial farming… it kills weeds at the meristem before they compete for precious resources. Crops grow healthier when they aren’t fighting weeds for water, nutrients, and sunlight.”

The product page explains: “ The device uses high-resolution cameras and state-of-the-art computing to distinguish between weeds and crops in real-time. This enables precision weed control through an array of high-powered lasers regardless of weather or time of day. LaserWeeding boosts crop yield, cuts farming costs, and supports sustainable farming.”

Aside from the huge benefit of not needing to use harmful pesticides to manage crops, the device reportedly has a 1-3 year payback time for farmers , it operates day & night 24/7, works in virtually all weather, has sub-millimeter accuracy that humans can’t replicate, works on 40+ crops and is certified organic and helps with regenerative agriculture.

You’d probably struggle to find an employee willing (or even capable) to do all that, for that price.

This is just one example of robotics being used in agriculture. There’s plenty others including robots for planting, irrigation, pest control and soil analysis .

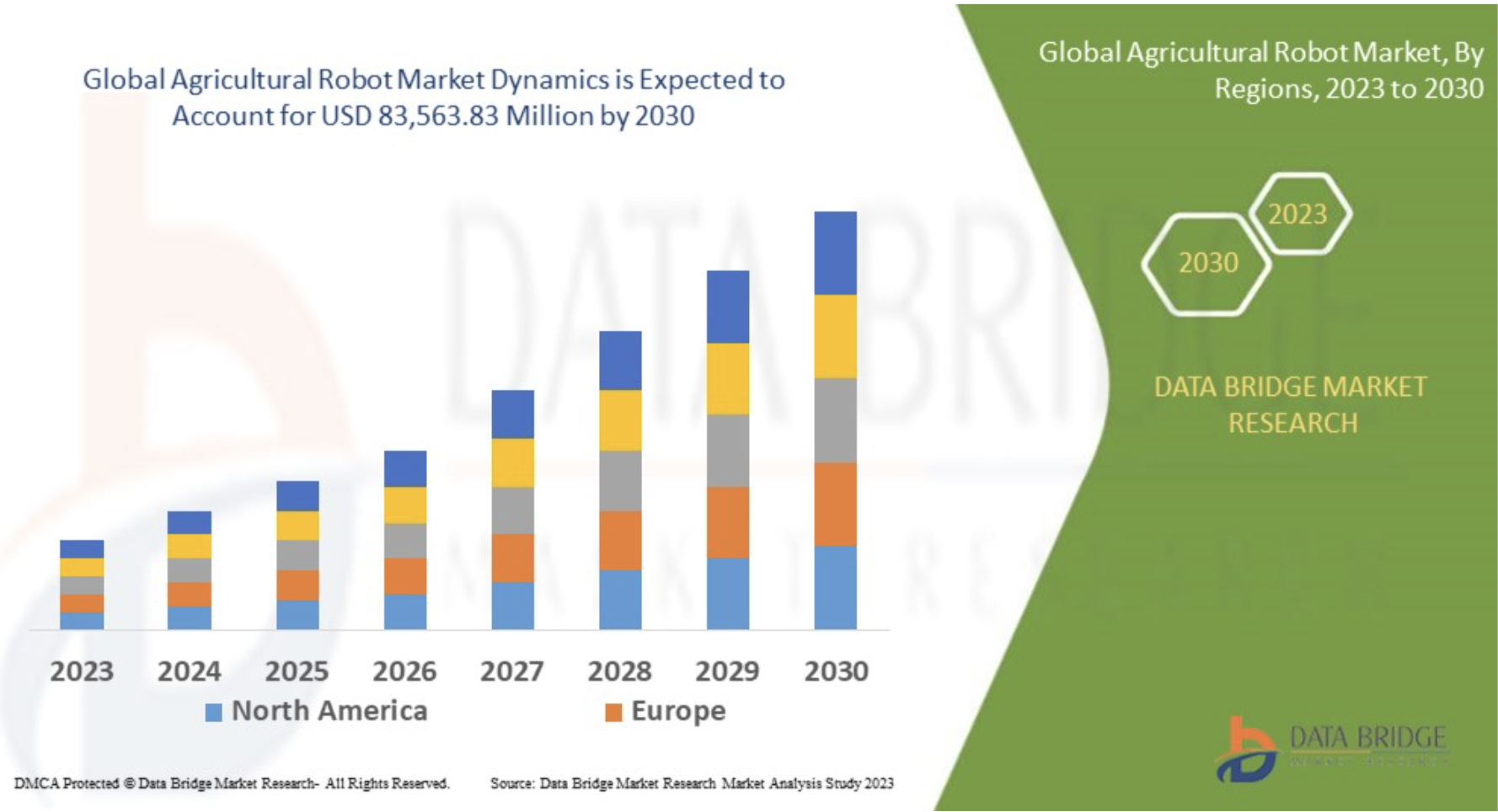

Data Bridge Market Research estimates that the Global Agricultural Robot Market size will reach $84bn USD in 2030 , up from $8.1bn USD in 2022, which is an annual growth rate of 33% per year.

Global Agricultural Robot Market 2030 Forecasts - Data Bridge Research

Manufacturing - Fully Automated Production Lines

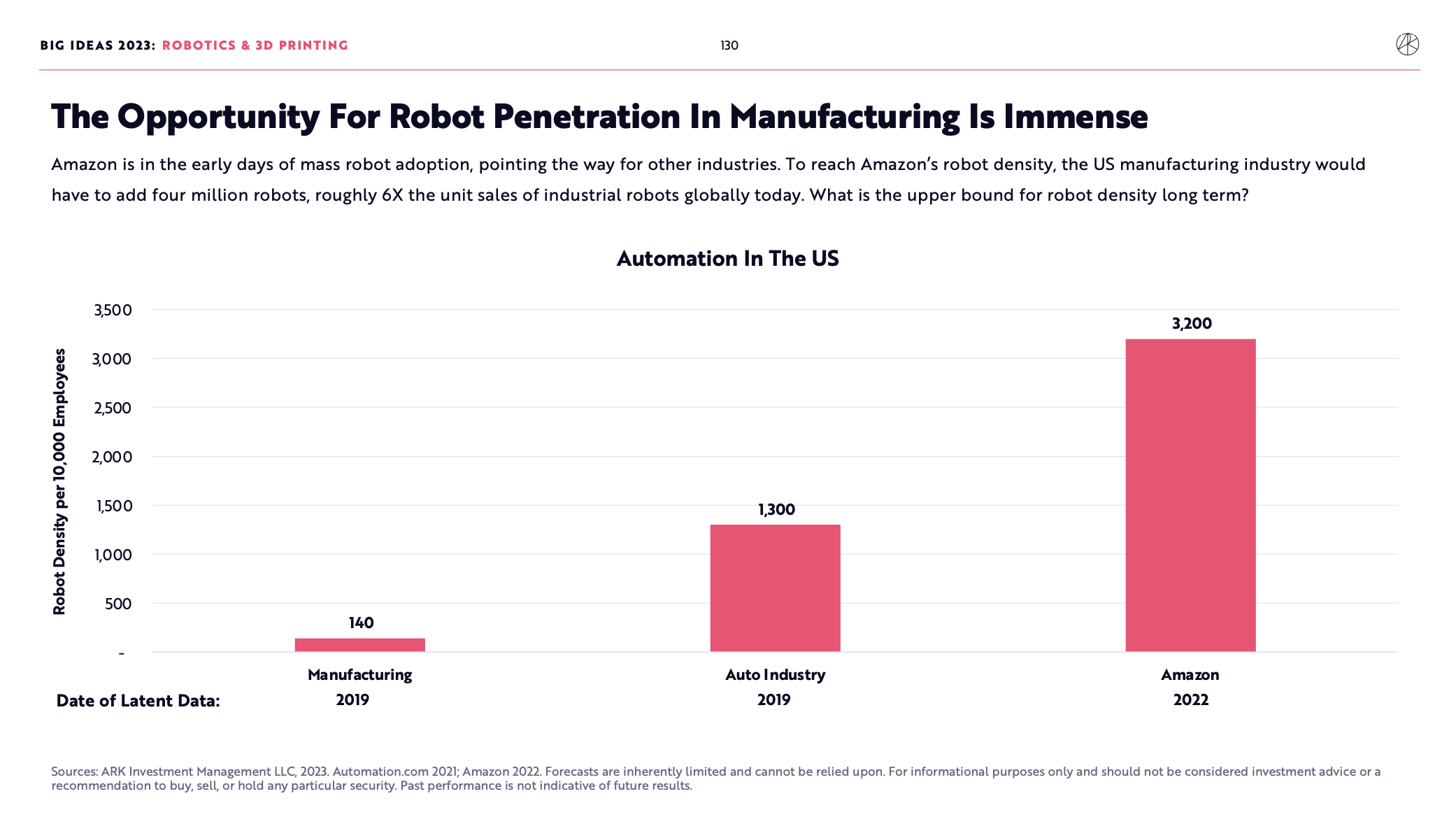

Robots have been in the manufacturing industry since 1938 , and have helped humans in countless ways to complete almost all tasks in factories. But even today, the penetration of robots in manufacturing has been surprisingly low, and only now are we seeing more widespread adoption occurring.

You may have already seen the likes of Amazon has 750,000 robots that are helping do the heavy lifting in its warehouses , which are increasing safety, reducing costs, upskilling employees and benefitting end consumers and shareholders.

Big Ideas 2023 - Ark Invest

Or the many different ways Tesla implements autonomy and robotics in its business , which led it to become the world's most advanced car manufacturer .

Tesla’s Gigafactory is probably the most well known example of robots in manufacturing. It uses self-navigating autonomous vehicles capable of free movement for shifting goods between workspaces.

In manufacturing nowadays, robots are used for material handling, picking, packing, palleting, transferring parts, machine loading, assembling, welding, painting, dispensing and processing.

As for the types of robots in manufacturing, we have articulated robots , cartesian robots , cylindrical robots and polar robots (no, not polar bear robots unfortunately, as cool as that would be).

As outlined by Universal Robots , the biggest benefits of using robots in manufacturing are increased safety, speed, consistency, productivity and most importantly, happier employees.

If industry estimates are anything to go by (11.4% annual growth to 2029), there seems to be plenty of runway ahead of demand for industrial robots that will benefit both the creators, and the manufacturing businesses using them.

Restaurants - Burgers Made By Bots

Even the food and restaurant industry is seeing plenty of robotic innovations that are helping improve operations.

For starters ( pardon the pun ), automated delivery has helped maintain and even increase volumes during COVID when prospective customers couldn’t dine out.

Dominos partnered with a robotics company to develop an autonomous pizza delivery system. Starship technologies has food delivery robots that have now delivered over 5 million meals, and are delivering thousands more each day.

Doordash announced plans in 2021 to develop its own form of automated delivery which can carry multiple packages, and would be programmed to travel between different businesses and make deliveries.

Big Ideas 2023 - Ark Invest

As for automated front of house areas , the likes of McDonalds , Shake Shack and others are implementing self service kiosks in restaurants, while others are implementing tabletop devices so that customers can order at tables and staff can focus on other tasks.

Those going all in have even implemented “ running and bussing ” robots for serving, drink serving, food running and even cleanup.

As for where the magic happens in the kitchen , automated robots are helping streamline simple, low-skill, repetitive tasks that assist cooks while they focus on the more intricate task involved with preparing meals.

Whether it be flipping burgers, mixing spices, prepping foods, operating fryers or measuring ingredients, there’s a robot for it that helps reduce waste, increase efficiency and improve product consistency.

Restaurants are notoriously low margin businesses, and with labor, food and rent being the 3 biggest inputs and all rising over the last 2 years, automation is at least helping keep a handle on rising labor costs by improving training costs, automating task management and helping with inventory management.

The likes of Chipotle , Sweetgreen , McDonalds , Starbucks , Dominos , Shake Shack and many others are all experimenting with robots and automation in different parts of their businesses, which could help improve their margins if they become implemented on a larger scale in the future.

Healthcare - Surgeons and Robots

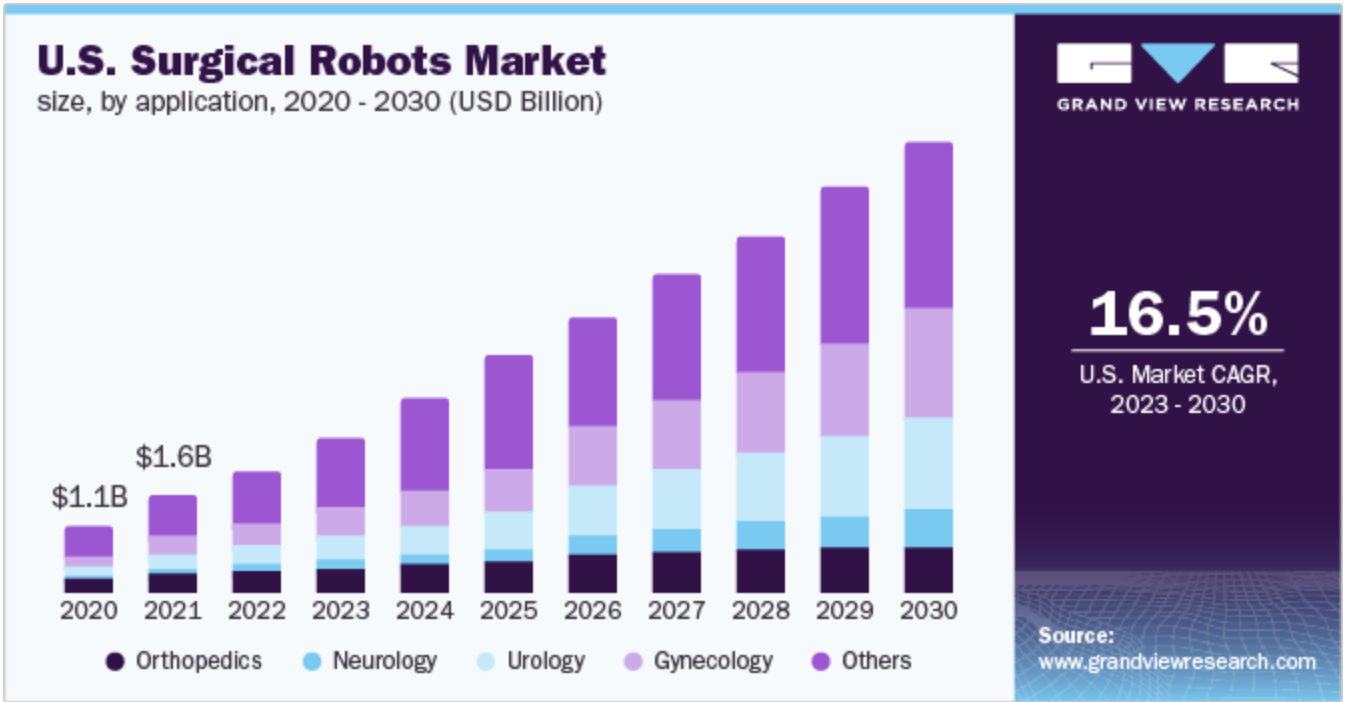

In the field of healthcare, precision can sometimes be a matter of life or death. So incorporating robotics and automation has been a game changer to assist doctors and surgeons with their tasks and reduce human error.

We’ve seen robot-assisted surgeries help many doctors perform minimally invasive intricate and complex procedures with more precision which has plenty of benefits .

These include greater range of motion and dexterity, highly magnified high-resolution images and live video, better access to areas being operated on, fewer complications during surgery, shorter hospital stays, less risk of infection, less blood loss, fewer blood transfusions, less pain, and faster recovery times.

Robots are used extensively through healthcare , from the surgical robots mentioned above, to exoskeletons helping with rehabilitation, care robots to assist nurses with aged care, and hospital robots which can disinfect items or deliver items around hospitals.

Toyota and Honda have been working on these care robots for a few years now, and Intuitive Surgical , Medtronic and Stryker provide surgical robots that are currently being used.

A Grandview Research report expects the global surgical robots market size to grow at 16.5% per year to reach $18.2bn USD by 2030, up from $4.4bn in 2022.

US Surgical Robots Market Estimates - Grand View Research

Benefits of Automation to Businesses and Consumers

Since businesses (at least the good ones) are looking to deliver value to their end users and shareholders, operational efficiency is one of the biggest opportunities of hitting two birds with one stone.

And investing in automation achieves exactly that.

Automation helps businesses deliver better products and services, save time, increase consistency and reduce waste, which ultimately leads to higher operating margins, and all else being equal, higher profits for shareholders.

While these investments may cost a lot more upfront due to the capital required to buy the equipment, the value over the long term provided by such robots and tools end up paying for themselves many times over.

Investing in automation has the potential to increase long term operating margins of those stocks that utilise automation and robotics, even if their sales don’t increase. It also has the potential to drastically increase revenues of those that actually make and sell the equipment or software, given the value they’re providing to businesses and end users.

How to Invest in Automation and Robotics

So, if you’re interested in investing in this trend of autonomous vehicles and robotics, you’re in luck. There are a plethora of businesses operating in the space. They’re either utilising robots to improve their own products and services, or actually selling the robotic products and services.

While this list isn’t exhaustive, and nor are all of them “pure-play” exposure, here’s a list of US stocks and ETFs that are in some way, exposed to the automation trends covered above.

Autonomous Vehicles

Stocks:

- Tesla , Alphabet , Ford , General Motors , Qualcomm , Amazon (owner of Zoox ), Nvidia , Micron Technology , UBER , Lyft , APTV

ETFs:

Robotics

Stocks:

- Rockwell Automation , Intuitive Surgical , Zebra Technologies , PTC , Deere , Trimble Caterpillar , Teradyne , UiPath , Medtronic , Stryker , Becton Dickinson , Zimmer Biomet , Smith and Nephew , Globus Medical , Vicarious Surgical , Kratos Defense and Security Systems .

ETFs:

What Else is Happening?

Here’s few news items that we thought were worth noting…

- 🏠 Mortgage rates in the US hit highest level in more than 20 years - CNN

- 30-year fixed rate mortgages averaged 7.09% last week, according to data released from Freddie Mac. Last time rates were that high was April 2002, when mortgages were 7.13%

- Buying a home is now more expensive thanks to higher financing costs and owners who secured lower rates are incredibly reluctant to sell. The combination of lower inventory levels and higher financing costs have driven home sales down about 20% lower than they were a year ago.

- 🚀 SpaceX reportedly turned a profit in the Q1 due to huge revenue increases, according to the WSJ .

- Quoting from documents detailing the company’s quarterly and annual reports, SpaceX reported a Q1 profit of $55m million on revenue of $1.5bn. Full year results were a loss of $559m on revenue of $4.6bn.

- CNBC said: “ The rare look at SpaceX’s financials offers a clue into how the company is faring while it ramps up its Starlink internet satellite service and races to get its monster Starship rocket delivering payloads to space… which are key to SpaceX’s success”

Key Events During the Next Week

As for economic data this week, we’ve got a big annual event: the Jackson Hole Symposium , one of the largest central banking conferences in the world. The event will be focusing on “ Structural shifts in the global economy ” and is being held from the 24th to the 26th of August.

The event brings together economists, financial market participants, academics, U.S. government representatives, and news media to discuss long-term policy issues of mutual concern, which can be very beneficial for investors to listen in on.

Elsewhere, we’ve got New Zealand and Australia reporting retail sales on Tuesday and Sunday respectively, Germany and Europe reporting Manufacturing PMI data on Wednesday, and Japan’s CPI figures coming out on Thursday.

As for earnings season, there’s still plenty of big names reporting, including:

Until next week, invest well!

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Michael Paige has a position in AMZN. Simply Wall St has no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Michael Paige

Michael is the Content Lead at Simply Wall St. With over 9 years of experience analysing and researching companies, Michael contributes to the creation of our analytical content and has done so as an equity analyst since 2020. He previously worked as an Associate Adviser at Ord Minnett, helping build and manage clients' portfolios, and has been investing personally since 2015.