“Let’s go invent tomorrow instead of worrying about what happened yesterday.” – Steve Jobs

This is the fourth edition of our big trends series, and we are going to have a look at disruptive technologies .

There’s a lot to cover, so we’ll spread it over a few weeks, starting today with:

- Artificial intelligence,

- Data, and

- Digital infrastructure.

We are also going to highlight some of the lesser well known companies within these industries for those of you who want to explore each area further.

🎧 Would you prefer to listen to these insights? Checkout the audio recording on Spotify and Apple Podcasts !

Artificial Intelligence

Artificial intelligence has been the hot topic of 2023, and could well be the most important disruptive technology of the century so far.

The launch of ChatGPT last year showed the world just how powerful large language models have become and we’re still only in the early days.

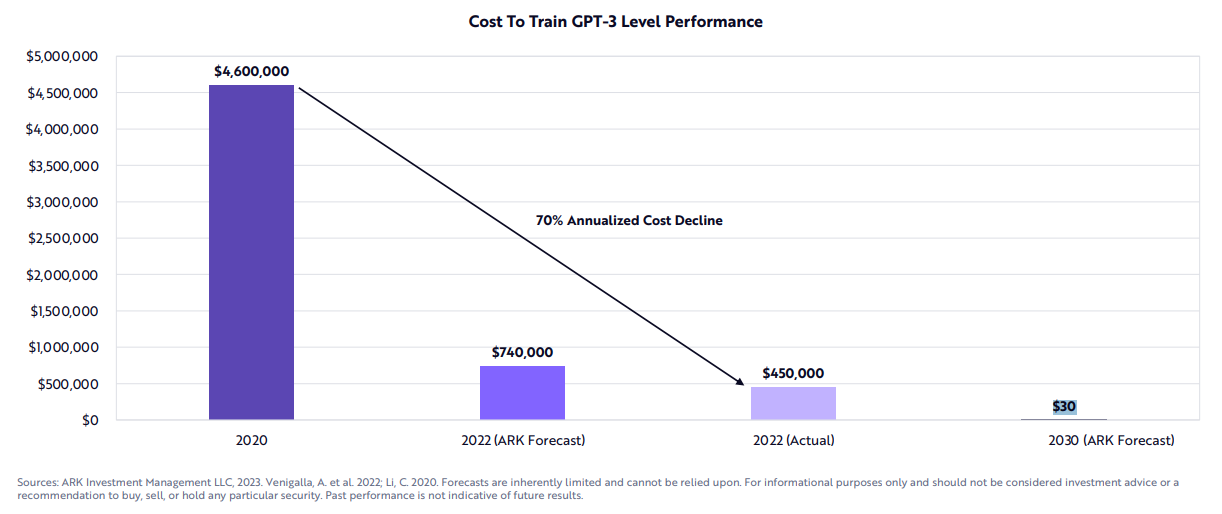

But AI has been around for a while and has been extensively used by many large companies. What has changed is the cost of training models, which is currently falling by about 70% a year.

Cost to Train Chat GPT Level AI Models - Image Credit : ARK Invest

Costs have fallen due to the performance of hardware improving and software becoming more efficient. This resulted in a massive increase in investment and research and development in the last five years, which in turn led to better performance.

But this won’t mean we’ll see LLMs integrated into everything immediately. The cost of training the model is just the tip of the iceberg.

What you don’t see here are the massive “inference costs” looming beneath the water’s surface. The inference cost for LLMs is the cost incurred every time the model is called upon for an output.

But where does this cost come from? Well consider this, LLMs like ChatGPT require an immense amount of computing power.

Semianalysis estimates that as of February 2023, OpenAI utilizes upwards of 3,600 Nvidia HGX A100 servers to serve ChatGPT. These HGX servers each contain 8 A100 GPUs which come at a cost of $10,000 per unit .

This roughly equates to $288 Million in hardware costs alone to serve ChatGPT. Now consider the costs of the energy required to run and cool these servers, the cost of hosting ChatGPT on the cloud, the labor cost of running and developing an LLM, the hardware cost of upgrading to more efficient hardware and so on and so forth.

You quickly begin to see the picture of how expensive generative AI currently is to service. Semianalysis stated “inference costs far exceed training costs when deploying a model at any reasonable scale. In fact, the costs to inference ChatGPT exceed the training costs on a weekly basis.”

These costs will inevitably decline overtime as hardware improves and the models become more efficient, but we are still a while away from a point where generative AI is a perfect substitute for traditional computational methods.

So, it seems like those selling the “ picks and shovels ” in the computing industry are well positioned to have their pockets lined, at least maybe more so than those actually providing the generative AI in a commercial sense.

AI for All

With all the hype around AI, a lot of the focus is on the companies that own the models Microsoft and Alphabet , make the semiconductors that power them ( Nvidia and AMD ) , and operate the data centers that house the servers (Microsoft and Alphabet again + Amazon ). Yes, those companies are all beneficiaries, but companies in almost every industry can benefit from using AI.

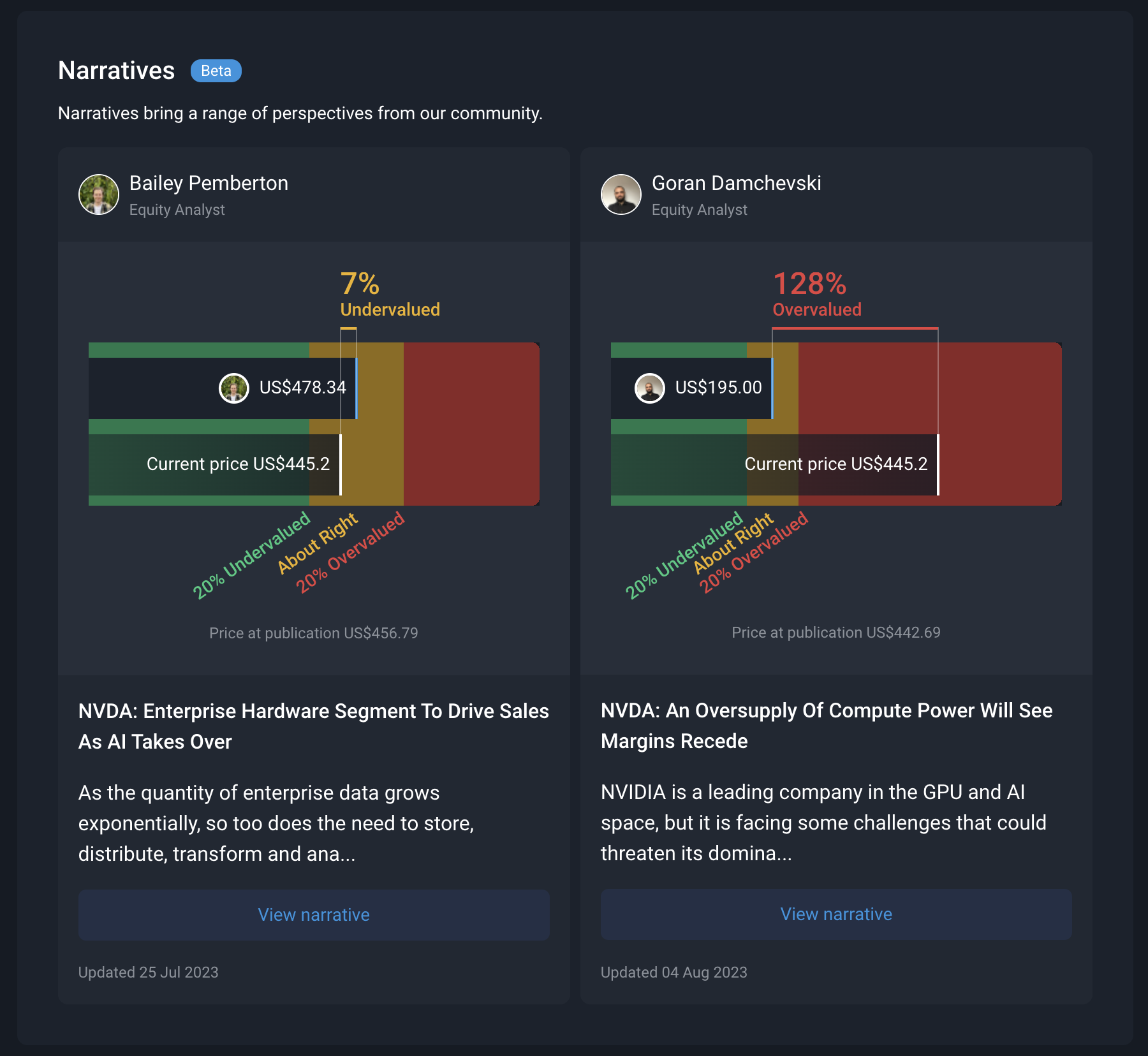

Also, if you’d like to read more about investors' opinions on these stocks, you can find narratives on these stocks mentioned above and more near the top of the company report! (currently in Beta, and we'd love to hear your feedback!)

Narratives on NVIDIA (NVDA) on Simply Wall St

Here are some examples of how companies are using AI within their businesses.

Customization is something a lot of companies can increase with the aid of AI. Businesses generally divide potential customers into ‘categories’ and then create standardized products for each category. Whether you are buying a Big Mac, a pair of jeans or an insurance policy, you are probably buying something that roughly matches the needs of a group of similar consumers.

By standardizing products, businesses can achieve economies of scale and pitch their products at a price that maximizes profits. The exception is companies that serve more affluent consumers, in which case bespoke products are justified by premium prices.

With the aid of AI (and automation), a company can customize products for each customer. This could result in:

- Premium pricing for some customers - customers pay more for a bespoke Big Mac with extra cheese,

- More potential customers at the same price point - every customer gets a pair of jeans that fits them perfectly, or,

- A larger addressable market at a lower price point - insurance premiums that match the risk profile of each customer, rather than the entire segment can be cheaper.

The technology to do this is already available to very large companies, but as AI models get cheaper and better, they will be available to smaller companies.

Although, for these small companies, we’d encourage you to think about how the inference costs of AI may impact a business with less capital, but at its core. AI is something to consider when you are looking at any company, not just AI companies.

The really interesting applications will be those we haven't imagined yet. New technologies spawn new industries and careers that couldn’t previously be imagined, let alone exist.

Benedict Evans wrote an interesting essay that puts AI in context in terms of the evolution of technology, business, jobs and prosperity - it’s worth a read.

As he points out, “new technology generally makes it cheaper and easier to do something, but that might mean you do the same with fewer people, or you might do much more with the same people. It also tends to mean that you change what you do. To begin with, we make the new tool fit the old way of working, but over time, we change how we work to fit the tool.”

Data - The Digital Oil

We mentioned previously that AI models learn and make predictions using data, so the quality and quantity of data a company has access to is key. In fact, data has been described as the oil of the digital economy. In other words, without useful data, artificial intelligence isn’t useful either.

Companies with access to rich data have a distinct advantage. Good examples include Alphabet , Meta , Uber , Airbnb , Visa and Tesla which collect massive amounts of unique data each day.

But it's increasingly important for every organization to have access to all the data generated within the business, and usually in real time too. Data needs to be gathered, organized, stored and made available as and when needed.

Most of the providers in the data software and ‘big data’ space specialize in storage, analytics, monitoring or security. It's a very competitive space, but it's also growing quickly.

The narrative for data companies isn’t as simple as “more data, more money”.

The cost of data acquisition and analysis is becoming greater and with more companies digitizing their workflow, there are more raw data points being collected. This data comes in an array of different formats, which makes storage, analysis and integration an exponentially more difficult task for big data.

Big Tech’s job is also getting more difficult.

Data privacy legislation means that data isn’t just getting harder to store and analyze, but harder to acquire too. Users of Apple’s phone may have noticed that since 2021 , their phone now asks them if they want to allow apps to track their activity across other apps and websites.

This is one of many steps legislators are making to help protect our data privacy in a digital world that knows more about your behaviors than yourself.

Who operates in this space?

Besides the big tech companies, these are some of the companies offering more specialized solutions:

- Database management and storage: Snowflake , Dropbox , Box , MongoDB

- Monitoring and security: Datadog , Dynatrace , Splunk

- Big data analytics: Palantir , Alteryx

Have a look at our cloud storage stocks collection for a few other ideas.

Infrastructure and Hardware

Software might be eating the world, but software still needs hardware and an infrastructure to operate on. The infrastructure that runs ‘the cloud’, consists of data centers, servers and networking equipment.

Revenue growth rates for cloud providers may be slowing (temporarily), but in dollar terms it's still rising as more software moves to the cloud and the amount of data being collected increases exponentially. Amazon , Microsoft and Alphabet dominate the cloud market, but IBM , Oracle , Alibaba also have growing cloud businesses.

Nvidia and AMD provide most of the GPUs (graphics processing units) that are essential for machine learning models. But there are other chip makers that supply essential components to data centers. These include Intel , Qualcomm , Marvell Technology and Micron Solutions .

But what aspects of these companies are important for the average investor and which ones are worth my time in researching?

Well, in the beginning, we had Moore’s Law to adhere to. Smaller transistors have been the horizon these companies are chasing and nothing has changed. Smaller transistors mean a number of things. Firstly, it means that you can fit more on a given chip.

Secondly, a smaller transistor has less “ gate capacitanc e”, which essentially means it can ‘switch’ (the job of a transistor) faster and less energy is expended.

So to put it simply, a company producing semiconductors will want to achieve the smallest transistor nodes, as that generally brings about faster and more efficient chips - precisely what the end customers like Apple, Samsung, Nvidia and AMD are looking for.

Speaking of end customers, it’s also a good idea to look at who these companies are selling to.

Where the silicon will end up and how much demand these end consumers could realistically have are two key questions you have to ask yourself as an investor.

Who operates in this space?

In addition to the stocks mentioned above, companies like Arista Networks , A10 Networks and Cisco provide the networking equipment that are essential to build out modern data centers.

Data Center REITs are real estate companies that own the physical land and buildings that house datacenters, and in some cases other telecom facilities like mobile towers. These REITs include Equinix , Digital Realty Trust , and American Tower Corporation .

Computing At The Edge

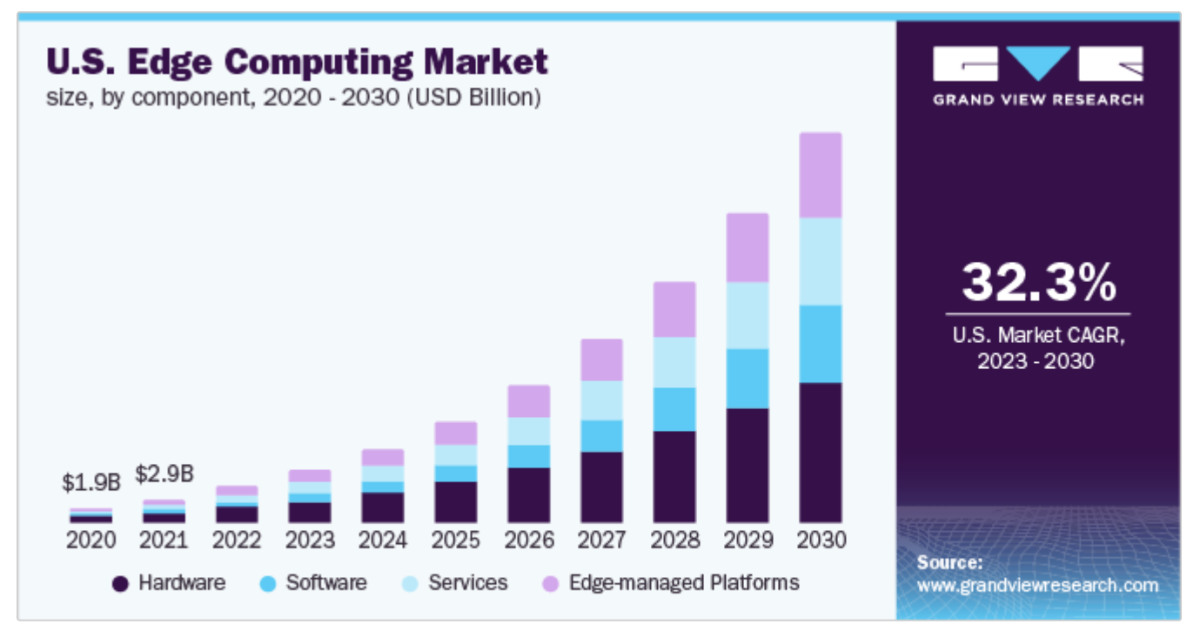

Not all data and software can be hosted half a world away from where it's needed. Autonomous vehicles, mobile phones and other connected devices need to have processes running closer to wherever they are physically located.

This is where edge computing comes in. Edge computing providers operate data centers across the globe and provide content delivery services to websites and applications close to where they are needed.

Edge Computing Market Growth Forecasts - Image Credit: Grandview Research

Who operates in this space?

Companies like Cloudflare , Edgio , Fastly , Akamai Technologies have become an essential cog in the digital economy. Most of us use these services multiple times a day whether we know it or not.

The extent to which applications depend on these services and are built on top of them makes this a very interesting space. Edge computing services are essential and switching costs are high.

What Else is Happening?

First a recap of the key data releases we mentioned last week…

- 🇺🇸 US J OLTs job openings fell slightly more than expected for June. The number of job openings fell to 9.58 million from 9.82 million in May , reflecting a gradual softening of the labor market.

- 🇺🇸 At the same time, the ADP employment report showed private sector employment increasing in July. Employment increased by 324,000, well above the expected 195,000 . However wage growth fell slightly which suggests inflationary forces are slowing without job losses.

And then, a few news items that we thought were worth noting…

- 📉 Fitch Ratings surprised the market by downgrading US debt. Specifically the US long-term foreign currency debt was downgraded from AAA to AA+.

- The agency cited the fact that US debt as a percent of GDP has risen from 60% to 113% since 2007 . Fitch also expects fiscal deficits and debt to continue rising for the next three years.

- In theory a lower rating could lead to higher borrowing costs. In reality, US bonds are the global benchmark, and there really isn’t an alternative that can accommodate the capital that flows into US bonds.

- 💵 More than half of the S&P 500 constituent companies have now reported second quarter earnings.

- Reports have on the whole been ahead of expectations which are of course quite low. Revenue and earnings growth remain at their weakest since Q2 2020, the start of the pandemic, but are at least not getting worse.

- Recent trends continued with telecom and tech companies outperforming and healthcare and energy underperforming.

- 🚕 Uber reported its first ever quarterly profit, $394 million in net income or $0.18 a share.

- Prior to these results the company had accumulated losses of nearly $33 billion since 2014.

Key Events During the Next Week

Inflation data is due in the US this week, with consumer price data (CPI) due Thursday, and producer price data due on Friday. All of which the Fed and investors will be watching closely to determine the likelihood and necessity of more rate increases.

On Friday the UK’s GDP growth rate and manufacturing production data will be released will give us a glimpse of the UK economy’s broader economic activity.

Earning season continues with a few large companies and lots of smaller technology companies reporting:

- Berkshire Hathaway

- Eli Lilly

- Alibaba

- Disney

- UPS

- The Trade Desk

- Palantir

- Datadog

- Restaurant Brands Int’l

- Rivian

- Roblox

- Skyworks

- Wynn Resorts

- Plug Power

- Duolingo

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman has a position in INTC. Simply Wall St has no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.