The Big Trends - Part 2: Demographic And Geopolitical Trends

Reviewed by Michael Paige, Bailey Pemberton

“We always overestimate the change that will occur in the next two years and underestimate

the change that will occur in the next 10.” - Bill Gates

We're 2 weeks into our Big Trends series and this week we’re focusing on the major demographic and geopolitical trends likely to shape the next few decades.

🎧 Would you prefer to listen to these insights? Checkout the audio recording on Spotify and Apple Podcasts!

1. The World Is Aging

There are several demographic trends occurring around the world, but the aging of the world population has to be the most important. It will also be happening for many decades to come.

In most countries, birth rates are falling while people are also living longer. The implications? It’s a triple whammy. Firstly the number of people entering the workforce is falling, secondly, the number of those leaving the workforce is rising, and then, to top it all off, people are living far longer after they retire.

While this creates several challenges, but also a number of opportunities.

Typically the age profile of a country changes gradually as it has in Japan and Europe. However, the aging of China’s population is happening at unprecedented rates. As of 2022 the population is shrinking, and it looks like the workforce will also be shrinking soon.

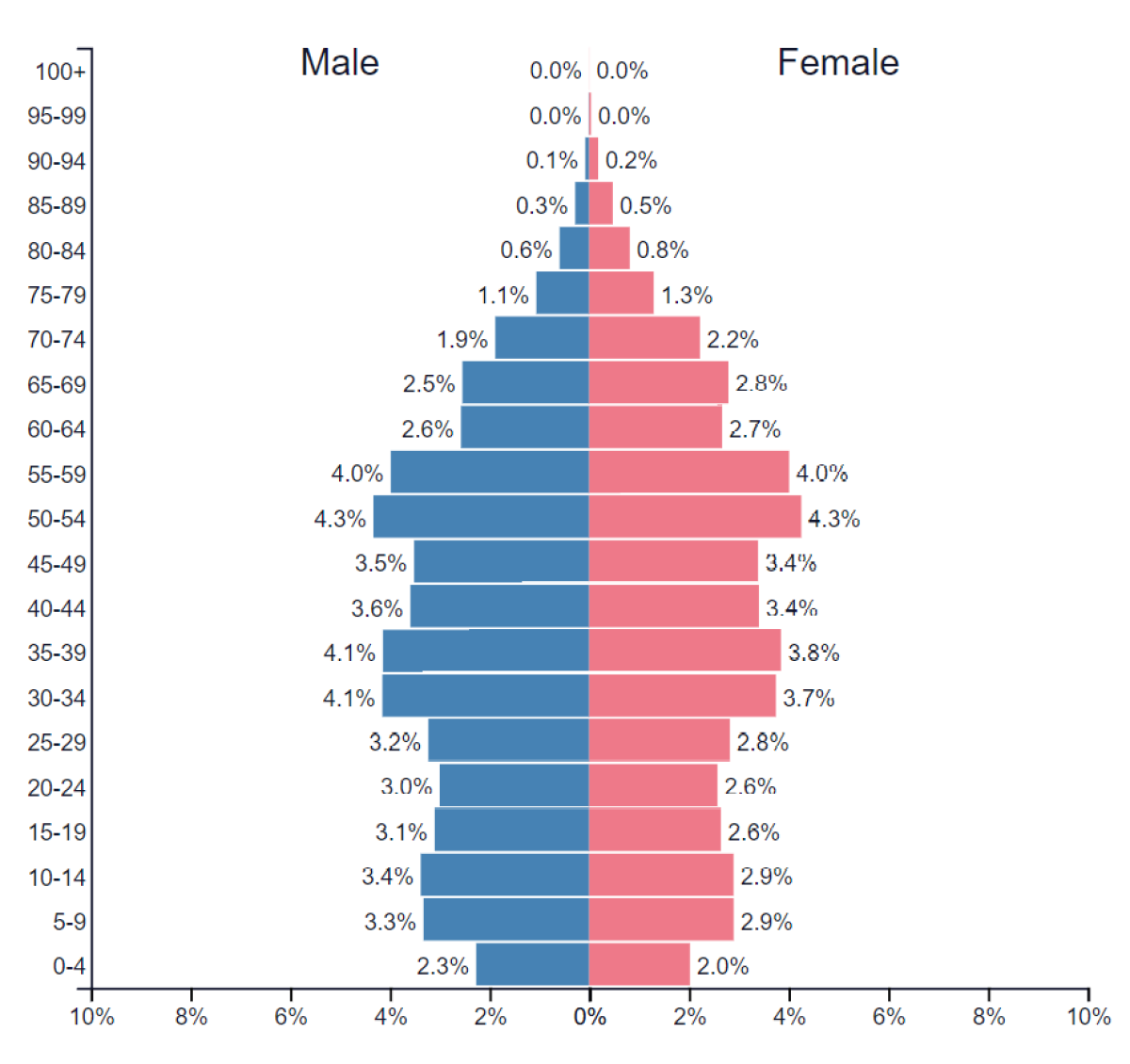

China's Population Age Profile in 2023 Image Credit: PopulationPyramid.net

There are several consequences to a shrinking workforce and a growing number of retirees, including:

- Wage inflation as companies compete for a shrinking pool of workers. This further reduces the cost advantage that China has leveraged in the past.

- A peak in the number of new consumers and taxpayers .

- More healthcare resources are required to care for a growing aged population.

- All of this puts pressure on the country’s finances which are already under pressure due to an over leveraged property sector

Of course technology and automation could offset some of these challenges - which underscores the need for automation to maintain productivity levels amidst a declining workforce.

But this begs the question: Will a declining workforce slow down the innovation required to reach widespread automation? Time will tell, but there is undeniably opportunity to be had for investors who can ride the automation wave.

The aging of China’s population is happening a lot quicker than elsewhere, but most countries will deal with similar challenges. The difference in Western countries is the level of government debt, and the fact that there will eventually be a shrinking pool of taxpayers.

The Opportunities?

One of the things investors like to see in a company is a growing market for its products. Well, the number of people aged sixty and over is a growing market. And it will continue to grow for years to come. Furthermore, many over 60s have far more disposable income than other age groups.

Our Top 5 US Stocks for an Aging Population collection includes some of the companies that stand to benefit from these trends, including Ventas (senior housing) and Carnival Corporation (cruise lines).

While this isn’t an all-encompassing list, it should give you an idea of areas and industries that are worth investigating further. We explain further down a process you can use to identify further opportunities within secular trends.

It will be interesting to see how the needs and wants of the over 60’s market changes. Each year, people turning 60 will be more comfortable with technology - and even with video games!

It’s also possible that fewer people will choose to retire in the conventional sense. Working arrangements are more flexible and there’s a growing number of knowledge worker-type jobs - which may keep people working out of choice.

2. Growing Middle Class Consumer Markets

When economies become industrialized a ‘middle class’ emerges. By middle class (rather than middle income) we mean households earning enough to make discretionary purchases after their basic needs have been met.

A growing middle class means more spending on discretionary goods and services like furniture, electronics, vehicles, restaurants and travel. It also means more people paying more tax, which allows the government to increase investment in infrastructure and services. In this way, a virtuous cycle is created leading to higher-paying jobs, a growing economy, and more opportunities for companies and their investors.

China and parts of South-East Asia have experienced the fastest growing middle class cohorts over the last few decades, as hundreds of millions of people joined the formal economy. These trends are maturing now and the ‘easy gains’ have already been made.

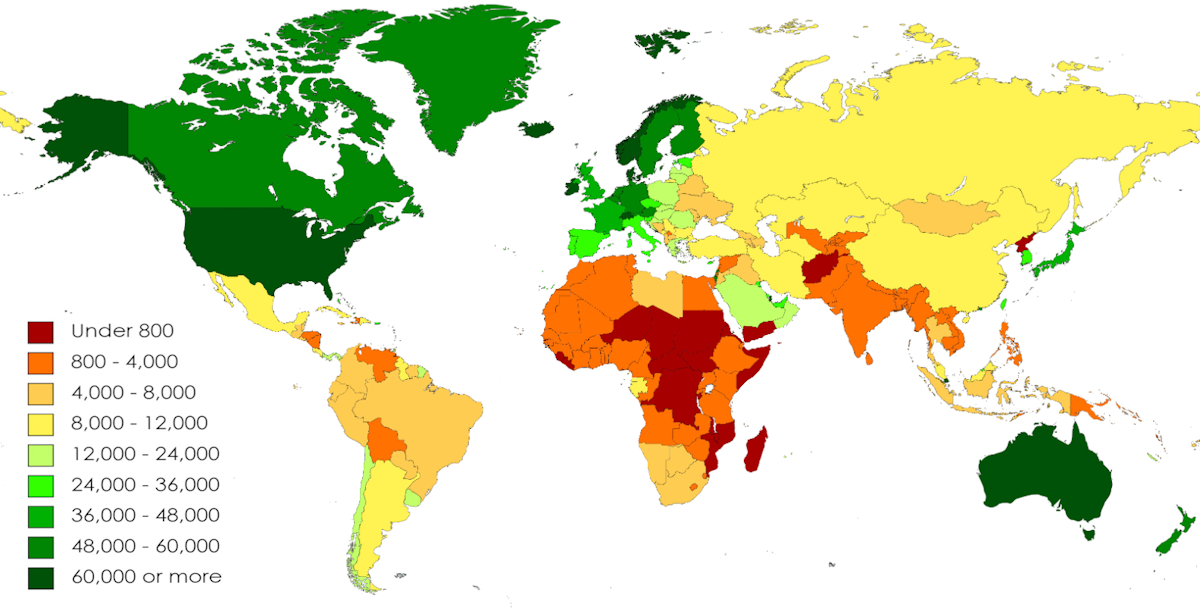

However, India still stands to see the biggest growth in the consumer class in the coming decades if the economy keeps growing at the current rate. Over 90% of India’s workforce earns less than $4,000 a year, leaving little (if anything) for discretionary spending. For context, 57% of China’s household’s are described as middle income with incomes of $14,800 and more.

The map below shows GDP per capita (as a proxy for average incomes) for each country as of 2021. Per capita GDP in the countries colored red and orange are still below $4,000. Besides India, the rest of South Asia, and Africa stand out as regions of opportunity.

Our Top African Stocks collection includes companies that can benefit from growth across Africa.

GDP per Capita by Country Image Credit: Wikipedia Commons

While the world’s population is getting older, it’s also still growing. Most of the population growth will now occur in many of the same countries that have low per capita GDP. That means that the working-age population and discretionary spending could increase for decades to come.

For low income economies to realize their potential they need to create a business and investor friendly environment, modernize their financial systems and controls, invest in education, and promote trade. And of course they need to invest in infrastructure.

3. Infrastructure Investment Can’t Be Avoided

Economies cannot grow without investing in new infrastructure and upgrading old infrastructure. If you believe an economy will grow meaningfully, you have to believe that there will be significant investment in infrastructure. This includes roads, ports, telecom infrastructure, power grids and water supply.

But infrastructure investment isn’t only essential to developing economies. Besides the fact that many developed economies desperately need an infrastructure overhaul, many of the other secular trends expected to occur over the next decade or two can’t occur without major investments in infrastructure.

In particular, the electrification of an economy requires a much bigger and more efficient power grid. Other innovations like artificial intelligence can’t deliver the promised improvements in global wealth without infrastructure investment.

The good news for investors is that governments can’t possibly fund these infrastructure projects on their own. Public-private partnerships have become standard to bring in private funding while providing the assurance of government commitment, allowing investors to reap the rewards of a growing or advancing economy

For investors, infrastructure investment companies like Brookfield Infrastructure Partners and Enbridge are one way to invest in infrastructure directly. Companies like Caterpillar that provide the equipment to build infrastructure are another option, and so are companies like BHP Group that produce the raw materials required to build infrastructure.

💡The Insight: How To Find The Opportunities

We’ve previously spoken at length about what to look for in a company once you find an opportunity, like in our deep dive into navigating the FinTech landscape , but not yet about how to actually find these opportunities. This week’s look at the world’s aging population, growing middle class and need for infrastructure has highlighted some of the prevailing trends in the market. So let’s take a journey on how we can go from identifying a trend to making an informed investment decision.

- Identify the Secular Trend

- The first thing you’ll need to do is identify the trend here. We’ve given you a brief headstart and covered three secular trends that we’ve identified in the market. But how would you go about finding one yourself? Let’s use aging populations as the example we use here.

- The first thing you’d need to ask yourself is: Is there substantial evidence of an aging population? Examine census data, World Health Organization reports, and statistical data on population growth and aging. Population pyramids like the one we included earlier in the article are an excellent graphical representation of the age breakdown of a population and can help you quickly identify any “upside-down pyramids”, the key marker of an aging population.

- Reports like this one from the United Nations are a good place to start in confirming your hypotheses on these secular trends.

- Understand the Implications

- Look into the social, economic, and political implications of the trend. How will it affect consumer behavior, government policy, healthcare, real estate, and other sectors? What are the undeniable consequences of this trend continuing?

- One of the most easily identifiable implications of an aging population is the inevitable impact on the healthcare system. Aging populations, specifically ones with a high proportion of elderly people will have greater medical needs and so we’ll need to see dramatic investment in healthcare to support this.

- It can be helpful to apply both empirical evidence and anecdotal evidence. For an aging population, consider some consumer trends that you’ve personally identified. What do you notice that older people tend to buy that younger people don't? What behavior do you notice differs between age demographics and how does that translate into the consumer market?

- Identify Potential Beneficiaries

- A direct follow on from identifying the implications of the trend is to recognise the industries, sectors or companies that could benefit from the changing behavior of consumers or the needs of the population.

- We’ve already identified that healthcare expenditure is likely to increase as the population ages, and so there are likely to be many opportunities in the MedTech, Pharmaceutical and Healthcare industries, but we encourage you to also think outside of the box.

- Aging populations are characterized by a greater component of people exiting the workforce. Ask yourself, what do retirees do? As touched on in our aging population collection, an overwhelming majority of cruise ship passengers occupy older age demographics, with nearly 50% of all passengers being older than 50. Could an aging population advantage the cruise industry seeing as their largest passenger demographic is growing?

- Assess Investment Opportunities

- Once you begin researching, you’ll begin to map out a series of industries where opportunity could lay through expanding addressable markets or greater sales growth due to market demand. Now comes the part you should be more familiar with. Evaluate specific investment opportunities within these sectors.

- Analyse specific companies to assess where their competitive advantages are, how well capitalized they are (some of these trends could take years to reverberate through the market and so healthy balance sheets are always great to look for) and how well positioned they are to take advantage of these trends.

- Consider the healthcare opportunities we’ve mentioned before. It’s not enough to just pick a healthcare provider and hope for the best. Take a look at what services they provide. If it’s a pharmaceutical company, take a look at their development pipeline. Are they undergoing clinical trials for drugs that are likely to tackle issues specific to old age like Alzeihmers, Heart disease, cancer etc.

- Assess the Risks With Your ‘Narrative’

- Once you’ve undertaken all this ground work, you’ll begin to form a narrative around a stock and have a very clear rationale for why you see this as a great opportunity. This is a great way to invest, but as always, you must consider the fundamental risks to your narrative.

- What if the trend begins to reverse? What if the trend takes longer than you anticipate to have an impact on the market? What if some of the opportunities you’ve discovered fundamentally change their strategy or operations?

- This part of the journey will be ongoing. You should constantly monitor regulatory changes, the competitive landscape of the company/industry you’ve taken a look at and any other things that could potentially prevent the secular trend from impacting the market in the way you expect.

What Else is Happening?

First a recap of the key data releases we mentioned last week…

- 🇨🇳 China’s GDP growth rate for the second quarter was lower than hoped and reflected weakening demand for exports and locally. The economy grew 0.8% from the first quarter and 6.8% year-on-year. That may seem high, but it came off a low base and was expected to have increased by 7.3%.

- 🇺🇸 US retail sales rose 0.2% in June. This was slightly lower than expected but reflected a fairly resilient US consumer. The figure for May was also revised higher (from 0.3% to 0.5%) so the overall trend is robust.

- 🇬🇧The UK’s inflation rate delivered a positive surprise for a change. Consumer prices rose 7.9% in the year to June, compared to the 8.2% economists anticipated. It’s still high, but down sharply from May’s 8.7% and heading in the right direction.

- 🇺🇸 The US Dollar Index fell to a new 52 week low , just below 100. Last year the strong USD hurt US companies that earn foreign revenue. This effect will now be reversing and should contribute to second quarter revenue. Some of the biggest offshore revenue earners are Coca Cola , Mondelez , Apple , and Microsoft .

And then, a few news items that we thought were worth noting…

- 🏦 Second quarter earnings from the largest US banks were a mixed bag - but there was a common theme. While results were generally better than expected, there were some big declines in revenue, particularly within investment banking divisions

- Profits at Goldman Sachs, Morgan Stanley and Citigroup were all lower due to lower revenue from trading and deal making. Meanwhile JPMorgan, Bank of America and Wells Fargo which have large consumer businesses reported earnings growth.

- Banks benefit from higher rates, but those gains can be offset when trading and M&A opportunities dry up.

- The Nasdaq 100 index is being adjusted to reduce the dominance of the largest components: Microsoft, Apple, Nvidia , Amazon.com and Tesla .

- The rally in big tech has resulted in the combined weight of these counters reaching 43.8%.

- On 24th July the combined weight of these stocks will be reduced to 38.5%.

- This is unlikely to have much of an impact on anything in the long term. But index tracking funds will need to reduce exposure to these companies which may create an opportunity in the short term.

Key Events During the Next Week

It’s a big week with the US Fed rate decision and the most important week for second quarter earnings.

The FOMC decision will be announced on Wednesday, with the market expecting a 0.25% hike . Also in the US, durable good orders are due on Thursday and personal income and spending data is due on Friday.

The ECB rate decision is also due this week - on Thursday. Also in Europe, France’s GDP growth and inflation rates will be released on Friday.

Australia’s inflation rate is due on Wednesday.

Besides the tech giants, there are some large consumer, industrial and financial companies reporting second quarter results:

- Microsoft

- Alphabet

- Amazon

- Meta

- Snap

- Dominos

- GM

- GE

- Spotify

- Raytheon

- MSCI

- Coca Cola

- Boeing

- McDonald’s

- Mastercard

- Visa

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.