The Big Trends - Part 12: Nuclear Energy

Reviewed by Michael Paige, Bailey Pemberton

“I would like nuclear fusion to become a practical power source. It would provide an inexhaustible supply of energy, without pollution or global warming.” - Stephen Hawking

Welcome to the last edition in our ‘ Big Trends ’ series!

If you missed any of the other 11 newsletters in this series you can find them all on the Global Market Insights page . To monitor the developments of these trends, We will be checking in on them from time to time and adding any new themes that look interesting.

For today though, we are looking at a topic that divides the room: nuclear energy. We didn’t cover it when we looked at Energy and Climate Change previously, because well, there’s a lot to cover and it deserved its own piece.

Let’s dive in!

🎧 Would you prefer to listen to these insights? You can find the audio version on our Spotify or Apple podcasts !

Nuclear Power: The Pragmatic and Inevitable Clean Energy Solution?

With all the debate around greenhouse gas emissions and renewable energy, a lot of people have wondered why the world isn’t pursuing nuclear energy in a major way.

This question became even more pertinent after Russia’s invasion of Ukraine triggered a global energy crisis and “energy independence” came to the front of most people's minds.

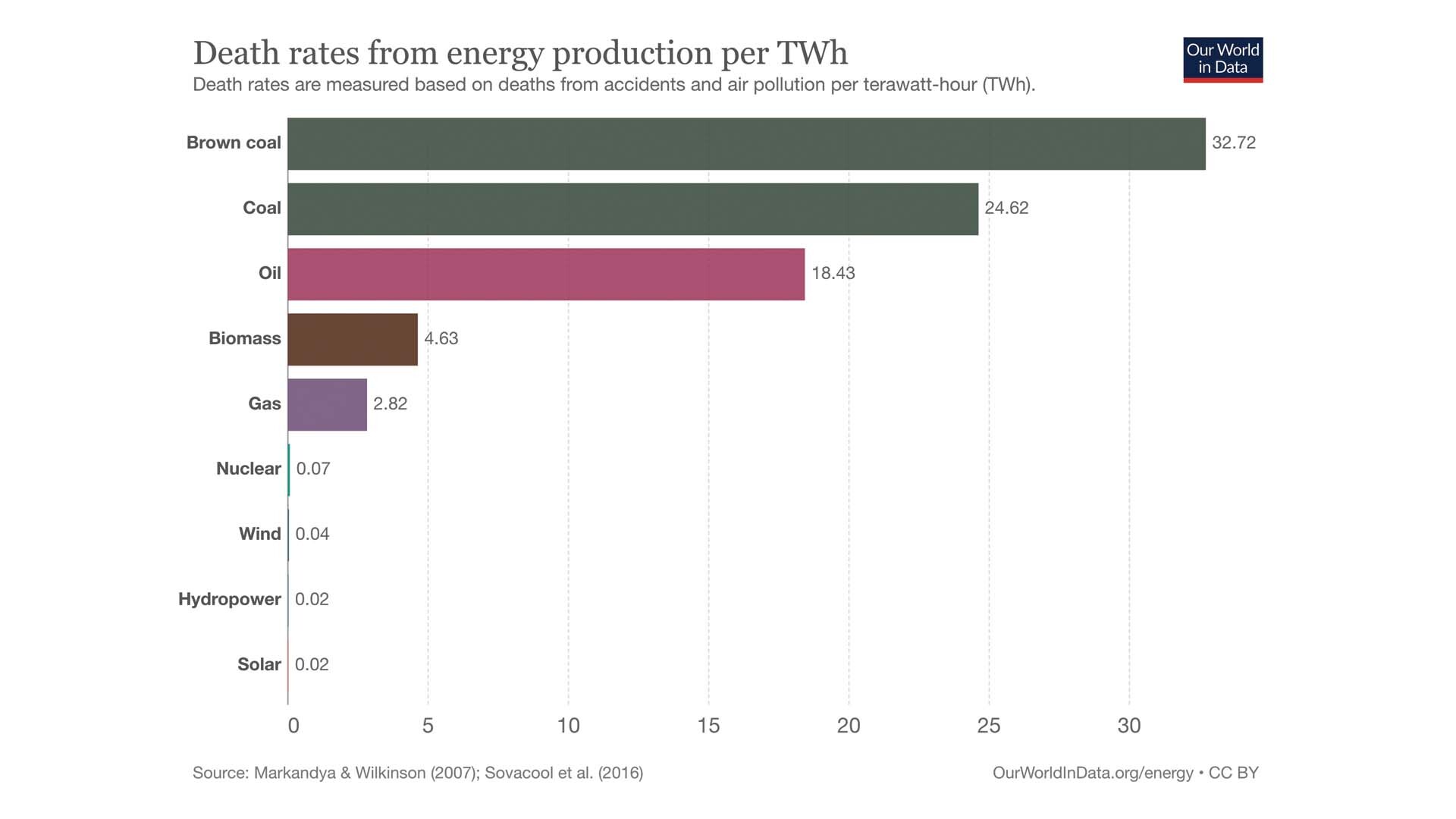

Nuclear energy is relatively cheap (over the long term) and despite what some may believe, it’s a much safer energy source than fossil fuel .

Just like some people view flying as more dangerous than driving ( which it isn’t ), nuclear energy faces similar problems around public perception, which can be harder to solve than engineering or technological challenges.

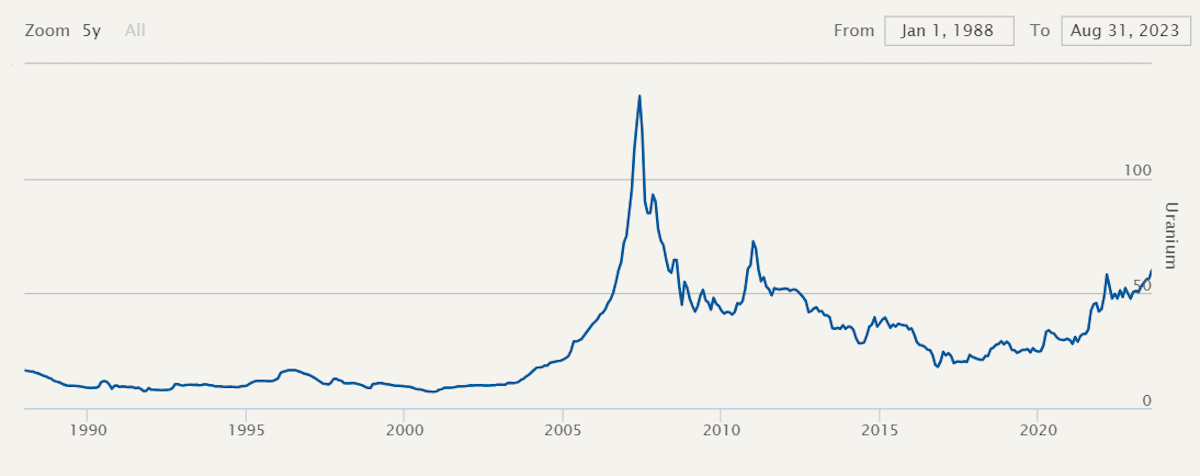

However, the price of uranium suggests investors are now betting that attitudes are changing.

Uranium is now the top performing commodity over the last 12-months, and its price is approaching its ‘pre-Fukushima’ levels.

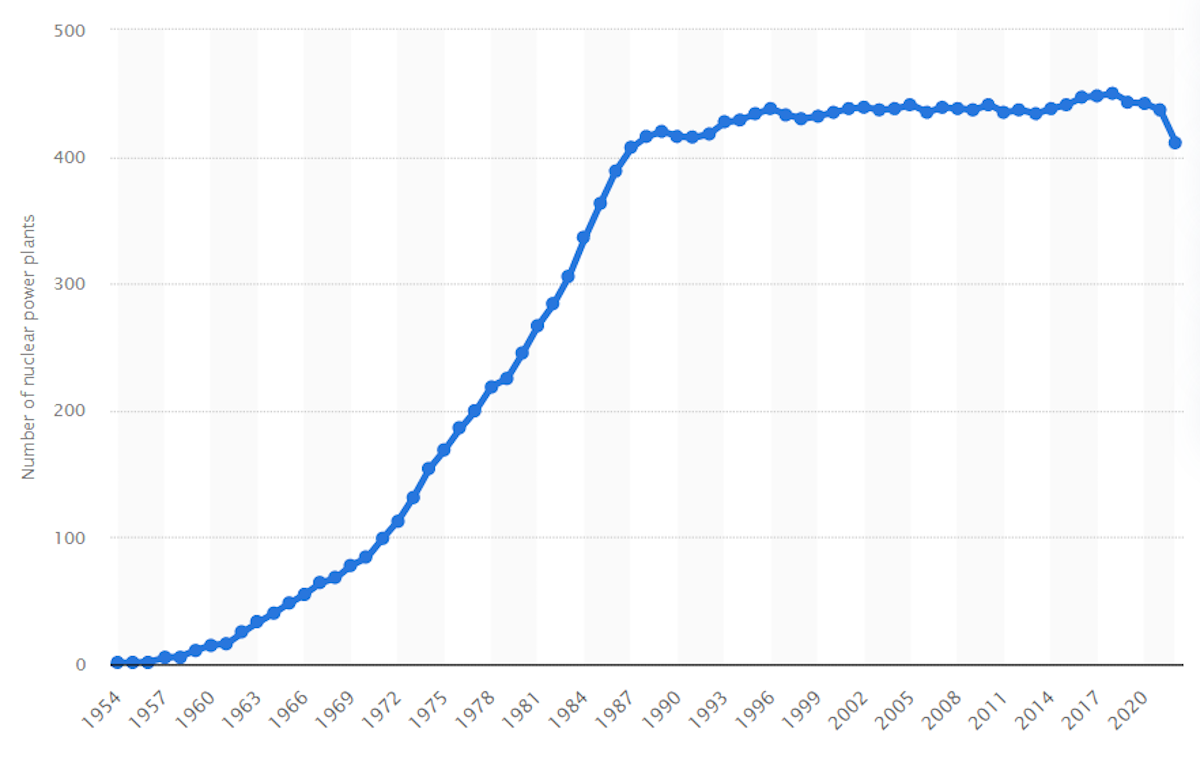

The uranium price (above), and the number of operational nuclear reactors around the world (further below) tell the story of nuclear energy quite clearly.

During the 1950s, 60s and 70s, nuclear energy was embraced as the future of energy. Then an accident at Three Mile Island in the US in 1979 and a fully fledged disaster at Chernobyl in 1986, just about ended new builds.

That remained the case until the early 2000s when the oil price began its rise from $20 to $140. This led to speculation that nuclear might be embraced once again, and a bubble quickly developed in the price of uranium, and burst during the GFC.

The post-2008 recovery was once again stopped in its tracks by the accident at Fukushima in 2011. It took five years for sentiment to recover, with an acceleration after the start of the war in Ukraine.

Add to that all the lobbying from the fossil fuel industry ( 1 , 2 , 3 ) over the years and public misconceptions , and nuclear energy has been fighting an uphill battle for decades.

While the uranium price has followed boom and bust cycles, the number of reactors in the world has barely changed.

Yes there have been new builds, but they have just about offset the number of reactors being retired - and total generation is about the same as it was in 2000.

There are currently around 430 nuclear plants operating globally , with 60 being constructed as follows:

- China: 21

- India: 8

- Turkey: 4

- Egypt, South Korea, Russia: 3

- Bangladesh, Japan, UK, Ukraine: 2

- Seven other countries including the US currently have one reactor under construction.

The Economics of Nuclear

It’s not only safety misconceptions that have contributed to the low levels of investment in nuclear power - politics and the economics of the technology play a role too.

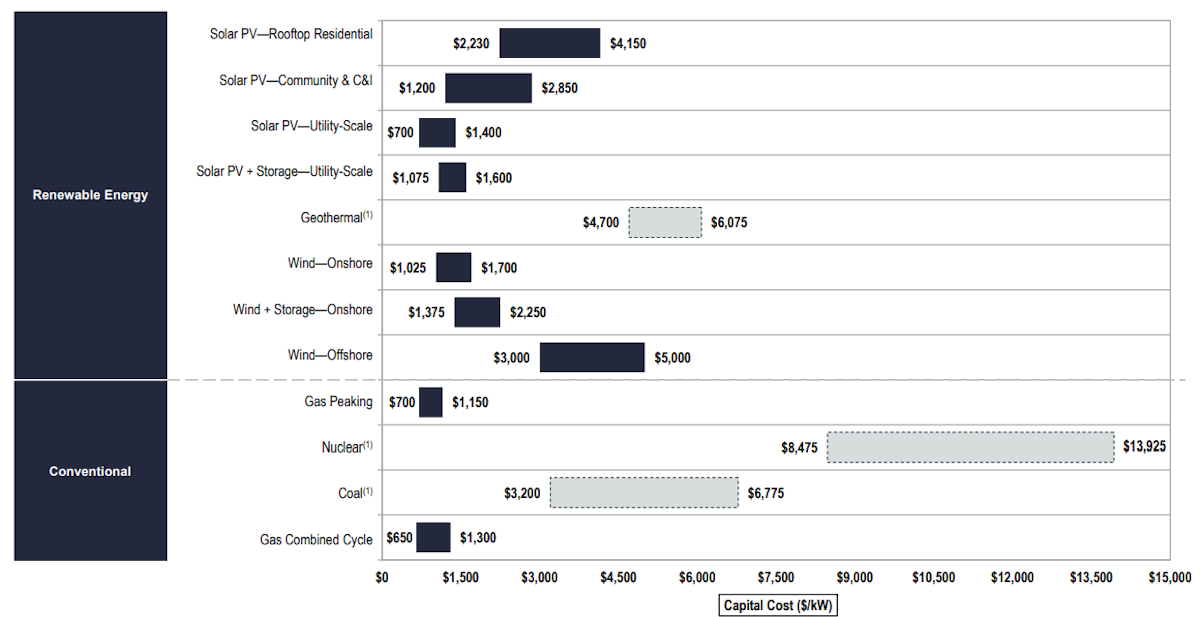

Nuclear plants last a long time (as long as 80 years), and the operating costs are relatively low. However, the upfront capital costs are very high, and nuclear plants take a long time to build.

They also have a reputation for being completed way behind schedule and way over budget. This chart reflects the upfront capital costs of various types of energy:

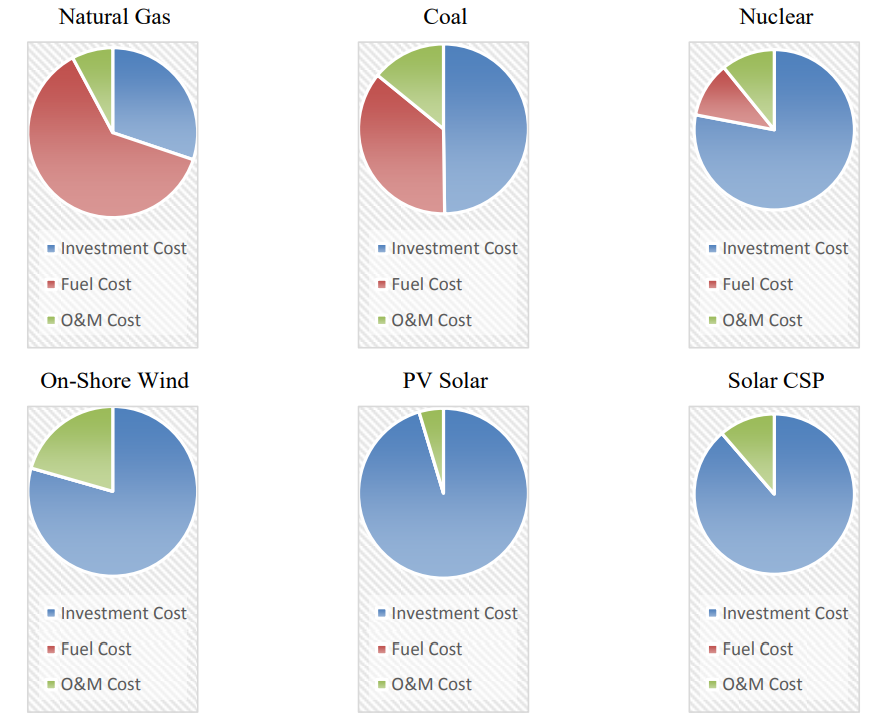

Meanwhile, this next chart here shows the breakdown of the fuel costs, operational costs and upfront capital costs of different energy sources. You can see nuclear fuel cost is much lower than Gas and Coal, but its upfront costs are much higher.

To make the most of the uranium they have, some countries are even utilizing the “ closed fuel cycle ”, rather than open fuel cycle .

This approach of reusing the waste over and over again (waste which is 96% reusable material) , “ significantly reduces the final waste’s radiotoxicity, improves resource utilization and economic viability”.

Countries like Japan, Russia and China already implement this process (because they have reactors built to do so), but it’s worth noting it can generally be more expensive ( 1 , 2 ), and there’s considerable debate around the pros and cons of each approach.

For countries without the ability to recycle nuclear fuel, the logistics and economics of nuclear waste management becomes slightly trickier. Spent nuclear fuel is still a valuable commodity due to its reusability but with most countries lacking the ability to repurpose spent fuel, an interim storage method is needed to store the radioactive material until an economical solution is found.

Most nuclear power facilities have interim storage capabilities for hosting dry cask fuel storage containers, however some facilities opt for geological storage, wherein the storage casks are often buried deep underground. While this method is remarkably safe when nothing goes wrong, the chance of environmental contamination during extreme events such as earthquakes has drawn criticism from environmentally conscious parties.

There are actually no permanent long-term nuclear waste storage facilities on Earth. Onkalo spent nuclear fuel repository once operational will become the first repository anywhere in the world intended for long-term nuclear waste storage . While this facility has been quite capital intensive to build, coming in at around US$1.07 Bn, it has a usable life of over 100,000 years. Not too bad all things considered!

So, while nuclear is competitive in the long term, it takes a long time to get to breakeven, comes with high upfront costs and faces public scrutiny. As you can imagine, this takes a certain kind of investor to take on projects like this.

In some countries it’s the politicians that make the decision to invest - but even when it's down to the private sector, investors want regulatory clarity . So it comes back to politics either way. Like renewables, often investors prefer to commit to these high upfront cost projects when the government provides support.

Since building large scale reactors has friction economically and politically, what alternatives are there?

Small Modular Reactors

One of the potential solutions to the funding and lead time problems is SMRs (Small Modular Reactors). These are smaller reactors that generate about a third of the energy that comes from a standard reactor. However, they are cheaper and can potentially be built in a factory.

So far only three SMRs are operational, but over 70 new designs are being developed. NuScale Power is a listed company that focuses on SMRs, though it has faced execution problems since listing in 2020. Rolls-Royce is another company developing SMRs, and appears to be in a good position to do so.

The Insight: Investing in Nuclear Energy

The bullish case for nuclear power is that leaders and regulators could eventually be forced to pursue it if other solutions can’t keep up with rising energy demand.

This also comes down to whether or not more efficient ways of storing energy generated from wind and solar are developed (to handle their intermittent nature).

There are two different approaches to investing in the industry:

- Uranium

Many investors choose to invest in uranium producers or uranium itself. This has worked out well over the last few years, but keep in mind the uranium price is prone to wild swings.

For a more passive approach than buying uranium first hand and storing it under your mattress (which we don’t recommend, because the superpowers you get are not worth it) there is one ETF that holds physical uranium: The Sprott Physical Uranium Trust Fund listed in Canada.

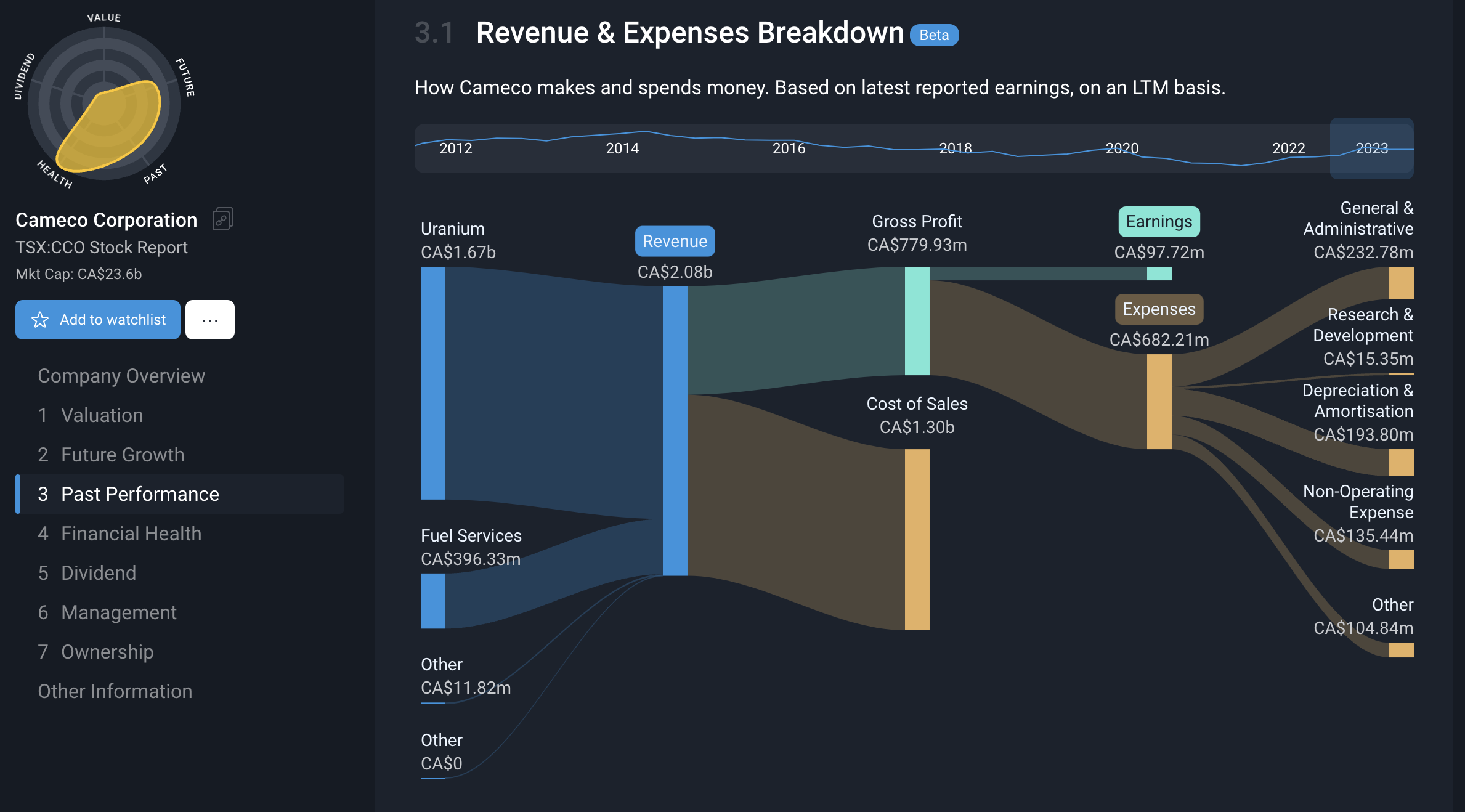

The more common investment approach is via uranium miners like Centrus Energy, Cameco Corporation , and Denison Mines. You can see below Cameco makes 80% of its revenue from Uranium mining.

The Global X Uranium ETF holds shares of uranium miners and the ETF mentioned above. Its holding list is a very comprehensive list of uranium miners - have a read through it and if any take your interest, add them to your SWS watchlist and be notified of any important developments!.

- Utilities and Energy Producers

The more diversified approach is to invest in the utilities that own or operate nuclear reactors. These companies typically own assets across the energy mix including fossil fuels, wind, solar, hydroelectric and nuclear.

If nuclear grows within the overall mix, it is likely to grow within the portfolios of the companies too. Examples include Enel, NextEra Energy and Duke Energy Corporation .

And finally, one “ picks and shovels ” play. In 2024 GE is due to spin off its energy business as GE Vernova. This business includes GE Hitachi Nuclear Energy, a leading supplier of reactors and services.

So that’s all well and good, what if you’re interested in Fusion?

Fusion: Abundant, Cheap Energy or A Pipe Dream?

The nuclear energy being produced today is nuclear fission energy. The other type of nuclear energy - fusion - is also gathering a lot of attention - though it’s still not commercially proven and skeptics believe it probably won’t be.

While nuclear fission energy is generated by splitting an atom, fusion energy is generated when atoms are fused. Or, as the International Atomic Energy Agency defines it “ the process by which two light atomic nuclei combine to form a single heavier one while releasing massive amounts of energy.” And here’s a more detailed explanation.

Fusion isn’t a new concept, and it’s been around since the 1950s. Since then there have been countless experiments using several different processes. And the process does work , in that it does generate energy. The challenge is generating and capturing more energy than the reaction required to start.

2028: The Line In the Sand

In the last year there has been a series of successful experiments, with two producing a net energy gain, although that term is a little misleading . This is one reason that fusion is attracting attention now.

The second is that proponents of fusion energy believe that it could eventually be far cheaper than all other power generation methods, and plentiful.

Investments in fusion technology have shot up in the last two years, with cumulative investments rising 50% to $6.2 billion in the last 12 months alone. There are over 60 fusion startups around the world, but two stand out: Commonwealth Fusion Systems has raised $1.8 billion and Helion Energy raised $500 million.

This video from Helion explains the particular process they are developing. Helion has signed a Power purchase agreement with Microsoft , committing to supply at least 50 megawatts of power starting in 2028. Commonwealth Fusion Systems are aiming to deliver energy to the grid by 2030.

These are very ambitious goals for a technology that hasn’t actually been proven. While the companies are confident they will be able to deliver, there are plenty of skeptics who believe fusion will always be an enigma. Well, at least we don’t have very long to see if they can get it right.

Can You Invest In Fusion Energy?

Right now fusion is only being pursued by startups, but there are a few indirect avenues for investors.

Cenovus Energy in Canada and Babcock International in the UK have invested in fusion startups and expressed interest in the technology. Chinese EV maker Nio has also invested in Neo Fusion (yep, very similar names), another startup developing the technology.

Keep in mind that investing in these companies would be very indirect exposure to fusion , but they are worth watching if the technology advances.

What Else is Happening?

These are a few news items that we thought were worth noting…

- 📉 The new wave of tech IPOs got off to a disappointing start. Arm Holdings, Instacart and Klaviyo all rallied (by up to 30%) above their IPO prices on the first day of trading - and then gave up all those gains within the next few days.

- The overall market has been weak which didn’t help - but most stocks end up below their IPO price at some point.

- It’s rarely a good idea to chase a share on its first day of trading, unless you are sure the price is right.

- 📦 Amazon is the latest big tech company in the cross hairs of regulators. The company is being accused by the SEC of operating as a monopoly.

- Some of these cases are raising an interesting question about monopolies and who they hurt. In the case of Amazon and other disruptors like Uber, customers benefit at the expense of suppliers and competitors.

- Critics of these cases say that taking away those monopoly powers could result in higher prices for consumers - which is what the laws are supposed to prevent.

- Some investors believe in the narrative that while regulation is a risk to revenue growth , if certain divisions of Amazon are forced to be spun off (like AWS) that wouldn't necessarily be a bad thing.

Key Events During the Next Week

This week is all about employment data and trade data - and just one interest rate decision in Australia on Tuesday.

Balance of trade data is due in Australia, Germany and Canada on Thursday.

In the US the JOLTs Job openings report is due on Tuesday, the ADP national employment report on Wednesday, and unemployment, non-farm payrolls, and average hourly earnings on Friday. Canada’s unemployment rate is also due on Friday.

There are just a handful of quarterly results due this week, including:

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.