The Big Trends - Part 1: Healthcare Technology

Reviewed by Michael Paige, Bailey Pemberton

New Frontiers In Healthcare

The trends unfolding in healthcare are some of the most compelling for investors. Healthcare costs are high, particularly in the world’s largest economy. People are also living longer, and requiring more healthcare. And, of course there are still diseases like cancers that remain resilient to treatment.

Technology can, and is, being used to solve multiple problems in the industry, from diagnosis, to finding new, effective treatments and to improve efficiency. Preventative medicine, early diagnosis and effective treatment improves outcomes, reduces costs, and allows more patients to be treated.

The main areas we’ll cover today are Life Sciences, Medical Devices, Remote Healthcare and Information systems and data.

🎧 If you'd prefer to listen along to this Market Insights article, you can do so here on:

Quote of the week: “If I had asked people what they wanted, they would have said faster horses.” - Henry Ford

Life Sciences

Biotech and pharmaceutical companies have always been at the leading edge when it comes to developing medical treatments. Recent developments are helping researchers develop treatments that are targeted and effective, and diagnosing illness earlier and more accurately.

Genomic Medicine

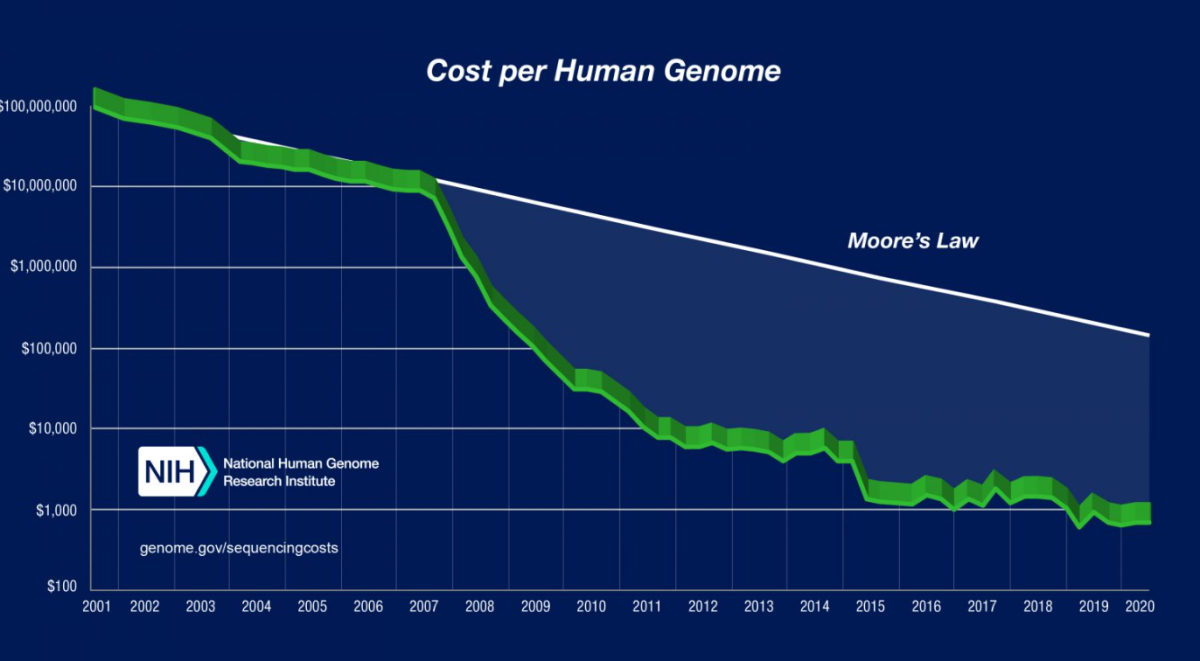

Genomic medicine uses an individual’s unique genetic makeup to diagnose and treat health conditions and diseases. Genomic research has been underway for decades (the Human Genome Project started in 1990) but the recent momentum is all about costs.

The cost of sequencing one human genome has fallen from $300 million in 2000 to $1,000 in 2020 - a decline of 99.9993%! At a price of $1,000 genomic research and therapy is now feasible. Furthermore, genomic data can now be analyzed at scale with the aid of artificial intelligence to find patterns and markers. This research can aid early diagnosis as well as treatment.

Companies in this space provide equipment and sequencing services, testing and diagnosis, and, at the real cutting edge stuff, gene editing .

Immunology And Immunotherapy

Genetic research is also being used to further the field of immunology. Moderna’s Covid-19 vaccine is an example of a vaccine based on genomic information. The field of immunotherapy - treating a disease by activating or suppressing the immune system - has also accelerated due to genomic research.

Some of the biggest stocks in the Life Sciences space include Exact Sciences (after buying Genomic Health back in 2019) , Illumina, and CRISPR.

Medical devices

The market for medical devices has been big for a long time and current revenue runs at over $500 billion annually . But the innovation is ongoing and new solutions to long standing challenges are coming to market each year.

Some of the current areas of innovation include:

- Equipment for minimally invasive surgery which reduces the time patients spend in hospital.

- Real time monitoring systems that can be accessed remotely.

- Systems that help surgeons plan and visualize procedures.

- Implants to treat epileptic seizures when they happen.

Some of the biggest stocks in the medical devices space include Abbott Laboratories, Johnson & Johnson and Intuitive Surgical.

Remote Healthcare

The ability to diagnose and treat conditions remotely saves time and money. It also means specialist healthcare providers can treat patients in a different city, or even on a different continent.

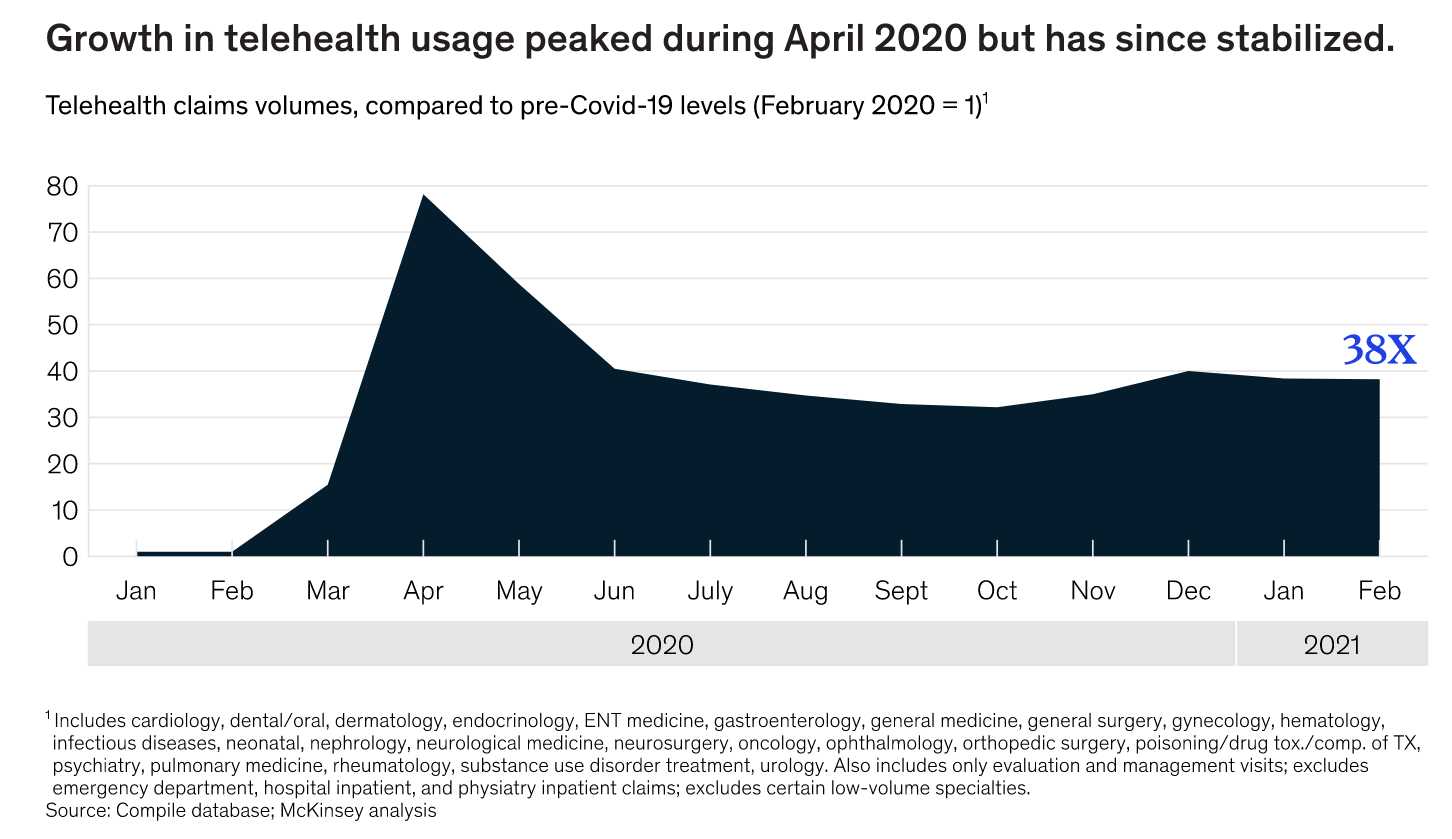

- Telehealth has been around for some time, but accelerated during the Covid pandemic. Platforms like Teladoc give patients access to thousands of doctors and specialists who can be located almost anywhere.

- Remote monitoring devices help doctors monitor patients without them needing to spend time in hospital.

- Telesurgery takes this a step further. Surgeons are beginning to use robotics to perform minor surgeries remotely.

Some of the biggest stocks in the remote healthcare space include Teladoc Health , Doximity and even CVS Health now operates telehealth services.

Information Systems And Data

Administrative costs are a huge burden to the healthcare industry. This is largely a result of numerous legacy systems that aren’t connected to one another, as well as regulations around patient data. Modern software from companies like Veeva Systems is slowly but surely being used to streamline these processes.

But there are still a lot of problems to be solved. A big one is ensuring that patient data is secure, yet also available to the right providers at the right time. This is one huge area of opportunity.

Data and artificial intelligence are also essential tools for finding new treatments and cures. AI can be used to analyze huge datasets to find patterns, identify markers, and experiment with new treatments. As AI models become more powerful, this process is accelerating and will hopefully result in cures to the diseases that are currently incurable.

Some of the biggest stocks in the information systems and data space include GE HealthCare Technologies , R1 RCM and 10x Genomics .

We also encourage you to check out our Top Healthcare Stocks and Top 10 AI in Healthcare Stocks collections for some more ideas from the industries listed above.

💡The Insight: Where To Begin When Investing In HealthTech

The biotech space has always been the land of high risk and high reward - perhaps more so than any other industry. The same tends to apply to a lot of the industries listed above.

Small companies have exponential potential, but come with plenty of risk. These companies typically don’t have incremental changes, they have plenty of instances of “quantum leaps” of success or failure where products are approved.

The larger, more mature and diversified companies have less upside and less risk. However, given the potential for the industry as a whole, larger companies may still have room to compound earnings for a long time.

Given the risk, investors often use thematic ETFs to invest in health technology. If you do so, make sure you understand how the index the ETF tracks is constructed. Not all indexes are efficient when it comes to tracking growth industries, particularly if they include companies that have little exposure to the industries you want to invest in.

If you want to go the ETF route, simply search online for “ Healthcare Tech ETF ” and you’ll see plenty of funds with offerings of exposure in the space. For example, TrackInsight provides great overviews, analysis and insights on the many different ETFs, and of relevance to this discussion, they have a list of ETFs within the Healthcare Technology and Innovation space.

From there, if you dig further into these ETF holdings and find individual names that are within your circle of competence, and that you want greater exposure to, you can then purchase those names individually outside of the ETF for more direct exposure.

Just remember, as is often the case with long term secular trends, there are often mini bubbles along the way. Opportunities for us investors are created when these bubbles burst.

What Else is Happening?

First a recap of the key data releases we mentioned last week…

-

🇺🇸 US Consumer price inflation was lower than expected . Consumer prices rose 3% in the year to June, down from 4% in May. This was lower than the 3.2% consensus estimate. The core inflation rate rose 4.8% year on year compared to 5.3% in the year to May, and also lower than expected. The core rate is still high, but clearly heading in the right direction.

-

🇬🇧 The UK unemployment rate rose to 4% in June, up from 3.8% in May . Economists had expected it to increase to 3.9%, so the increase wasn’t surprising. While unemployment is now rising, wage growth and inflation is still high, meaning the Bank of England may have to keep raising interest rates.

And then, a few news items that we thought were worth noting…

-

🏦 Ant Group, the financial arm of Alibaba is a step closer to reviving its plans for an IPO. Chinese authorities announced the firm had completed a regulatory overhaul which culminated in a $984 million fine . The regulator’s blocking of the IPO in 2020 was the first step in the regulatory crackdown on Chinese tech firms.

- The $984 million fine is a lot, but the delayed IPO costs Alibaba far more. When Ant Group’ original IPO was about to happen it was expected to list at a $300 billion valuation. In January this year Fidelity valued the company at $64 billion!

- The relationship between China’s regulators and its biggest tech firms does seem to be improving- on Wednesday the state planner acknowledged Alibaba and Tencent’s contribution to tech innovation.

-

🤖 Comedian Sarah Silverman is suing Meta and OpenAI (owner of ChatGPT) for copyright infringement . Silverman’s complaint is that Meta and OpenAI’s large language models were trained on her copyrighted works.

- How this case (and other similar cases) plays out could become an issue for the companies deploying them, and set the precedent for how generative AI is legally allowed to use online content.

- In Silverman’s case, the material is actually a copyrighted book, but it will be interesting to see where the line eventually gets drawn.

Key Events During the Next Week

There’s lots of data out this week, starting with China’s GDP rate on Monday.

US retail sales are due on Tuesday, where we’ll learn a bit about US consumer confidence trends, and building permits will be released on Wednesday, which gives us insights on building confidence.

The UK’s (closely watched) inflation rate will be published on Wednesday, which will give us cues about future Bank of England rate decisions, followed by retail sales on Friday.

Japan’s inflation rate is also due on Friday.

Second quarter earnings season is now in full swing, with some of the big technology companies joining the party:

- Goldman Sachs

- ASML

- Netflix

- Tesla

- IBM

- Alcoa

- Johnson and Johnson

- Taiwan Semiconductor

- SAP

- American Express

- American Airlines

- Bank of America

- Morgan Stanley

- Lockheed Martin

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.