What Happened in the Market Last Week?

🎧 Prefer to listen to these insights? Check out the audio recording on Spotify!

From another bank losing billions in deposits to seeing early signs of A.I. successes and failure, a lot has happened this week!

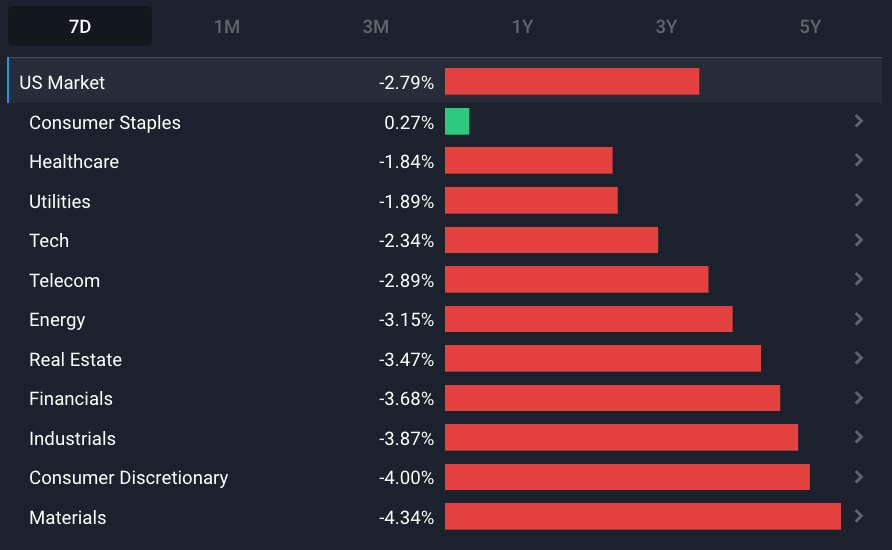

Quarterly results from First Republic Bank and some of the European banks suggested the banking system might still be in a fragile state. The selling was broad-based with most sectors falling by similar percentages. The only sector that held up a little better was US consumer staples as some of the sector heavyweights like Procter and Gamble and Pepsi reported better-than-expected results.

Last week we let you know of important economic data being released. Here’s how the numbers turned out:

- 🇺🇸 US Q1 GDP : ↗️ 1.1% - GDP grew slightly in Q1 but had slowed from 2.6% growth in the prior quarter.

- 🇺🇸 US Income & Spending : Income ↗️ 0.3% and Spending ↗️ 0.2% Month-on-Month - While wage growth beat out spending in March, Spending drastically outpaced income 2% vs 0.6% for the month of February.

- 🇦🇺 AU Inflation Rate : Year-on-Year inflation 7.0% , down from 7.8% in Feb but slightly ahead of forecasts (6.9%) - Inflation eased off the back of a slowdown in transport, housing and furnishings costs.

- 🇯🇵 JP Interest Rate: Year-on-Year inflation 3.2% , down from 3.3% in Feb - Inflation is now at the lowest point since last September thanks to utility prices easing.

We’ve got some insights to share on the price of lithium and India’s demographics:

- The collapse of the lithium price may open up some opportunities to acquire long-term gems in the space.

- India will overtake China’s population and has set the scene for an appealing demographic and macro landscape for investors.

Despite Lithium’s Nosedive, Some Gems Remain

Once a hot commodity, now as cold as ice. The price of Lithium has now given up all its gains since October 2021 and those gains amounted to 260% less than six months ago. Those familiar with commodity cycles won’t be surprised since this is a classic example of the type of boom and bust cycles that virtually every commodity experiences over time.

Rising Supply or Falling Demand? A bit of both really. The biggest source of demand for lithium is the electric vehicle market. EV sales are still rising but the pace has slowed over the last six months. However, one of the reasons for that slowdown has been affordability - which in turn was related to the high lithium prices. Now that the price has fallen, EV makers are able to drop their prices, as Tesla has recently done.

On the other side of the equation, new production is coming online faster than expected - both in terms of mining and processing capacity. Lithium mining is still very profitable , so there’s no shortage of capital for new projects. Lithium production is seen as strategically important, so some governments are also making funding available (which we’ll cover below).

It seems the balancing act of supply and demand has teetered the way of the supply side, as analysts downgrade their future lithium carbonate demand projections in anticipation that the demand for EVs will fall as a response to household budgetary constraints.

Where to next? It’s hard to see demand for lithium not increasing significantly over the next decade - unless of course someone comes up with a more efficient way to store energy. But the tug of war between supply and demand will probably lead to a few more price cycles like this - until there’s some sort of equilibrium between EV affordability and the investment that goes into new production.

Governments Want A Piece Of The Lithium Pie Too

Chile’s government announced plans to take more control of its lithium industry . It’s doing this by requiring lithium miners to partner with the government - so not quite nationalization.

Other governments have already taken similar steps. Mexico has nationalized its lithium industry and Zimbabwe has banned exports of unprocessed lithium. But this is a bigger deal because Chile has the world’s largest known reserves.

The good news for producers in Chile is that current contracts still stand. Contracts held by SQM , the world's largest producer, expire in 2030, and those held by Albemarle in 2043. However, it appears that the government may want to renegotiate those as part of a larger plan.

This does have some investors worried though. There’s plenty of foreign investment in South American lithium and if other countries follow in Chile’s footsteps, the region could quickly see investment dry up, and investors in early-stage companies could be caught in a bit of a pickle.

💡The Insight: Prices Are Down But The Some Lithium Stocks Look Rock Solid

The shares of lithium producers are now trading at more attractive levels than they were six months ago - but there are still a lot of factors that can affect their earnings over time. A declining lithium price does mean there’s less opportunity, but as always, high-quality companies can rise to the occasion. Here are a few things to keep in mind when looking for long-term lithium stocks:

- Commodity stocks go through boom and bust cycles regularly, so make sure the stocks you’re considering are:

- Well capitalised (strong financial health),

- Low-cost producers (can still profitably produce when the price drops substantially), and

- Have plenty of visibility (life) on their remaining mines

- Check out our Top 5 Lithium Stocks for some stocks meeting these criteria.

- Focus on the long-term and the core use cases for the commodity you’re considering. Ask yourself:

- What will the demand for X commodity be in 10 years’ time? Higher or lower than today?

- Which miner or company is best positioned to benefit from this? (the above criteria can help)

- Can I purchase this company when the market expectations are low because investors are focusing on the current downturn in the price and not the long-term potential?

- Alternatively, if you don’t want to invest in lithium miners directly, you could consider battery makers which are further down the value chain and arguably less risky. Our Top 6 Battery Stocks include both types of companies, so check it out if you’d like some ideas!

India Takes the Population Crown

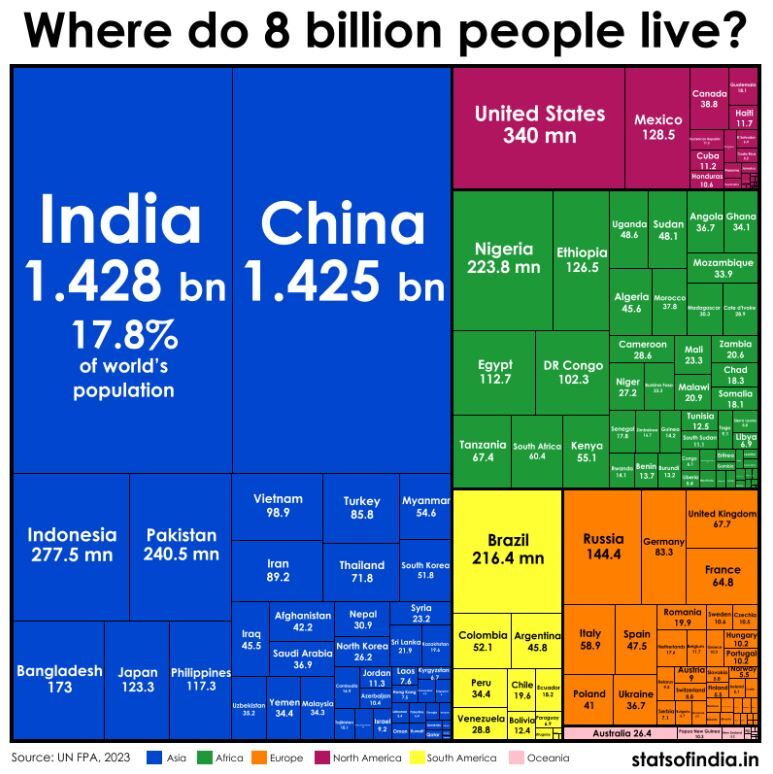

The UN’s latest estimates see India’s population overtaking China’s in the next few months. That’s not a complete surprise as China’s population growth rate has slowed dramatically, and even went negative last year.

While the two country’s populations are now roughly equal, their economies are very different.

Both countries are expected to experience economic growth above 5% this year, which is well ahead of most of the world.

But India is coming off a much lower base, and its demographics make it appealing from an investment point of view:

- Its GDP per capita is less than a third of China’s (and about 20% of the global average)

- Large parts of the economy are still very much informal - room for innovation and efficiency gains.

- India’s population is also much younger than China’s - average age of 28 vs 39 . This means India has the potential for long-term sustainable growth and there’ll be less pressure to support an ageing population’s needs for social security and health care.

💡 The Insight: India Is Well Positioned To Be A Growth Story

India’s stock market outperformed in 2022, but investors have rotated into other markets in 2023. However, the fundamentals and demographics are still in place to support quality companies and the longer-term growth of the economy. You can explore India’s entire stock market on the Simply Wall Street markets page .

In emerging economies, the best opportunities for sustained growth are usually in companies that benefit from a growing middle class, infrastructure development, and exports. Additionally, Banks are often a good ‘catch-all’ industry in developing markets as they have exposure to the whole economy.

What Else is Happening?

It’s been a very big week for news flow, but we will touch on some of the key stories:

-

Apple won its court case with Epic Games over rules and fees for the App Store.

- That’s good news for Apple’s shareholders since that means it’s still able to get a cut of in-app purchases (In their growing “Services” revenue segment).

- However this likely won’t be the last time Apple is challenged over its fees

-

Microsoft’s share price rose 7% after the company reported first-quarter earnings, suggesting Microsoft's AI efforts are paying off.

- Shareholders will be rejoicing at Microsoft’s decision to partner with AI powerhouse OpenAI. The success of ChatGPT bodes well for future business cases that involve AI integration.

- A.I. is all the rage at the moment, so investors have to be diligent in avoiding “all bark, no bite” rallies that cause A.I. related stocks to jump in price with very little merit.

-

First Republic Bank’s share price fell another 60% after their quarterly results revealed that the lender had lost nearly $100 billion in deposits in March.

- The bank’s future appears to now depend on a bailout of sorts, which the US government is reluctant to do.

- It also appears that the pressure many banks are facing from deposit withdrawals and interest rate risk isn’t over yet.

-

BuzzFeed is closing its new division after failing to find a way to make it profitable.

- BuzzFeed shares rallied 300% when the company announced that it would use OpenAI's ChatGPT to generate content as a cost-cutting measure

- The share price is now below where that rally started. It’s all very well using AI to cut costs, but you still need revenue to be profitable.

Key Events During the Next Week

It’s everyone’s favourite week! (Well, maybe not everyone). That’s right, it’s Fed Fund Rate week. The US central bank is announcing its interest rate decision on Wednesday. Consensus forecasts still expect a 0.25% hike, but some economists are expecting a pause.

Also in the US, the ISM Manufacturing PMI is due on Monday, JOLT’s job openings on Tuesday, and employment data on Friday.

In Europe there’s some inflation data on Tuesday, the Euro area unemployment rate on Wednesday and the ECB rate decision on Thursday.

And Australia's interest rate decision is also due - on Tuesday, with trade data out on Wednesday.

First quarter earnings season is still in full swing. Some of the big names reporting include:

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.