What Happened In The Market Last Week?

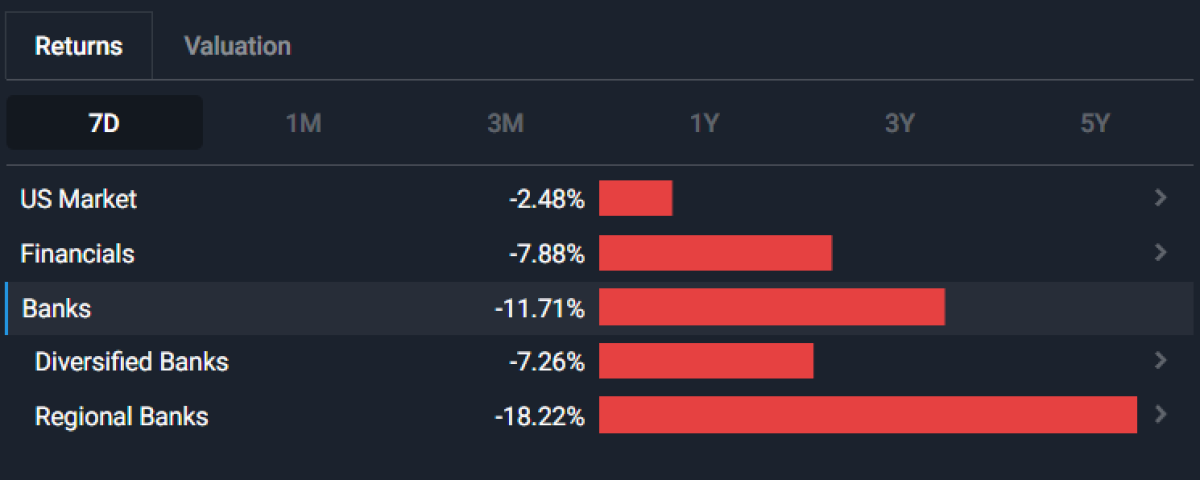

Last week was a bad time to be a bank stock. Equity markets had another rocky week in the wake of the collapse of Silicon Valley Bank.

While US Bank stocks were among the worst off, the entire Financial sector was under pressure. Commodities, including oil, also fell leading to losses for the US Energy and Materials sectors.

Investors turned to the defensive sectors which were flat, and Tech stocks recovered some ground after regulators stepped in to cover depositors at SVB.

This week we are having a look at the Silicon Valley Bank collapse and what it might mean for:

- Interest rates

- The technology and start-up industry

- The banking sector

- Banking regulations

- The broader financial system and economy

The Collapse Of Silicon Valley Bank

Last week we witnessed a US$42 billion bank run that resulted in the second largest bank failure in US history. Silicon Valley Bank, part of the SVB Financial Group ( Nasdaq:SIVB ) was the 16th largest bank in the US and the bank of choice for the venture capital and start-up industry in California. SVB had deposits and assets of close to US$200 billion at the end of 2022. Two smaller banks, Signature Bank ( Nasdaq: SBNY ) and Silvergate Capital Corporation ( NYSE:SI ) that also collapsed, were key institutions for cryptocurrency related ventures.

So any company starting with “Si” should check their balance sheet to make sure they’re not next. Wait that means us too.... Brb.

So What Happened And How Did We Get Here?

The three banks ultimately collapsed because of a ‘run on the bank’, which occurs when depositors try to withdraw more cash than the bank has in liquid assets.

Bank runs are particularly disastrous for banks because of the snowball-like effect. If one major depositor voices their concern and withdraws their funds, it could cause a chain reaction where other depositors follow suit as they don’t want to be the last man standing. An initial withdrawal of a single concerned party can result in tens of billions in cash needing to be shored up in a small amount of time.

That’s just one of the huge downsides to Fractional reserve banking . If customers don’t all need their money all at once, you’re fine to keep investing deposits and earn the difference. But if they do, you’re in trouble.

But the underlying reasons for the bank failures were the boom and bust in technology (and crypto) investments combined with the sudden rise in interest rates in 2022.

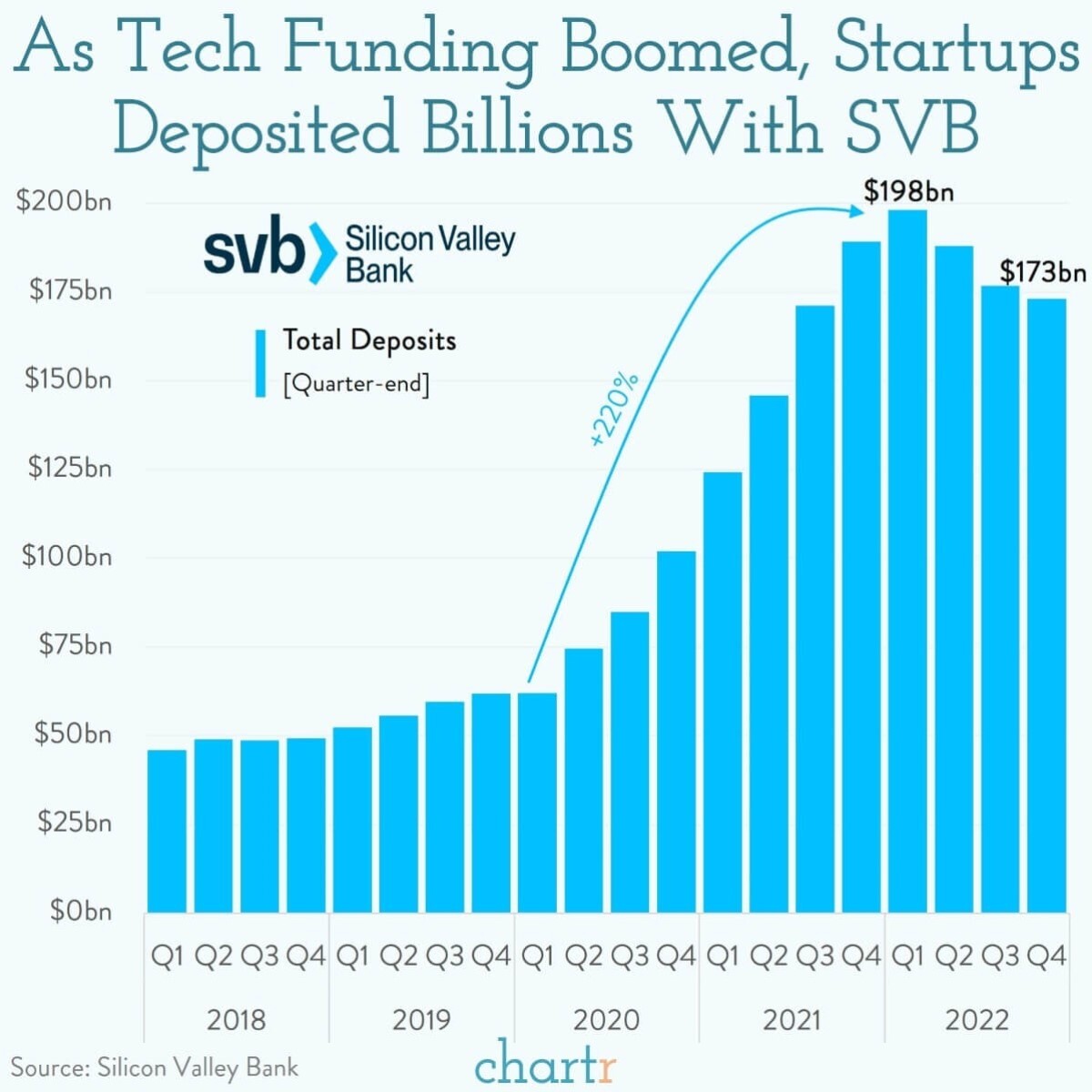

- In the years leading up to 2022, venture capital firms raised billions of dollars which they invested in start-up companies. Many of these funds and start-ups deposited that money with SVB . This resulted in deposits rising from around US$50 billion in 2018 to nearly US$200 billion at the end of 2021.

-

Last year, two things happened: The US central bank began raising rates at the fastest rate in history to combat inflation, and the tech industry faced a slowdown - both in terms of growth and new investment. This meant new deposits slowed down and while companies were also withdrawing cash to fund operations .

-

SVB invested its assets in government bonds that are generally considered safe, and should have paid out the full principal if they were held to maturity. However, because they were marked-to-market (ie. valued at the current market price) SVB faced billions in unrealized losses when interest rates rose and bond prices fell . And because clients were withdrawing more than they were depositing, SVB had to sell those bonds at a terrible time, turning unrealized losses into realized losses .

-

When the bank attempted, and failed, to raise $2 billion to shore up its balance sheet, prominent investors including Bill Ackman began to sound the alarm . This led depositors to panic and withdraw their capital.

-

On 10th March, California regulators took possession of the bank and appointed the Federal Deposit Insurance Corporation (FDIC) as receiver . Two days later regulators approved plans to use the Deposit Insurance Fund to make all depositors at SVB and Signature bank “whole” (read: get all their money back), including deposits that wouldn’t automatically be covered by deposit insurance .

-

This wasn’t a bailout like the infamous bailouts of 2008 . Depositors will be paid, but shareholders and other creditors are likely to end up with zip. In addition, it seems that most of the deposits could be paid out of the remaining assets if they are managed carefully.

Interest Rate Policy Caused Both The Boom And The Bust For SVB

It’s easy to see how the rapid rise in interest rates over the last 12 months led to SVB’s losses. But the near zero rates of the prior years also resulted in the massive increase in deposits that arguably set it up to fail. When rates are close to zero, the opportunity cost of investing in companies that will take years to become profitable is low. The result was what could probably be regarded as a bubble in technology investments.

As Mohammad El-Erian put it: “ We had a prolonged period of overly loose monetary policy. When it came to adjusting monetary policy, the Fed did not act fast enough, and then it had to hit on the brakes .”

Regulators Saved Depositors, But Risks Could Have Been Handled Better

Regulators were quick to act to avoid the meltdown that would have occurred if companies weren’t able to access their deposits. But some analysts believe they should have been aware of the risks earlier , and some have blamed changes to ban regulations in 2018. Essentially banks with assets worth less than $250 billion were exempt from rules that applied to ‘systemically’ important banks.

Whether or not SVB should have been exempt from the same stress tests as banks that are ‘too big to fail’ is debatable.

You could also argue that every man and their dog knew that rates were going to rise well before the Federal Reserve actually started raising rates. So from the Bank’s asset allocation point of view, it would have made sense to considerably reduce their exposure to those US long term government bonds by buying shorter term government bonds (1-3 years), which wouldn’t experience the same price decline as much as longer duration bonds, but would be just as “safe” as them.

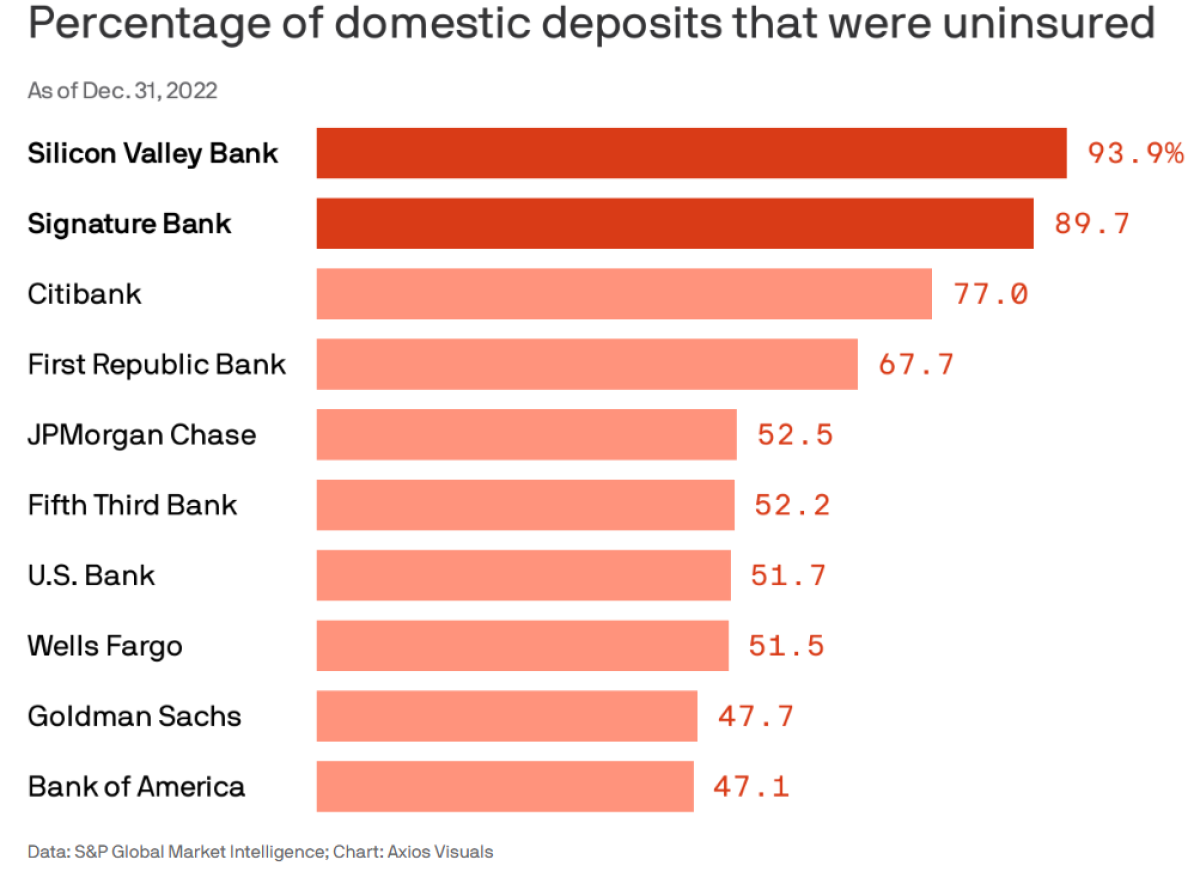

But regulators should have been aware of the risks posed by banks that were exposed to the tech industry. In addition, SVB and Signature Bank were outliers when it came to the percentage of deposits that aren't insured by the FDIC.

Rapidly Rising Rates Were Needed, But Was It Too Fast Too Soon?

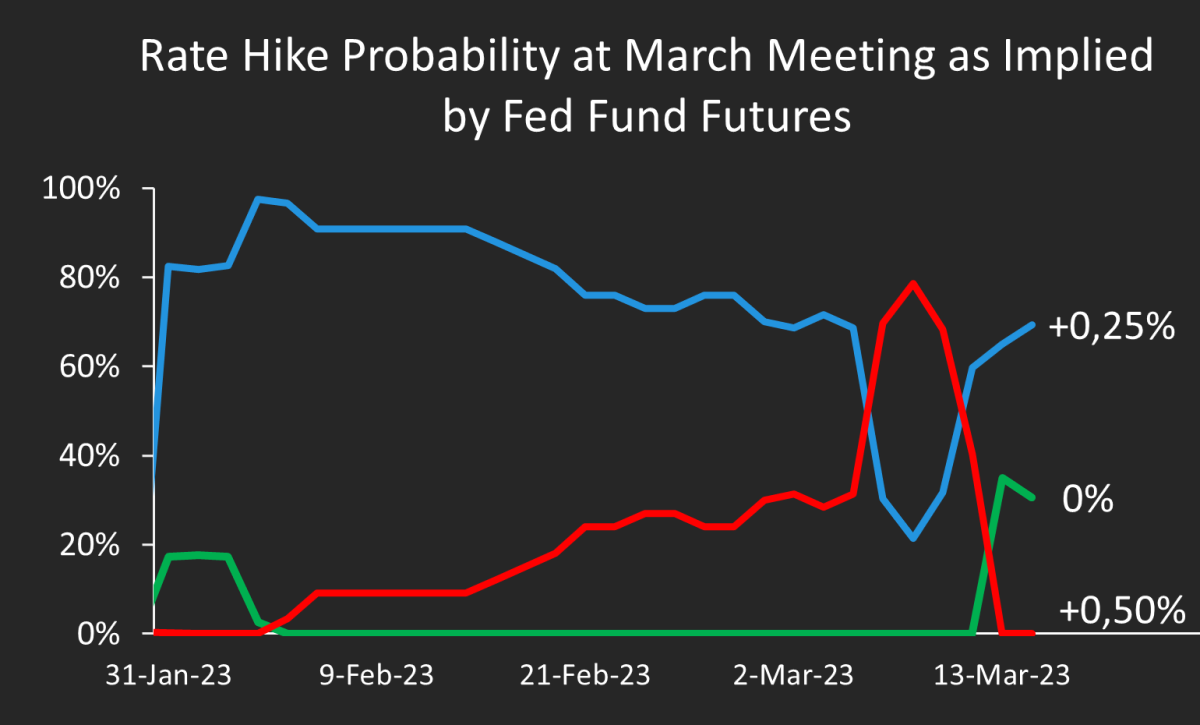

Over the last 12 months pundits have been saying that central banks will have to raise rates until something breaks. That’s now happened, and interest rate expectations have changed completely.

When we posted the chart below a week ago, the market was pricing in a 75% chance of a 50 basis point (0.5%) hike, and the ‘no change’ option didn’t feature.

The market is now expecting a 0.25% hike again, but the odds of a pause are rising. And believe it or not, but at least one economist is even expecting a rate cut!

The thinking is that banks and depositors will now be more cautious which will take liquidity out of the system - ie. The Fed can now hand off the job of raising rates to the banking system.

The Tech Industry Was Saved From A Payroll Crunch, But Access To Credit Will Be Harder

The Fed and the FDIC have saved a lot of technology companies from disaster, which would have had knock on effects throughout the economy. If companies couldn’t access their bank accounts they wouldn’t have been able to make payroll, or pay suppliers. Even fairly large companies like Roku ( Nasdaq: ROKU ) had a substantial chunk of their cash reserves at SVB .

These companies may still have temporary problems processing transactions, but in the long run companies that were well capitalized will be able to operate.

The bigger problem is that venture backed firms may struggle to access credit now that one of their biggest lenders is gone, and tech investors may stay away for longer.

Regional Banks’ Concentrated Client Bases Make Them More At Risk

Investors fled from banking stocks - particularly the stocks of regional banks - after the collapse of SVB. The fear was that depositors would withdraw their cash from other regional banks leading to more failures. The shares of several regional banks fell more than 50% even though the banks appeared to be solvent.

Regional banks tend to have concentrated client bases, often operating in specific industries. This makes them vulnerable when those industries go through a crisis. But they can also be affected when a bank run is triggered by events elsewhere.

One of the consequences of these events is that depositors have flocked to the largest banks. Bank of America reportedly received $15 billion in new deposits last week , as companies and individuals moved their assets away from regional banks. This means the banking sector is now more concentrated which creates greater systemic risk.

Appetite for bank stocks fell elsewhere too. The share price of Credit Suisse ( SWX: CSGN ) fell 30% after its top investor said it would “Absolutely not” provide further capital . The group has now turned to the Swiss National Bank for a $53 billion bailout.

If there’s a positive takeaway here it’s that bank stocks have now been rerated and their share prices now reflect the heightened risk.

Contagion In The Financial System Appears Contained, For Now

For now the risk of contagion appears to be limited. Most of the banking system had limited exposure to the three banks, unlike 2008 when the largest banks all had massive exposure to one another.

However, while bond yields have fallen, liquidity in the bond market has dried up . This will make it difficult for the Fed’s plans to shrink its balance sheet and is likely to be a key topic at Jerome Powell’s press conference on Wednesday.

💡 Key Takeaways

So what does all of this mean for investors?

- The tech industry has survived a disaster, but companies that need further funding are likely to struggle.

- Bank stocks have been repriced to account for the increased risk. Some regional banks could still be at risk if they lose more deposits.

- The pace of rate hikes might slow down after all, but the banks are likely to be more cautious. That means credit markets could still tighten even if rates don’t continue to rise.

- The financial system isn’t facing the same risks it faced in 2008, but liquidity could become an issue.

Key Events During the Next Week

It’s Fed Fund’s week with the US central bank due to announce its next rate hike (or pause) on Wednesday. The market currently expects a 0.25% hike, though the probability of a pause has risen since last week.

It’s also a big week in the UK with the inflation rate out on Wednesday and the BOE’s interest rate announcement out on Thursday.

Friday’s US retail sales will also give an indication of the strength of the economy.

There are just a few notable companies still due to report, including:

- PDD Holdings ( Nasdaq:PDD )

- Foot Locker ( NYSE:FL )

- Tencent Music Entertainment ( NYSE:TME )

- Nike ( NYSE:NKE )

- Accenture ( NYSE:ACN )

- Chewy ( NYSE:CHWY )

- General Mills ( NYSE:GIS )

- Factset ( NYSE:FDS )

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.