What Happened in the Market This Week?

Market Insight for 27th June - 4th July 2022

Equity markets fell after rallying from the years’ lows after U.S. consumer confidence data disappointed investors. The U.S. Healthcare , Utilities and Real Estate sectors have been outperformers of late, while the U.S. Energy sector continues to lag.

Some of the developments over the last week include:

- Investors have begun to sell rallies rather than ‘buy the dip’ as the bear market has taken hold during the second quarter.

- Russia has defaulted on its debt for the first time since 1918 as sanctions have prevented the country making payments.

- A shortage in U.S. oil refining capacity is maintaining the upward pressure in fuel prices despite the oil price falling from recent highs.

The Second Quarter - from ‘Buy the Dip’ to ‘Sell the Rally’

The risks facing the global economy and markets began to come to a head during the second quarter. Most major indices officially entered bear market territory during the quarter. An index is officially in a bear market when it declines 20% from its high point.

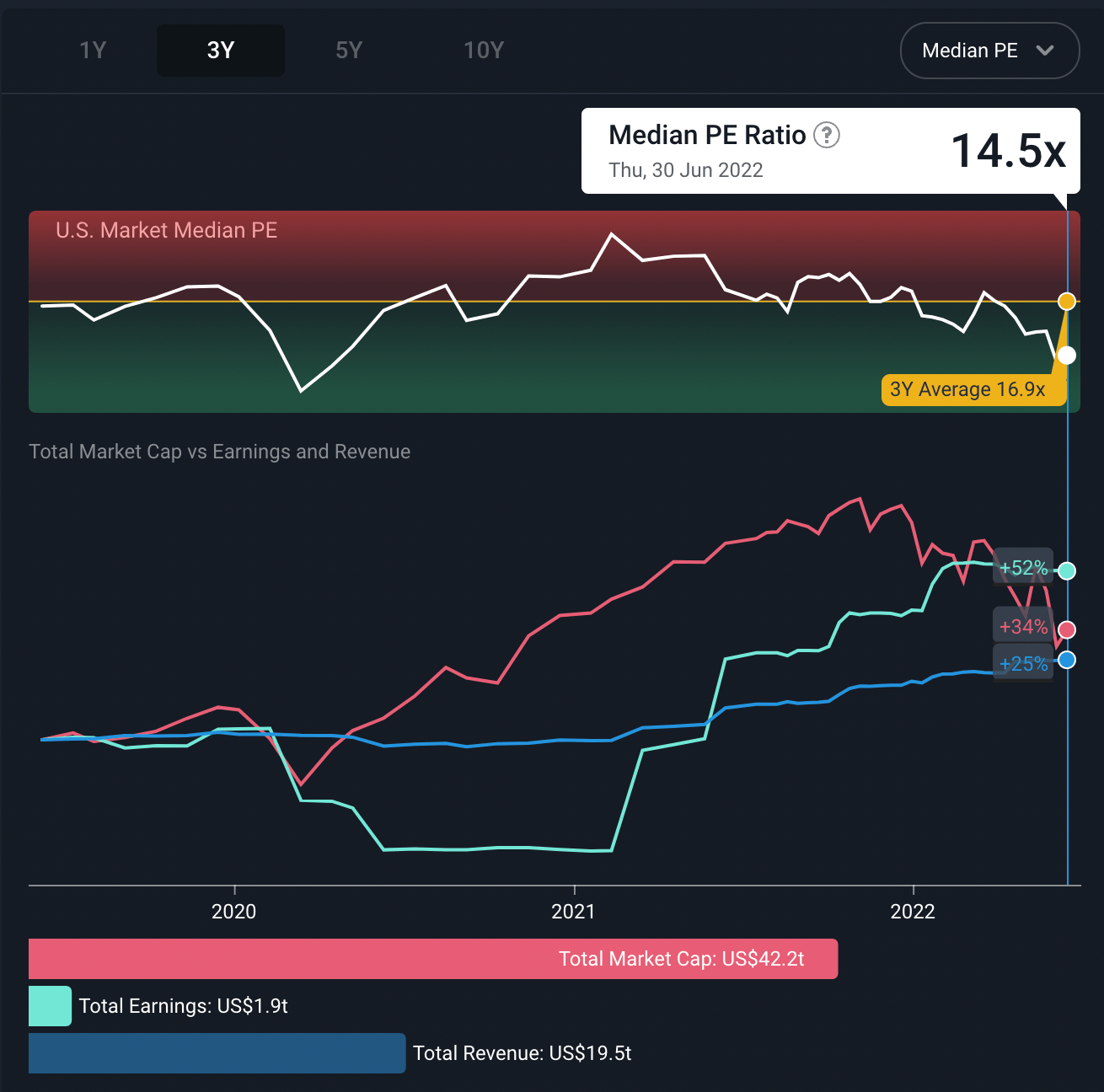

During the quarter, the median P/E ratio for U.S. stocks fell from 16.9x to 14.9x as US equity prices fell 17.9%. The median P/E ratio is now well below the 10 year average of 17.7x.

U.S. Market Median P/E, Market Cap, Revenue and Earnings - 1st July 2022 - Simply Wall St

The chart above also illustrates the fact that earnings for U.S. companies fell slightly despite revenue rising during the quarter. This reflects the impact of inflation on profit margins - consumers are spending more but rising costs are eroding company margins.

We mentioned earlier in the quarter that the S&P 500 may not be as cheap as it seems . This is because earnings forecasts for the remainder of the year have held up remarkably well so far, but if Q2 earnings come in lower than expected, the current cheapness may be misleading.

At least some of the downside during the quarter can be attributed to deleveraging, as investors and funds were forced to close leveraged positions. This was most apparent in the cryptocurrency market, but also played out in the most speculative parts of the stock market.

What does Leverage in the Stock Market Mean?

Leverage in the stock market means borrowing funds from your broker and using that to make your positions several times larger than your initial deposit. If an investor holds a leveraged position, losses are magnified when prices fall. When losses exceed margin deposits investors, including hedge funds that use leverage extensively, have to deposit additional funds to top up their margin or close the position - which can add to the selling pressure. Higher interest rates mean leveraged positions cost more to hold, and falling prices increase the risk of doing so.

Should I Buy the Dip?

To be clear, at Simply Wall St we believe you should only buy stocks when they are trading at an appealing discount to your estimate of fair value (regardless of whether the market has dipped or not). But macroeconomically speaking, “Buying the dip” can be an effective strategy when interest rates are falling, and particularly when they are close to zero.

When the opportunity cost (interest rate) is close to zero, there are few limits to the market’s appetite for riskier assets like stocks, so downward corrections are usually short lived in those environments because investors are buying during any dips.

Conversely, when rates are rising, such as they are now, the alternatives like bonds and commodities begin to look more attractive and may provide a better risk-return ratio compared to stocks.

The Insight: The ‘buy the dip’ motto that has proved effective for most of the last decade but may have been replaced by ‘sell the rally’ due to a change in the macroeconomic conditions and a more bearish outlook. At the same time, bond ETFs are beginning to see inflows , suggesting investors are beginning to find current yields attractive.

👉 However, long-term investors that focus on value investing may find a lot more opportunities in the current market. Investors should review their Watchlist on Simply Wall St to see if any stocks might now be good opportunities!

Many participants now believe the market won’t bottom until there is an indication that rates will stop rising. From the Fed’s comments, we can expect that’ll only happen when there’s ”clear and convincing evidence” that inflation is reducing. Sharp rallies are a characteristic of most bear markets , but investors are likely to use these rallies as an opportunity to sell until there are signs that interest rate hikes are coming to an end.

Russia Defaults on Debt for the First Time in a Century

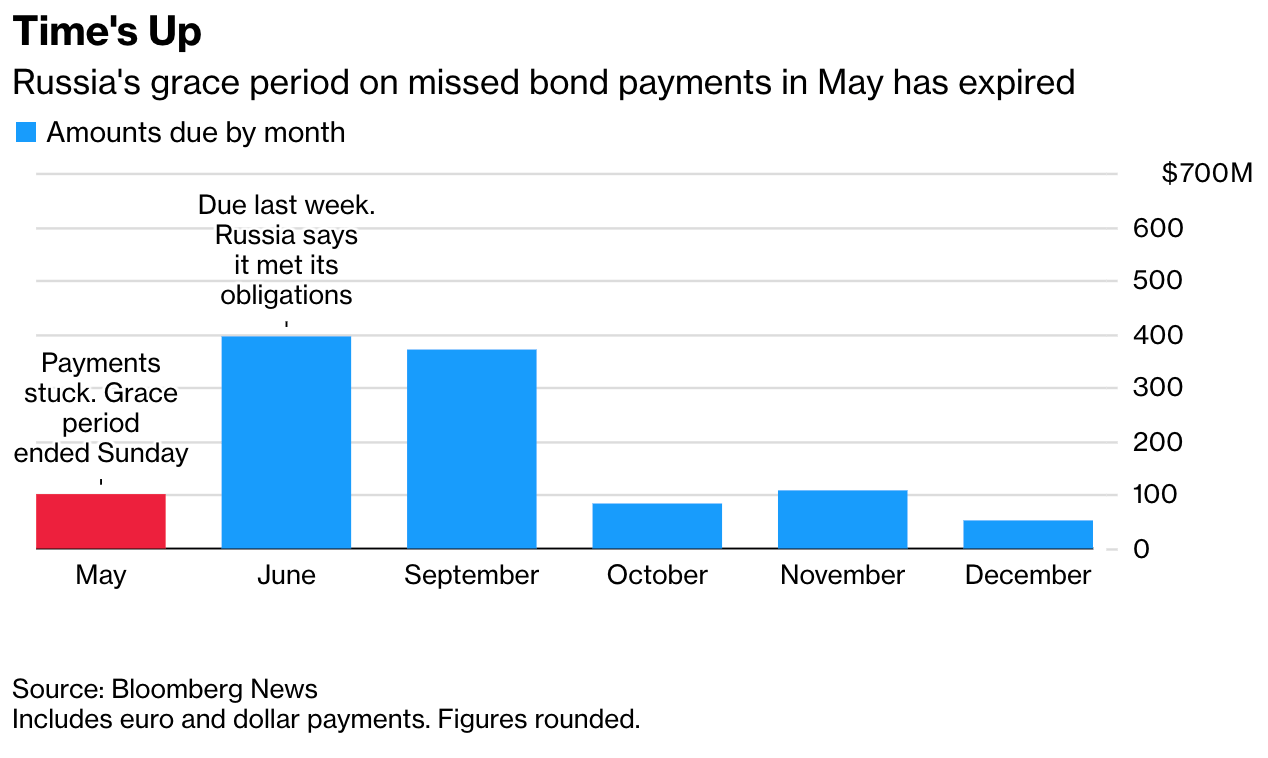

Last week, Russia defaulted on US$100 million in interest payments , meaning the country has officially defaulted on its debt for the first time since 1918.

The interest payments were due to be paid to investors by May 27th, but due to Western institutions freezing all of Russia’s funds (US$640bn prior to the war), Russia was unable to pay its interest payments denominated in USD. The default was made official this week, as the 30-day grace period from the May deadline had passed.

With the sanctions, Putin established new regulations in June that say that Russia’s obligations on foreign interest payments would be fulfilled once the equivalent amount in Russian Rubles is paid out to local paying agents. Under the regulation, the country’s June interest payments, totalling US$400m, have been considered to be paid (from Russia’s perspective) because they claim they’ve sent the money to the US. If true, it’s an interesting case of a country changing its own rules, and then literally throwing money at its creditor, only for the creditor to refuse.

During the Russian Financial Crisis in 1998, the country defaulted on some debt that technically belonged to a state owned entity rather than the government itself - so technically that was not a proper default. Some would argue that this default is also not a proper default as Russia has been prevented from making the payments (and claims to have made them in Rubles ). Nevertheless, according to Moody’s Investor Services this constitutes a default.

The Insight: Under normal circumstances, defaulting on government debt affects both the debtor and the investors that own the debt (in the form of bonds). If a country doesn’t repay its debt, it will be difficult to convince anyone else to lend to it again. Kind of like if you get a bad credit score, it can take years to build a better credit rating.

Any loans it does manage to access are then likely to come with a much higher interest rate. For this reason, most countries will attempt to restructure the debt or find some agreement with their creditors.

How does Russia’s Debt Default Affect Me?

Debt defaults can also have a knock on effect in two ways, known as contagion . The first way is investors become wary of holding or buying the bonds of similar countries, typically emerging markets . This has previously triggered a selloff in emerging market assets, which then spreads to currencies and equities too.

The second way is if that creditor country was relying on the repayment to meet its own debt repayments (and therefore can’t), it can spread and affect its own creditors. It becomes a domino effect of “I can’t repay you because I haven’t been paid”.

While Russia’s debt seems to be an isolated case at this stage (and may have technically made a payment, albeit in Rubles), investors still need to be aware of this in case other countries suffer through contagion.

Limited U.S. Oil Refining Capacity

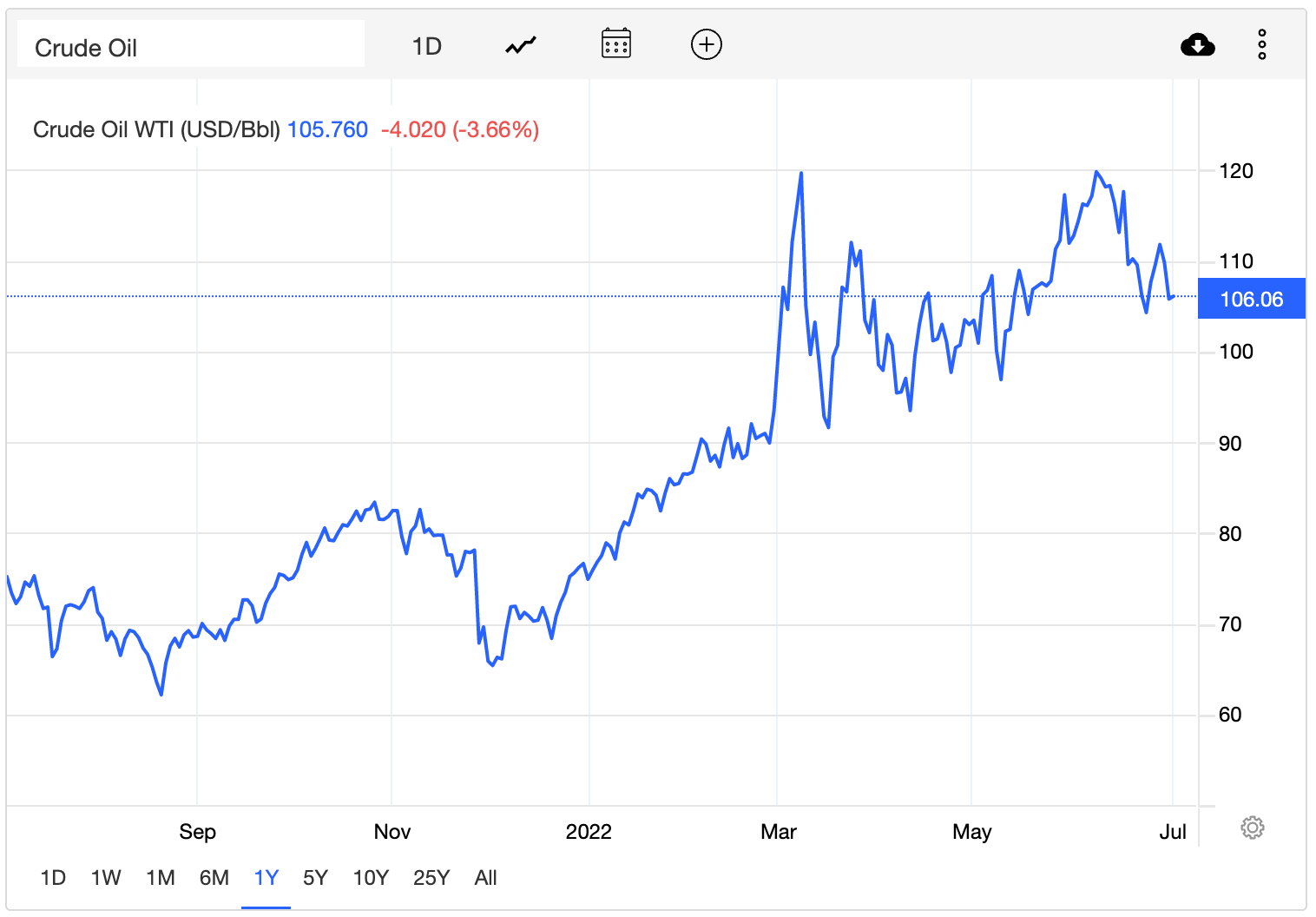

The oil price has fallen to as low as US$104 in the last week, but this hasn’t really helped with fuel prices which have remained at historically high prices in several countries. One of the problems is the lack of capacity, particularly in the U.S., to refine oil and convert it into gasoline and other products.

Crude Oil Price 1Y - tradingeconomics.com

Why is oil refining capacity down?

There are several reasons for the lack of refining capacity. At the beginning of the pandemic, demand for gasoline plummeted as airplanes were grounded and travel halted, so several refineries put operations on hold. Some of those refineries are still not back online, so current refining capacity is still as much as 1 million barrels a day lower than it was at the start of 2020.

The Insight: The drop in refining capacity is not only a result of the pandemic. Capital expenditure by U.S. Energy companies has been in decline for the last decade as energy prices have remained in a slump (up until recently). Regulations and the transition away from fossil fuels also give oil and gas companies little incentive to invest for the long term, like we discussed in last week’s insights on the Australian Energy debacle. If the transition from fossil fuels to renewable energy is not managed holistically, price spikes are going to be inevitable.

Relating to this, our analysts have curated a list of companies that provide investing opportunities in an environment of rising energy prices, that may help you discover new stocks in the Energy sector.

Market Outlook Next Week

U.S. markets are closed for Independence Day on Monday the 4th of July. Later in the week, the minutes from the last Fed’s monetary policy committee meeting will be released (keep an eye on inflation commentary and rate comments), and U.S. employment data comes out on Friday.

The employment data includes the unemployment rate, non-farm payrolls and average hourly earnings, all of which are good indicators of a country’s economic performance and growth.

Away from the U.S., there will be an interest rate decision from Australia’s central bank, and trade data from Australia and Germany. There’s also some purchasing manager data coming out in the U.K. and U.S. which is widely seen as a leading indicator for economic activity.

The only notable company reporting results this week is:

- Levi Strauss & Co ( NYSE:LEVI )

Until next week,

Invest Well,

Simply Wall St

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.