What Happened in the Market Last Week?

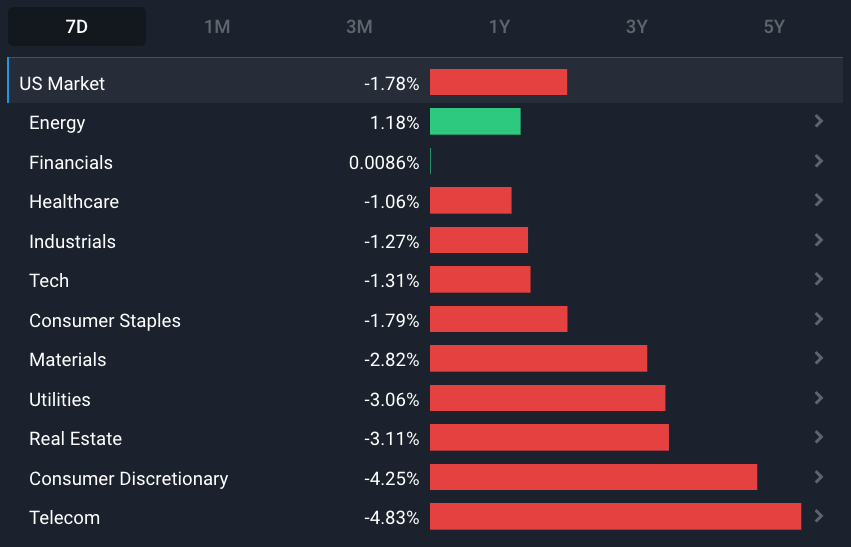

Equity markets struggled to find direction as investors attempted to decipher comments from several Fed Reserve officials. Most sectors drifted lower while US Energy stocks were amongst the strongest as the oil price attempted a bounce.

The US Telecom sector was dragged lower by Alphabet (Nasdaq:GOOGL) after Google’s AI chatbot Bard botched an answer about the first exoplanet discovery in its promo video.

Maybe they should’ve asked ChatGPT to fact check their press release for Bard.

Some of the developments we have been watching over the last week include:

- The US labor market is red hot - which could be a problem for the ‘disinflation process’

- Big tech companies are in the midst of a major slowdown, which doesn’t bode well for the sector.

Strong Jobs Data Makes Inflation Reduction Harder

The January US jobs report reflected an increase in non-farm payrolls of 517,000, while the unemployment rate fell to 3.4% - its lowest level in 53 years . The non-farm payrolls figure was nearly three times the expected number and the highest since July last year.

While several high profile companies have announced layoffs and hiring freezes , the broader US job market remains strong. This is good news for workers and the economy, but also makes the fight against inflation more of a challenge.

Does this mean rate hikes won’t end anytime soon?

The Fed’s Not Sure Either

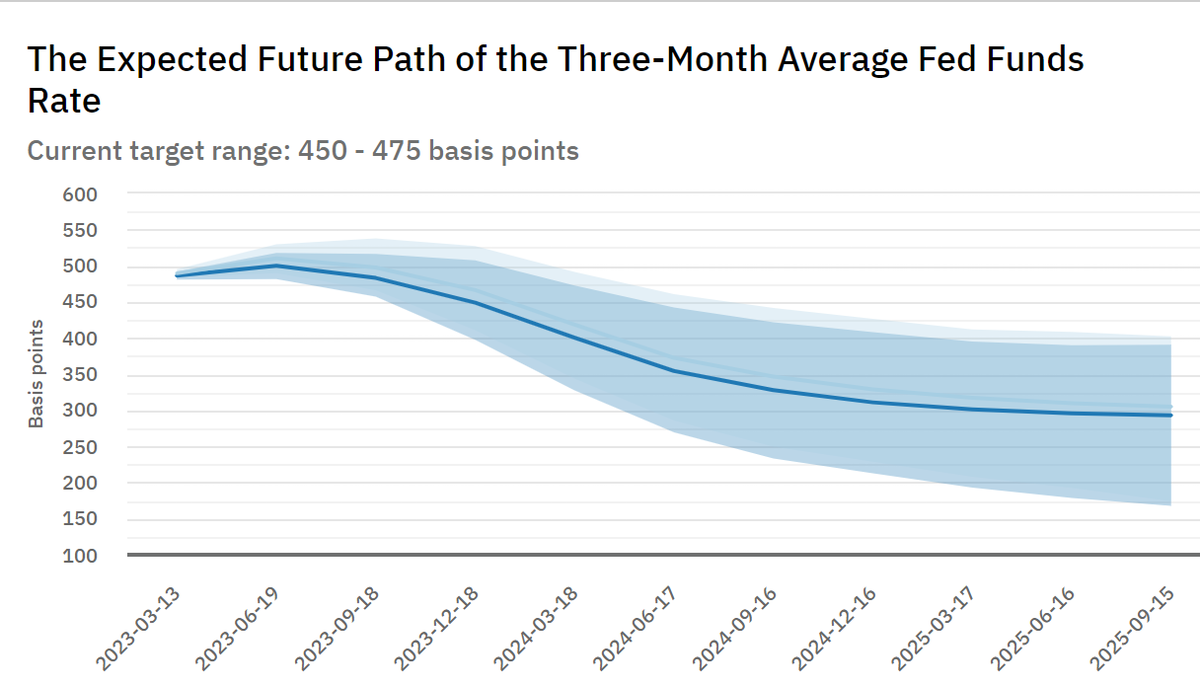

Bond markets have been indicating that the market doesn’t expect rates to rise much more, and that they may well be falling by the end of 2023. The following chart is based on the Fed Fund Futures contracts, and suggests rates will peak in the middle of the year at around 5.25%, and then fall quite quickly after that.

The Fed’s own forecasts from December have a slightly higher terminal rate (ie. the high point), and then a more gradual decline. Jerome Powell’s comments after the Jobs report were less hawkish than expected and he stressed that the FOMC will react to the data as it comes in.

He did say the Fed was prepared to raise rates more aggressively if necessary.

Other members of the Fed’s Board of Governors have also said rates may need to go higher - but that they will monitor the path of inflation.

💡 The Insight: The Fed Is Now Taking A Wait-and-see Attitude - Nothing Is Certain

Low and falling unemployment rates are generally considered to be inflationary. As the pool of people looking for jobs shrinks, companies are more likely to increase wages to attract new hires. At the same time, lower unemployment means more people have disposable income which keeps pressure on demand.

Some economists believe that the current low unemployment rate might not be as inflationary as it was in the past , and that wage growth is already slowing. The labor force has also changed a lot over the last few decades, and it’s possible the economy can accommodate lower unemployment without it being inflationary.

That said, the Fed seems to now be waiting to see what the full effect is of the last eight rate hikes (totalling 4.5%) and one or two more 0.25% hikes.

For Short or Medium-Term Investors (< 5 years)

The bond market (and the equity market) appear to be betting that rates will soon peak and then start to decline. The market may turn out to be correct - but if it isn’t there’s likely to be some more volatility ahead.

For Long-Term Investors (5+ years)

We don’t know what the end game for this inflation cycle is. As we mentioned a few weeks ago, inflation and rates might not come down to the historically low levels of the last few years. If you are valuing a company, and want to include a margin of safety, check that your discount rate isn’t too low.

Big Tech Under Pressure - What Does It Mean For The Sector?

The biggest tech companies recently reported results for the December quarter . On the whole the results were below the market’s already low expectations: Alphabet (Nasdaq:GOOGL) and Apple (Nasdaq: APPL) missed analyst consensus for both revenue and earnings. Amazon (Nasdaq: AMZN) and Meta (Nasdaq:META) managed to beat on revenue, but missed on earnings, and Microsoft (Nasdaq: MSFT) missed on revenue.

There were several common themes from the results and earnings call commentary:

- For the world’s biggest cloud providers, growth continues to slow .

- Companies and consumers are under pressure and being more careful with their spending.

- Advertisers are spending slightly less, and trying to optimize their budgets.

- The near term outlook is very uncertain.

- The immediate focus for management teams is on managing or cutting costs.

There were also a few notable brights spots:

- Amazon’s ad business revenue rose 19% last year.

- Apple’s quarterly Services revenue rose to a record high of $20.77bn (17% of total revenue)

- Mark Zuckerberg managed to convince investors that Meta is back on track as the company focuses on efficiency. The company also reported over 2 billion monthly active users for the first time.

The Great Revenue Slowdown

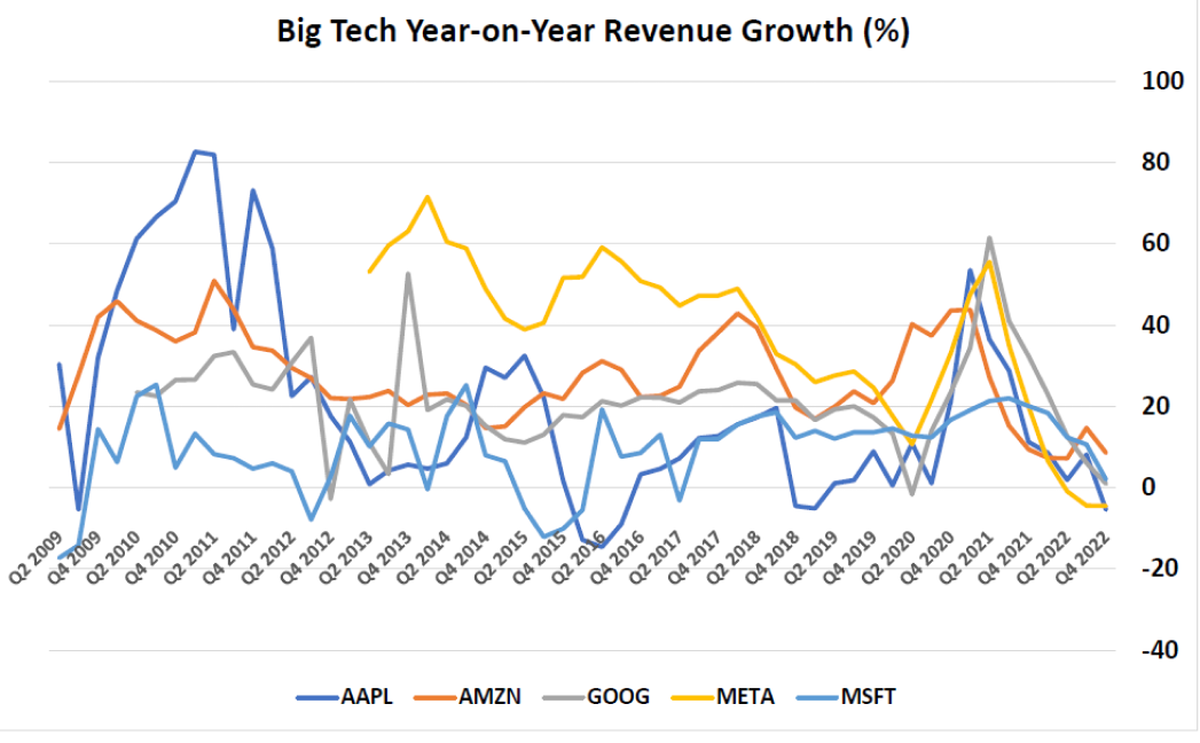

The chart below illustrates just how dramatically revenue growth has slowed compared to the past for all five companies. Growth accelerated during and after the pandemic, but that growth clearly ‘pulled forward’ sales, while also setting a very high base for 2022.

Last year these companies were also faced with higher costs due to inflation, and probably also due to over-hiring in 2021.

Rising costs aren’t the only thing stunting revenue growth for Big Tech. A defining characteristic for these companies over the last decade has been its ability to ‘buy’ growth through acquisitions. This too is now in jeopardy as regulatory scrutiny and tougher economic conditions have put a stop to rapid expansions.

Government crackdowns on tech’s dominance in financial markets have resulted in yearly mega tech acquisitions nose-diving from around 100 acquisitions per year throughout the late 2010s to now less than 25 for 2022.

Even when revenue is flat, companies can still increase profits, to an extent. They can cut costs and they can buy back shares (so that net income is divided by fewer outstanding shares). There’s probably been a lot of excess over the last few years, which would give them a fair amount on the chopping board to work with. That’s likely to be a priority in the near term.

Longer term earnings growth requires revenue growth, because you can only cut costs so much. Nothing is certain, but revenue growth will probably begin to recover when there is more certainty about the broader economy. Ultimately companies need to invest in technology to remain competitive - but it’s also arguable that the biggest increases in tech spending are in the past.

💡 The Insight: Tech Sector EPS Estimates Are Still Falling

It’s not just ‘big tech’ that’s under pressure - the entire sector is likely to face the same challenges, and some smaller companies may not have the resources to survive.

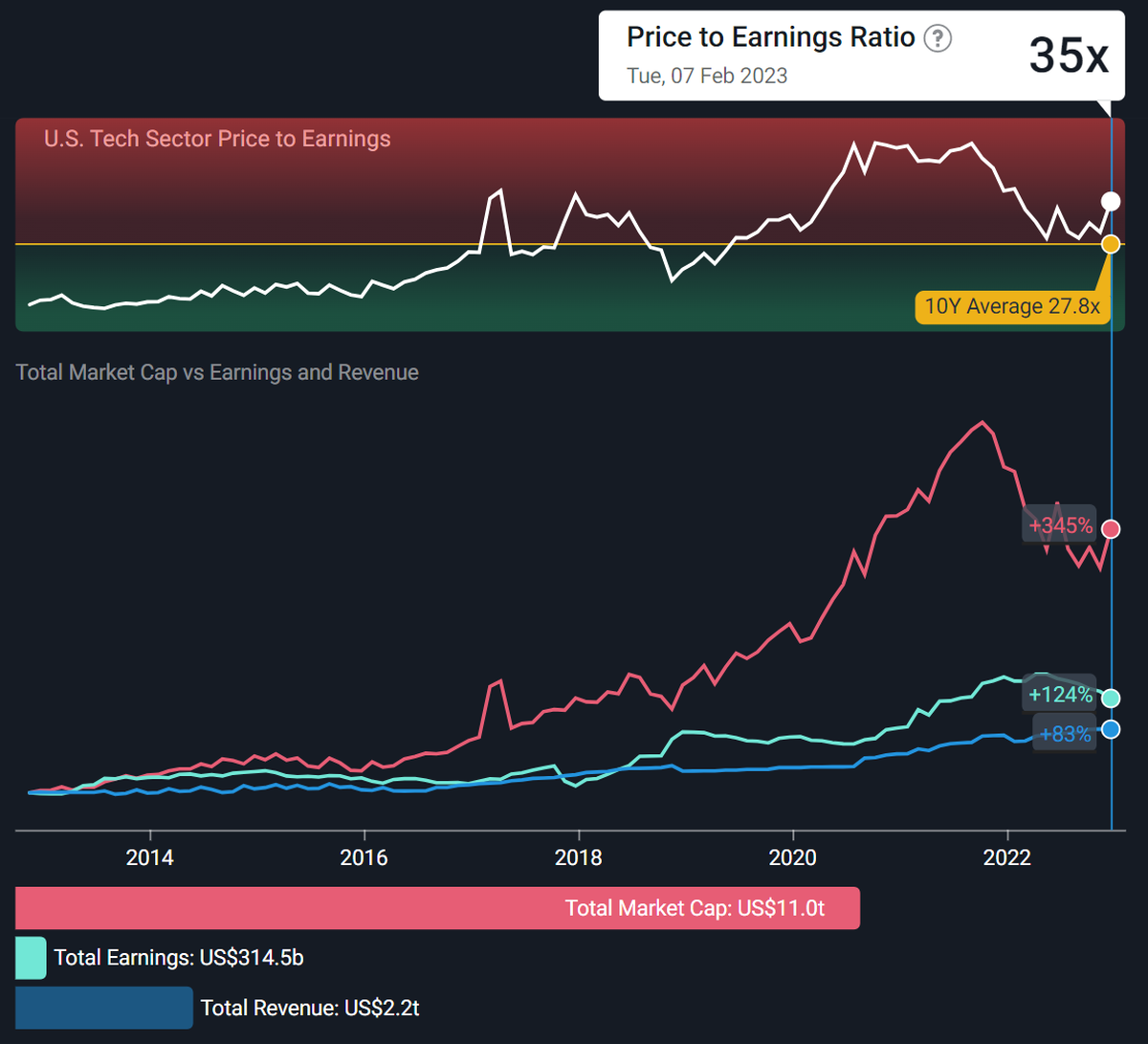

After the recent rally, the price to earnings ratio for the entire tech sector has risen to 35x. That’s well below the 44x peak in 2020, but also quite a bit higher than the 10-year average (27.8x).

EPS estimates for FY 2023 for most stocks in the sector are still falling, and could soon point to a decline in EPS for the year. That would mean the forward P/E would be higher than 35x which could be a problem if the outlook doesn’t improve soon.

What this means for investors

Tech has been a good bet for a long time. The entire sector has ridden the tailwinds of the early years of a digital revolution, combined with super low interest rates. This made it possible for some companies without a proven business model to survive for a long time. Going forward, investors may need to be a lot more selective with technology stocks.

Make sure any technology companies (and for that matter media companies) you hold will be able to survive a tough year (or maybe two) without turning to shareholders for a bailout (raising new funds by issuing new shares). Also, check that the valuation implies a realistic growth rate, and a reasonable discount rate.

This year might also show us which companies really have an edge. Look out for the companies that don’t have to cut prices, and those that can keep, or win, customers without increasing their marketing budgets.

Key Events During the Next Week

The key data this week will be US inflation numbers. CPI will be published on Tuesday and PPI on Thursday. Also in the US, retail sales are being released on Wednesday and building permits on Thursday.

There’s also some key data being published in the UK: employment data on Tuesday, inflation numbers on Wednesday and retail sales on Friday.

There are plenty of companies reporting this week - they include:

- Palantir (NYSE: PLTR)

- Avis (Nasdaq: CAR)

- Coca Cola (NYSE: KO)

- Airbnb (Nasdaq: ABNB)

- Upstart (Nasdaq: UPST)

- Roblox (Nasdaq: RBLX)

- The Trade Desk (Nasdaq: TTD)

- Kraft Heinz (Nasdaq: KHC)

- Analog Device (Nasdaq: ADI)

- Shopify (NYSE: SHOP)

- Roku (Nasdaq: ROKU)

- Cisco (Nasdaq: CSCO)

- Albemarle (NYSE: ALB)

- Datadog (Nasdaq: DDOG)

- Applied Materials (Nasdaq: AMAT)

- Deere (NYSE: DE)

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.