Not All Retail Stocks Are Struggling

Reviewed by Bailey Pemberton, Michael Paige

What Happened in the Market Last Week?

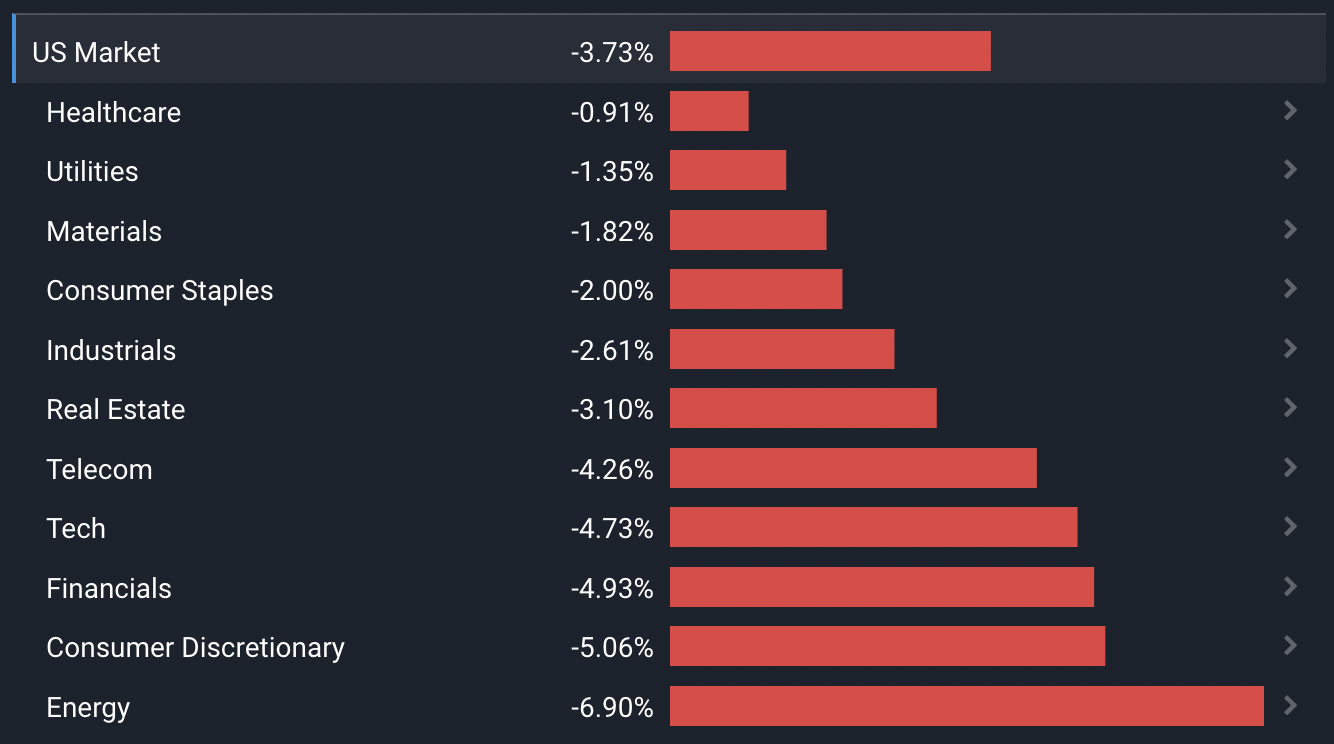

Equity markets took a tumble as the previous week’s rally ran out of steam, and stronger than expected jobs data suggested central banks still have work to do. U.S. Energy stocks fell the most as the price of crude oil fell to a 52-week low. Some of the other cyclical sectors ( US Financials and US Real Estate ) were also under pressure due to global growth concerns. Defensive sectors ( US Healthcare , US Consumer Staples , and US Utilities ) fared slightly better.

Some of the developments we have been watching over the last week include:

- Consumer spending is coming under increasing pressure, but some retailers have performed well despite the weakness. We have a look at who’s set to benefit going forward.

- The Healthcare sector’s performance is normalizing after the pandemic , but could prove reliable in 2023. The diversity of companies within the industry could provide both growth and defensive opportunities.

Consumers are getting less value for their money

Consumer spending trends are important for two reasons:

- They affect the economy as a whole - and by extension interest rates.

- They affect consumer facing companies, which covers quite a few sectors.

On the face of it US consumer spending remains relatively strong.

Sales over Thanksgiving, Black Friday and Cyber Monday reached record levels. Revenue was the highest on Cyber Monday with consumers spending US$11.3 billion online, up 5.3% from a year ago, while Black Friday sales were up 2.3%.

Of course when we consider the fact that prices were up 7.7% as of October (as measured by CPI), holiday sales were actually down 2 to 5% in real terms. That isn’t a disaster - consumers aren’t spending less, but they are getting less for their money.

Elsewhere things are more concerning. As of October, Eurozone retail sales were down 2.7% from a year ago , and were lower than expected. Retail sales are also beginning to falter in Australia and Canada .

Current consumer spending trends might not be sustainable

The other factor to consider is how sustainable consumer spending is.

If the average consumer is using credit to cover monthly expenses, the economy is in dangerous territory. When consumers run out of credit and spending power hits a wall, aggregate spending will fall and a recession is likely to follow. Incidentally - if that happened the Fed would probably be able to stop hiking rates.

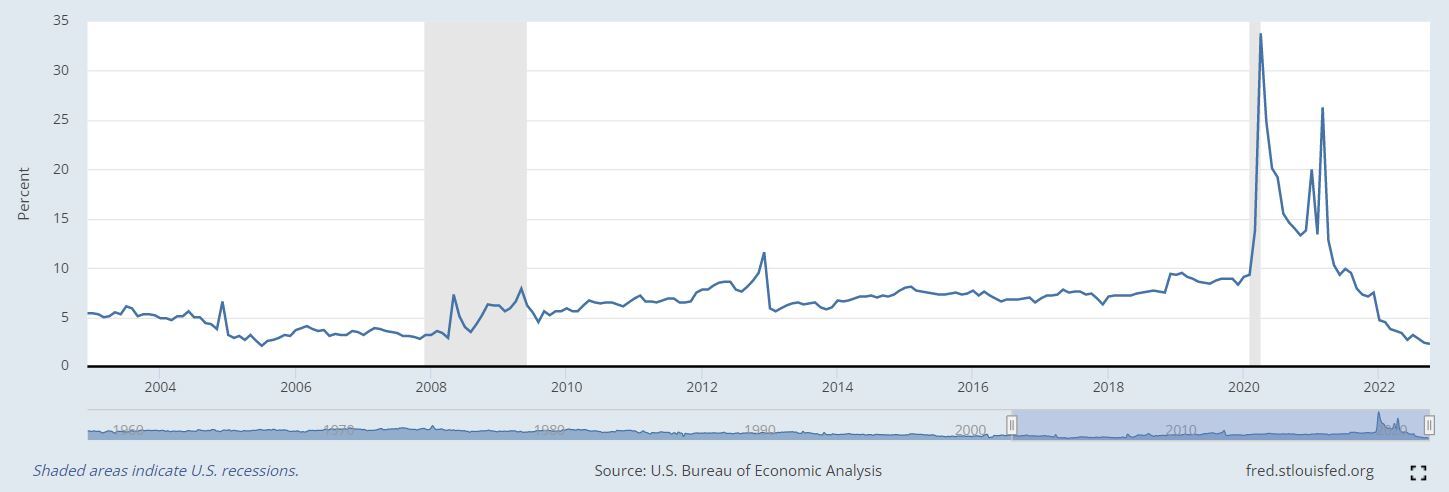

The chart below reflects the US personal savings rate (as a percent of personal disposable income.) The savings rate shot up to unprecedented levels during the pandemic when there were fewer opportunities to spend - but it’s already fallen to the lowest level since 2005.

The chart suggests that consumers are spending most of their income, which isn’t surprising given the inflation rate. Credit card balances also increased by 15% year-on-year in the third quarter . That’s the biggest increase in 20 years, but the actual level isn’t abnormally high when compared to historical balances.

Delinquencies on credit card accounts increased slightly in the third quarter , but are still at historically low levels. Right now there don’t seem to be signs that consumers are overextended.

While the consumer credit situation doesn’t seem to be a major risk to the economy (yet), consumers are clearly under pressure and being careful with their spending. This has implications for consumer facing companies because some are better positioned than others.

💡 The Insight: Most retail stocks are struggling, but there are exceptions

Financial performance amongst consumer business has been very company specific in 2022. Certain segments have been stronger than others, but performance within segments has varied widely too.

For example, Lululemon Athletica ( Nasdaq: LULU ) has continued to grow earnings through 2022, while V.F ( NYSE:VFC ) - owner of North Face, Timberland and Vans - has had a terrible year. Similar patterns are playing out throughout consumer industries.

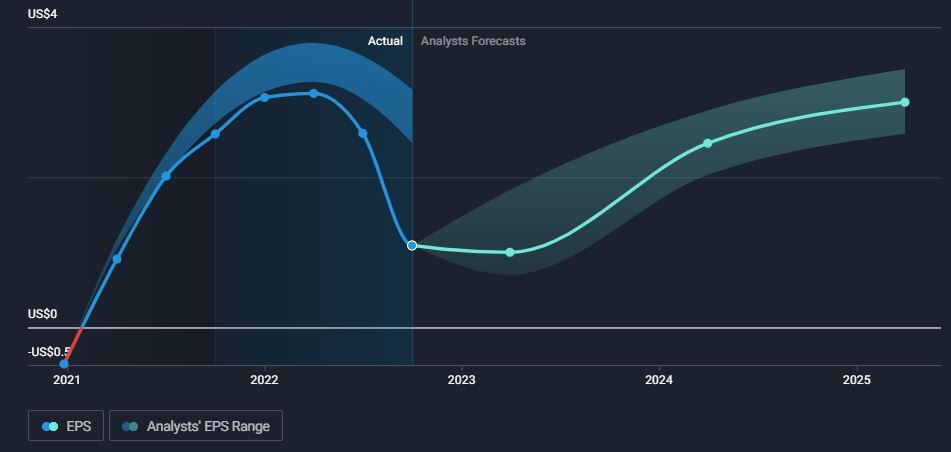

The charts below reflect actual EPS (the blue line) and the range of EPS estimates (the blue shaded area), as well as the range of EPS forecasts and the average in green.

Lululemon has continued to grow EPS, though estimates have drifted a little ahead of the actual number…

….while V.F has seen EPS fall off a cliff and analysts have been increasingly behind the curve.

These charts are a great way to see how a company is performing vs. expectations, and what analysts are expecting for the next few years. You can find them on each stock’s company report under ‘Future Growth’. The charts for Nike ( NYSE: NKE ) and PUMA ( XTRA:PUMA ) are worth a look too.

Consumers are “Trading down”, but not all discount options have benefitted

When consumers start to feel the pinch, they often ‘trade down’ - i.e. they start shopping at stores that offer better value. This can benefit discount retailers and other retailers that are perceived to offer better value. The same phenomenon occurs in the restaurant industry with companies like Mcdonalds ( NYSE:MCD ) and Wendy’s ( Nasdaq:WEN ) benefitting at the expense of premium restaurants (many of which are unlisted). It’s also likely that healthy eating becomes less of a concern when budgets are tight.

But once again, performance has been very company specific over the last few quarters. Amongst general retailers Kroger ( NYSE:KR ) and Costco ( Nasdaq:COST ) have done well, Walmart ( NYSE:WMT ) has had its ups and down (but may be better positioned now), while Target ( NYSE:TGT ) and Kohls ( NYSE:KSS ) have had a rough year.

Performance amongst discount retailers has also been mixed. Dollar Tree ( Nasdaq:DLTR ) has really capitalized on the situation, Dollar General ( NYSE:DG ) and Five Below ( Nasdaq:FIVE ) have underperformed but may be turning a corner now, while Big Lots ( NYSE:BIG ) has completely missed the opportunity.

In other areas of the market:

- Some of the specialty retailers like AutoZone ( NYSE:AZO ) , Lowe's Companies ( NYSE:LOW ) and Home Depot ( NYSE: HD ) are performing well - and better than expected.

- Apparel retailers are mostly struggling - they are facing twin threats of inflation and direct to consumer ecommerce channels.

- Department stores are also struggling for similar reasons.

- Ecommerce companies are struggling for different reasons - sales are now rising at a slower pace while costs are rising faster.

We’ve looked at retailers here, rather than the manufacturers of consumer goods. But the situation is much the same. Most are struggling, but there are exceptions.

For Short or Medium-Term Investors (< 5 years)

With higher interest rates, holding inventory becomes expensive. There will probably be a lot of sales early next year, and they could be a good indication of which companies are stuck with a lot of inventory.

For Long-Term Investors (5+ years)

If you are concentrating on the long term, you can look at weakening consumer demand as an opportunity rather than a problem. The economy will recover eventually, and so will consumer spending. The question is, which companies will bounce back? We would say the most likely candidates are those with very strong brands and a good e-commerce strategy.

Is the Healthcare sector underperforming expectations?

Healthcare is widely recognised as one of the most defensive sectors. Spending on healthcare increases every year and it's fairly recession proof. So you may have expected better performance from the sector this year. It has outperformed the broad market, but it's still down 8.3% over the last 12 months.

That’s actually not a bad result when you consider that revenue for healthcare companies increased by far less than the market (2% vs 13% for broader market) and earnings fell by 9% compared to an increase of 4% for the entire market.

The lower revenue growth and drop in earnings is probably a result of the sector normalizing after the pandemic. In 2020 and 2021 many healthcare companies achieved record profits, while some suffered when certain services had to be suspended. As the impacts of the pandemic move further into the past, financial performance in the Healthcare sector should become less volatile.

Also, the growth companies in the sector have been marked down (a lot) for the same reason that other growth stocks have been markets down - higher interest rates mean future cash flows are worth less today.

Prior to 2020 the healthcare sector outperformed the market over most periods - so it's really a growth sector and a defensive sector. This applies to most countries actually - not just the US.

💡The Insight: Healthcare sector's diversity provides plenty of options

When you dig into the sector it’s actually very diverse. The various healthcare industries have different dynamics driving them, and very different growth rates, profit margins and valuations. This graphic shows just how wide the gap is between the P/E ratios and expected growth rates for the different healthcare industries.

What this means for investors

2023 is expected to be a challenging year for most sectors. As mentioned, healthcare companies could start to look more attractive on a relative basis - so it might be a good place to look for opportunities. You can find stocks in each healthcare subsector using the Simply Wall Street Screener , or the healthcare dashboard for each country via the Markets page .

Key Events for the Week

The key event this week will no doubt be the announcement of the US Fed funds rate on Wednesday. The rate is now expected to rise 0.5% to 4.5%, but a larger increase isn’t out of the question.

The UK has a fair amount of data being released this week with third quarter GDP on Tuesday, inflation on Wednesday, and retail sales on Friday.

In the US, consumer inflation data is due on Tuesday and retail sales data on Thursday.

It’s mostly small and microcap companies still reporting, but there are a few larger ones, including:

- Oracle ( NYSE: ORCL )

- Coupa Software ( Nasdaq: COUP )

- Adobe ( Nasdaq: ADBE )

- Accenture ( NYSE: ACN )

Simply Wall St analyst Richard Bowman holds a beneficial long position in Walmart (NYSE:WMT). Simply Wall St have no position in any of the companies mentioned. This article is general in nature. Any comments below from SWS employees are their opinions only, should not be taken as financial advice and may not represent the views of Simply Wall St. Unless otherwise advised, SWS employees providing commentary do not own a position in any company mentioned in the article or in their comments. We provide analysis based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.