🎧 Would you prefer to listen to these insights? You can find the audio version on our Spotify!

“It is better to be roughly right than precisely wrong.”

— Carveth Read (but often incorrectly attributed to John Maynard Keynes)

While 2022 was a rough year for the technology sector, it was even worse for listed fintech companies. Even industry leaders like PayPal and Block (Formerly Square) saw their stock prices fall 80%. Very few fintech stocks have recovered meaningfully either - with the exception of the more established companies.

But there is a lot happening in the fintech industry, and analysts aren’t changing their long term outlook. This week we are having a look at fintech and the key factors to look for if you go bargain hunting in the sector looking for long term opportunities.

A $1.5 Trillion Opportunity?

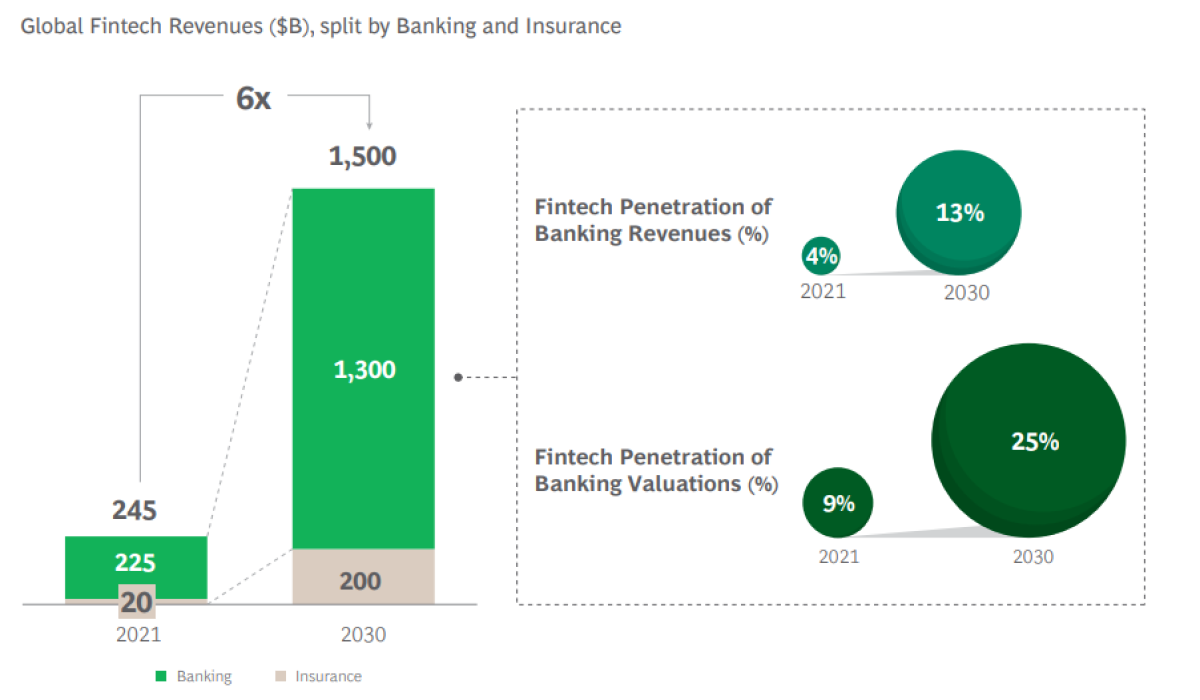

Estimates for the size of the global financial services industry are around $28 trillion USD ,and estimates of fintech’s current share vary widely. Nevertheless, most estimates put fintech’s current share of global financial services revenue at between 2 and 6%, with annual growth expected to be between 15 and 25% through 2030.

A recent report from Boston Consulting Group sets a target of $1.5 trillion by 2030, up six fold from 2021. Most of that gain will be in the banking space, and several estimates also show faster gains in Asia than elsewhere.

Besides the size of the opportunity, there seems to be some momentum with more rapid adoption. Once consumers get used to making payments on an app or website, it's a smaller step to applying for insurance or a loan the same way. Institutions have also embraced the change and are aggressively partnering with startups.

The bad news for public market investors is that most fintech companies (including some of the most successful) are unlisted. But if growth is anything near BCG’s estimate, they will have to become listed at some point.

Fintech 2.0

When the idea of fintech emerged, the widely accepted vision was that a bunch of hyper efficient companies would use technology to disrupt (and replace) the institutions that dominated finance. Most of the early platforms targeted consumers directly, offering alternative ways to make payments and loans.

Payment apps and digital wallets (like PayPal with Venmo and Block with Cash App) have prospered, but they haven't made much of a dent in the credit and debit card industry. On the other hand, the peer-to-peer lending and crowdfunding platforms that were meant to cut out the middlemen haven't had much luck, at least not yet. Cryptocurrency and blockchain platforms have also only succeeded in isolated areas.

The reality now is that thousands of fintech start ups are trying to innovate in every area of the economy. The innovation has as much to do with partnerships as it does with technology and products, and most are now partnering with companies and the institutions they were meant to disrupt.

Many of the most successful fintech platforms help companies streamline the payment process or provide financial services to their customers (embedded finance). They compliment these services with other value added services like accounting software. Examples include Affirm which lets merchants offer ‘buy now pay later loans’ to customers at the point of sale, and Block which provides a range of payments and accounting services to merchants.

The Future Of Fintech

Consumer facing apps have more prominent profiles, but the companies that work behind the scenes are just as important. The situation is different in developing markets where fintech apps (often mobile) are providing financial services to people who have never had access to banks. These users don’t have to “migrate” from existing apps or processes, they’re starting from square one so there’s no opportunity cost clouding their decision making process.

Worldwide, the next growth area looks set to be business-to-business payments and services. This is an area of the market that has barely been penetrated by fintech. Two other areas that worth keeping an eye on are digital banks which are still in their infancy after all these years, and insurance which has barely been touched by fintech.

A Few Thoughts On Analyzing Fintech Companies

Fintech companies do often have rapid revenue growth early on as they target their most obvious potential customers with big marketing budgets. It's also likely that they will be unprofitable for a long time, until they reach scale. But to do that, the total addressable market needs to be big enough.

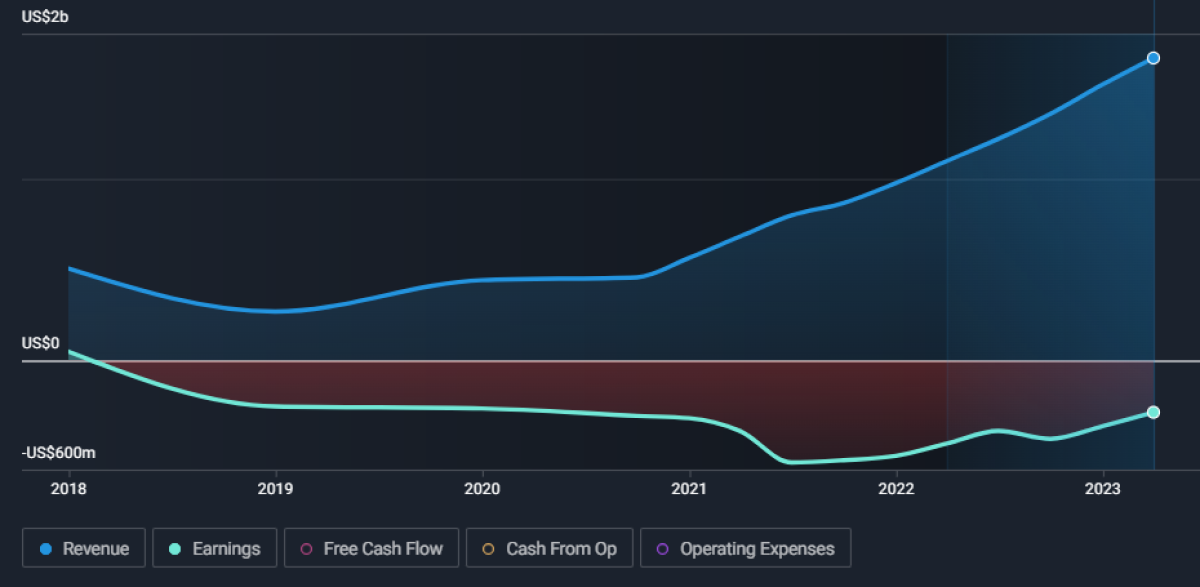

They should also have a sustainable market, and if not, diversified revenue streams to smooth things out. The chart below illustrates the point. First is the revenue growth of SoFi, which provides a range of financial services…

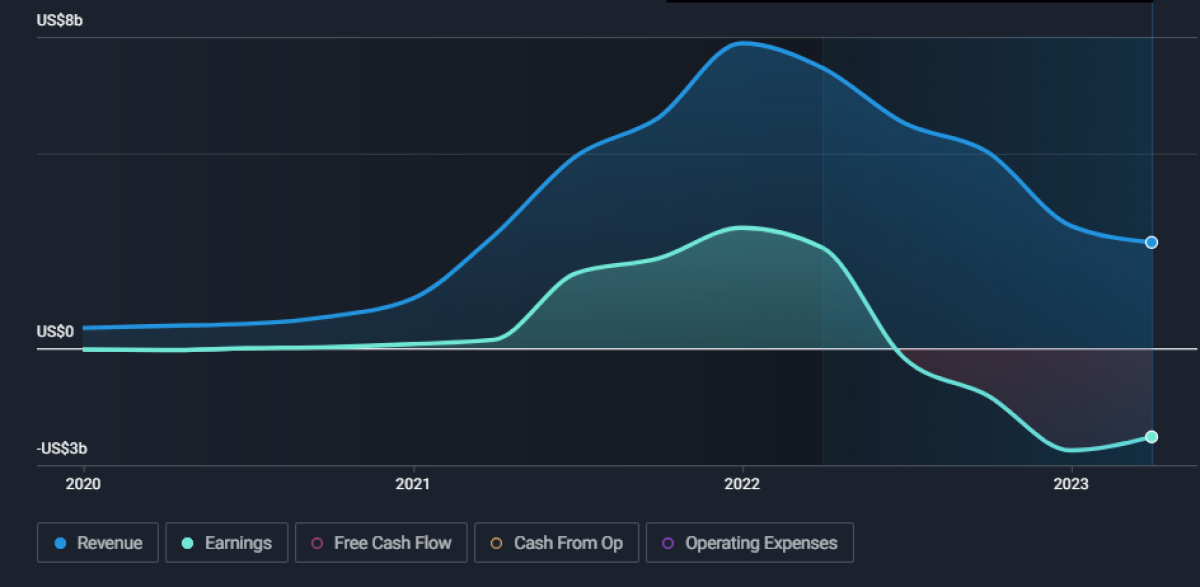

Next is Coinbase which is dependent on cryptocurrency trading volumes…

As with any company, understanding the business model and strategy is also essential. Media and software companies can often get away with building a user base first, and figuring out how to monetise it later. That won’t work with most fintech companies. How they plan to make money needs to be clear from the start.

Some fintech companies are very much like software companies, and charge a fee for providing a service. Others are more like banks, and take on risk - which also means they need more capital. The two types of companies need to be assessed in a very different way.

In the long run it may be the less exciting companies like Visa and Mastercard (the original fintechs) and infrastructure providers like Fiserv and Adyen that benefit regardless of how the industry evolves.

Check out our collection of fintech companies which includes some of the most promising companies. This list from Centre for Finance, Technology and Entrepreneurship , includes the largest 250 listed and unlisted fintech companies in the world.

The Wrap-Up: Simply Wall St’s Guide For Investing In Fintech

Things for you to consider:

- Consider your needs as a consumer. You must remember that you often fall within the target demographic of these companies and so it could be helpful to consider the utility that these businesses provide. Would you use them? What would be a barrier to your use? Would the service make your life easier? Are there many customers to be had?

- Consider how the business operates. What are the acquisition costs of adding a new customer? What sort of margins is the company running with? SaaS companies often have lower customer acquisition costs and are less likely to run into funding issues in their pursuit of customers.

- Consider the market in which the business is looking to enter. Is it highly regulated? Highly regulated industries are naturally harder to break into and are often costly for newcomers like fintechs to comply with.

- Consider the growth stage of the company. Is the company just starting out? Has it already undergone a period of rapid growth? Understand that many new fintechs will have to invest large amounts of capital back into the business and those that are successful in doing so will attract competition. Competitive margins and the path to profitability can become muddled quickly if strong competition arises.

- Consider the profitability metrics when it’s growing vs “maintaining”. Since the company might be aggressively trying to acquire users through sales and marketing spend, what would happen if it halved its spend in this area when it reached “enough” users to slow down investment in this area? How would net margins and ultimately, profits, improve? Would that be reasonable to assume, or is the company’s churn of users too high where it needs to be constantly acquiring new users to replace old ones?

Focus on those business that:

- Are relatively well established business (generating revenues),

- With a large untapped total addressable market (long runway of growth left),

- A clear path to profitability, if they aren’t already profitable (solid gross margins, with decent net margins in the near future).

- Can eventually generate decent returns on capital. Estimate what costs are growth expenses vs maintenance expenditures.

- Have a clearly defined and sustainable competitive advantage. “Just another banking app” won’t cut it when there are hundreds around. Find a differentiating factor that will help capture market share from legacy institutions or competitors.

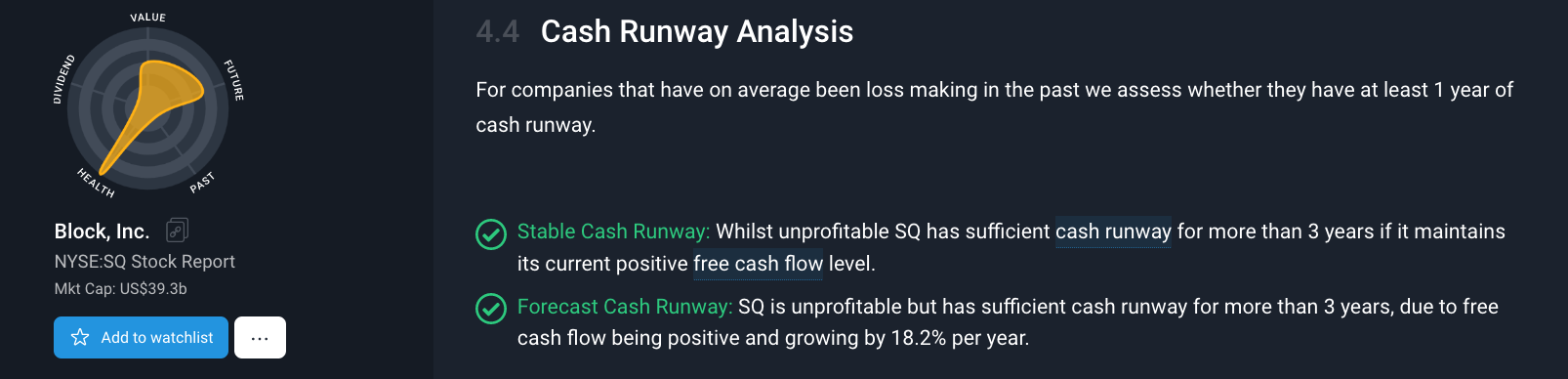

- Are not burning cash too quickly where the risk of another equity raise or debt issuance in the next few years is high. Our Financial Health checks on all cash-burning stocks will enlighten you to this risk and if it is a concern.

What Else is Happening?

First a recap of the key data releases we mentioned last week…

- 🇦🇺 Australia’s central bank held rates at 4.1% after May’s inflation data showed inflation slowing. Like many other central banks, RBA governor Phil Lowe did warn that further hikes may be necessary.

- 🇺🇸 US factory activity contracted for an eighth month in June . Manufacturing data continues to show weakness, as the ISM purchasing managers index fell for the third consecutive month and factory employment is declining. However factory prices are declining which is good news for inflation.

- 🇺🇸 US auto sales reflect a different story. Several leading automakers have reported very strong sales for the second quarter. GM said sales rose 18.8% from a year ago, and analysts now expect industry wide sales to be up 16-18%.

- 🇺🇸 US - The minutes from the last FOMC meeting held no surprises. The committee sees more rate hikes ahead, but at a slower pace . There was some disagreement over the pace of further hikes, but all but 2 of the 18 committee members agreed that at least one more 0.25% increase would be needed this year .

And then, a few news items that we thought were worth noting…

-

🚙 Electric vehicle makers had a bumper second quarter. Tesla, Rivian and BYD all reported record deliveries, and Xpeng's sales recovered from a slump. This is a big turnaround from six months ago when EV sales were expected to slow dramatically.

- The fact that legacy automakers also reported strong sales, and numbers were strong in China and the US suggests this is more about consumer confidence than an accelerating trend aways from gas guzzling vehicles.

- This is particularly good news for Tesla as rising inventories have been a major concern for investors.

-

🧵 While Twitter is facing more problems and having to limit user activity, Meta launched its new Threads service. The service is a direct competitor to Twitter and is linked to users' Instagram profile.

- It will be interesting to see how quickly a new text based social media platform can build a user base - it already has 30 million users after 24 hours . None of the many Twitter competitors has managed to build a noteworthy audience so far.

- Of course Meta has a few very big advantages. Instagram already has 1.6 billion active users (estimated). It can also wait years before attempting to monetise it since there are currently no ads on it (which is refreshing).

-

📱 India’s Reliance Industries is launching a new model of internet-connected mobile phone priced at just $12. The phone from Reliance subsidiary Jio will have access to the 4G network but won’t be a full feature smartphone. The phone will however allow users to make payments and stream some video content.

- The world’s first mobile phone came out in 1983. It cost $3,995 and weighed nearly a kilogram . It didn’t have video streaming, but users could save up to 30 phone numbers before all the memory was used up.

- Motorola sold 300,000 of those phones. Reliance is doing a beta run with 1 million of its $12 phone.

-

New products that cost a fortune when they are first released get better and cheaper over time. As the price comes down, the market gets bigger and more profitable.

Key Events During the Next Week

This week the latest US inflation data will be released. Consumer price inflation is due on Wednesday and producer price inflation is due on Thursday.

In the UK the unemployment report will be published on Tuesday and GDP data on Thursday.

Also on Thursday, China’s latest trade data will be published.

Second quarter earnings season kicks off this week with the big banks as well as some other large companies:

- Bank of America

- Charles Schwab

- Lockheed Martin

- PepsiCo

- HDFC Bank

- Delta Air Lines

- Morgan Stanley

- UnitedHealth

- JPMorgan

- Wells Fargo

- BlackRock

- Citigroup

- State Street

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.