Quote of the Week

“The trick is not to learn to trust your gut feelings, but rather to discipline yourself to ignore them. Stand by your stocks as long as the fundamental story of the company hasn’t changed.” — Peter Lynch

If you’ve read our deep dive into the Key Investment Themes of 2024 , you may remember that Mexico was a favorite amongst global strategists and major asset managers for 2024.

Traditionally, Mexico’s economic growth has lagged behind other Latin American countries, averaging just above 2% a year between 1980 and 2022 . However, things look to be changing as Mexico’s economic growth has boomed, spurred on by what some are calling ‘ Deglobalization ’.

So this week we are taking a closer look at this market which is enjoying a moment in the spotlight.

🎧 Would you prefer to listen to these insights? You can find the audio version on our Spotify or Apple podcasts !

What Happened in Markets this Week?

Here’s a quick summary of what’s been going on:

- 🇨🇳 China's Central Bank Cuts Reserve Requirements to Boost Lending ( WSJ )

- Our take: Policymakers In China are going to have to walk a fine line between encouraging banks to lend, and preventing the excessive lending that resulted in the real estate ‘house of cards’ that contributed to the current slump. Companies that depend on China's economy are still a risky bet - but the quality tech names are likely to become less correlated with the rest of the market.

- 📽️ Netflix Flexes With $5 Billion WWE Deal ( FT )

- Our take: Netflix announced that it added 13.1 million new subscribers in the last quarter, which is great news. Perhaps even better news is the announcement that it will be the new home for World Wrestling Entertainment’s Raw program, as well as SmackDown and WrestleMania from January 2025. Not only will this content bring in new subscribers, but it’s another reason for existing subscribers to stay on the platform.

- 🍎 Apple Takes a Low-Key Approach to Vision Pro Headset Launch ( NYT )

- Our take : The Vision Pro is now available, though wait times have risen to six weeks. The reception has been mixed, mostly due to the limited number of apps currently available. Nevertheless, Wedbush Securities have upped their forecast for 2024 sales of the headset to 600k. If they are right, it might be a while before the Vision Pro moves the needle for Apple. The bigger picture perspective is that Apple is creating an entirely new product category and a new way to interact with the rest of the Apple ecosystem.

And some of the key economic data released recently:

- 🇨🇳 China’s central bank kept the one and five-year prime loan rates at 3.45% and 4.5% respectively - as expected. However, as mentioned, reserve requirements for banks have been lowered, allowing them to increase their loan books.

- 🇯🇵 The Bank of Japan also kept rates steady at -0.1% . However, the BOJ Governor Kazuo Ueda suggested that the bank is confident that Japan will achieve its 2% inflation target and will be able to bring short term rates out of negative territory .

- 🇯🇵 Japan’s trade balance swung to a ¥62.8 billion surplus from a ¥780 billion deficit . The deficit was expected to fall, but the small surplus was a surprise.

- 🇨🇦 The Bank of Canada joined the list of central bank’s keeping rates steady , in this case 5%.

Mexico Wins As US Brings Manufacturing Closer to Home

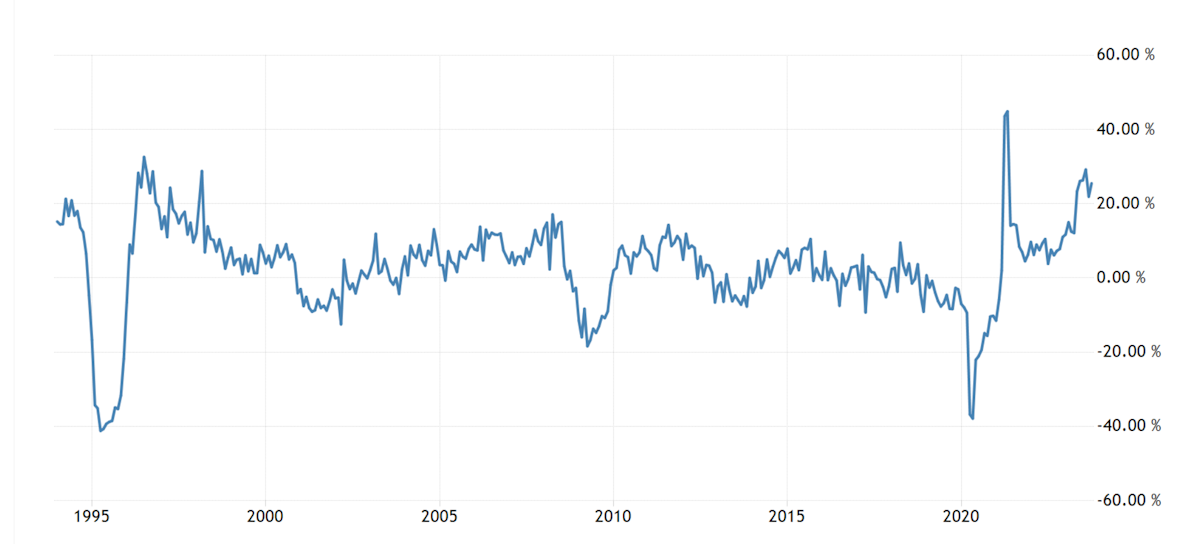

Mexico was one of the first countries to be described as an emerging market when the term was first coined in the 1980s. Since then, it has experienced many of the classic emerging market fiasco’s including a series of debt and currency crises. The country is now enjoying a new growth period, and its stock market has been one of the world’s best performers over the past few years. In fact, as the chart below, reflecting MSCI country indexes, illustrates, it's done even better than India.

The primary driver of Mexico’s growth has been the ‘near-shoring’ of US manufacturing. ‘Near-shoring’ is the practice of shifting part of a company’s production to a neighboring country. ✨ The idea is that companies engaging in near-shoring will still get the labor cost benefits of off-shoring, but with way less global supply-chain risk, less time-zone differential and (hopefully) a closer cultural alignment.

This started with the US-China trade war and the United States-Mexico-Canada Agreement (USMCA) which replaced NAFTA. This agreement incentivizes companies to source goods within North America.

More recent events have given companies even more reason to bring their manufacturing closer to home. These include China’s strict lockdowns, and supply chain disruptions due to the pandemic and the war in Ukraine. Even more recently, traffic through both the Suez Canal and Panama Canal have been disrupted by conflict and drought .

In addition to tariffs and logistics, China is no longer the low-cost manufacturer it once was, and manufacturing wages are now notably lower in Mexico .

As of July 2023, Mexico became the US’s biggest trading partner, ahead of both China and Canada . This also occurred in 2019, but the growth in imports from Mexico seems to be part of a more permanent trend. Trade between the US and Mexico is also more balanced between imports and exports, unlike trade with China, which is skewed toward imports by the US.

Some of the notable US companies that have invested in manufacturing plants in Mexico are GM , Ford , while Tesla plans to build a $5 billion plant . Many of the other global automakers including Toyota , Hyundai , BMW and Audi are following suit. China’s electric car giant BYD is also reportedly considering building a manufacturing plant in Mexico to give it a gateway to the North American market.

The largest investments have been made by automakers, but other manufacturers from around the world are also growing their presence in the country. These include US companies like Medtronic and Honeywell , as well as Asian electronics giants like Samsung and Sony . Suppliers to these companies are following their largest customers too: Several Tesla suppliers are said to be investing $1 billion on facilities in Northern Mexico.

The chart below shows fixed investment in the country at multi-decade highs:

Leveraging A Structural Advantage

From time to time, countries are lucky enough to enjoy a structural advantage. In Mexico’s case, its proximity to the US and the ‘de-globalization’ trend gives it such an advantage.

Deglobalization refers to a recent trend of slowing global trade. There have been a number of factors that contributed to this, but COVID-19 and the recent war in Ukraine have sped things up as governments and corporations reconsider their dependence on external economies that could be more unstable.

The result of this has been positive for some economies, and for Mexico this has resulted in money flowing into the manufacturing sector and an increase in exports.

The immediate beneficiaries are construction companies and cement manufacturers - and workers. Mexico’s unemployment rate has fallen to a 20-year low despite high inflation and interest rates above 11%. The secondary effects are growing incomes and spending, which will benefit consumer facing businesses.

Mexico’s Stock Market Is Shaping Up For A Change

There are around 140 listed companies in Mexico, including subsidiaries of US giants like Walmart ( WALMEX ) and Kimberly-Clark ( Kimberly-Clark de México ) . Coca-Cola’s largest bottling partner ( FEMSA ) is also based in Mexico.

Mexico's indexes are unusual by global standards as they tend to be very overweight consumer staples , financials and materials companies. No less than five of the largest companies are food retailers and manufacturers, and most of the other index heavyweights are banks and materials companies. So the index performance doesn't necessarily reflect the performance of the companies with higher growth rates.

Mexico Sector P/E Ratios and Forecast Growth Rates - Image Credit: Simply Wall St

Valuations for Mexico’s equity market actually appear to be quite reasonable by historical standards. One of the reasons for this is that earnings growth has been strong (ie. the denominator in the P/E is high), but growth is expected to be a little slower in 2024. What matters now is how the outlook beyond 2024 develops, it’s possible that the impacts of deglobalization and near-shoring could reverberate through the market, particularly if unemployment stays low and household expenditure begins to flourish .

Investment In Mexico Doesn’t Come Without Risks

Mexico is a very interesting market and the outlook appears bright. But it’s not without its risks, and investors have been burnt in the past, with the aforementioned debt and currency crises playing a large role in the pain felt by investors. Fortunately, Mexico’s finances are in better shape than they were in the past, when Mexico was often caught up in emerging market contagion.

Nowadays, Mexico’s economy is probably more sensitive to the US economy - so any US slowdown or a financial crisis on Wall Street is likely to have an outsize effect on its economy. Of course, for long term investors, this could create opportunities.

Mexico is also having an election this year, which could result in more (or less) state interference in key industries.

💡 The Insight: Investing In Mexico Is More Accessible Than You Think

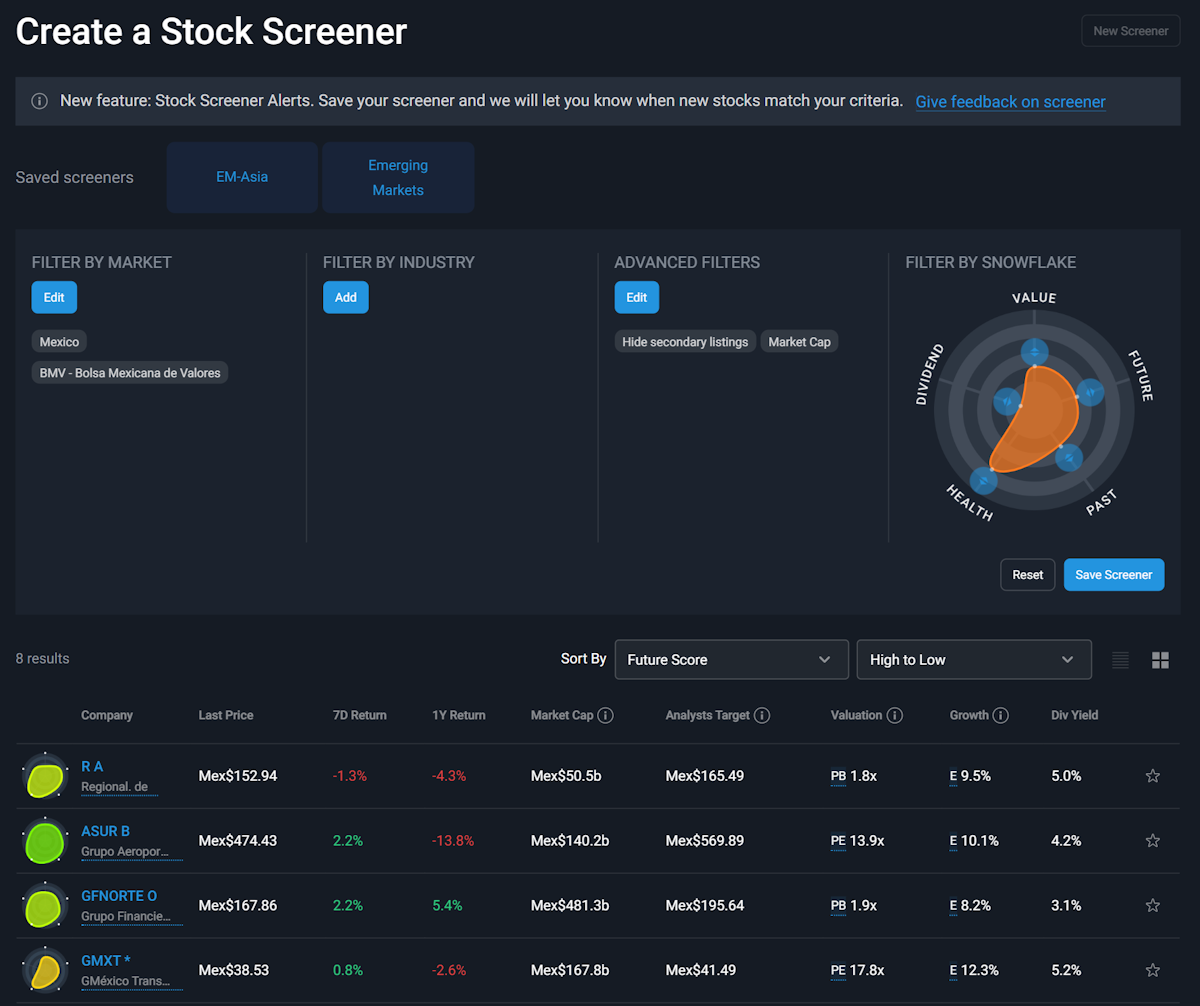

Fortunately for investors, Mexico’s stock market is more accessible to foreign investors than markets like India and China. There are a handful of Mexican companies listed on US exchanges, but a lot of large online brokers offer access to the BMV (Mexican Stock Exchange).

With only 139 companies, Mexico’s market is easier to explore, and you can use the Simply Wall St Stock Screener to do that.

There are lots of different ways to use the screener - but let’s walk through an example:

- Step 1: Select the market - in this case, Mexico.

- Step 2: Adjust the minimum market cap under ‘Advanced Filters’ . We are setting it to $1 billion as we want more established companies.

- Step 3: Drag each tab on the snowflake to the minimum level you’d like to include. At this stage, it’s worth giving the screener a bit of leeway by keeping the values on the low side. You can always increase them if there are too many results. In this case, we are favoring companies with a strong health score, but giving it more leeway on the other scores.

- Step 4: At this stage you can sort the results by any one of the five scores , total score, or several other factors. We’ve sorted these by ‘future score’ because we are looking for growth opportunities.

- Step 5: This example only produced eight results, so we can go through them one by one. If there were too many results, we could use the ‘Filter by Industry’ tab to refine the list and select only the industries that we’re interested in .

Alternatively, you can start with the industries that interest you, and then refine the list using the snowflake, or individual metrics. Whichever approach you use, if you end up with 5 to 20 companies that fit the profile you are looking for, you can then look at each one in more depth.

✨ This process should allow you - in a relatively short amount of time - to find a handful of stocks that are worth researching in a lot more depth.

The screener is an excellent tool to discover new companies, but it should not be used as the sole factor in making an investment decision, the Simply Wall St Screener is complimented by well-founded research .

As always, we encourage you to dig deeper into some of the companies you find and determine:

- 🪑 Where the company sits in the market.

- Is it an emerging company or is it an established operator in its industry?

- 💪 The competitive advantages it has.

- What does this business do better than the others?

- 📈 The catalysts for the business’ growth in the future.

- Begin to build your narrative, what is going to be the driving force behind the company’s earnings.

- 🎁 If there’s an opportunity for you that meets your personal risk tolerance.

- There may be times when you discover a company that ticks all the boxes, but you feel it is still too risky for one reason or another. That’s okay! Understanding your own tolerance for risk will help you become a more rational investor.

Mexico ETFs

There are also a handful of ETFs that track Mexico indexes. As mentioned, they are heavily weighted to certain sectors, so make sure you understand how they are constructed before investing. As always, looking at the stocks held by ETFs is another way to find stocks to look at in more detail. These are the largest Mexico focussed ETFs:

- iShares MSCI Mexico ETF (EWW) - Listed in US

- Franklin FTSE Mexico ETF (FLMX) - Listed in US

- Vanguard FTSE BIVA Mexico Index ETF (VMEX) - Listed in Mexico

- X Trackers MSCI Mexico UCITS ETF (XMEX) - Listed in UK

Key Events During the Next Week

It’s a big week for markets with the Fed rate decision and quarterly earnings from five of the ‘Magnificent Seven’.

On Wednesday, the FOMC is expected to keep the Fed Funds target range at 5.25 to 5.5%. The real event will be the commentary that comes with the announcement, which will be closely followed by investors. There will also be an announcement on US Treasury refunding, which could impact bond yields.

It’s also a big week for US employment data, with the ADP employment report on Wednesday and the Unemployment rate on Friday. US unemployment is expected to tick up slightly, from 3.7% to 3.8%. Average hourly earnings and non-farm payrolls are also due on Friday.

Inflation rates will also be released in Australia on Wednesday (4.3% expected vs 5.4% previously) and the Eurozone on Thursday (2.2% expected, down from 2.9% previously).

On Thursday, the Bank of England will set its bank rate, which is expected to remain at 5.25%.

Besides Big tech, corporate earnings are due from a number of large caps. These are the big names, and you’ll find a more comprehensive list on the Nasdaq website :

- Apple

- Microsoft

- Alphabet

- Amazon

- Meta

- Mastercard

- Exxon

- Merck

- AbbVie

- AMD

- Chevron

- Qualcomm

- Alibaba

- Pfizer

- UPS

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.