"Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas." — Paul Samuelson

On Tuesday, Japan’s Nikkei 225 index crossed 33,000 for the first time since 1990. We decided to have a look at Japan’s stock market to see what’s driving the outperformance against other global benchmarks and whether it’s sustainable.

The Nikkei 225 index is now up about 30% year-to-date compared to the S&P 500 and MSCI world indexes which are up 14% and 12% respectively. That 30% gain is a little misleading as the Nikkei is priced in Yen, but even priced in USD it’s up 20% for the year.

Despite the strong performance, Japan’s index is still 14% below its 1989 peak of 38,957. So why is Japan performing so strongly now, and what caused this decade’s long slump?

The Lost Decade(s): Japan’s Deflationary Slump

From 1960 to 1989 Japan’s economy and stock market experienced a golden period. Local consumption and growing exports (think Sony and Toyota ) helped to establish the country as the world’s second largest economy. During the 1980s alone the benchmark stock index rose 500% as Japan became the investment destination of choice.

As is often the case, the boom turned into a bubble which burst in 1989 when the central bank raised rates to discourage speculation in the real estate and stock markets. The deflating asset bubble had long lasting consequences and made Japan’s economy an anomaly within the global economy - ie. near zero growth, inflation and interest rates. Japan’s stock market went from global outperformer to underperformer, falling 80% in 14 years.

Low Growth and Low Returns For Investors

Global investors were understandably cautious after a 14 year bear market. But that hasn’t been the only reason they were reluctant to return until recently. When the bubble popped, corporate balance sheets were in seriously bad shape due to plummeting asset prices. Companies then became overcautious and hung on to any cash flows rather than reinvesting. You can’t generate returns on invested capital if your capital is sitting in a bank account earning 0.01%.

The third factor that has discouraged global investors is corporate governance. Until recently, shareholders have had little say over corporate decisions, and company leaders have prioritized liquidity (i.e. having cash and healthy balance sheets) over generating returns.

In addition to these major challenges, Japan’s market has never been the most ‘user friendly’ for foreign investors. Company information is often hard to come by, particularly in languages other than Japanese, and the regulatory environment is complex.

Abenomics And Shareholder Returns

In 2012, the late Prime Minister Shinzo Abe implemented a new strategy to reignite the economy. Abenomics as it became known was based on a combination of monetary easing, fiscal stimulus and structural reforms. The fiscal and monetary programs have had mixed successes, but did restore investor confidence. Equity prices began their recovery in 2012, and that year also marked a low point for valuations.

The structural reforms are probably more important for the long term, and appear to now be paying off. Most importantly a corporate governance code was introduced in 2014. Companies are now responding to shareholders, and beginning to look at ways to improve shareholder returns by restructuring, buying back shares, and selling unprofitable assets.

The latest development has been the restructuring of the TSE (Tokyo Stock Exchange) which took effect in April. The new structure encourages (and in some cases forces) companies to be more transparent and shareholder friendly, and to increase liquidity and shareholder value.

Outside of corporate governance, Japan’s policy makers are looking at ways to reduce red tape, create a supportive start-up ecosystem, and even increase immigration to provide workers for certain industries.

If you think about some of the political, legal and financial traits that make a country and economy appealing to invest in, those are some of them.

💡 The Insight: Reforms And A Global Rebound Help Drive Japan's Rally

The structural reforms have probably contributed to improved profitability, but there have also been other catalysts driving the current rally.

The weaker Yen, and the reopening of China’s economy has boosted exports. Japan’s inflation rate has also risen - something the BOJ has been trying to achieve for decades - which has stimulated consumer spending.

Foreign investors have also begun to pay attention after seeing the gains on Berkshire Hathaway’s Japanese investments. In 2020 Warren Buffett began buying shares in Japan’s five largest conglomerates (shown below), some of which are now up more than 200%.

Where to Next?

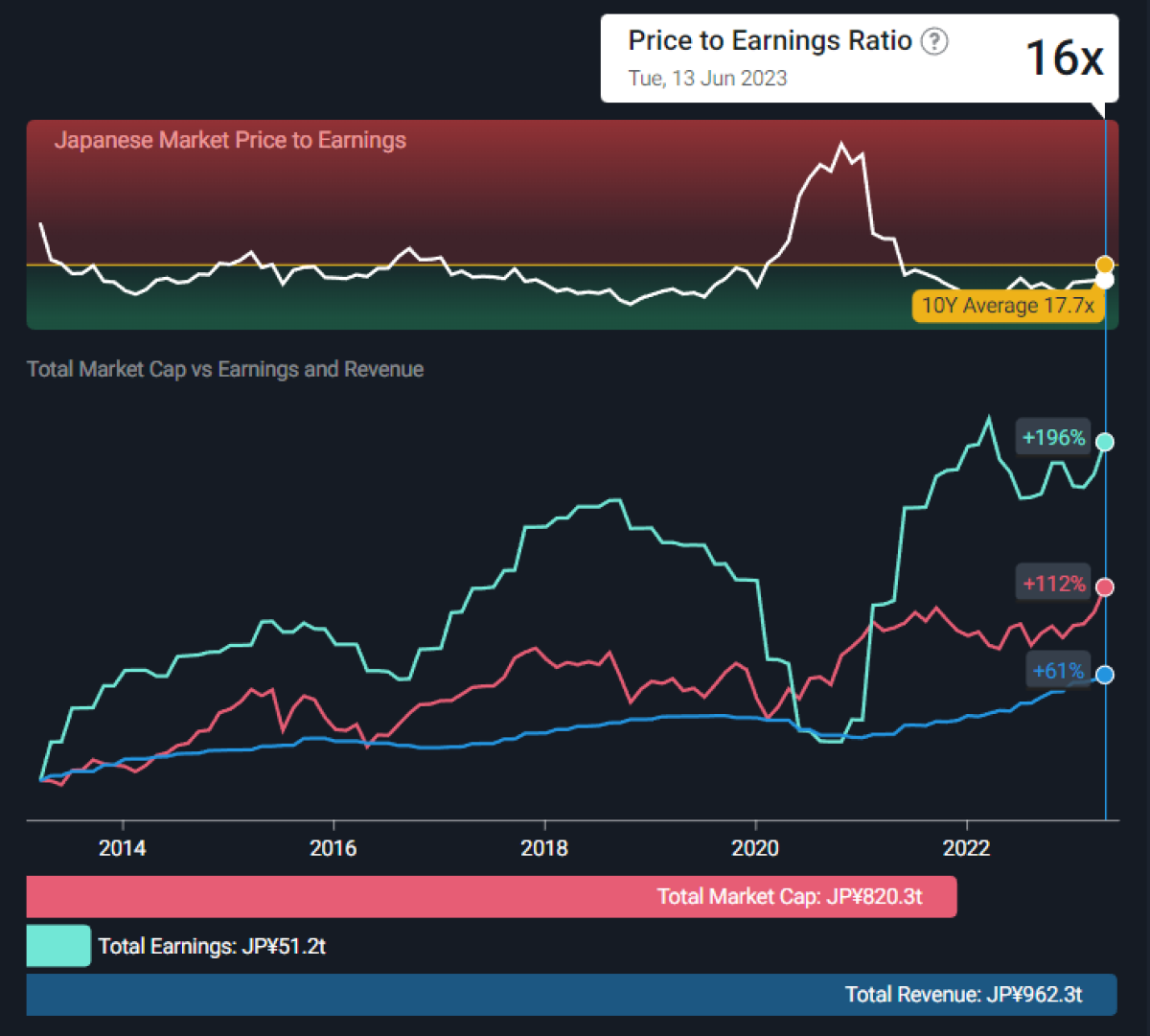

Despite the recent gains, Japan’s average price to earnings ratio is still below the 10 year average of 17.6x. The CAPE ratio is closer to 21x , but that’s also below average (see our recent article explaining what the CAPE ratio is for the UK market).

While valuations are arguably reasonable, in the medium term the catalysts listed above could continue to support the market - or do the opposite if they reverse.

The longer-term picture is more interesting. The corporate environment and the economy could be completely transformed as companies focus on shareholder returns rather than maintaining the status quo.

At the moment, Japan’s stock market isn’t very accessible to foreign investors - just 9 Japanese companies worth over $1 billion are listed on US exchanges. There are more companies listed on OTC exchanges, but most foreign investors are currently limited to ETFs like the iShares MSCI Japan ETF . This is likely to change as companies look to improve tradability and sources of capital.

If the reforms started by Shinzo Abe continue, Japan could become a new land of opportunity for investors.

Check out our analysis on the Japanese stock market , to get our insights on sector trends, market and sector valuations, performance figures and more.

What Else is Happening?

First a recap of the key data releases we mentioned last week…

- 🇺🇸 The US central bank kept the Fed Funds Rate at 5.25% as expected. But Fed Chair Jerome Powell warned that the pause doesn’t mean rate hikes are over. In fact, a majority of members of the monetary policy committee expect another two hikes this year, with the possibility of at least one more hike next year.

- 🇺🇸 US Producer Prices fell 0.3% during the month of May and were just 1.1% higher than they were a year earlier. This was largely due to lower energy prices and the effect of the stronger USD on imports.

- 🇺🇸 US Consumer Prices rose 4% year-on-year in May, down from 4.9% in April. While this was lower than the 4.3% expected which is good news, the core inflation rate, which includes the ‘stickier’ components of inflation, fell just 0.2% to 5.3%. This suggests it may take a while to get the inflation rate down to the target level of 2%.

- 🇬🇧 UK’s employment data pointed to a stronger than expected jobs market. The unemployment rate fell slightly to 3.8% , while the number of claimants fell, and payrolls rose.

- 🇬🇧 UK GDP rose 0.2% in April after falling in March. The improvement was attributed to improving auto sales and consumer services spending. The stronger economic and jobs data has raised the odds of another rate hike by the BOE.

- 🇨🇳China’s central bank cut its short term lending rate by 0.1% to 1.9% in an effort to reignite the economic recovery which has been losing steam since March.

And then, a few news items that we thought were worth noting…

-

🚙 Tesla will now be allowing both General Motors and Ford electric vehicles to use its Supercharger network starting in 2024.

- Reactions to this development have been mixed. On the positive side, it means Tesla’s charging standard will now become the charging standard in North America. It will also earn new revenue by providing the charging service to other vehicles.

- Some analysts believe the company is giving up a key competitive advantage - i.e. the charging network is no longer unique to Tesla. That’s true for now, but if Tesla didn’t go ahead with this it may have ended up shut out from an even bigger rival network.

- Reactions to this development have been mixed. On the positive side, it means Tesla’s charging standard will now become the charging standard in North America. It will also earn new revenue by providing the charging service to other vehicles.

-

🔋 Thyssenkrupp Nucera (go ahead,it’s fun to say!) is set to be Europe’s largest IPO in a while. The company makes hydrogen electrolysers which are used to produce green hydrogen, and is a joint venture by Germany's Thyssenkrupp AG and Italy’s De Nora .

- Nucera will be a major pure-play listed hydrogen company, and give investors in the clean energy transition a new listing to consider.

-

The listing was previously delayed due to market weakness, and the fact that its back on is another sign of improving confidence in the market.

Key Events During the Next Week

Fed Chair Powell’s testimony to the US congress on Thursday is likely to be the key event for the week. Investors will be keen to hear the update he provides congress, and how he answers questions from members of the committee.

The only other notable US releases are building permits and housing starts on Tuesday. These will give us great insights into the US construction industry, and whether trends are improving or not.

The UK’s inflation rate is due on Wednesday, and then on Thursday the Bank of England (BOE) will be announcing its interest rate decision. Expectations are almost certain on a further rate hike, to 4.75%, with rates expected to close this year at 5.5%.

The following companies are still due to report quarterly results:

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.