“If you give people tools, and they use their natural abilities and their curiosity, they will develop things in ways that will surprise you very much beyond what you might have expected.”

Bill Gates

Generative AI is being described as the most important innovation since the birth of the internet. Pretty big claim, right? But when you really think about it, it’s not as far-fetched as it sounds.

When the internet first became a thing, Newsweek author Clifford Stoll made a now infamous prediction that the internet will be a passing fad . Could the detractors of AI be seen in a similar light 20 years down the track?

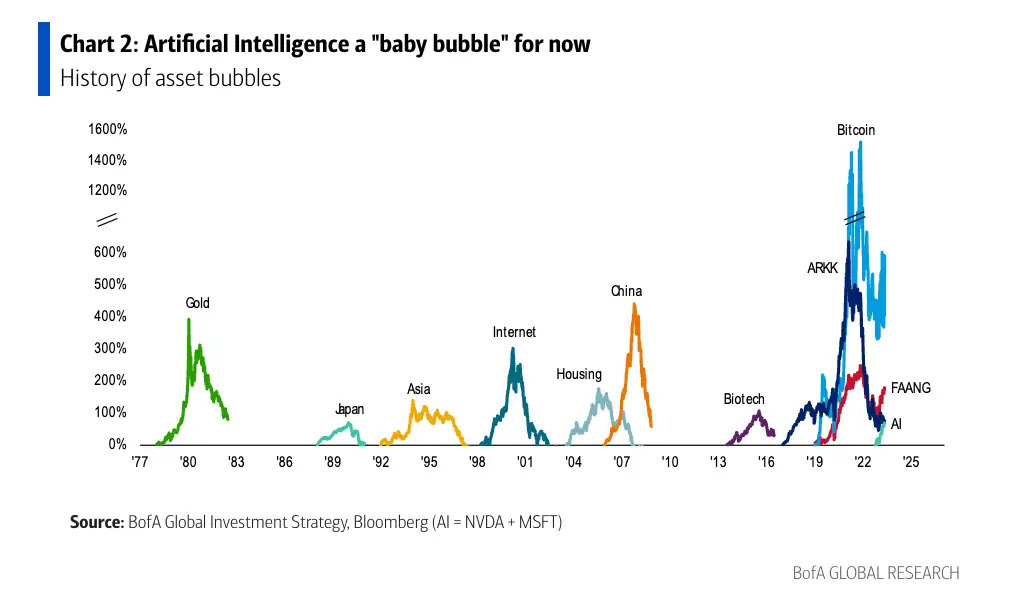

As AI stocks continue to make new highs, the potential parallels with the dot com bubble are also hard to ignore.

That’s why, this week, we’re taking a look at the arguments for and against AI being in a bubble. Given the amount to cover on this topic, this is the first of a two-part series on AI investments, so stay tuned next week for part 2!

But first, a quick recap of what happened in markets.

What Happened in Markets this Week?

Here’s what’s been going on:

- ⚡ Siemens Energy to Build Power Transformer Factory in US ( Axios )

- Our take : Last year we mentioned that a transition to clean energy required electrification of demand . The obvious examples are EVs. One of the less obvious ones is building a bigger and more efficient power grid. Siemens already manufactures steam turbines and electrical generators in the US. This move speaks to the need for infrastructure as well as generating capacity.

- 🏠 Zillow Beats Expectations Despite Housing Slowdown ( Barron’s )

- Our take: If Zillow’s fourth quarter results are anything to go by, the US housing market might be staging a recovery. Quarterly revenue was up 9% for the year and the net loss was narrower than estimates. Full-year revenue fell 1%, but revenue from residential sales was up 3%. That’s pretty good considering mortgage rates hit 8% in October.

- 🇬🇧 UK Missed Target to Build 300,000 Homes in 2023 ( Bloomberg )

- Our take: In 2019 the government pledged to build 300K homes each year to help with housing affordability - but they have managed to fall short every year. On average, 200K homes have been built each year, meaning the target has to be raised and achieved if the shortage is to ever be resolved.

And some of the key economic data released recently:

-

🇦🇺 Australia’s Westpac Consumer Confidence Index rose to a 20-month high.

- The 6.2% jump was a surprise, as economists were expecting a slight drop. The improvement in confidence was attributed to expectations that interest rates had reached their peak.

-

🇬🇧 UK unemployment surprised analysts, falling from 3.9 to 3.8%.

- There was also good news on the inflation front, with headline inflation remaining at 4% vs. estimates of 4.1%.

-

🇺🇸 US headline inflation rose 3.1% as expected.

- However, the core inflation rate remained at 3.9% vs consensus estimates of 3.7%. The hotter-than-expected data makes the chances of a March rate cut even less likely.

Now, let’s dive into the main piece!

🫧 The Next Dot Com Bust?

You’ve no doubt seen the word “bubble” thrown around recently in discussions revolving around AI stocks, since they’ve appreciated so much. So are stock prices correctly anticipating the future, or are they way too optimistic?

Most people agree that there is massive long-term potential for AI. Others are a bit more sceptical and think that its impact will be big, but not that big.

✨ The thing is, the reasonableness of current prices ultimately depends on valuations (what you’re currently paying for), and how the fundamentals develop.

Even if you believe in the long-term potential, there is a risk that investors’ currently optimistic expectations re-rate downwards sharply for whatever reason in the interim, even if current valuations are eventually justified.

Think of Cisco, Microsoft, Amazon, Intel, and Qualcomm all in the 1999 dot com crash. They’ve taken at least 10 years to recover from their 1999 highs , while some haven’t recovered at all.

The point is, no matter how great a business is, no business is worth an infinite price.

As Buffett once said:

“Investors making purchases in an overheated market need to recognize that it may often take an extended period for the value of even an outstanding company to catch up with the price they paid. ”

So with that in mind, are we still in the early days like 1995, or are we in 1999, hurtling towards a rude dose of reality?

Or, is this time completely different?

Let’s look at some of the arguments for and against a bubble.

5 Arguments For: Of Course it's a Bubble

We will start with a few scenarios that could prove the current rally is a bubble.

You’ll note some of these are contradictory, so they aren’t all going to occur. But just one or two could lead to expectations and valuations collapsing.

1️⃣ Adoption Isn’t Ready To Keep Up With Capacity

The current boom in AI investment is mostly directed toward infrastructure in the form of GPUs, other hardware and data centers. This infrastructure is all being built in anticipation of demand from application developers and end users.

✨ If adoption further down the value chain doesn’t keep up, the industry could be dealing with an oversupply problem for a few years. Did somebody say EVs ?

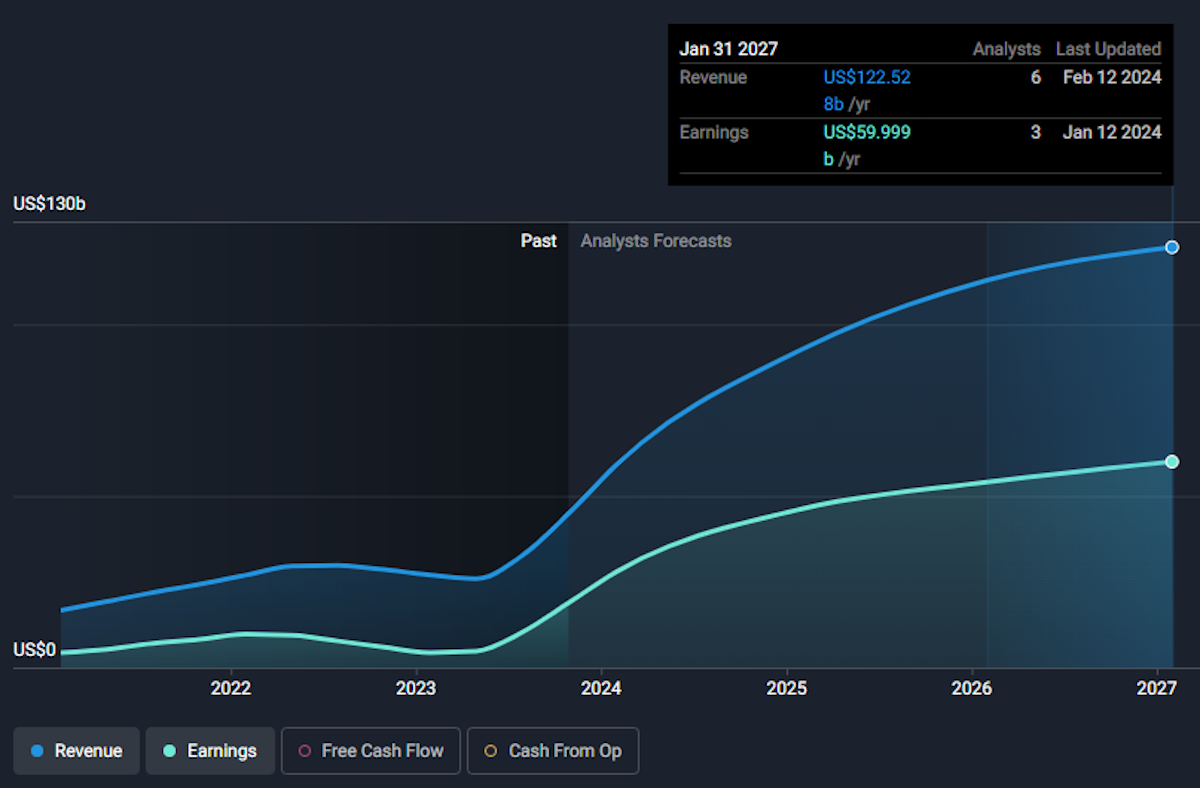

Industry leader Nvidia is a good example of current expectations.

Consensus estimates suggest Nvidia will generate revenue of $122 billion in the 12 months to January 2027, and $138 billion the following year. The current share price suggests the market’s expectations are even higher.

The company’s current order book probably might make those numbers doable - but orders could also disappear if end-user demand disappoints. There’s no point in creating GPUs for customers that don’t need them.

This scenario is one of the primary catalysts behind this narrative for Nvidia.

2️⃣ No Moat, No Margin

Some analysts believe that the speed at which new foundational models are being developed means their owners will struggle to build a moat.

If that’s the case, they will struggle to earn the margins needed to justify their investments. The introduction of open-source models like Meta’s Llama complicates this more. A leaked memo from Google summed it up with the statement: “We have no Moat, and Neither Does OpenAI” .

If a developer is building an application, they are unlikely to pay top dollar to access the latest iteration of ChatGPT or Gemini if they know a cheaper model with similar capabilities will be available in a matter of months.

3️⃣ Too Efficient

Another scenario that could up-end the rally would be if increasingly efficient AI models combined with increasingly efficient GPUs resulted in less compute power being required.

Companies like Nvidia may struggle if future AI models are so efficient that they can run sufficiently on older hardware. Demand for the latest hardware will nosedive.

We have yet to see this kind of relationship play out in computer hardware before, but perhaps accelerated computing could be the catalyst for us getting there.

✨ This would actually be good news for developers and end users. But it could put pressure on cloud providers and chipmakers until demand catches up.

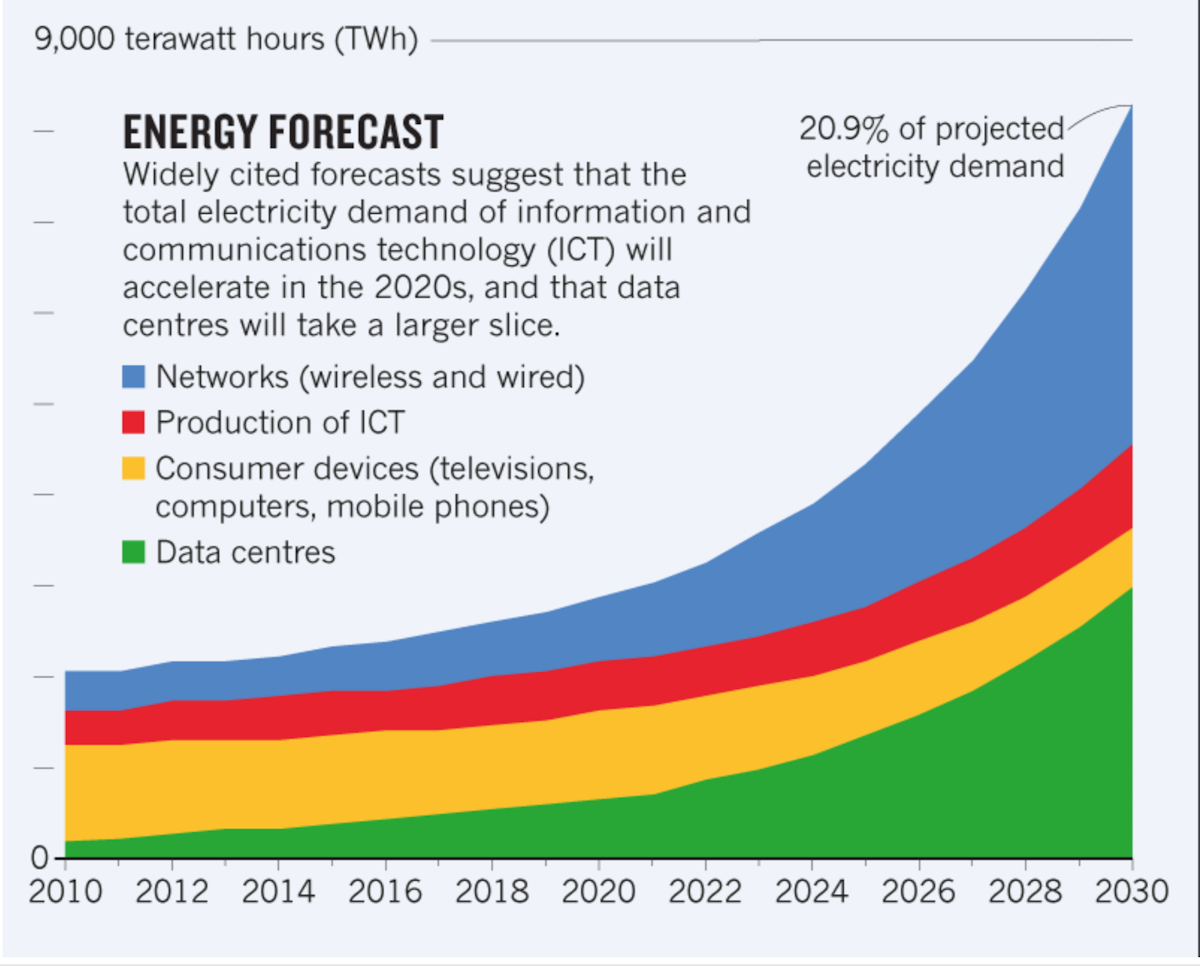

4️⃣ Power Demand

If demand for training and inference rises as fast as expected, or even faster - the price of compute power will rise. This will also lead to higher power consumption.

Data centres already account for about 1% of global energy demand . If that rises to say 5, or 10%, it’s going to put enormous pressure on electricity prices.

Operators are already investing in their own wind and solar generation - but that’s still intermittent. If demand rises to say 5 or 10% of total demand, that’s going to put pressure on baseload resources. All of this could make compute power too expensive for sustained adoption.

5️⃣ Job Will be Lost Before New Jobs Are Created

It’s generally accepted that artificial intelligence will (and is already) eliminate certain jobs while creating other, hopefully better, jobs. It’s likely that a large number of white-collar jobs that can be automated will be the first to go.

If that happens faster than new jobs are created, it's going to put pressure on consumer spending and the global economy. This could in turn slow adoption as corporates cut back on IT investment.

4 Arguments For: Nope, The Party’s Just Getting Started

Right, now let’s look at the bullish arguments that suggest that demand will continue to increase and justify valuations.

1️⃣ We Are On The Cusp Of Accelerating AI-Driven Economic Growth

One of the promises of AI is that it can kick off a new period of global growth. There are lots of ways this can happen.

- 📉 Operational efficiency will lead to lower costs and lower prices for consumers.

- This will give them more money to spend elsewhere, leading to bigger markets for everyone.

- 🤖 AI is also converging with other new technologies like automation and virtual reality

- This will help these technologies evolve, leading to even more new opportunities.

- ⏩ AI will also help new companies create and launch new products faster and with less capital.

- That means more, better-paying jobs, and even more consumer spending.

- 🔁 All of this can create a virtuous cycle of innovation, investment and spending.

- Technology is inherently deflationary, and where costs and barriers to entry reduce, opportunity and innovation increase.

This narrative for Adobe touches on some of the ways that AI can lead to larger addressable markets and more opportunities for innovation.

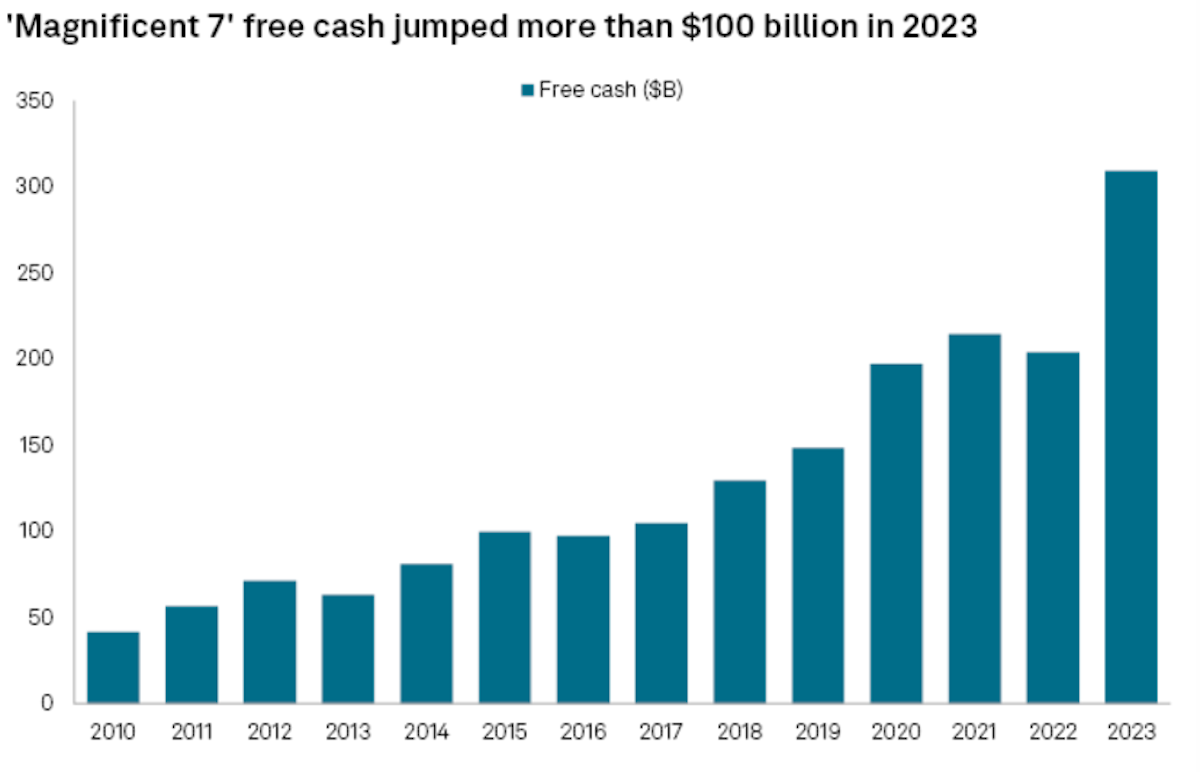

2️⃣ The Market Leaders Are Cash Flush

Goldman Sachs’ market strategist pointed out that the companies leading this phase of the investment cycle are very profitable and sitting on large cash piles .

✨ If these companies believe the demand will be there in the long term, they’ll continue to invest.

Goldman Sachs also believes we are still early in this stage of this investment cycle, implying that there’s more investment to come.

OpenAI ’s Sam Altman is trying to raise $7 trillion (ie. the value of Microsoft, Apple and most of Alphabet combined) to build a new AI chip business. If he manages to do that, it’s going to be many years before any chips are produced. But this does reflect the scale of demand people at the center of the industry are seeing.

3️⃣ Labor Shortages

Fundstrat’s Tom Lee pointed out that parts of the world are facing a major labor shortage, which can only be solved with AI and automation. He reckons the current demand for AI infrastructure is real because a real problem is being solved.

4️⃣ Corporates Have to Go All In on AI

For many companies, AI is both an opportunity and an existential crisis.

After 20 years of disruption, corporate leaders are compelled to make AI their priority. This means investment will continue even if the first few attempts fail.

AI Companies Are At Different Stages Of The Hype Cycle

The evolution of artificial intelligence is happening very quickly, and a lot can happen in the next few years.

There are quite a few risks, and if they become a reality, then yes this will probably turn out to be a bubble. But the fact that valuations are high and accompanied by hype doesn’t mean this is a bubble.

Another point to mention is that bubbles can continue for years - just because an industry is in bubble territory doesn’t mean it will burst tomorrow.

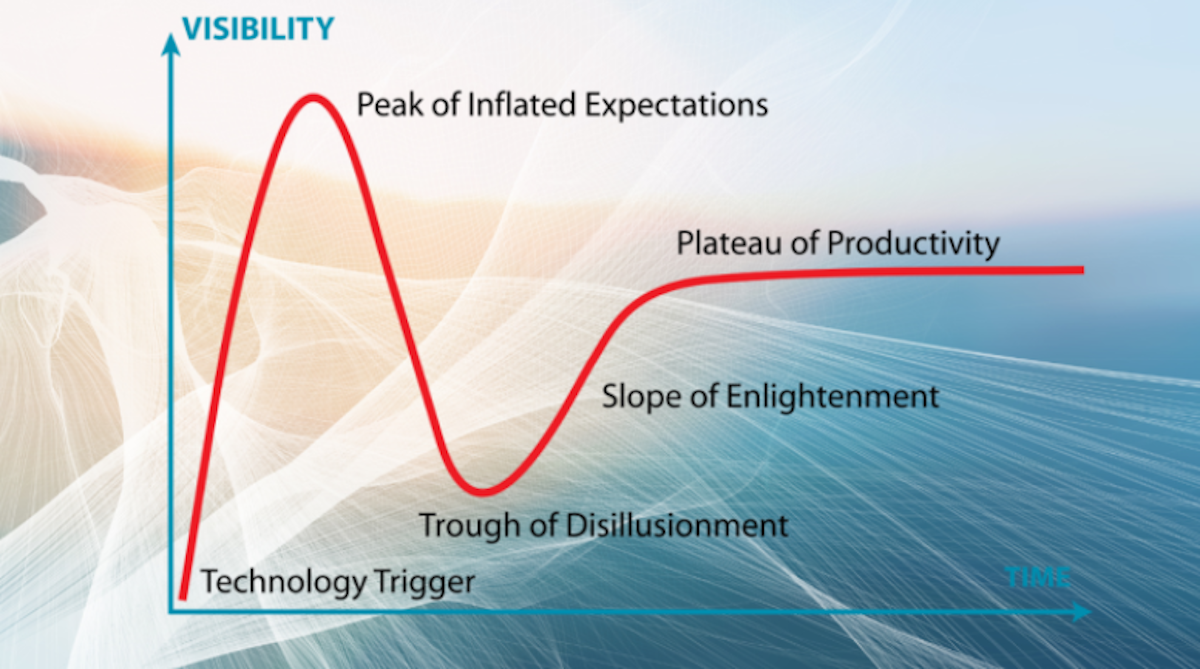

US consulting firm Gartner believes new innovation follows a similar hype cycle.

✨ They believe that generative AI is right at the peak of inflated expectations . When expectations are high, the risk of disappointing returns is also high. This probably applies to most of the companies closely associated with GenAI.

But expectations aren’t that high for companies further down the value chain. Next week, in part 2, we’ll take a look at some of the risks and opportunities across the AI value chain.

💡 The Insight: Building Exposure To AI Can Be Done Cautiously

In the spirit of diversification and irrespective of whether you think this is a bubble or an opportunity that has just begun, you may be considering gaining some exposure to the AI space.

That’s great! But as a word of warning: New technological breakthroughs have the ability to provide you with the opportunity for incredible returns if things go well, but if there is more show than substance, the losses could be ugly and potentially permanent.

So, the best way to gain exposure would be to do so cautiously. Here are some tips to help you on your way:

- 💸 Dollar Cost Averaging is your friend.

- Slowly investing a fixed amount into AI exposure over a long time frame is a great way to minimize the impact of the volatility that often comes with extremely hyped technology.

- It can also help reduce the emotional burden of investing - which is hard to put a price on. There’s no feeling of “missing the bus” or mistiming the market if you participate at a regular cadence.

- 👀 Look for value in the market

- We mentioned earlier in the article that the market’s expectations of growth for Nvidia outpace consensus estimates. The result of which is a sky-high share price and price-to-earnings ratio of 97.7x.

- This is not to say that the market is wrong, but there’s definitely more downside risk now that the valuation is so high.

- Perhaps there’s more value to be found further down the value chain. Companies like Nvidia and AMD are the backbone of AI, and they’re being priced as such. There may be more chances to find a diamond in the rough as you journey through the companies that are implementing AI to achieve greater profitability or even companies that haven’t implemented it but could massively benefit from doing so.

- 💰 Follow the money

- Particularly in the current economic climate, funding for projects isn’t easy to come by. As with a lot of tech, AI may only find success in pockets of the market where capital is freely accessible and cash balances are large. Companies journeying down the path of creating new models or hardware, without sufficient access to the capital to do so, could find themselves in strife down the line.

- ✨ Look for where the Magnificent Seven’s cash is flowing.

- Who are they partnered with?

- Who supplies them with the hardware?

- Are they developing their own AI or are they collaborating with someone else?

Key Events During the Next Week

There’s very little economic data out this week, so the main event will be Nvidia’s earnings, which are due on Wednesday after the close.

Tuesday

- Canada's inflation rate is expected to be 3.2% down slightly from the previous month’s 3.4%.

Wednesday

- Japan is expected to report a wider trade surplus at ¥50 billion vs. ¥62 billion.

- The minutes from the US Fed’s last FOMC meeting will be published in the evening.

Earnings season continues with the first of the retailers and a handful of UK companies amongst others:

- Nvidia

- HSBC

- Walmart

- Home Depot

- BHP

- Palo Alto Networks

- Barclays

- Rio Tinto

- Analog Devices

- Intuit

- MercadoLibre

- Medtronic

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.