What Happened in the Market Last Week?

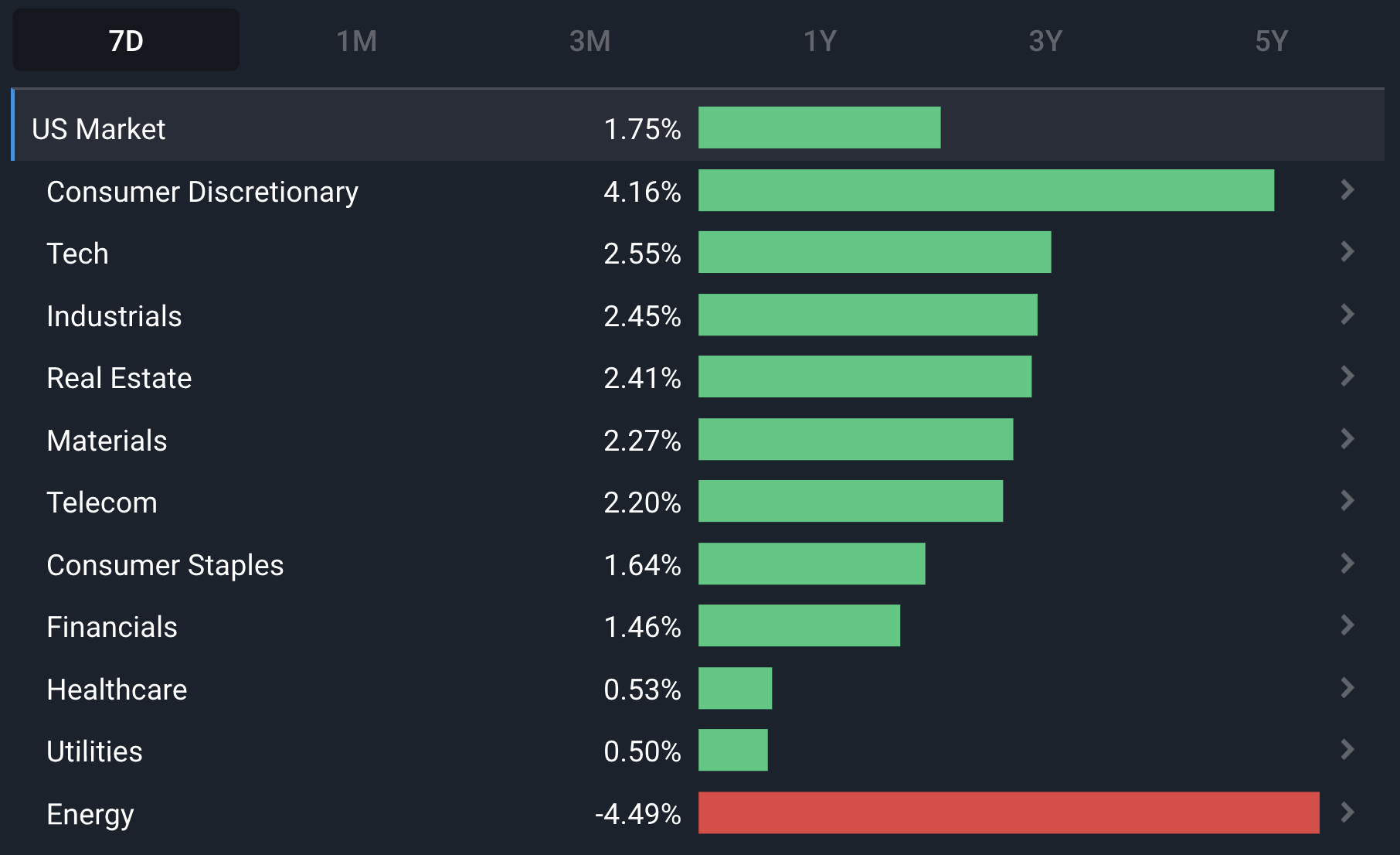

The US market experienced gains galore in the second half of the week after the Fed raised rates for the 8th time since March last year. The 0.25% increase was expected, and more rate hikes are likely coming, but investors chose to focus on particular comments like “the disinflationary process has started”.

As a result, stocks of all virtually all shapes and sizes ripped higher during and after the press conference (apart from US Energy stocks which tracked the oil price lower).

Some of the developments we have been watching over the last week include:

- 2023 got off to a strong start as risk appetite returned to global markets.

- It’s been 30 years since the world first ETF was launched and ETFs will soon account for more assets than mutual funds.

Risk Appetite Returns

Equity markets started the year with a bang. The S&P 500 (+6.3%) had its best monthly return since October and its best January since 2019. Most major indexes are now back above their 200-day moving averages, which is one gauge of being in a bull vs a bear market.

Around the world, ‘risk-on’ sectors and asset classes rose, while investors sold stocks in the defensive sectors that outperformed in 2022. Cyclical sectors also performed well as recession fears faded slightly.

The extent to which risk appetite has returned was illustrated by the returns of certain asset classes. The ARK Innovation ETF (NYSE:ARKK) which holds ‘hyper growth’ stocks was up 27% while the MSCI Emerging Markets Index rose 9%. Commodities and gold were also strong during the month.

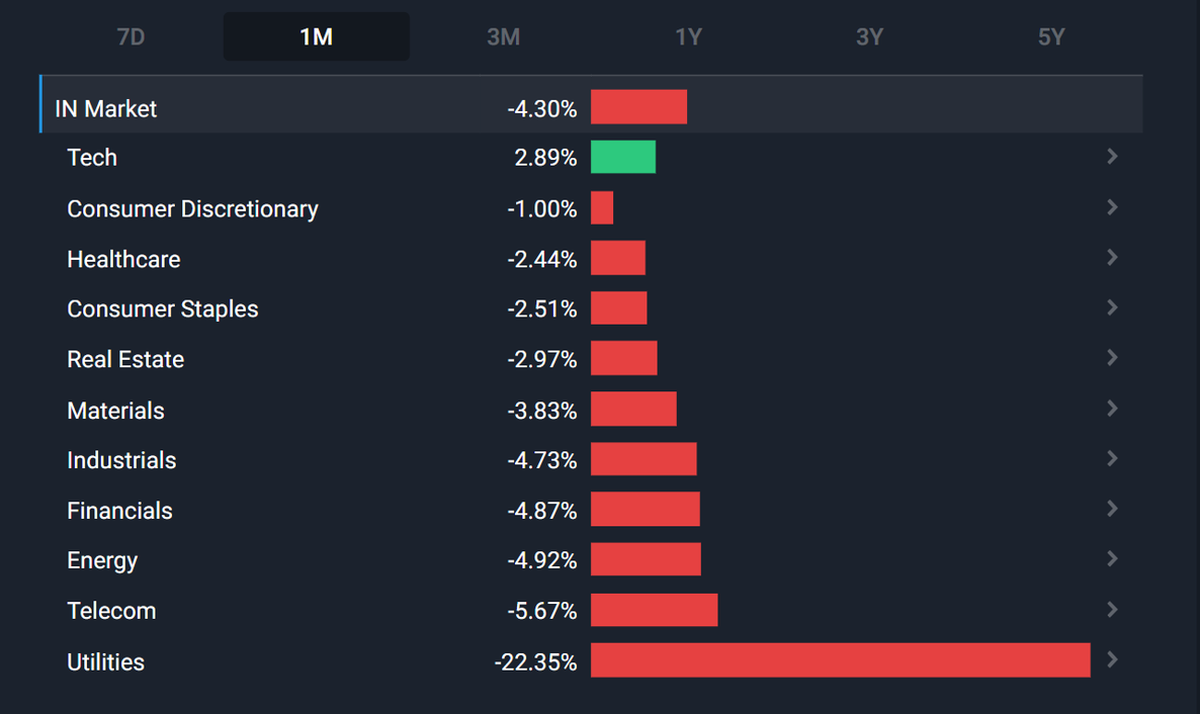

Are Investors rotating from India to China?

There were also signs of rotation between markets. India was one of the worst performing markets during January, while China’s stock market was up 7%.

India's stock market was one of the best performers in 2022, and is down just 2.6% over the last 12-months despite the selling in January. Meanwhile investors seem to be buying into the China recovery narrative we outlined last week.

What’s been driving this rally?

There has been some good news from various parts of the economy in the last month:

- Fed officials have expressed optimism about the outlook for inflation .

- US GDP grew by 2.9% in the last quarter of 2022 , which was slightly higher than expected. China’s economy has also shown tentative signs of a recovery.

- Employment data has been strong despite layoffs at prominent tech companies and some banks. In fact, Boeing (NYSE: BA) and Chipotle (NYSE: CMG) are now hiring.

- Earnings so far have been weaker than usual relative to consensus - but there haven't been really nasty surprises.

- The US housing market recovered slightly in December , with pending home sales rising for the first time in 14 months.

- Goldman Sachs chief global equity strategist said "fears of a recession in Europe have faded" as natural gas prices have fallen.

It appears that investors are beginning to believe that a soft landing is more likely and that interest rates won’t rise much more. Still, investors should understand that 'signs' of a recovery are merely indications of what could happen. There needs to be several quarters of material improvement before we can start calling a recovery. Take Australia as an example. Previous CPI reports indicated that inflation was slowing, however their latest inflation figures actually came in hotter than expected and was illustrative of an uptick in inflation again.

The Insight: Markets Don’t Move in a Straight Line

While the outlook is looking slightly better than previous forecasts, there are also technical reasons for this rally. Equity allocations were at historical lows in December which suggests those who wanted to sell had already done so. So it didn’t take a lot of buying to get the market moving. But towards the end of the month there seems to be an element of FOMO with very speculative stocks rallying for no apparent reason.

Markets do usually bottom ahead of the economy. So even if there is a mild recession, stocks could continue higher. If the outlook continues to improve investors might be happy to look beyond a mild recession.

There are still several risks though. Some analysts are expecting a second wave of inflation, and increased optimism may reinforce that. Consumers are a little stretched which may hit spending and corporate profits. And, that may result in a more severe recession.

It’s very likely that sentiment will oscillate between bullish and bearish over the next few months regardless of where things end up.

For Short or Medium-Term Investors (< 5 years)

In the short to medium term, the market may have gotten ahead of itself - so don’t be surprised if there’s at least a short term correction. As we mentioned recently, markets are entering a new regime so there will probably be a fair amount of back and forth sector rotation. Remember: be careful around the temptation to chase low quality stocks just because they are rallying.

You should also be wary of chasing stocks that have already rallied, period. Investors are prone to buying stocks that have already undergone a re-rate as FOMO kicks in. But a stock jumping in price has no guarantee of doing so again. In fact, it is probably less likely to jump again as the catalyst for the previous movement should be priced in.

For Long-Term Investors (5+ years)

Long term investors should focus more on individual companies than the macro picture. Companies with competitive advantages and good leadership teams figure things out as the environment changes.

In the short term most stock returns are highly correlated to the market. But over the long term returns are correlated to each company's earnings, and those depend on products, competitive advantages and management.

The US ETF Industry Turns 30 🥳

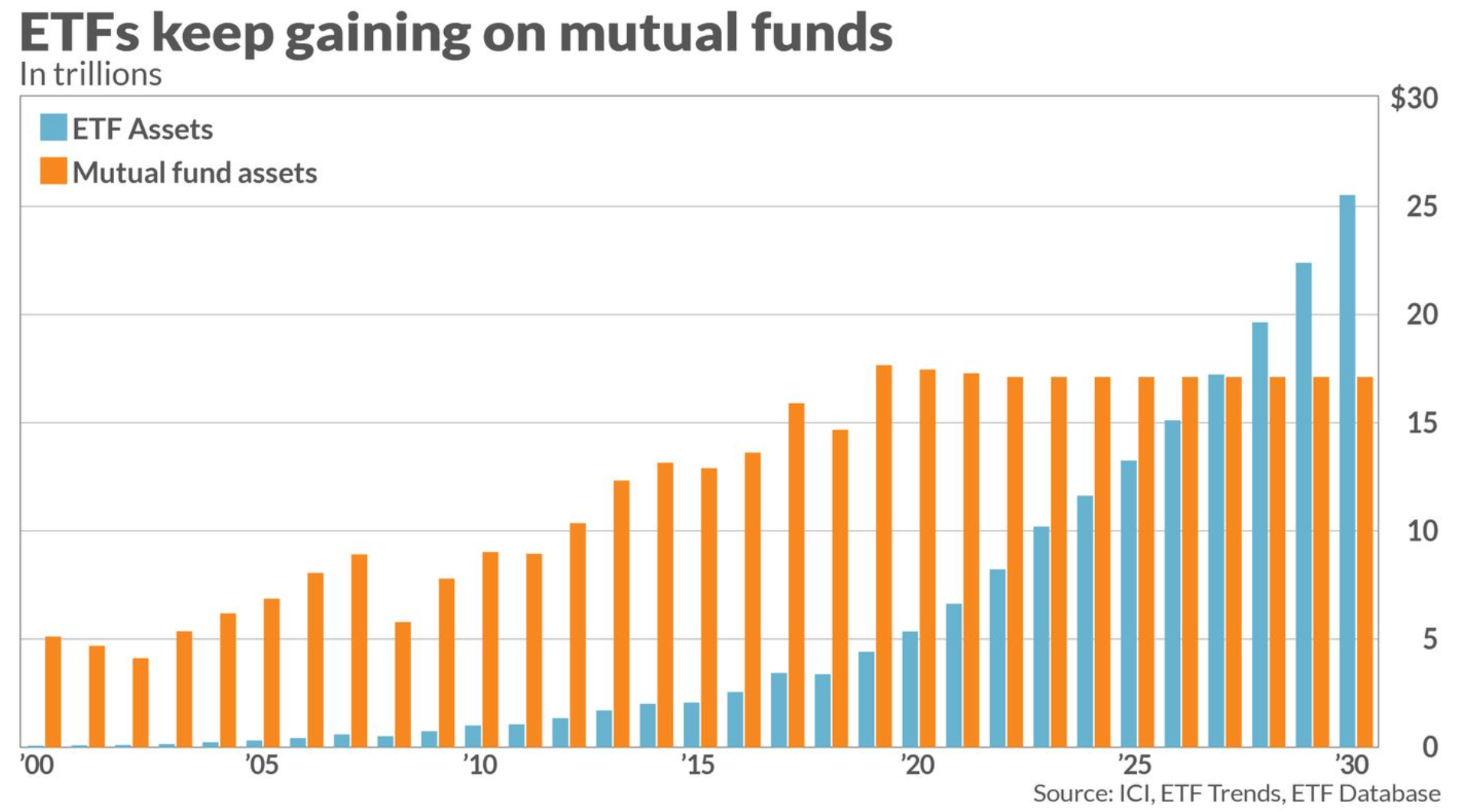

The 24th of January marked 30 years since the United States’ first ETF (exchange traded fund) was launched . The SPDR S&P 500 Trust (NYSE: SPY) was launched in 1993 and remains the largest ETF in the world ($374 bln) and the most actively traded index fund.

ETFs offer investors a low cost vehicle to either track almost any index, or invest in many investment “themes”. Since most mutual fund managers underperform their benchmarks, there is little reason to pay higher fees. Since 1993 ETFs have attracted the bulk of inflows at the expense of the mutual fund industry, as investors started to realise they’re often overpaying for underperformance.

This chart below from 2021 shows how much US ETF assets have grown relative to mutual funds, and are set to overtake them by around 2025. On a global basis this has likely already happened.

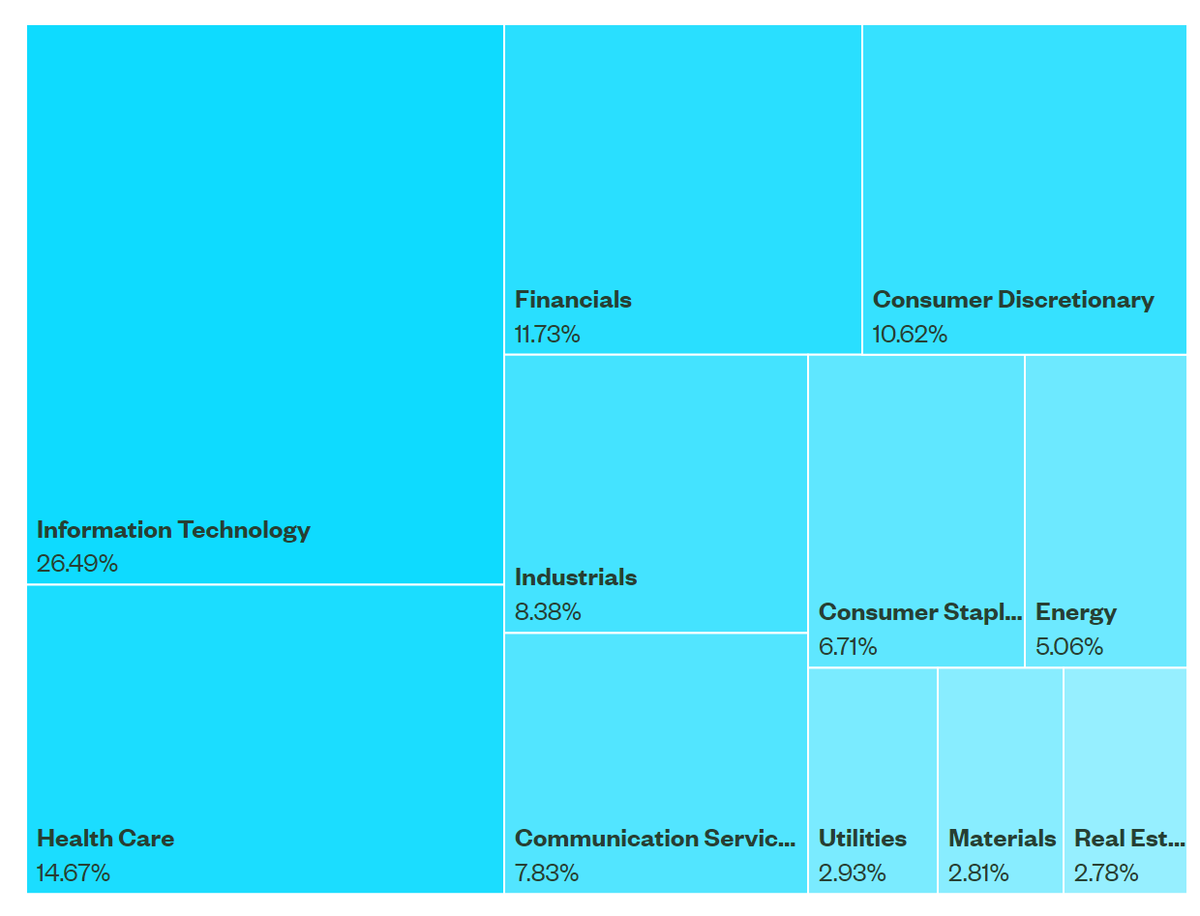

💡 The Insight: Some Indexes have Become very Concentrated in Mega Cap Stocks

It only takes a few multi-baggers in your portfolio to drive good long term performance. The decade from 2010 to 2020 was the era of technology growth stocks, and in particular the likes of Alphabet (Nasdaq:GOOGL) , Apple (Nasdaq: APPL) , Amazon (Nasdaq: AMZN) and Microsoft (Nasdaq: MSFT) performed incredibly well . As the value of these companies grew their weighting in the S&P 500 index increased and helped drive the strong performance.

The relative weight of the entire US Tech and US Communications sectors also increased within the index. Those two sectors now account for nearly 35% of the index.

What this means for investors

If you hold ETFs in your portfolio, make sure you are comfortable with sector concentration.

Broad market ETFs are a great way to hold a diversified portfolio of shares cheaply. You will earn the market return (net of the investment fees), but if you want to generate higher returns you’ll need to add individual stocks or more focussed ETFs or funds. However, it's worth being careful with ETFs that track a narrow theme.

Every time there’s a new ‘hot’ sector or industry, a range of ETFs are launched to cash in on investor FOMO. In the last decade we’ve seen ETFs for 3D printing, crypto companies, cannabis, EVs and every other ‘shiny new thing’. These often launch when sentiment peaks and then it's downhill all the way.

If you are interested in a particular industry, try and find the best companies in that industry, study them carefully and see if you can make a strong case to invest. That way you’ll know what you're buying (even if you choose the ETF option) and what needs to happen for your investment to be a success.

Key Events During the Next Week

It’s a very quiet week for economic data.

On Tuesday the Reserve Bank of Australia will announce its interest rate decision. Also on Tuesday, trade data will be released in Australia, Canada and the US.

On Friday the UK’s 4th quarter GDP growth rate and December’s manufacturing production numbers will be published.

Earnings season continues, with companies in several sectors reporting. Some of the companies reporting are:

- Pinterest (NYSE: PINS)

- BP (LSE: BP)

- Illumina (NYSE: ILMN)

- UBER (NYSE: UBER)

- Yum Brands (NYSE: YUM)

- Disney (NYSE: DIS)

- Robinhood (Nasdaq: HOOD)

- AbbVie (NYSE: ABBV)

- PayPal (Nasdaq: PYPL)

- Lyft (NYSE: LYFT)

- Cloudflare (NYSE: NET)

- Enbridge (NYSE: ENB)

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.