What Happened in the Market Last Week?

Markets went through a lot last week. From historic banking takeovers, and wild swings in the treasury bond market, to comments from Jerome Powell and Janet Yellen and plenty more, markets went in all sorts of different directions as it digested the developments.

The week started with a relief rally after UBS agreed to buy Credit Suisse, but share prices reversed after the Fed’s rate decision was announced and Janet Yellen played down “blanket” deposit guarantees .

The Fed Fund rate was raised by 0.25% as expected - but Jerome Powell also said “financial conditions have tightened more than the market shows”. He also said rates may continue to rise and rejected the idea of a rate cut this year.

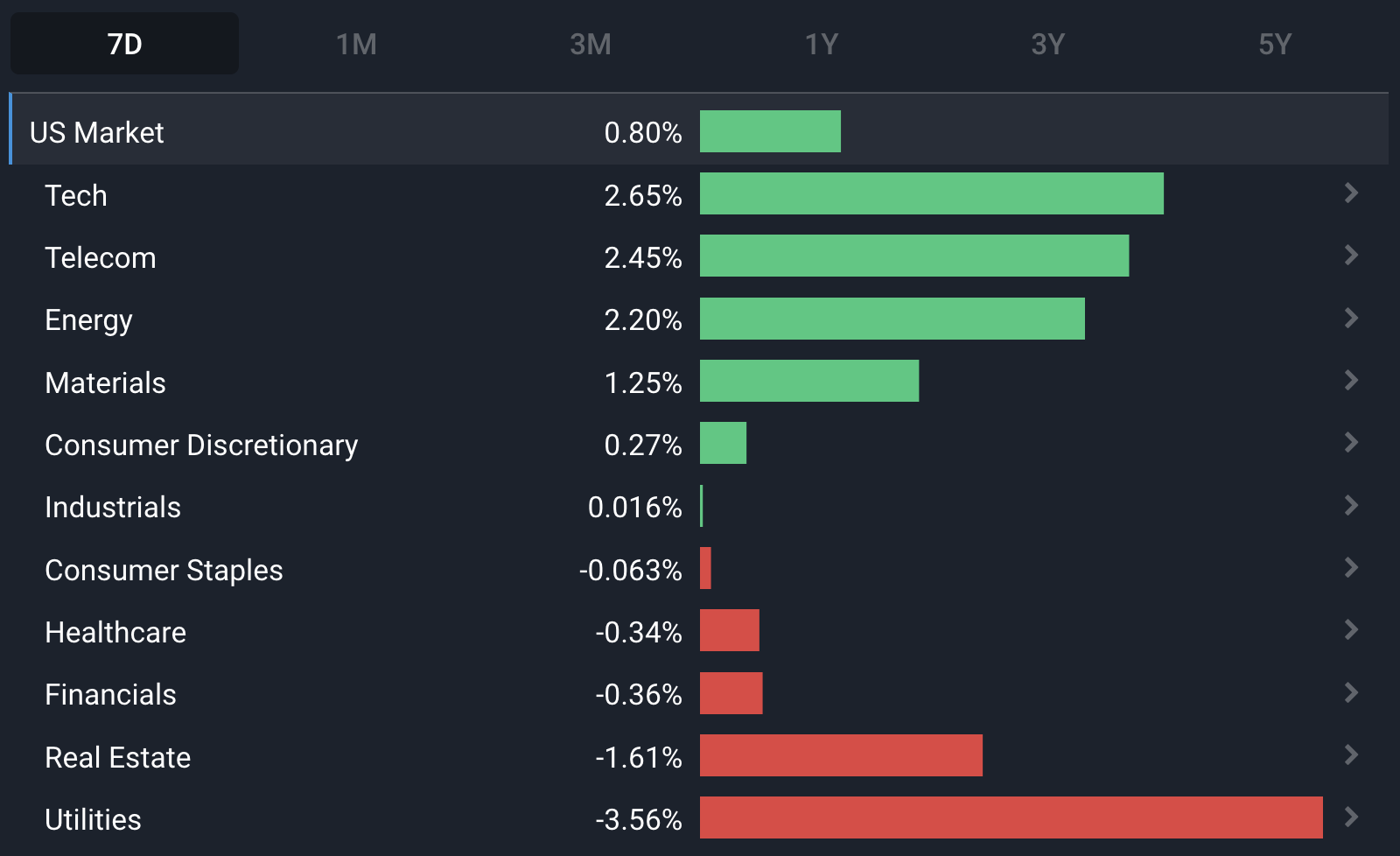

The US Energy sector was stronger after the oil price rebounded from a 15 month low, meanwhile the US Utilities sector declined the most. US Real Estate stocks retreated as investors have become cautious about the effect of tighter financial conditions on the commercial property market.

Some of the developments we have been watching over the last week include:

- UBS agreed to buy Credit Suisse which was on the verge of collapse.

- Fourth Quarter Earnings season is over - we had a look at the key takeaways.

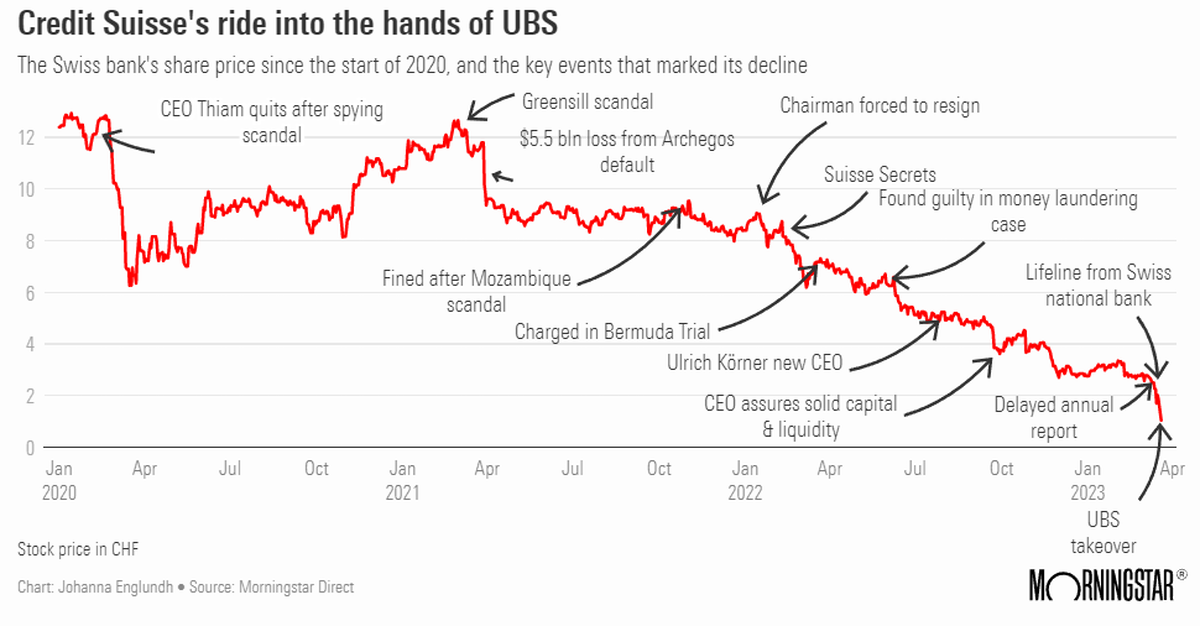

Credit Suisse Has Been Quite Sus For Decades

Last week Switzerland's biggest bank, UBS (SWX:UBSG), agreed to acquire its second biggest bank, Credit Suisse (SWX:CSGN), which was on the verge of collapse after failing to raise enough capital to shore up its balance sheet.

This deal was arranged by the Swiss National Bank to prevent further panic and contagion in the financial system - not just in Switzerland, but around the world. Unlike SVB, a lot of systemically important banks have exposure to Credit Suisse.

A Brief Timeline:

- Credit Suisse has been on shaky ground for a long time and never really recovered from the GFC in 2008 (its share price has been falling since 2007). It’s been the subject of scandals dating back to the 1980s and investors have always been rather skeptical about the bank.

- In 2021 the bank lost $5.5 billion when Archegos Capital Management collapsed and lost even more money when Greensill Capital collapsed.

- In September last year the share price fell 30% when UK and European bond yields rose . The bank announced a restructuring plan and raised $4 billion in new capital with Saudi National Bank buying 9.9% of the bank.

- Over the course of the last month, Credit Suisse announced massive outflows and its largest annual loss since 2008. It also delayed publishing its annual report, and then said there was material weakness in its balance sheet. Essentially it was losing deposits and assets under management, while the value of its assets (bonds and loans) fell as yields rose.

- Adding fuel to the fire, the Saudi National Bank said it would not inject more capital into the bank. Of course this all happened during the week after Silicon Valley Bank collapsed and investors fled from banking stocks.

- On Friday 16th March, the Swiss National Bank agreed to lend the bank 54 billion Swiss Francs. When it became apparent that this wouldn’t be enough to save it, the Swiss central bank brokered a deal with UBS Bank buying Credit Suisse.

UBS is buying Credit Suisse for $3.2 billion, but also taking on losses of $5.4 billion. The central bank is also making up to 100 billion francs in liquidity available and guaranteeing around $10 billion in potential losses.

Shareholders will receive CHF 0.76 a share, which is about 70% lower than the share price at the beginning of the month, and 99% below the 2007 peak - not much, but better than nothing.

Some Credit Suisse Bondholders Weren’t as “Lucky”

Typically when a company is acquired or liquidated, shareholders are only paid after creditors and bondholders. In this case, $17 billion of Credit Suisse’s AT1 bonds will be written off. This condition of the deal was dictated by Swiss regulators and has triggered a lawsuit from bondholders .

How the legal process plays out remains to be seen, but AT1 bonds are supposed to be the riskiest tranche of a bank’s bonds. They were introduced after the GFC to transfer risk from taxpayers to investors - but this is the first time their place in the pecking order has been tested. Investors that own similar bonds issued by other European banks are now questioning their value.

💡 The Insight: There's Pros and Cons To The UBS Takeover

- The near collapse of Credit Suisse had as much to do with sentiment and confidence as solvency. Investors were nervous about the entire banking sector, and specifically about Credit Suisse due to its reputation.

- UBS has bought a bank with some good assets (in particular some of the asset and wealth management business) - but it may end up with a lot of toxic loans too. Whether those loans are paid back will probably depend on where interest rates and the economy go from here.

- Switzerland now has one very large investment bank, which isn’t ideal. Just as the collapse of SVB led depositors to rush to the largest US banks, this crisis has resulted in more concentration in the banking sector.

- Investors are understandably (again) comparing this to the collapse of Lehman Brothers and the GFC. But there are two key differences:

- Firstly, regulators and central banks have acted very quickly to prevent contagion. It’s likely that they will continue to step in to prevent any systemically important banks from collapsing. This will go a long way to restoring confidence.

- Capital adequacy requirements have been improved since the GFC and most banks are much better capitalized than they were in 2008.

Key Takaways from Earnings Season

Earnings season has been overshadowed by the banking crisis in the US and Switzerland - but there were a few takeaways worth noting.

As of 17 March, with 498 of the S&P 500 company reports for the fourth quarter out, Refinitiv expected earnings to be down 3.2%, and revenue up 5.8%. The energy sector might be getting sore back by now because it carried the index again. If you exclude the energy sector, earnings were down 7.7% for the index. The industrial sector also performed well with earnings up 42%.

The biggest earnings declines came in the Telecom sector (dragged down by Meta (Nasdaq:META) and Alphabet (Nasdaq:GOOGL), Materials and Consumer discretionary stocks.

The Energy, Industrials, Utilities, and Consumer discretionary sectors reported double digit increases in revenue. The only sectors that actually reported lower sales were Materials (-4.6%) and Technology (-1.6%).

It was interesting to see which sectors outperformed and underperformed relative to consensus estimates.

Revenue surprises:

- Highest percentage of positive revenue surprises : Utilities, consumer staples, and health care

- Highest percentage of negative revenue surprises : Telecom, materials, and energy

Earnings per Share surprises:

- Highest percentage of positive EPS surprises : Healthcare, tech, and industrials

- Highest percentage of negative EPS surprises : Telecom, materials, and real estate

What Does This Tell Us?

- The three most defensive sectors continued to outperform and did even better than expected on sales.

- Sales at telecom companies ( including Meta (Nasdaq:META) and Alphabet (Nasdaq:GOOGL) remained under pressure and missed forecasts that had already been slashed.

- Analysts overestimated revenue for energy and commodity producers. They knew energy prices fell, but must have overestimated volumes.

- The technology sector seems to have stabilized in terms of earnings.

First Quarter and Full Year 2023 Expectations

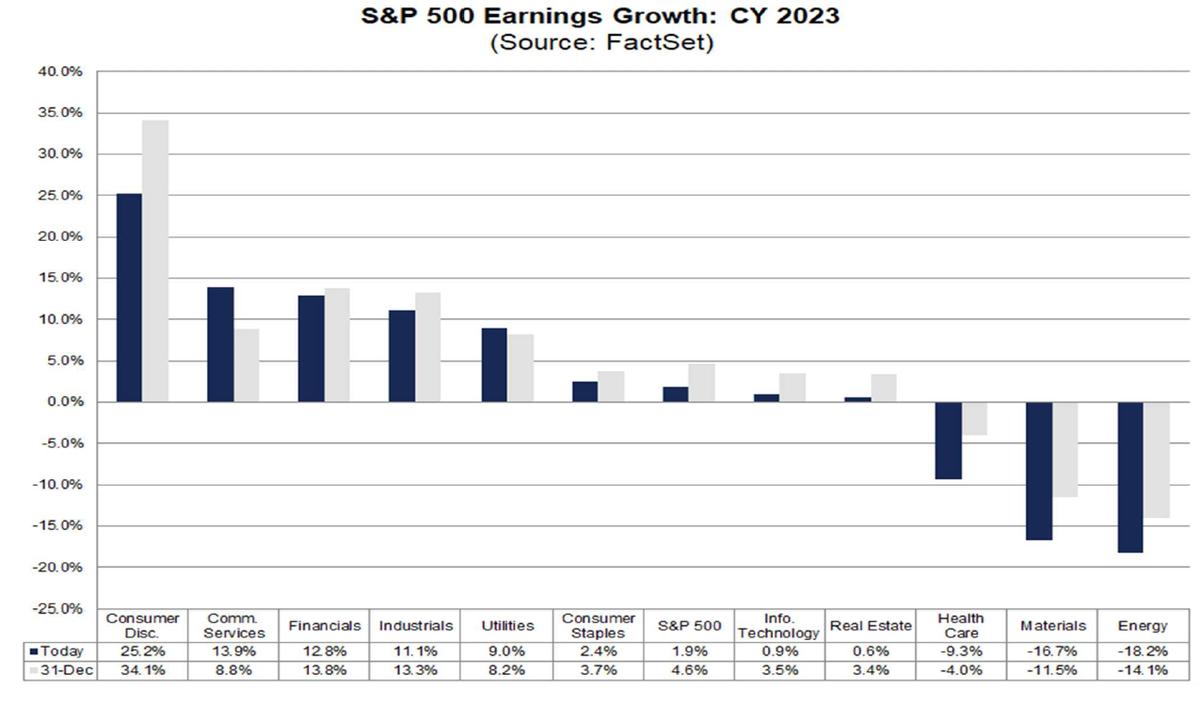

EPS CY23 Growth Forecasts for S&P 500 Sectors - Image Credit: FactSet

While companies were reporting fourth quarter results, analysts were trimming their growth estimates for the first quarter and the 2023 calendar year. Growth rates for S&P 500 EPS fell from -0.3% to -6.1% for the first quarter and from +4.6% to 1.9% for the full year. These are significant revisions - but you wouldn't think so given the performance of the market during that period.

As it stands analysts are still expecting EPS growth from eight sectors (with two just about flat) and EPS to fall for the healthcare, materials and energy sectors.

💡 The Insight: Once Again Analysts Are Taking It One Quarter At A Time

For the last few quarters, analysts have been waiting for results to come out before revising their forecasts for the next quarter and the next 12 months. This reflects the current level of uncertainty and how little analysts have to go on to make long term forecasts.

What This Means For Investors

With earnings estimates changing so much from one quarter to the next, it’s not worth reading too much into forecasts for the following quarters. In this environment, the best you can do is focus on how well a company is executing on its strategy and be conservative with valuations relative to historical performance.

Key Events During the Next Week

This week attention will turn to Europe where employment, inflation and consumer confidence data will be published throughout the week.

In the US, personal income and savings rates and the PCE price index will be published on Friday.

The notable companies reporting this week are:

- Carnival Corp (NYSE:CCL)

- Walgreens Boots Alliance (Nasdaq:WBA)

- Lululemon (Nasdaq:LULU)

- Micron Technology (Nasdaq:MU)

- Skillz (NYSE:SKLZ)

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. Any comments below from SWS employees are their opinions only, should not be taken as financial advice and may not represent the views of Simply Wall St. Unless otherwise advised, SWS employees providing commentary do not own a position in any company mentioned in the article or in their comments.We provide analysis based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.