Investors Are Betting Against The Fed... Again

Reviewed by Bailey Pemberton, Michael Paige

What Happened in the Market Last Week?

🎧 Prefer to listen to these insights? Check out our Spotify!

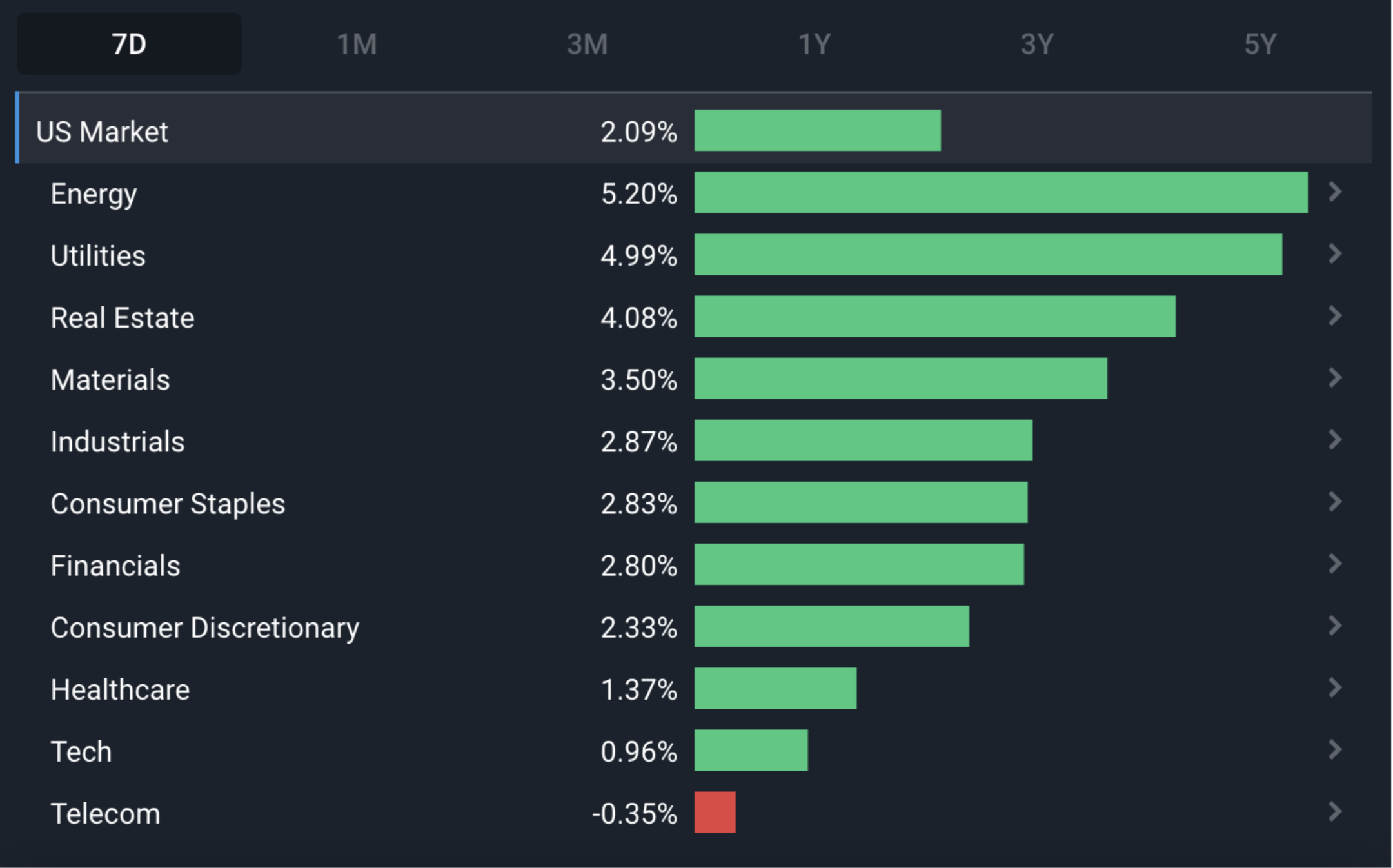

Equity markets rebounded last week as fears of a financial crisis subsided.

US Energy and Materials stocks once again tracked the oil price higher, and Financials continued to recover from oversold levels. The lagging sectors were Healthcare , Tech and Telecoms which had outperformed over the previous two weeks.

This week we are having a look at where things stand as we head into the second quarter:

- While valuations for most markets are still below average, the US and China are notable exceptions.

- Indexes have held up quite well over the last few weeks, but risk appetite has actually fallen significantly.

- The market is (again) betting on a Fed Pivot - or is it?

Market Valuations and Growth Forecasts

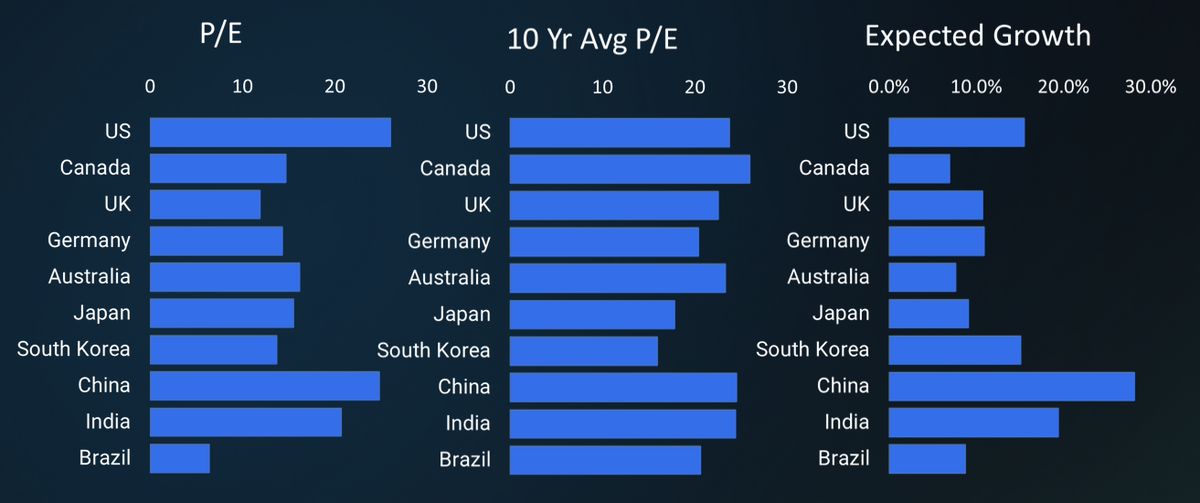

After the events of the last few weeks, we thought it would be worth taking stock of where things stand with regard to equity valuations. The image below reflects the price-earnings (P/E) ratios for 10 major markets, as well as the 10-year average P/E ratio and the expected EPS growth rates over the next few years.

For most markets, P/E ratios are still well below their 10-year average. The two exceptions are the US and China - but that makes sense since those markets have higher earnings growth forecasts than the rest. Investors pay up for growth.

These are the averages for each market, but within each market, valuations and forecasts vary widely. You can drill down to the sector and industry level for each country on the Simply Wall St Markets page .

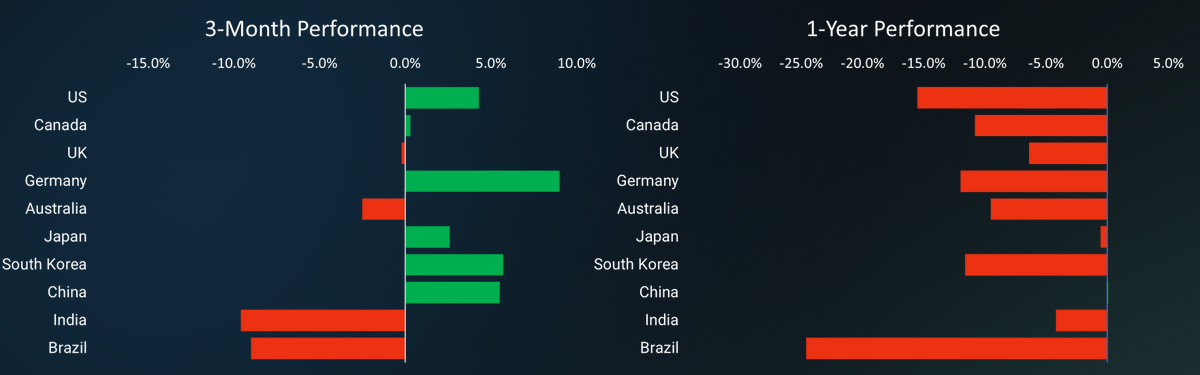

Looking at performance over the last 3 months and 12 months, it’s interesting to see that countries with significant exposure to tech and telecom companies were some of the worst performers over 12 months, and then regained the most ground over the last 3 months.

However, weak commodity prices have weighed on commodity producers like Canada, Australia and Brazil.

In most countries, the top performing sectors over the last few months have been the same, namely: technology, telecom, consumer discretionary, utilities and industrials .

However, the lagging sectors vary considerably from one country to the next.

💡 The Insight: Forecasts Change As The Facts Change

We mentioned last week that earnings forecasts have continued to fall each quarter. The forecasts above are for the longer term, but they will also have to come down if the earnings recession continues. Equity prices will be at risk if valuations are high AND forecasts continue to fall.

So as new information arises about companies' earnings, and the macroeconomic environment continues to develop, expect these valuations and growth forecasts to adjust accordingly.

A key thing to keep in mind is that it’s very hard to make investments off macroeconomic predictions (which we don’t endorse), so focusing on a specific company’s future prospects can be a somewhat easier endeavour because there are fewer moving parts.

Is The Market In ‘Risk On’ or ‘Risk Off’ Mode?

With sectors associated with growth (tech and consumer discretionary) leading the upside, it looks like investors are either expecting rate cuts very soon, or a fairly rosy outlook for the economy. On the other hand, some defensive and safe haven assets including gold, bonds and utilities stocks have also performed well.

Callie Cox at eToro summed it up well, saying 'Defense looks different these days.'

If we dive a bit deeper into the top-performing sectors, it's actually the large, well capitalized companies with strong cash flows that are leading. And since many of those are the index heavyweights they have dragged the sectors higher. In effect, companies like Microsoft ( Nasdaq:MSFT ) and Apple ( Nasdaq:APPL ) have become defensive stocks, though they are also growth stocks. At the same time some of the large caps that were sold heavily last year have bounced back too - Meta ( Nasdaq:META ) being a good example.

The financial and real estate sectors have lagged because of two banking crises and rising rates, while energy and materials stocks have been dragged down by falling commodity prices.

But other ‘risk on’ assets have also underperformed since January, namely small caps, emerging market stocks, and high-yield bonds.

💡 The Insight: Risk Appetite Has Disappeared Faster Than It May Seem

Earlier in the year we noted that risk appetite had returned to global markets as investors rotated into sectors that had underperformed, but said sentiment could oscillate between bullish and bearish for a while. Since then headline indexes have fallen only slightly - but really there has been a lot of rotation into more defensive assets.

What This Means For Investors

With growth sectors performing relatively well there is a danger that lower quality, or riskier stocks (and other assets) will get caught up in the momentum. If you are considering these stocks make sure they are well capitalized and likely to be cash flow positive soon. As to whether Bitcoin is now a safe haven asset or a speculative risk asset, that’s a question we will leave to others to answer.

The Market Is Betting Against The Fed… Again!

Since the banking crisis started, bond yields have fallen sharply, despite the Fed going ahead and raising rates by 0.25% on the 23rd of March. With the Fed fund target rate currently at 4.75 to 5%, 1-year treasury yields are now at 4.6%, having fallen as low as 4.15%.

The chart below shows the yield on one-year treasuries (in red) crossing below the fed funds rate (in blue) for the first time this cycle.

Investors buying these bonds will earn 4.6% over the next 12 months, despite short-term rates being higher. This implies that investors believe the average short-term rate will be lower over the next 12 months.

The Fed disagrees with that. When the recent 0.25% rate hike was announced, Jerome Powell rejected the idea of rate cuts this year and said they might need to raise rates further. Projections from the Fed’s monetary policy committee are still suggesting one more 0.25% hike this year, with rates then falling around 0.5% by the end of 2024 . Only one member of the 18-person committee doesn’t foresee another rate hike this year.

BlackRock’s research team also think the market has it wrong. Their argument is that while central bank’s would typically cut rates to prevent a recession, the Fed is prepared to cause a recession if that’s what it takes to bring inflation under control.

One thing that would probably cause the Fed to cut rates is a more serious financial crisis or a very severe recession.

💡 The Insight: This Is A Defensive Move Too

There’s no doubt that a lot of investors are once again anticipating a ‘Fed Pivot.’ In fact, a Google search for the term ‘Fed Pivot’ brings up thousands of results. But the sudden decline in bond yields is also the result of investors moving to the safety of short-dated bonds. Money has to go somewhere, and if cash means a bank deposit, government bonds seem like a safer bet. While some investors may be betting on lower rates, others are simply looking for a safe haven.

What Does This Mean For The Next Quarter?

At some point, those expecting rates to start falling this year will be proved either right or wrong. The Fed Funds futures market currently sees that being in July , but it could be sooner or later. Either way, it will probably lead to another round of volatility and more sector rotation as the market interprets the implications.

What you as an investor can do is be conservative in your estimations.

If you’re relying on rates falling say 2% for your valuation of a company to look appealing, you’re setting yourself up for a bad time if rates don’t fall. However, if your estimated valuation of a company still looks appealing with rates remaining where they are, or even going slightly higher, then you’ve built in a buffer where rates could elevate, or drop, and your probability of doing well is higher! (all else being equal).

So do your best to be conservative in your estimates in order to avoid succumbing to fear or greed, and increase your chances of performing well.

Key Events During the Next Week

This week the focus will be on US employment data and what that means for interest rates and the likelihood of a recession. The now widely followed, JOLTS Job Openings is out on Tuesday, the ADP employment report on Wednesday and Non-Farm Payrolls on Friday.

There’s also trade data being released for a few economies: Germany on Tuesday, the US and Canada on Wednesday, and Australia on Thursday. On Tuesday the RBA will also announce its interest rate decision.

Heading into Easter it’s one of the quietest weeks of the year for quarterly earnings. Only three well-known companies are reporting in the US:

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.