Quote of the Week: “Most of the value comes from the value that others place in it. Gold, for instance, is pretty, non-corrosive, and easily malleable, but most of its value is clearly not from that. Brass is shiny and similar in color. The vast majority of gold sits unused in vaults, owned by governments that could care less about its prettiness.” - Satoshi Nakamoto

Happy $100k Bitcoin to all those who celebrate. Bitcoin has been in the news again for a few reasons:

- Firstly, it just passed the milestone of $100k USD per coin last week, though it did pull back shortly after.

- Secondly, the incoming administration has talked about a Bitcoin strategic reserve, and

- Thirdly, more companies are discussing the idea of adopting it as a treasury reserve asset.

- Lastly, the ETFs are reporting growing inflows and AUM.

This week, we wanted to discuss some of those news items, what institutional and corporate adoption of Bitcoin would mean for the commodity, and those stocks exposed to it.

🎧 Would you prefer to listen to these insights? You can find the audio version on our Spotify, Apple Podcasts or YouTube!

What Happened in Markets this Week?

Here’s a quick summary of what’s been going on:

-

⚡ Meta to invest $10 billion in new AI data center and in renewable energy to power it ( ABC )

- What’s our take?

- Good news for nuclear - and for solar and wind, which can be brought online faster.

- Meta’s new data center in Louisiana will be a mile long, and use several gigawatts of power. Meta has already committed to invest $200 million to ensure the water and road infrastructure can support the facility.

- Local utility Entergy has committed to increase generation from gas-fired plants to meet the power demands. However, Meta also aims to deliver enough renewable energy to the grid to offset its consumption. Meta is seeking proposals from nuclear developers for 1 to 4 GW of power by 2030 .

- That doesn’t mean Meta has stopped investing in other forms of clean energy, but nuclear projects have a much longer lead time. If data center power demand increases faster than nuclear projects come online, there could be more opportunities for renewable developers.

- What’s our take?

-

🤖 Salesforce jumps as investors focus on AI agent despite earnings miss ( Barrons )

- What’s our take?

- Is this the first big AI app?

- Salesforce’s earnings were below consensus estimates, but the stock price jumped 10%. Investors were excited by the promise of its new Agentforce product. We mentioned in our recent recap on AI that the first big AI app could be an AI agent, and Salesforce is one company going big on agents. The market seems to agree, but it is very early.

- Agentforce was only launched in late October, just before the end of Q3 for Salesforce, but five weeks before the earnings call. Marc Benioff said 200 deals have been signed, and the pipeline was looking good. We will only really know what that means for revenue in the next one or two quarters.

- What’s our take?

-

🏈 Robinhood considering a move into sports betting ( CNBC )

- What’s our take?

- Speculation is very profitable - for the platforms it happens on.

- Robinhood followed the speculative activity from crypto to meme stocks and then same-day options. Sports betting seems to be a logical next step.

- The potential for big payouts makes it easier to build margin into prices of derivatives, and probably on betting odds too. A move into sports betting could be profitable for shareholders, though possibly not for customers.

- For customers, at least sports betting can’t be confused with investing - unlike meme stocks and options. As always, the odds are stacked in the house’s favor.

- What’s our take?

-

🇨🇳 China bans exports of strategic metals ( Reuters )

- What’s our take?

- Didn’t China do that a year ago?

- In August 2023 China severely restricted the export of Germanium, Gallium, and Antimony. At the time, this was interpreted as a ban - but this time it’s for real. This move isn’t actually a reaction to Trump’s tariffs but to the Biden administration’s latest curb on chip sales to China.

- These metals are actually quite abundant and can be produced in quite a few countries. But China is the low-cost provider, so that’s where it's typically sourced.

- Production can be ramped up elsewhere, but it might take a while, which could lead to delays for manufacturers. This wasn’t a huge surprise, so most have probably built up some inventory, but we will probably hear more about potential bottlenecks in the next few months.

- What’s our take?

-

🚗 GM takes more than $5bn charge against China businesses ( FT )

- What’s our take?

- Like Buffett says, “The auto industry is just too tough.”

- Most automakers, including manufacturers of electric and combustion vehicles, are having a hard time at the moment. General Motors US business has been a bright spot recently, with robust SUV sales and EVs now breaking even.

- Over in China, things aren’t going quite as well. Sales at GM’s joint venture with SAIC are down 59% in the last year as competitors like BYD have managed to sell cheaper vehicles. GM is writing down the value of its JV’s by $2.6 billion, and taking a similar restructuring charge. These are both non-cash charges but will affect net income.

- On the positive side, GM will have less exposure to China’s market, which is becoming ridiculously competitive.

- What’s our take?

-

🇫🇷 France’s PM Resigns after no-confidence vote ( le Monde )

- What’s our take?

- Political gridlock is unlikely to fix sluggish growth.

- France’s Prime Minister Michel Barnier resigned after losing the no-confidence vote. His government lasted exactly three months, and seemed to echo Liz Truss’s disastrous spell as UK PM.

- Mohamed A. El-Erian pointed out that it’s quite different. Liz Truss worsened a ‘bad budgetary situation’ at a time of global financial uncertainty, while Barnier was trying to fix a bad budgetary situation. Europe is also in a stronger position than it was at the time of the 2012 debt crisis.

- Still, France is struggling with slow growth and a wide budget deficit. It now looks like Parliament will be gridlocked for the foreseeable future, so don’t expect to see a solution anytime soon.

- What’s our take?

Now let’s dive into the main piece.

👀 The Renewed Interest In Bitcoin

It’s fascinating how much can change in 12 months.

This time last year, the news around Bitcoin was about the ETFs possibly being approved early in 2024, and the block reward halving in April.

Now, besides the new all-time high being reached last week, the news revolves around a possible US strategic Bitcoin reserve, possible further adoption from companies as a balance sheet asset, and record-breaking inflows into the ETFs.

The Bitcoin bulls seem pretty happy about it all, so let’s go through each story briefly, and then discuss what these trends could mean for Bitcoin and the stocks exposed.

But before we do, it’s worth briefly mentioning the high-level narrative that the Bitcoin bulls believe (and we’ll cover the bearish narrative later).

🐂 What Is The Bullish Narrative Behind Bitcoin?

The main premise of the argument from the Bitcoin bulls lies in the belief that it is a better store of value than alternatives, and that currency debasement will continue.

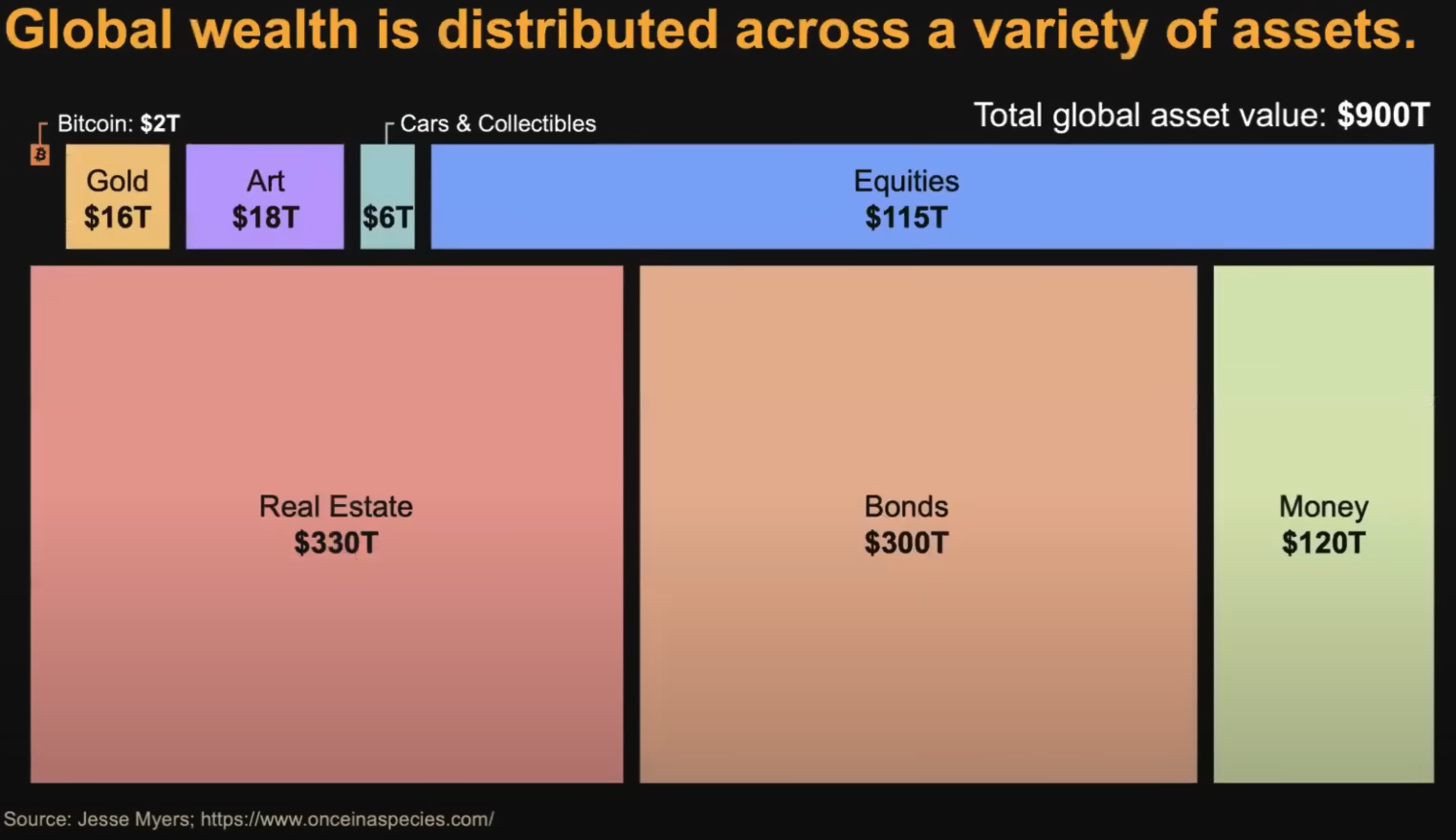

Estimates are that there is $900trn in global wealth, spread across real estate, equities, bonds, money, art, cars, collectibles, and gold. Some of that value is the utility of those assets (living in a home, dividends from a stock, gold used in industrial cases, etc.), and the remainder of the value is a monetary premium .

The thinking is that the “monetary premium” baked into their value is above and beyond their utility value. And that premium has only accrued because investors bought these assets more and more over time in an attempt to outpace inflation and maintain their purchasing power over time.

✨ Some bullish estimates would say that half of that value, or $450trn, is simply a monetary premium. If that’s the case, then their thinking is that Bitcoin could grow to that value, or more, given the belief that it is a better long-term store of value than those other ones (More durable, more portable, more divisible, more scarce, etc).

As a "store of value”, these assets each have their pros and cons. Bitcoiners believe that if you’re simply looking to maintain and or grow your purchasing power over time, then Bitcoin serves as a good vehicle to do that.

As for the currency debasement argument, that is simply referring to the belief that many governments will need to continue to print money to afford their growing deficits and debt levels.

By that notion, more money would be in circulation, inflation would continue, and scarce assets would appreciate in price, because the thing they’re being valued in is becoming worth less over time.

If you believe all that, then you’re probably bullish on Bitcoin too. We’ll cover the bearish narrative and risks later on once we’ve covered the news stories.

Let’s get into what the US government's strategic reserve could mean for US treasuries.

🏛️ Would The US build A Strategic Bitcoin Reserve?

At the 2024 Bitcoin Conference, President-elect Donald Trump gave a speech where, among many things, he promised to establish a US strategic Bitcoin reserve.

Just like the US’s gold reserves at Fort Knox, or its oil stockpiles at the 4 major SPR (strategic petroleum reserve) locations around the country, a Bitcoin strategic reserve would be set up in a similar way, if approved of course.

The idea came from Senator Cynthia Lummis, a Republican from Wyoming and Bitcoiner, who proposed a piece of legislation called the Bitcoin Act . The bill aims to improve the national economy and address the growing national debt.

What’s the goal? Accumulate 1m Bitcoin over the next 5 years, hold the Bitcoin for at least 20 years, and then use it only to pay off the national debt.

We don’t have too many more details to go off, but that’s the general premise of the act. Considering that the US government already owns an estimated 200,000 seized BTC, they have about 800k left to buy over 5 years.

Just FYI, the chart above was from April this year, so the values are probably about 60% higher, and Germany no longer owns any Bitcoin after it finished selling its seized Bitcoin on July 12th.

✨ The Bitcoin strategic reserve plan will only work well if the bullish narrative on Bitcoin plays out. So, whether that is a smart move or not, will depend on what happens to the price of Bitcoin over the next 20 years.

As a thought experiment though, if the US government managed to buy the remaining 800k Bitcoin at $100k per coin (price subject to volatility of course), then it would spend $80bn, on top of the $20bn already owned. If that $100bn appreciates at say 30% per year for 20 years, which some people expect, then it would reach $19trn, which is great.

But, while the deficit is currently at $36trn, and growing, in this scenario, it would only pay off about half of the current debt.

That’s still much better than nothing, but unless government expenses are reduced or income increases significantly, that $36trn debt balance is likely to keep growing, so in that scenario, it would be less than half the balance.

The prospect of Bitcoin becoming a reserve asset could also cause some concern for US leaders. If it does, and the world piles into it, would it undermine the USD and US treasuries?

Well, there are two ways to look at it.

If Bitcoin becomes more attractive than treasuries, demand for treasuries could fall, and yields would rise. That would make it more expensive to fund the deficit.

Alternatively, if investors liked Bitcoin and wanted bond exposure to a country that held Bitcoin in reserve, they might view US treasuries as more attractive. In this case, demand may remain, yields on treasuries could stay flat or reduce, and that could help make the deficit more affordable.

This idea of a strategic Bitcoin reserve is not a sure thing yet, and it’s not without its drawbacks , such as possible seizure risk, and possible price manipulation.

Over the next few months, the price of Bitcoin is likely to be very sensitive to what Trump and others in the administration say and do with regard to this bill.

If it does go ahead, the thinking is that there would be a big buyer wanting to purchase around 800k units of a scarce asset, which would push the price up.

Now let’s discuss what’s happening on the corporate side of things.

🏢 Will Companies Buy Bitcoin?

Management teams have the all-important role of capital allocation. Their goal is to allocate it where they will generate the highest risk-adjusted return for their shareholders.

If a company has cash on their balance sheet, they could choose to:

- 💸 Reinvest it in the business,

- 💰 Distribute funds back to shareholders via buybacks and/or dividends,

- 📉 Pay down their debt to reduce leverage,

- 🤔 Keep cash for optionality,

- 🤝 Or they could do a mix of the above.

✨ It seems that since 2020, despite plenty of reinvestment and capital returns to shareholders, companies have managed to increase their cash stockpiles too.

US companies currently hold around $4 trillion in cash, while companies across the globe hold similar amounts.

Corporations are well aware of the fact that inflation is reducing the purchasing power of their cash balances over the long term, but they want to keep the optionality. Plus, holding cash reduces their short-term liquidity risks.

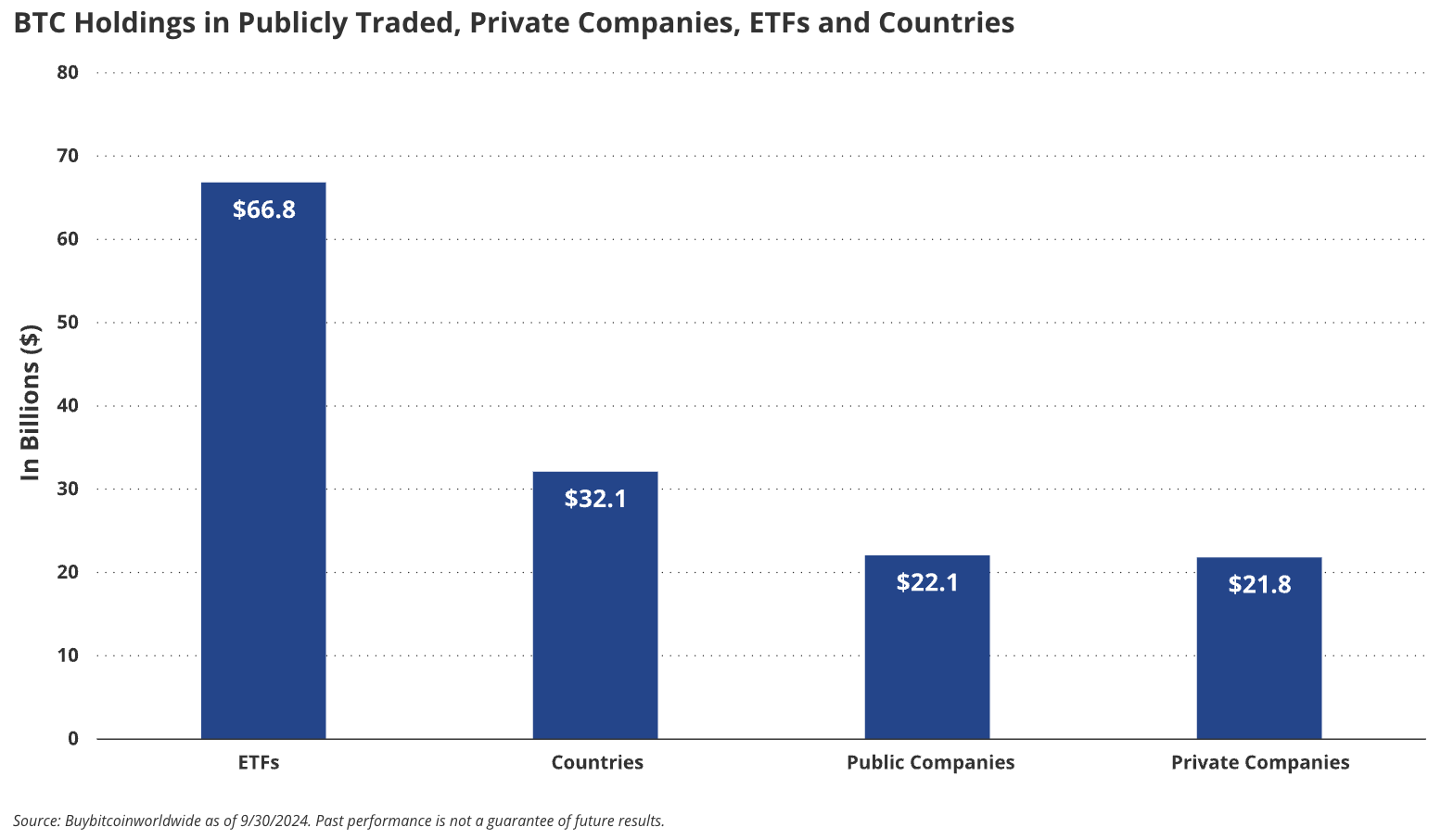

While some public companies have already started acquiring Bitcoin for their balance sheet , it seems the estimated number of private and public companies using the same approach is growing.

MicroStrategy is one company that others are looking to for what can occur when Bitcoin is on their balance sheet. That company has gone from a 30-year-old enterprise software analytics company worth $1.5bn in 2019 to a 35-year-old Bitcoin holding company worth $90bn.

The company obviously believes in the bullish narrative around the commodity, and they noticed an opportunity to give institutional investors exposure to Bitcoin, all while those investors remain within their investment mandate.

For funds that can only buy credit instruments but want Bitcoin exposure, the company issued convertible bonds. For funds that can only buy equities but want Bitcoin exposure, the company issued new equity.

MicroStrategy managed to not dilute shareholders because the company is trading at such a high multiple above its net asset value, and the bitcoin per share keeps increasing.

A Microsoft shareholder ( NCPPR ) recently raised the proposal for Microsoft to put at least 1% of its treasury into Bitcoin. The board has voted no, and suggested shareholders do the same, but the vote will be finalised on December 10th. NCPPR got Michael Saylor to do their presentation to their board on their behalf, and he was given 3 minutes. Whether it gets voted for or against, it’s still a bit moment for a $3trn company to discuss the idea of investing in it.

Anyway, while other companies might not want to follow the exact MicroStrategy approach, they’re considering if allocating a portion of their cash reserves to it is right for them.

Smaller companies like Metaplanet , Semler Scientific , and others have started adding Bitcoin to their balance sheet as a diversification strategy.

With regard to capital allocation, if a company is presented with an investment opportunity that could generate returns above the cost of capital, that’s something they’ll consider.

✨ If there is a portion of that $4trn worth of capital that starts to think that way and flow towards BTC, then same as before, that could create a situation where demand outweighs supply.

Of course, not every company that wants to own BTC will want to hold it directly. The responsibility around self-custody can be quite daunting. Some might be happy to own an instrument that gives them exposure to the underlying asset.

This might explain the other recent news story around the Bitcoin ETFs and their inflows.

💸 Bitcoin ETFs Receive Record Inflows

Since being launched in early January this year, the Bitcoin ETFs have attracted significant inflows.

This is likely from a mix of both individuals and institutions wanting a bit of exposure, but not wanting the job of self custody.

According to Bloomberg ETF analyst Eric Balchunas, IBIT, the Bitcoin ETF from BlackRock, took 211 days to reach $50bn in AUM, and that is the fastest in history. Apparently, the second-fastest ETF to reach $50bn AUM was IEFA, and it took 1,329 days(IEFA is an ETF investing in international small, mid and large cap stocks in developed markets outside of the US and Canada).

The ETFs have opened up the doors for many investors to gain exposure to the asset class through a brokerage account.

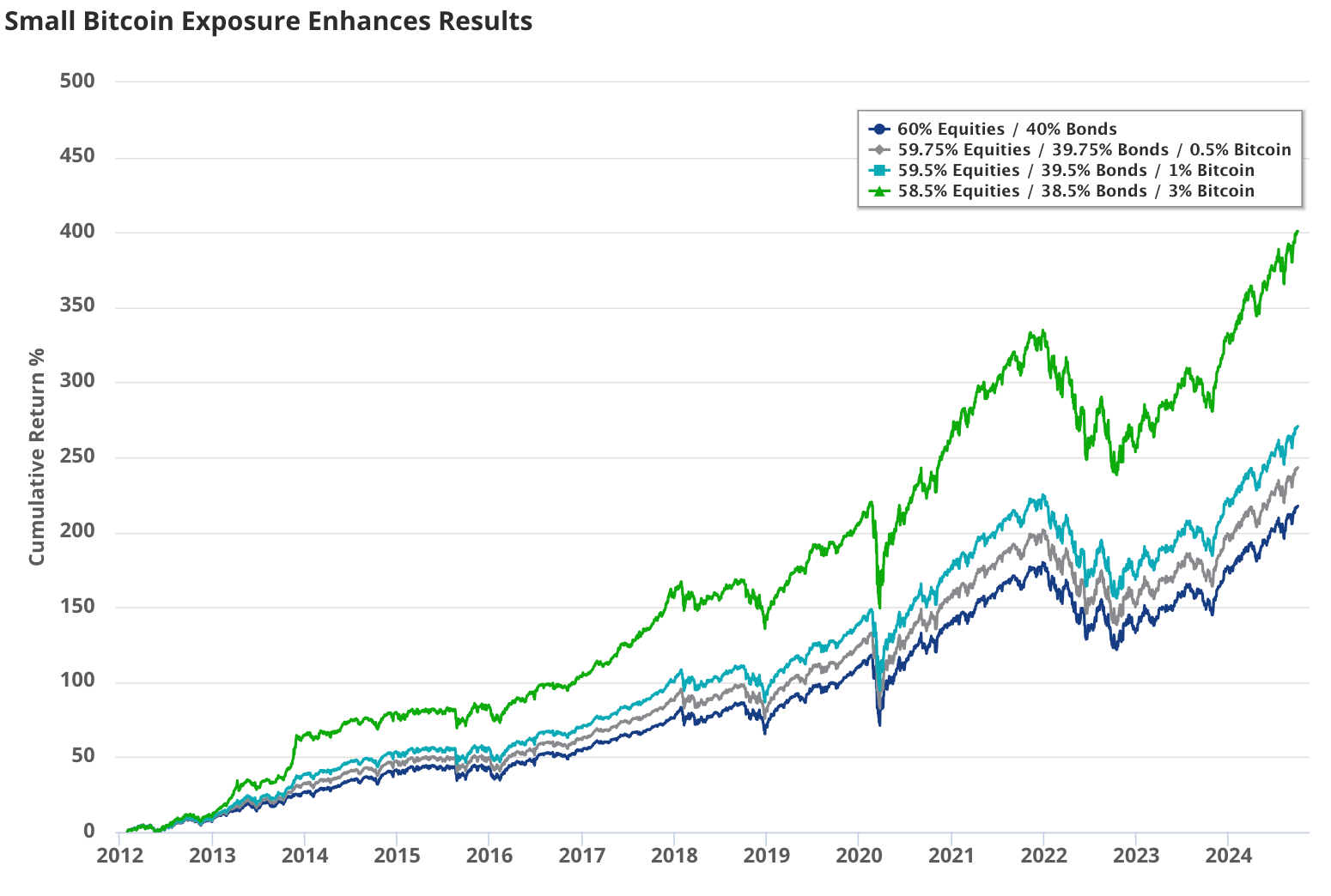

Each ETF provider has provided their own research into the topic. BlackRock has written a report about how it can be a unique diversifier for client’s portfolios. The other ETF providers have done similar research reports.

The great thing about those reports is that they clearly lay out the plethora of risks as well. It’s an emerging technology and an incredibly volatile asset.

There are also plenty of risks with the ETFs that have been raised by Fideres, such as concentration risk, price distortion, custodian risk, and more.

Speaking of risks, let's now go over the bearish narrative surrounding Bitcoin and the risks involved with investing in the cryptocurrency.

🐻 ⚠️ The Bearish Narrative And Risks

Every coin has two sides, even digital ones. 😏

There are risks to the bull case, with the most immediate being the chance that Congress blocks the proposal for a strategic reserve.

Senator Kirsten Gillibrand (a Democrat, but pro-crypto) questioned the purpose of such a reserve. Other lawmakers may be more skeptical.

Since the proposal for a strategic reserve is likely ‘priced in’, a rejection would probably be negative, at least in the short term.

There are plenty of other risks outside the regulatory side too.

- ⚠️ As mentioned, there are concerns around market concentration and custodian risk at the ETFs.

- It’s still an emerging technology , so there are risks that the ecosystem may have unforeseen challenges as it grows.

- The path to broader adoption is very uncertain.

- The currency debasement argument could reverse if governments decide to reduce expenditure and rein in expenses.

Either way, volatility is likely to remain a feature of Bitcoin for some time, even if the most bullish scenario plays out.

✨ The fact that Bitcoin can’t be valued like an income-generating asset, means there is no ‘value’ it can be anchored to. As mentioned in the quote at the start: “ Most of the value comes from the value that others place in it.”

Much like other commodities and investments, demand will always be subject to some bouts of speculation, and the availability of capital. Some positions will always be held with leverage, meaning some holders will become forced sellers if a correction occurs.

💡 The Insight: Broader Interest Is Growing, But The Commodity Isn’t Without Its Risks

Bitcoin is receiving a lot of attention for its potential as a store of value. It’s an emerging technology and nascent protocol that is still in the early days.

What started out as an invention 15 years ago and was only discussed in small cypherpunk communities is now globally recognised and a $2trn asset.

However, while the possible price appreciation has made it an appealing prospect to some, prospective investors are all too aware of its history of volatility.

It takes a certain temperament to be able to handle those kinds of drawdowns, and it’s almost certain that it will have that kind of volatility going forward.

If the bullish narrative plays out, then the commodity is well positioned to receive additional inflows as investors, both large and small, decide to allocate a portion of their capital to it.

If the bearish narrative plays out, where governments reign in their expenses and become fiscally responsible, or there is a flaw in the protocol or disruption in the network that causes miners and holders to leave, then the price would decline because “the value that others place in it” has been lost.

But the best way to look at this, with any investment, is from a probabilities point of view.

The more conviction you have in the asset and the narrative behind it, the more you’d probably allocate to it. The less conviction you had, you’d either stay at 0% allocation or only allocate a few percentage points.

VanEck has outlined how some model portfolios have improved returns with only a small allocation to the asset.

If you believe an allocation might be right for you given your financial goals and risk profile, then there are a few ways you can get exposure to the asset class:

- The SPOT ETFs that own the underlying bitcoin.

- Any stock that has exposure to Bitcoin. Here’s a screener of Global Stocks with Exposure to Bitcoin.

- The underlying commodity itself.

Each option has its own benefits and drawbacks, which you need to thoroughly consider and evaluate against your personal financial goals, risk profile, and temperament.

There’s a chance that it could go to $0, and there is a chance it could go to $10m per coin and beyond. As the original creator, Satoshi Nakamoto said: “ I'm sure that in 20 years there will either be very large transaction volume or no volume. ”

We’re 15 years in, and so far things are moving towards the former.

Key Events During The Next Week

Monday

- 🇯🇵 The final estimate of Japan’s Q3 GDP growth rate is forecast to be 0.9%, compared to 2.9% for Q2.

- 🇨🇳 China’s inflation rate is forecast to be 0.5%, vs 0.3% for the previous month. Producer price inflation is forecast at -3%.

Tuesday

- 🇦🇺The Reserve Bank of Australia is expected to keep rates at 4.35%.

Wednesday

- 🇺🇸 US consumer price inflation is expected to be 2.7% year-on-year, up 0.1% from November. Core inflation is expected to remain at 3.3%.

- 🇨🇦 The Bank of Canada is expected to lower the benchmark interest rate to 3.5%, from 3.75%.

Thursday

- The ECB will also set interest rates. The marginal lending, deposit facility, and benchmark rates are all expected to be lowered by 0.25%.

- US producer price inflation is forecast at 2.6%, up from 2.4%.

- US initial jobless claims are expected to be 225k, up marginally from last month.

Companies due to report Q3 earnings include software and a handful of others:

Simply Wall St analyst Michael Paige holds a position in MSTR and Bitcoin. Simply Wall St has no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Michael Paige

Michael is the Content Lead at Simply Wall St. With over 9 years of experience analysing and researching companies, Michael contributes to the creation of our analytical content and has done so as an equity analyst since 2020. He previously worked as an Associate Adviser at Ord Minnett, helping build and manage clients' portfolios, and has been investing personally since 2015.