What Happened in the Market This Week?

Market Insight for 15th July - 22nd July 2022

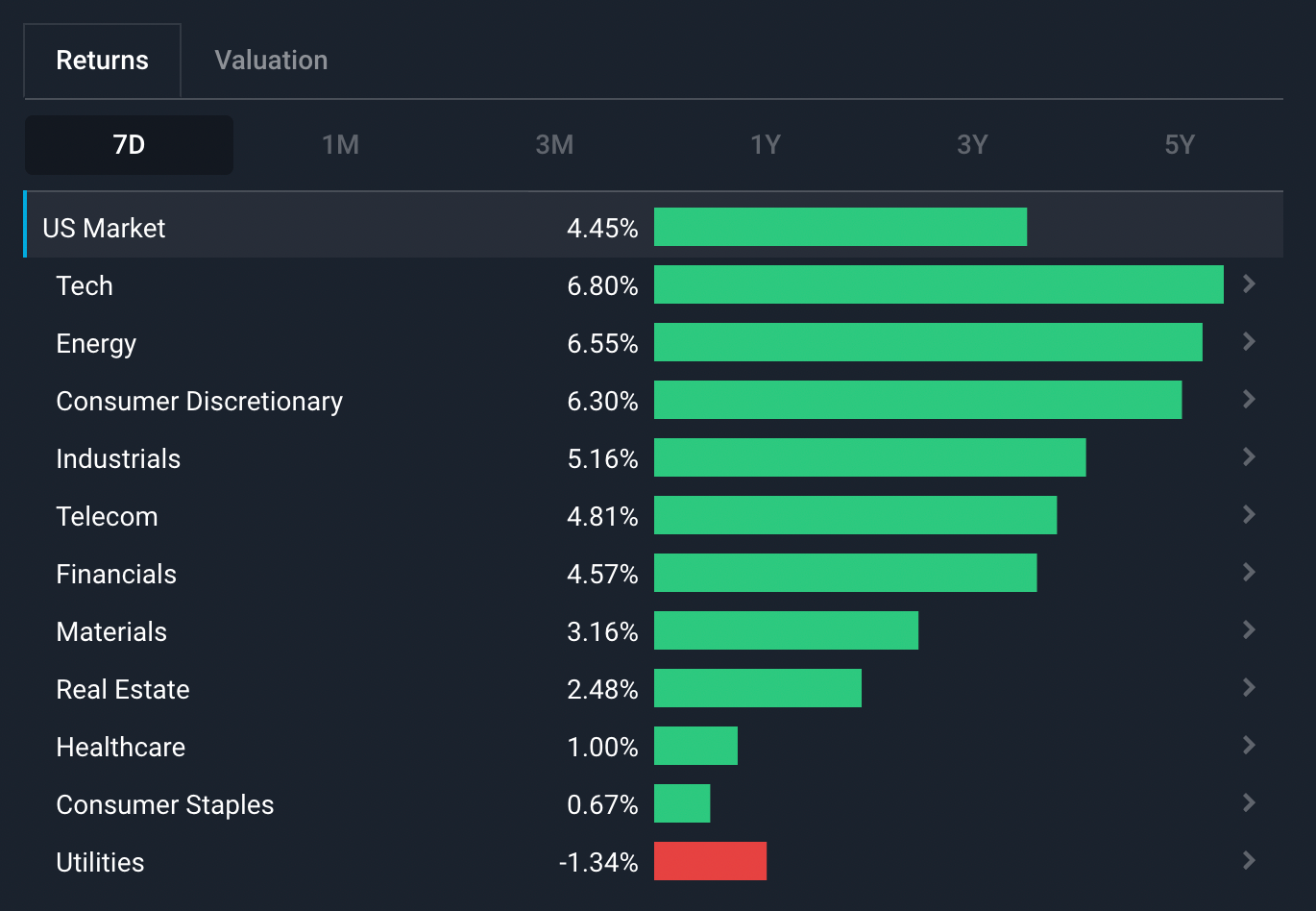

Global markets finally saw green last week, with investors buying stocks in the ‘risk on’ technology, consumer discretionary, energy and industrials sectors. The more defensive utilities, healthcare and consumer staples sectors lagged.

Global Companies are continuing to release Q2 Earnings Reports, with Tesla (Nasdaq:TSLA), AT&T (NYSE:T), Goldman Sachs (NYSE:GS), and several others heading the pack by releasing theirs last week (we have a list of last week’s reporting companies in this market insights article). This week, several notable companies are due to report - we have created an earnings calendar, which is at the bottom section of this article.

Some of the developments we have been watching over the last week include:

- U.S. inflation hits new 40 year highs, and the PPI numbers suggest it may not be peaking yet.

- China’s ongoing property crisis has worsened as homebuyers refused to continue making mortgage payments on over 100 property developments that have been delayed due to rising costs.

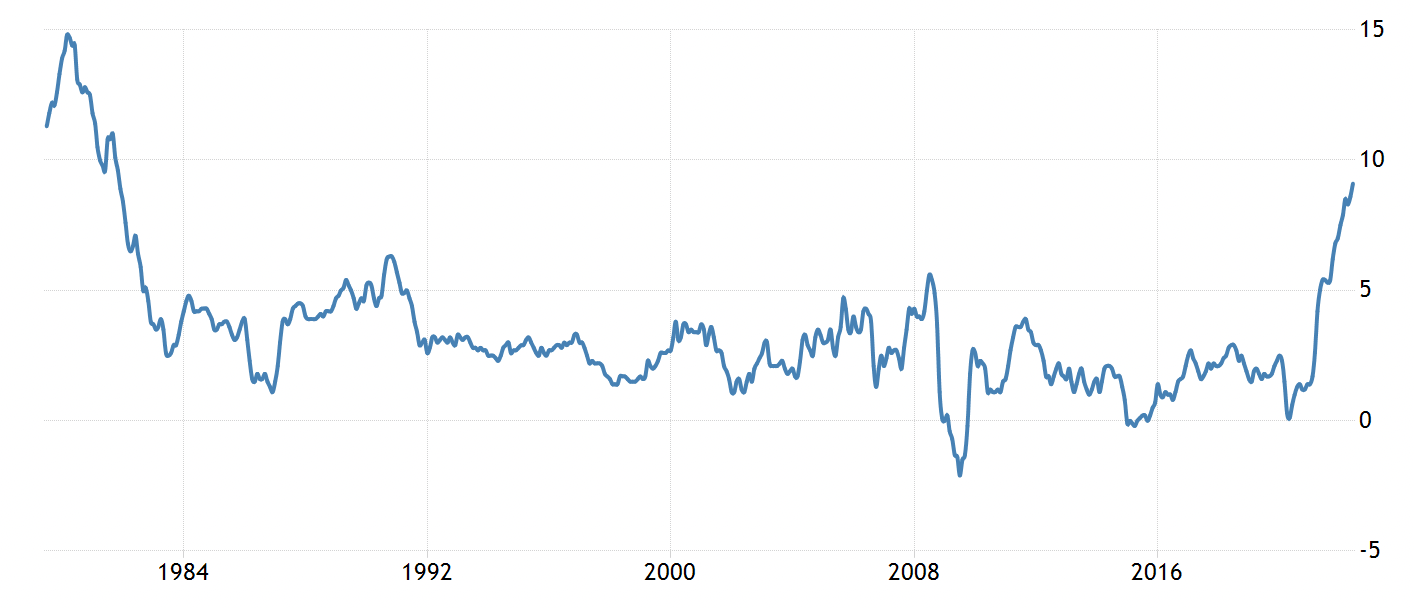

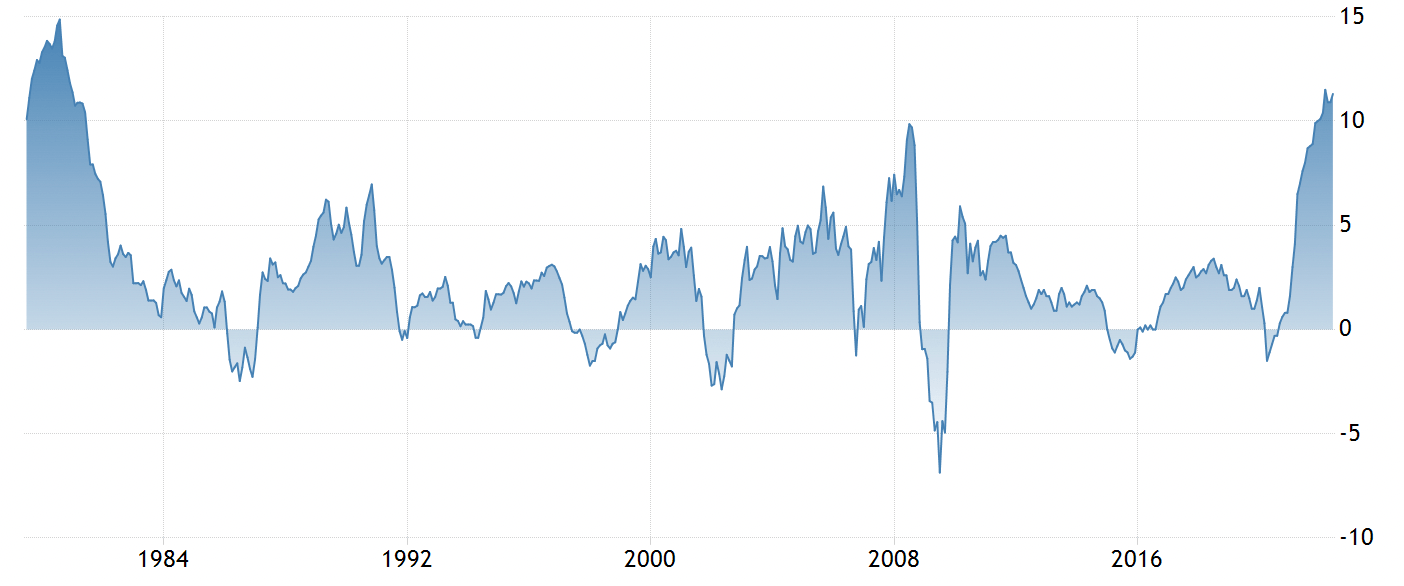

Inflation at 40-year High and It’s Still Rising

Last week, the U.S. Bureau of Labor Statistics released their June inflation report. The U.S. Producer Price Index (PPI), a leading indicator for inflation, recorded an annual 11.3% increase this June from last year’s levels. While this was slightly lower than the March YoY number, it remains at 40-year highs. Consumer prices on the other hand, rose 1.3% over the month and 9.1% over the last 12 months, the highest that yearly inflation has been in 41 years. The highest it has ever been in recent history was in 1980, when inflation passed 14% in the United States, during another energy crisis that was going on at the time.

U.S. Annual Inflation Rate 1979-2022 - Image Credit: Tradingeconomics.com

How Inflation is Calculated: What do CPI and PPI mean?

The Consumer Price Index (CPI) reflects changes in the prices consumers pay for goods and services. PPI reflects the wholesale prices that manufacturers receive for their goods and that service providers receive for their services.

As an example, if you buy a product at a supermarket, the price you pay might be included in the basket of goods used to calculate CPI. The price the supermarket pays the manufacturer might be included in the basket of goods used to calculate PPI.

Both measures of inflation are very broad-based and include goods and services bought and sold throughout the economy. PPI is regarded as a leading indicator for CPI as there is typically a lag between a product being sold by the wholesaler and then to the consumer. June’s high PPI number means CPI may not be peaking yet, as many analysts have suggested.

Inflation is not always a bad thing

Moderate inflation is actually beneficial to the economy as it stimulates spending, so central banks usually target an annual inflation rate of 1-3%. But, when inflation rises above that level it tends to compound and becomes difficult to control. High inflation erodes the real value of savings, as well as consumers’ purchasing power. This leaves companies with less to reinvest and ultimately stunts economic growth.

How will the Government get Inflation under control?

Central banks use monetary policy tools (e.g. interest rates and money supply) to slow inflation when it gets too high. Recall that higher interest rates reduce the purchasing power available to companies and consumers, as higher rates makes borrowing cash more expensive and makes saving more attractive. This results in lower overall economic demand for purchases, which prevents companies from raising prices.

The Insight: Sometimes central banks need to risk a recession to combat inflation. Recessions are bad for the economy, but they usually don’t last very long. On the other hand, inflation can spiral out of control and eventually cause more destruction on the economy that a short-term recession can.

When companies anticipate an economic slowdown they often cut back on hiring and investment. Some of the larger companies including Microsoft, Meta and GM have already initiated hiring freezes. Smaller companies that expanded too quickly and are not yet self-sufficient have also started retrenching staff.

👉 During this earnings season, investors should pay particular attention to profit margins. Companies with pricing power are able to pass cost increases on to consumers and maintain their margins. Those without pricing power will be left with lower margins and may need to cut costs. We have also curated a list of stocks that can weather a recession, and also a list of the best stocks for a rising interest rate.

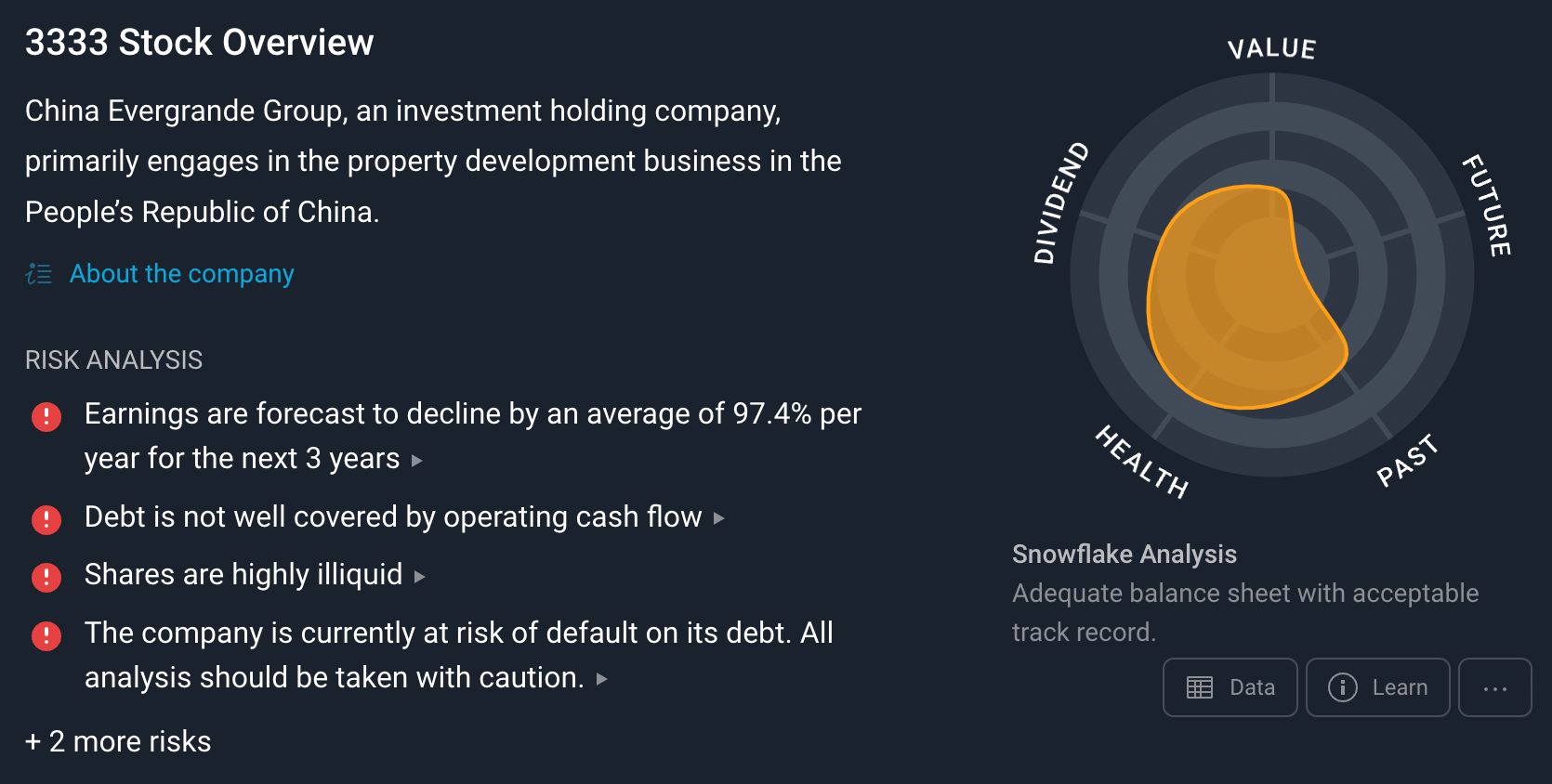

Chinese Mortgage Crisis Worsens

China’s property sector has been under pressure for at least two years, and initially came to a head in June last year with the infamous liquidity crisis at Evergrande (SEHK:3333), China’s second largest property developer.

China Evergrande Group (SEHK:3333) Company Summary on Simply Wall St - view our analysis on the company by clicking on the image!

The sector is once again in crisis, as thousands of homebuyers are refusing to continue making mortgage payments on properties whose developments have been delayed and/or halted.

How did China’s Property Crisis start?

To provide some background, a popular real estate sales strategy in China revolves around incentivizing homebuyers to close on deals for homes that were yet to be built. This did not prove to cause any major issues until Covid lockdowns started disrupting work flows and supply chains, causing several real estate developers to delay projects. Due to rising costs, a few developers have also inadvertently had to declare bankruptcy.

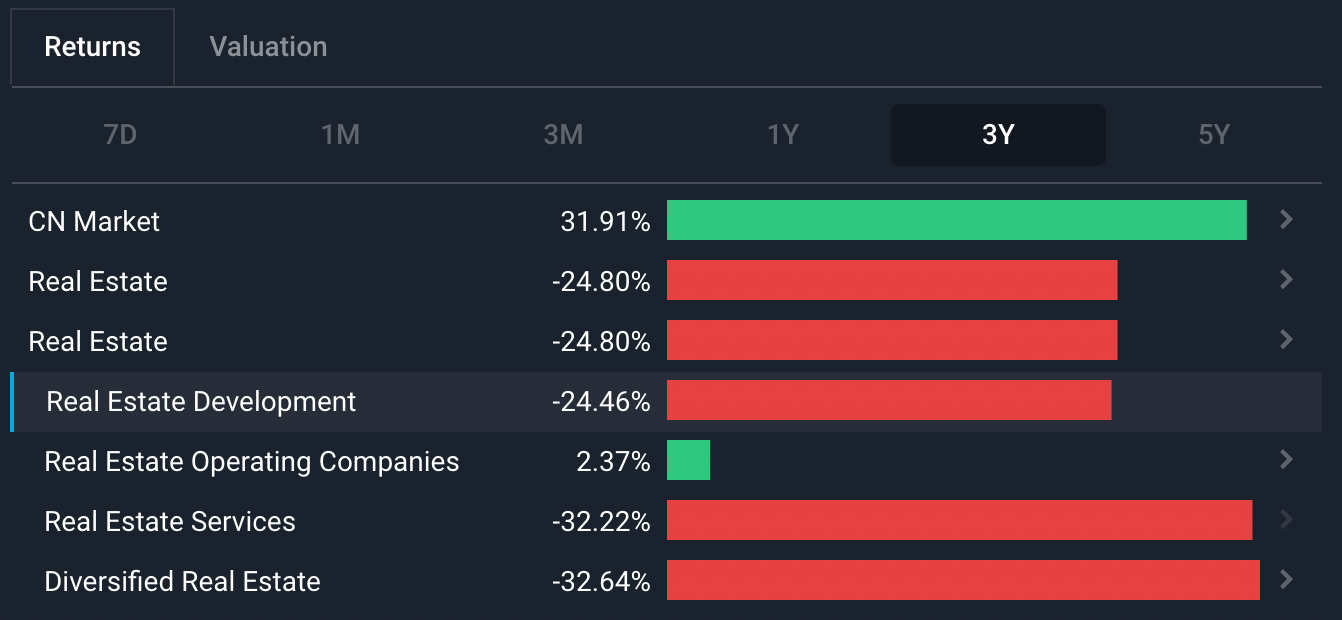

Chinese Real Estate Development Industry on Simply Wall St - check the analysis!

Since then, construction has been stalled as the remaining developers face cash flow and liquidity problems. With homebuyers in at least 100 developments now holding back their mortgage payments, the liquidity squeeze for developers is compounded even more.

The Chinese Government’s Role in the Current Mortgage Crisis

Aside from the country’s zero-COVID policy that has resulted in large-scale lockdowns in China, Chinese regulators had also decided to reduce the amount of leverage developers could use through borrowing from banks. Back then, this was done to slow the speculative bubble that had formed in the property market — but with the change in economic environment, it has now resulted in a liquidity crisis for the developers.

Regulators have now ordered banks to extend more loans to these developers to prevent a complete collapse in the sector. Naturally however, this would transfer the risks to the banking sector.

Insight: Some analysts are now worried that we are witnessing the start of a mortgage crisis in China similar to the subprime crisis that led to the Global Financial Crisis in 2008. China’s banks are reported to have as much as $9.2 trillion in exposure to the real estate sector, with most of that in the form of mortgage loans. In the last year, nearly a third of the top 100 developers in China have defaulted on loans.

👉 There have been concerns about China’s real estate and banking sectors for years, but there are now some tangible signs of trouble. Investors should be very careful about investing in either the banking or property sectors in China. The lack of corporate transparency in China compounds the risk further.

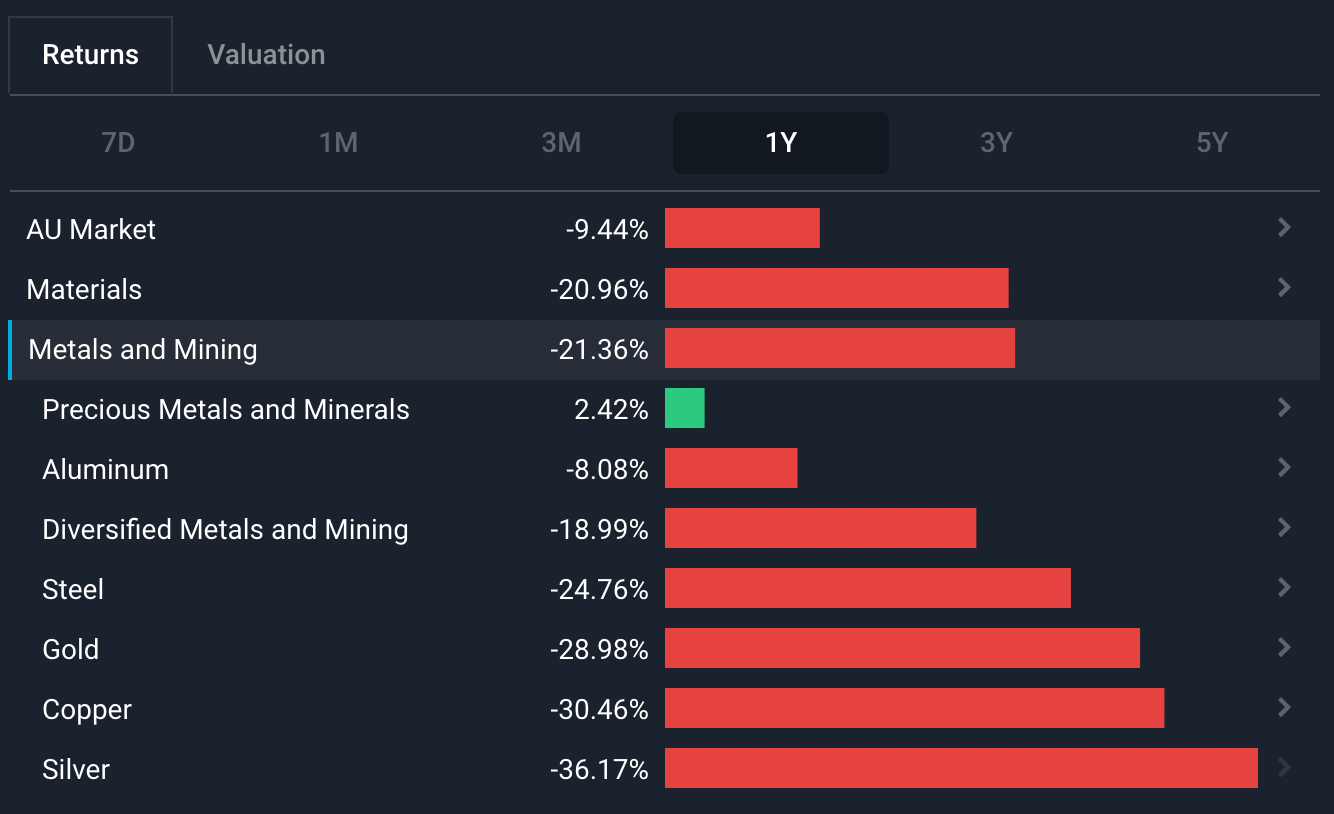

The crisis is also affecting commodity markets, particularly for iron ore and copper. If it continues, it’s likely to continue to weigh on the basic materials sector, and specifically companies like BHP Group (ASX: BHP) and Rio Tinto (LSE: RIO) that produce iron ore.

Stock Market This Week

This is a big week for the economy and markets. Four of the five largest companies in the S&P 500 index, and a number of other market leaders will be reporting second quarter results.

🗓 Earnings Season Calendar (25 July - 29 July)

Mon, July 25

Newmont Mining Corp • NXP Semiconductor

Tue, July 26

Microsoft • Alphabet • Visa • LVMH Moet Hennessy • Coca-Cola • McDonald's • Unilever

Wed, July 27

Meta Platforms • T-Mobile • Qualcomm • Rio Tinto

Thu, July 28

Apple • Amazon • Mastercard • Nestle • Samsung Electronics • Pfizer • Shell • Intel

Fri, July 29

Exxon Mobile • P&G • Chevron • AstraZeneca • Hermes • Sony

Did you know that we provide a complete company analysis (Fundamentals, Growth, Dividends, etc.) on our platform? Click on any company above to have a look!

On the economic front, the US Federal Reserve will be announcing the new Federal Funds rate on Wednesday. Consensus forecasts are for a 0.75% increase, with a slight chance of 1%.

On Thursday, US GDP growth for the second quarter will be published. Economists are widely divided on what to expect.

Inflation data will also be published in Germany, France and Australia.

Until next week,

Invest Well,

Simply Wall St

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. Any comments below from SWS employees are their opinions only, should not be taken as financial advice and may not represent the views of Simply Wall St. Unless otherwise advised, SWS employees providing commentary do not own a position in any company mentioned in the article or in their comments.We provide analysis based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.