What Happened in the Market Last Week?

Investors are starting to believe the Fed now. Markets are accepting the fact that the Fed is focusing on inflation first, and avoiding a recession second, despite the latter no doubt being painful.

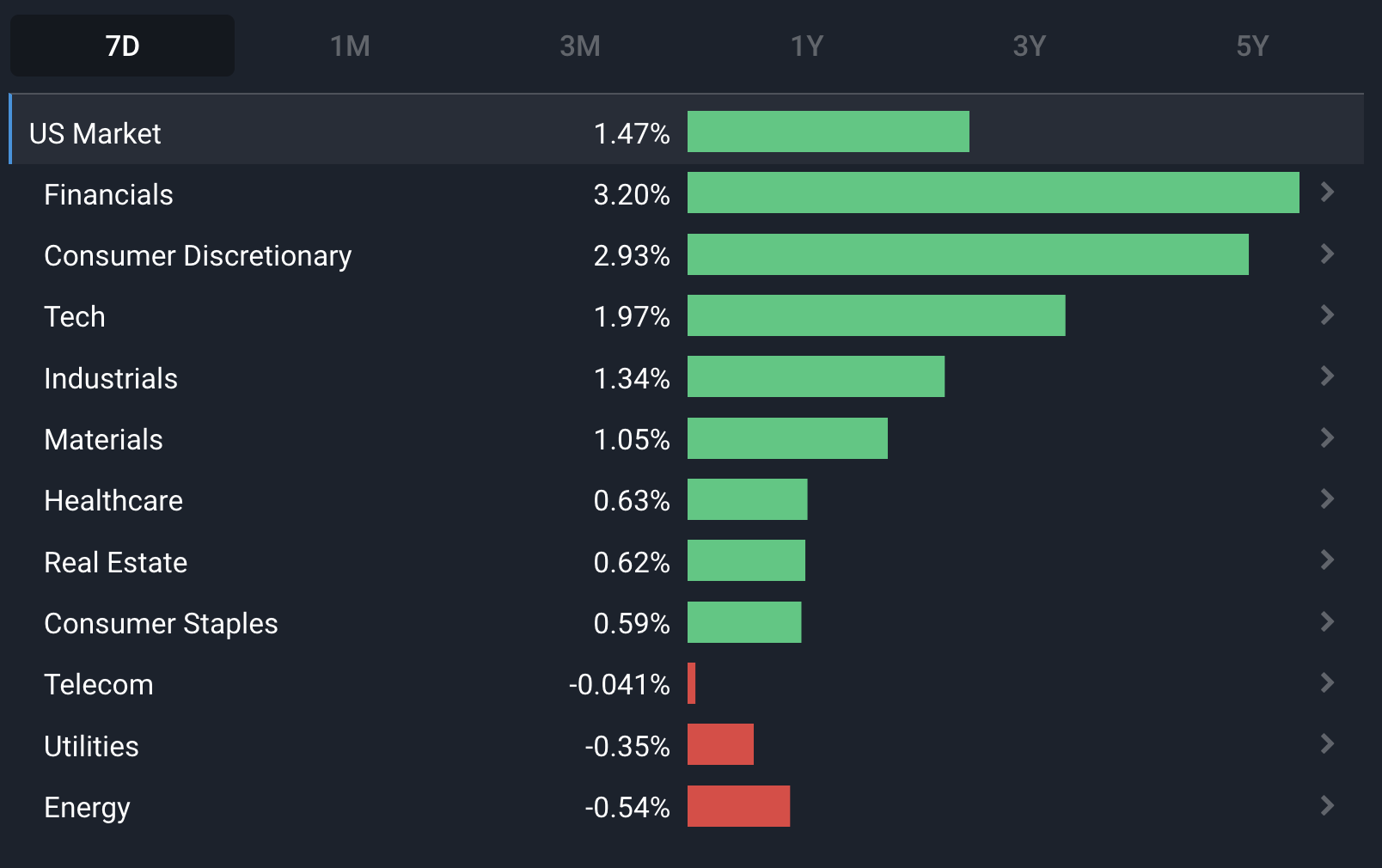

This benefitted the cyclical sectors including Real estate, Financials, and Industrials, who outperformed last week.

The stronger USD weighed on commodities, and the price of oil, which led to Energy and Materials stocks giving up some of their recent gains.

Last week we let you know of important economic data being released. Here’s how the numbers turned out:

- US Housing Starts : ↘️ - 0.8% - A slight decline in the new homes being built this month following a 7.3% spike in Feb.

- UK Unemployment : ↗️ 0.1% to 3.8% - The highest level since Q2 2022 but still lower than most of the last 5 years.

- UK Inflation Rate : Year-on-Year inflation 10.1%, down from 10.4% in Feb but ahead of forecasts (9.8%) - Inflation is cooling slightly but still running hotter than market expectations.

- US Retail Sales : ↘️ 1% from February - Consumers are spending less at the store despite inflation causing the cost of goods to rise.

This week’s Market Insights is a 5-minute read! Let’s go

Some of the developments we have been watching over the last week include:

- Slowdown Ahead: The IMF’s latest economic outlook po ints to a slowdown followed by an even slower recovery.

- Consumers spend less, but are also more confident? Retail sales are slowing around the world, but consumer confidence is improving.

IMF's "Rocky Road Recovery" Won't Taste Nice

Want an updated outlook for the global economy? Well, the IMF has got you covered.

It recently published its quarterly outlook for the global economy, and while we encourage you to not base an investment decision solely on this data, it’s worth having a look so that we can at least gauge what expectations are for different countries.

At the global level, the IMF has decreased its GDP growth forecast for 2023 by 17% to 2.8% (from 3.4%) and for 2024 to 3%. Interestingly , those figures rely heavily on good performance from China and India.

Advanced economies are only expected to grow by 1.3% and 1.4% in 2023 and 2024 respectively.

- Those expected to grow? ↗️ Ireland and Taiwan have the most optimistic forecasts, followed by the US , Canada and Australia .

- Those expected to decline? ↘️ The UK, Germany, and Sweden.

The biggest revision was for Japan, with the 2023 forecast falling from 1.8 to 1.3%. While that may not seem like much, that’s almost a 30% reduction in growth expectations .

The IMF expects emerging and developing economies to grow by 3.9% and 4.2% in 2023 and 2024, respectively. However, those averages include rates for India and China both above 5% - growth in the remaining developing economies is expected to be below those averages.

The chart below, from the report, shows how much these forecasts have fallen since January 2022. What does stand out is the difference in forecasts between advanced and emerging economies.

💡 The Insight: ‘Downside Risks Dominate’

By all accounts, economic activity seems to have picked up during the first quarter. China has already reported growth of 4.5% during the quarter , and the consensus estimate for US growth (due next week) is 2.3%. At the same time, many expect a recession later in the year - and of course, companies are already experiencing an earnings recession.

💡Cost increases (inflation) drove the “earnings recession”, and now demand decreases are expected to lower revenues.

The IMF’s baseline forecasts point to a drawn-out slowdown (ie. a ‘softish’ landing). These forecasts could still hold if there is a mild recession later in the year, with a strong first quarter offsetting a few quarters of negative growth. They also suggest a very slow recovery with growth only picking up in 2025.

However, the IMF also highlighted the growing number of risks which could lead to a hard landing. In particular:

- USD appreciation,

- Tightening credit conditions, and

- Falling equity prices are seen as potential risks to growth.

We would also say that the reliance on China and India to achieve the forecasted growth figures is also a risk - as well as the obvious geo-political risks.

As we know the world economy is in somewhat uncharted territory and no one really has a handle on where things are headed. In response to the IMF’s outlook, Janet Yellen said the outlook is reasonably bright. Meanwhile, the minutes from the last Fed meeting revealed that policymakers expect a recession later in the year. So there you have it……

What can we investors do? Focus on high-quality companies, not countries.

Consumers Showing Resilience

Data from the world of the consumer has been very mixed.

US retail sales fell 1% month-on-month in March, which was more than expected. Most of the decline can be attributed to auto and gasoline sales, but, as this chart indicates, there’s been a marked slowdown in retail activity since the middle of last year. In particular, consumers are cutting back on discretionary spending.

Elsewhere, China reported a big increase in retail activity (+3.5%) in March, though that’s coming off a low base. Other countries have reported slowing sales growth, although there have been a few positive surprises - notably in the UK, which surged 1.2% in March.

Retail Sales Down, Consumer Sentiment Up?

While retail sales are slowing, consumer sentiment is actually improving… go figure. The Conference Board Consumer Confidence Index rose in March and the University of Michigan Consumer Sentiment for April also rose unexpectedly, despite the banking crisis.

IPSOS (a market research company) has reported conflicting changes in sentiment around the world , over one month and one year. The one theme that’s emerged is that consumers in developing countries appear to be far more optimistic - possibly because energy prices and the USD have both weakened which translates to much lower energy costs.

💡 The Insight: Consumers Appear “OK”

As it stands, consumers in most countries don’t appear to be overextended. In the US, the savings rate has increased (4.6% now vs 3.6% a year ago), and while private sector credit has continued to rise, it’s rising at a slower pace than it was six months ago.

The improved sentiment probably reflects the fact that fuel prices are lower, inflation is cooling and it appears that interest rates are near a peak. But consumers are clearly being more careful and delaying discretionary purchases, as well as purchases that require credit.

The fact that consumers are in reasonably good shape could support the ‘softish landing’ scenario - but it might be a while before discretionary spending picks up again. This is something to consider if you are investing in industries like Retail, Consumer electronics, or Autos.

What Else is Happening?

Here’s some other important things that occurred this week that we felt it was important to touch on:

- Apple ( Nasdaq:AAPL ) is launching a new savings account for Apple Card users . The card pays 4.15% annual interest rate and allows cardholders to save their cash rewards. Considering that the interest rate is 10x higher than the US national average , some savers may consider the jump and therefore help Apple expand its financial services business.

- Fox News ( Nasdaq:FOXA ) agreed to pay Dominion Voting Systems $787.5 Million to settle the defamation suit Dominion brought against it. That’s a lot of money, but to put it in perspective it’s about half of Fox’s annual net income, and less than 25% of the company’s cash balance.

- Netflix ( Nasdaq:NFLX ) released a mixed set of results. What did stand out was a massive increase in free cash flow. The company says it is on track to generate $3.5 billion in free cash this year, nearly double what it did in 2022. The increase in free cash is due to lower content costs. Keeping content costs under control was one of the key bullish narratives we recently identified for Netflix.

Key Events During the Next Week

Given earnings season is ramping up, corporate results are likely to be the main focus this coming week. However, the first estimate of US 1st quarter GDP is due on Thursday and will be closely watched ahead of the Fed meeting next week.

On Friday, US personal income and spending data and the core PCE price index will be published.

Other data includes Australia's inflation rate on Wednesday and Japan’s interest rate announcement on Friday.

It’s the biggest week of earnings season with four of the big tech companies and several other index heavyweights reporting:

- Microsoft (Nasdaq:MSFT)

- Alphabet (Nasdaq:GOOGL)

- Meta Platforms (Nasdaq:META)

- Amazon (Nasdaq:AMZN)

- Visa (NYSE:V)

- Coca-Cola (NYSE:KO)

- UPS (NYSE:UPS)

- GM (NYSE:GM)

- McDonalds (NYSE:MCD)

- Caterpillar (NYSE:CAT)

- Boeing (NYSE:BA)

- Spotify (NYSE:SPOT)

- AbbVie (NYSE:ABBV)

- Mastercard (NYSE:MA)

- Exxon Mobil (NYSE:XOM)

- Chevron (NYSE:CVX)

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.