🎧 Would you prefer to listen to these insights? You can find the audio version on our Spotify!

“There are five basic ways a company can increase earnings: reduce costs; raise prices; expand into new markets; sell more of its product in the old markets; or revitalize, close, or otherwise dispose of a losing operation.” — Peter Lynch

Over the course of June we have seen small and midcap stocks outperforming the headline indexes in the US, as well as in other markets. Most value oriented indexes have also performed slightly better than the S&P 500, after lagging during the previous five months.

So this week we are having a look at the long-term performance of small and midcap stocks vs large cap stocks, and more importantly, how to identify potential future large caps.

We’ll also cover the age-old battle of “ Growth vs Value ” and how a third point of view might be more useful.

Large Caps vs Small Caps

A few decades ago, it was widely accepted that value stocks generally outperformed over the long term, while growth stocks had sporadic periods of outperformance. Research also suggested small caps tend to outperform large caps. Let's see how that’s played out over the last twenty years…

Longer Term Performance

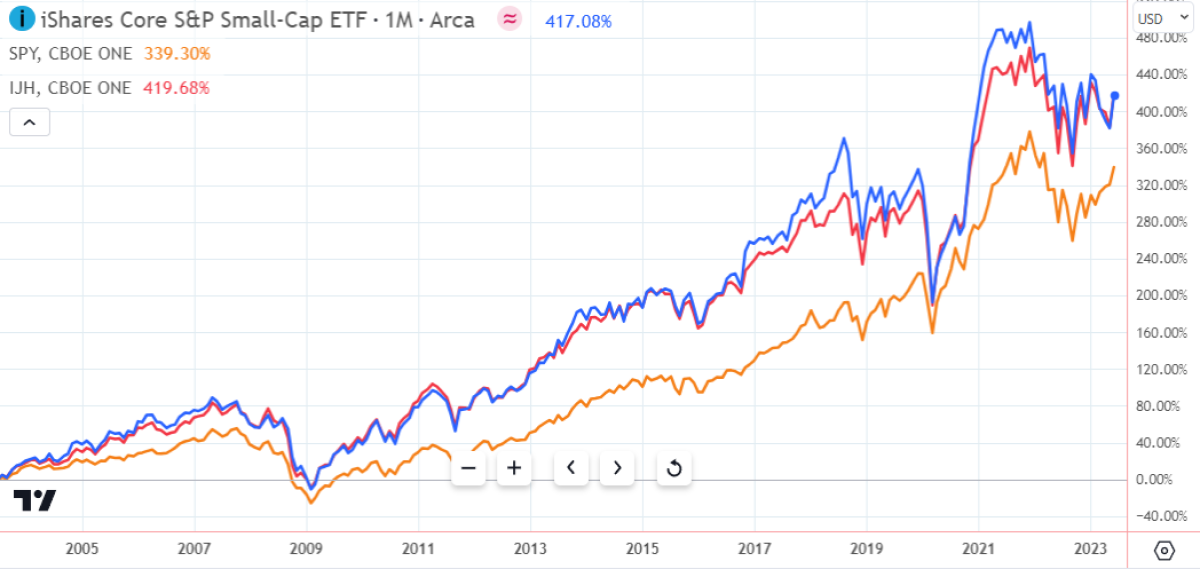

The chart below shows the last 20 years of price performance of the S&P 500 index in orange, and the indexes of the S&P Mid-cap in red (companies of $2bn to $10bn in size) and the Small-caps in blue ($300m to $2bn in size).

Based on price alone, the mid and small-cap indexes outperformed substantially.

However, when dividends are included the performance of all three indexes was just about equal. Larger companies are typically more mature and more likely to pay dividends - so dividends are an important part of the long term return they earn.

The S&P 500’s performance during the first decade was also impacted by very weak performance from some of its largest constituents at the time - GE , CitiGroup and Intel .

Ultimately the size of a company hasn’t been a major factor over the last 20 years. However, the really successful small companies move on to the mid and then large cap indexes - which is what we’re going to talk about later. So there’s no reason to overlook smaller companies either. These examples are for the US market, but the pattern has been similar elsewhere.

A Look At The Shorter Term: What Has Contributed To YTD Returns?

At the end of May, the year-to-date performance of the small and midcap indexes was very close to that of the equal weighted S&P 500 and apart from a handful of stocks, large caps performance seemed to track quite similarly.

So what does this mean? Well, looking at the entire market, the correlation between market cap and year to date returns is close to zero. Interestingly, there was also almost zero correlation between returns and price ratios (price to earnings, sales and cash flow), margins and ROE/ROC. Meaning, don’t simply go looking for stocks based on these metrics alone and expect a return.

There was a slight inverse relationship between returns and dividend yields. That’s probably due to the underperformance of the biggest dividend paying sectors energy and utilities .

So what has contributed to returns? The two factors that have correlated with recent returns have been:

- The sector a stock is in, and

- Analyst revisions on the back of earnings releases and news.

This isn’t surprising, but it does suggest some stocks have simply followed their sectors higher or lower, rather than any amazing performances individually.

Assess Companies On Individual Merits - Identifying Future Large Caps

Six months is a short timeframe, and we want to focus on the long term. So let’s focus on what we should look for, no matter the market cycle, industry or company size.

Ultimately, the performance of the underlying business is more important than how a business ranks in terms of size, growth rates, price multiples and other metrics.

Successful investments come from figuring out when the market is underestimating a company’s potential - and that comes from getting to know its products, strategy and other qualitative factors.

A useful first step is to identify products or services that you think will be in demand in the future, determining the key players within that space and then assessing them on the merits of their competitive advantages in things like cost, product differentiation or resources.

So if you want to identify future mega cap, or large cap stocks while they’re still a small or mid cap stock, you’ll need to focus on finding those businesses with a sustainable competitive advantage, and a large remaining total addressable market (TAM).

Some competitive advantages include Economies of Scale, Network Effects, Switching Costs, Counter Positioning, Branding, etc. Hamilton Helmer’s book "The 7 Powers" is a great read on these powers, so once you know them, you’ll know what to look for among these smaller companies to identify potential future juggernauts.

The Battle Of Value vs Growth

The terms value and growth are quite subjective and when it comes to indexes they become relative terms. So a value index doesn’t necessarily include undervalued stocks, but stocks that are trading on the lowest valuations within an index. Likewise, growth stocks have the highest growth rates in the index.

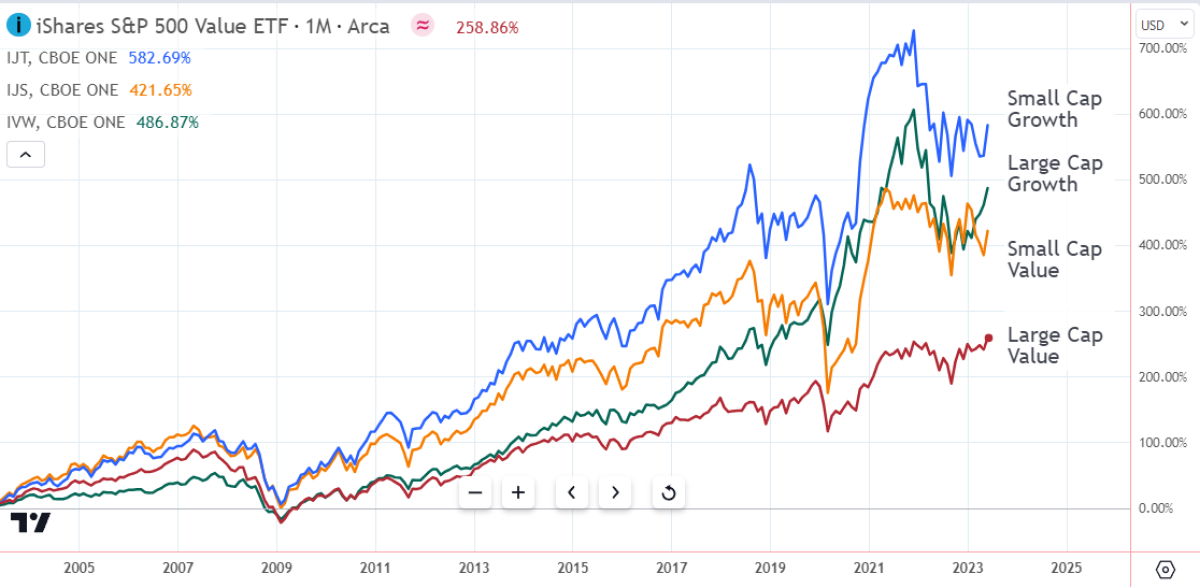

The chart below reflects the price performance of the S&P large and small cap indexes weighted by value and growth. In this case when dividends are included the large cap growth stocks are about equal to small cap growth. However, value stocks all lagged by about the same amount, even with dividend included.

This has been the longest period of outperformance by growth stocks - but there are some good reasons for this.

- Firstly, interest rates have been the lowest they have ever been (as we discussed in our coverage of Howard Marks’ Memo ), and,

- Secondly we’ve had a period of unprecedented innovation around the internet, software and cloud computing, which has driven productivity gains at a scale never seen before.

The Importance Of Interest Rates

So, will growth stocks continue to outperform? It depends.

If interest rates go lower from today’s levels, that will have a major impact on growth stocks. The vast majority of the value of a “growth” stock is reliant upon future cash flows that will only be earned many years into the future. So the higher the interest rate the lower the current value of those future cash flows.

Growing companies also need capital (be it debt, or equity) which is easier to access when rates are low and access to credit is easy.

Your view on interest rates should contribute to your decisions about how much you invest across asset classes like fixed income vs equities, and more importantly, how you value those investments.

At the end of the day, both matter to the long term return an investment can generate.

💡 The Insight: Growth Is A Component of Value

Before you go off looking for stocks through the lens of “ Growth vs Value ”, remember the wise words from Buffett: "In our opinion, the two approaches are joined at the hip: Growth is always a component in the calculation of value."

It's important to remember that all real investing is determining if what you are buying is worth more than what you are paying.

And while “value” is subjective (each person’s future estimates will be slightly different), you increase your chances of success if you focus on buying undervalued stocks, irrespective of whether it is considered a ‘growth’ or ‘value’ stock.

What Else Is Happening?

We thought these recent news items were worth noting…

-

💻 Micron Technology reported a smaller than expected loss, and beat revenue estimates. Perhaps more importantly, the company said it sees the supply glut beginning to ease .

-

While sector leaders Nvidia and AMD have been firing on all cylinders, most of the semiconductor industry has been dealing with the consequences of inventory buildup. The supply chain disruptions during 2020 and 2021 caused companies to over-order components, meaning they haven't had to re-order during the last year.

-

Besides too much inventory, smartphone and PC sales have been weak for the last year. Improving sales and low inventory could set up a bullish cycle for the sector.

-

-

🚀 Employees at SpaceX are reportedly selling shares at a price that puts the company on a $150 billion valuation. Virgin Galactic is finding out that space tourism is an expensive business with uncertain returns. SpaceX however is in the much more lucrative businesses of space haulage and space based internet.

-

On a recent podcast Scott Galloway pointed out that SpaceX could have an even wider moat than Tesla . Most automakers can make EV’s - how many companies can do what SpaceX does?

-

This must be the most anticipated IPO in a long time - if it’s going to happen.

-

-

🏦 Citigroup is warning employees that employees who don’t spend enough time in the office may face consequences. While many companies have adopted a hybrid policy, some employees are refusing to spend any time in the office. Google and other companies are also having to resort to threats to get staff back to the office.

-

The way this plays out will also have consequences for commercial real estate. These companies will probably win this battle, but if they don’t it will be more bad news for office landlords.

-

Key Events During The Next Week

There’s plenty of employment data this week. On Thursday the US ADP National Employment report will be released and on Friday Nonfarm Payrolls and the unemployment rate will be published. Canada’s employment rate is also due on Friday.

Also in the US the FOMC minutes from the last meeting is out on Wednesday and the balance of trade report is due on Thursday.

Elsewhere, Australia’s central bank will announce its interest rate decision on Tuesday and the Balance of Trade report is due on Thursday.

Just two major companies, Levi Strauss and BYD , are reporting quarterly results this week.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.