What Happened in the Market This Week?

Market Insights for week ending 23rd September

Equity markets remained under pressure last week with the S&P 500 index trading at its lowest level since mid-July. The energy and consumer discretionary sectors completely reversed their positive trends last week , and telecom and real estate continue to be heavily battered.

The market's pessimism last week was further exacerbated by the Fed's interest rate decision last Wednesday to increase rates by another 75bps, taking the target range to between 3% and 3.25% , its highest since 2008. This also came as the yield on U.S. 10-year treasuries crossed 3.6% for the first time since 2011.

This week, we are looking at housing markets in the U.S. and around the world:

- The U.S. housing market is indeed in a deep recession , as confirmed by economic data released last week.

- We also had a look at some of the bubbliest housing markets around the world namely: Portugal, Canada, and New Zealand .

U.S. Housing Market in "Deep Recession"

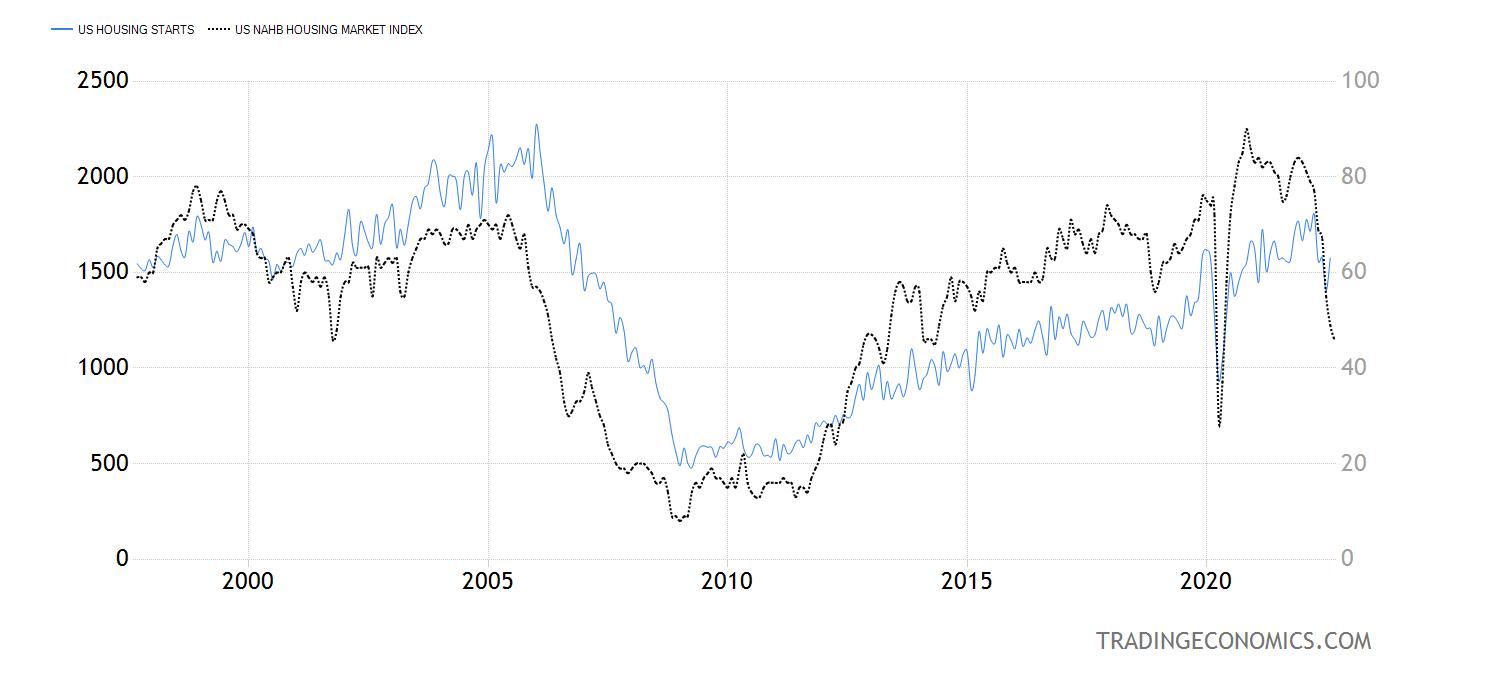

Some leading indicators on the U.S. housing market aren’t signaling a bright year ahead. The NAHB Housing Market Index, as per the National Association of Home Builders website , is based on a survey that “asks respondents to rate market conditions for the sale of new homes at the present time and in the next six months as well as the traffic of prospective buyers of new homes.”

Presented in a scale of 0-100, the NAHB index was recorded at 46 last week (black dotted line in the graph below), compared to the 48 that analysts expected and 84 at the beginning of the year . Generally, a NAHB index at 50 and below means that home builders see sales conditions as being poor. So now isn’t a great time to be a home builder.

Apart from a few months at the beginning of the pandemic, the index is now at the lowest level it’s been since 2014. This reflects a general loss of confidence in the housing market and its outlook.

On the other hand, data on housing starts (blue line), which was released last Tuesday, were higher than expected and actually rose 12.2% month-on-month. However, building permits fell 10% month-on-month and were lower than expected. So we’re getting somewhat mixed signals here, but the general sentiment looks to be more pessimistic.

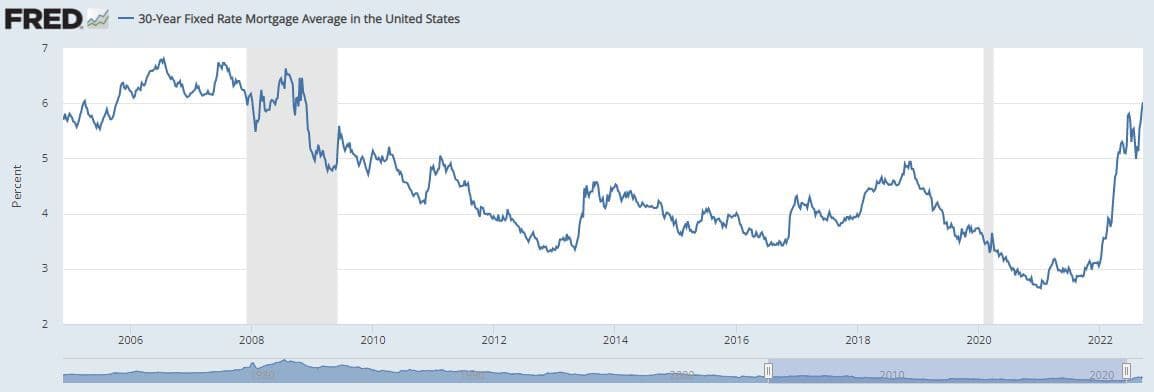

What is the connection between rising interest rates and real estate?

Rising mortgage rates typically act like gravity on real estate valuations. They bring valuations down when those rates rise, and increase the valuations when those rates fall . Those mortgage rates are based on the benchmark interest rates like the Fed Funds Rate. So, when the Fed increases its benchmark rate, the cost of financing a home rises as retail banks pass on the rate increase to consumers. So all else being equal, mortgages become less affordable, and you’d expect house prices to then decline accordingly.

S&P 500's worst days of the 2022 - Image Credit: CNBC

Given current data, there’s no doubt the U.S. housing market is in a major slump. Builder confidence has declined for the 9th straight month , new home sales in July were down 29.6% compared to July last year, and existing home sales were also down 20.2% in July year-on-year.

In our previous Market Insight, we explained why house prices can take a while to actually fall when the real estate market slows. As of June, home prices were still up YTD, but virtually flat month-on-month. However the house price index is an average of the entire country’s data - prices have already fallen in the most overvalued cities .

It seems inevitable that house prices in most areas will ultimately fall as rates continue to increase and home sales slow down. This affects not only the real estate market and its associated industries, but the entire economy.

How does real estate affect the rest of the economy?

For many homeowners, their home is their most valuable asset, and this creates a psychological ‘wealth effect’ amongst consumers. When home prices rise, consumers feel wealthier and are inclined to spend more. Of course, the opposite occurs when house prices fall. In fact, analysts have suggested that GDP is going to fall in the coming months as consumers tighten their discretionary spending to cover higher mortgage payments.

A slowdown in housing causes ripples throughout the economy. Most consumer-facing businesses receive less demand for their products and services, construction slows (as we’re already seeing) and banks issue fewer loans and can even experience defaults in their loan book.

💡 The Insight: Real Estate and the Economy

As interest rates continue to rise, it will put more pressure on the real estate market and on consumer spending. Homeowners with variable rate mortgages may become forced sellers if their mortgages become too unaffordable.

The counter argument from some economists is that more pressure on the housing market could lead to rates peaking sooner. Ian Sheperdson, Chief Economist at Pantheon Macroeconomics believes the housing market slump could cause the Fed to slow the pace of rate hikes . Ultimately, the Fed wants to bring inflation under control, and a housing recession might assist by dampening demand.

For Short or Medium-Term Investors (< 5 years)

Unfortunately, the ongoing pressure on consumers provides very few areas of safety. Until an end to rate hikes seems likely, investors are likely to turn to defensive sectors ( utilities , healthcare and consumer staples ) - leading to their continued outperformance. Contrarily, companies in the real estate sector may see less income or even revenue in this environment, as rising rates deter consumers and supply chain problems continue to drive building costs up.

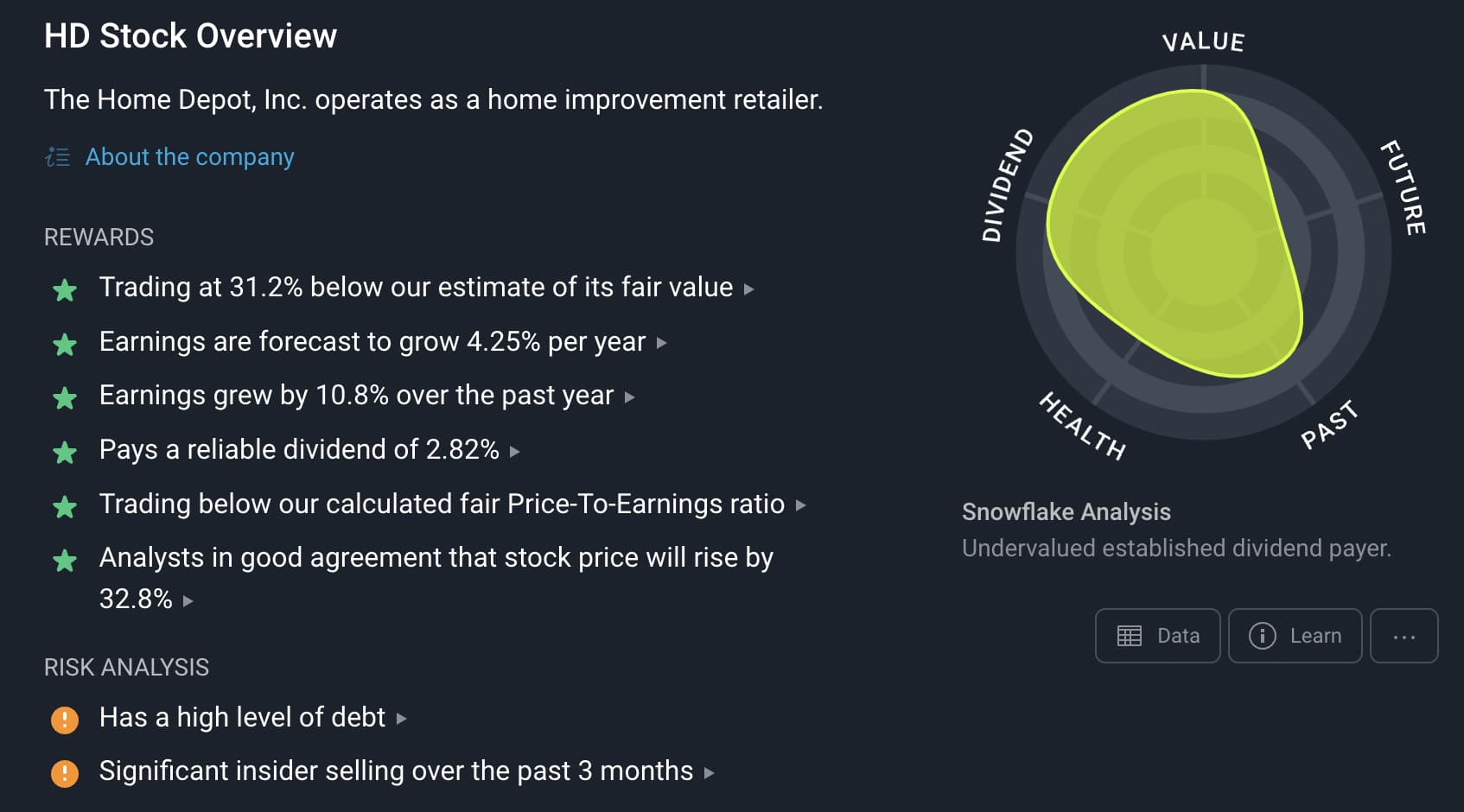

There are always exceptions within each sector - it is possible that companies like Home Depot ( NYSE:HD ) may benefit if home owners decide to make improvements to existing homes rather than trading up. This would however, need to be weighed up against overall sentiment in the sector.

See our Company Analysis on Home Depot by clicking on the image! - Image Credit: Simply Wall St Home Depot

For Long-Term Investors (5+ years)

As always, long-term investors can use bear markets to find great long term opportunities. Most beginner investors make the mistake of investing only in a bullish stock market and shying away from a bear market, when bear markets have the best entry point for those with at least 5 years of investing time horizon.

Should inflation and rates eventually normalize, many of the sectors affected by this recent slump have the potential to perform well longer term. If you are investing for the long-term, it’s important to focus on the potential future earnings growth, and not get caught up in short-term market noise.

Real Estate Bubbles around the World 🌎

Beyond the U.S., home prices are also beginning to lose their froth as interest rates climb worldwide. Markets with the highest probability of being in a housing bubble tend to experience the worst effects of a housing downturn, and as such, we will be discussing this situation in-depth.

What factors contribute to housing bubble conditions?

Determining which markets are most at risk is always going to be subjective. These are some of the factors that contribute to bubbles:

- Affordability - a combination of home prices, average incomes and mortgage rates.

- Speculation - More speculative ownership leads to more risk.

- Price appreciation - Prices often fall the most where they have previously risen the most.

In October last year, UBS published a Real Estate Bubble Index which flagged Frankfurt, Zurich, Munich, and Vancouver as major housing bubbles.

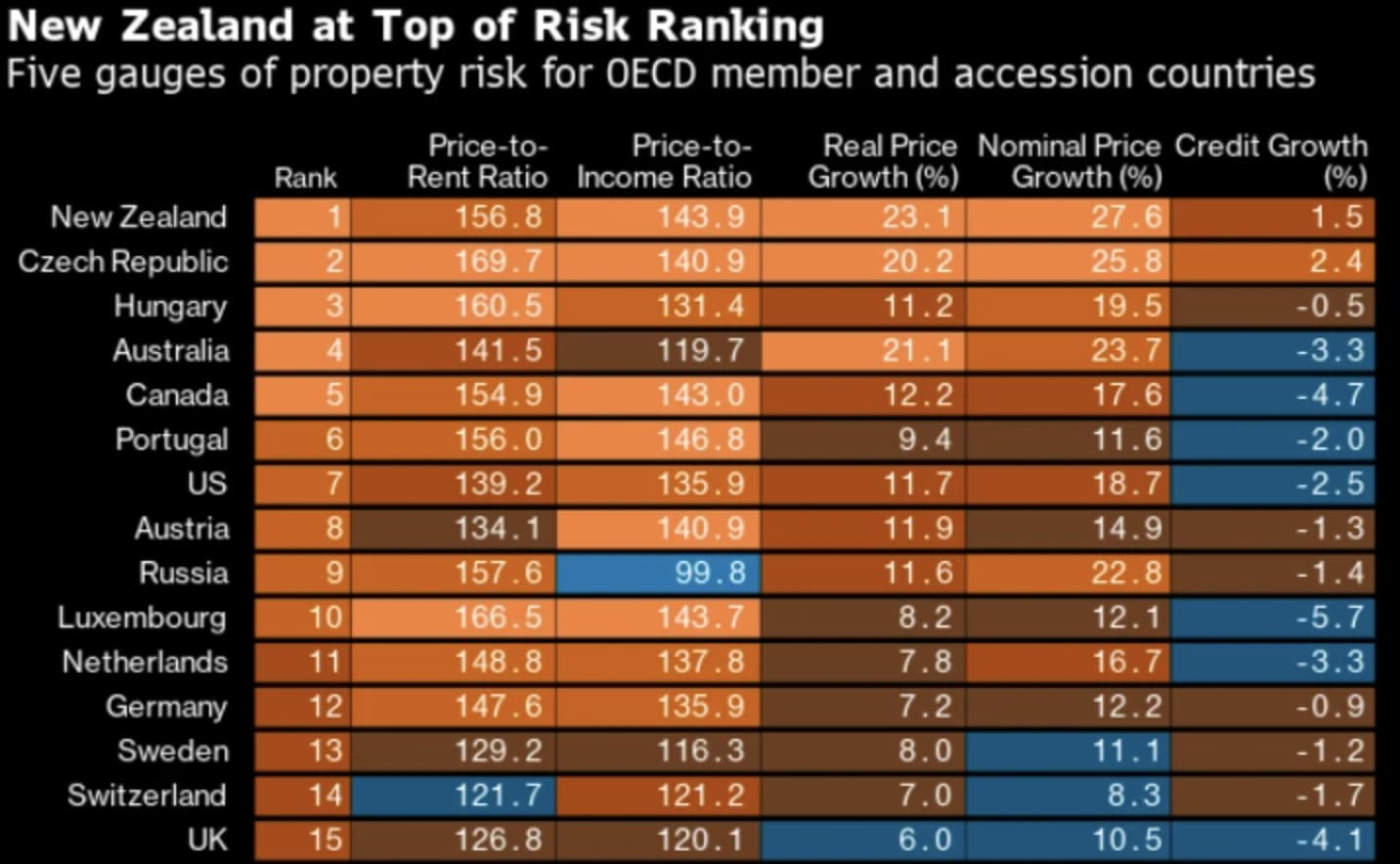

More recently, in June, Bloomberg published another report on housing bubbles , this time based on countries rather than cities. The report identified 19 OECD countries with home prices that are less affordable than they were before the 2008 financial crisis.

At the top of the table (i.e. riskiest) are New Zealand , Czech Republic , Hungary , Australia , Canada , and Portugal . Let’s take a look at the Portuguese, Canadian and Kiwi housing markets.

Portugal 🇵🇹

A shortage of housing caused prices to rise sharply in cities in Portugal, but prices are now amongst the most unaffordable in the world. Adding to the risk is the fact that as many as 93% of mortgages have variable rates . As mortgage rates rise, some homeowners won’t be able to cover these mortgages so they will become forced sellers. This is the type of situation that can cause prices to fall rapidly.

Canada 🇨🇦

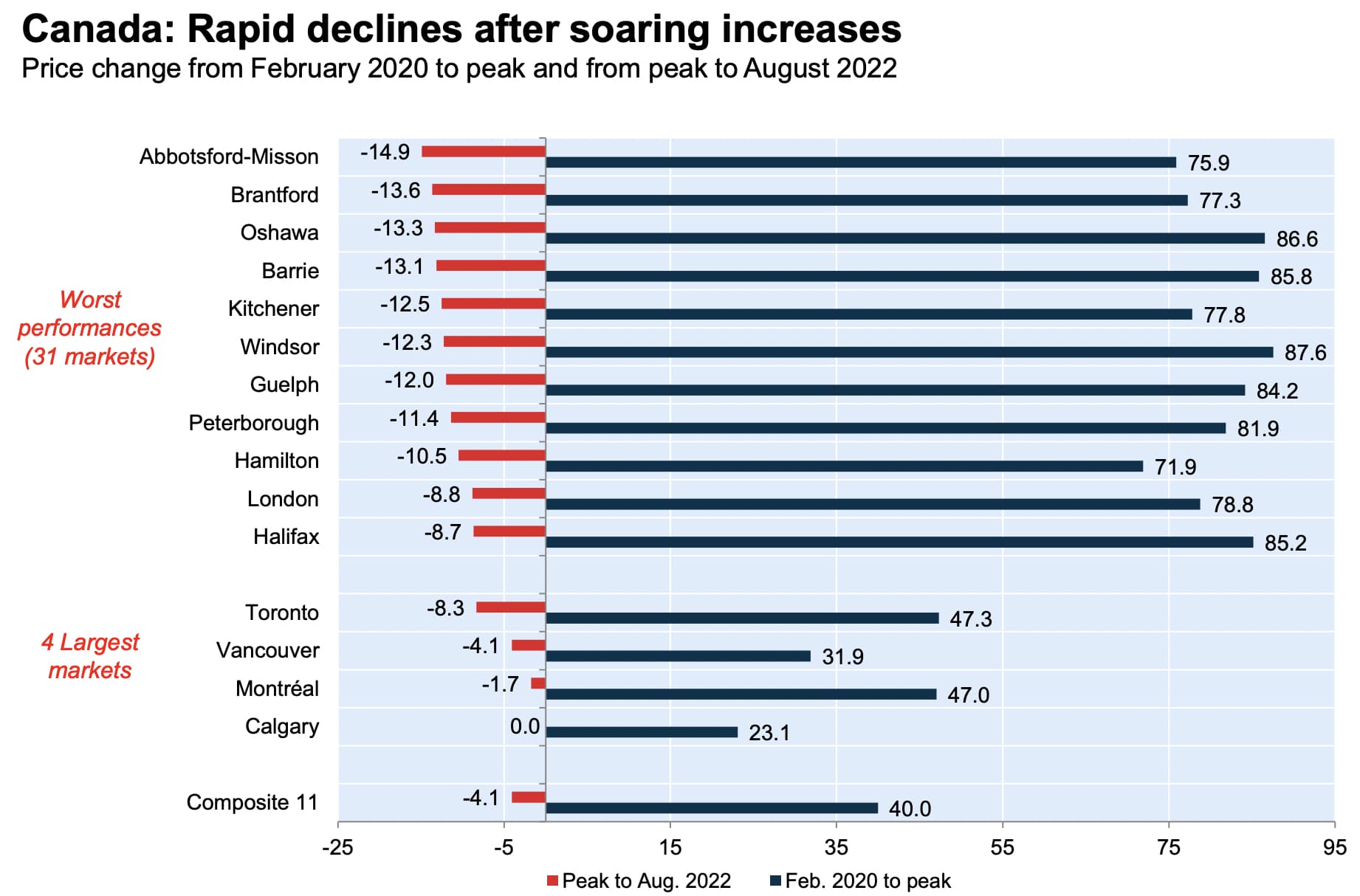

NBC and Teranet recently released their house price index for Canada which included a breakdown by city. The overall index has only fallen marginally, but larger declines have already occurred in some of the cities that saw gains of over 70% between February 2020 and their peaks earlier this year.

Canada House Prices by City 2020 to 2022 - Image Credit: NBF Economics and Strategy/Teranet-National Bank

New Zealand 🇳🇿

New Zealand, which tops Bloomberg’s list, saw prices begin to decline in May. Between June and September, home prices fell in 803 of 955 New Zealand suburbs . The magnitude of the declines may not be substantial, but they are the largest declines since 2008, and have brought a decade-long housing boom to an end.

💡 The Insight: Outlook of the Real Estate Market

The downside risk for home prices depends on a variety of factors. If homes become unaffordable, prices will stop rising, but not necessarily fall. The declines come when homeowners become forced sellers because they simply can’t afford to make mortgage payments.

Some economists don’t think a 2008-type crash is likely as lending standards have been improved. While it would be great if that ends up being true, the reality is that the outcome could be quite different in each market depending on the amount of speculation, the number of variable rate mortgages, and how much mortgage rates rise.

Key Events This Week

It is a very quiet week for economic data and corporate earnings.

Some companies are now starting to publish Q3 earnings, but the only notable companies reporting this week are Nike ( NYSE:NKE ) and Micron Technology ( NASDAQ: MU ) , both of which report on Thursday.

On Tuesday, U.S. durable goods orders and new home sales will be released , which will give us an indicator on economic activity, and housing demand, respectively.

And then on Friday, U.S. personal spending and income and the University of Michigan consumer sentiment survey will be released.

Until next week,

Invest Well,

Simply Wall St

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.