What Happened in the Market This Week?

Market Insight for 22th July - 29nd July 2022

Equity markets resumed their rally after the ‘big tech’ companies reported results that were slightly better than expected. Q2 Earnings Reports released this week included those of Apple ( Nasdaq:AAPL ) , Alphabet ( Nasdaq:GOOGL ) , Microsoft ( Nasdaq:MSFT ) , and Amazon ( Nasdaq:AMZN ) , amongst several other big names - a full list is available in our earnings calendar at the bottom of last week’s market insight article .

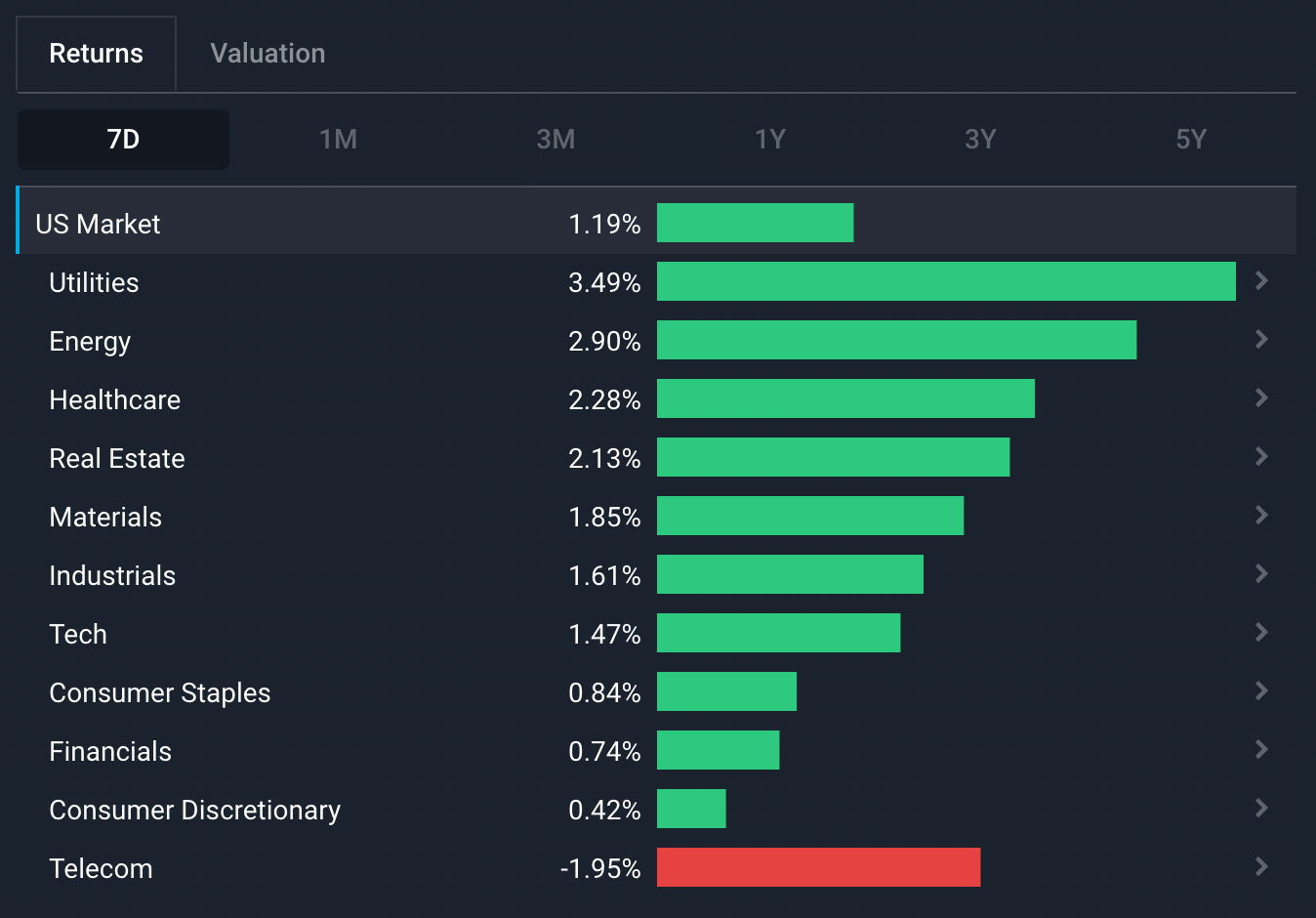

In the U.S. Market, the utilities , energy and real estate sectors outperformed, while the telecom sector weighed on the market after several telecom and media companies reported disappointing results.

Some of the developments we have been watching over the last week include:

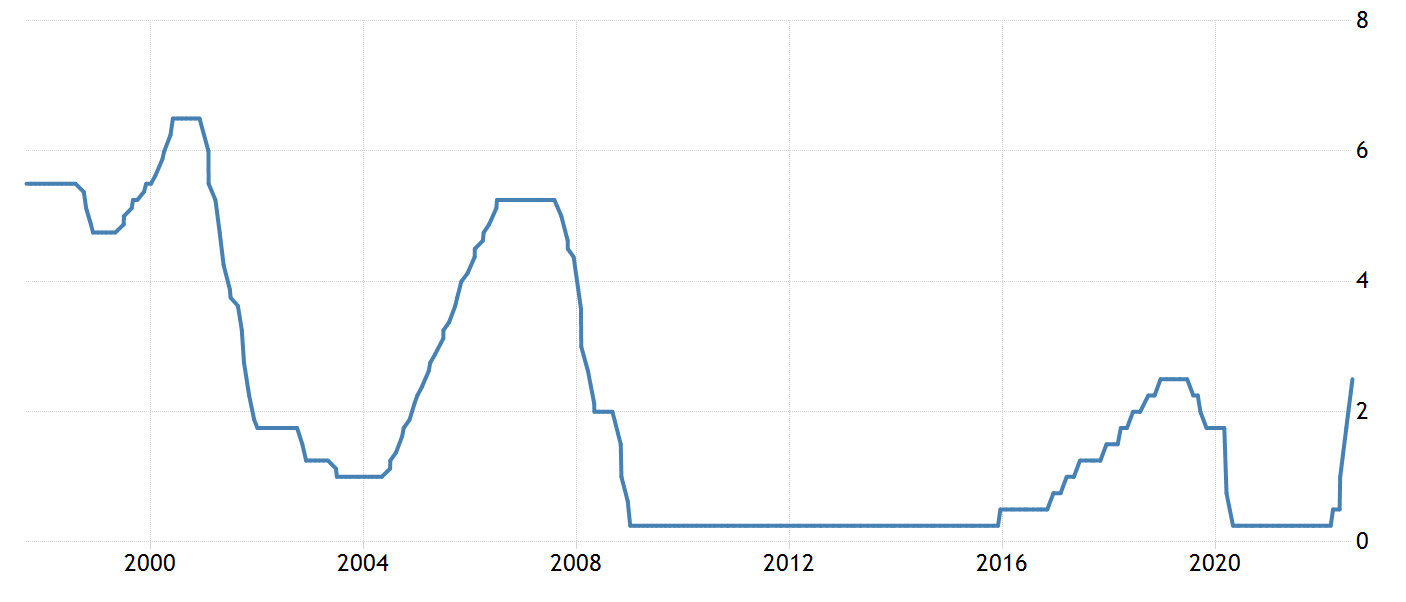

- The Fed hiked rates by 0.75% to a range of 2.25 to 2.5% , the fourth rate hike this year; up from the range of 0 to 0.25% at the start of 2022.

- Real estate markets around the world are experiencing a major slowdown which has some analysts worried about a potential crisis.

U.S. Federal Reserve Hikes Rates for the Fourth Time This Year

As widely expected, the Federal Reserve raised interest rates by 0.75% for the second consecutive time, following a similar 0.75% hike just last month . The target range is now 2.25% to 2.5%, up from 0 to 0.25% at the beginning of the year — the highest it has been since 2019.

Equities rallied on Wednesday after Fed Chairman Jerome Powell hinted that the pace or magnitude of rate hikes may slow . He also said that he does not believe the economy is in a recession, and that there may still be a path to reduce inflation without causing a recession. Though last year he also claimed inflation was transitory and we all know how that turned out. So do with that what you will...

U.S. Federal Fund Rate 1997-2022 - Image Credit: Tradingeconomics.com

How do rate hikes affect the economy?

Higher interest rates increase the cost of doing business for companies and the cost of borrowing for consumers. This means that companies generally cut back on investment given the higher rate of borrowing - which means fewer new jobs, and even possibly retrenchments. This then leads to less discretionary income for individuals, which alongside the higher rate for debt, altogether leads to less aggregate demand in the economy.

The compounded effect of all the above result in lower consumer spending and corporate profits, and therefore an overall lower level of economic growth.

What do rate hikes mean for investors?

Some companies actually benefit from higher rates, while others are less sensitive to interest rates and become relatively more attractive. On the other hand, companies that rely on consumer discretionary spending typically see their revenues decline, while those that borrow excessively can see their profit margin decline. With that in mind, who’s actually set to perform well in these cycles?

Which sectors perform well during a rate hiking cycle?

- The Financial sector typically benefits as banks earn higher margins on loans . However the rest of the financial sector tends to respond to overall economic conditions more than to interest rates.

- Energy stocks tend to benefit when rising inflation leads to interest rate hikes , and particularly if inflation is caused by supply issues, such as gas or oil shortages.

- The Technology sector is less affected by interest rates than other sectors , and can perform well if businesses continue to invest in technology to run their operations.

- Utilities and Healthcare companies can outperform as they aren’t as sensitive to rate hikes and therefore become more defensive than other sectors due to their more reliable cash flows.

Which sectors underperform during a rate hiking cycle?

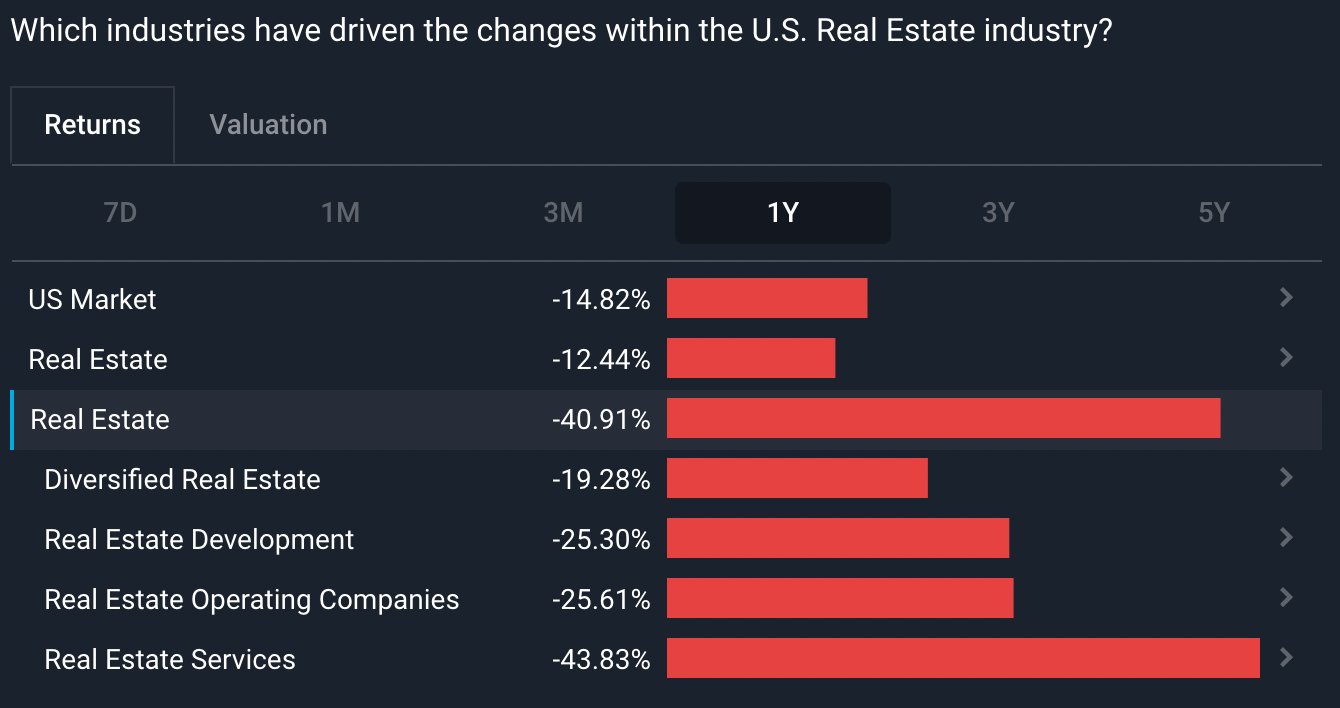

- The Real Estate sector is negatively affected by rate hikes as mortgage rates rise and REITs (real estate investment trusts) have to pay more to borrow capital .

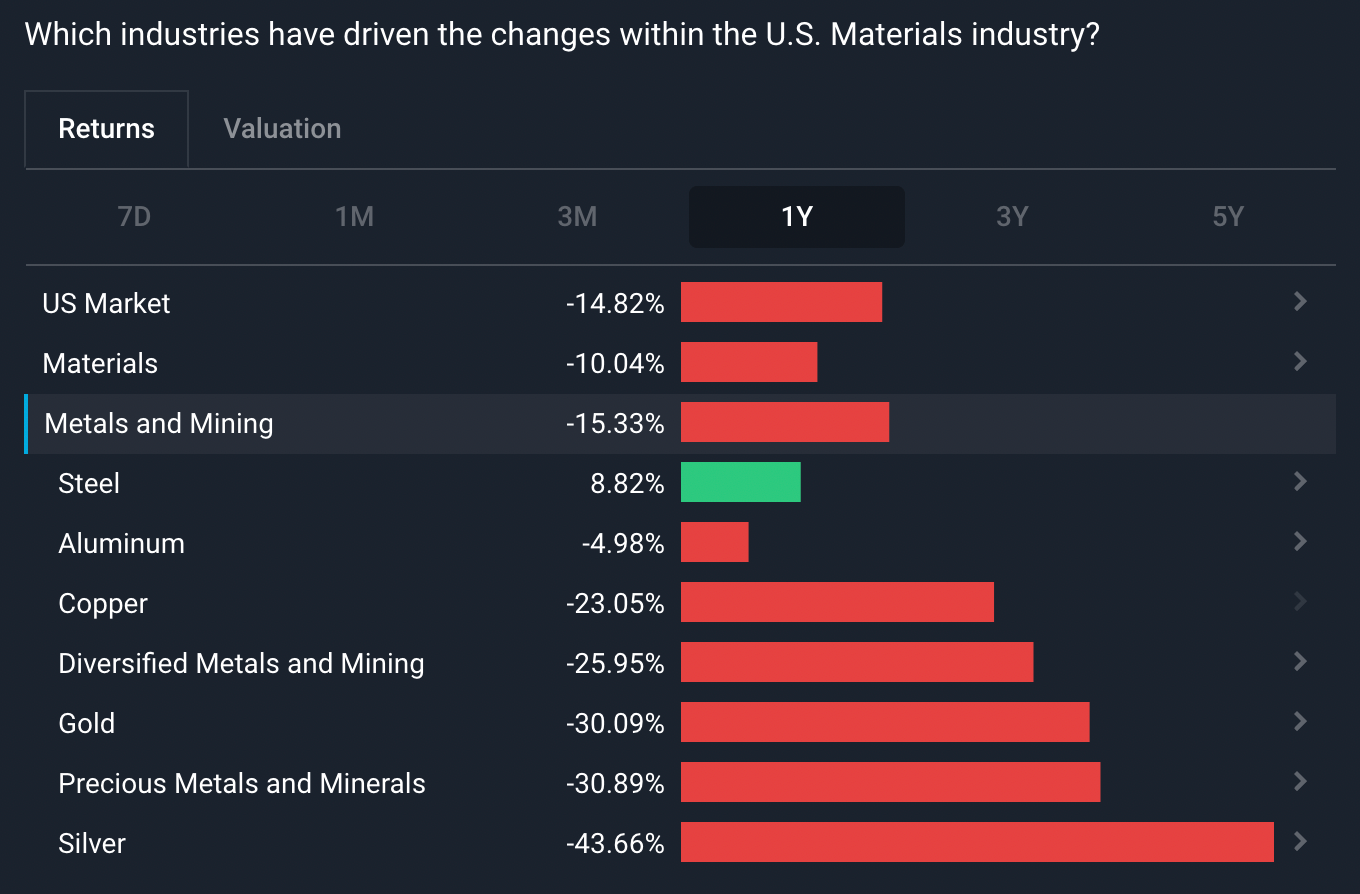

- Cyclical sectors like Consumer Discretionary , Industrials and Materials are also negatively affected when rates rise quickly, as spending typically falls . However, if rates rise gradually and economic growth is strong these sectors can still perform well.

- Consumer Staples companies that don’t have pricing power may suffer from falling margins as inflation leads to higher costs which can’t be passed onto consumers.

- The valuations of growth stocks and stocks trading on high price earnings multiples fall when interest rates rise . If a company’s valuation is largely based on future profits and rates rise, those profits are worth less today.

- Bond prices also fall when rates rise. If a bond pays a fixed interest rate, it becomes less attractive as the rate paid by fixed deposits and other instruments rises.

The Insight: How to Invest in a Rate-Hiking Economic Environment

Every interest rate cycle is different and sectors don’t always behave the same way. Besides the level of interest rates, a company’s performance is affected by the pace of rate hikes, how long the cycle lasts, consumer confidence and other factors that are unique to each sector and business. In addition, the market is forward-looking and share prices usually reflect expectations for the future direction of interest rates, as much as current rates.

👉 With this year's expectations of rate hikes well-known to many investors, current market prices most likely already account for future anticipated hikes ( economists anticipate the rates to get to 3.25-3.5% by the end of 2022 ). So with the information above, and our own informed expectations of the future developments, we need to try and identify mispriced opportunities. Additionally, our analysts have written a list on the best stocks for rising interest rates to assist with your investment decisions.

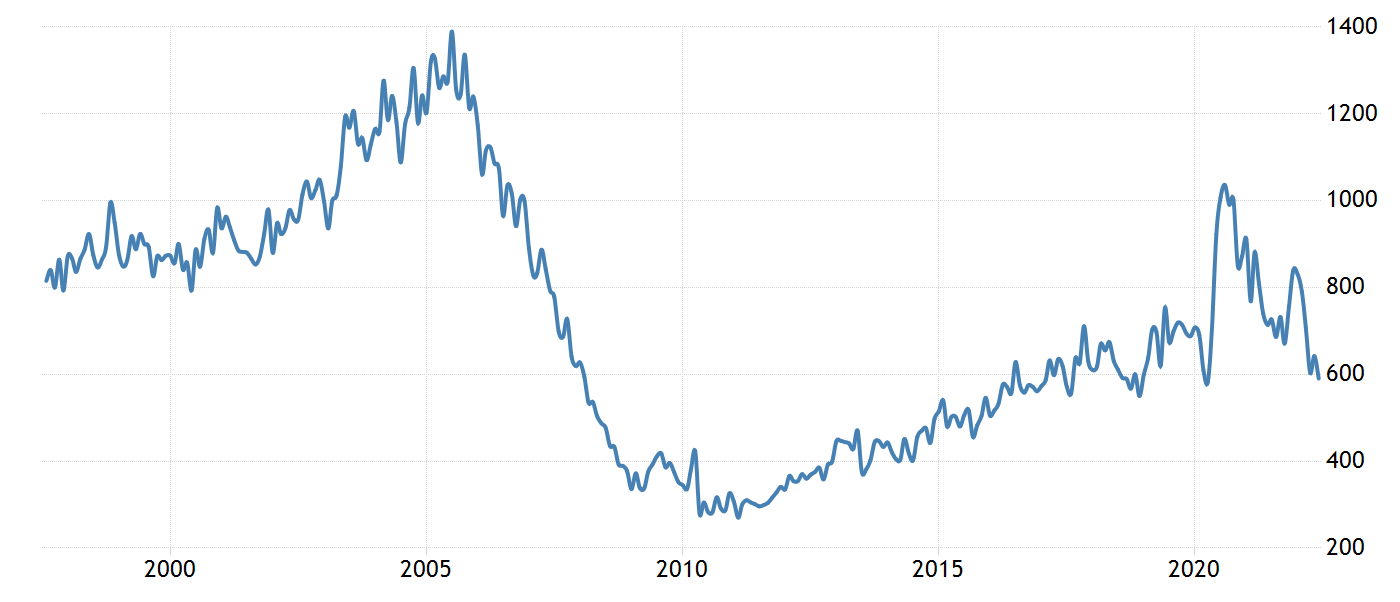

Global Real Estate Markets Experience Major Slowdown

New and existing home sales have plummeted in the U.S. and around the world as mortgage rates have risen sharply since January. For the last decade, there has been a boom in home prices fuelled by near zero interest rates. This meant that at the beginning of the year, real estate had already become unaffordable to many home buyers. Now that mortgage rates have nearly doubled, buying a home is even further out of reach for many.

United States New Home Sales 1997-2022 - Image Credit: Tradingeconomics.com

Is there a housing market crash?

House prices are actually still rising in some countries, although there is evidence they are falling in several others . The latest U.S. home price data available is for May, which still had house prices up 19.7% year-on-year , compared to a 20.6% increase in the year to April. However, this isn’t a realistic reflection of what’s happening in the real estate market.

Unlike the stock market, real estate is relatively illiquid and it takes time for a cooling market to be reflected in the prices that homes sell for. When buyers decide to sit on the sidelines, prices don’t immediately fall. Rather, activity dries up and the number of transactions fall — as we have already seen . After a few months of this, sellers begin to lower their asking prices in a bid to sell, another phenomenon we are already seeing happen around the world.

But even then, homes may not sell as buyers remain sidelined. In fact, when homes don’t sell, many sellers may take their homes off the market if they don’t need to sell them. This simply results in less available supply of houses for sale, and less activity.

Eventually though, home prices fall when opportunistic sellers become forced sellers due to mortgages becoming unaffordable, or for other economic reasons. The longer a recession or rate-hiking cycle lasts, the more chance there is that this happens.

1Y U.S. Real Estate Industry on Simply Wall St - check the analysis!

What can we see for the housing market in 2023?

Analysts are divided over the outlook for the real estate market. Some fear a 2008-like housing crisis , while others believe the world will experience a housing recession . The latter will play a necessary role in taming inflation given that the housing market greatly stimulates the economy with its hefty requirements in materials and labor.

Ultimately, the direction of the housing market largely depends on how long the rate-hiking cycle lasts. The silver lining is the fact that lower prices would make homes more affordable for first-time buyers from a purchase price point of view, but the ability to service the mortgage might be equally difficult due to higher rates.

The Insight: Stock Investing when Real Estate Slows

When home sales fall, inventory builds up and developers stop building new homes. This results in job losses and less demand for building products and materials like lumber and cement. There are also knock on effects in parts of the financial, retail, transportation and manufacturing industries .

👉 Investors need to look beyond the real estate sector itself to see where they may have exposure to a slowdown.

Stock Market Next Week

This week will see the release of new data that will reflect the strength of the economy. The U.S. and Eurozone employment rates will be announced, as well as the U.S. ISM Manufacturing and non-Manufacturing PMI ; which releases the survey results of purchasing managers on their level of business activities. The U.S. balance of trade report will also be published , which shows the net levels of U.S. imports and exports.

Elsewhere, Australia and the U.K. ’s central banks will announce their latest interest rate decisions . And the expectations are that both will increase rates.

🗓 Earnings Season Calendar (Aug 1 - Aug 5, 2022)

Mon 1 Aug

Berkshire Hathaway (BRK.A) • HSBC Holdings (HSBA)• Activision Blizzard (ATVI) • Heineken (HEIA)

Tue 2 Aug

AMD (AMD) • Uber Technologies (UBER) • Paypal (PYPL) • Starbucks (SBUX) • Mitsubishi (TSE:8058) • Airbnb (ABNB) • Nintendo (TSE:7974)

Wed 3 Aug

Booking Holdings (BKNG) • Moderna (MRNA) • Siemens (SIEMENS) • MetLife (MET)

Thu 4 Aug

Tesla (TSLA) • Alibaba (BABA) • Toyota (TSE:7203) • Cigna (CI) • Glencore (GLEN) • Atlassian (TEAM) • Block (SQ)

Fri 5 Aug

Allianz (ALV) • EOG Resources (EOG) • State Bank of India (BSIN) • BANDAI NAMCO (TSE:7832)

Until next week,

Invest Well,

Simply Wall St

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.