What Happened in the Market This Week?

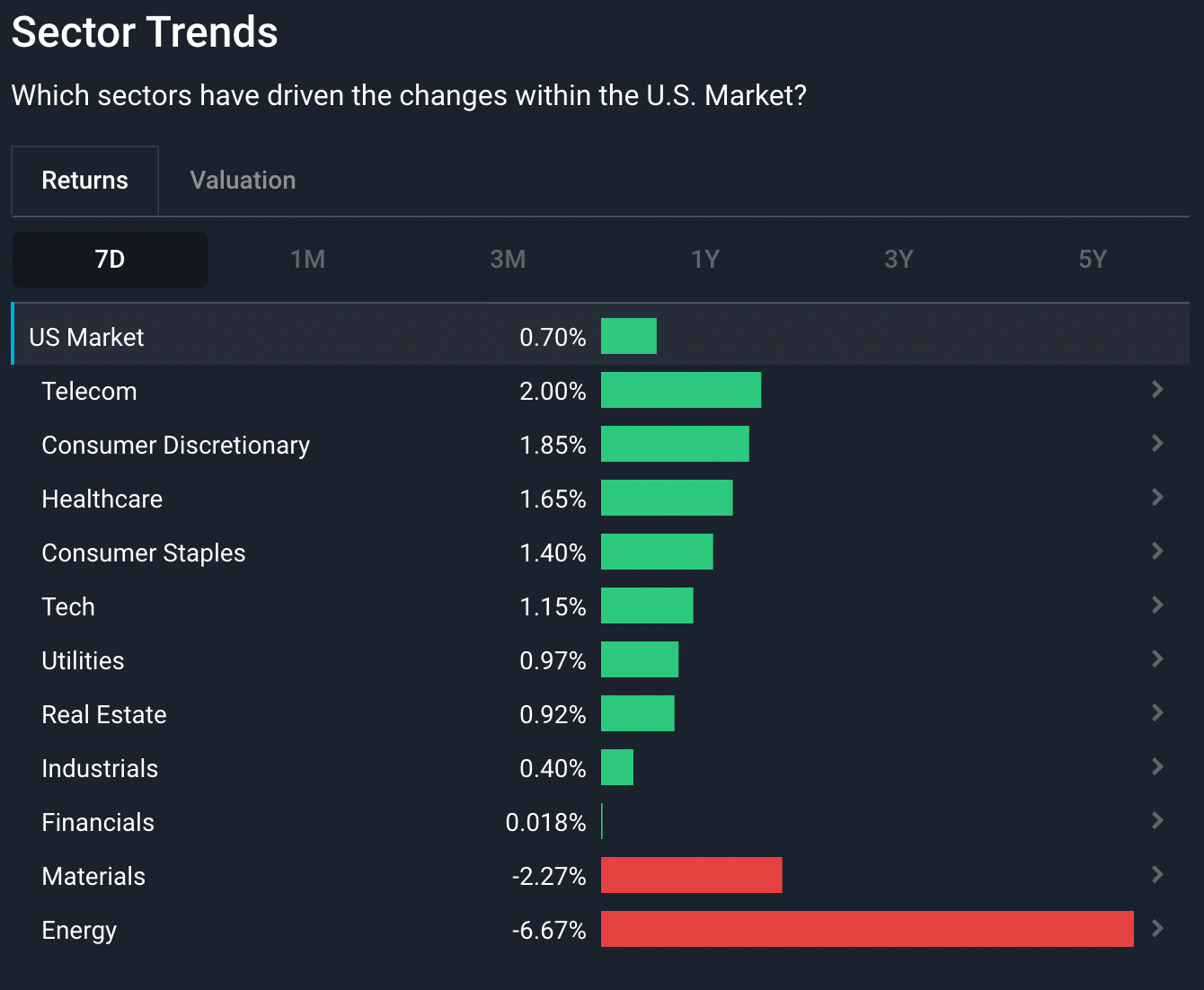

Global equity markets were mixed last week, with the likes of New Zealand , and India performing better than the United States , United Kingdom and Germany . Around the world, consumer discretionary , healthcare and telecom stocks traded higher, whereas the materials and energy sectors continued their downward slide.

Some of the developments we are watching over the last week include:

- Global corporate debt levels have fallen as higher interest rates have made companies reluctant to take on more debt.

- The price of Crude Oil fell below US$100 as fears of a recession led investors to anticipate falling demand.

- The Copper price has fallen to a 17-month low which some analysts see as another sign of a global recession.

Global Corporate Debt Falls for the First Time in Eight Years

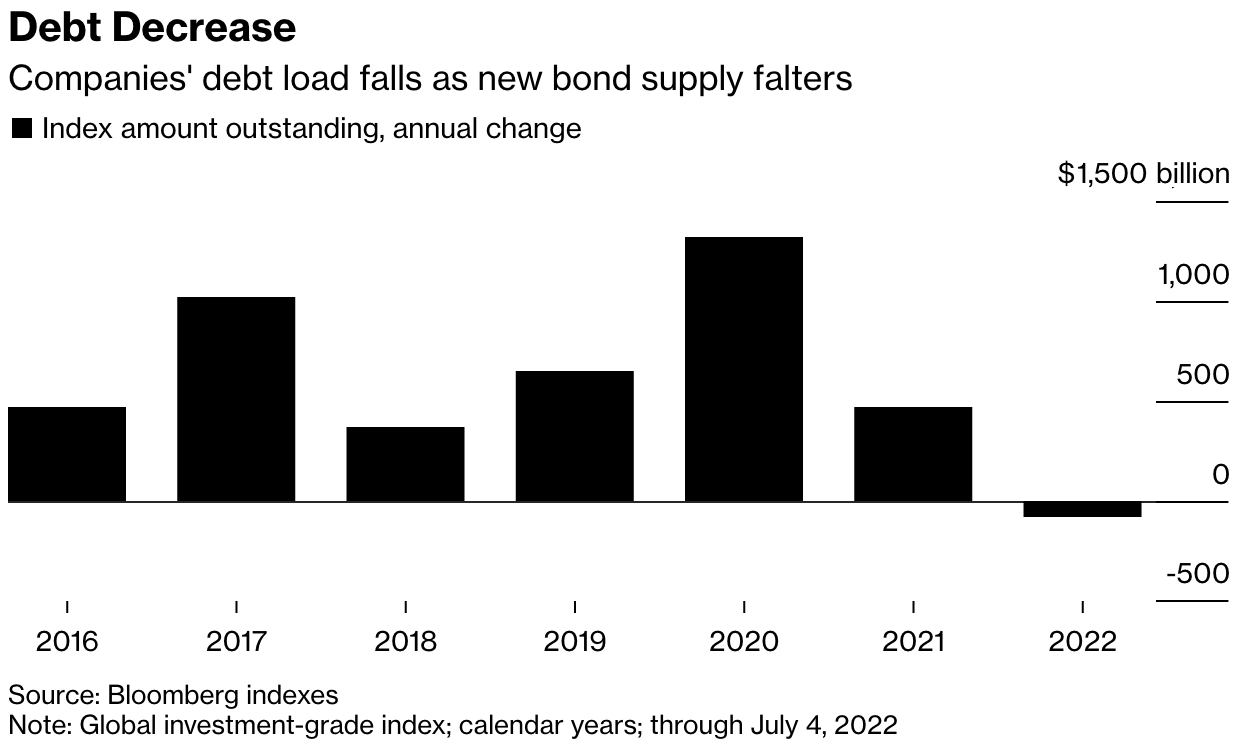

Global corporate debt has fallen for the first time in eight years as higher interest rates have led companies to stop issuing new bonds. Just 15 months ago, there were fears of a corporate debt bubble as the total amount owed by US companies reached $10.5 trillion . However, a study by asset manager, Janus Henderson, found that corporate net debt has fallen to $8.15 trillion in the last year . Companies in the U.S. actually increased their total debt slightly, while companies in other countries reduced their use of debt.

Businesses took advantage of low interest rates in 2020 to borrow enough cash to survive the pandemic, and many of these borrowings don’t mature for a few more years. Reportedly $1.5 trillion of corporate debt in developed economies will be maturing in 2023 and 2024 , and $2 trillion will mature in 2026.

In 2021 and 2022, with the prospect of higher interest rates, it appears businesses have since used their cash flows to pay down that debt rather than take on the higher interest charges. Therefore, if the trend of repayment over refinancing continues, net debt may fall even further. If you invest in corporate bonds to get those slightly higher yields, the size of the investment pool available may reduce over the next few years.

The Insight: If interest rates remain higher for an extended period, businesses are likely to be more reluctant to borrow as much as they might have back in 2020. Those companies that need to borrow will be faced with a choice between higher interest costs, alternative financing options, or restructuring. This may in turn affect their operational leverage.

👉 Given this environment, investors would do well to check in on the financial health of the stocks they own in their portfolio or are watching on their watchlist . A company with high levels of debt will be affected more in an high-interest rate environment than others. If you’re interested in low leverage stocks, we have curated a list of companies with low debt levels and a high return-on-equity (ROE) .

Crude Oil falls below US$100 a Barrel

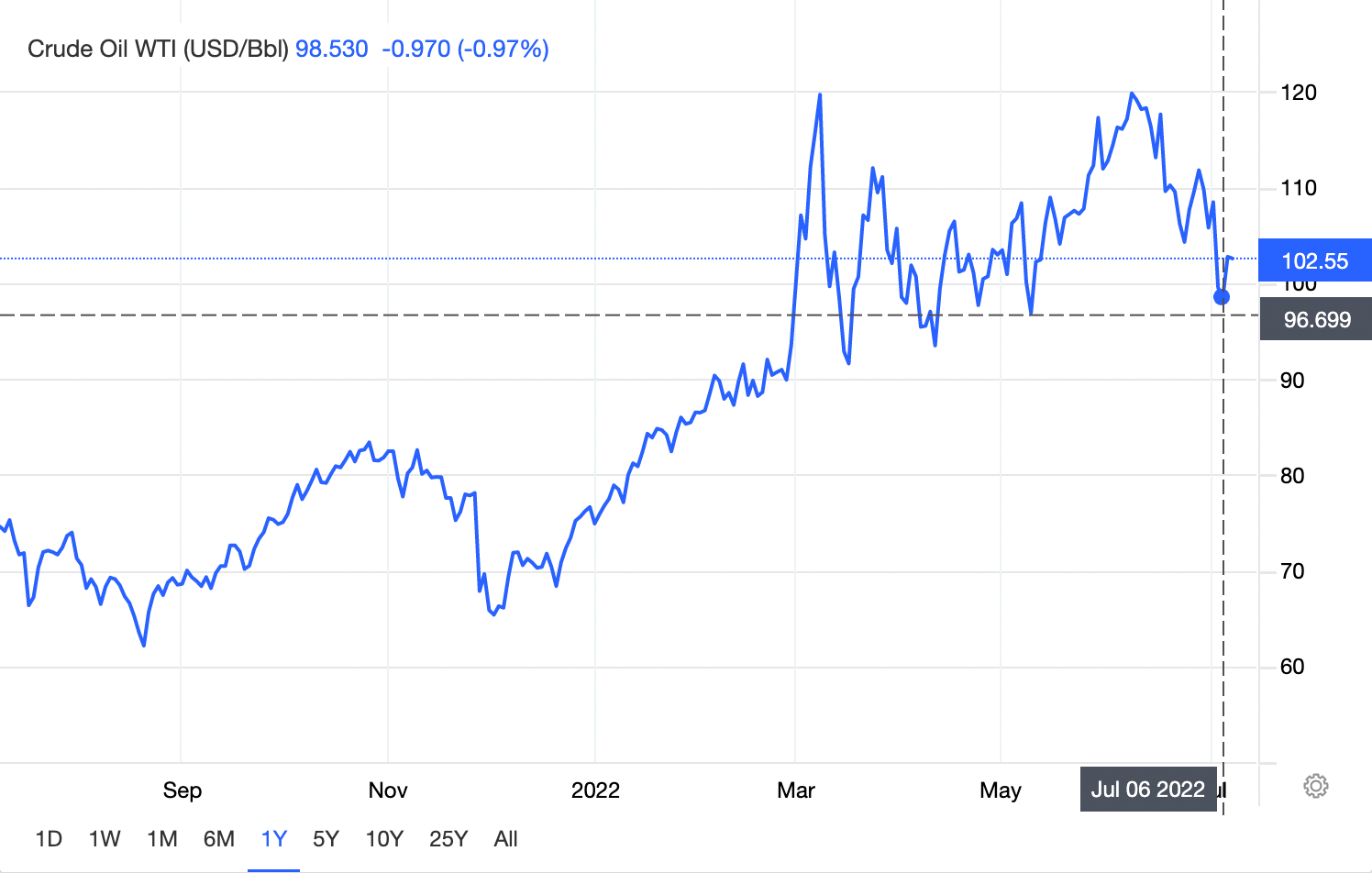

The price of crude oil fell the most since March last week, and both the U.K. and U.S. benchmarks traded below US$100. The spot price of oil is often very volatile due to logistical issues, but in this case, futures contracts out to July 2023 are now trading below US$80. This suggests that the market is expecting the prospect of a global recession to result in lower demand for oil.

As we mentioned last week, fuel prices are still rising around the world due to limited refining capacity . Fuel prices are also subject to supply and demand dynamics, so demand may need to fall before fuel prices do stop rising. According to analyst estimates however, global oil demand is expected to continue increasing as air and land travel resume post-pandemic.

The Insight: Last week’s PCE core inflation rate suggested that inflation in the U.S. may be peaking . If the oil price remains closer to $100 it should eventually filter through to consumer inflation. While the prices of consumer goods and services seldom fall, they may at least stop rising. Nevertheless, it may take a few months for the lower oil price to be reflected in inflation data — and that’s assuming the price remains at these lower levels.

👉 Given the uncertain outlook over oil prices, how you should act depends on what you think is more likely. If you believe oil prices are likely to rebound and remain higher for a longer time, you might be interested in investing in stocks that benefit from higher oil prices . Alternatively, if you think the elevated prices are shorter term, you may be more interested in looking at some renewable energy stocks since they’re expected to receive a lot of business over the next decade.

Is Dr. Copper Predicting a Recession?

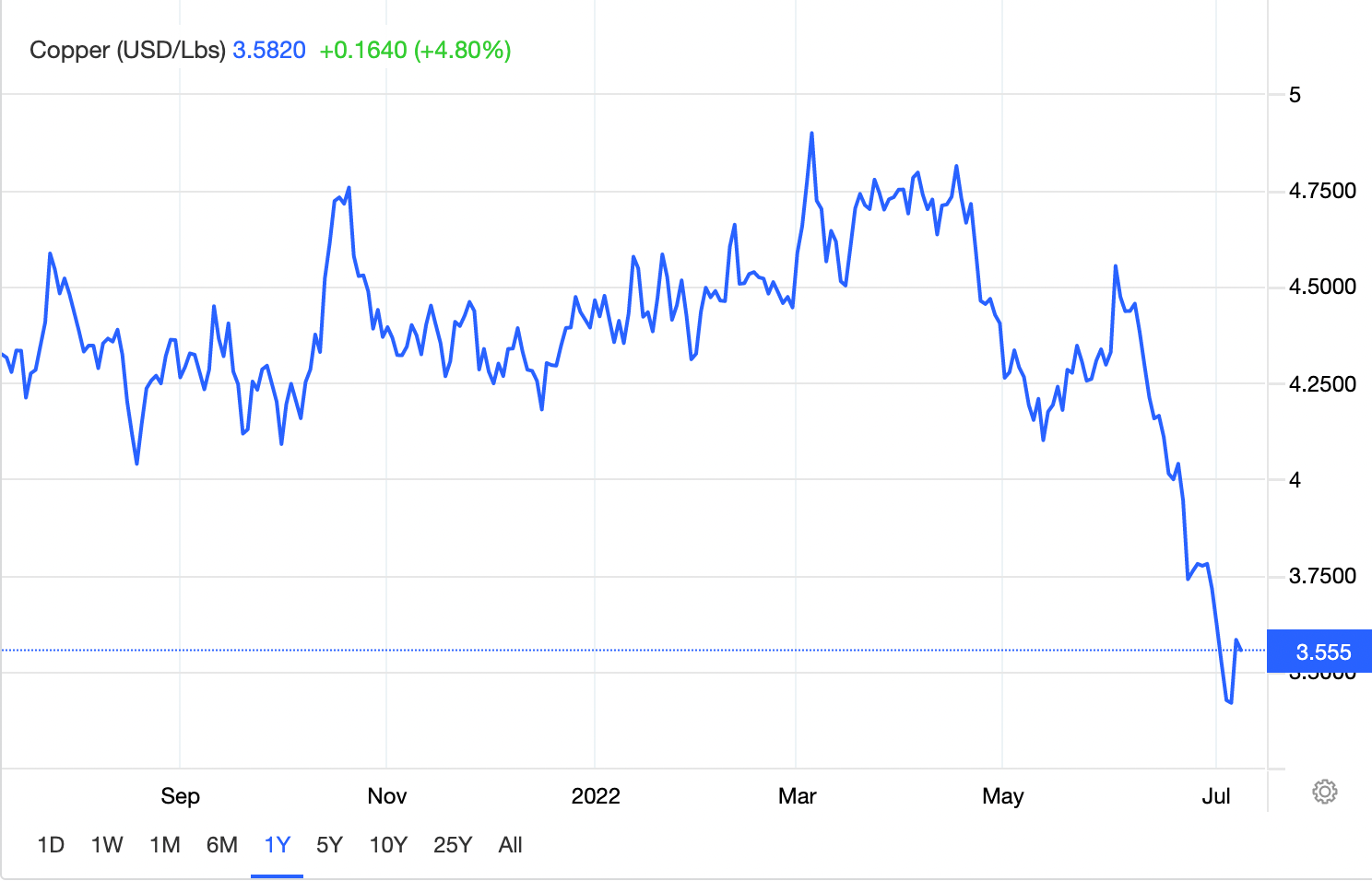

The price of Copper has fallen as much as 30% since it touched US$5 a pound in March. Copper is often referred to as Dr Copper as it is widely viewed as a leading indicator for global economic growth, and it’s been suggested that the metal ‘deserves a PhD in economics’. Indeed, copper is used in many industries, including construction, manufacturing, technology and communication — so it is very much tied to industrial activity.

With copper back at levels last seen 17 months ago, analysts are suggesting this is further proof of a recession on the horizon , or even under way. However, the copper price is still well above the average for the last few years and is arguably still in an uptrend.

The Insight: Dr Copper’s track record is actually quite mixed when it comes to predicting global GDP growth . There have been periods when its predictive power has been quite good. But there have also been periods when it’s been inversely correlated to GDP growth. A recent example is the period from 2011 to 2016 when the copper price trended lower while the global economy continued to grow. The copper price can be used alongside other tools, but it’s not reliable enough to use in isolation to make investment decisions.

It’s also worth remembering that the economy is not the stock market. Stock prices often discount changes in GDP before the fact, just as the copper price sometimes does. In other words, despite all his wisdom, it might not be the best idea to use Dr Copper as a market timing tool.

👉 Regardless of copper’s movements, if you believe a recession is likely, you’ll want to own stocks that can still perform well in that environment. To help with the search, we recently compiled a list of stocks that typically perform well in recessions .

Market Outlook Next Week

This week’s key economic data releases will be the U.S. inflation data on Wednesday and Thursday, and retail sales on Friday. China and the U.K. will also be publishing 2nd quarter GDP growth rates which will give us insights into whether they too could experience a recession.

Second quarter earnings season kicks off this week in the U.S. with the banks and other financial sector companies reporting first. Notable companies announcing results include:

- JP Morgan ( NYSE:JPM )

- Morgan Stanley ( NYSE:MS )

- Wells Fargo ( NYSE:WFC )

- Citigroup ( NYSE:C )

- Blackrock ( NYSE:BLK )

Away from the financial sector, a few of the large companies reporting include:

- Taiwan Semiconductor Manufacturing ( NYSE:TSM )

- Delta Airlines ( NYSE:DAL )

- PepsiCo ( NASDAQ:PEP )

- Ericsson ( NASDAQ:ERIC )

Until next week,

Invest Well,

Simply Wall St

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.