What Happened in the Market This Week?

Market Insights for week ending 2nd September

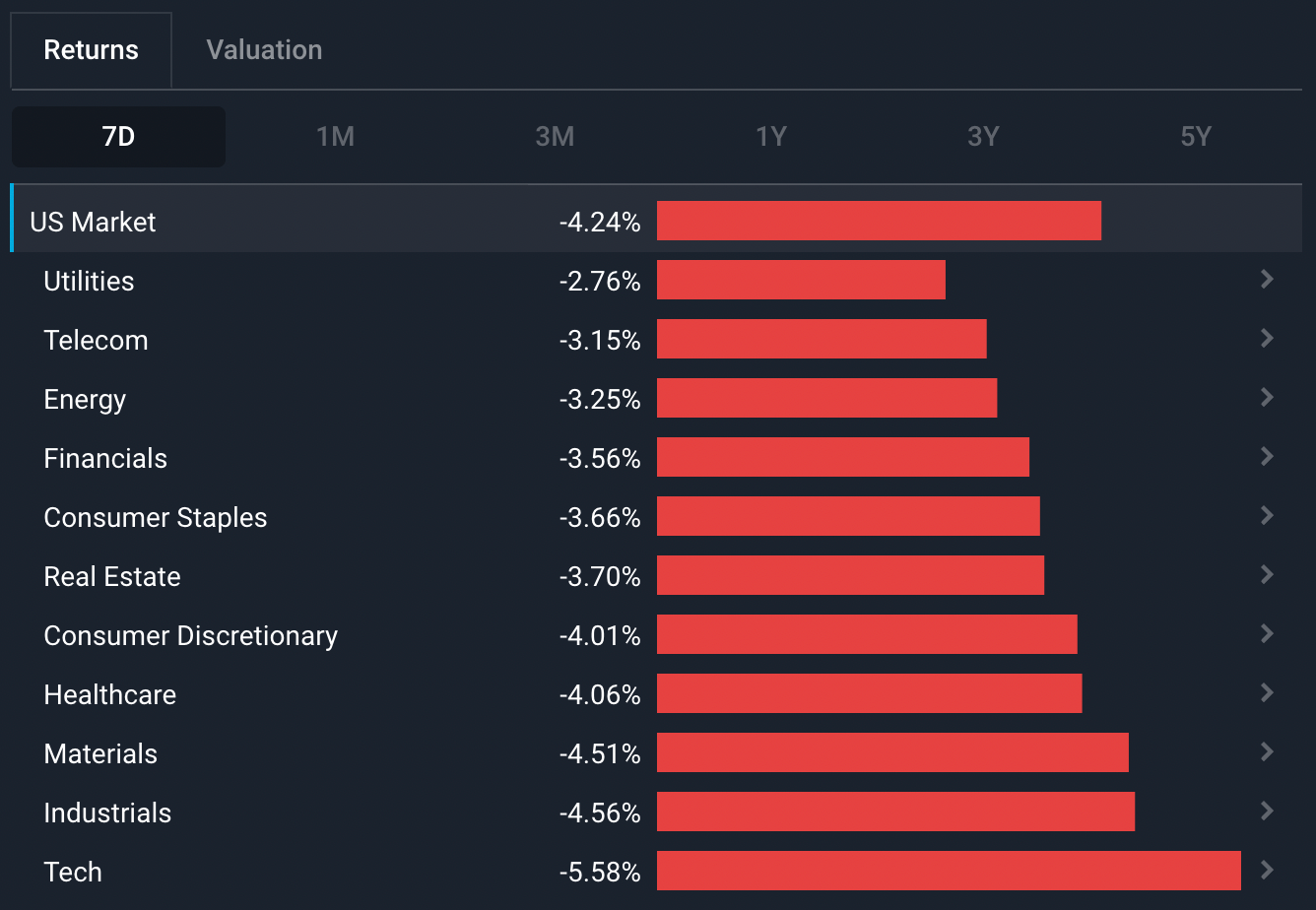

Words carry a lot of weight in markets these days. Investors came to terms with the fact that rate hikes won’t be ending soon after commentary from Fed Chairman Jerome Powell re-affirmed that more rate rises are likely . The selling in equity markets this past week was broad-based, and even Energy stocks that have rallied in past weeks gave up recent gains along with the oil price.

U.S. Sector 7D Performance - 2nd September 2022 - Simply Wall St

Some of the developments we have been watching over the last week include:

- Fed Chairman Jerome Powell spooked the market by making it clear that rate hikes aren’t going away any time soon.

- Higher interest rates are also putting emerging markets at risk - but may ultimately create opportunities for long term investors.

Nope - Rate Hikes Aren't Ending Soon!

Fed Chairman Jerome Powell sent markets into a nosedive with an eight minute speech at the Central Bank’s Economic Symposium . The gathering is held every year in Jackson Hole and it’s where the current Fed chair gives his annual policy speech.

So what did Powell say that made the stock market dive? 📉

Well, in short, he said “ higher interest rates likely will persist for some time” and that “the Fed will use our tools forcefully to attack inflation .”

He acknowledged that the process of bringing inflation under control would bring some pain to households and businesses - but that “ a failure to restore price stability would mean far greater pain .”

These comments were notable because the market had begun to anticipate cooling inflation and the prospect of rate hikes slowing . This was one of the drivers of the recent stock market rally, particularly for rate sensitive growth stocks.

The Weight of the Fed's Words

When we think of the tools that central banks use to influence the economy and inflation, we generally think of three things:

- Interest rates;

- The buying and selling of bonds; and

- Money supply.

But believe it or not, “words” are also a tool in a central banker’s arsenal. With one comment on rate hikes, Powell almost completely took away the optimism seen in global markets in the last few weeks - his words arguably having as much effect as an actual rate hike . The old rhyme “Sticks and stones may break my bones, but words shall never hurt me” doesn’t seem to include stock markets!

Central Bank officials can thus influence markets with a few carefully chosen sentences. In this case, Powell’s comments ended the market’s complacency over inflation. Back in March 2020, his comment of “we will do whatever it takes to preserve stability” did exactly what they intended and reassured markets (followed swiftly by their actual monetary support).

When is the Fed's next rate hike?

Now that the Fed has reminded us they don’t plan on allowing us to relax, all eyes are on the next FOMC meeting which will be held on the 20th and 21st September . The market is now expecting another 0.75% hike which will take the top of the target range to 3.25% .

How high will interest rates go?

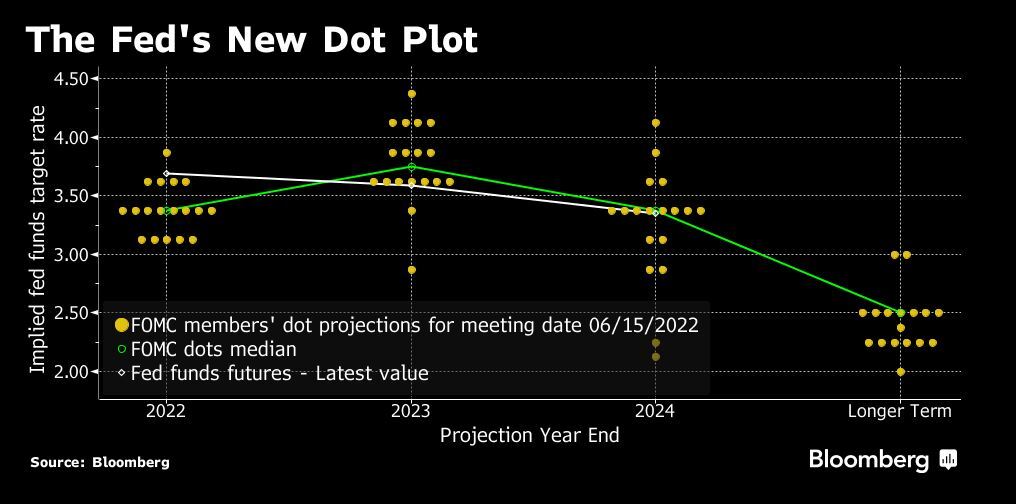

It’s hard to say how high the Fed would raise rates exactly, but below is the Fed’s dot plot from June. Each yellow dot reflects what rate a member of the interest rate policy committee (the FOMC) forecasts the Fed funds target rate to be at the end of each year.

Fed Dot Plot published after June 2022 meeting - Image Credit: Bloomberg.com

As you can see, their forecasts are not unanimous, but there is a cluster in the middle, as well as a median projection (the green line). There were also a few committee members with slightly higher (or hawkish in Fed speak, as hawkish means a contractionary monetary policy) projections, and two much lower (or dovish , an expansionary policy) projections.

The current Fed funds target range is 2.25 to 2.50% , with a mid point of 2.375%. The median projection for year end was 3.37% rising to 3.75% by the end of 2023 and then falling back to 3.37% by the end of 2024 . However only a few committee members need to become more hawkish for the median to rise another 0.5 to 1%.

Keep in mind that FOMC members change their forecasts as new data comes in. Just like anyone else trying to make accurate forecasts, their projections can and probably will change as economic and inflation data changes.

💡 The Insight: Investing when the Fed is being Hawkish

It’s important to remember that markets trade on interest rate expectations rather than the actual interest rate at any given time. Expectations have now risen again after Powell’s comments - U.S. 10 year bond yields have risen from 2.5% to 3.2% over the last month .

For Short or Medium-Term Investors (< 5 years)

In the short term, investors will need to navigate the prospect of higher rates as well as a weakening economy. Until there is evidence of an improvement in one or the other, or both, investors may seek out the safety of defensive sectors ( utilities , healthcare and consumer staples ) leading to their outperformance. Tech companies that are continuing to perform well might also be viewed as defensive as businesses must continue to invest in technology to remain competitive.

💸 As we mentioned in last week’s Market Insight , investors who want to preserve psychological capital (to lessen the stress!) should also feel no shame in deciding to hold cash. Market volatility is not for everyone, and it’s better to hold your cash than to impulsively sell your stocks at a loss.

For Long-Term Investors (5+ years)

Investors focused on long-term returns, and who can stomach some volatility, can look at the current bear market as a once in a decade opportunity. Companies with industry leadership, competitive advantage, good margins and cash flows, a growing market, and good leadership may currently be priced too low, meaning opportunities are out there.

Tech stocks that are known for their growth potential have also been heavily battered by rate rises, as their valuations have gone down in addition to investors moving out of equity markets. Additionally, long-term investors interested in supporting climate change initiatives (as governments start ramping up support to improve environmentalism) may find a good entry price into the market.

Given the interest in this investment narrative, our analysts have created lists such as the top lithium battery stocks , top stocks for fighting climate change , and top future transportation stocks .

How are Emerging Markets doing?

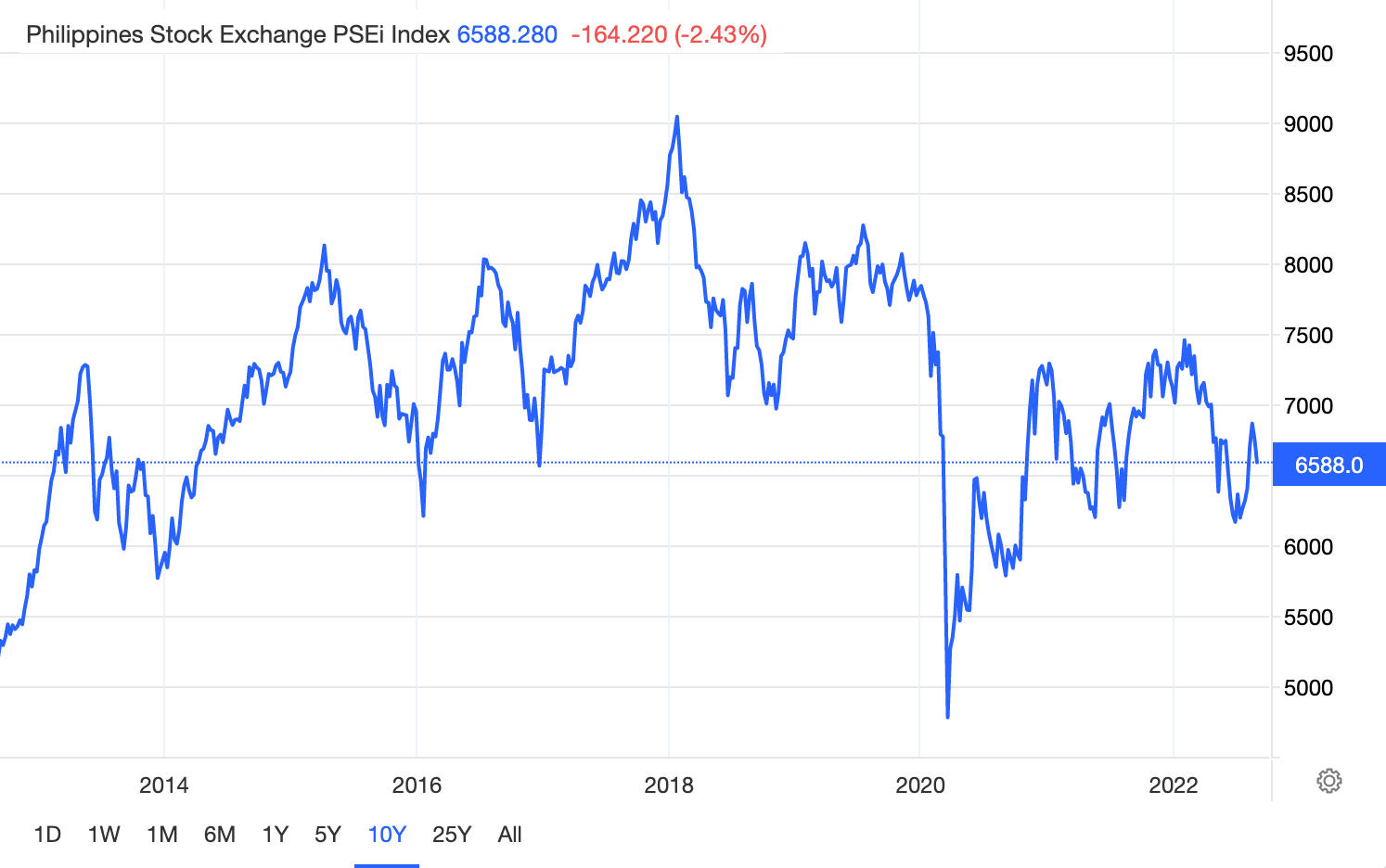

We’ve covered the U.S., Europe and the U.K. , and China in previous Market Insights. However, the prospect that U.S. interest rates are heading higher is also a concern for emerging markets . As they say, when the U.S. sneezes, the rest of the world catches a cold. Higher rates in developed markets give investors less reason to chase the higher yields in emerging markets, which also puts some of these markets at risk.

Emerging vs. Developed Markets

The chart below reflects the performance since 2004 of the MSCI emerging markets index (red), the S&P 500 (black) and the Euro Stoxx 50 index (green) . Emerging market equities have underperformed the S&P 500, and by a very wide margin, since 2009. They have also underperformed European stocks since 2012. But they don’t always underperform - there have been periods of notable outperformance along the way.

MSCI emerging markets index (red) , the S&P 500 (black) and the Euro Stoxx 50 index (green)

- Image Credit: tradingview.com

💡 The Insight: How to Invest in Emerging Markets

Emerging market assets (including equities, bonds and currencies) are often lumped together as a single asset class. They also become highly correlated during market downturns as weakness in one market quickly spreads to similar markets.

However, the reality is that emerging economies are all very different, with different types of companies dominating each exchange. In some economies, manufacturing and exports dominate, while in others, it is commodity production . In more developed markets on the contrary, retail and services usually play a bigger role.

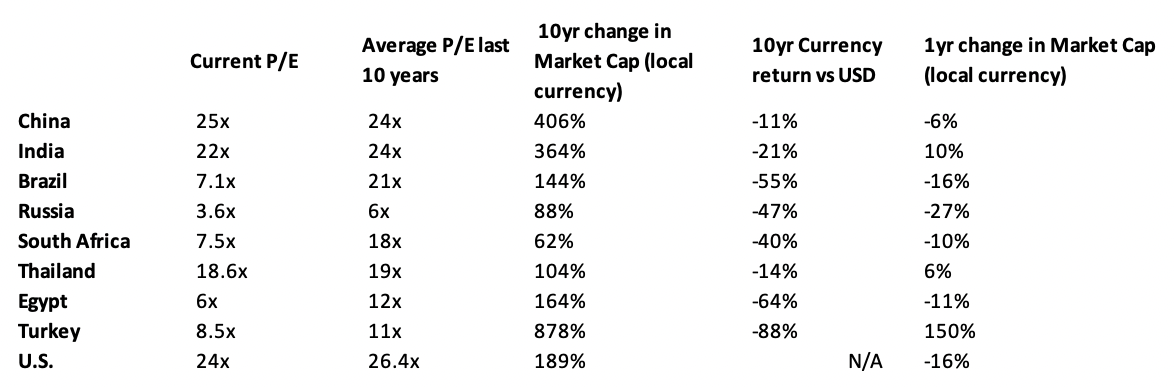

This table illustrates how different the performance and valuations of equity markets in key emerging economies has been over the last 10 years. Keep in mind that currency movements also play a role in the performance of an index, with Turkey being a rather extreme example.

Emerging markets performance and P/E ratios - Simply Wall St Markets Page

For Short or Medium-Term Investors (< 5 years)

In the short to medium term, macroeconomic factors in emerging markets often dominate what happens to share prices. When risk appetite is low, countries with trade and budget deficits are particularly vulnerable (those that spend more than they make) as they are seen as riskier countries to invest in. However, exporters in these countries can benefit from a weak currency and offer a currency hedge in the case of a complete currency collapse.

Macroeconomic factors can also create unique opportunities for certain types of companies. An example is in Turkey , where the weak currency has made the country a destination of choice for foreign tourists. This obviously benefits the tourism industry, but the foreign currency is also flowing into other industries and the broader economy. Several factors come into play when investing in emerging markets - and while countries and companies in these markets are often lumped together, each country has its own unique economic and political landscape.

👉 Investors who plan to invest for a short-term must do plenty of research on both the company and the country the company operates in before any investment. Otherwise, ETFs that invest in companies specifically in emerging markets also exist.

For Long-Term Investors (5+ years)

If you are taking a longer-term view, you can look at market weakness as an opportunity rather than a risk. You can use our Simply Wall St Stock Screener to look for companies with strong fundamentals in any country , and then research the qualitative aspects in more detail.

Just always make sure that if you do consider buying, you have a large enough margin of safety to account for country and company risk accordingly. Also keep in mind that while the S&P 500 has constantly grown over the past decades, the major stock indices of emerging markets may not exactly do the same.

- Source: Bloomberg

Key Events Next Week

Next week, Tuesday will see the release of the U.S. ISM Non-Manufacturing PMI data , which is a leading indicator for economic activity, while U.S. trade data will be released on Wednesday . PMI data is expected to be lower than last month’s, showing that business activity might have slowed down.

The next interest rate decision in Australia will also be announced on Tuesday , and the country’s second quarter GDP growth rate will be published on Wednesday . Australia’s current cash rate is at 1.85%, and consensus forecasts have rates increasing by 0.50% to 2.35%. Last quarter’s GDP growth rate was at 0.8%, and it is forecast to be 0.7% for Q2 - a comforting sign that the country will not enter a recession.

The European Central Bank (ECB) will announce its rate decision on Thursday . Like Australia, a 0.5% increase is expected, bringing the cash rate from 0.5% to 1%.

For earnings season, only a handful of U.S. companies are still due to report, but they do include a few notable companies such as Docusign ( Nasdaq:DOCU ), Gamestop ( NYSE:GME ) and Gitlab ( Nasdaq:GTLB ).

Was this email helpful? Register for free with Simply Wall St to receive our weekly market insights straight to your inbox!

Until next week,

Invest Well,

Simply Wall St

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.