What Happened in the Market This Week?

Market Insight for 18th March - 25th March

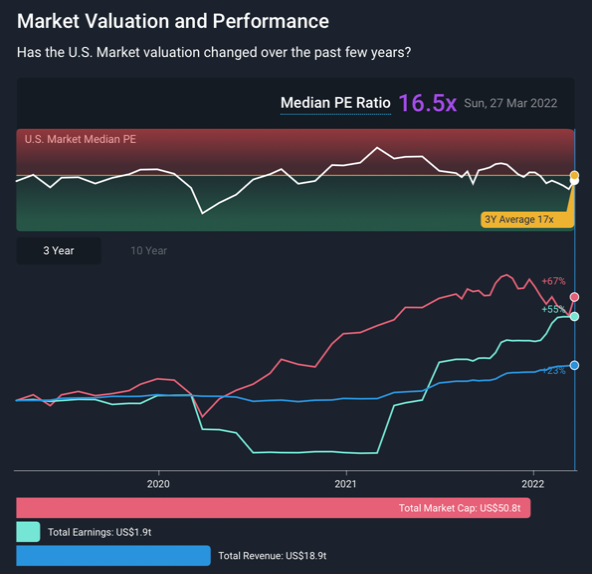

This past week marks 2 years since the S&P 500 dropped some 35% to reach its lows of 2,237 on March 23rd, 2020. Since then, the S&P 500 Index has risen 103%, closing at 4,543 last Friday.

Over the last 7 days, the US Market has risen 2.7%, driven by gains one every sector and the Information Technology sector leading the way. As for the past year, the market is still up 9.2%.

- Federal Reserve taking a more aggressive stance - Announcement of potentially higher rate hikes to fight inflation

- IPOs slowdown – Less IPOs compared to the trends seen in 2021

- Warren Buffet made the biggest deal since 2016 - Acquiring insurer Alleghany for US$11.6b

Fed's Stance On Inflation Remains Aggressive

Federal Reserve Chairman Jerome Powell stated last week that the central bank may look to raise interest rates in 50-basis-point (0.5%) increments rather than the standard 25-basis-point increments as a way to combat the high levels of inflation that have been seen recently. Doing this would accelerate the raising of rates, bringing the effects of those hikes forward.

He said this because while they believe the “US is currently in a strong position” (in terms of its labor market), “high inflation jeopardizes the country's otherwise strong economic recovery”.

Powell also mentioned that the effects of the war in Ukraine constitute a “supply shock one would tend to want to look through”. This signals that the Fed does not believe it is able to control inflation coming from the disruptions to the supply of food and other raw materials in Ukraine, as monetary tools generally only have an effect on demand, rather than on supply.

IPOs Slow Down In Q1 2022

IPOs are when private companies decide to raise additional equity capital from new investors by opening their ownership to the public markets.

IPOs typically thrive when investors are willing to take on risk (i.e. 2021 market conditions). The recent slowdown in IPOs is thanks to the market environment driven by investors' lack of appetite for risk and thus the reduced valuations they’re receiving. Lower optimism from investors means lower company valuations, which means lower amounts of money raised through the IPO.

Through the first quarter of 2022, quite a few IPOs seemingly disappeared. Big names like Stripe and Instacart are expected to delay their IPOs given these current market conditions. Software startups like WeTransfer and Justworks, or apparel chain operator Authentic Brands Group are among the companies that withdrew their IPO plans in the market turbulence. Even the more traditional businesses like a Spanish financial operator Ibercaja Banco or a real estate investment trust Four Springs Capital Trust, are postponing their IPOs.

According to Deallogic, 396 companies that went public in 2021 (excluding special purpose acquisition companies) were trading below their initial listing price in February – down 28% on average. Of the 1,033 IPOs that occurred in 2021 in the US, 609 (59%) of them were SPACs, leaving the remaining 424 (41%) as standard IPOs.

Buffett Deploying Some Of Berkshire’s Cash

Inflation typically makes everyone poorer since it reduces the purchasing power of the dollar. While those that hold certain assets (like particular stocks/real estate/commodities can fare better than most), it especially hurts those holding cash. Warren Buffett’s cash pile at Berkshire Hathaway has reached almost $150b, because he has found it hard to find attractive and very large (i.e. multi-billion dollar) investment opportunities to spend the company’s cash on. Recently it appears that’s changed and he’s found an opportunity that finally meets his criteria, and it’s a size big enough that Berkshire can pursue.

Thus, days after re-entering a position in Occidental Petroleum (NYSE:OXY), Buffett struck an agreement to buy Alleghany (NYSE:Y), an insurance company, for US$11.6b - a 26% premium to book value. He has made a fortune in insurance businesses during his lifetime, so this move isn’t too surprising.

If you didn't know, institutional investors typically don’t hold cash. Instead, they hold securities with the lowest risk, high liquidity, and yield, which turn out to be treasuries. But, when inflation is high, they still lose money because while the nominal yield is currently positive, the real interest rate turns out to be negative.

This theory is known as the Fisher Effect, as economist Irving Fisher explained in his work “Theory of Interest“ in 1930. To simplify, if Warren Buffet held Berkshire’s cash entirely in 10-year US treasuries with a current yield of 2.5%, with the inflation rate at 7.9%, this would give him a -5.4% real interest rate on that cash balance. Despite the positive 2.5% yield, it's essentially losing value (purchasing power) thanks to inflation.

Why it happened and how can it impact investors?

Inflation is becoming a burden, but accelerating rate hikes could seriously hamper the market’s advance in 2022. According to the data by Ned Davis Research, there is a big difference in velocity of tightening of the money supply. That is, how quickly and aggressively supportive monetary measures under QE (Quantitative Easing) become more restrictive measures under QT (Quantitative Tightening)

While slow tightening cycles deliver 10.5% returns for S&P 500 (in line with historical averages), fast tightening cycles deliver -2.7%. The fast cycle has the upper hand in the second year with 4.3% vs. 1.6%, but it is still a relatively modest performance. For comparison, over the last decade, the average annual return for S&P 500 was 13.6%.

If the Federal Reserve chooses to go with a faster tightening cycle to combat the high inflation, stock market returns for 2022 could be in for a pretty rough year.

Looking Ahead

Next week marks the end of the first quarter of the year. While the US market has rallied from lows in the last 2 weeks, S&P 500 is still down about 4% year-to-date. Earnings season is coming to a close, with some late reporters like Lululemon (NASDAQ:LULU), Chewy (NYSE:CHWY) and Micron Technology (NASDAQ:MU) announcing their results earlier this week.

Meanwhile, Friday, April 1 will bring the latest Non-farm Payroll report. The current forecast is a 450k gain, while the previous payroll report exceeded expectations posting an impressive 678k jobs vs 400k estimated.

Prudent investors will have noted a yield curve inversion occurred this week. The difference between the 2-year U.S bond and a 10-year U.S bond is the most famous yield spread globally. When short-term yield goes higher than the long-term yield, the market is pricing short-term risk higher than the long-term risk. This indicates that investors are expecting turbulence in the short term.

This spread, which has predicted almost every recession in the last 60 years, is now close to inversion again at just 0.18 as of Friday, March 25.

Until next week,

Invest well,

Simply Wall St

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.