Cyclical Stocks On The Rise And Natural Gas Prices Plunge

Reviewed by Bailey Pemberton, Michael Paige

What Happened in the Market Last Week?

US equity markets edged higher last week and received a little boost when the minutes of the last Fed meeting were released. The minutes were music to investors' ears since they revealed that officials do in fact see the pace of rate hikes slowing . Growth investors will be stoked.

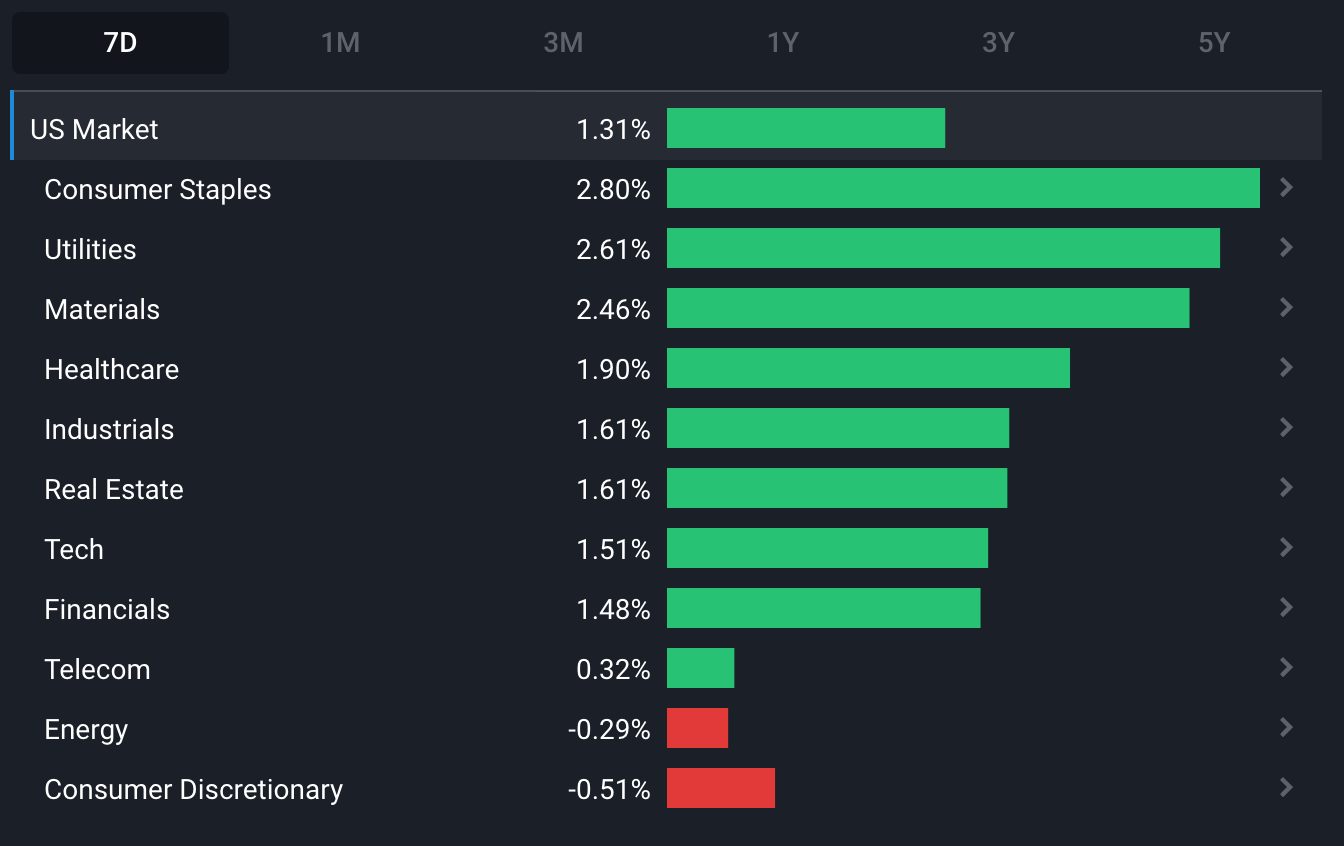

While the rally continues, it seems to be a ‘risk-off’ rally as the defensive US utilities, US consumer staples and US healthcare sectors led the way, while US telecom, US tech and US consumer discretionary lagged. Seems like investors are leaning towards those “recession-proof” stocks.

Some of the developments we have been watching over the last week include:

- Cyclical sectors have outperformed over the last month, and we had a look at why that’s the case.

- Natural gas prices in Europe have plunged since August, despite the start of winter and more reductions in supply from Russia.

Why are cyclical sectors outperforming?

Cyclical sectors have shown notable out-performance since the market low on the 13th of October. Cyclical companies typically see their profits increase during periods of economic expansion and decrease during economic contractions. Some (i.e. financials ) also benefit from rising interest rates which often occur during the later stages of a business cycle.

While interest rates are rising fast, economic growth is slowing, and many countries seem to be heading toward a recession.

So why are cyclical stocks out-performing? This probably has more to do with valuations and interest rates than the economic cycle. Cyclical sectors have become value sectors over the last decade, and value stocks are now back in favor.

💡 The Insight: This ain’t your normal cycle

We have said this before, but it’s worth repeating: this is not a normal cycle. Typically, inflation and interest rates increase as growth accelerates and the economy eventually becomes overheated.

Over the last few years, economies have experienced a pandemic, massive fiscal stimulus, disrupted supply chains and an energy shock due to the war in Ukraine. The normal cycle has been interrupted, repeatedly.

There’s another difference too. During the last decade, interest rates were the lowest they have ever been, and this favored growth stocks. When you buy a growth stock, you are often paying for cash flows that will only materialize in a few year's time. When rates are low, those future cash flows are worth more today. So, with those super low rates, growth stocks traded at a growing premium to stocks with slower growth rates - regardless of profitability.

The chart below illustrates the fact that the sectors that include growth stocks ( US Consumer Discretionary, US Tech and to an extent US Healthcare ) still have much higher price-to-earnings ratios than other sectors - and this is despite the out-performance of cyclical stocks over the last year.

So, what we have really been witnessing is sector rotation into sectors with better valuations as investors come to terms with rates staying higher for longer. Most retirement and mutual funds need to remain invested all the time, so when one stock is sold the money needs to go into another - even if it's a stock with less downside risk, rather than upside potential.

What this means for investors

This rotation is unwinding a decade of flows that favored growth stocks - so it may have some way to go. But we would be cautious of chasing value stocks, as the narrative could turn quickly if the market suddenly believes rates will stop rising.

We previously mentioned some of the dynamics driving energy and materials stocks . There are a couple of points to note on the other cyclical/value sectors too:

- The industrial sector includes a lot of very different industries ranging from construction to machinery, airlines and professional services. These industries are all subject to different dynamics. Some have quite reliable cash flows, while others are more sensitive to the state of the economy.

- Financials also includes different industries. Banks do earn higher margins when interest rates rise, but they also become vulnerable during a financial crisis. Brokers are dependent on trading volumes which tend to increase during a bull market. Insurers have fairly robust cash flows as long as consumers can afford to keep paying their premiums.

- Companies, within the real estate sector ( REITs in particular), vary according to the types of markets they are exposed to, be it residential, commercial, industrial, etc.

- The consumer discretionary sector, also known as the consumer cyclical sector is very sensitive to the business cycle and also includes some large growth stocks like Tesla (Nasdaq:TSLA) and Amazon (Nasdaq: AMZN). Both factors can help explain the underperformance this year.

If you are assessing companies in these sectors, there are three questions to consider:

- Will customers keep buying the company’s goods and services if the economy continues to slow?

- Does the company have pricing power (ie. the ability to raise prices as costs rise)?

- Is the valuation reasonable with fairly conservative earnings estimates?

What happened to natural gas prices?

Last week the European Commission proposed a price cap for natural gas of €275 MWh . Many countries believe the cap is too high - but the price of natural gas in Europe has already plummeted in recent months. It’s now around €119 MWh, and price caps are only part of the reason.

When price caps were first considered there were fears that prices would spiral out of control as winter approached. Indeed they did rise as much as 275%, but despite Russia limiting gas exports to Europe and gas leaks on the Nord Stream 1 and 2 pipelines between Russia and Germany, the price has since crashed.

The chart below shows the price of natural gas in the US (orange) and the price of futures contracts in Europe (blue) since the beginning of the year. In the US, the price of NG fell 40% between mid-August and mid-October, but it has since rebounded. In Europe, the price has fallen 65% with little recovery since.

Why has the price of natural gas fallen?

Several factors have contributed to natural gas prices plummeting:

-

Firstly storage facilities in Europe reached capacity meaning it wasn’t possible for European countries to buy more gas. Because Europe previously had a steady supply of gas from Russia, there was little reason for large storage capacity. This has changed now that European countries need to stockpile gas ahead of winter - but it takes years to build these sorts of facilities. Many of the ships transporting gas from the US are now anchored off the coast of Western Europe waiting for capacity to be freed up at the ports.

-

Speculators who bought natural gas futures were forced to sell those contracts to avoid having to take delivery of the physical product. This is also what caused crude oil contracts to fall below $0 in March 2020.

-

The prospect of price caps, which could have been lower than those proposed, meant buyers were reluctant to chase the price higher.

-

Russian gas now accounts for just 10% of European imports , down from 40% at the beginning of the year. This means that further interruptions should have less effect on supply.

This is a great example of real-world supply and demand dynamics catching up with speculative price action.

💡 The Insight: US Gas industry will benefit from European demand

As Europe turns to the US for gas, the prospects for US companies are looking good. New terminals and storage facilities are being built which will allow for higher volumes to be exported. But companies in the energy industry have quite different business models which means they don’t necessarily benefit the same way or at the same time.

The following five companies are some of the prominent players in the natural gas industry, but their businesses are quite different from one another:

- EQT (NYSE:EQT) concentrates on the upstream (exploration and extraction) part of the natural gas supply chain and is the largest producer of gas in the US.

- Cheniere Energy (NYSEAM:LNG) : Natural gas has to be compressed into liquid form (liquid natural gas) before it can be transported across the Atlantic. Cheniere Energy is the largest producer and exporter of LNG in the US, with two large liquefaction facilities.

- DCP Midstream LP (NYSE:DCP) concentrates primarily on midstream activities (transportation, compression, and storage) related to gas.

- Kinder Morgan (NYSE: KMI) builds and manages pipelines and storage terminals for oil, gas and other products. KMI is more sensitive to volumes than the price of these products.

- Shell (LSE:SHEL) is an integrated energy company, which means it operates at every stage of the princess from exploration to extraction, refining, and distribution. It's also diversified by region and product.

What this means for investors:

While the prospects for natural gas producers are looking up, it's likely to be a bumpy ride for investors.

Before you invest in these types of companies, make sure you understand where a company fits into the supply chain and how that can affect its revenues and profitability . You can learn a lot by listening to earnings calls, or reading the transcripts of those calls.

The other thing to pay attention to is debt . Energy companies are notorious for taking on huge amounts of debt which overwhelm them when prices fall. Generally, the more integrated and diversified companies are safer bets as they aren't dependent on oil and gas prices staying above a certain level.

Key Events Next Week

This is going to be a big week for inflation expectations. On Wednesday the US GDP growth rate will be released, on Thursday there’s personal income and spending data coming out, and on Friday the unemployment rate and other jobs data will be released. All of which will give us an idea of the strength of the US economy and consumers.

There is also some Eurozone inflation data due on Tuesday and Wednesday.

As we approach the end of the earnings season there are still several prominent cloud software companies due to report, as well as a few China-based companies. Amongst them are:

- CrowdStrike Holdings (Nasdaq:CRWD)

- Intuit (Nasdaq:INTU)

- Workday (Nasdaq:WDAY)

- Salesforce (NYSE:CRM)

- Snowflake (NYSE:SNOW)

- Okta (Nasdaq:OKTA)

- Pinduoduo (Nasdaq:PDD)

- XPeng (NYSE: XPEV)

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.