What Happened in the Market This Week?

Market Insights for week ending 7th October

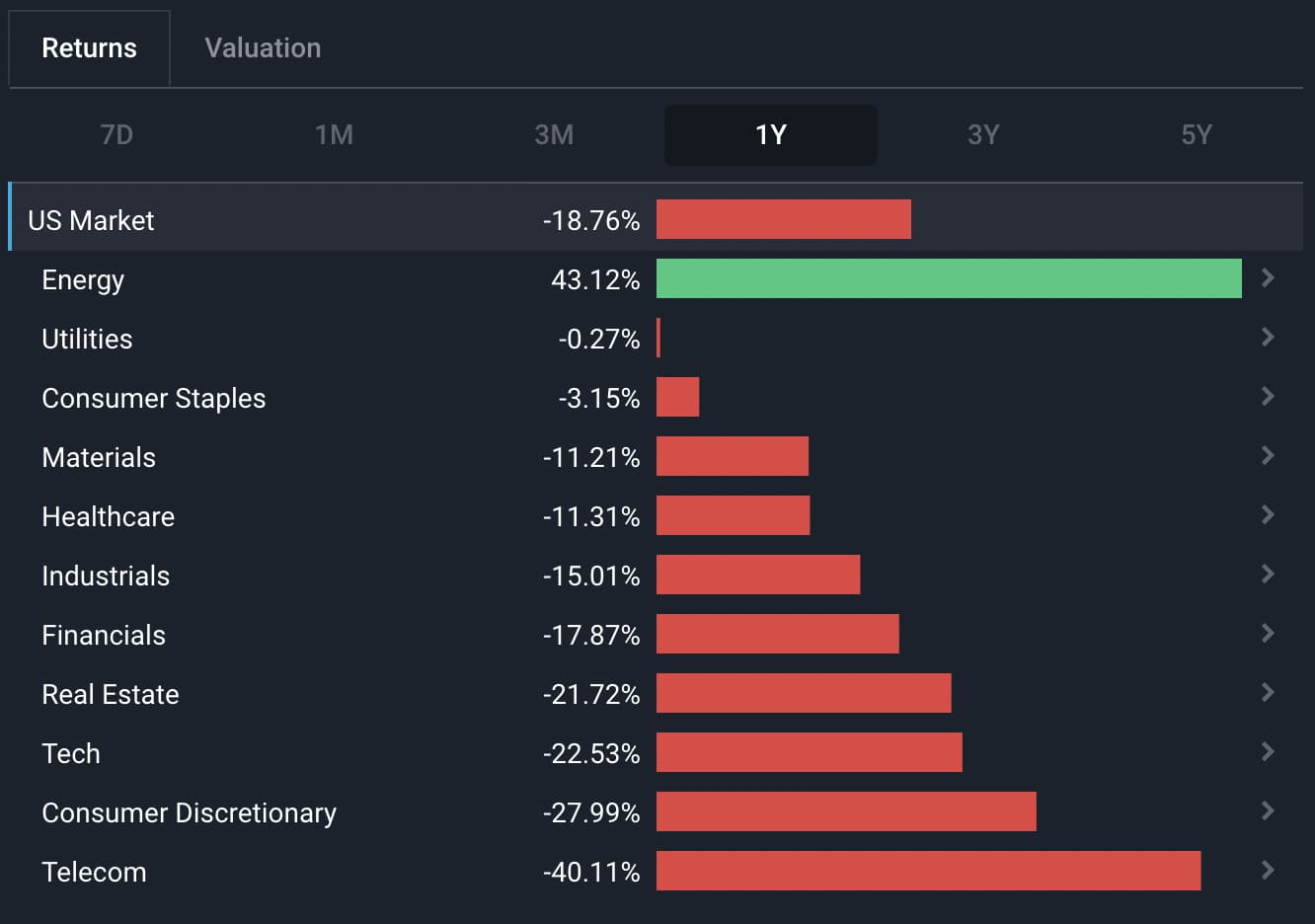

Equity markets bounced back slightly last week after briefly making new 52-week lows the previous week . Hopefully you filled up your tank last week because oil jumped $10 after OPEC decided to cut oil output , which pushed energy stocks higher.

Last week also saw some of the cyclical sectors shine - materials , industrials and financials were the other top performing sectors. The consumer discretionary sector lagged after Tesla ( NASDAQ:TSLA ) fell 12%. With ‘risk on’ sectors outperforming, it wasn’t surprising to see the more defensive consumer staples and utilities sectors lagging too.

U.S. Sector 7D Performance - 7th October 2022 - Simply Wall St

Some of the developments we have been watching over the last week include:

- Credit Suisse saw its share price plunge and movements in credit default swaps on the bank’s bonds indicated investors were nervous about the company’s health.

- Analysts reduced their S&P 500 earnings expectations for Q3 by 6.6% , the biggest downward revision since mid-2020.

Credit Suisse Under Siege

Credit Suisse ( SWX:CSGN ), and to a slightly less extent Deutsche Bank ( XTRA:DBK ), came under pressure last week, with credit default swaps on Credit Suisse bonds rising as much as 55% in a matter of days, while the share price fell as much as 20% in two days.

What's going on with Credit Suisse?

European banks are all under pressure at the moment, but Credit Suisse is facing some unique additional challenges.

European banks have a combination of challenges to deal with:

-

Government bonds are a bank’s most important asset. The selloff in government bonds, which the U.K.’s current crisis has also contributed to, means bank balance sheets aren’t as strong as they were.

-

The prospect of a recession means non-performing loans are bound to rise and other sources of income are also likely to take a knock.

In the case of Credit Suisse, the bank has had a rough couple of years:

- Last year, the bank lost $5.5 billion (that’s half its current market value) when one of its prime broking clients, Archegos Capital Management collapsed . This resulted in the closure of its prime broking unit and ongoing litigation.

-

It also lost money last year when U.K. lender Greensill Capital collapsed .

-

Some other parts of the group are underperforming.

-

The group has been through a series of leadership changes and lost some key employees.

-

Credit Suisse has a long history of scandals behind it which has left it with a questionable reputation.

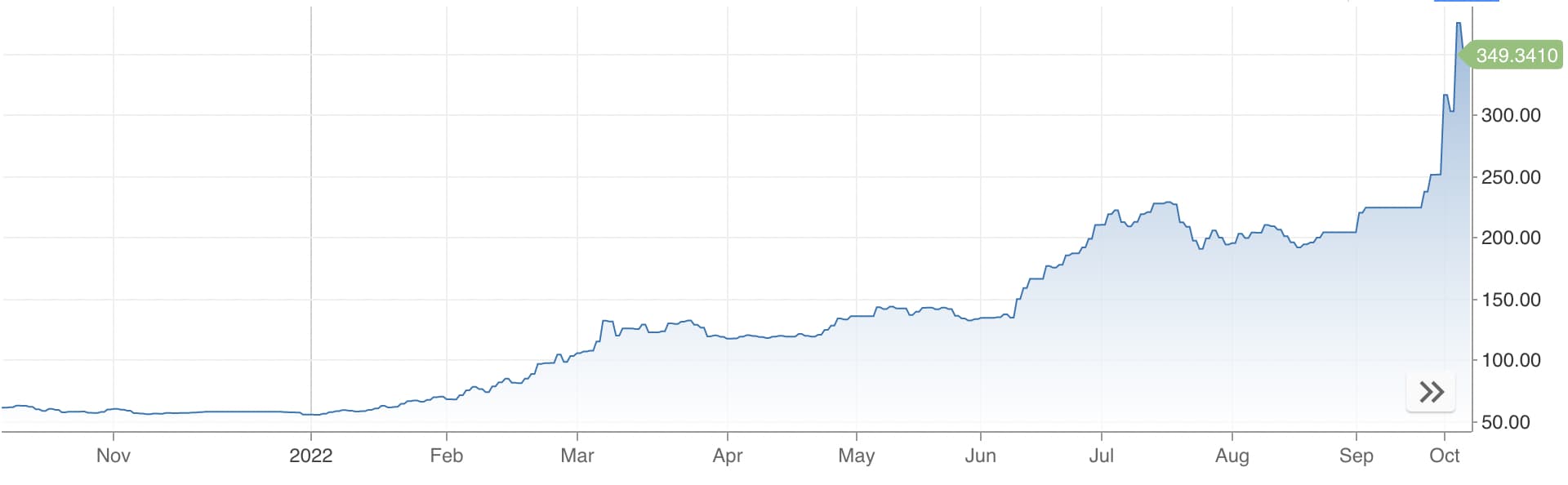

Credit Suisse's Share Price over the last year; the company is down over 50% - Image Credit: Simply Wall St Company Analysis

All of this has left the bank in need of restructuring and probably a capital injection. But some analysts believe the fears are unfounded . Capital adequacy requirements for banks are a lot more stringent than they were before the financial crisis in 2008 (for good reason), and some investors will be relieved to hear that Credit Suisse passed a recent stress test in the U.S.

Watch this video on Credit Suisse that our partner, Brandon from New Money, has created.

The latest round of speculation started when a memo from the CEO meant to reassure staff appeared to backfire. He said the bank’s restructuring would be announced on 27th October, but also suggested that there would be “more noise” between now and then . Those two words seem to have triggered speculation that there was more bad news to come.

Whether or not that’s the case, the effect on the bank's share price and reputation won’t help Credit Suisse retain clients and staff, or attract new capital from investors.

What is a Credit Default Swap?

A CDS, or credit default swap, is a derivative contract that pays out the holder if a bond issuer defaults on a bond repayment - much like an insurance policy . It’s called a swap because the CDS buyer swaps the risk with the seller. You may recall hearing Michael Burry use them during the GFC, depicted in the movie “The Big Short”. CDS’ are generally traded over-the-counter rather than on an exchange, and typically by institutional investors rather than retail investors.

Bank defaults don’t only affect the bank’s own creditors. If banks default on loans to other banks, it can affect their solvency too, and create a domino effect throughout the banking system - i.e. systemic risk. Which is why we should care, even if we aren’t invested in that bank directly.

This is also why liquidity is so important for banks, and why they have to comply with strict capital adequacy requirements introduced since the GFC.

💡 The Insight: Investing in Financial Institutions

Theoretically, investors buy credit default swaps to manage the risk on bonds they own. But traders and hedge funds can also use them to speculate on an institution defaulting or becoming insolvent. They can also be used to hedge against a liquidity crisis.

If you think about it, buying a CDS on a bank with a weak balance sheet is a smart way to hedge against a financial crisis. If there is a major crisis, the weakest banks are likely to implode first, which means the CDS will pay out.

🚩 Credit Suisse may not be on the verge of collapse, but seeing CDS prices spike like they did last week tells us investors think otherwise.

What this means for investors: Bank liquidity regulations may be better than they were in 2008, but the market is still likely to be skeptical. Banks can be very good compounding machines during periods of economic stability, but their balance sheets can be wiped out very quickly. If you invest in banks, it’s a good idea to stick to the ones with track records of prudent risk management.

Q3 Earnings Estimates Down 6.6% For S&P 500 Index 📉

All eyes are now on the third quarter earnings season. Analysts will be tracking EPS and guidance in each sector and are very likely to make adjustments to the earnings and revenue estimates for the next few quarters.

What are EPS estimates and what do they mean?

At its most basic level, a share price reflects the present value of the profits a company is expected to generate over its remaining life . Of course we don’t know exactly how much each company will make each quarter for the next five, ten or twenty years, so investors must rely on estimates - either their own, or those of analysts at brokerage firms.

The consensus estimate for a company’s quarterly EPS and revenue is the average of the estimates published by analysts covering that company.

Analysts rely on a company’s guidance and commentary during quarterly earnings calls, as well as their own research and models. They adjust their estimates as new information becomes available - which usually occurs when quarterly results are released or when other announcements are made.

When consensus estimates change, stock prices typically adjust to account for those changes. Stock prices also tend to rise and fall ahead of quarterly results as traders speculate on whether a company will beat or miss estimates.

Third Quarter EPS Estimates are Trending Lower

At the end of June, analysts were expecting third quarter EPS for the S&P 500 index to be 10.3% higher than the third quarter last year. Those estimates have been cut substantially over the last three months and EPS growth is now expected to be just 3% for the third quarter. This marks a major slowdown after earnings growth of 11.6% and 9.9% in the first and second quarter respectively.

Some analysts expect EPS for the index to be even lower. Economist Ed Yardeni for example expects a 5.4% decline from a year ago . If they are right, this could be the beginning of an ‘earnings recession’.

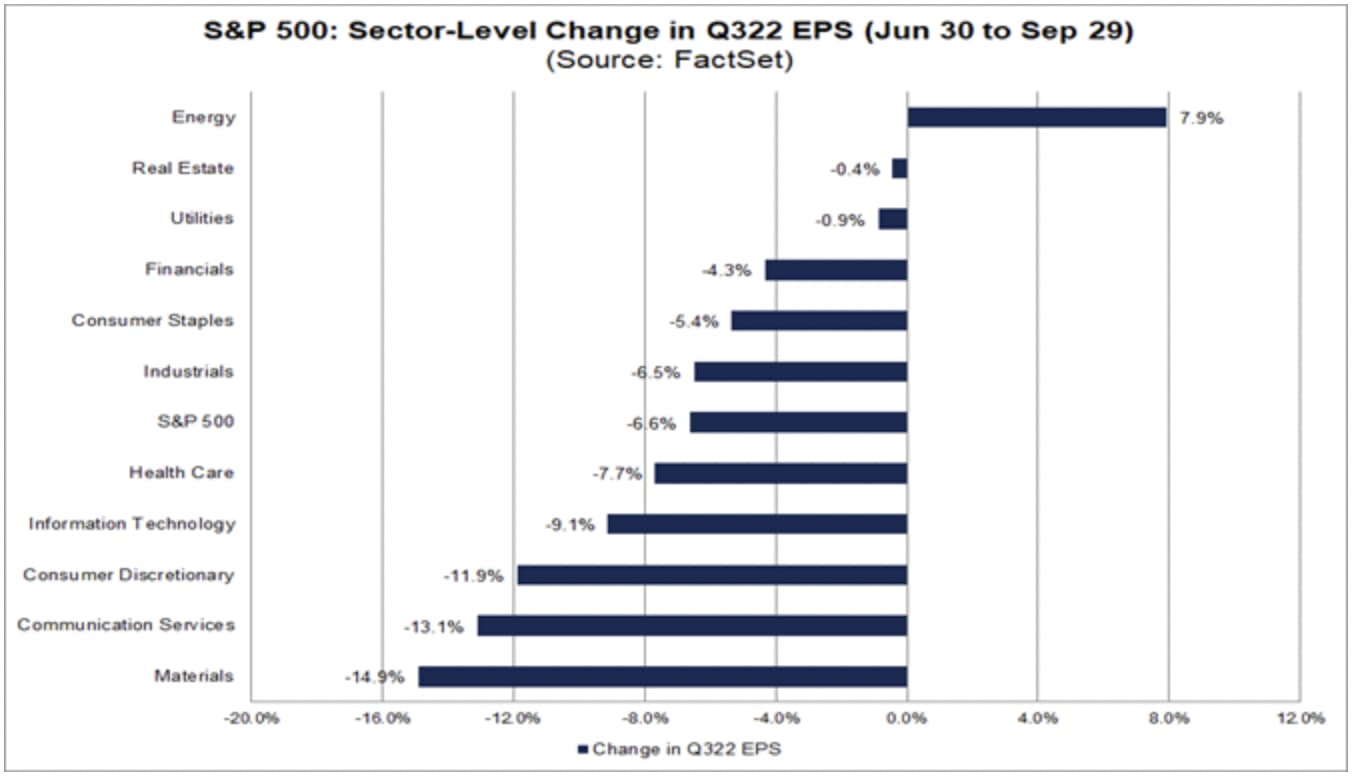

It’s actually normal for estimates for the current quarter to fall during the course of that quarter - but in this case the median estimate for an S&P 500 company has been cut by 6.6% which is more than we usually see.

Change in EPS Estimates by Sector

Of the 11 S&P 500 sectors, only the energy (+11.4%) and utilities (+2.4%) sectors have seen an increase in consensus estimates (you hopefully already know why ). The other nine sectors have seen estimates cut by between 0.7% for healthcare , 8.5% for communication services and 8.8% for consumer discretionary .

Change in third quarter EPS estimates for S&P 500 companies over the last three months - Image Credit: Factset

💡 The Insight: Changes in Analyst Estimates

Interestingly, the changes in estimates for each sector over the last quarter matches up pretty well with their relative price performance over the last year.

That suggests the market has done a very good job at discounting futures changes in earnings estimates before they happened. Remember, earnings continued to rise during the first and second quarter of this year, while stock prices fell.

The price-to-earnings (P/E) ratio of the S&P 500 has fallen from about 25x a year ago to 20x now . So far all that’s changed in that ratio is the numerator (price). If we now have an earnings recession, the denominator (earnings) will fall and that ratio will rise again for the current index level.

The question is, have stock prices already discounted an earnings recession, or, have stock prices only discounted higher interest rates? Either way, we will have to see what this earnings season does to estimates for the next few quarters.

For Short or Medium-Term Investors (< 5 years)

The first few weeks of earnings season are likely to set the tone for the results to come. If earnings disappoint early, particularly for the large companies, companies in similar sectors are likely to be sold off very quickly.

For Long-Term Investors (5+ years)

Some of the best bargains for long term investors are created when the market discounts bad news twice. In other words, a stock might sell-off in anticipation of a bad quarter, and then get sold off again when the results come out. This could create the perfect environment for hunting long-term opportunities.

Key Events This Week

Speaking of banks this week, the third quarter earnings season gets officially underway with some of the major banks reporting. These include Goldman Sachs ( NYSE:GS ), JP Morgan ( NYSE:JPM) , Wells Fargo ( NYSE:WFC) and Citigroup ( NYSE:C ) .

In other sectors, Delta Airlines ( NYSE:DAL ), Alcoa ( NYSE:AA ), Pepsico ( NASDAQ:PEP ) and Walgreens ( NASDAQ:WBA ) are also reporting.

There’s also some important data out in the U.K. and the U.S. On Tuesday, the U.K. unemployment rate will be published, and on Wednesday U.K. GDP and manufacturing data is due.

On Wednesday, U.S. PPI will be released, as well as the minutes from September‘s FOMC meeting . On Thursday, the U.S. inflation and core inflation rates will be published . And then on Friday, U.S. Retail sales will give us an idea of how consumer spending is holding up in the face of recent rate hikes .

Until next week,

Invest Well,

Simply Wall St

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.