What Happened in the Market Last Week?

Last week the recessionary clouds looming over the economy were temporarily blown aside by the computing clouds at Microsoft, as growth from Azure helped the stock narrowly beat analysts estimates on earnings. However it did issue downbeat guidance, so it wasn’t a long celebration.

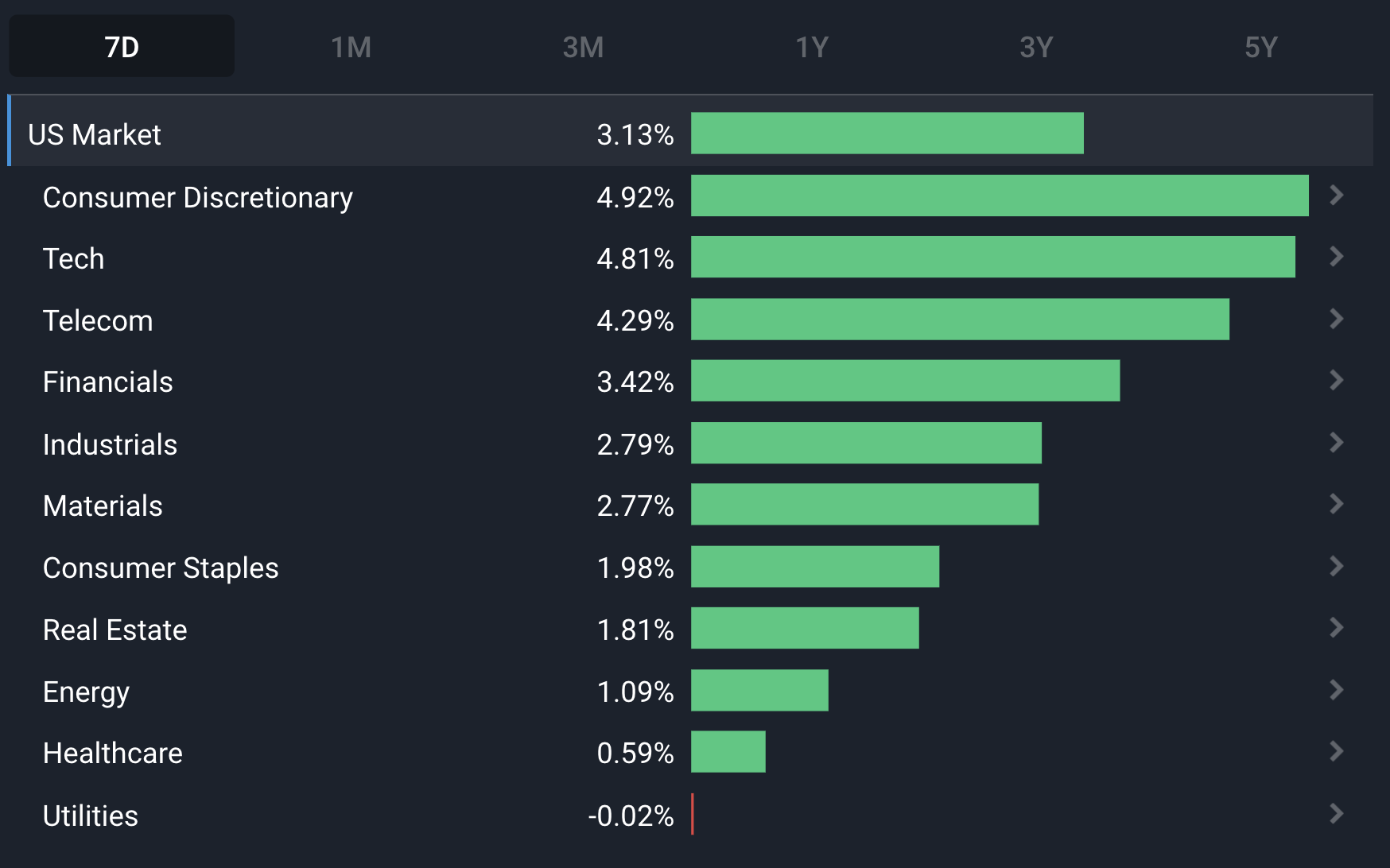

Sector rotation continued to some extent - with defensive sectors (US Utilities, US Consumer Staples, US Healthcare) comparatively weaker as money moved into cyclicals (US Financials and US Materials) and growth sectors (US Consumer Discretionary, US Telecom and US Tech).

This week we are looking at China, and specifically:

- The GDP growth outlook after the country’s economy grew by the second lowest rate in 40 years last year.

- China’s population fell for the first time in 2022 and what that means for the economy.

- Confidence in the property sector has improved , but the underlying problems may remain.

- China is still the world’s largest consumer of commodities , but imports are unlikely to increase as fast as they have in the past.

China’s Economy in 2023

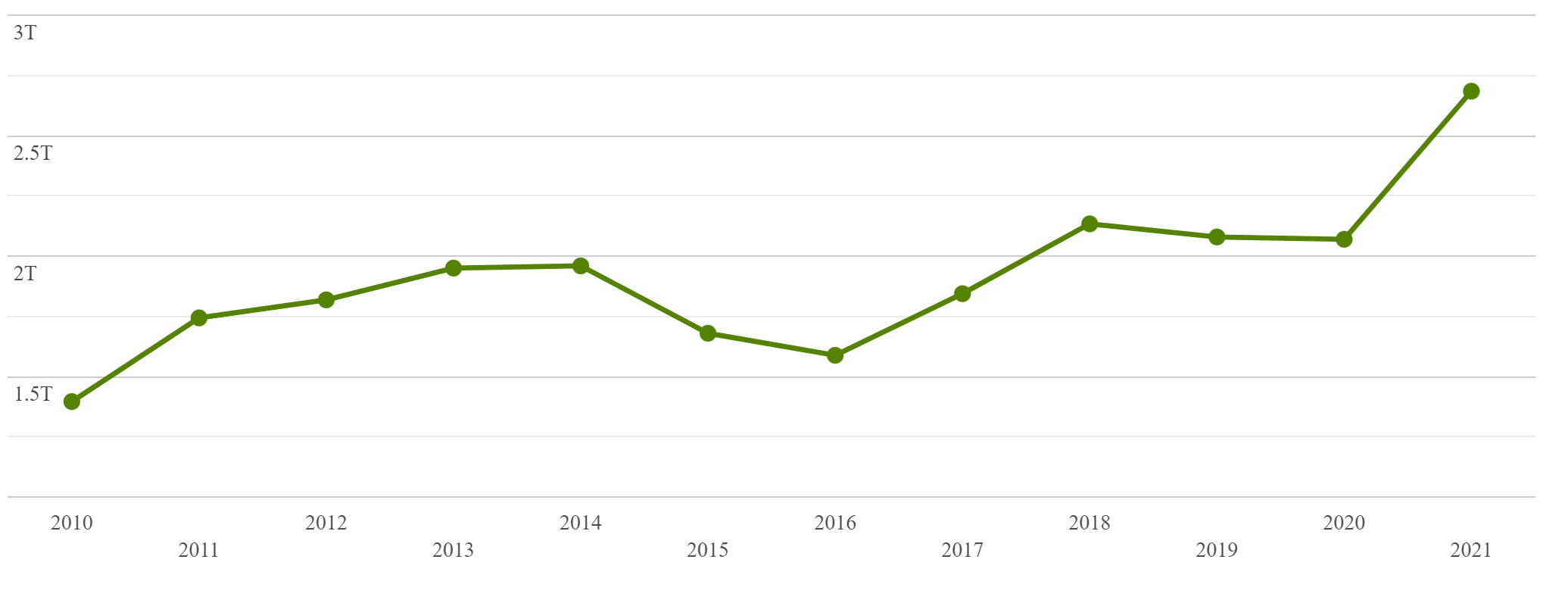

China recently reported that its GDP grew by 3% in 2022. That was ahead of the expected rate of 2.8%, but well below the 5.5% target set in March. It’s also well below the growth levels of the last decade. The economy grew by 2.2% in 2020 and by 8.4% in 2021.

The last three years can probably be viewed as anomalies related to Covid - but the overall trend is clearly down.

.png)

China’s economic growth rate has slowed due to short term and long term factors. Over the last few years, a few things have played a role:

- China’s zero-COVID policies,

- The bursting of the real estate bubble,

- A crackdown on tech and education companies, and

- An ongoing trade war with the US.

But growth has actually been steadily trending lower since 2007. It’s inevitable that after more than a decade of significant growth, we’re naturally reaching a point of diminishing returns. The country is also facing demographic changes (see below) and foreign companies are looking to diversify their investments away from China after the becoming aware of the political risks.

The outlook for China in 2023

Economists are cautiously optimistic about China’s economy recovering in 2023. Morgan Stanley recently upgraded its growth forecast to 5.4% , though that’s probably at the upper end of the range. With Covid restrictions being relaxed, there could be a recovery in consumer spending like other countries experienced in 2021.

Chinese policy makers are also prioritizing growth and a stimulus package to reignite the country’s semiconductor industry is apparently in the works. There are of course risks, both in the form of the global economy and the potential for policy makers to reverse course once again.

At this stage any uptick in growth will be more of a recovery from last year's low growth number than a change of trend. Beyond that, policymakers will need to address structural issues if growth is going to re-accelerate

💡 The Insight: China has less growth, but more global presence

China’s growth rate may be falling, but the economy is still a lot bigger than it was 10 or 20 years ago. Three percent of China’s economy now is equivalent to 15% of China’s economy in 2003. The country now has the second biggest economy in the world, and it’s bigger than the entire EU as of 2021 . It’s less of a growth story than it was in the past, but still a key part of the world economy.

China’s Population Begins to Decline

China’s National Bureau of Statistics also announced that the population shrank by 850,000 during 2022. That’s only 0.6% of the population, but it does reflect changing demographics. The annual growth rate was fairly steady at 0.6% to 0.7% between 1998 and 2012, but has declined sharply since, despite the ‘one child’ policy being scrapped in 2015.

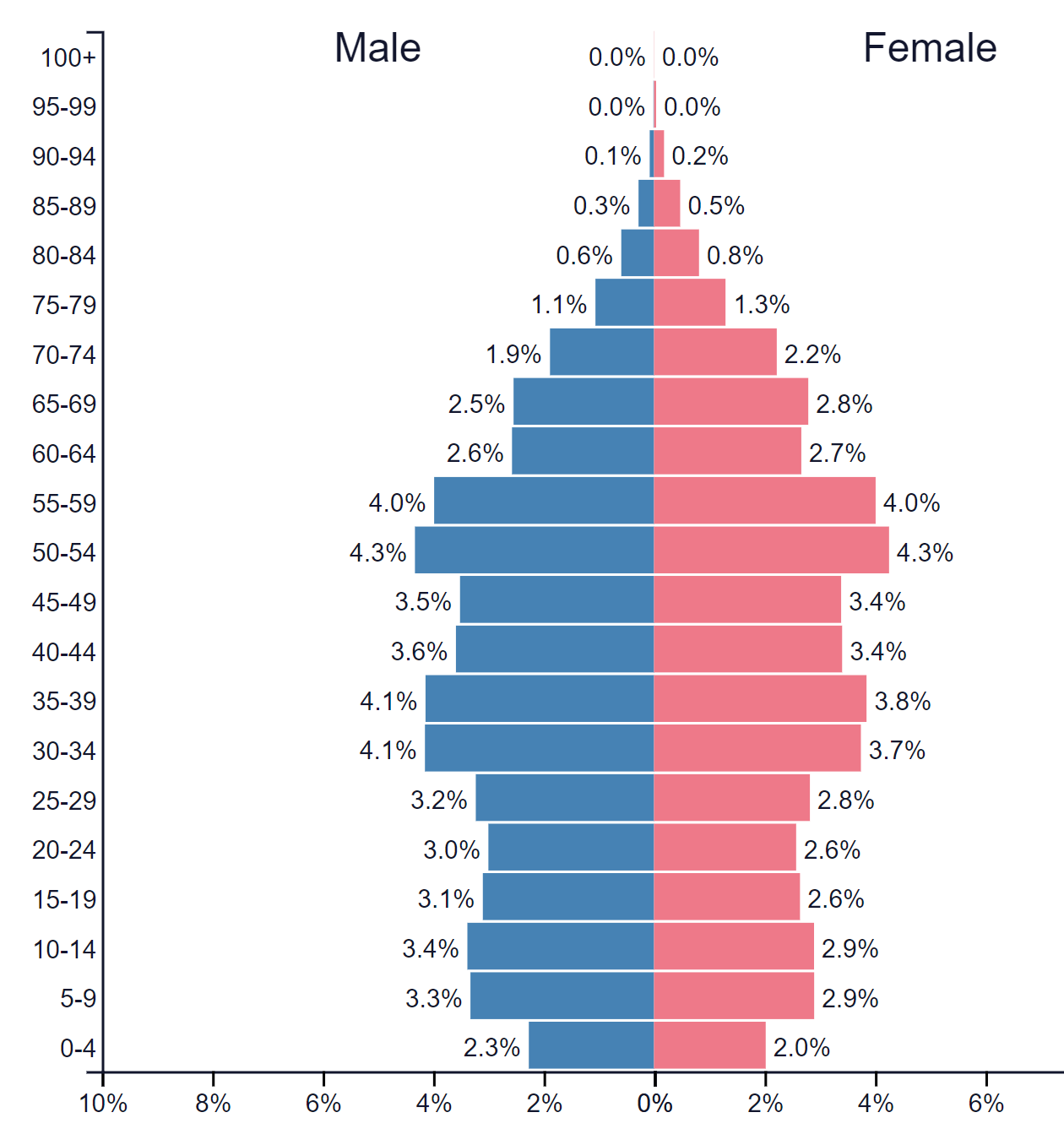

When the population of a country stops increasing the average age increases, fewer people enter the workforce each year and more people hope to retire each year. That means fewer people working to support a larger retired population.The average age in China is now 38 and will increase each year (unless there’s a sudden increase in the birthrate).

This is what the age profile of China's population looks like.

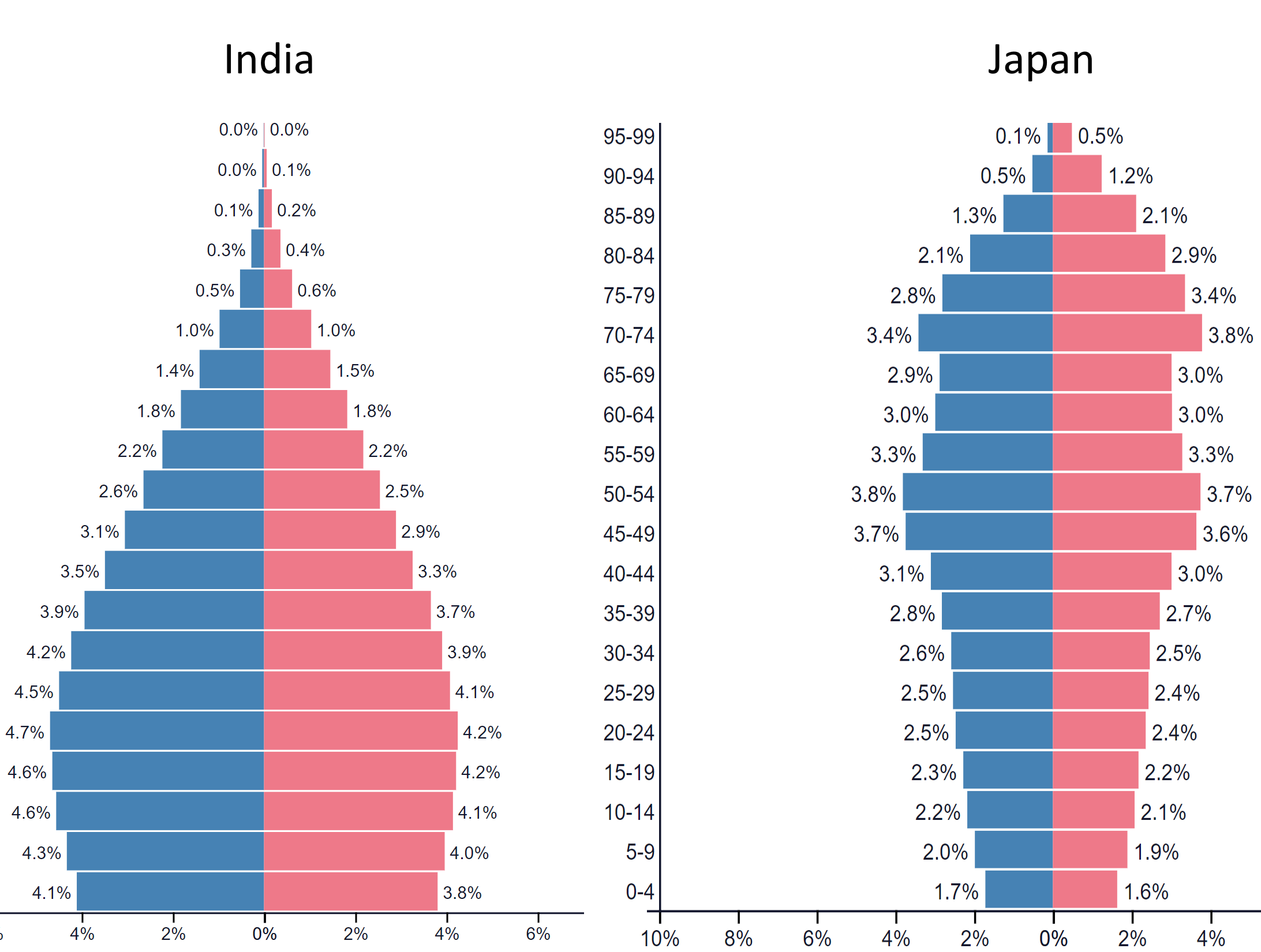

For context here’s what India and Japan’s population profile looks like:

These are the two extremes within Asia. India's population is young (with an average age of 29) and growing. Japan’s population has been declining since 2010 and the average age is 48.

The current trend suggests that in 10 to 15 years, China’s population profile will be very similar to Japan’s.

💡 The insight: Ageing populations don’t typically precede economic growth

China’s economic growth rate had two peaks of around 15%, one in 1992 and one in 2007. Those peaks coincided with two large age cohorts (now aged 50 to 59 and 30 to 39) entering the workforce. That may be partly coincidental but it certainly helps to have a large number of young people entering the workforce.

Over the next 30 years those groups will be retiring, while fewer people will be entering the workforce. This could also put upward pressure on wages as companies compete for a smaller pool of workers - though the effects will probably be offset to an extent by the impact of technology and improved healthcare (Allowing people to work less strenuous jobs for longer).

What this means for investors

Most populations outside of Africa and a select few Asian countries are now ageing. As economies develop and urbanize, birth rates typically fall, so China’s situation isn’t unique. But considering China is the second largest economy in the world and is experiencing declines in both economic growth rates and population, it seems to be losing its status as an emerging market with each coming year.

For companies operating in China, both local and foreign, the easy growth may be in the past. That doesn’t mean there won’t be growth or opportunities - but the economy will become more competitive. Last week we looked at the improving outlook for emerging markets . In the past China was central to the emerging markets theme - but that may start to change as investors and corporates look beyond China. India is one country attracting a lot more interest.

On a related note, we recently put together a collection of companies set to benefit from an ageing population.

Is China’s Real Estate Crisis Over?

Last year China’s property market imploded after regulators reduced the amount of leverage developers could use. This brought a sudden end to a speculative bubble that had been developing for years, and developers found themselves in a liquidity crisis.

Toward the end of last year regulators relaxed the restrictions which allows developers to access new loans. China’s high-yield dollar bond index has recovered by 50% since November . The index consists mostly of bonds issued by property developers - so it suggests that confidence in the sector is improving. It is worth noting that risk appetite amongst global investors has picked up over the same time period, so it will be interesting to see what happens in a “risk off” environment.

💡 The insight: China’s real estate sector is no longer in the headlines, but risks still remain

The liquidity crisis has receded because developers have been able to borrow more capital. The underlying problem of too much leverage remains, although speculative activity may have slowed. We would still be cautious about China’s real estate sector as well as the financial sector which is exposed to developers.

China’s Influence on Commodity Markets Continues

While China’s economic growth rate has been slowing over the last decade, its imports of commodities have not. It remains the largest consumer of commodities, particularly iron ore, copper, oil and coal.

The data for 2022 isn’t in yet, but imports are expected to have been a little lower. Some analysts also expect imports to be slightly lower in 2023 before picking up again next year. China is also increasing its own Iron ore output, though the impact will be limited.

💡 The insight: Commodity stocks could still benefit, but not as much as the early 2000s

In November we considered the prospect of another commodity super cycle beginning. China was the major catalyst for the last supercycle from the late 1990s to 2007. Even if China’s growth rate continues to decline it will likely remain a very big buyer of commodities, and probably the largest importer in the world. Meanwhile demand from elsewhere may pick up. However, without China’s previous growth rates, the next cycle may be more subdued and less likely to develop into a speculative frenzy.

What this means for investors

If you are watching commodity stocks, it’s probably worth managing your expectations and not expecting commodity prices to rise as quickly as they did in the early 2000s. That also means that speculative stocks (explorers and those with high production costs) might be a risker bet than they were the last time around.

Key Events During the Next Week

It’s another ‘Fed Funds week’ as the US central bank will announce the new interest rate on Wednesday. An increase of 0.25% is expected as the Fed begins to slow the pace of rate hikes.

In Europe the unemployment and inflation rates will be announced on Wednesday, and the ECN will hold a press conference on Thursday.

On Friday US jobs data will be published, including the unemployment rate, average hourly earnings and non-farm payrolls.

It’s also arguably the biggest week of earnings season with Meta Platforms (Nasdaq: META) reporting on Wednesday and Alphabet (Nasdaq: GOOGL), Amazon (Nasdaq: AMZN) and Apple (Nasdaq: AAPL) on Thursday.

There are also plenty of other companies reporting, including:

- Caterpillar (NYSE: CAT)

- Exxon (NYSE: XOM)

- Chevron (NYSE: CVX)

- General Motors (NYSE: GM)

- Ford (NYSE: F)

- Pfizer (NYSE: PFE)

- UPS (NYSE: UPS)

- Eli Lilly (NYSE: LLY)

- Atlassian (Nasdaq: TEAM)

- Qualcomm (Nasdaq: QCOM)

- Starbucks (Nasdaq: SBUX)

- Intel (Nasdaq: INTC)

- Visa (NYSE: V)

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.