What Happened in the Market Last Week?

🎧 Prefer to listen to these insights? Check out the audio recording on Spotify !

Lots of data came out last week that sent mixed feelings to investors. While US employment data pointed to a slowdown in hiring, the Fed raised rates by 0.25% and said rate cuts are unlikely anytime soon. Additionally, fears of further bank failures and the impact of the debt ceiling debate also weighed on sentiment.

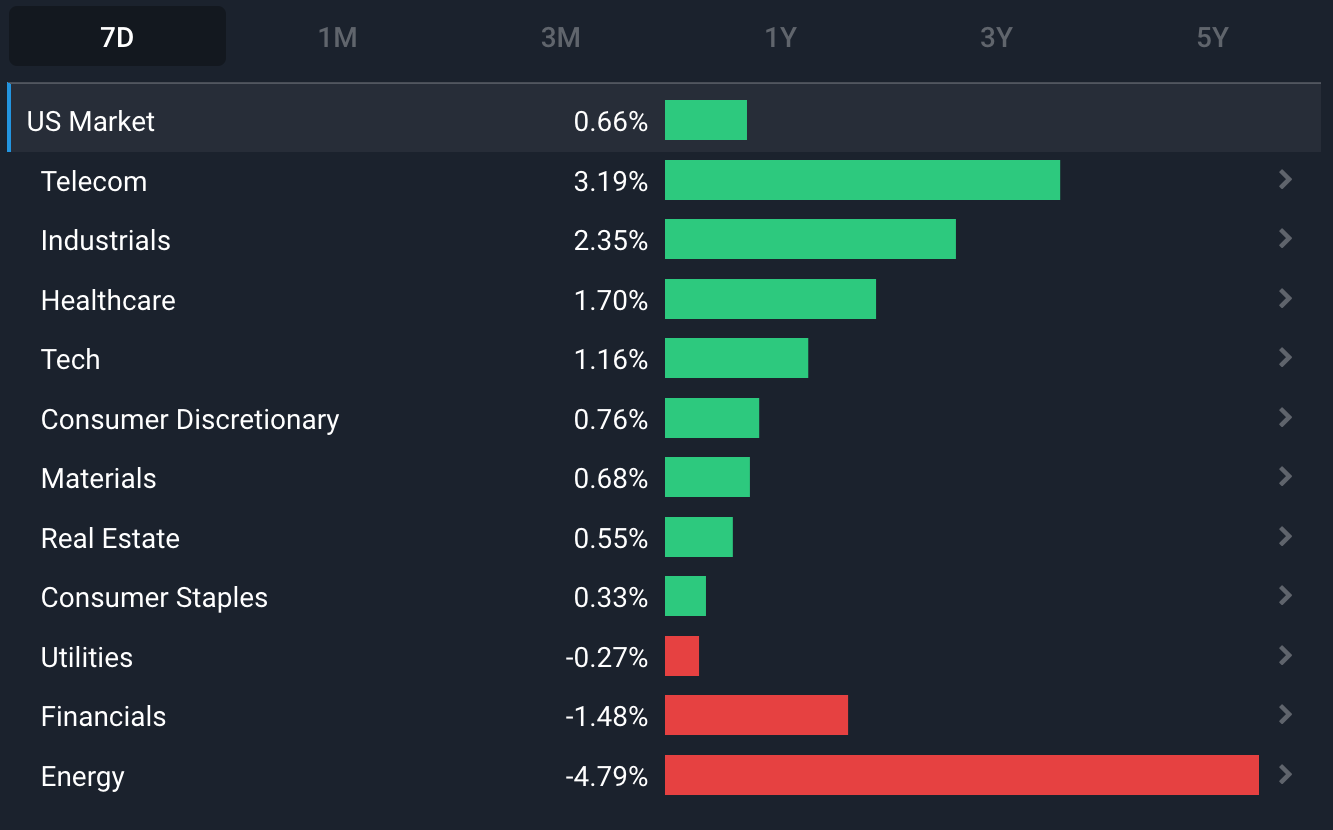

Meanwhile, performances from sectors and certain asset classes suggest that economic growth is the bigger concern. For starters, the oil price fell below $65 despite OPEC recently cutting production with the hopes of raising prices, and commodities also fell.

Growth stocks were also lower, along with financials which remain under pressure following the collapse of First Republic Bank , and other regional banks that are having difficulties.

Here’s a recap of the key economic data that was released over the last week:

- 🇺🇸 US Interest Rates: ↗️ 0.25% to 5.25% as per expectations - This was the 10th rate hike during the current cycle!

- 🇦🇺 AU Interest Rates: Unexpectedly ↗️ 0.25% from 3.6% to 3.85% - This was also the 10th rate hike in 12 months.

- 📝 US JOLTs Job Openings: ↘️ 384,000 to 9.59 million from 9.97 million - A bigger decrease than expected and suggests the labor market is starting to slow.

- 🇪🇺 Euro Area Inflation: ↗️ 0.1% to 7% - Hotter than anticipated given inflation was forecasted to remain unchanged.

There are two insights we want to share this week and they are:

- 🏢 Current concerns around commercial real estate appear justified, BUT the widespread exposure may be overstated. There may be long term opportunities to acquire higher quality and well diversified REITs that have more staying power than others.

- 💵 Pricing power is something that many businesses claim to have, but not all can prove it. A strong brand is one of the main assets companies can use to increase prices without decreasing demand, and these are the kinds of businesses you want to buy well and hold over the long term.

Is Commercial Real Estate The Next Domino?

Concern is increasing about the US commercial real estate (CRE) market and what it could mean for banks and the broader financial system. Charlie Munger recently weighed in saying that banks were “full of bad commercial property loans.”

What’s The Problem?

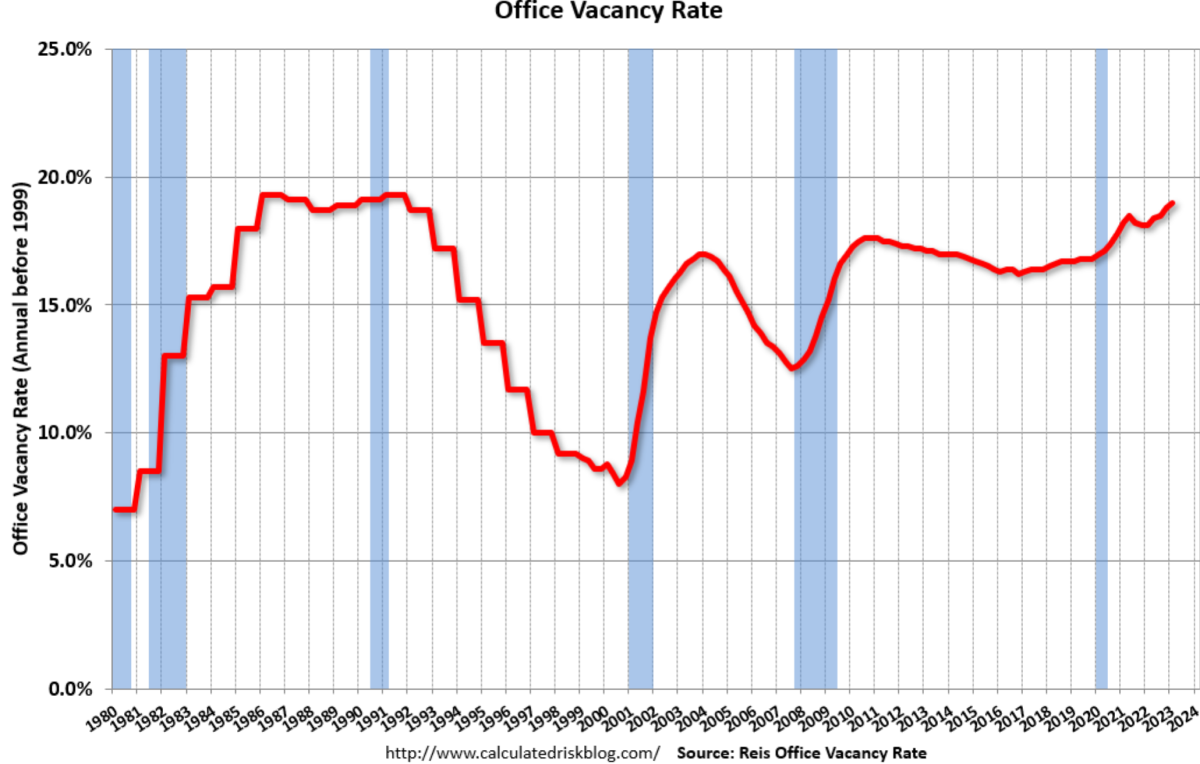

The main area of concern is office real estate where vacancies are now at the highest levels in 30 years. Low occupancies and rising interest rates mean property valuations are falling. Add to this the fact that about 25% of CRE loans will need to be refinanced (at higher rates) in the next year - just as banks are cutting back on lending.

This is one of those perfect storms that seem to occur too often in the economy. What caused it?

- The trend toward remote work accelerated during the pandemic, which resulted in less demand for office space, which put pressure on property valuations.

- And then rising rates put more pressure on valuations while increasing borrowing costs.

Retail real estate has been under similar pressure as retail moves online, but that’s been happening for years now and is no longer a surprise.

For now retail vacancy rates are stable - but the long term trends are negative for both office and retail space.

Who’s Exposed?

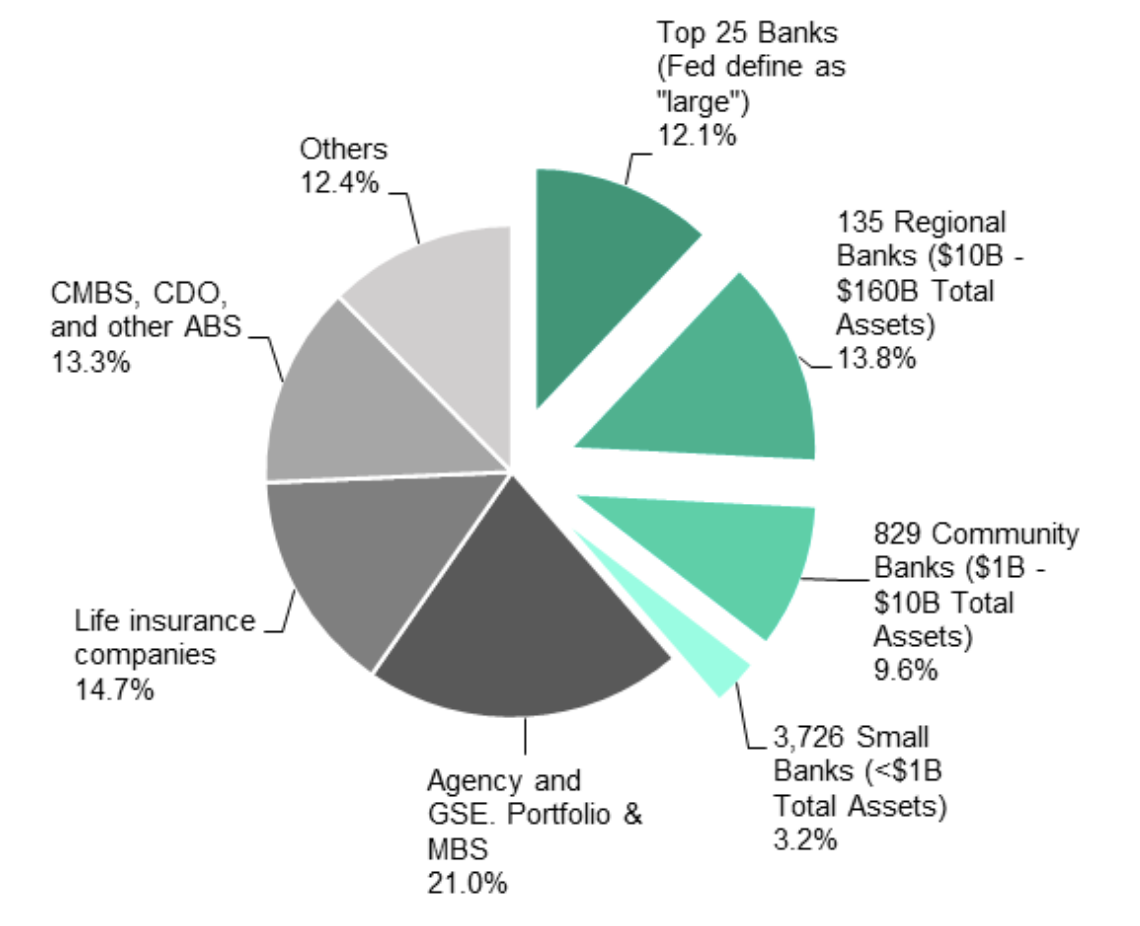

The biggest concern is the smaller regional and community banks. Financing real estate deals is an important part of their business, so they have a lot of these loans on their balance sheets. But, as we know these banks are losing deposits and having to reduce their lending, which puts more pressure on borrowers because their access to funding could dry up.

A Perfect Storm In A Teacup?

This obviously looks like a crisis in the making and the media is full of headlines predicting a 2008-like crash. But there are quite a few nuances and differences. Moody’s analytics pointed out that:

- For smaller, regional and community banks, CRE loans represent about a third of all loans.

- Of these loans, less than a third are for office and retail properties combined.

- Banks don’t carry all CRE loans. A big chunk is securitized and held by asset managers and insurers.

- Banks are far better capitalized than they were in 2008.

In addition, not all office properties are equal. The more desirable office locations have low vacancy rates. The problem is also more serious in some cities than others. In particular, the technology industry has embraced ‘work from home’ more than other industries - so cities like San Francisco have particularly high vacancy rates .

So, while there will almost certainly be defaults, the exposure isn’t nearly as widespread as it was in 2008 with subprime lending. It’s also likely that regulators, and the Fed, will intervene quickly if the risk becomes systemic.

Obviously some banks could end up in trouble, and there may be ‘unknown unknowns’ that magnify the crisis - but the situation might not be as dire as headlines suggest.

💡 The Insight: Look For Businesses With Staying Power

With the current level of uncertainty the banking and real estate sectors are a risky proposition on the surface. While most of the pain is being felt in the REITs with exposure to office space, the negative sentiment is also weighing on the entire REIT sector. And that means a potential opportunity has arisen to find high quality assets being mispriced due to short term sentiment. If you want to look into the REIT sector, look for businesses that can weather short term turmoil, specifically:

- Exposure - A diversified portfolio of industries and tenants that they lease to (reduce exposure to any industry)

- Tenants - A REIT with tenants who are solid businesses themselves, and are likely to keep paying their leases (think of businesses that aren’t cyclical, and can also survive a downturn)

- Financials - Make sure the REIT has solid financial health - where they themselves aren’t leveraged to their eyeballs in debt

- Debt maturity - Make sure their debt maturity profile is long term so that they don’t have any debt maturing in the next 1-2 years when it would be less than ideal to refinance.

You can find all these details in the company’s annual report.

Short-term uncertainty is the friend of the long term investor. If you’re interested in REITS and can find REITs with those kinds of traits above, now may be a chance to buy those high quality businesses for the long term, where their current valuations are expecting the worst.

The Enviable Benefits Of A Business With Pricing Power

When a company faces rising costs, there are two ways it can protect its margins: raise its prices or cut costs.

So far this earnings season pricing power has been mentioned more than cost cutting during earnings calls. It’s been interesting to see which companies have managed to raise prices without losing volumes.

You may recall Buffett LOVES businesses with strong brands, because they typically have pricing power.

Most of the companies that managed to increase their prices without losing sales have been the consumer staples giants like Procter & Gamble and Kimberly Clarke . Food and beverage companies at the cheaper end of the spectrum also managed to raise prices enough to grow sales faster than the inflation. Coca-Cola , PepsiCo , Chipotle and McDonalds managed to keep volumes while raising prices.

A notable exception is Constellation Brands which has had to stop raising prices after seeing a decline in sales in the last quarter.

Consumers have been more reluctant to accept higher prices for discretionary purchases. Tesla in particular is having to cut prices to keep sales going (though some investors actually expected price cuts in their Bull case for Tesla, so while some view it as a negative, some expected it). Interestingly, General Motors and Porsche have managed to raise prices, though GM expects it will soon have to pause on the price hikes.

Pricing Power and Moats

In the short term pricing power means a company can still be reasonably profitable during periods of inflation. But it's also evidence of brand loyalty which is a competitive advantage.

Companies that can keep generating profits when their competitors can’t are also in a strong position. This is when they get to outspend competitors on marketing and win market share. Or they simply buy market share by making acquisitions.

💡 The Insight: Pricing Power Is The Ultimate Flex

Pricing power and stable revenues have helped consumer staples companies outperform over the last year. But their valuations are now quite high relative to expected growth rates, which could lead to disappointing returns - unless of course growth rates turn out to be higher than these forecasts.

Often investment opportunities are best when investor expectations are low for an industry or market and high quality companies get dragged down with them. These are times when you can act with conviction and secure high quality businesses for prices that are well below what they’re worth.

Companies with pricing power may deserve a premium, but there’s always a limit to that premium. However, if a company has strong evidence of pricing power, that can help assess a company’s long term competitive position.

Remember, think long term. Consider where the company will be in 5-10 years time. Will its customers be willing to continue paying slightly higher prices for the product or service over that period? If your answer is yes, then that sounds like it might be a business with a strong competitive advantage (brand power, high switching costs, etc).

If not, then it may be one of many companies with no moat and pricing power, where it simply competes with others based on cheapest price alone and watches its own margins shrink as it does. Avoid these types of businesses!

What Else is Happening?

-

🏦 JP Morgan agreed to buy First Republic Bank after the bank was seized by regulators.

- This was the second largest bank failure in US history.

- Investors initially cheered this development, but grew cautious of the level of consolidation in the banking sector on further reflection.

-

🇺🇸 US first quarter GDP was reported at 1.1% , which was well below the 2.3% consensus estimate. The headline number suggest the US economy is slowing faster than expected, however:

- The overall growth rate was impacted by a large decline in inventories. Personal consumption increased by 3.7%, the highest rate in two years.

- Since not all industries have reported yet, this was a preliminary estimate - so it may well be adjusted higher or lower when all have reported later in May.

-

☕️ Starbucks reported what appeared to be a good set of first quarter results on Wednesday, but the stock price fell 9.7%.

- The results were ahead of forecasts, the company managed to raise prices without losing customers and full year guidance was reaffirmed.

- It seems investors were hoping for even more though since it was reflected in the share price movements.

-

🖥 UK Semiconductor company Arm has filed for a US IPO. The company was previously listed before being acquired by Softbank in 2016.

- Arm differs from most semiconductor companies in that it licenses its designs rather than selling chips. Its technology is used in most smartphones, as well as other devices.

- This comes after Nvidia’s proposed acquisition of Arm was terminated following regulatory challenges.

Key Events During the Next Week

There’s a couple of key pieces of data to keep an eye out for this week. We’ll be paying close attention to US inflation data, with CPI due on Wednesday followed by PPI on Thursday.

In the UK, the interest rate decision is also due on Thursday and first quarter GDP on Friday.

Turning to the East, we have China’s inflation rate being announced on Thursday too, with forecasts predicting an increase of 0.2% to reach 0.9%

Earnings season continues with some notable growth companies, and others, reporting:

- PayPal

- Skyworks Solutions

- Airbnb

- Occidental Petroleum

- Affirm

- Upstart

- Twilio

- Electronic Arts

- Roblox

- Wendy’s

- Walt Disney

- The Trade Desk

- Unity Software

- Robinhood

- Beyond Meat

- JD.com

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.