How to Invest Like the Best - Part 5: Building your narrative and knowing when to buy

Key Takeaways:

- Only when you have a narrative around a stock, and an estimate of its fair value, can you then make an informed buy decision.

- If a stock has a great narrative, but it’s overvalued, the key is to just be patient and wait until it’s trading below your fair value estimate. No business, no matter how good, is worth an infinite price.

- There are 5 key questions we can ask ourselves that will help us summarize our narrative, and ultimately complete our valuation on a stock.

Scroll horizontally on table below to view weaknesses

Revenue and Earnings growth forecast are above industry average (albeit still low)

Expected to still be very profitable in 3 years time (118% ROE)

Low expected growth in revenue and earnings

Growth is lower than the US market average

CEO pay seems fair vs company performance

Management and board heavily invested as shareholders

Plenty of experience among board members and management team

Cheaper than peers like AMZN and MSFT, but doesn't have as much growth ahead as they do

Slightly undervalued vs SWS's Fair ratio

Analysts seem to mostly agree that there's a little bit of upside potential over the next year

It's roughly Fairly valued compared to SWS's estimate of Fair value

It appears overvalued compared to the Global Tech hardware industry

Finalizing your Narrative on a stock

You’re so close to finishing your narrative, there’s only a few final steps to go!

Now that you’ve found a business within your circle of competence , you understand how it makes and spends money , you’ve got to know the stock and learned how to value the stock , you need to just get clear on a few assumptions you’re going to make about the future, to help finish putting your narrative together.

You reviewed the valuation analysis on Simply Wall St in Part 4, but in order to have conviction in your decision, you need outline a few assumptions you have about the company’s future, and how they will impact its valuation.

These questions below will help you articulate the assumptions you’re making about the stock’s future:

You can hopefully see how each of these questions above relate to the 4 parts we’ve covered so far in this series. However, now, rather than just consuming the information, in this narrative section, you add your own assumptions in , based on what you know and believe about the business.

A key thing to remember here is you’re trying to estimate the future . It’s not about being precisely right, it’s about being approximately right.

Now, let’s get into answering each of these questions with the stock you've taken through this whole series. We’ll show you what an example with Apple might look like, but you should be able to fill this section out with the stock you’re assessing.

What do I think the business will look like in 5 years time, and why?

To answer this question, you simply need to think about the products and services it offers, its industry, and competition. This involves making forecasts based on the work and research you did in Part 1 and 2 of the series.

For our Apple example, here’s how you might answer it:

“I believe Apple will still have its core products and services businesses running in 5 years time. I believe its current sticky customer base for the iPhone will remain customers due to its strong brand, customer loyalty, and switching costs (e.g. learning a new operating system like Android).

I believe customers will continue upgrading their devices on a typical cycle with a new product every 2-3 years. I also believe that the Mac, iPad, Wearables (e.g. Airpods, Apple Watch), and Home (Apple HomePod) will continue to grow steadily as Apple users increase the amount of Apple devices they own in the iOS ecosystem, and those devices meet more user needs and adoption increases.

However, I believe the services business will continue to grow much quicker than the products business, and it will therefore make up a larger portion of Apple’s total business. I also believe that in 5 years time, it will have new products in the VR and Electric Vehicle space, but I don’t believe these will be large parts of the business by then.”

Depending on the business you’ve chosen, you’ll need to think about similar things mentioned above.

- Do I expect the business to sell the same things in 5 years time?

- Are there any new products or services that it might sell?

Answering these questions above then helps you shape your answer to the next question.

What do I think the business’ revenue and earnings will be in 5 years time, and why?

This part here is all about forecasting where we think the business will be in terms of its sales and profitability, which ultimately filters down into your estimated valuation. This involves making forecasts and assumptions based on the work you did in Part 2 and Part 3 of the series.

“Based on my assumptions above, I expect Apple’s revenue to reach $500bn in 5 years time due to increased adoption of Mac’s, Airpods, Apple Watch, Homepod, but mostly increases in sales from its services businesses. This equates to a growth rate similar to analysts current estimates (~5% growth per year).

Considering the Services business has much higher gross margins than the Product businesses (71% service vs 36% product, as I read in the annual report in Part 2), I believe that the company’s overall gross margin profile could improve from 43% to 46%, given I expect Services to make up 30% of its revenue (currently 20%), and products to make up the remaining 70% (currently 80%).

However, given the company’s comments on research and development costs (page 6 of annual report), I believe its net profit margins will remain the same because it will still be heavily investing in research and development to improve its products and services, as well as launching its EV and VR projects which would only be a few years old by then. While sales for the VR and EV may have started by then, I won’t assign any revenue to them given I'm not sure how they'll go. If they have any notable revenue by then, that’s a bonus.

Therefore, I believe Apple's earnings will likely be $125bn in 5 years time, ($500bn x 0.25%), which roughly equals a 5% annual growth rate, which is similar to what analysts currently expect.”

We’ve used our knowledge of the business in Part 1, our knowledge of the industry and business from Part 2, and our knowledge of the company’s existing growth prospects from Part 3 to make the above assumptions in our narrative.

Do I agree with the current growth rate expectations from analysts?

Here you have to decide if, based on your assumptions of the company’s future, if you agree or disagree with analysts estimates.

“The consensus estimates from analysts (future growth section) is that Apple will experience around 5% revenue and earnings growth over the next few years. Based on my assumptions about its future mentioned above, I largely agree with those growth rates.”

If not, what do I think the growth rate should be, and why? (higher/lower)

In this Apple example, considering our hypothetical growth estimates are in line with analyst’s growth expectations, we don’t need to provide a different growth rate here.

But if you disagree with the growth rate in the future growth section with the stock you’re taking through this series, then the next step is to input your own growth rate, based on your narrative outlined from Q1 and Q2.

To get a visualization of the different growth rates, you can refer to the Simply Wall St Valuator Tool (in Beta), to see how different growth can impact the value of a stock (the final question - Q5).

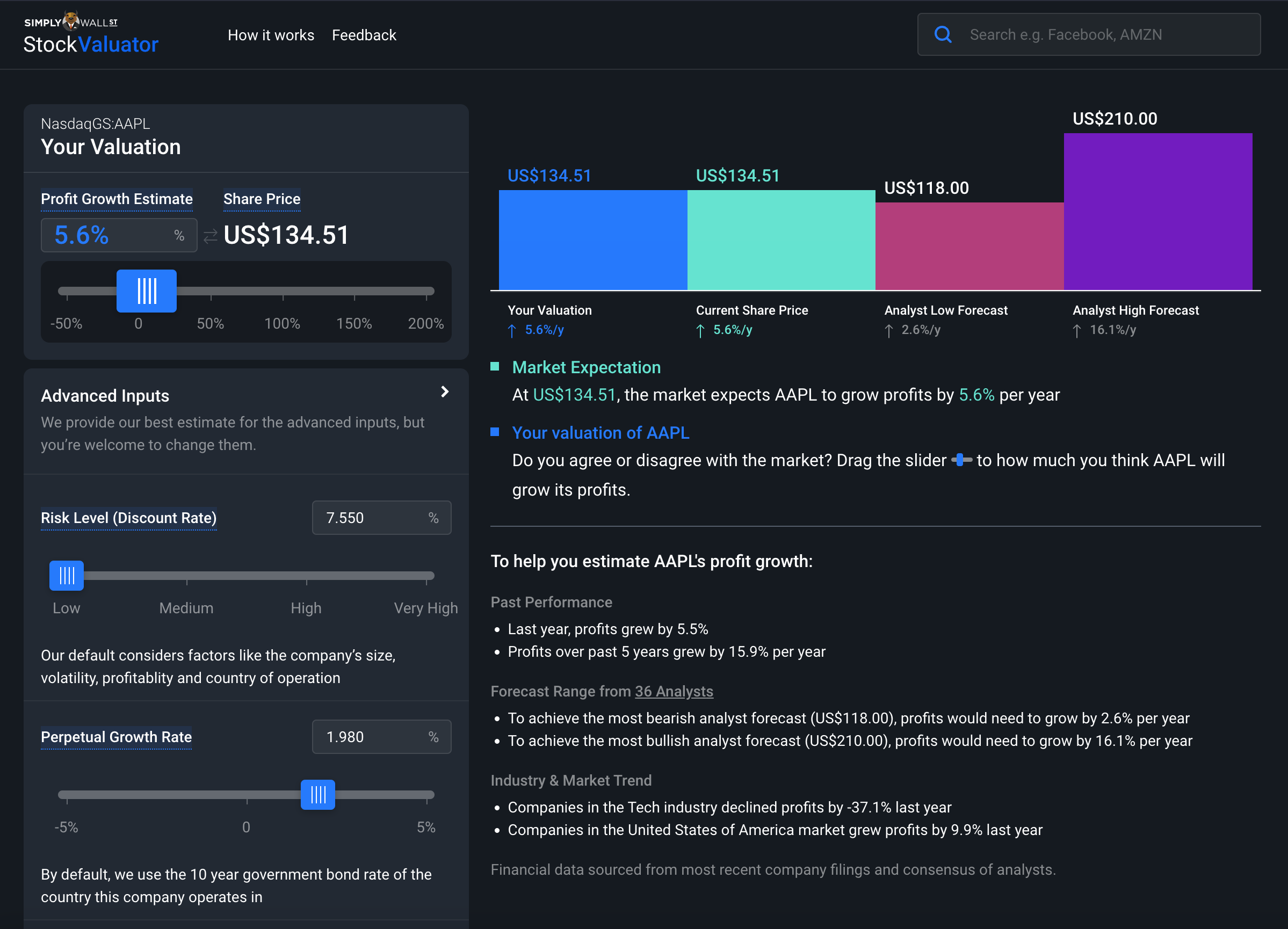

Here in the Stock Valuator Tool you’ll see what the market is currently expecting from the stock, as well as what price targets have been assigned by the most bullish and bearish analysts, as well as what profit growth justifies each of those price targets.

While there’s an option to adjust “advanced inputs” on the left, for this series we’re just going to focus on Profit Growth , just above it .

Now that you’re here, think about the narrative you wrote in Q1 and Q2. Depending on where you expect profits to be in 5 years time, that will determine what rate of profit growth you think is likely to occur. You can calculate that growth rate by either going to a CAGR calculator online, or doing the calculation yourself .

You can see in this example, the most bullish analysts expect 16.1% profit growth per year , whereas the most bearish analysts expect only 2.6% profit growth . Based on Q1, and Q2, and your growth rate calculation, what is your expected profit growth rate? Whatever it is, drag the slider on the left to that figure.

Lastly, we need to bring this back to how our estimated growth rate impacts your estimate of its value . You’ll notice as you change the growth rate slider on the left hand side of the stock valuator, the “Your Valuation” column moves up and down.

If I have different growth expectations, is the stock currently overvalued or undervalued?

Once you’ve moved the slider to your estimated growth rate, and seen what the estimated valuation changes to, you’ll be able to see if the stock is potentially undervalued or overvalued based on your expected growth rate. In our Apple example, this part of our narrative may look like this:

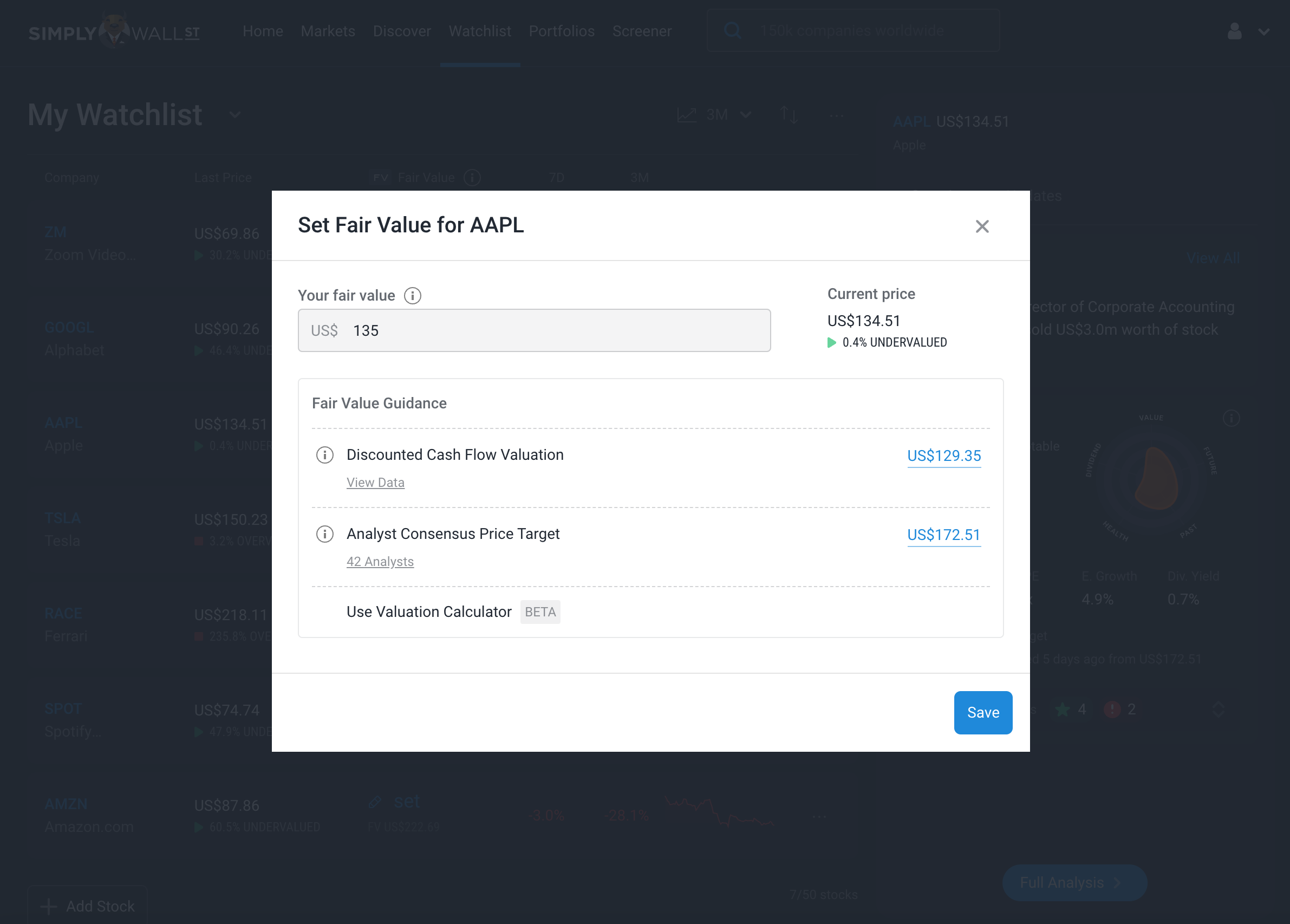

“I believe Apple is likely to grow its profits by around 5% over the next few years. With this in mind, it appears that the market is largely expecting the same amount of profit growth as I am, and is pricing Apple accordingly. Therefore, I think today’s market price is fair, and I don’t believe there is a huge opportunity with Apple at the current price. I would be interested if the stock was available at a notable discount to this value (say 20% or more), so I will set my fair value to $135 on the SWS watchlist , and keep an eye out to see if it ever becomes available well below this price. Also, I will monitor the stock and keep an eye out for any developments that could change my narrative and result in an increase or decrease in my profit growth estimates.”

Congratulations! That was the final step of putting your narrative together! In regards to buying a stock, it can be useful to ask ourselves a few final questions before pulling the trigger and building a position.

Knowing when to buy a stock

There are a few useful questions to ask yourself when considering buying a stock, and they are:

- Do I have a well thought out narrative around this stock?

- Do I have conviction in my narrative around this stock?

- Is the stock trading at a decent* discount to my estimate of fair value?

*”Decent” can be whatever discount you decide, but beginning with a 20% discount can be a good place to start.

If you can confidently answer “ Yes ” to those 3 questions, then you’re in a good position to make an informed buy decision on a stock!

There’s a lot more to learn about position sizes, portfolio management, opportunity costs, but we’ll get into those at a later date.

For now, you’re hopefully in a great position where you’re either:

- Confident enough to make a buy decision, or

- Confident enough to put a fair value on the stock on your watchlist

Alternatively, you’ve disregarded the stock altogether since you’ve found the business model or narrative aren’t good enough to justify investing in!

We'll cover how to "know when to sell a stock" in the next part of this series, so check out Part 6 to find out.

Next Steps

Now that you've finished compiling your narrative and valued the stock, the final part of the narrative based investing approach is Part 6: Monitoring your stocks and discovering new investing ideas!

Lastly, since you've hopefully now finished the How to Invest like the Best series, we'd love to hear your feedback!

Simply Wall St analyst Michael Paige holds a long position in AAPL. Simply Wall St has no position in any of the companies mentioned. This article is general in nature. Any comments below from SWS employees are their opinions only, should not be taken as financial advice and may not represent the views of Simply Wall St. Unless otherwise advised, SWS employees providing commentary do not own a position in any company mentioned in the article or in their comments. We provide analysis based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Michael Paige

Michael is the Content Lead at Simply Wall St. With over 9 years of experience analysing and researching companies, Michael contributes to the creation of our analytical content and has done so as an equity analyst since 2020. He previously worked as an Associate Adviser at Ord Minnett, helping build and manage clients' portfolios, and has been investing personally since 2015.