“The FOMC has considerable control over short-term interest rates. We have much less influence over long-term rates, which are set in the marketplace.” - Jerome Powell

Welcome back to our regular schedule for Market Insights! Last week we wrapped up our 12-part Big Trends series , but that won’t be the last you hear of them.

Keep your eyes peeled for the latest updates to these trends in our future newsletters, or better yet, take some time to re-read them because these trends will be relevant for years to come!

As for this week, we’re heading into the fourth quarter so we are discussing:

- Investors now believing the “Higher for longer” narrative

- The Strength (and weakness) of the consumer

- Consumer spendings relation to GDP

- What to look for to find safe dividend stocks on Simply Wall St

- A preview of Q4 earnings season

Let’s dive in!

🎧 Would you prefer to listen to these insights? You can find the audio version on our Spotify or Apple podcasts !

Investors Now Believing The “Higher For Longer” Narrative

The world remains focused on inflation and what that means for interest rates.

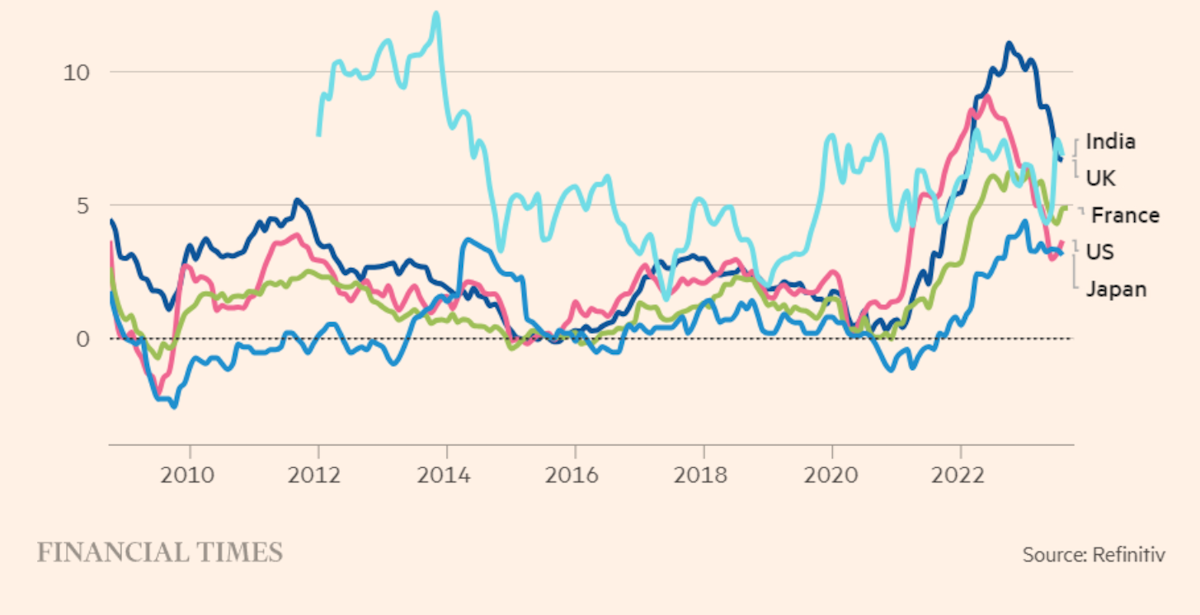

After a sharp decline during the first six months of the year, inflation has stabilized - but well above the 2 to 3% target range set by policy makers.

Central bankers around the world continued to warn that interest rates were likely to stay higher for longer - But investors didn’t buy it. They were betting that central banks would pivot and cut rates later this year.

Adding to the hawkish picture was the oil price which rose more than 30% during the quarter, and generally better than expected economic data (e.g. jobs data).

This has all been a bit of a shock for investors who were hoping for the miraculous soft landing and rate cuts sooner rather than later.

So while assets were probably being priced in with expected rate cuts, it seems investors at large are now believing the narrative of “higher for longer” and adjusting their valuations accordingly (higher discount rates).

Are Consumers About To Crack?

Consumer spending has defied expectations and helped some economies avoid a recession so far. In the US spending has continued to rise, though August’s data was slightly weaker than expected.

UK consumer spending has also remained strong despite stubborn inflation . In China, retail sales have been one bright spot in an otherwise weak economy.

But there are several headwinds that could begin to impact spending.

- In many economies, rates on credit card debt, mortgages and home loans are very high, and it doesn’t look like there will be relief any time soon.

- At the same time, savings which were accumulated during the pandemic have been depleted .

- In the US, private sector credit increased noticeably in August after remaining stable for the previous six months.

- Also in the US, the pause on student loan repayments ended last week and will now cost consumers another $8 billion a month.

Consumer Spending and GDP

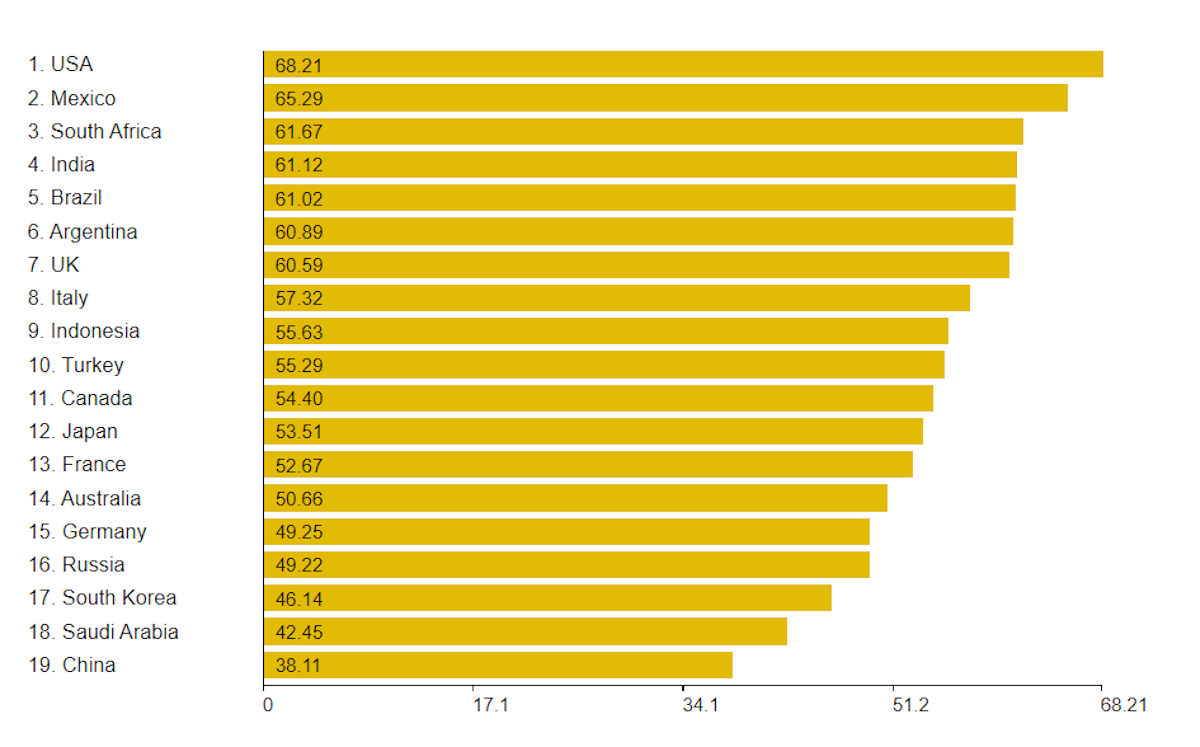

The market is already anticipating weakening consumer demand, but spending doesn’t only affect consumer facing businesses. GDP is mostly made up of consumer spending (technically known as household consumption).

The chart below reflects the actual percentage for G20 countries in 2021 - you can check the percentage for other countries here .

A slowdown in consumer spending would have a major effect on economic growth and sentiment - not just consumer facing sectors.

As long term investors, our concern is more about the long term earning potential of a company versus its valuation .

To see this in action, we’ve got investors “narratives” on the platform where the analysts are looking at least 5 years out to 2028. Stocks like AMZN , AAPL , NVDA , PYPL , GOOGL , NFLX , DIS , ADBE , V , META and others all have coverage. More narratives are coming soon, and if you’d like to create your own narratives, register your interest by clicking “create narrative” at the top right!

But if you are hoping to reduce portfolio volatility this is something to pay close attention to over the next few months, particularly heading into the holiday season.

If consumer spending does lead to deeper recession, there will be two silver linings:

- Inflation will fall faster, and rate cuts will occur sooner , and

- There will be better long term buying opportunities for investors.

- This is a good time to review your watchlist and update your fair value levels, which you can do on the watchlist.

Global Markets - Mean Reversion or Something Worse?

After a strong start to the quarter in July, equity markets fell in August and September.

Investors grew cautious as the reality of ‘higher for longer’ interest rates became apparent. Bond yields rose throughout the quarter with US 10-year yields hitting a 16-year high on the first day of the fourth quarter.

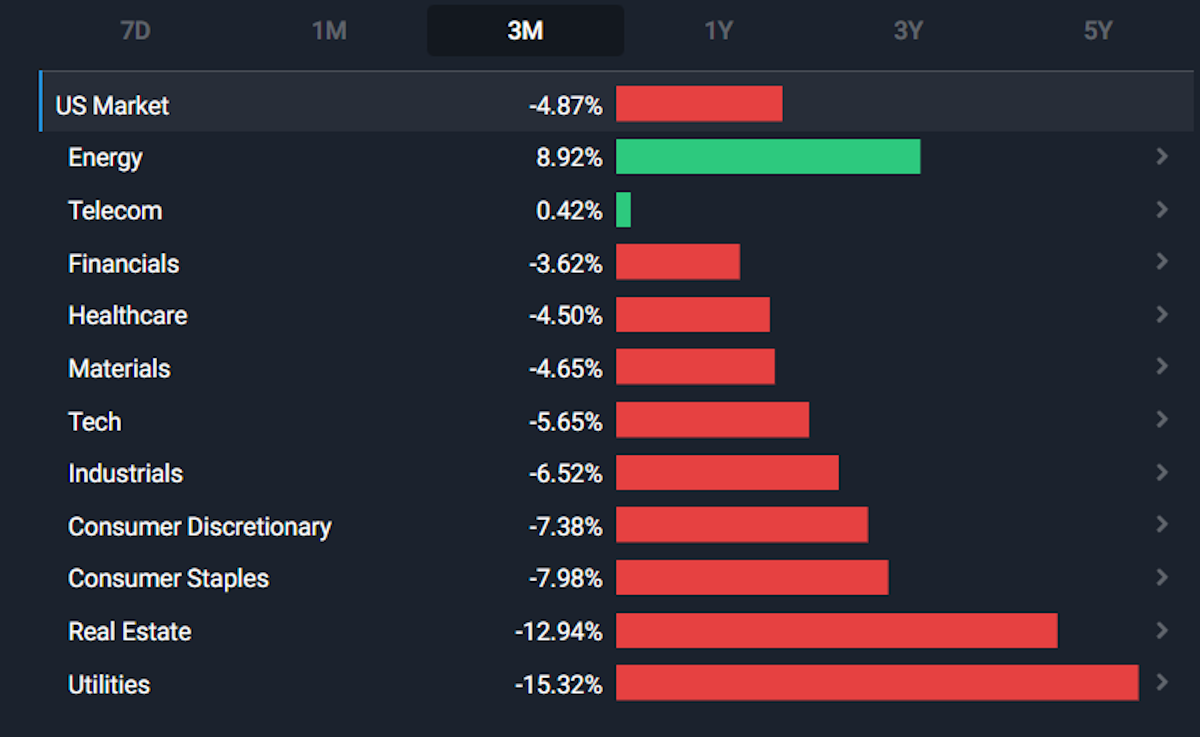

While growth stocks have been under pressure, this round of higher interest rates has had more of an impact on two specific groups of stocks: dividend stocks and stocks exposed to consumer spending.

US Market 3- Month Sector Performance - Image Credit: Simply Wall St

In most markets the utilities , real estate , consumer discretionary , and even consumer staples sectors were weakest. The weakness in consumer sectors suggests investors have been anticipating the headwinds mentioned above. We’ll come back to utilities and real estate in a moment.

The only area of strength has been the energy sector, which rebounded as the oil price rallied throughout the quarter due to production cuts from OPEC nations looking to increase the price. The same didn’t occur for most other commodities, and commodity producers remained in a slump.

India has been making a habit of bucking the global trend, and did so once again in the third quarter.

Utilities was the top performing sector over the quarter, while energy was the worst performer - the mirror image of the US and most other countries. This was at least partly mean reversion after the prior sell off in Adani Group companies .

Dividends Aren’t Always as Safe As They Seem

The utilities and real estate sectors are sensitive to rates for two reasons:

- Firstly, these companies use a lot of debt so higher rates means their cost of capital goes up .

- And secondly, these types of stocks are typically owned for their dividends. When AAA rated government bonds are yielding over 4.5%, those dividends don’t look nearly as attractive .

- Why buy a “risky” stock yielding 4% when a “risk-free” government bond earns you 4.5%?

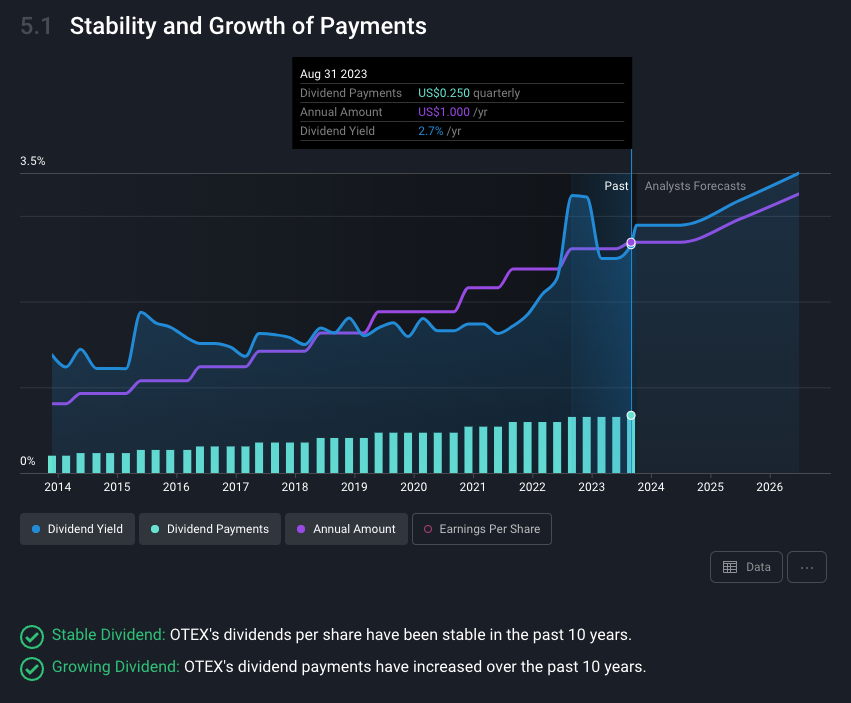

The yield on a dividend paying stock can quickly be wiped out if the company is forced to cut the dividend.

Many investors are aware that stocks with very high dividend yields carry risk. But the risk for some stocks with lower yields can easily be underestimated when the company appears to be very stable.

Ultimately the more debt a company uses, the higher payout ratio it has, the less earnings growth it's expected to have and the higher its yield, the more risky that dividend becomes.

A more cautious approach to dividend investing is to pick companies with lower yields but higher compounding potential. If earnings rise and the payout ratio stays the same, the dividend amount will rise even though the yield stays the same.

Our Dividend, Financial Health and Future Growth Analysis on every company report will give you insights into each of these aspects:

- Stability and growth of dividend payments - Section 5.1

- Does it have a proven track record of dividend payments?

- Payout ratios - Section 5.3 and 5.4

- How much of its earnings and cash flow does it pay out as a dividend? Is this affordable?

- Debt to Equity analysis - Section 4.2

- How much debt does it have, and can it afford it?

- Earnings and Revenue Growth - Section 2.1

- Are earnings and cash flows expected to grow? (this is how future dividends would be paid)

- Are earnings and cash flows expected to grow? (this is how future dividends would be paid)

Example: Open Text Dividend Stability and Growth of Payments - Simply Wall St

Q2 Earnings Season Was Less Eventful

Most of the earnings recession was already in the forecasts and stock price movements also suggest investors were looking way ahead of current earnings, and even third quarter guidance.

Case in point, the US consumer discretionary has been the third worst performing sector despite reporting the biggest increases in earnings over 12 months.

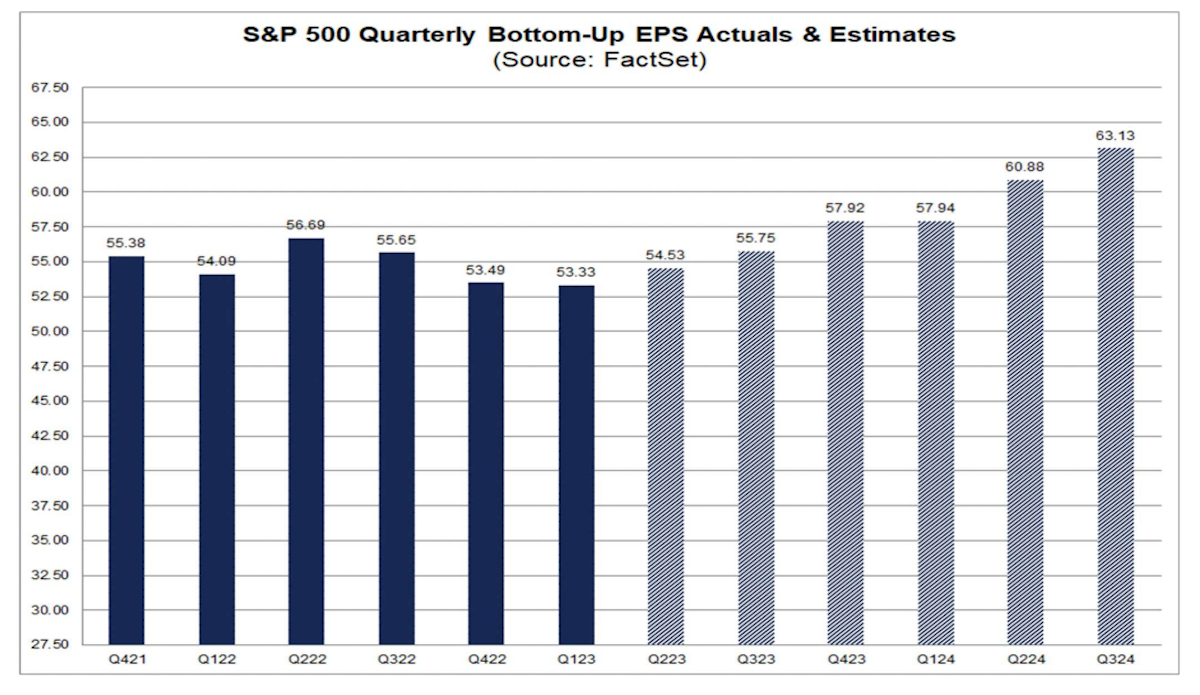

Additionally, 79% of S&P 500 companies beat consensus EPS estimates (more on that below), reporting an overall 4.1% year on year decline in earnings. That was better than the 7% decline expected at the beginning of the quarter.

Year on year revenue growth for the index was 0.9%, compared to the 0.4% decline expected by analysts. Sales were heavily skewed in favor of companies that earn most of their revenue in the US (since a stronger USD made non-USD sales weaker). Profit margins were lower than a year earlier, but improved from the first quarter.

Over the quarter, EPS and sales forecasts for the third quarter were raised marginally.

Analysts now expect earnings to be down -0.1% on sales that are 1.6% higher year-on-year. This implies that analysts still expect the current quarter to be the low point for earnings with a reasonably strong recovery next year.

💡 The Insight: Focus on Long Term Trends, Not Short Term Noise

During earnings season a lot of attention is paid to whether companies beat analyst estimates. For us long term investors, this is more of a distraction than anything else.

Companies manage expectations from one quarter to the next to make sure they have a good chance of beating the average estimate.

As a long term investor, it's more important to pay attention to longer term trends, and the qualitative aspects of earnings calls, like company strategies and operational goals, like we discussed further up with the narratives.

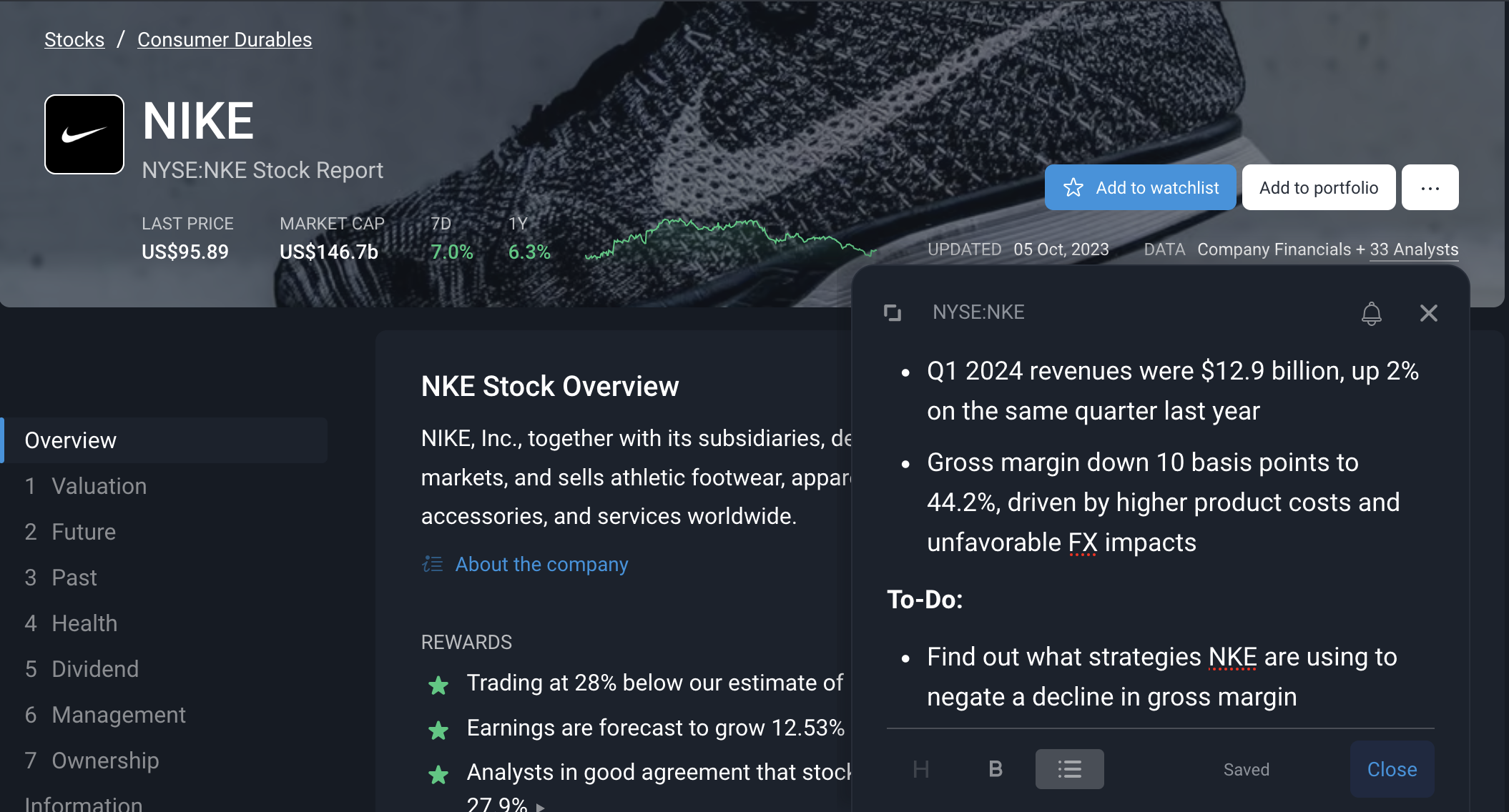

To keep track of these important developments, you can jot down any key points within the “notes” feature on the company report. Then, you can refer to those points whenever you’re forming your own narrative, or if the company reports any new developments that impact your narrative!

What Else Is Happening?

First a recap of two key data releases…

- 🇺🇲 The US job openings stood at 9.6 million at the end of August , up from 8.9 million in July according to the JOLTs report.

- The figure was also higher than expected - which added to investor expectations of “higher for longer” rates.

- 🇺🇲 The US ADP national employment report showed job growth of just 89,000 in September which was far below the 160,000 expected.

- This suggests the labor market may be loosening and seems to contradict the job opening report.

- The ADP report is more recent, but it's not unusual for these numbers to contradict each other.

And then, a few news items that we thought were worth noting…

-

🚗 The New York Times reported that Chinese EV maker Nio is losing $35,000 for each car it sells. Rivian Automative’s losses aren’t far behind at about $33,000 per truck .

- Most of these losses are really R&D expenses, which can be recouped with enough scale. Nevertheless these companies require massive amounts of capital before they can become profitable.

- If you are assessing these types of companies the key questions to ask yourself are

- a) What scale can this company realistically achieve? and;

- b) What will be a realistic profit margin when that scale is achieved, given the competitive landscape when that happens?

-

👟 Nike which has been a notable underperformer over the last two years has been stronger since releasing its first quarter results last week. However the stock price is still 46% below its 2021 high.

- Nike has been on the wrong side of both inflation (higher costs), interest rates (lower valuation) and China’s economic slump (lower sales growth). These are all factors that could improve.

- The valuation is also interesting. By most measures the valuation is low relative to the past 10 years, but if you look further back it's quite high relative to the 2000 to 2012 period.

- These are two periods that had very different interest rates, and the valuation going forward is likely to depend on what a ‘normal’ interest rate level is.

Key Events During the Next Week

The focus for the week will be US inflation data. US PPI (producer price inflation) will be released on Wednesday, and consumer inflation data will follow on Thursday. The minutes from the last FOMC meeting will also be published on Wednesday.

UK GDP and manufacturing production data will be published on Thursday.

Rounding out the week, China’s balance of trade data is due on Friday.

Third quarter earnings season kicks off with the big banks reporting on Friday. A few other large companies are also reporting earlier in the week:

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.