“Think in decades, not months. Reach your own conclusions. Be a lifelong learner.” - Simply Wall St

2023 has been another interesting year for investors, with plenty of surprises. We should be used to this by now, right? Expect the unexpected.

At the start of the year we had bank collapses, expectations of a hard landing and inflation was still running hot. Now though? We’ve got inflation prints that are much lower, the Dow 30 index at a new all-time high, and Investors are optimistic that rate cuts are on the horizon.

Along the way there have been a few good timeless lessons and reminders for investors that we can implement in 2024 and beyond, and this week, we’re covering 7 of them.

By the way, this is our last Market Insights before we take a few weeks off and start again on the 8th of January! Hope you all have a great holiday and a happy new year!

🎧 Would you prefer to listen to these insights? You can find the audio version on our Spotify or Apple podcasts!

Lesson 1: Quality Outperforms During Periods Of Uncertainty 💪

The market’s recovery continued during 2023, but there was still plenty of uncertainty to go around. One thing that became clear was that investors were rewarded by sticking with high quality stocks, rather than rotating into stocks that were lagging or may have appeared to be ‘cheap’.

The performance of the S&P 500 index was heavily influenced by the strong performance of the ‘Magnificent 7’ which accounted for nearly 30% of the index. But several indexes that track stocks with high quality earnings still managed to outperform the index. Amongst global indexes, quality also outperformed.

The chart below reflects the performance since November of the S&P 500 (blue) and the iShares USA Quality Factor ETF (green). Also shown are the MSCI world index (red) and the iShares MSCI Intl Quality Factor ETF (purple).

During the downturn in 2022 defensive sectors like utilities and consumer staples did outperform - but over the full two-year period, high quality stocks left those defensive stocks in the dust.

✨The lesson here is that if you can tolerate some volatility, it's worth sticking with your quality investments, rather than switching to defensive stocks. As Morgan Housel put it:

“Volatility is the price of admission. The prize inside is superior long term returns”.

The big challenge with trying to switch back and forth, is that you have to get the timing right on two trades. And after all, the age-old saying “time in the market beats timing the market” has been proved time and time again. It’s much easier and less stressful as an investor to stick with a high quality stock you’re familiar with.

If you missed it, we covered earnings quality in more detail in November. Companies with high quality earnings are few and far between, and don’t often trade at reasonable valuations.

It’s incredibly useful to keep a watchlist of the companies you would love to own, with an idea of what you think they’re each worth, so you don’t miss them when they do trade lower, and you’re disciplined about what price you pay.

You can also use the notes tool on each company report to keep track of the qualitative aspects that make them potential long-term winners.

Lesson 2: Ignore The Predictions 🔇

Every year around this time, the financial media publishes a list of S&P 500 price targets from Wall Street strategists for the end of the following year. An example from December 2022 included 18 targets ranging from 3,400 to 4,500 , with an average of 4,031. With two weeks to go until the end of the year, the index is at 4,719, well above the highest of those estimates and about 17% higher than the average!

So, how did they do in 2022? Well target levels ranged from 4,400 to 5,300, and the index ended the year at 3,839, about 13% below even the lowest of those targets.

Now this is not to say these professional analysts don’t know the market, it’s simply a representation of how market movements are heavily dictated by unforeseen factors .

✨ Making a prediction like these is very difficult and usually clouded by recency bias.

Another observation to note is that annual returns are seldom close to the average. The average return for the S&P 500 index since 1957 is just over 10%. In the last 60 years it's only been within 5% of that 15 times.

Lesson 3: Markets Do A Pretty Good Job Of Discounting The Future 🔮

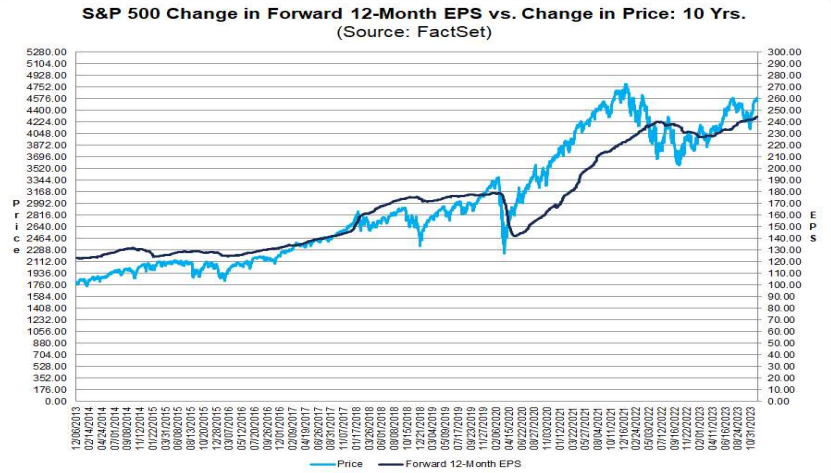

While market strategists struggle with price predictions, markets are actually quite good at discounting the future. The S&P 500 index turned lower nine months before earnings began to fall, and then bottomed about nine months before earnings growth turned positive again. This was despite the predictions and recession talk.

The chart below illustrates the index level relative to the 12-month forward EPS estimates.

It’s difficult to navigate these earnings cycles in real time. But it's worth remembering that earnings are a reflection of the recent past, while markets are forward-looking.

✨ Opportunities are created when markets are still reacting to the past, and stocks are trading at attractive valuations. These opportunities become apparent when you ignore the noise (which can be difficult) and take a 5 to 10 year view.

Lesson 4: It’s Often A Bumpy Road For New Industries 🚧

The global EV industry has been growing at an astronomical rate - but it hit a speed bump as it started going mainstream. EV prices are still relatively high, and most auto buyers can’t afford them yet. Prices need to come down, which means companies need to achieve economies of scale.

Any growing industry can face challenges like this, even if it's growing fast and generating positive cash flow. The silver lining is that these bumps in the road create opportunities for patient investors.

One of the advantages of narrative investing is that you can work out the right price to pay for a share, and then wait patiently. Creating a narrative for a company doesn’t mean you have to either invest, or reject the share outright. You can carry on updating your narrative and getting to know the company while you wait for the right price.

So if you feel you have missed out on new industries like AI, don’t worry, you may get another chance.

If you start developing narratives for the best companies, you’ll be properly prepared when an opportunity does come around. You can use the narratives that have been published for Microsoft, Alphabet, Nvidia and AMD as a starting point.

Lesson 5: Investors Need To Pay Close Attention To Their High Yield Stocks ⚠️

October was a reminder of the risks inherent in some dividend stocks, particularly those with attractive yields. Many investors were caught off guard when real estate and utility stocks (which typically have the highest dividend yields, and use a lot of debt) plunged as bond yields rose.

These stocks suffered from a double whammy as higher rates raised the cost of refinancing their debt, and at the same time their 4 or 5% yields suddenly didn’t look as attractive compared to bond yields.

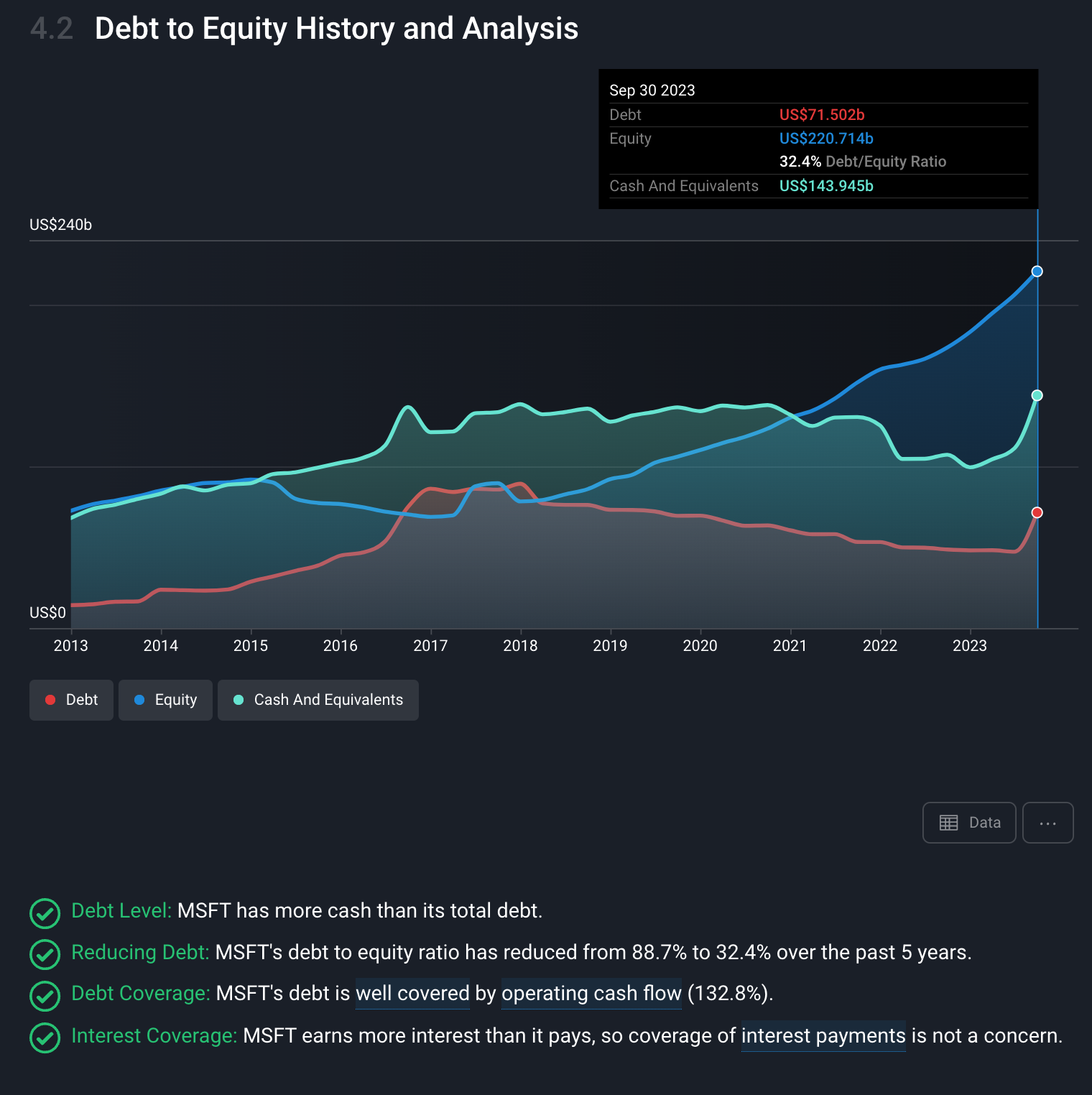

It’s crucial that inventors know how much debt the companies they invest in have, and how easily they can manage that debt. And you also need to know how sustainable their dividend payments are.

For this, you can always check out a company's financial health (section 4) and dividend payments (section 5) on the company report. To give those topics context, make sure you also have a look at section 2, to see what their future growth prospects look like.

Lesson 6: Companies Can Also Be Over-Concentrated ❗️

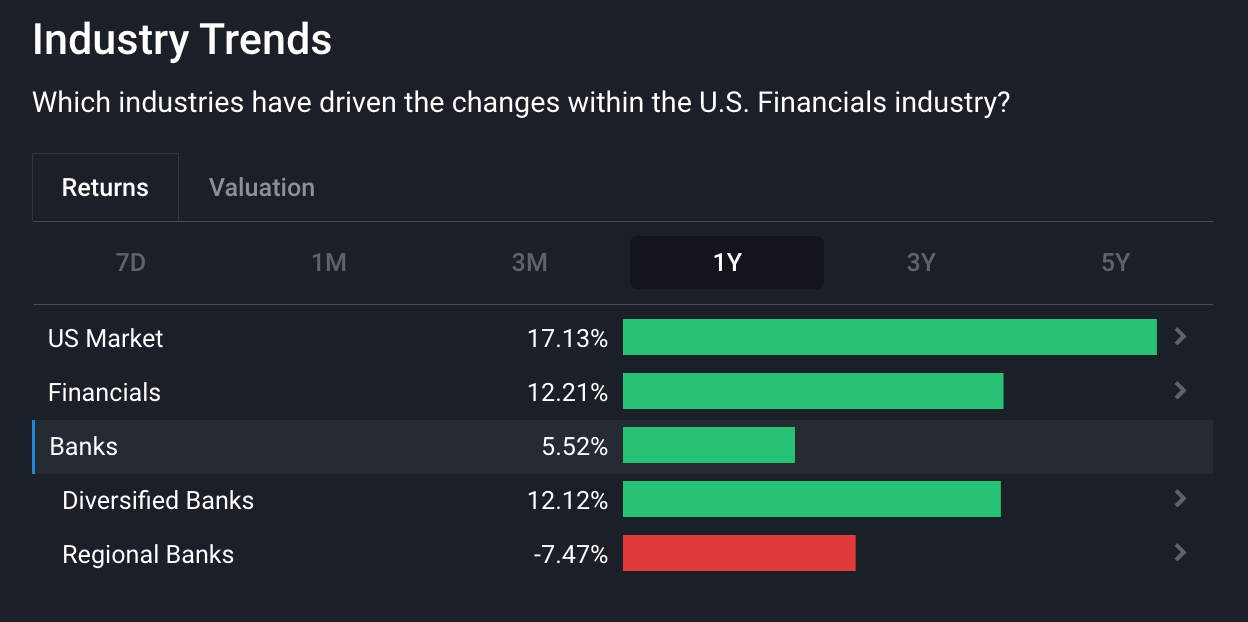

One of the biggest events of 2023 was the collapse of Silicon Valley Bank in March. There were lots of lessons to learn from this, and we covered some of them at the time.

Looking back, it’s worth highlighting one aspect of this story. SVB almost exclusively served technology companies in California, as well as their employees. When the tech sector experienced a downturn, companies and employees started drawing down on deposits. This resulted in a run on the bank, which was compounded by the fact that the bank’s assets weren’t as liquid as they should have been.

This ultimately led to the collapse of the bank. But, even if the bank hadn’t collapsed, its business would have been severely impaired, because it was so reliant on a specific market.

Other regional banks also became vulnerable due to the pressure facing the commercial real estate industry. While few actually collapsed, their stock prices still reflect the risk of being dependent on a single region or industry.

✨ This doesn’t only apply to banks. Companies can be at risk when they are reliant on a single product, market or a small group of customers. This doesn’t mean you should avoid such companies, but it’s important to account for the risk when it comes to position sizing and valuation.

Lesson 7: Great Companies Continuously Reinvent Themselves 🔧

The performance of some of the world's most valuable companies this year is a reminder of a Warren Buffett and Charlie Munger quote we mentioned recently:

"It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price".

In particular, Microsoft, Alphabet and Nvidia and a few others have all benefited from the growth of the AI industry. Yet, when these companies were founded, artificial intelligence wasn’t part of the plan. The same can be said for Apple with the iPhone and Amazon with AWS.

✨ Companies with great leaders, culture, intellectual property, and strong cash flows can end up doing things you didn’t imagine when you first invested. With these ingredients they can keep employing smart people, innovating, investing in new businesses and growing their profits.

Apple is a great example of this. A once struggling computer company was able to redefine itself as the largest consumer electronics company in the world by endeavouring to “Think Different” and launch a mobile phone in a market dominated by Nokia, Motorola, Samsung and Blackberry.

And with the pace at which technology is advancing, this process seems to be happening faster and faster.

If you can invest in companies like this at a reasonable price, your narrative can keep evolving way beyond your initial thesis. These are the companies to hold for as long as they keep innovating.

What Else Is Happening?

Here’s a recap of the key data releases we mentioned last week…

-

🇺🇸 The US Fed kept the Fed Fund rate steady at 5.25 to 5.5% as expected.

- However, Fed Chair Jerome Powell surprised by indicating that the committee now expects three rate cuts in 2024. Powell said the Fed is now “ seeing progress on inflation across the three main core areas .”

-

🇺🇸 US Inflation data was mostly positive.

- Consumer prices rose 0.1% in November and 3.1% year-on-year.

- The monthly change was slightly higher than expected due to higher food and rent costs, but lower energy prices contributed to inline 12-month price changes.

- Producer prices rose 0.9% over the last 12-months, their lowest rate since 2021. Again, the drop in energy prices offset small increases elsewhere.

-

🇬🇧 The UK’s unemployment rate was stable at 4.2% in the three months to October.

- However, the number of job vacancies fell by 45,000 between September and November, indicating the labor market is weakening.

-

🇬🇧 GDP data from the UK also pointed to further weakness, with the economy contracting by 0.3% in October.

- This adds to the central bank’s challenge, as inflation is still higher than elsewhere.

And here are a few other news items worth noting:

-

🎮 Epic Games wins trial against Google ( The Verge )

- Our Take: While the verdict has been delivered by the jury, the Judge (James Donato) is yet to deliver what the appropriate remedies might be. If Epic gets their wish, Google’s $10bn in revenue from its Play store and in-app purchases will be at risk. Considering Google is going to appeal the verdict, any outcome is still likely years away.

-

📺 Netflix releases first ever engagement report ( Axios )

- Our Take: After facing criticisms over transparency, Netflix decided to go above and beyond by releasing their latest engagement report titled “ What We Watched: A Netflix Engagement Report ” . While interesting for audiences, this data is super valuable for creators who can now gain a greater understanding of what is popular among audiences, why and where the most value was being created for license holders. There’s no immediate impacts to Netflix’s business, but there’s hope that greater transparency will help improve the quality of content delivered to the platform, hopefully boosting subscriber numbers in the long-run and enticing new production companies to license their content on the platform.

-

🚗 Tesla recalling more than 2m cars in US over Autopilot system ( The Guardian )

- Our Take: In this day and age, the term ‘recall’ should really be revised. The remedy here is actually really simple, at no cost to customers, impacted Tesla models will receive an over-the-air software update to deploy a fix for the monitoring system. The headline seems like a lot of fanfare for something that’s quite easily fixed. This is quite minor in the scheme of things, and it’s unlikely there’ll be any noticeable changes from a financials perspective, however Tesla reeling in the functionality of its Enhanced Autopilot could leave a sour taste among owners and prospective buyers alike, leaving them looking for alternatives.

Key Events During The Next Week

This week’s data releases starts with the Bank of Japan’s interest rate decision. Japan’s trade balance is also due on Wednesday, and inflation data will be released on Friday.

UK inflation data will be published on Wednesday, and UK retail sales are due on Friday.

In the US, the final 3rd quarter GDP estimate is out on Thursday, and the PCE price index and personal spending and income data will be published on Friday.

There are still a few large companies due to report earnings, including:

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.