6 Takeaways From The Woodstock Of Capitalism

Reviewed by Bailey Pemberton, Michael Paige

🎧 Prefer to listen to these insights? Check out the audio recording on Spotify !

Broad market indexes like the DOW JONES and S&P 500 are sitting just below their year-to-date highs. The MSCI World index and S&P 500 are up 8.5% and 8% respectively. So considering the headlines this year have included bank runs and bankruptcies, investors seem mostly undeterred !

In the case of the US, this doesn’t reflect the reality of the broader market as just 15 stocks account for 97% of the S&P 500’s YTD gains .

Our quote of the week:

“ The investor of today does not profit from yesterday's growth.” - Warren Buffett

Last weekend Berkshire Hathaway held its annual general meeting, commonly referred to as Woodstock for Capitalists. Warren Buffett and Charlie Munger always have a few pearls of investing wisdom to share and this year was no different.

So this week we are listing our key takeaways from the Q&A session.

But just quickly before that, here’s a recap of the key economic data that was released over the last week:

- 🇺🇸 US CPI ↗️ 4.9% year-on-year, which was just below the 5% expected by economists - Core CPI was 5.5% as expected, while the month-on-month rate was slightly higher at 0.4%. Although the inflation rate fell more than expected, it was the smallest decline since the peak in June last year.

- 🇬🇧 UK Interest rates ↗️ 0.25% - The Bank of England has yet again hiked interest rates, in the 12th consecutive rise since December 2021. This takes the base rate to 4.5%

- 🇺🇲 US Producer Price Index ↗️ to 141.13 - An increase of 2.38% from one year ago.

Right, now with that covered, let’s see what Warren and Charlie had to say….

1: The Banking Crisis And Commercial Real Estate

Buffett was critical of the way regulators have handled the banking crisis. Buffett said “it would have been catastrophic” if Silicon Valley bank deposits had not been insured. But he also implied that regulators weren’t paying attention and that communication from government officials and regulators has created confusion amongst the public. Munger meanwhile said the

“The gamier it gets, the more it look like it does with investment banking, the less I like it as a citizen”

Deposit Insurance Shouldn’t Be A License For Excessive Risk Taking

The banking system depends on the confidence of depositors (who are really lenders) and investors. Deposit insurance is one part of this, but effective oversight and unambiguous communication from regulators is also essential.

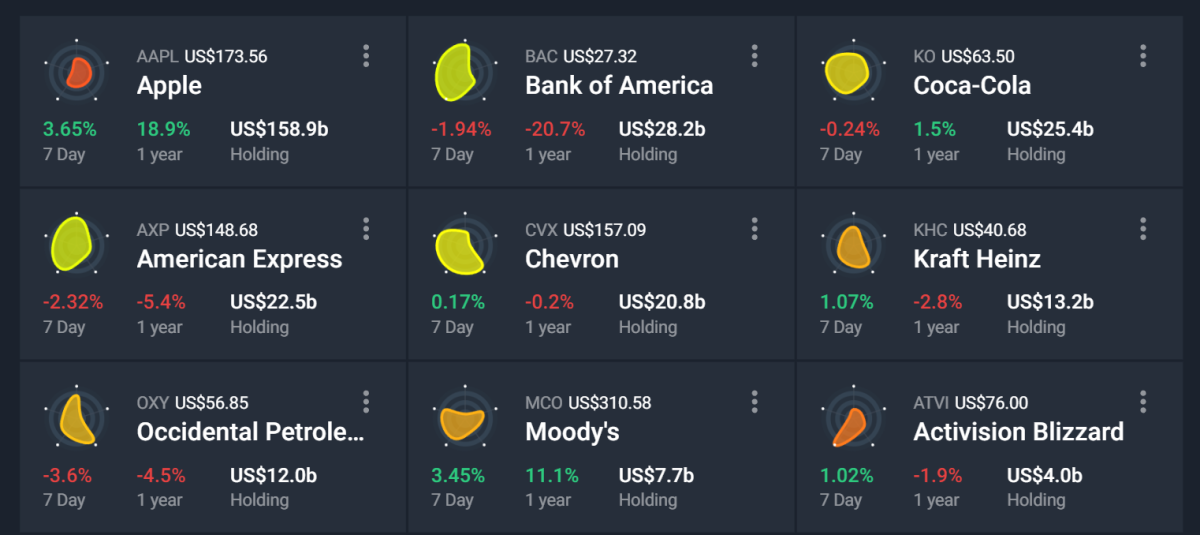

Berkshire has been selling bank stocks over the last six months - but Buffett expressed confidence in Bank of America , the one bank the company is sticking with.

CRE: The Building will Remain - Probably With A Different Set Of Owners

“I do think the hollowing out of the downtowns in the United States is going to be quite significant and quite unpleasant. We’ll get through it okay, but it’ll often involve a different set of owners.”

2: The Auto Industry And EVs

Buffett was asked about investing in electric vehicles. He acknowledged that EVs will change the vehicle market but said the auto industry is just too tough: “I think I know where Apple will be in five to ten years - I can’t say the same for automakers.”

Some Industries Are Just Very Tricky

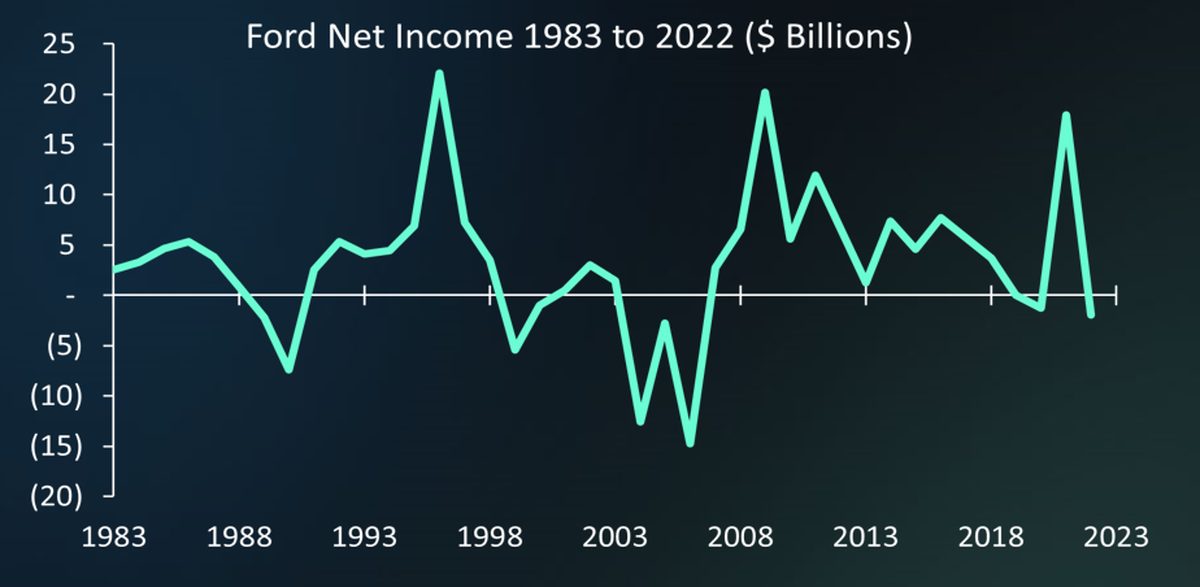

The auto market is extremely competitive (so margins are quite low) and an automaker's edge 5 to 10 years into the future is difficult to predict. This is what Ford’s earnings have looked like over the last 40 years:

Though he did have praise for one auto-maker, and that was Ferrari .

He said : “I would say Ferrari is in a special place, but they only sell 11,000 or 12,000 cars a year”.

Despite the lower volume than typical car makers, the company has a lot of traits that we mentioned last week that Buffett loves, namely an incredibly strong brand, and subsequently, pricing power.

This explains why despite being in the low margin auto-business where the likes of Ford and Toyota have net profit margins of 1.75% and 6.6% respectively, Ferrari has profit margins of 18.55%.

So, how does Tesla fit in? Tesla is currently a premium brand, but to scale its vehicles need to be affordable for a lot more people. We will soon see how its price cuts translate into volumes.

If you are investing in a company in very competitive and capital intensive industries, it can be a tough game. So IF you do venture into those waters, make sure that:

- You’re focusing on those businesses with some sort of competitive advantage over others in the industry (E.g. Ferrari and its strong brand).

- You’ve assessed its future prospects and come to a valuation with conservative estimates , and

- You only purchase when there’s a large enough margin of safety between your valuation and buy price , where it would deliver you a return above your hurdle rate

- If you have a hurdle rate of 10% per year, you’d only buy a stock when the price could deliver you a return greater than 10% per year.

- If you have a hurdle rate of 10% per year, you’d only buy a stock when the price could deliver you a return greater than 10% per year.

- Then simply make sure it stays on course.

3: Apple is different from the other businesses we own….It just happens to be a better business."

When asked whether Berkshire’s position in Apple might not be too big, Buffett simply said Apple was a better company than any other they own. He also pointed out that the position wasn’t 35% as claimed - that percentage doesn’t take all the unlisted, wholly owned companies into account.

Munger’s response was that vast diversification is overrated - or “insane” as he put it. His point was that finding a few great opportunities is difficult. So if you know what you’re doing, why would you put money into your 25th best idea when you could invest more into your best 5-15 ideas?

To support this point, Buffett’s old quote should clarify their view on diversification:

“We believe that a policy of portfolio concentration may well decrease risk if it raises, as it should, both the intensity with which an investor thinks about a business, and the comfort level he must feel with its economic characteristics before buying it.”

How Big Is Too Big?

Regardless of the actual number, Apple is a very big slice of the Berkshire empire. If we go by the percentage of the current market cap, it's 21% which is higher than many investors would want in one stock.

There is some context to consider here. Firstly, Berkshire generally invests in very stable, well capitalized businesses. They focus on companies that steadily compound earnings and those types of companies seldom trade at very high valuations. If you invest in riskier growth stocks, having 20% in a single position might not be as prudent.

The other thing to consider as an individual investor is your tolerance for volatility. If you are likely to panic when you have a drawdown in your largest holdings, then it might be better to trim positions when they become outsized. This may well reduce your overall returns, but managing psychological capital is important too.

4: On “De-Dollarization”

Buffet was asked about the potential for the end of the dollar’s status as the global reserve currency. His response was that he sees no option for any other currency to be the reserve currency.

But he did emphasize the danger that overspending could have on the value of the USD. He also said that Berkshire Hathaway is better prepared for inflation than most companies - but not perfectly prepared, which he said is impossible.

It Won’t Happen Overnight

The concept of ‘de-dollarization’ has been getting a lot of airtime lately. Indeed some countries are starting to use other currencies for trade .

But replacing the USD as the global reserve currency, or even the major trading currency, would require a very complex and co-ordinated process. Most foreign reserves are held as USD assets (59% vs 20% for the Euro) and global investors are heavily invested in USD denominated assets. Dumping all these assets would result in massive losses for all parties, and would probably outweigh any benefit. You can read about more of the obstacles to de-dollarization here .

It’s probably inevitable that the USD will eventually lose its status at some point, BUT it would likely take decades. Of course the USD can still weaken for the same reasons as any other currency - and it's worth paying attention to those factors. But predictions about the USD being replaced imminently doesn’t appear to be a sound basis for investment decisions.

5: “Old Fashioned Intelligence Works Pretty Well”

It wasn’t a surprise to see the topic of artificial intelligence come up. Buffett and Munger didn’t dismiss AI, but they did express some skepticism.

Buffett pointed out that AI won’t replace the gene and that AI can “change everything in the world except the way men think and behave”. Munger remains a fan of good old fashioned intelligence.

A.I. Can’t Do Everything

AI will likely be applied to everything, in many cases successfully - but there will probably be some monumental failures too. In some cases AI might become a differentiating factor (like it is at the moment for Microsoft’s Bing). But in other cases it may level the playing fields giving no single company an edge. If companies are all using similar technology for similar tasks, they will still need other ways to differentiate their products.

6: Berkshire’s $130 Billion Cash Pile

The topic of potential distributions from Berkshire’s US$130 billion cash pile came up too. Buffett said they would rather make great acquisitions, but opportunities were hard to find. Public companies are difficult to buy without pushing the price up, and there are very few big enough private companies.

If you are struggling to find investment opportunities you're not alone. However, individual investors do have the advantage of a larger universe of opportunities. Berkshire's size means it has a pretty limited criteria for what it can invest in. It can typically only invest in multi billion dollar companies, it prefers private companies and generally avoids technology, which leaves them with a small pool of opportunities, regardless of the price.

💡 The Insight: Follow Timeless Investing Principles

If two of the best investors, at 93 and 99 years of age are able to patiently wait for long term investing opportunities while still implementing sound investing principles, we should be able to as well.

However, the fact that Berkshire isn’t investing doesn’t mean there are no investable opportunities for us smaller investors. We aren't limited by having $130bn in cash, so as long as you continue trying to live by these below principles, you should be ok.

- “Buy high-quality businesses that you understand at a fair price. Then just monitor and wait” - Buffett.

- Think in decades, not months.

- Reach your own conclusion.

- Be a lifelong learner.

What Else is Happening?

-

💵 PayPal published quarterly results that seemed to tick all the right boxes: an EPS and revenue beat and raised EPS guidance for the full year. The stock promptly fell to a new 52-week low and was down 15% by Wednesday.

- Investors were disappointed by the outlook for operating margins which the company expects to narrow substantially in the second half of the year.

- This would probably have been overlooked a few years ago when growth was all that mattered - but these days investors want profits.

-

🏠 Airbnb also came under pressure, despite the company beating estimates. The company actually reported a big jump in revenue and net income on the back of strong performance.

- The weak point was Q2 guidance which was lower than expected and cautious.

- The problem Airbnb is now facing is that travel rebounded strongly last year setting very high comparable numbers for the next few quarters. The numbers are actually well ahead of where they were prior to the pandemic.

-

🛢 Occidental Petroleum’s results reflected the impact of the lower oil price. Revenue was 13% lower than a year ago, and net income was 36% lower.

- If we compare the numbers to June when the oil price peaked, revenue was 32% lower almost in-line with the 35% drop in the price of crude.

Key Events During the Next Week

Tuesday is the big day for data this week, with the key economic release, US retail sales.

Also on Tuesday, Australia’s central bank will be publishing the minutes from the last policy meeting, the UK unemployment rate is due, and Canada’s inflation rate will be released.

Some of the big retailers and Chinese tech companies are reporting quarterly results this week. The big names include:

- Home Depot

- Sea Limited

- Baidu

- Tencent Music Entertainment

- Target

- TJX Companies

- Cisco Systems

- Walmart

- Alibaba

- Applied Materials

- Deere and Company

- Foot Locker

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.