Quote of the Week: “For future geopolitical stability and global prosperity, we need to build a culture of greater trust and understanding between China, America and the rest of the world.”

- Stephen A. Schwarzman

Our first newsletter of the year covered The Key Investment Themes of 2024 . Market strategists disagreed on a lot, but most agreed that geopolitical risks will play a larger role in 2024.

Now that inflation is less of a concern (for now at least), investors may just be looking to the next risk. But some analysts do believe geopolitical risks are at elevated levels.

Regardless, these risks are ever present and investors need to ensure their portfolios can survive the potential fallout.

This week we are looking at the most commonly cited risks, as well as a few of the ways you can mitigate that risk.

What Happened In Markets This Week?

Here’s a quick summary of what’s been going on:

-

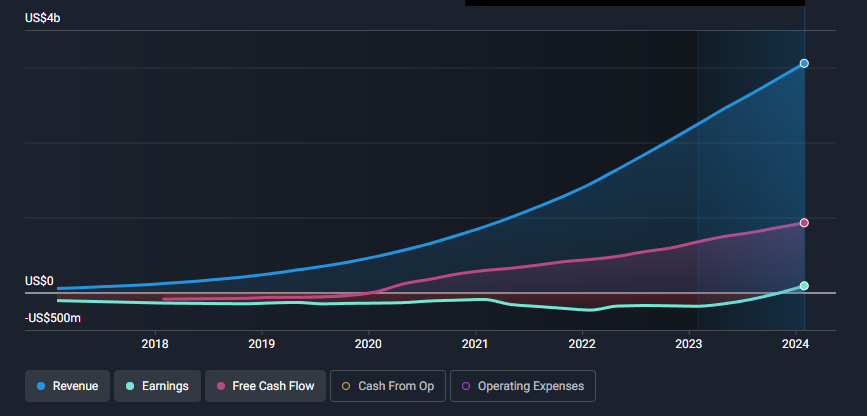

🚗 EV stocks had a rough week after Tesla announces new incentives in China and elsewhere ( Morningstar )

- Our take: The EV industry is now going through a full-blown price war. BYD has already responded with a price cut of its own in China. Falling demand and prices could weigh on profits at these two companies for a while. For their smaller rivals, the risk is existential since they don’t have the operating scale, and they may need to be acquired soon.

-

🥇 Gold traded to a new record high above $2,150 ( Reuters )

-

Our take : The latest rally has been attributed to the prospect of rate cuts, but there are other tailwinds. Central banks increased their purchases of gold in 2023 taking supply out of the market - and heightened risk around two wars have no doubt increased demand too.

-

-

🇨🇳 China sets 2024 GDP growth target of ‘around 5% and ‘ultra long’ bonds to fund major projects ( CNBC )

- Our take: 5% was the growth rate published for 2023, but economists are skeptical about the country achieving that growth rate again. Investors are also increasingly skeptical of the official figures released in China - so whatever does get reported is likely to be doubted. It’ll be interesting to see who buys those bonds.

And some of the key economic data released recently:

- 🇦🇺 Australia’s GDP grew 1.5% over the last 12 months and 0.2% month on month.

- These numbers matched consensus estimates.

- 🇺🇸 The US ADP employment report showed 140k new jobs were created, ahead of the 90k expected.

- Job openings were just below the 8.9 million expected as the labor market continues to slow.

- 🇨🇦 Canada’s central bank kept the overnight rate steady at 5%.

- Governor Tiff Macklem said it was too soon to consider a cut and wouldn’t indicate when cuts could be likely.

Managing Portfolio Risk In The Face Of Geopolitical Risks

Geopolitical risks are defined as the potential political, economic, military, and social risks that can emerge from a nation’s involvement in international affairs.

The last decade has seen a growing number of these risks due to ongoing conflicts as well as strategic positioning by the world’s largest economies.

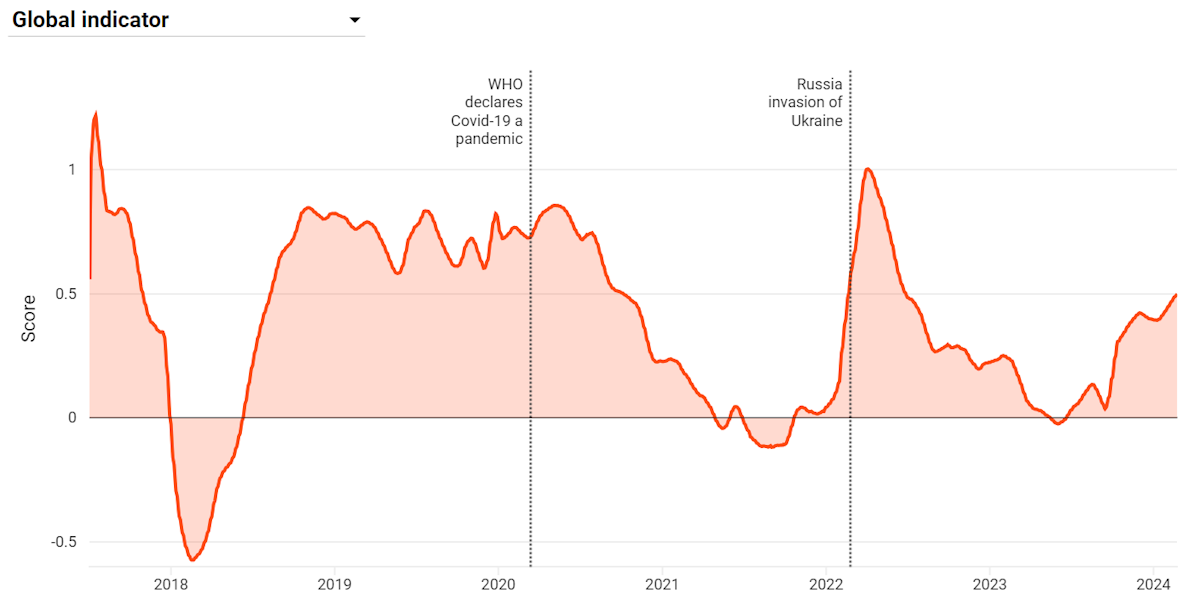

BlackRock has been running a 'Geopolitical Risk Indicator' since 2017. This model reflects the market’s attention to 10 geopolitical risks , rather than the likelihood or potential impact. The model has risen sharply since mid-2023 but remains well below prior highs.

BlackRock also assigns a likelihood to each risk. The 10 major risks and their likelihood are currently as follows:

- High: Major cyberattacks, major terror attacks, US-China strategic competition, Global technology decoupling, Russia-NATO conflict, Gulf tensions.

- Medium: Emerging markets political crisis, North Korea conflict, Climate policy gridlock.

- Low: European fragmentation.

The above risks have all been around for some time. This year economists and investors are more focussed on the following more immediate ones:

🇺🇦🇷🇺 Ukraine and NATO vs Russia

As the war between Russia and Ukraine continues, the risk of further confrontation between Russia and NATO members remains.

A wider European war would obviously have devastating consequences for Europe and for the global economy. This would affect supply chains, energy and food security, and most likely market liquidity across the globe.

An even more likely scenario could occur if a standoff escalates between the two sides. This could be consequential even if the situation ultimately de-escalates.

✨ Global food and energy prices would rise, and risk aversion could drain liquidity and confidence from the global economy. So the risk of stagflation (higher inflation and lower growth) is very real.

🌏 The Middle East

The risk of a wider Middle East war has been ever present since the Hamas attacks on Israel in October. The major risks are to oil supply and shipping routes in the region.

A wider conflict would likely result in a higher oil price in the short to medium term. But there are a few factors that might prevent it staying at elevated levels for very long.

- Firstly, OPEC+ has spare capacity due to the production cuts currently in place, and the US is less dependent on oil imports.

- In addition, the effect on the global economy could result in lower demand.

There have already been several attacks on ships in the Red Sea, which have resulted in cargo ships having to be rerouted around Africa. This adds up to 14 days to shipping times and additional fuel costs. In this case, the impact was contained by the fact that freight costs had fallen to historically low levels.

The Baltic Dry Index is a benchmark for global freight costs. The chart below illustrates the December spike, which was still well below the post-pandemic highs.

✨ Ongoing disruptions would probably lead to higher shipping costs, which is inflationary - though the effect could be offset by a drop in demand if consumer confidence is affected.

🇨🇳 China

China poses multiple risks to the global economy and markets.

✨ The one playing out right now is the slowing economy. If this persists, China’s demand for commodities is likely to be lower than expected. This will have knock on effects for emerging markets which rely on commodity exports.

The second China risk concerns its relationship with the West (particularly the US).

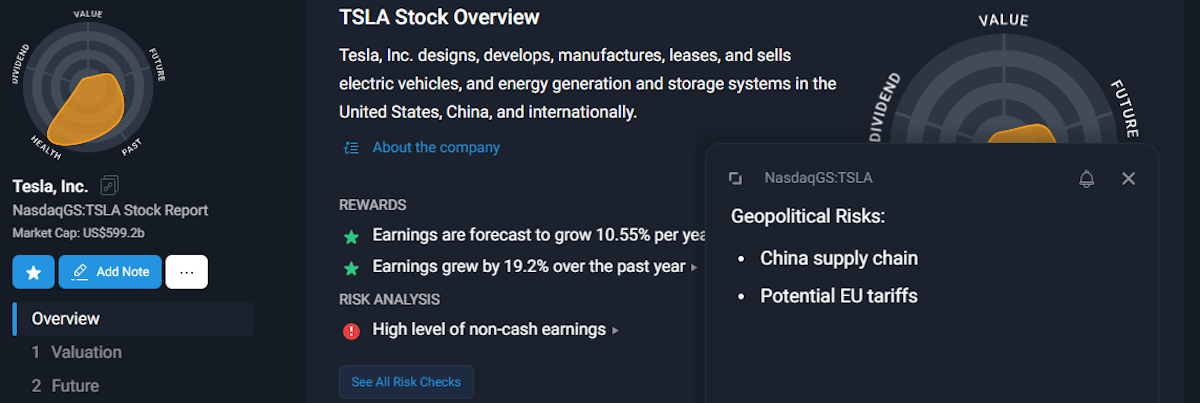

The rhetoric between China and the US is less hostile than it has been in the past as it grapples with internal challenges. But China could still retaliate for the US ban on high performance exports. Separately, the EU has proposed tariffs on Chinese EVs, which could lead to another trade war.

✨ China is crucial to the West’s solar and battery supply chain. If it uses that as a bargaining chip, it won’t only affect companies in the EV and solar industries, but the West’s clean energy goals too.

You can use the ‘Notes’ feature to keep track of these types of risks facing individual companies like Tesla:

The bigger, but less likely China risk concerns its intentions around Taiwan, where most of the world's semiconductors are manufactured. The risk of China actually invading Taiwan may be low, but the risk of posturing is high.

🤝 Trade Realignment And Protectionism

Around half the world’s population has voted or will vote in general elections this year.

Taiwan and Pakistan have already held elections, and India, the US, UK and many others will head to the polls during the remaining months.

These elections can affect individual economies, but from a geo-political point of view, rising populism and the prospect of increased protectionism are important.

There are two parts to the impact of an election;

- The rhetoric prior to the election, and

- The election itself.

Often the rhetoric has more impact than the election. Whether or not protectionist policies are actually enacted, the lead up to some of these elections could result in market volatility.

As historical trade relationships are being realigned, some economies are emerging as beneficiaries.

✨ These countries are inserting themselves in supply chains and effectively bridging the gap between historical trading partners. Bloomberg identified Vietnam, Poland, Mexico, Morocco, and Indonesia as connector countries playing this role.

🧑💻 Cyberattacks

There haven't been many reports of major cyberattacks in the media lately, but they are ongoing. In fact, many corporate leaders say this is the risk that keeps them up at night.

Cybercrime is a risk for just about every company in the world. But a major state sponsored cyberattack could potentially bring down power grids, financial systems and communication networks. Cyberattacks are becoming more sophisticated and the probability of a catastrophic attack is difficult to gauge.

Ironically, the growing risk of cyberattacks means cybersecurity is a growth industry and one risk that you can actually hedge by investing in growth companies.

Industry leader CrowdStrike (below) has increased revenue by 5,200% in the last seven years. We covered the cybersecurity industry in more detail in August, and the Top Cybersecurity Stocks collection includes more leading stocks in the industry.

💡 The Insight: How To Reduce The Effect Of Geopolitical Risks On Your Portfolio

Typically, geopolitical events don’t play out as feared, and asset prices hit their worst levels at the beginning of the event.

But that doesn’t mean the worst case scenario will never happen, and short term volatility can still make for sleepless nights, depending on your financial needs and goals. So if this is you, it's worth taking some steps to mitigate the risk to your portfolio.

Steps you can take include:

- 🌍 Diversification:

- By spreading risk across sectors, countries and regions, you can reduce the impact of geopolitical events. The new Simply Wall St portfolio tool helps you view your exposure across companies, industries and countries.

- 🏰 Safe haven assets:

- Cash, gold and bonds usually (not always) perform well when major risk events occur. Allocating part of a portfolio to these types of assets can reduce portfolio volatility and give you some peace of mind. But remember, they do tend to act as a drag on performance over the long term.

- 📈 Stocks that benefit from geo-political risk events:

- Oil producers, and cybersecurity and defense companies can benefit from rising risk and generate growth over the long term.

There are two things to keep in mind when it comes to managing risk with safe haven assets and these types of stocks:

⚖️ Overhedging

It can be tempting to get carried away, investing in assets that will perform well during ‘end of the world’ scenarios. As mentioned, safe haven assets can be a drag on performance. Investors are paid (compensated) to take risk, and trying to eliminate the risk entirely often results in poor returns.

⏳ Timing

Trying to time the market is hard enough. Trying to buy assets to hedge your portfolio is even more difficult.

As mentioned, asset prices usually reach their worst levels at the beginning of an event. This applies to things like oil and gold too, and investors have often been burnt buying oil and gold stocks just as a geopolitical event begins to unfold.

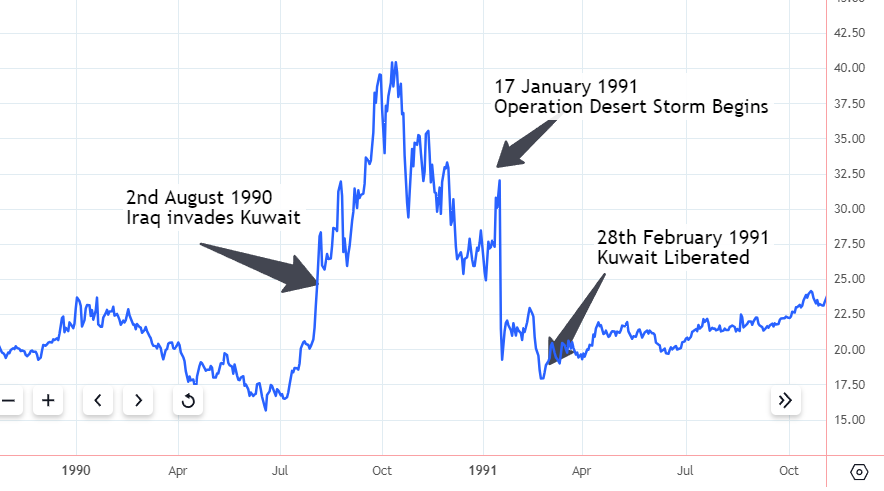

When Russia invaded Ukraine, the oil price peaked within days. After a smaller spike in May it trended lower for the next 12 months. This pattern has happened several times before, and famously played out during the First Gulf War in 1990 and 1991. This was an episode that burnt many seasoned investors.

Similar patterns have occurred with the gold price during financial crises. In 2008 after Lehman Brothers collapsed, the gold price fell for months before eventually rising.

✨ The moral of the story here is that if you’re looking to reduce the price volatility of your portfolio, you need to own these portfolio hedges as a permanent part of your portfolio, rather than trying to use them as a temporary hedge.

Alternatively, if price volatility isn’t a concern to you (because you have a long time horizon and/or an iron stomach), then as we always say, owning high quality businesses is the best way to go.

Key Events During The Next Week

Tuesday

- 🇬🇧 The UK’s unemployment rate (currently 3.8%) will be published.

- 🇺🇸 US consumer price inflation will be published. Economists are expecting a slight increase in consumer prices month on month, from 0.3% in the prior month to 0.4%. However, the core inflation rate is expected to fall slightly.

Wednesday

- 🇬🇧 UK Economic growth data is due. The economy is expected to be flat month on month after a 0.1% decline last month.

Thursday

-

🇺🇸 US producer price inflation data will be released. PPI rose 0.9% in the year to January and 0.3% during the month of January.

-

🇺🇸 US retail sales are also due. Retail sales fell sharply 0.8% in January but rose 0.6% over 12 months.

Friday

- 🇺🇸 The University of Michigan Consumer Sentiment Index is expected to rise to 78 from 76.9.

The last handful of S&P 500 companies are due to report in the next two weeks, although there are lots of small caps still reporting. The bigger names reporting this week include:

- Oracle

- Kohl’s

- PDD

- Dollar Tree

- UiPath

- SentinelOne

- Adobe

- Dollar General

- Dick’s Sporting Goods

- Ulta Beauty

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.