What Happened in the Market Last Week?

Investors enjoyed a bit of stability last week. The S&P 500 is now approaching its 200-day moving average and has risen over 10% since its October lows.

While the recent lower-than-expected inflation figures gave early signs that inflation might be slowing, strength in October’s retail sales data and the labour market may give the Fed enough reason to keep raising rates sharply.

We are devoting this week’s newsletter to summarizing the third-quarter earnings season, and specifically:

- 3 Key Takeaways from Q3 Earnings - What we’ve learnt from the results so far

- The Outlook for Q4 and onwards - How it’s changed and what it means for long-term investors.

What happened and what did we learn during earnings season?

Third quarter earnings season for 2022 isn’t quite finished, but more than 90% of companies have reported, so we have a good idea of the major themes. This was a pivotal earnings season as we saw earnings and revenue growth begin to decelerate for the first time since the bear market began.

Takeaway 1: Results beat expectations - but expectations were low

While the bar wasn’t very high in the first place due to the overall market sentiment, some companies managed to beat expectations.

As of 11th November, 92% of companies in the S&P 500 index had reported, and 70% of companies reported EPS and revenue that was higher than consensus estimates . However, as we mentioned just after the quarter ended, those Q3 EPS estimates were lowered by 6.6% during the third quarter. As more bearish news came out, estimates fell, but it seems the reduction in expectations might have been slightly overdone.

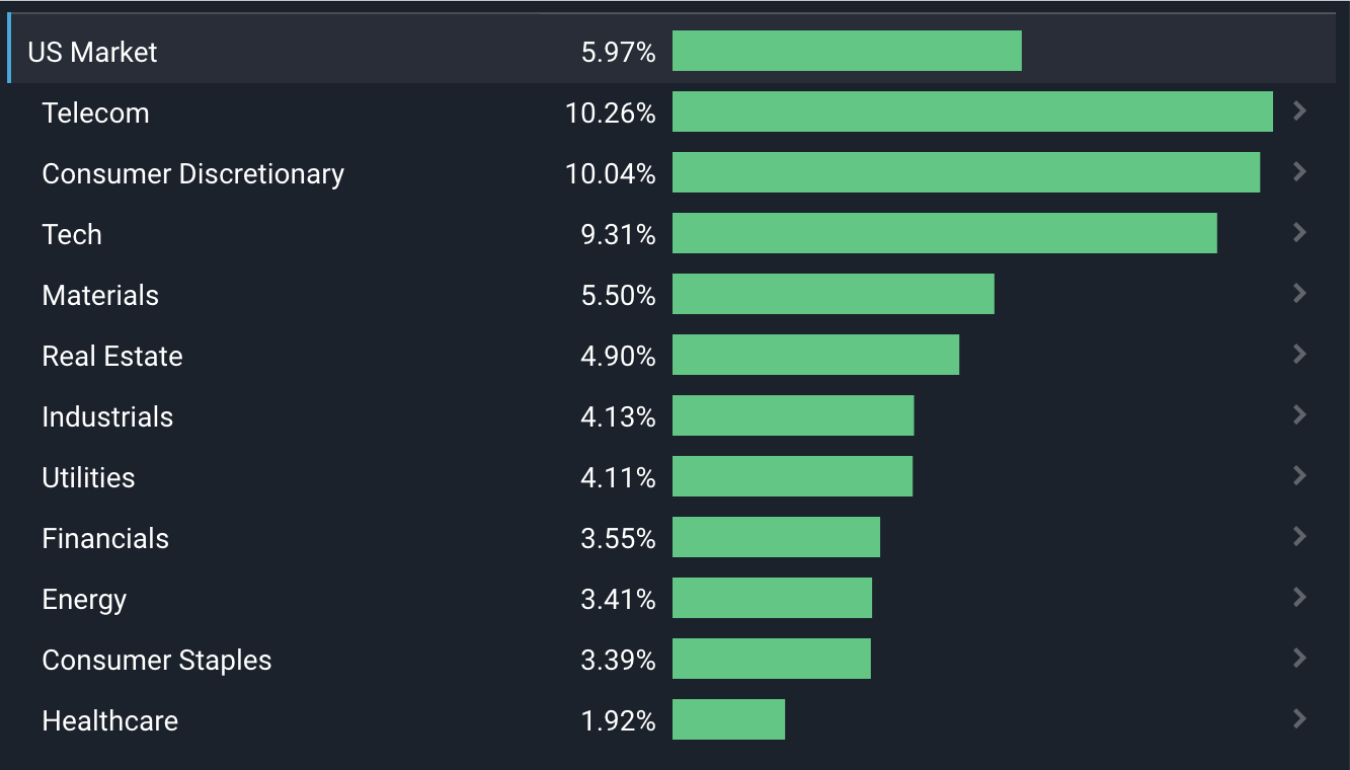

The notable out performances compared to forecasts came from the US tech, industrials, and energy sectors. Meanwhile the highest number of negative surprises came from the US telecom sector.

Takeaway 2: The energy sector was the MVP

Overall, EPS for companies in the S&P 500 index were up between 2.2% and 4% compared to the third quarter last year (depending on how you average the results). On the surface, this seems pretty good considering the macro landscape companies have had to deal with.

But when you dig into the numbers, that positive earnings growth mostly comes from a whopping 140% increase in EPS from the energy sector.

If you exclude the energy sector, EPS actually fell 3.6% from where it was a year ago. So it seems like the energy sector is the MVP carrying the whole team here. Four sectors reported year-on-year increases in EPS, while seven sectors reported year-on-year declines.

Takeaway 3: Inflation and the USD compress profits

The USD and inflation have been strong for some time now, and Q3 results showed how they’re impacting company’s bottom lines.

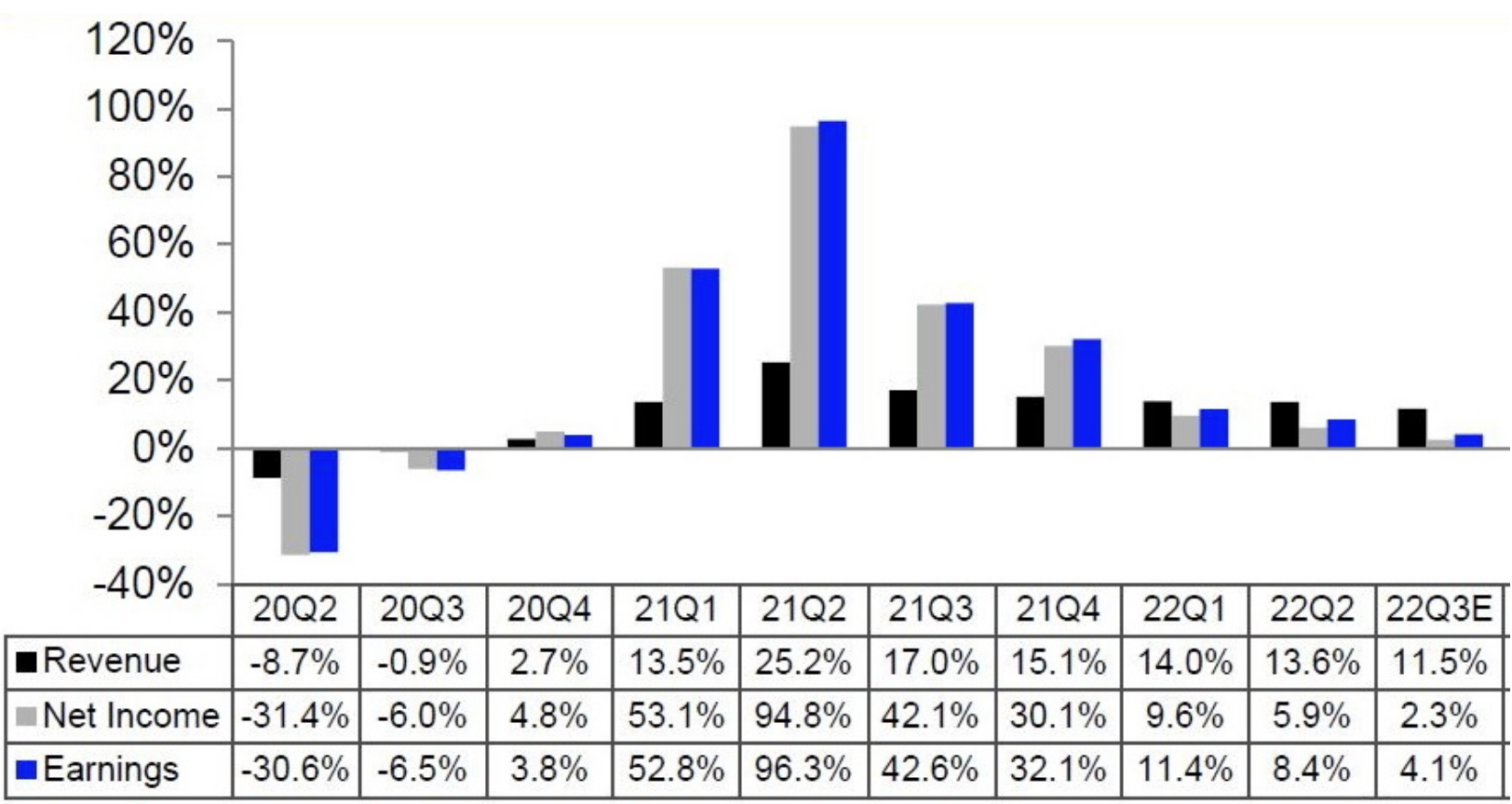

The chart below from Refnitiv , illustrates the way revenue and EPS growth for S&P 500 companies have declined from the peak in Q2 last year. While year-on-year revenue growth slowed slightly during the last quarter (13.6% to 11.5%), net income and earnings fell by more than 50% between the second and third quarter (the two far right columns in the table).

The rate of revenue growth declined slightly, so companies still saw a growth in sales but not as much. However, profits were squeezed tightly by rising costs, in particular material and energy costs.

That 11.5% revenue growth was actually quite impressive when we consider the effect of the strong USD on foreign sales by multinationals - which account for a substantial portion of the index (their non-US sales are then worth less in USD if the USD is strong, relatively speaking).

If you want to dive into more detailed data from earning season, have a look at the Refinitiv/I/B/E/S earnings scorecard and Yardeni.com’s quant briefing .

💡 The Insight: An earnings recession is already accounted for

It’s probably fair to say that corporations are now experiencing an earnings recession. But this had already been largely discounted by the market, and equity prices have risen during the course of earnings season. Some stocks beat investors already low expectations. Investors are clearly looking to the future and hoping for a Fed Pivot.

Q4 Outlook - How has it changed?

Expectations for Q4 have been falling since June 30 2022, and after this Q3 earnings season, they’ve been revised downwards, again. EPS are now expected to decline compared to the fourth quarter last year .

At June 30 2022, expectations were for 9.1% earnings growth (year over year), by September 30 it was 3.9%, and now after Q3 it’s -1.0%. Just shows the importance of updating your estimates as new information arises.

These new estimates are pretty much in line with company guidance and have likely been discounted by the market already.

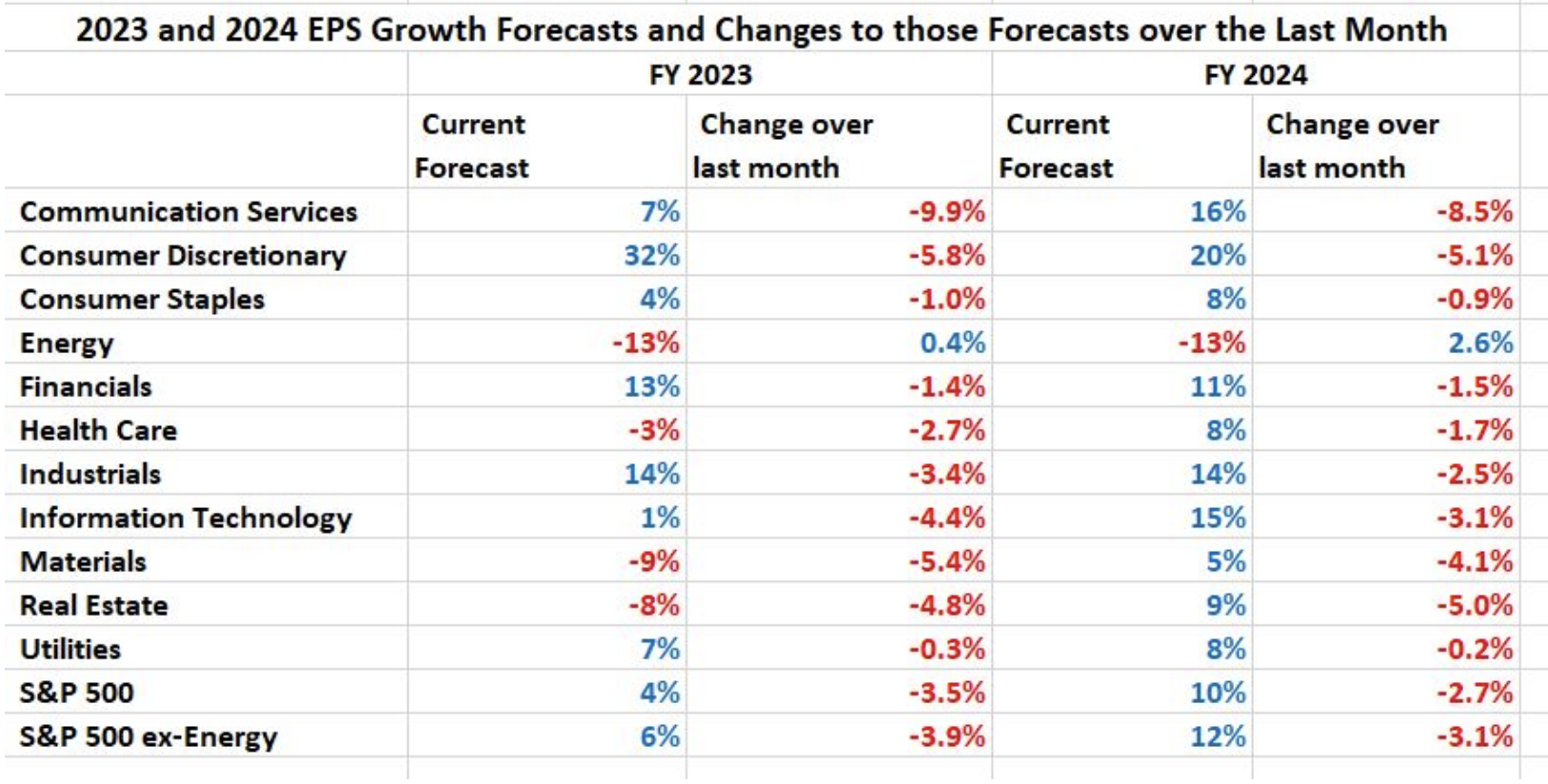

Changes in longer-term forecasts are of more use. The following data from Yardeni.com gives an indication of the EPS growth rates analysts now expect for each sector during 2023 and 2024, and how those forecasts have changed over the last few weeks.

Look for the sector/s you’re invested in, and see how its estimates for 2023 and 2024 have changed.

While there have been some substantial downward revisions, it’s quite possible that analysts will need to reduce these forecasts again. At this stage, analysts aren’t looking for a deep or extended earnings recession. If forecasts are reduced further, they may come in the same sectors that received the biggest cuts, namely telecom, tech, consumer discretionary and real estate.

It’s worth noting that forecasts for the energy and materials sector will keep changing as the price of the underlying commodities change.

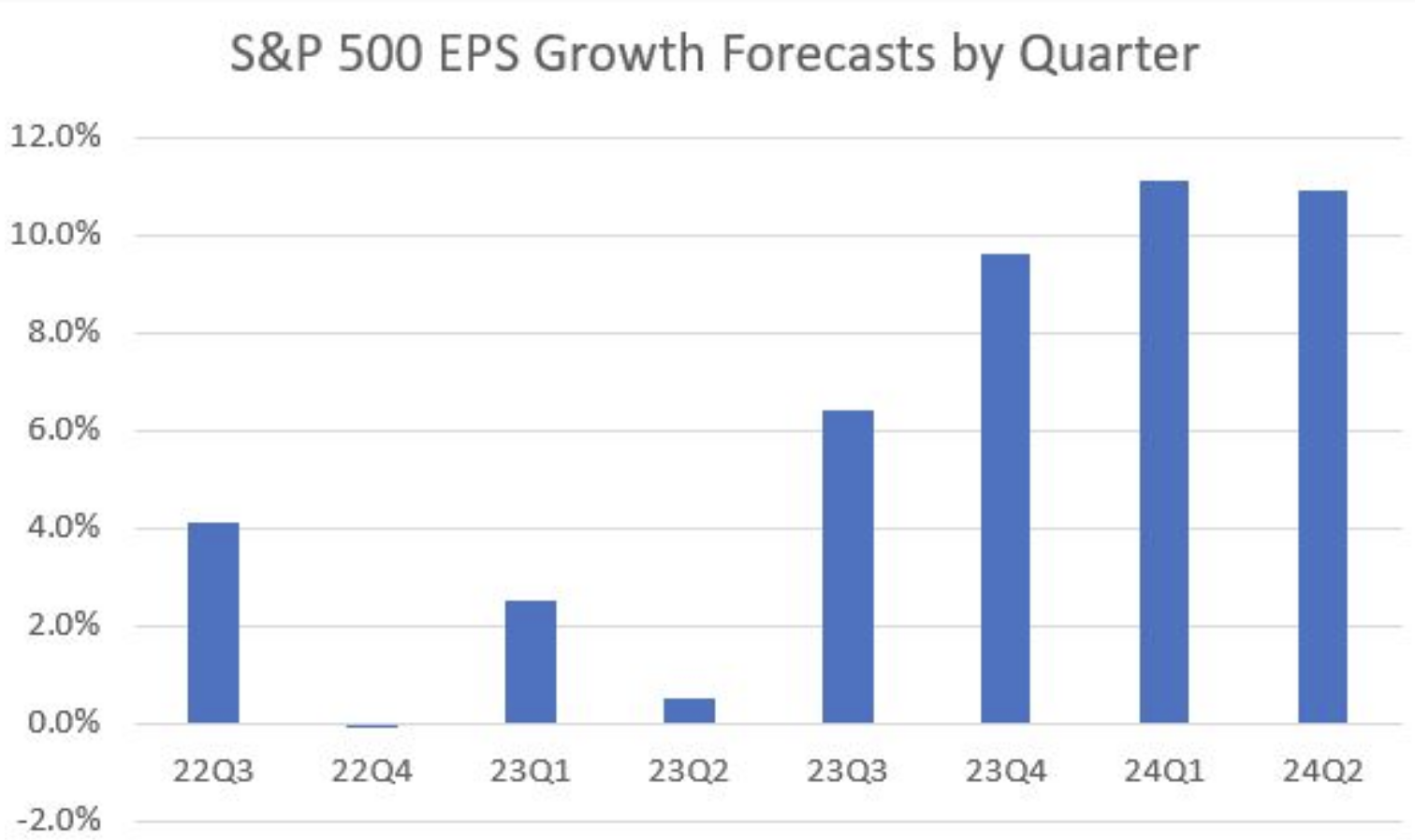

Looking at quarter-by-quarter forecasts for earnings growth, we see that EPS are expected to begin to increase again after the second quarter next year.

💡 The Insight: Don’t try and time the market, and think longer term

The timing suggested by the chart above is almost certainly a moving target. Economists are still somewhat divided over the likelihood of a recession (which is different to an earnings recession ). In addition, earnings will be impacted by inflation, interest rates and consumer sentiment. The longer it takes for central banks to bring inflation under control, the longer and deeper the earnings recession is likely to be.

This earnings season confirmed that corporations are experiencing an earnings recession, but when it comes to the future there are still too many unknowns to place too much weight on forecasts for the next year.

So while it can be useful to look at those charts above to gauge investor sentiment around a sector for the next year or so, take them with a grain of salt. It’s more important to think longer term than just 1-2 years out.

What this means for investors

Earnings recessions and bear markets don’t last forever, and they often create some of the best opportunities for long-term investors. Challenging environments are also an opportunity to find out which companies really have a competitive advantage and pricing power. As Warren Buffett famously said, “Only when the tide goes out do you discover who's been swimming naked.”

When you invest in a company, you really need to consider its earning potential over the next five to ten years, so even one or two-year forecasts can only tell you so much. In fact, you can use those forecasts to identify companies that might be experiencing temporary challenges but still have strong long-term potential.

If there is one thing we have all learnt this year, it's the power of diversification . As long term investors, we need to look for the best companies in each sector, rather than chasing the sectors that happen to be performing at any given time. As we repeat quite often, the companies that tend to perform well long-term usually have some combination of:

- Industry leadership,

- Competitive advantage,

- Good margins and cash flows,

- A growing market, and

- Solid management team.

Key Events Next Week

It’s a relatively quiet week on the economic front, and US markets will be closed on Thursday for Thanksgiving. However, the minutes from the last FOMC meeting are being released on Wednesday, along with durable goods orders and new homes sales data.

Earnings season is nearly over but there are a few tech and retail companies due to report. They include:

- Zoom Video (Nasdaq:ZM)

- Dell (NYSE:DELL)

- HP Inc ( NYSE:HPQ)

- Analogue Devices (Nasdaq:ADI)

- Agilent (NYSE:A)

- Dollar Tree (Nasdaq:DLTR)

- Baidu (Nasdaq:BIDU)

- Autodesk (Nasdaq:ADSK)

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.