These 4 Measures Indicate That Collegium Pharmaceutical (NASDAQ:COLL) Is Using Debt Reasonably Well

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that Collegium Pharmaceutical, Inc. (NASDAQ:COLL) does use debt in its business. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Collegium Pharmaceutical

What Is Collegium Pharmaceutical's Net Debt?

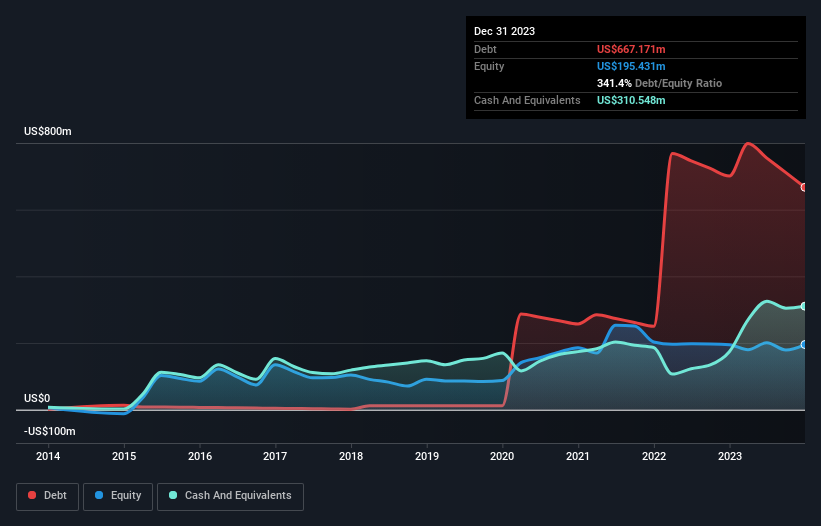

As you can see below, Collegium Pharmaceutical had US$667.2m of debt at December 2023, down from US$701.0m a year prior. However, it also had US$310.5m in cash, and so its net debt is US$356.6m.

How Healthy Is Collegium Pharmaceutical's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Collegium Pharmaceutical had liabilities of US$457.9m due within 12 months and liabilities of US$490.0m due beyond that. On the other hand, it had cash of US$310.5m and US$179.5m worth of receivables due within a year. So its liabilities total US$457.8m more than the combination of its cash and short-term receivables.

While this might seem like a lot, it is not so bad since Collegium Pharmaceutical has a market capitalization of US$1.16b, and so it could probably strengthen its balance sheet by raising capital if it needed to. But it's clear that we should definitely closely examine whether it can manage its debt without dilution.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Given net debt is only 1.1 times EBITDA, it is initially surprising to see that Collegium Pharmaceutical's EBIT has low interest coverage of 2.5 times. So while we're not necessarily alarmed we think that its debt is far from trivial. Pleasingly, Collegium Pharmaceutical is growing its EBIT faster than former Australian PM Bob Hawke downs a yard glass, boasting a 401% gain in the last twelve months. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Collegium Pharmaceutical's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the last three years, Collegium Pharmaceutical actually produced more free cash flow than EBIT. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Our View

Collegium Pharmaceutical's conversion of EBIT to free cash flow suggests it can handle its debt as easily as Cristiano Ronaldo could score a goal against an under 14's goalkeeper. But the stark truth is that we are concerned by its interest cover. Taking all this data into account, it seems to us that Collegium Pharmaceutical takes a pretty sensible approach to debt. That means they are taking on a bit more risk, in the hope of boosting shareholder returns. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. For example, we've discovered 2 warning signs for Collegium Pharmaceutical (1 is potentially serious!) that you should be aware of before investing here.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you're looking to trade Collegium Pharmaceutical, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Collegium Pharmaceutical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

This article has been translated from its original English version, which you can find here.